Asia Pacific Pharmaceutical Vials Market

Market Size in USD Billion

CAGR :

%

USD

17.23 Billion

USD

28.31 Billion

2025

2033

USD

17.23 Billion

USD

28.31 Billion

2025

2033

| 2026 –2033 | |

| USD 17.23 Billion | |

| USD 28.31 Billion | |

|

|

|

|

Asia-Pacific Pharmaceutical Vials Market Size

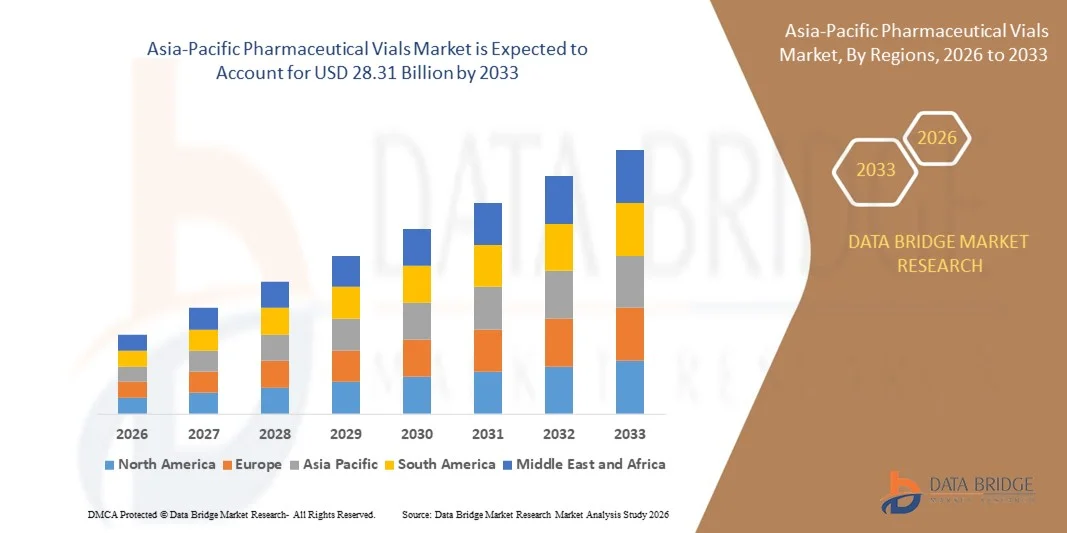

- The Asia-Pacific Pharmaceutical Vials Market size was valued at USD 17.23 billion in 2025 and is expected to reach USD 28.31 billion by 2033, at a CAGR of 6.40% during the forecast period.

- The market growth is largely driven by increasing pharmaceutical production and rising demand for injectable drugs, vaccines, and biologics across the region, supported by expanding healthcare infrastructure and regulatory approvals.

- Furthermore, advancements in vial manufacturing technologies, such as sterilization, glass quality enhancement, and multi-dose solutions, are boosting production efficiency and safety standards. These converging factors are accelerating the adoption of pharmaceutical vials, thereby significantly propelling the industry’s growth.

Asia-Pacific Pharmaceutical Vials Market Analysis

- Pharmaceutical vials, used for storing and transporting injectable drugs, vaccines, and biologics, are increasingly vital components of modern healthcare and pharmaceutical supply chains in both hospital and laboratory settings due to their enhanced sterility, durability, and compatibility with advanced drug delivery systems.

- The escalating demand for pharmaceutical vials is primarily fueled by the growing production of injectable drugs, rising vaccination programs, and increasing adoption of biologics and specialty medicines.

- China dominated the Asia-Pacific Pharmaceutical Vials Market with the largest revenue share of 32.2% in 2025, characterized by well-established pharmaceutical manufacturing infrastructure, high healthcare expenditure, and a strong presence of leading vial manufacturers, with the U.S. experiencing substantial growth in multi-dose and prefilled vial usage, driven by innovations in glass quality, sterilization processes, and regulatory compliance.

- India is expected to be the fastest-growing region in the Asia-Pacific Pharmaceutical Vials Market during the forecast period due to expanding pharmaceutical manufacturing, increasing government healthcare initiatives, and rising demand for vaccines and biologics.

- The glass segment dominated the market with the largest revenue share of 47.5% in 2025, driven by its proven chemical resistance, sterility, and compatibility with a wide range of drug formulations, including biologics and vaccines.

Report Scope and Asia-Pacific Pharmaceutical Vials Market Segmentation

|

Attributes |

Pharmaceutical Vials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Pharmaceutical Vials Market Trends

Enhanced Efficiency Through Advanced Vial Technologies

- A significant and accelerating trend in the Asia-Pacific Pharmaceutical Vials Market is the adoption of advanced manufacturing technologies and digital solutions, including automation, precision filling systems, and real-time quality monitoring. These innovations are significantly enhancing production efficiency, product safety, and consistency across the pharmaceutical supply chain.

- For instance, automated filling lines with integrated sterilization and capping systems allow manufacturers to maintain high throughput while minimizing contamination risks. Similarly, prefilled and multi-dose vial solutions streamline drug administration and reduce dosing errors in clinical and hospital settings.

- Digital integration in vial manufacturing enables features such as real-time monitoring of production parameters, predictive maintenance, and enhanced traceability throughout the supply chain. For instance, some Stevanato Group and Schott AG solutions utilize IoT-enabled sensors to monitor vial integrity and ensure compliance with regulatory standards. Furthermore, automated tracking and labeling systems provide ease of inventory management and batch traceability.

- The seamless integration of pharmaceutical vials with digital quality control platforms and smart packaging solutions facilitates centralized oversight over production, storage, and distribution. Through a single system, manufacturers can monitor multiple production lines, ensure sterility, and track batches in real time, creating a highly efficient and reliable workflow.

- This trend towards more automated, precise, and interconnected manufacturing and quality control systems is fundamentally reshaping expectations for pharmaceutical vial production. Consequently, companies such as Corning, West Pharmaceutical Services, and Stevanato Group are developing high-tech vials with features such as AI-assisted quality monitoring, automation-ready designs, and compatibility with advanced drug delivery systems.

- The demand for pharmaceutical vials that offer enhanced manufacturing efficiency, safety, and digital integration is growing rapidly across both hospital and commercial pharmaceutical sectors, as manufacturers increasingly prioritize product quality, regulatory compliance, and streamlined operations.

Asia-Pacific Pharmaceutical Vials Market Dynamics

Driver

Growing Need Due to Rising Demand for Injectable Drugs and Vaccines

- The increasing prevalence of chronic diseases, coupled with the accelerating demand for vaccines and biologics, is a significant driver for the heightened adoption of pharmaceutical vials.

- For instance, in 2025, key manufacturers such as Schott AG and Stevanato Group announced expansions in their automated vial production lines to meet the rising demand for multi-dose COVID-19 and influenza vaccines. Such strategies by major companies are expected to drive the pharmaceutical vials market growth during the forecast period.

- As healthcare providers and pharmaceutical companies aim to ensure safe, sterile, and efficient drug delivery, pharmaceutical vials offer advanced features such as multi-dose capability, compatibility with prefilled syringes, and enhanced sterility, providing a compelling advantage over alternative packaging formats.

- Furthermore, the growing emphasis on vaccination programs, biologics, and specialty injectable drugs is making pharmaceutical vials an integral component of modern healthcare supply chains, facilitating seamless integration with automated filling, storage, and distribution systems.

- The convenience of prefilled, multi-dose, and automated-ready vials, along with regulatory compliance and traceability features, are key factors propelling adoption across hospitals, clinics, and pharmaceutical manufacturing sectors. The trend towards scalable production lines and user-friendly vial designs further contributes to market growth.

Restraint/Challenge

Concerns Regarding Regulatory Compliance and Production Costs

- Concerns surrounding stringent regulatory requirements and high production costs pose a significant challenge to broader market expansion. Pharmaceutical vials must meet strict standards for sterility, glass quality, and biocompatibility, which increases manufacturing complexity and costs.

- For instance, compliance with FDA, EMA, and ISO standards requires rigorous testing and validation, which can slow down time-to-market for new vial designs.

- Addressing these regulatory challenges through robust quality control, automated production systems, and adherence to global standards is crucial for building trust among pharmaceutical companies. Manufacturers such as West Pharmaceutical Services and Corning emphasize compliance and quality assurance in their production processes to reassure clients. Additionally, the relatively high cost of advanced glass or multi-dose vials compared to basic vials can be a barrier for smaller pharmaceutical manufacturers, particularly in emerging markets.

- While manufacturing efficiencies and economies of scale are gradually reducing costs, the perceived premium for high-quality, sterile vials can still hinder widespread adoption, especially among price-sensitive buyers.

- Overcoming these challenges through improved automation, cost-effective production methods, and consistent adherence to global quality standards will be vital for sustained market growth.

Asia-Pacific Pharmaceutical Vials Market Scope

The pharmaceutical vials market is segmented on the basis of the material, neck type, cap size, distribution channel, capacity, drug type, application, end-user and market.

- By Material

On the basis of material, the Asia-Pacific Pharmaceutical Vials Market is segmented into glass, plastic, and others. The glass segment dominated the market with the largest revenue share of 47.5% in 2025, driven by its proven chemical resistance, sterility, and compatibility with a wide range of drug formulations, including biologics and vaccines. Glass vials are widely preferred by pharmaceutical manufacturers for high-value injectable drugs due to their stability and low reactivity.

The plastic segment is anticipated to witness the fastest CAGR of 22.3% from 2026 to 2033, fueled by its lightweight nature, shatter resistance, and suitability for large-scale vaccine distribution. Plastic vials are increasingly adopted for cost-effective solutions, especially in emerging markets, and for applications requiring low breakage risk during transportation. The rising demand for safe, lightweight, and easily transportable drug containers is expected to propel overall growth across both material types.

- By Neck Type

On the basis of neck type, the market is segmented into screw neck, crimp neck, double chamber, flip cap, and others. The screw neck segment dominated with a market share of 44.6% in 2025, owing to its ease of sealing, compatibility with automated capping machines, and widespread use in injectable drugs and biologics. Screw neck vials offer reliable leak-proof closures and are preferred for both single-dose and multi-dose applications.

The double chamber segment is projected to witness the fastest CAGR of 20.8% from 2026 to 2033, driven by its ability to store lyophilized drugs separately from solvents, facilitating advanced drug delivery and stability. Increasing adoption of lyophilized biologics and combination therapies is expected to fuel growth in this segment, particularly among biopharmaceutical manufacturers seeking innovative vial designs for complex formulations.

- By Cap Size

On the basis of cap size, the Asia-Pacific Pharmaceutical Vials Market is segmented into multiple sizes ranging from 8-425 mm to 24-400 mm. The 13-425 mm segment dominated with a market share of 41.2% in 2025, due to its versatility in packaging a wide variety of injectable drugs and ease of use with standard capping machines. This cap size is preferred in hospitals and large-scale vaccine programs for its compatibility with commonly used syringes and filling equipment.

The 22-350 mm segment is expected to witness the fastest CAGR of 21.0% from 2026 to 2033, driven by increasing demand for larger-volume vials used in multi-dose vaccines and biologics. Growing production of high-volume injectable therapies and expanding vaccination programs across the Asia-Pacific region are fueling adoption of these cap sizes in both commercial and hospital settings.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales, medical stores/pharmacies, e-commerce, and others. The direct sales segment dominated with a market share of 45.7% in 2025, owing to strong relationships between pharmaceutical manufacturers and hospitals, clinics, and large-scale drug distributors. Direct sales enable bulk procurement, quality assurance, and regulatory compliance, making it the preferred channel for large pharmaceutical companies.

The e-commerce segment is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, fueled by growing online pharmaceutical retail platforms, increasing digitalization, and the convenience of doorstep delivery for smaller healthcare providers and pharmacies. Rising adoption of e-commerce channels is particularly notable in emerging Asia-Pacific markets, where accessibility to medical supplies is rapidly expanding.

- By Capacity

On the basis of capacity, the market is segmented into various vial volumes. The 10 ml segment dominated with a market share of 42.8% in 2025, due to its widespread use for injectable drugs, vaccines, and multi-dose formulations. It provides an optimal balance between dosing flexibility and storage efficiency.

The 2 ml segment is expected to witness the fastest CAGR of 22.6% from 2026 to 2033, driven by increasing production of high-value biologics and vaccines requiring small-volume dosing. Small-capacity vials are favored for lyophilized drugs, prefilled syringes, and pediatric formulations, creating strong demand across hospitals, clinics, and pharmaceutical manufacturers.

- By Drug Type

On the basis of drug type, the market is segmented into injectable and non-injectable drugs. The injectable segment dominated with a market share of 56.3% in 2025, driven by the growing adoption of vaccines, biologics, and specialty injectable drugs in both hospital and clinical settings. Injectable vials are critical for ensuring sterility, dosage accuracy, and safe storage.

The non-injectable segment is expected to witness the fastest CAGR of 20.5% from 2026 to 2033, fueled by rising demand for oral liquid formulations, nasal sprays, and topical medications stored in small vials. Expanding pharmaceutical product pipelines and increasing patient-centric formulations are expected to accelerate growth in this segment.

- By Application

On the basis of application, the market is segmented into oral, nasal, injectable, and others. The injectable segment dominated with a market share of 57.1% in 2025, due to the high demand for vaccines, biologics, and parenteral drugs. Injectable vials ensure sterility, dosage precision, and long-term stability, making them indispensable in hospitals, clinics, and pharmaceutical manufacturing.

The nasal segment is expected to witness the fastest CAGR of 21.9% from 2026 to 2033, driven by increasing popularity of nasal vaccines, drug delivery systems for chronic conditions, and patient-preferred non-invasive therapies. Rising innovation in nasal drug formulations and device compatibility is boosting adoption in the region.

- By End-User

On the basis of end-user, the market is segmented into pharmaceutical companies, biopharmaceutical companies, contract development & manufacturing (CDMO) companies, compound pharmacies, and others. The pharmaceutical companies segment dominated with a market share of 48.5% in 2025, driven by large-scale production of vaccines, biologics, and injectable drugs. Established pharmaceutical firms prefer reliable suppliers for consistent vial quality and regulatory compliance.

The biopharmaceutical companies segment is expected to witness the fastest CAGR of 22.7% from 2026 to 2033, fueled by the growing biologics and biosimilars sector, increasing R&D pipelines, and the need for specialized vial formats for sensitive compounds.

- By Market: Parenteral, Gastro, ENT, and Others

On the basis of market, the Asia-Pacific Pharmaceutical Vials Market is segmented into parenteral, gastro, ENT, and others. The parenteral segment dominated with a market share of 54.2% in 2025, driven by the widespread demand for injectable drugs, vaccines, and biologics requiring sterile and reliable vial storage. Parenteral vials are critical in hospitals and clinical settings for ensuring patient safety and maintaining drug efficacy.

The ENT segment is expected to witness the fastest CAGR of 21.3% from 2026 to 2033, supported by the rising use of specialized drug delivery systems for ear, nose, and throat therapies, particularly in outpatient care and specialized clinics. Growing awareness of disease-specific treatments and increasing pharmaceutical innovation is driving this segment’s growth.

Asia-Pacific Pharmaceutical Vials Market Regional Analysis

- China dominated the Asia-Pacific Pharmaceutical Vials Market with the largest revenue share of 32.2% in 2025, driven by a growing pharmaceutical manufacturing base, high demand for vaccines and biologics, and well-established healthcare infrastructure.

- Healthcare providers and pharmaceutical companies in the region prioritize high-quality vials due to their reliability, sterility, and compatibility with a wide range of injectable and biologic drugs.

- This widespread adoption is further supported by stringent regulatory standards, advanced manufacturing technologies, and strong relationships between vial suppliers and major pharmaceutical companies, establishing high-quality glass and specialty vials as the preferred choice for both commercial production and hospital use.

China Asia-Pacific Pharmaceutical Vials Market Insight

The China pharmaceutical vials market accounted for the largest revenue share in the Asia-Pacific region in 2025, driven by the country’s robust pharmaceutical manufacturing base, expanding vaccine production, and growing demand for biologics and injectable drugs. Rapid urbanization, rising healthcare expenditure, and government initiatives promoting healthcare access are further fueling market growth. China is also emerging as a key manufacturing hub for pharmaceutical vials, enabling the production of cost-effective, high-quality glass and plastic vials for both domestic and international supply chains.

Japan Asia-Pacific Pharmaceutical Vials Market Insight

The Japan pharmaceutical vials market is witnessing steady growth, fueled by the country’s high demand for advanced biologics, vaccines, and injectable drugs. Japan’s focus on technological innovation, strict quality standards, and an aging population drives the adoption of prefilled and multi-dose vials that offer convenience, sterility, and safety. The integration of automated filling and packaging systems in Japanese pharmaceutical manufacturing further strengthens market expansion.

India Asia-Pacific Pharmaceutical Vials Market Insight

The India pharmaceutical vials market is expected to grow at the fastest CAGR in the Asia-Pacific region during the forecast period, driven by increasing pharmaceutical manufacturing, rising vaccine production, and expanding biopharmaceutical facilities. Government initiatives promoting vaccination campaigns, rising healthcare awareness, and the growing export of injectable drugs contribute to the rapid adoption of glass and plastic vials. India’s cost-competitive manufacturing ecosystem also attracts global pharmaceutical companies seeking reliable vial supplies.

South Korea Asia-Pacific Pharmaceutical Vials Market Insight

The South Korea pharmaceutical vials market is growing steadily due to increasing investment in biologics, vaccines, and sterile injectable drug production. Rising adoption of high-quality glass vials, stringent regulatory compliance, and technological advancements in vial sterilization and filling systems are supporting market growth. Additionally, the country’s well-developed pharmaceutical infrastructure and export-oriented manufacturing drive demand for both domestic use and international supply.

Asia-Pacific Pharmaceutical Vials Market Share

The Pharmaceutical Vials industry is primarily led by well-established companies, including:

• Schott AG (Germany)

• Stevanato Group (Italy)

• Corning Inc. (U.S.)

• West Pharmaceutical Services, Inc. (U.S.)

• BD (Becton, Dickinson and Company) (U.S.)

• Suzhou Hengrui Medicine (China)

• Vials India Limited (India)

• Sun Pharmaceutical Industries Ltd. (India)

• Flexion Therapeutics (U.S.)

• SG Pharma (India)

• Huhtamaki PPL (Finland)

• Daikyo Seiko Ltd. (Japan)

• Agilent Technologies (U.S.)

• Camber Pharma (U.K.)

• Kangtai Biological Products (China)

• Hikma Pharmaceuticals (U.K.)

• Ricerca Biosciences (U.S.)

• Stein Pharma (China)

• Corning Life Sciences (U.S.)

• Daikyo Pharmaceutical Packaging (Japan)

What are the Recent Developments in Asia-Pacific Pharmaceutical Vials Market?

- In April 2024, Schott AG, a global leader in specialty glass solutions, launched a strategic initiative in India aimed at enhancing the production and supply of high-quality pharmaceutical vials for vaccines and biologics. This initiative underscores the company's commitment to delivering reliable, sterile, and regulatory-compliant vials tailored to the growing healthcare needs of the region. By leveraging its global expertise and advanced manufacturing technologies, Schott AG is not only addressing regional pharmaceutical challenges but also reinforcing its position in the rapidly expanding Asia-Pacific Pharmaceutical Vials Market.

- In March 2024, Stevanato Group, an Italy-based vial and prefilled syringe manufacturer, introduced a new line of multi-dose vials designed specifically for large-scale vaccination programs in Southeast Asia. The innovative vial design ensures improved sterility, reduced contamination risk, and compatibility with automated filling lines. This development highlights Stevanato Group’s commitment to supporting mass immunization efforts and enhancing operational efficiency for healthcare providers.

- In March 2024, Corning Inc. successfully expanded its production capacity for injectable vials in China, aiming to meet the rising demand for vaccines, biologics, and specialty drugs. This initiative leverages state-of-the-art production technologies to ensure high-quality, consistent, and sterile vial supplies, highlighting Corning’s dedication to supporting the region’s rapidly growing pharmaceutical industry.

- In February 2024, West Pharmaceutical Services, Inc., a leading provider of injectable drug delivery solutions, announced a strategic partnership with several regional biopharmaceutical manufacturers in Japan to supply prefilled and multi-dose vials. The collaboration is designed to enhance production efficiency, improve supply chain reliability, and streamline distribution for hospitals and clinics. This initiative underscores West’s commitment to innovation and operational excellence in the pharmaceutical sector.

- In January 2024, BD (Becton, Dickinson and Company) unveiled its advanced line of prefilled and glass vials at the Asia-Pacific Pharmaceutical Expo 2024. Equipped with enhanced sterility and compatibility with automated filling systems, these vials enable pharmaceutical companies to manage production and distribution more efficiently. The BD vials highlight the company’s commitment to integrating cutting-edge technology into pharmaceutical packaging solutions, offering manufacturers enhanced quality, safety, and operational convenience.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Pharmaceutical Vials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Pharmaceutical Vials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Pharmaceutical Vials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.