Asia Pacific Point Of Care Poc Drug Abusepoint Of Care Poc Drug Abuse Testing Market

Market Size in USD Million

CAGR :

%

USD

299.73 Million

USD

470.56 Million

2024

2032

USD

299.73 Million

USD

470.56 Million

2024

2032

| 2025 –2032 | |

| USD 299.73 Million | |

| USD 470.56 Million | |

|

|

|

|

Asia-Pacific Point-of-Care (POC) Drug Abuse Testing Market Size

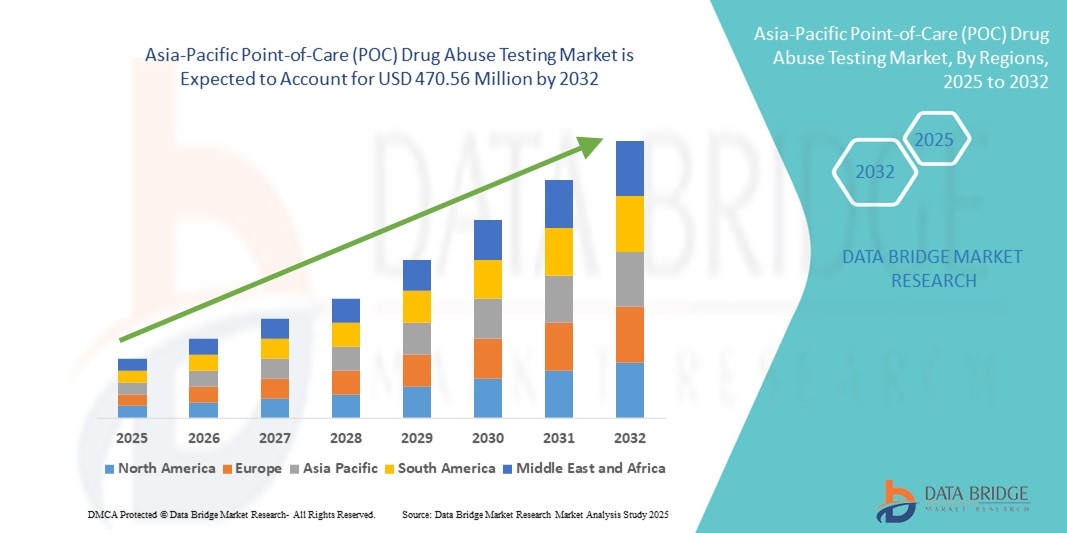

- The Asia-Pacific point-of-care (POC) drug abuse testing market size was valued at USD 299.73 million in 2024 and is expected to reach USD 470.56 million by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is primarily driven by increased substance abuse rates and growing awareness of early detection through rapid, onsite diagnostics across workplaces, rehabilitation centers, and law enforcement agencies

- In addition, government initiatives to curb drug misuse, rising healthcare expenditure, and the need for cost-effective, easy-to-use testing solutions are reinforcing the market's expansion. These converging drivers are accelerating the adoption of POC drug testing tools across the region, thereby substantially fueling industry growth

Asia-Pacific Point-of-Care (POC) Drug Abuse Testing Market Analysis

- POC drug abuse testing devices, which provide rapid on-site detection of illicit substances, are becoming increasingly essential across healthcare, workplace, and law enforcement sectors in the Asia-Pacific region due to their speed, portability, and minimal training requirements

- The accelerating demand for these tests is primarily driven by rising substance abuse rates, heightened public health concerns, and growing awareness around early intervention and treatment pathways

- China dominated the Asia-Pacific point-of-care (POC) drug abuse testing market with the largest revenue share of 37.2% in 2024, supported by expanding healthcare infrastructure, government-led anti-drug campaigns, and increased adoption of rapid screening in both clinical and non-clinical settings

- India is expected to be the fastest growing country in the point-of-care (POC) drug abuse testing market during the forecast period, owing to increasing youth drug misuse, evolving regulatory frameworks, and the need for low-cost, easy-to-administer testing options

- The urine segment dominated the Asia-Pacific point-of-care (POC) drug abuse testing market with a market share of 50.1% in 2024, favored for its non-invasive nature, accuracy, and wide adoption across workplace and roadside testing applications

Report Scope and Asia-Pacific Point-of-Care (POC) Drug Abuse Testing Market Segmentation

|

Attributes |

Asia-Pacific Point-of-Care (POC) Drug Abuse Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Point-of-Care (POC) Drug Abuse Testing Market Trends

Rising Adoption of Rapid and Portable Diagnostic Solutions

- A major and accelerating trend in the Asia-Pacific POC drug abuse testing market is the increasing preference for rapid, portable diagnostic solutions that deliver accurate and on-site results without the need for centralized laboratory facilities. This is especially relevant in remote, resource-limited, or high-volume screening environments such as schools, workplaces, and roadside checkpoints

- For instance, devices such as the Abbott SoToxa Mobile Test System and Securetec DrugWipe are gaining traction across various Asia-Pacific countries for their ease of use and quick turnaround times. These devices enable authorities and healthcare professionals to screen for a range of commonly abused substances within minutes, improving efficiency in enforcement and treatment referrals

- Furthermore, miniaturized test kits and handheld analyzers are becoming increasingly available with multi-panel capabilities, allowing for simultaneous testing of multiple drug classes from a single sample. Companies such as OraSure and Drägerwerk AG offer solutions that support oral fluid and breath-based testing, meeting growing demand for less invasive sampling methods

- The adoption of portable and easy-to-use testing platforms supports faster decision-making and immediate intervention, particularly in time-sensitive scenarios such as emergency care or roadside impairment checks

- This trend reflects a broader regional shift toward decentralization of diagnostics and improving healthcare accessibility. It is also fueling innovation among diagnostic device manufacturers focused on affordability, rapid deployment, and ease of operation tailored for the Asia-Pacific context

- As governments and private institutions continue to invest in public health and safety measures, demand for compact and field-deployable drug testing tools is expected to rise steadily, reshaping the competitive landscape in this segment

Asia-Pacific Point-of-Care (POC) Drug Abuse Testing Market Dynamics

Driver

Increasing Substance Abuse and Government-Led Screening Initiatives

- The growing prevalence of substance abuse, particularly among youth and urban populations, alongside proactive governmental campaigns, is a major factor driving demand for POC drug abuse testing in Asia-Pacific

- For instance, the Narcotics Control Bureau in India and the National Narcotics Board of Indonesia have expanded community-based testing programs to include onsite screening at schools, workplaces, and transport hubs

- These initiatives are designed to enable early detection, reduce illicit drug use, and promote timely rehabilitation goals supported by the immediacy and efficiency of POC testing methods

- In addition, increasing healthcare investment and the prioritization of preventive diagnostics by regional governments are further catalyzing the adoption of POC drug testing, especially in under-resourced or remote areas where laboratory access is limited

- The ability to conduct cost-effective, non-laboratory-based drug screening through user-friendly kits enhances accessibility, making them a preferred choice for both clinical and non-clinical settings

- Expanding awareness programs and partnerships with NGOs, law enforcement agencies, and educational institutions further support the rapid scaling of this market segment throughout the region

Restraint/Challenge

Accuracy Concerns and Regulatory Standardization Gaps

- While the market for POC drug abuse testing is expanding, concerns regarding test accuracy, false positives/negatives, and the lack of consistent regional regulatory standards pose significant challenges

- In many Asia-Pacific countries, regulatory bodies are still in the process of establishing unified frameworks for the validation and approval of POC diagnostic tools. The absence of harmonized standards can limit cross-border product deployment and affect user confidence in test reliability

- For instance, inconsistencies in certification requirements for urine versus oral fluid testing devices across different countries can delay product rollout and complicate procurement for multinational buyers

- Furthermore, improper usage due to inadequate training or unfamiliarity with interpretation protocols may result in erroneous outcomes, particularly in decentralized or field settings

- Manufacturers are investing in improving test sensitivity, simplifying user instructions, and providing digital companion apps to assist in result interpretation and reporting. However, sustained industry growth will depend on strengthening quality control processes, promoting regional regulatory harmonization, and increasing end-user training initiatives to ensure accurate and reliable testing outcomes

Asia-Pacific Point-of-Care (POC) Drug Abuse Testing Market Scope

The market is segmented on the basis of drug type, product, prescription mode, sample type, testing type, application, end user, and distribution channel.

- By Drug Type

On the basis of drug type, the Asia-Pacific point-of-care (POC) drug abuse testing market is segmented into amphetamines, opiates, cannabinoids, cocaine, barbiturates, benzodiazepines, methadone, phencyclidine, tricyclic antidepressants, and others. The cannabinoids segment dominated the market with the largest market revenue share in 2024, driven by the high prevalence of cannabis usage and routine screening in workplaces, law enforcement, and treatment programs. Cannabinoids are commonly targeted in multi-panel drug testing kits due to widespread recreational use, making them the most frequently detected substances in initial screening tests.

The amphetamines segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing misuse of stimulant medications and synthetic drugs across urban and youth populations. Government awareness campaigns and stricter drug monitoring policies are expected to reinforce the growth of amphetamine testing in public and private sectors.

- By Product

On the basis of product, the Asia-Pacific point-of-care (POC) drug abuse testing market is segmented into devices and consumables and accessories. The devices segment dominated the market with the largest market revenue share in 2024, attributed to the increasing deployment of handheld analyzers, test readers, and mobile screening units. These devices offer ease of operation, real-time results, and are widely adopted across law enforcement, emergency settings, and clinical diagnostics.

The consumables and accessories segment is projected to witness substantial growth during the forecast period, driven by recurring demand for test cassettes, specimen cups, swabs, and other disposable components necessary for each test cycle. The affordability and single-use nature of consumables ensure steady product turnover across high-volume testing environments.

- By Prescription

On the basis of prescription, the Asia-Pacific point-of-care (POC) drug abuse testing market is segmented into over the counter testing and prescription-based testing. The over the counter testing segment held the largest market revenue share in 2024, driven by growing consumer interest in at-home drug monitoring, rising parental concerns, and the easy availability of testing kits through pharmacies and online retail channels. OTC kits are gaining traction due to their affordability and privacy, making them highly preferred for home and workplace use.

The prescription-based testing segment is expected to grow steadily during the forecast period, as clinical testing for rehabilitation, pain management, and psychiatric treatment programs often requires physician-supervised drug screening using advanced diagnostics with trace-level detection capabilities.

- By Sample Type

On the basis of sample type, the Asia-Pacific point-of-care (POC) drug abuse testing market is segmented into urine, saliva, blood, hair, breath, and others. The urine segment dominated the market with the largest market revenue share of 50.1% in 2024, owing to its cost-effectiveness, wide drug detection window, and established accuracy. Urine tests remain the gold standard across workplace, healthcare, and forensic testing, with the ability to detect a broad range of substances in multi-panel kits.

The saliva segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its non-invasive nature, real-time drug detection capabilities, and increasing use in roadside and field-based applications. Saliva-based tests are gaining popularity due to minimal privacy concerns and ease of specimen collection without the need for restroom facilities.

- By Testing Type

On the basis of testing type, the Asia-Pacific point-of-care (POC) drug abuse testing market is segmented into random testing, post-incident testing, and abstinence testing. The random testing segment held the largest market revenue share in 2024, supported by its effectiveness in deterring substance use in regulated workplaces, schools, and athletic organizations. Employers and agencies frequently conduct random testing to comply with safety regulations and reduce risk.

The post-incident testing segment is projected to grow rapidly during forecast period, fueled by mandatory testing protocols following workplace accidents, law enforcement encounters, or road traffic incidents. The need for rapid and legally admissible drug test results in time-sensitive situations is driving increased adoption of POC methods for post-incident screening.

- By Application

On the basis of application, the Asia-Pacific point-of-care (POC) drug abuse testing market is segmented into medical screening, workplace screening, law enforcement and criminal justice, pain management, substance abuse treatment and rehabilitation, parental or home drug testing, sports and athletics testing, drug screening in schools and educational institutions, and others. The workplace screening segment dominated the market with the largest market revenue share in 2024, driven by regulatory compliance mandates, occupational safety policies, and rising employer awareness about drug-related productivity loss and liabilities.

The substance abuse treatment and rehabilitation segment is anticipated to witness significant growth during forecast period, supported by government and NGO-led initiatives to expand community-based treatment programs and reintegration efforts, where POC testing plays a key role in ongoing patient monitoring and relapse prevention.

- By End User

On the basis of end user, the Asia-Pacific point-of-care (POC) drug abuse testing market is segmented into healthcare facilities, employers, government institutes, and others. The healthcare facilities segment held the largest market revenue share in 2024, due to the high volume of patient screening in hospitals, emergency rooms, outpatient clinics, and rehabilitation centers. Medical institutions rely heavily on POC testing to ensure rapid intervention and initiate treatment protocols efficiently.

The employers segment is expected to exhibit strong growth during forecast period, as an increasing number of companies in sectors such as construction, logistics, and transportation implement regular drug screening programs to improve safety and maintain regulatory compliance.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific point-of-care (POC) drug abuse testing market is segmented into direct tender, retail sales, and others. The direct tender segment accounted for the largest market revenue share in 2024, driven by large-scale government and institutional procurement of drug testing devices and consumables for public health programs, workplace safety enforcement, and law enforcement needs.

The retail sales segment is projected to expand rapidly during the forecast period, supported by the growing availability of at-home drug test kits through e-commerce platforms, pharmacy chains, and convenience stores. Increasing consumer preference for privacy and self-monitoring is further boosting demand across retail channels.

Asia-Pacific Point-of-Care (POC) Drug Abuse Testing Market Regional Analysis

- China dominated the Asia-Pacific point-of-care (POC) drug abuse testing market with the largest revenue share of 37.2% in 2024, supported by expanding healthcare infrastructure, government-led anti-drug campaigns, and increased adoption of rapid screening in both clinical and non-clinical settings

- The demand for portable and fast-acting drug testing kits is growing in China due to high population density, government-led awareness campaigns, and strategic investments in community-level screening infrastructure

- This dominance is further supported by favorable regulatory initiatives, technological advancements in diagnostic tools, and increased deployment of POC testing in transportation hubs, educational institutions, and workplaces positioning China as the leading market for POC drug abuse testing in the Asia-Pacific region

The China POC Drug Abuse Testing Market Insight

The China point-of-care (POC) drug abuse testing market captured the largest revenue share in the Asia-Pacific region in 2024, driven by the country’s intensifying anti-drug campaigns, large-scale public testing initiatives, and robust government funding. The Chinese government’s commitment to improving drug monitoring systems and expanding rapid testing in transport hubs, schools, and community clinics is propelling market growth. Furthermore, strong local manufacturing capabilities and strategic partnerships with global diagnostic firms enhance the accessibility and affordability of advanced POC testing devices across the country.

India POC Drug Abuse Testing Market Insight

The India point-of-care (POC) drug abuse testing market is projected to grow at a substantial CAGR during the forecast period, supported by the country’s rising drug dependency rates and the government's focus on preventive healthcare and awareness. Increasing efforts by state and central agencies to implement school-based and workplace screening programs are creating strong demand for fast, easy-to-use testing kits. India’s expanding healthcare infrastructure, combined with the affordability of domestically produced diagnostic solutions, is accelerating adoption across both urban and semi-urban regions.

Japan POC Drug Abuse Testing Market Insight

The Japan point-of-care (POC) drug abuse testing market is gaining traction due to a growing emphasis on early detection, rehabilitation, and strict drug policies. The country’s highly regulated and technologically advanced healthcare system is fostering the adoption of precise and efficient POC diagnostic tools. Japan’s focus on quality, safety, and innovation supports the integration of compact drug screening devices in hospitals, emergency services, and law enforcement. In addition, the aging population and associated health monitoring needs contribute to the demand for reliable, non-invasive testing methods.

Australia POC Drug Abuse Testing Market Insight

The Australia point-of-care (POC) drug abuse testing market is expanding steadily, driven by strong government support for substance abuse prevention and harm-reduction programs. Nationwide efforts to increase roadside drug testing, coupled with workplace safety regulations, are driving high-volume adoption of POC test kits. Australia’s healthcare providers are also prioritizing fast, on-site diagnostics for community outreach and addiction treatment centers. The country’s focus on mental health and rehabilitation, combined with robust infrastructure, is expected to continue fueling market growth.

Asia-Pacific Point-of-Care (POC) Drug Abuse Testing Market Share

The Asia-Pacific Point-of-Care (POC) Drug Abuse Testing industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Drägerwerk AG & Co. KGaA (Germany)

- OraSure Technologies, Inc. (U.S.)

- Securetec Detektions-Systeme AG (Germany)

- MP Biomedicals, LLC (U.S.)

- Premier Biotech, Inc. (U.S.)

- Wondfo Biotech Co., Ltd. (China)

- Zhuhai Livzon Diagnostics Inc. (China)

- Guangzhou Decheng Biotechnology Co., Ltd. (China)

- Tianjin Era Biology Technology Co., Ltd. (China)

- SD Biosensor, Inc. (South Korea)

- InTec PRODUCTS, INC. (China)

- Microprofit Biotech Co., Ltd. (China)

- Sugentech, Inc. (South Korea)

What are the Recent Developments in Asia-Pacific Point-of-Care (POC) Drug Abuse Testing Market?

- In April 2024, SD Biosensor Inc. (South Korea) expanded its presence across Southeast Asia by launching a new range of saliva-based point-of-care drug testing kits. Designed for rapid and non-invasive screening, these kits cater to increasing demand from law enforcement and corporate workplace testing. The launch reflects the company’s strategic vision to offer fast, user-friendly diagnostics that enhance drug monitoring efficiency in decentralized settings across emerging Asian markets

- In March 2024, Guangzhou Wondfo Biotech Co., Ltd. (China) announced a collaboration with Indian diagnostic networks to supply POC drug abuse testing kits for school-based screening programs. The initiative is part of a government-supported public health effort aimed at early intervention among adolescents. This move highlights the role of cross-border partnerships in making advanced testing accessible and scalable across rural and semi-urban regions in Asia

- In February 2024, the Japanese Ministry of Health partnered with domestic medtech firms to pilot real-time mobile drug testing units integrated with AI-powered result interpretation. These portable vans equipped with POC analyzers were deployed during public events and transportation hubs, aiming to reduce drug-related incidents. This reflects a growing focus on using smart technology to enable rapid decision-making and enhance public safety

- In January 2024, Alere Medical Pvt. Ltd. (India), a subsidiary of Abbott, launched a multi-drug rapid screening device compatible with smartphone-based reporting systems. The new device supports cloud integration for seamless data tracking and has been adopted by several private rehabilitation centers across India. The development showcases innovation tailored for digital health ecosystems, offering real-time insights for healthcare professionals managing substance abuse cases

- In December 2023, Bioeasy Biotechnology Co., Ltd. (China) introduced an advanced handheld immunofluorescence analyzer optimized for roadside drug testing by traffic police authorities in China and Malaysia. The system delivers high-sensitivity results within five minutes, enabling officers to detect a wide range of narcotics with minimal training. This advancement aligns with rising regulatory enforcement and the need for efficient roadside diagnostics in high-traffic regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.