Market Analysis and Insights Asia-Pacific Powder Coatings Market

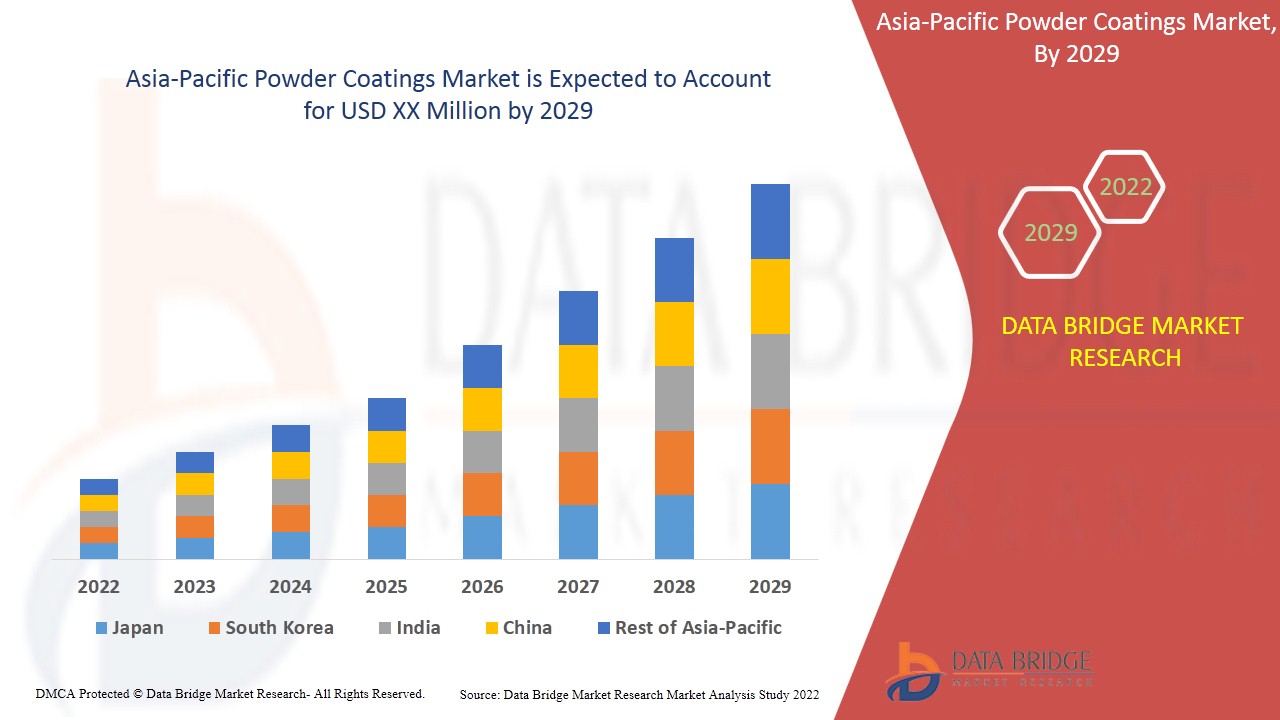

Data Bridge Market Research analyses the Asia-Pacific powder coatings market will exhibit a CAGR of 5.3% for the forecast period of 2022-2029.

Powder coating is a dry finishing method that offers several advantages, including increased resilience to deteriorated coating quality, which decreases scratches, corrosion, chipping, fading, and other wear concerns. This powder coating is made up of finely ground pigment and resin particles that are electrostatically charged and sprayed on grounded objects.

The rising production of automobiles will influence the growth rate of the powder coatings market. The surging demand for medical devices is the key elements driving market expansion. Along with this, increasing number of applications in shipbuilding and pipeline industries and surge in industrialization especially in the developing countries will increase the demand for the powder coatings market. The powder coatings market is also being driven by significant factors such as the upsurge in the level of disposable income and increasing urbanization. Furthermore, the rise in transportation infrastructure and changing lifestyle are the root cause for fuelling up the market growth rate. Rising number of technical innovations and expansion of various end user verticals in the emerging economies will also directly and positively impact the growth rate of the market. Rising demand for high-performance fluorine resin-based powder coating and strict government regulations will have positive impact on the growth rate of powder coatings market.

Moreover, rising demand for powder coatings for coil coating applications and upsurge in new application methods will create beneficial opportunities for the growth of the powder coatings market. Additionally, emerging new markets and growing focus on the technological advancements and modernization in the production techniques will provide lucrative opportunities for market’s growth.

However, complications linked with powder coatings to obtain thin films will pose a major challenge to the growth of the market. High costs involved with the product and growing concern for environment will dampen the market growth rate. Lack of awareness in the underdeveloped economies will also restrict the scope of growth.

This Asia-Pacific powder coatings market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographical expansions, technological innovations in the market. To gain more info on Asia-Pacific powder coatings market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Asia-Pacific Powder Coatings Market Scope and Market Size

The powder coatings market is segmented on the basis of resin type, coating method, substrate and end user industry. The growth amongst the different segments helps you in attaining the knowledge related to the different growth factors expected to be prevalent throughout the market and formulate different strategies to help identify core application areas and the difference in your target market.

- On the basis of resin type, the powder coatings market is segmented into thermoset and thermoplastic. Thermoset is further segmented into epoxy polyester hybrid, epoxy, polyester, acrylic, polyurethane and others. Thermoplastic is further segmented into polyvinyl chloride, nylon, polyvinyl fluoride (PVF) and polyolefin.

- On the basis of coating method, the powder coatings market is segmented into electrostatic spray coating, fluidized bed coating, electrostatic fluidized bed process and flame spraying.

- On the basis of substrate, the powder coatings market is segmented into metallic and non-metallic.

- On the basis of end user, the powder coatings market is segmented into appliances, automotive, general industrial, architecture, consumer goods, construction equipment and furniture.

Asia-Pacific Powder Coatings Market Country Level Analysis

The powder coatings market is segmented on the basis of resin type, coating method, substrate and end user industry.

The countries covered in Asia-Pacific powder coatings market report are China, Japan, India, South Korea, Australia and New Zealand, Indonesia, Singapore, Malaysia, Thailand, Philippines and rest of Asia-Pacific.

The country section of the Asia-Pacific powder coatings market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Powder Coatings Market Share Analysis

Asia-Pacific powder coatings market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to Asia-Pacific powder coatings market.

Some of the major players operating in the Asia-Pacific powder coatings market are Kansai Paint Co.,LTD, Asian Paints, Jotun, Evonik Industries AG, PPG Industries, Inc., The Sherwin-Williams Company, Valspar Industrial, Akzo Nobel NV, DSM, Arkema, DuPont, TCI Powder, and Axalta Coating Systems, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Powder Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Powder Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Powder Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.