Asia Pacific Potting And Encapsulating Compounds Market

Market Size in USD Billion

CAGR :

%

USD

1.52 Billion

USD

2.30 Billion

2025

2033

USD

1.52 Billion

USD

2.30 Billion

2025

2033

| 2026 –2033 | |

| USD 1.52 Billion | |

| USD 2.30 Billion | |

|

|

|

|

Asia-Pacific Potting and Encapsulating Compounds Market Size

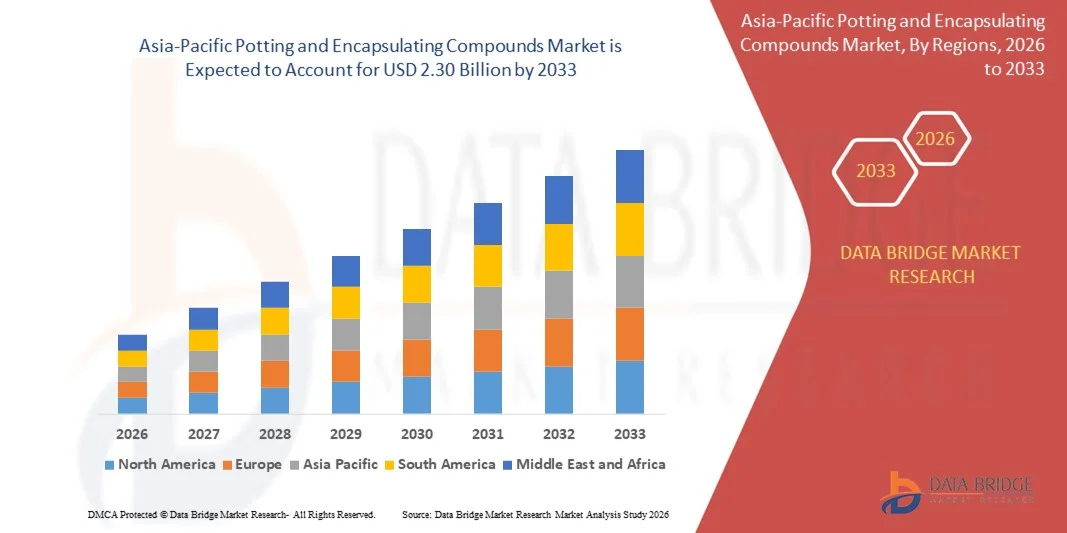

- The Asia-Pacific potting and encapsulating compounds market size was valued at USD 1.52 billion in 2025 and is expected to reach USD 2.30 billion by 2033, at a CAGR of 5.30% during the forecast period

- The market growth is largely fuelled by the increasing demand for reliable and durable electronic components in consumer electronics, automotive, and industrial applications. These compounds offer superior protection against moisture, dust, chemicals, and thermal shock, which extends the operational life of electronic assemblies

- In addition, the rising trend of miniaturization and the growing adoption of electric vehicles (EVs) are driving the need for advanced potting and encapsulation solutions to ensure component safety and performance under harsh conditions

Asia-Pacific Potting and Encapsulating Compounds Market Analysis

- The market for potting and encapsulating compounds is expanding steadily as more industries adopt these materials to protect sensitive electronic components from environmental damage and mechanical stress, ensuring longer product lifespans and reliability

- Manufacturers are focusing on developing advanced compounds with improved thermal stability and electrical insulation properties to meet the growing requirements of complex electronic devices, enhancing overall performance and safety

- China dominated the potting and encapsulating compounds market, driven by large-scale electronics manufacturing and strong presence of consumer electronics and automotive industries

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific potting and encapsulating compounds market due to increasing adoption of advanced automotive electronics and next-generation power systems. Rising focus on electric vehicles, robotics, and precision electronics is driving demand for high-performance encapsulation solutions

- The epoxy segment dominates with the largest market revenue share of 38.5% in 2025 due to its excellent adhesion, high mechanical strength, and superior chemical resistance, making it highly reliable for long-term electronic protection. Epoxy compounds are widely used in industrial electronics, power modules, and circuit boards where durability and rigidity are critical. Their cost-effectiveness and ease of formulation further strengthen adoption across high-volume manufacturing environments. Strong resistance to moisture and vibration also supports their use in harsh operating conditions

Report Scope and Asia-Pacific Potting and Encapsulating Compounds Market Segmentation

|

Attributes |

Asia-Pacific Potting and Encapsulating Compounds Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Potting and Encapsulating Compounds Market Trends

Rise of Eco-Friendly and Sustainable Potting Compounds

- There is a growing trend towards developing eco-friendly potting and encapsulating compounds that minimize environmental impact while maintaining performance standards, as manufacturers seek to reduce carbon emissions and comply with stricter environmental regulations. These solutions focus on lowering toxicity, improving recyclability, and reducing energy consumption during production, making them suitable for sustainable electronics manufacturing. In addition, end users increasingly prefer environmentally responsible materials without compromising reliability

- Manufacturers are investing in bio-based and recyclable materials to address increasing regulatory pressures and consumer demand for sustainable electronics, particularly in regions with stringent environmental policies. These investments support long-term sustainability goals while enhancing brand reputation and regulatory compliance. In addition, innovation in green chemistry is enabling improved material performance alongside environmental benefits

- For instance, Henkel introduced a new line of bio-based encapsulants aimed at reducing carbon footprints in electronic manufacturing, supporting sustainability targets across the electronics value chain. These products help manufacturers lower lifecycle emissions while maintaining essential mechanical and thermal properties. In addition, such innovations encourage wider adoption of sustainable materials in high-performance applications

- These sustainable compounds offer comparable thermal and electrical protection, helping industries such as automotive and consumer electronics align with green initiatives and regulatory requirements. They ensure effective insulation, heat dissipation, and component protection under demanding operating conditions. In addition, their performance parity with conventional materials reduces resistance to transitioning toward sustainable alternatives

Asia-Pacific Potting and Encapsulating Compounds Market Dynamics

Driver

Increasing Demand for Protection of Electronic Components

- The demand for potting and encapsulating compounds is driven by the need to protect sensitive electronic components from moisture, dust, chemicals, and mechanical shock in harsh environments. These materials ensure consistent performance and prevent premature failure of critical components. In addition, increased deployment of electronics in outdoor and industrial settings strengthens this demand

- Increasing miniaturization and sophistication of electronic devices across industries such as automotive, consumer electronics, aerospace, and renewable energy make durability and reliability crucial. Compact designs leave little margin for component failure, requiring advanced protection solutions. In addition, higher power densities elevate the need for effective thermal and environmental shielding

- These compounds provide insulation, thermal management, and protection against vibration and corrosion, enhancing device performance and lifespan. They help maintain electrical stability and reduce maintenance requirements over time. In addition, improved durability supports longer product lifecycles and reduced replacement costs

- For instance, electric vehicle manufacturers use potting compounds extensively to protect batteries and power modules from temperature changes and moisture ingress. These materials improve safety, reliability, and operational efficiency of electric drivetrains. In addition, robust protection supports wider adoption of electric vehicles in diverse climatic conditions

- The rise of IoT devices and smart electronics fuels the adoption of potting materials to ensure secure, long-lasting performance in both industrial and outdoor settings. These devices often operate continuously and in remote locations, increasing the need for reliable protection. In addition, widespread sensor deployment amplifies demand for durable encapsulation solutions

Restraint/Challenge

High Production and Raw Material Costs

- One major challenge to adopting potting and encapsulating compounds is the high production cost due to expensive raw materials such as high-purity resins and fillers. These materials are essential for achieving desired performance characteristics but significantly increase product costs. In addition, limited availability of specialized raw materials can constrain supply

- Price fluctuations caused by supply chain issues and geopolitical tensions add uncertainty to raw material costs, impacting overall manufacturing expenses. Such volatility makes long-term pricing strategies difficult for manufacturers. In addition, unpredictable costs can discourage investment in advanced potting technologies

- The need for precision and strict quality control in production further increases operational costs, making these compounds less accessible for price-sensitive applications. Specialized equipment and skilled labor are often required to maintain consistency and performance. In addition, compliance with industry standards raises testing and certification expenses

- For instance, the push for sustainable and eco-friendly components raises expenses due to research, development, and sourcing of greener alternatives, which can result in higher prices and slower adoption in cost-conscious markets. Developing bio-based formulations requires significant investment and longer development cycles. In addition, limited economies of scale initially keep prices elevated for sustainable solutions

- Small and medium-sized enterprises often struggle to afford these costs, limiting their ability to use advanced potting materials in their products. Budget constraints can restrict innovation and adoption of high-performance solutions. In addition, cost barriers may force smaller players to rely on lower-quality alternatives

Asia-Pacific Potting and Encapsulating Compounds Market Scope

The Asia-Pacific potting and encapsulating compounds market is segmented based on type, substrate type, function, curing technique, distribution channel, application, and end-user.

- By Type

On the basis of type, the Asia-Pacific potting and encapsulating compounds market is segmented into epoxy, polyurethane, silicone, polyester system, polyamide, polyolefin, and others. The epoxy segment dominates with the largest market revenue share of 38.5% in 2025 due to its excellent adhesion, high mechanical strength, and superior chemical resistance, making it highly reliable for long-term electronic protection. Epoxy compounds are widely used in industrial electronics, power modules, and circuit boards where durability and rigidity are critical. Their cost-effectiveness and ease of formulation further strengthen adoption across high-volume manufacturing environments. Strong resistance to moisture and vibration also supports their use in harsh operating conditions.

The silicone segment is expected to witness the fastest growth rate from 2026 to 2033 due to its high flexibility, superior dielectric properties, and resistance to extreme temperatures. Silicone materials perform reliably in both high-heat and low-temperature environments, making them suitable for automotive, aerospace, and outdoor electronics. Their ability to absorb thermal expansion and mechanical stress enhances component reliability. Increasing demand for high-performance and long-life electronic systems is accelerating silicone adoption.

- By Substrate Type

On the basis of substrate type, the Asia-Pacific potting and encapsulating compounds market is segmented into glass, metal, ceramic, and others. The metal substrate segment holds the largest market revenue share of 42.3% in 2025, as metals are extensively used in electronic housings, power components, and automotive assemblies. Potting compounds provide corrosion resistance, vibration dampening, and electrical insulation for metal-based components. Strong bonding compatibility between metals and encapsulants supports widespread industrial usage. The growing use of metal substrates in power electronics further sustains this dominance.

The glass segment is expected to witness the fastest growth rate from 2026 to 2033, supported by increasing use in optical sensors, displays, and advanced electronic devices. Glass substrates offer excellent insulation, transparency, and chemical stability. Encapsulation improves durability and protects sensitive glass-based components from mechanical damage. Rising adoption of smart sensors and advanced monitoring systems is boosting demand.

- By Function

On the basis of function, the Asia-Pacific potting and encapsulating compounds market is segmented into electrical insulation, heat dissipation, corrosion protection, shock resistance, chemical protection, and others. Electrical insulation dominates with a market share of 44.1% in 2025 owing to its critical role in preventing short circuits and electrical failures. These compounds ensure safe operation of high-voltage and high-density electronic systems. Growing integration of electronics across industries increases the need for reliable insulation solutions. Long-term operational safety remains a key driver for this segment.

The heat dissipation segment is expected to witness the fastest growth rate from 2026 to 2033 driven by increasing power density in electronic devices. Effective thermal management is essential in electric vehicles, renewable energy systems, and power electronics. Potting compounds with enhanced thermal conductivity help maintain optimal operating temperatures. This supports longer component life and improved system efficiency.

- By Curing Technique

On the basis of curing technique, the Asia-Pacific potting and encapsulating compounds market is segmented into room temperature cured, high temperature or thermally cured, and ultraviolet cured compounds. Room temperature cured compounds lead the market with a 46.0% revenue share in 2025 due to their ease of processing and reduced energy requirements. These materials simplify manufacturing workflows and lower operational costs. They are widely used in small- and medium-scale production environments. Compatibility with sensitive components further increases adoption.

The ultraviolet cured compounds segment is expected to witness the fastest growth rate from 2026 to 2033 due to rapid curing speed and high production efficiency. UV curing enables precise control and shorter cycle times in automated manufacturing. These compounds support eco-friendly processes by reducing energy consumption. Growing demand for high-throughput electronics manufacturing is accelerating their use.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific potting and encapsulating compounds market is divided into offline and online. The offline segment accounts for 71.5% of the market revenue in 2025 supported by established supplier networks and long-term procurement contracts. Industrial buyers often prefer offline channels for bulk purchasing and technical consultation. Strong distributor relationships ensure consistent supply and after-sales support. This channel remains dominant in traditional manufacturing sectors.

The online distribution segment is anticipated to witness the highest growth from 2026 to 2033 driven by increasing digitalization of procurement processes. Online platforms offer wider product visibility, competitive pricing, and faster ordering. Small and mid-sized manufacturers increasingly adopt online sourcing for convenience. Improved logistics and digital payment systems further support growth.

- By Application

On the basis of application, the Asia-Pacific potting and encapsulating compounds market is segmented into electronics and electrical applications. The electronics application dominates the market with a 63.8% revenue share in 2025 fuelled by rising demand for consumer electronics, automotive electronics, and IoT devices. Miniaturization and increased circuit complexity require advanced protection solutions. Potting compounds enhance reliability and performance of sensitive electronic components. Rapid innovation in electronics continues to drive demand.

The electrical application segment is expected to witness the fastest growth rate from 2026 to 2033 supported by expansion of global power infrastructure. Growing investments in transmission, distribution, and renewable energy systems increase the need for durable insulation materials. Potting compounds protect switchgear, transformers, and control systems. Enhanced safety and operational reliability remain key growth factors.

- By End-User

On the basis of end-user, the Asia-Pacific potting and encapsulating compounds market is categorized into transportation, consumer electronics, energy and power, telecommunication, healthcare, and others. The consumer electronics segment holds the largest revenue share of 35.7% in 2025 owing to widespread adoption of smartphones, wearables, and smart home devices. High production volumes and frequent product upgrades sustain consistent demand. Protection against moisture and mechanical stress is critical for compact devices. Continuous innovation further supports market growth.

The transportation end-user segment is expected to witness the fastest growth rate from 2026 to 2033 driven by increasing electric vehicle production and electrification trends. Vehicles require advanced potting materials for battery systems, power electronics, and sensors. These compounds enhance safety, thermal stability, and durability. Growing focus on autonomous and connected vehicles further accelerates adoption.

Asia-Pacific Potting and Encapsulating Compounds Market Regional Analysis

- China dominated the potting and encapsulating compounds market, driven by large-scale electronics manufacturing and strong presence of consumer electronics and automotive industries

- Rapid growth in electric vehicles, renewable energy installations, and industrial electronics significantly boosts demand for advanced potting materials

- This dominance is reinforced by cost-efficient manufacturing capabilities, high production volumes, and strong government support for domestic electronics and power industries

Japan Potting and Encapsulating Compounds Market Insight

The Japan potting and encapsulating compounds market is expected to witness the fastest growth rate from 2026 to 2033, supported by rising adoption of advanced automotive electronics and next-generation power systems. Increasing focus on electric vehicles, robotics, and precision electronics is driving demand for high-performance encapsulation solutions. Strong emphasis on quality, reliability, and miniaturization further accelerates market growth. In addition, continuous innovation in materials and electronics manufacturing strengthens Japan’s growth outlook.

Asia-Pacific Potting and Encapsulating Compounds Market Share

The Asia-Pacific potting and encapsulating compounds industry is primarily led by well-established companies, including:

• Shin-Etsu Chemical Co., Ltd. (Japan)

• ThreeBond Holdings Co., Ltd. (Japan)

• Nagase ChemteX Corporation (Japan)

• Sanyu Rec Co., Ltd. (Japan)

• Kaneka Corporation (Japan)

• KCC Corporation (South Korea)

• Chang Chun Group (Taiwan)

• Nan Ya Plastics Corporation (Taiwan)

• Hubei Huitian New Materials (China)

• Jiangsu Sanmu Group (China)

• Pidilite Industries Ltd. (India)

• Atul Ltd. (India)

• Elantas Beck India Ltd. (India)

• Momentive Performance Materials Asia (Japan)

• Wacker Chemicals Asia (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Potting And Encapsulating Compounds Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Potting And Encapsulating Compounds Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Potting And Encapsulating Compounds Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.