Asia Pacific Playing Cards And Board Games Market

Market Size in USD Billion

CAGR :

%

USD

7.04 Billion

USD

12.20 Billion

2025

2033

USD

7.04 Billion

USD

12.20 Billion

2025

2033

| 2026 –2033 | |

| USD 7.04 Billion | |

| USD 12.20 Billion | |

|

|

|

|

Asia-Pacific Playing Cards and Board Games Market Size

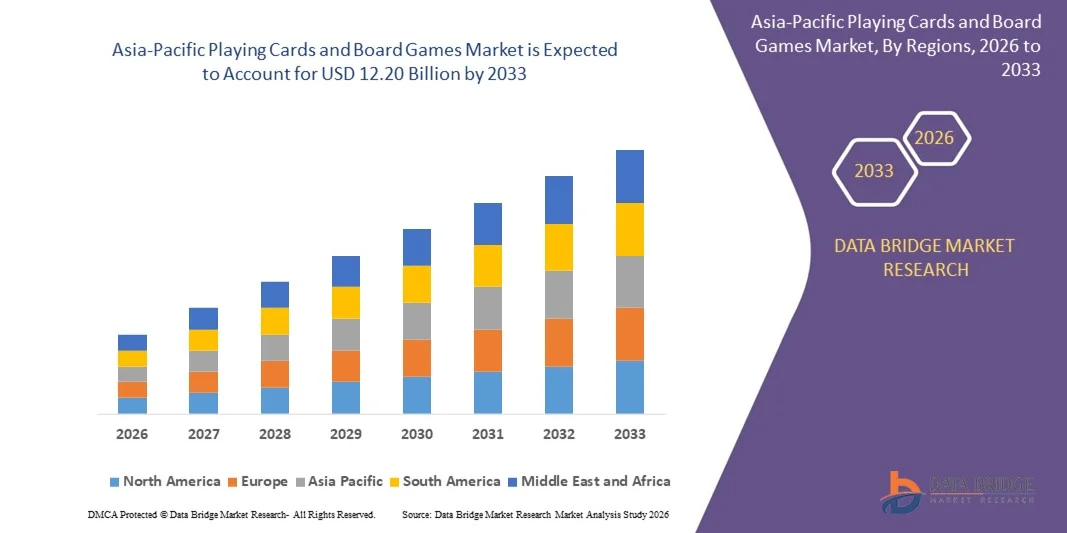

- The Asia-Pacific playing cards and board games market was valued at USD 7.04 Billion in 2025 and is expected to reach USD 12.20 Billion by 2033

- During the forecast period of 2026 to 2033 the market is likely to grow at a CAGR of 7.2%, primarily due to rising consumer interest in tabletop entertainment, fueled by nostalgia, social gaming trends, and increasing demand for family-friendly activities. The popularity of strategy and collectible games, combined with growth in online communities and retail expansion, also drives market growth. Additionally, innovation in game design and licensing collaborations with popular media franchises further boost sales.

Asia-Pacific Playing Cards and Board Games Market Analysis

- The playing cards and board games market represents a rapidly evolving segment within the broader toys, entertainment, and experiential gaming industry, accounting for a critical share of the global tabletop entertainment and social recreational segments. The market is increasingly shaped by rising consumer preference for immersive, narrative-rich gameplay, growing demand for social and family-oriented recreational activities, and the emergence of hybrid physical–digital formats that integrate mobile apps, AR/VR tools, and digital extensions.

- Growth is further driven by the proliferation of e-commerce platforms, the rise of crowdfunding models (Kickstarter, Gamefound) for indie game development, and the expansion of board game cafes, hobbyist communities, and social gaming clubs worldwide. The increasing adoption of educational & STEM-based board games, along with cognitive development-based gameplay formats, is reshaping demand particularly among parents, schools, and learning institutions.

- Innovation in modular gameplay mechanics, storyline-driven experiences, expansion packs, miniature strategy games, and collectible card formats (TCGs & CCGs) is supporting long-term engagement and repeat purchases. Additionally, digital extensions of physical games, including mobile companion apps, cloud-based multiplayer formats, and augmented/virtual reality-based mechanics, are fueling demand for interactive and hybrid gaming ecosystems.

- Key players in the playing cards and board games market are focusing on continuous innovation in game design, premium materials, and franchise-based titles to attract diverse age groups. Strategic collaborations with entertainment brands, digital influencers, and crowdfunding platforms are reshaping product development and marketing approaches. With growing consumer demand for social, family-oriented, and hobby-focused games, companies are expanding distribution across retail and e-commerce channels. As preferences shift toward immersive, thematic, and collectible formats, sustained growth will depend on creativity, strong licensing partnerships, and adapting to evolving consumer engagement trends.

- China is expected to dominate the playing cards and board games market with the largest revenue share of 32.15% in 2026, driven by rising consumer interest in premium and strategy-based board games, a rapidly expanding middle-class population, and growing urban engagement in indoor leisure activities. The country has a strong manufacturing base and increasing presence of both local and international game publishers, which support product availability and innovation. Additionally, high e-commerce penetration and widespread digital marketing channels further strengthen China’s leadership in the Asia-Pacific market.

Report Scope and Playing Cards and Board Games Market Segmentation

|

Attributes |

Playing Cards and Board Games Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Playing Cards and Board Games Market Trends

Subscription-Model Expansion

- The subscription-based model offers a compelling growth avenue for the Asia-Pacific playing cards and board games market. By transitioning from traditional one-time purchases to recurring delivery of curated game experiences, manufacturers and retailers can benefit from improved customer lifetime value, predictability of demand, and deeper engagement. Subscription services facilitate discovery of new titles, reduce the risk of consumer choice overload, and allow brands to bundle exclusive or limited-edition content.

- Additionally, the model supports incremental monetisation through tiered memberships, themed boxes, and community-driven features. As e-commerce logistics and digital payments mature, subscription frameworks become more feasible across geographies and consumer segments, creating a scalable channel for the tabletop games industry to diversify revenue streams and foster brand loyalty.

- In May 2022, Gibsons (company announcement) launched a monthly jigsaw-puzzle subscription offering, demonstrating publisher-level adoption of recurring-revenue product formats in adjacent tabletop/puzzle categories.

- In October 2024, Build Game Box published a company press release announcing the launch of a monthly subscription box for game design and desktop game kits, indicating new entrant activity in curated game-box subscriptions.

- The Asia-Pacific playing cards and board games market is increasingly positioned to benefit from the expansion of subscription-based models. Publisher acquisitions of digital platforms, integration of premium membership services, and the emergence of curated game-box offerings all indicate growing institutional commitment to recurring-revenue formats. These developments are reinforced by maturing digital-commerce infrastructure, rising consumer interest in curated physical experiences, and the steady adoption of hybrid physical-digital engagement models.

- As subscription ecosystems scale, they strengthen pathways for product discovery, customer retention, and portfolio monetisation. Collectively, these factors point toward a market environment that supports sustained subscription adoption, enabling industry participants to diversify revenue, stabilize demand, and enhance long-term strategic positioning within the tabletop entertainment landscape.

Asia-Pacific Playing Cards and Board Games Market Dynamics

Driver

Rise in Demand for Thematic and Strategy-Based Board Games

- Demand for thematic and strategy-based board games has been observed to increase significantly, providing a substantial growth driver for the Asia-Pacific playing cards and board games market. Consumers are increasingly seeking games that go beyond simple mechanics and offer deeper narrative engagement, strategic decision-making, and immersive thematic settings.

- These preferences reflect broader shifts in leisure-time allocation: players seek social interaction, intellectual stimulation and replay value rather than just casual or party-style formats. The growth in immersive themes (fantasy, historical, scientific), complex strategy mechanics (resource management, area control, legacy elements) and community-driven play (clubs, cafés, competitive frameworks) has broadened the addressable market and allowed game-publishers to launch premium variants and expansions with higher price-points. As a result, thematic and strategy-based titles are enhancing product differentiation, supporting longer shelf-life, and strengthening consumer loyalty in the tabletop segment.

- In March 2023, Yahoo Finance reported that strategy-based board games were witnessing higher demand, noting that while preschool children preferred chance-based tabletop games, adults were moving toward more strategic titles.

- The reviewed instances collectively indicate a clear and sustained shift toward deeper thematic engagement and strategic gameplay within the Asia-Pacific board-games market. Across multiple regions and sources, rising consumer interest in narrative-rich mechanics, cooperative formats, intellectually stimulating play structures and immersive social environments has been consistently documented. This trend reflects changing leisure preferences, where players increasingly prioritize depth, replay value and meaningful interaction.

- The convergence of retail demand patterns, evolving design approaches and growing social-play ecosystems reinforces the view that thematic and strategy-based titles are becoming central to market expansion, strengthening long-term growth prospects and shaping future product-development priorities across the value chain.

Restraint/Challenge

Competitive Displacement from the Larger Digital/Video Games

- The growth of digital and video game platforms is exerting competitive pressure on the physical playing cards and board games market. As consumers allocate more leisure time and spending towards immersive digital entertainment, including mobile games, consoles, and online multiplayer experiences—the analog tabletop segment faces a displacement risk. Digital formats offer convenience, frequent content updates, subscription models, and social connectivity, which heighten competitive intensity. Consequently, manufacturers and retailers of board games and playing cards must contend with not only traditional leisure alternatives, but also a rapidly expanding digital ecosystem that weakens analog market share, increases consumer-acquisition costs, and heightens the need for differentiated positioning and hybridization of physical-digital blends.

- In March 2023, a peer-reviewed study in PLOS ONE observed that video-game play time was a significant predictor of cognitive-function metrics whereas board-game play was not, suggesting higher engagement levels and longer sessions in digital formats.

- It is concluded that displacement risk from the larger digital/video game sector constitutes a significant challenge for the playing cards and board games market. The evidence demonstrates that digital gaming has achieved dominant revenue share, sustained consumer engagement and rapid innovation, thereby reducing the available leisure time and spend for physical tabletop formats. For analogue-game producers, this means increased urgency to enhance value through hybrid digital integration, augment social-play propositions, and strengthen marketing differentiation. Without such strategic adaptation, the analog segment may face slower growth, thinner margins and diminished competitive standing within an entertainment landscape increasingly dominated by digital experiences.

Asia-Pacific Playing Cards and Board Games Market Scope

The market is segmented on the basis of product type, age group, distribution channel, and end user.

- By Product Type

On the basis of product type, the Asia-Pacific playing cards and board games market is segmented into board games, playing cards. In 2026, the board games segment is expected to dominate the market with a 72.30% market share, driven by growing consumer preference for strategy-based and cooperative gameplay, increasing popularity of family-oriented and educational board games, strong uptake of licensed and themed game titles, and the rise of board-game cafes and community gaming events that continue to boost engagement and sales regionally.

The playing cards segment is the fastest-growing in the Asia-Pacific playing cards and board games market, with a CAGR of 7.5%, driven by rising popularity of collectible and themed card decks, increasing interest in casual and social card games, growing adoption of playing cards in family entertainment and travel-friendly gaming, and the expansion of online retail channels that offer wider variety and easier accessibility.

- By Age Group

On the basis of age group, the Asia-Pacific playing cards and board games market is segmented into 5–12 years, above 12 years, 2–5 years, 0–2 years. In 2026, the 5–12 years segment is expected to dominate with a 49.11% market share, driven by strong demand for educational, skill-building, and interactive games; increasing parental focus on cognitive development; widespread adoption of board and card games in schools and learning centers; and the popularity of character-based and themed gaming products among children in this age group.

The above 12 years segment is the fastest-growing segment in the Asia-Pacific playing cards and board games market, with a CAGR of 7.5%, driven by the increasing interest in strategy-based and complex tabletop games, rising engagement among teenagers and young adults, the growing popularity of hobby gaming communities, and the strong influence of social media, gaming events, and pop-culture trends that encourage participation in advanced board and card games.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific playing cards and board games market is segmented into offline, online. In 2026, the offline segment is expected to dominate the market with 66.19% market share, driven by the strong presence of specialty game stores, toy retailers, supermarkets, and hobby shops; consumers’ preference for in-store product evaluation; the rise of board-game cafés and experiential retail formats; and the continued popularity of physical shopping environments that allow hands-on engagement and immediate product availability.

Online is the fastest-growing segment with a CAGR of 7.6% in the Asia-Pacific playing cards and board games market driven by rapid expansion of e-commerce platforms, increasing consumer preference for convenient home delivery, wider product availability compared to offline channels, frequent online discounts and promotions, and the growing influence of digital marketing and social media in shaping purchasing decisions for gaming products.

- By End User

On the basis of end user, the Asia-Pacific playing cards and board games market is segmented into children's and adult. In 2026, the children’s segment is expected to dominate the market with 62.60% market share, driven by rising demand for educational and skill-enhancing games, increasing adoption of play-based learning in schools and homes, strong popularity of character-themed and licensed game titles, and the growing influence of online and offline toy retailers that actively promote children-focused board and card games.

Children's is the fastest-growing segment with CAGR of 7.3% in the Asia-Pacific playing cards and board games market driven by increasing parental focus on educational and skill-building games, rising popularity of character-themed and licensed products, expanding online retail accessibility, and the growing adoption of board games as a tool for cognitive development and social interaction among young players.

Asia-Pacific Playing Cards and Board Games Market – Regional Analysis

- China is expected to dominate the Asia-Pacific playing cards and board games market with the largest revenue share of 32.04% in 2025, driven by strong consumer interest in board gaming culture, high disposable incomes, and the presence of well-established game manufacturers and retailers.

- Asia-Pacific markets are seeing frequent launches of themed and educational board games and playing cards, attracting diverse age groups and boosting market growth.

- Countries such as China, Japan and India are leading due to high consumer adoption of board games and playing cards, strong retail and e-commerce infrastructure, and a growing culture of social and family gaming.

China Playing Cards and Board Games Market Insight

China holds a substantial 32.04% share in the Asia-Pacific playing cards and board games market in 2025, reflecting its dominant position in the region. This strong market share is driven by a large and growing consumer base with increasing disposable income, coupled with a rising interest in both traditional and modern tabletop games. Popularity of strategy games, collectible card games, and family-oriented board games has significantly contributed to market growth.

Additionally, the rapid expansion of e-commerce platforms and online gaming communities has made these products more accessible to a wider audience. Local game manufacturers, along with international brands, are introducing innovative and culturally tailored games, further strengthening China’s leadership in the Asia-Pacific market.

Japan Playing Cards and Board Games Market Insight

The Japan accounted for the second-largest share of the Asia-Pacific playing cards and board games market at 21.55% in 2025, supported by its strong gaming culture and long-standing popularity of both traditional and modern board and card games. The country’s affinity for social and family-oriented gaming, combined with themed and pop-culture collaborations, has helped sustain steady consumer demand.

Additionally, the growth of online retail and specialty stores in Japan has made a wide range of games more accessible, while rising disposable incomes and interest in offline leisure activities have further boosted the market share.

India Playing Cards and Board Games Market Insight

India is emerging as one of the fastest-growing markets for playing cards and board games in Asia-Pacific, fueled by rising disposable incomes and a growing middle class that increasingly spends on leisure and quality entertainment. The shift toward screen-free, social activities has made board games and playing cards popular choices for family and friends.

The expansion of online retail and specialty stores has improved accessibility across cities, while the revival of traditional games and the introduction of modern strategy and educational games are attracting a wider age group, further driving market growth.

The Major Market Leaders Operating in the Market Are:

- Mattel, Inc. (U.S.)

- Hasbro, Inc. (U.S.)

- Asmodee Group (France/Sweden)

- Spin Master Corp. (Canada)

- Cartamundi Group (Belgium)

- Buffalo Games, Inc. (U.S.)

- CMON Limited (Singapore)

- Czech Games Edition (CGE) (Czech Republic)

- Goliath Games — (Netherlands)

- HABA USA — (U.S.)

- Hicreate Games (China)

Latest Developments in Asia-Pacific Playing Cards and Board Games Market

- In September, 2025, Hasbro and Disney Consumer Products announced an expanded collaboration bringing PLAY-DOH together with iconic Disney storytelling through new sensory-focused, compound-led playsets. The debut collection features Disney Jr.’s Mickey Mouse Clubhouse with multiple on-the-go playsets now available on Amazon and broader retail availability coming in January 2026. This collaboration is expected to strengthen Hasbro’s preschool portfolio and drive long-term brand growth through expanded licensing opportunities and broader consumer reach.

- In July 2025, Hasbro announced new multi-year licensing partnerships with Aristocrat Technologies, Evolution, Galaxy Gaming, and Bally’s to expand its popular brands, including MONOPOLY, YAHTZEE, and BATTLESHIP, into the casino gaming sector. These partnerships aim to bring Hasbro’s iconic IP to land-based slots, online slots, table games, and online casinos for adult audiences. The new titles are set to launch in January 2026, reflecting Hasbro’s “Playing to Win” strategy of innovation and brand expansion. This move is expected to generate new revenue streams and strengthen Hasbro’s presence in the growing adult gaming market.

- In January 2025, Addo Play signed a multi-year global licensing agreement with Spin Master to revitalize the iconic Meccano brand, designing and manufacturing a new range of playsets, junior products, and STEM-focused collaborations. The partnership aims to reposition Meccano in regional markets and reintroduce it in the UK through over 1,200 retail outlets, strengthening the brand’s presence and growth potential.

- In September 2024, Spin Master announced new consumer product licensing agreements for Unicorn Academy following the greenlight for Season Two on Netflix, including deals with Sony Music, Panini, Make it Real, Ravensburger, and VTech, along with new international licensing agents to expand the franchise regionally. These initiatives are expected to strengthen the brand’s market presence and drive revenue growth for the company.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPETITIVE INSIGHTS

4.1.1 MARKET STRUCTURE AND ROLES

4.1.2 MANUFACTURING CAPACITY AND SCALE ADVANTAGES

4.1.3 PRODUCT, IP, AND LICENSING STRATEGIES

4.1.4 DIGITAL, HYBRID, AND TECHNOLOGY COMPETITION

4.1.5 HOBBY PUBLISHERS, MINIATURES AND COMMUNITY ECONOMICS

4.1.6 REGIONAL MANUFACTURERS, CHINA OEMS AND SUPPLY OPTIONS

4.1.7 DISTRIBUTION CHANNELS AND GO-TO-MARKET COMPETITION

4.1.8 QUALITY, PROVENANCE, AND ANTI-COUNTERFEIT POSITIONING

4.1.9 SUSTAINABILITY, COMPLIANCE AND REGULATORY PRESSURES

4.1.10 CONSOLIDATION, FINANCING AND STRATEGIC MOVES

4.2 CONSUMERS BUYING BEHAVIOUR

4.2.1 PRICE SENSITIVITY AND VALUE CONSIDERATION

4.2.2 ROLE OF SOCIAL INFLUENCE, FAMILY ENGAGEMENT, AND GROUP

4.2.3 IMPACT OF CLIMATE AND REGIONAL CONDITIONS

4.2.4 IMPORTANCE OF BRAND TRUST AND PRODUCT RELIABILITY

4.2.5 SHIFT TOWARD THEMATIC DEPTH, AESTHETICS AND COLLECTIBILITY

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 OVERVIEW

4.3.2 RAW MATERIALS

4.3.3 MANUFACTURING AND PACKAGING

4.3.4 DISTRIBUTION

4.3.5 END USERS

4.4 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.4.1 AUTOMATION, ROBOTICS & INDUSTRY 4.0 IN PRINTING, CUTTING & PACKAGING

4.4.2 ADVANCED MATERIALS & SURFACE ENGINEERING

4.4.3 DIGITAL–PHYSICAL HYBRIDIZATION (NFC, BLUETOOTH, APP INTEGRATION)

4.4.4 AUGMENTED REALITY (AR) & ARTIFICIAL INTELLIGENCE (AI) INTEGRATION

4.4.5 RAPID PROTOTYPING & SHORT-RUN CUSTOMIZATION

4.4.6 SUSTAINABILITY TECHNOLOGIES & ECO-FRIENDLY MATERIALS

4.4.7 QUALITY ASSURANCE & ANTI-COUNTERFEIT TECHNOLOGIES

4.5 VENDOR SELECTION CRITERIA

4.5.1 QUALITY AND CONSISTENCY

4.5.2 TECHNICAL EXPERTISE AND R&D SUPPORT

4.5.3 SUPPLY-CHAIN RELIABILITY AND LOGISTICS COVERAGE

4.5.4 COMPLIANCE, SAFETY, AND REGULATORY DOCUMENTATION

4.5.5 SUSTAINABILITY AND ENVIRONMENTAL CREDENTIALS

4.5.6 COST STRUCTURE, PRICING TRANSPARENCY AND TOTAL COST OF OWNERSHIP

4.5.7 FINANCIAL STABILITY AND BUSINESS CONTINUITY CAPACITY

4.5.8 FLEXIBILITY, CUSTOMIZATION, AND COLLABORATION CAPABILITIES

4.5.9 RISK MANAGEMENT, CONTINGENCY PLANNING AND TRACEABILITY

5 MARKET OVERVIEW

5.1 DRIVERS-

5.1.1 RISE IN DEMAND FOR THEMATIC AND STRATEGY-BASED BOARD GAMES

5.1.2 ONLINE COMMERCE AND DIGITAL RETAIL CHANNELS

5.1.3 GROWING INTEREST IN OFFLINE SOCIAL ENTERTAINMENT

5.1.4 HIGH-PROFILE INTELLECTUAL-PROPERTY TIE-UPS AND LICENSED PROJECTS

5.2 RESTRAINTS

5.2.1 COMPETITIVE DISPLACEMENT FROM THE LARGER DIGITAL/VIDEO GAMES

5.2.2 PRONOUNCED SEASONAL DEMAND PATTERNS, PARTICULARLY AROUND HOLIDAY PERIODS, RESULTING IN UNEVEN REVENUE CYCLES AND COMPLEX INVENTORY MANAGEMENT REQUIREMENTS

5.3 OPPORTUNITIES

5.3.1 AUGMENTED-REALITY (AR) AND MIXED-REALITY INTEGRATIONS

5.3.2 PREMIUM COLLECTOR AND LICENSED-IP PRODUCTS

5.3.3 SUBSCRIPTION-MODEL EXPANSION

5.4 CHALLENGES

5.4.1 COMPLIANCE BURDENS AND COST OF MEETING EVOLVING PACKAGING/WASTE LAWS

5.4.2 FRAGMENTATION OF CONSUMER ATTENTION

6 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

6.1 OVERVIEW

6.2 GAMES

6.3 PLAYING CARDS

6.4 ASIA-PACIFIC BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.4.1 ASIA-PACIFIC

6.4.2 NORTH AMERICA

6.4.3 EUROPE

6.4.4 MIDDLE EAST AND AFRICA

6.4.5 SOUTH AMERICA

6.5 ASIA-PACIFIC PLAYING CARDS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

6.5.1 ASIA-PACIFIC

6.5.2 NORTH AMERICA

6.5.3 EUROPE

6.5.4 MIDDLE EAST AND AFRICA

6.5.5 SOUTH AMERICA

7 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

7.1 OVERVIEW

7.2 5–12 YEARS

7.3 ABOVE 12 YEARS

7.4 2–5 YEARS

7.4.1 0–2 YEARS

7.5 ASIA-PACIFIC 5–12 YEARS IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.5.1 ASIA-PACIFIC

7.5.2 NORTH AMERICA

7.5.3 EUROPE

7.5.4 MIDDLE EAST AND AFRICA

7.5.5 SOUTH AMERICA

7.6 ASIA-PACIFIC ABOVE 12 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.6.1 ASIA-PACIFIC

7.6.2 NORTH AMERICA

7.6.3 EUROPE

7.6.4 MIDDLE EAST AND AFRICA

7.6.5 SOUTH AMERICA

7.7 ASIA-PACIFIC 2–5 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.7.1 ASIA-PACIFIC

7.7.2 NORTH AMERICA

7.7.3 EUROPE

7.7.4 MIDDLE EAST AND AFRICA

7.7.5 SOUTH AMERICA

7.8 ASIA-PACIFIC 0–2 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

7.8.1 ASIA-PACIFIC

7.8.2 NORTH AMERICA

7.8.3 EUROPE

7.8.4 MIDDLE EAST AND AFRICA

7.8.5 SOUTH AMERICA

8 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 OFFLINE

8.2.1 SUPERMARKETS AND HYPERMARKETS

8.2.2 SPECIALTY STORES

8.2.3 OTHERS

8.3 ONLINE

8.3.1 3RD PARTY DISTRIBUTOR

8.3.2 COMPANY OWN WEBSITE

9 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY END USER

9.1 OVERVIEW

9.2 CHILDREN'S

9.2.1 BOY

9.2.2 GIRL

9.3 ADULT

10 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 JAPAN

10.1.3 INDIA

10.1.4 SOUTH KOREA

10.1.5 AUSTRALIA & NEW ZEALAND

10.1.6 INDONESIA

10.1.7 THAILAND

10.1.8 PHILIPPINES

10.1.9 MALAYSIA

10.1.10 REST OF ASIA-PACIFIC

11 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: COMPANY LANDSCAPE

11.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

12 COMPANY PROFILES

12.1 MATTEL

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 HASBRO

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 ASMODEE NORDICS

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 SPIN MASTER

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 CARTAMUNDI

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 BUFFALO GAMES

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 CMON

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 CZECH GAMES EDITION (CGE)

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 GOLIATH GAMES

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 HABA USA

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 HICREATE GAMES

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 LONGPACK GAMES

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENT

12.13 NECA/WIZKIDS LLC (WIZKIDS)

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 NINGBO THREE A GROUP CO., LTD.

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 PIATNIK

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 R&R GAMES

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 THE RAVENSBURGER GROUP

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 UNIVERSITY GAMES CORPORATION

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENT

12.19 THE OP GAMES

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENT

12.2 Z-MAN GAMES

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC PLAYING CARDS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC 5–12 YEARS IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC ABOVE 12 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC 2–5 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC 0–2 YEARS IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC ONLINE IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC ONLINE IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC ADULT IN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 30 CHINA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 CHINA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 CHINA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 33 CHINA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 CHINA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 35 CHINA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 36 CHINA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 37 CHINA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 38 CHINA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 39 CHINA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 40 CHINA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 41 JAPAN PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 JAPAN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 JAPAN BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 44 JAPAN PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 JAPAN PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 46 JAPAN PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 47 JAPAN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 48 JAPAN OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 49 JAPAN ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 50 JAPAN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 51 JAPAN CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 52 INDIA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 INDIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 INDIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 55 INDIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 56 INDIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 57 INDIA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 58 INDIA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 59 INDIA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 60 INDIA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 61 INDIA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 62 INDIA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 63 SOUTH KOREA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 SOUTH KOREA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 65 SOUTH KOREA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 66 SOUTH KOREA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 SOUTH KOREA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 68 SOUTH KOREA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 69 SOUTH KOREA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 70 SOUTH KOREA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 71 SOUTH KOREA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 72 SOUTH KOREA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 73 SOUTH KOREA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 74 AUSTRALIA & NEW ZEALAND PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 AUSTRALIA & NEW ZEALAND BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 AUSTRALIA & NEW ZEALAND BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 77 AUSTRALIA & NEW ZEALAND PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 AUSTRALIA & NEW ZEALAND PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 79 AUSTRALIA & NEW ZEALAND PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 80 AUSTRALIA & NEW ZEALAND PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 81 AUSTRALIA & NEW ZEALAND OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 82 AUSTRALIA & NEW ZEALAND ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 83 AUSTRALIA & NEW ZEALAND PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 84 AUSTRALIA & NEW ZEALAND CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 85 INDONESIA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 86 INDONESIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 87 INDONESIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 88 INDONESIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 INDONESIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 90 INDONESIA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 91 INDONESIA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 92 INDONESIA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 93 INDONESIA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 94 INDONESIA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 95 INDONESIA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 96 THAILAND PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 THAILAND BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 THAILAND BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 99 THAILAND PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 THAILAND PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 101 THAILAND PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 102 THAILAND PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 103 THAILAND OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 104 THAILAND ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 105 THAILAND PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 106 THAILAND CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 107 PHILIPPINES PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 PHILIPPINES BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 PHILIPPINES BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 110 PHILIPPINES PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 111 PHILIPPINES PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 112 PHILIPPINES PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 113 PHILIPPINES PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 114 PHILIPPINES OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 115 PHILIPPINES ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 116 PHILIPPINES PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 117 PHILIPPINES CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 118 MALAYSIA PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 MALAYSIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 MALAYSIA BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 121 MALAYSIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 MALAYSIA PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 123 MALAYSIA PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 124 MALAYSIA PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 125 MALAYSIA OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 126 MALAYSIA ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 127 MALAYSIA PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 128 MALAYSIA CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 129 SINGAPORE PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 SINGAPORE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 SINGAPORE BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 132 SINGAPORE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 SINGAPORE PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 134 SINGAPORE PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 135 SINGAPORE PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 136 SINGAPORE OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 137 SINGAPORE ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 138 SINGAPORE PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 139 SINGAPORE CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 140 REST OF ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 REST OF ASIA-PACIFIC BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 REST OF ASIA-PACIFIC BOARD GAMES IN PLAYING CARDS AND BOARD GAMES MARKET, BY THEME, 2018-2033 (USD THOUSAND)

TABLE 143 REST OF ASIA-PACIFIC PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 REST OF ASIA-PACIFIC PLAYING CARDS IN PLAYING CARDS AND BOARD GAMES MARKET, BY MATERIAL, 2018-2033 (USD THOUSAND)

TABLE 145 REST OF ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 146 REST OF ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 147 REST OF ASIA-PACIFIC OFFLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 148 REST OF ASIA-PACIFIC ONLINE IN PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 149 REST OF ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 150 REST OF ASIA-PACIFIC CHILDREN'S IN PLAYING CARDS AND BOARD GAMES MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: ASIA-PACIFIC VS REGIONAL ANALYSIS

FIGURE 5 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 EXECUTIVE SUMMARY

FIGURE 10 STRATEGIC DECISIONS

FIGURE 11 TWO SEGMENTS COMPRISE THE ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY DISTRIBUTION CHANNEL (2026)

FIGURE 12 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: SEGMENTATION

FIGURE 14 INCREASING CONSUMER PREFERENCE FOR THEMATIC AND STRATEGY-FOCUSED TABLETOP GAMES EXPECTED TO DRIVE THE ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 OFFLINE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET IN 2026 & 2033

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 DROC ANALYSIS

FIGURE 18 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

FIGURE 19 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

FIGURE 20 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: BY DISTRIBUTION CHANNEL, 2025

FIGURE 21 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: BY END USER, 2025

FIGURE 22 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: SNAPSHOT (2025)

FIGURE 23 ASIA-PACIFIC PLAYING CARDS AND BOARD GAMES MARKET: COMPANY SHARE 2025(%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.