Global Antimicrobial Powder Coatings Market

Market Size in USD Billion

CAGR :

%

USD

2.56 Billion

USD

4.01 Billion

2024

2032

USD

2.56 Billion

USD

4.01 Billion

2024

2032

| 2025 –2032 | |

| USD 2.56 Billion | |

| USD 4.01 Billion | |

|

|

|

|

Antimicrobial Powder Coatings Market Size

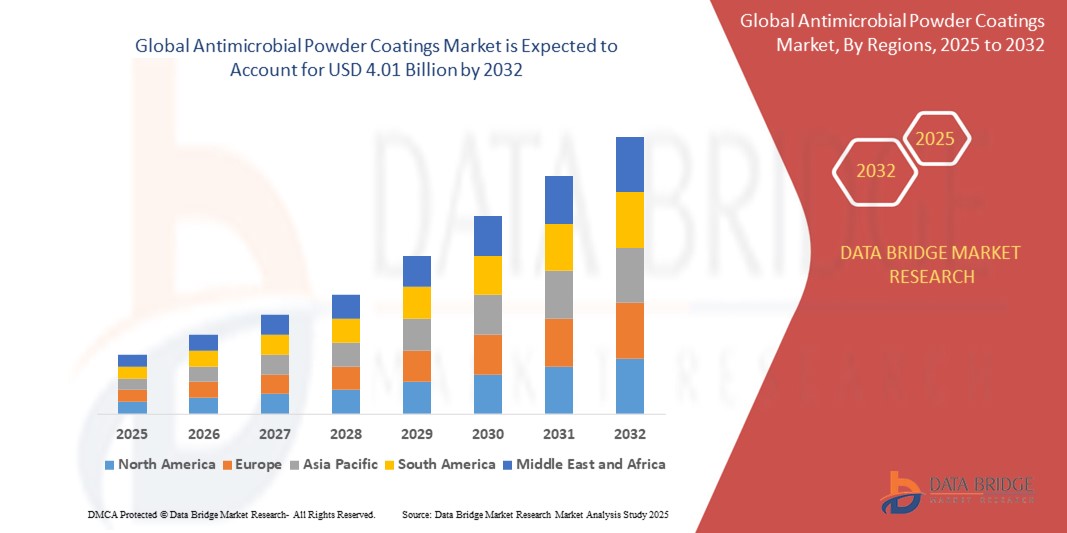

- The global antimicrobial powder coatings market size was valued at USD 2.56 billion in 2024 and is expected to reach USD 4.01 billion by 2032, at a CAGR of 5.75% during the forecast period

- The market growth is largely fueled by the rising awareness of hygiene and infection prevention, coupled with increasing demand from end-use industries such as healthcare, food processing, and construction, where surface protection is critical for safety and compliance

- Furthermore, the integration of advanced antimicrobial agents into powder coatings, combined with durability, eco-friendliness, and regulatory support for non-toxic solutions, is driving adoption across high-touch applications, thereby significantly boosting the industry's growth

Antimicrobial Powder Coatings Market Analysis

- Antimicrobial powder coatings are surface treatments formulated with agents that inhibit the growth of microorganisms such as bacteria, mold, and fungi. These coatings are applied to various substrates including metals, plastics, and ceramics, providing both protection and extended product life in high-use environments

- The escalating demand is primarily driven by stringent hygiene standards in sectors such as healthcare and food & beverage, growing awareness of surface-transmitted infections, and increased use in public infrastructure and HVAC systems to maintain clean, safe surfaces over time

- North America dominated the antimicrobial powder coatings market with a share of 45.2% in 2024, due to stringent hygiene regulations across healthcare, food processing, and public infrastructure sectors

- Asia-Pacific is expected to be the fastest growing region in the antimicrobial powder coatings market during the forecast period due to expanding industrialization, rapid urban development, and growing demand for antimicrobial protection in densely populated countries such as China and India

- Silver-based segment dominated the market with a market share of 61.8% in 2024, due to its superior antimicrobial efficacy, long-lasting protection, and broad-spectrum activity against bacteria, viruses, and fungi. Silver ions disrupt microbial cellular function, making them effective even at low concentrations. These coatings are widely used in high-touch environments such as hospitals, food processing units, and public infrastructure where hygiene is critical. Their thermal stability and compatibility with various substrates also enhance their applicability across industries

Report Scope and Antimicrobial Powder Coatings Market Segmentation

|

Attributes |

Antimicrobial Powder Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Antimicrobial Powder Coatings Market Trends

“Rising Demand in Healthcare”

- A significant and accelerating trend in the antimicrobial powder coatings market is the rapidly increasing demand from the healthcare sector, where infection prevention and hygiene standards are paramount

- For instance, hospitals, surgical centers, and dental practices are increasingly adopting antimicrobial powder coatings for medical devices, hospital beds, wheelchairs, handrails, and other high-touch surfaces to reduce the risk of hospital-acquired infections and contamination by bacteria, viruses, and fungi

- Stringent regulations and heightened awareness about infection control, especially after the COVID-19 pandemic, have intensified the focus on antimicrobial surfaces in healthcare environments, driving innovation and adoption of these coatings

- The World Health Organization reports a high incidence of healthcare-associated infections globally, further underscoring the need for effective antimicrobial solutions in medical facilities

- The trend is also expanding into other sectors such as food processing, public transportation, and residential construction, as businesses and consumers increasingly prioritize hygiene and cleanliness in shared and personal spaces

- Key players are developing advanced formulations that offer long-lasting antimicrobial protection, improved durability, and compliance with evolving regulatory standards, supporting the ongoing growth of the market

Antimicrobial Powder Coatings Market Dynamics

Driver

“Increasing Demand for Hygiene and Cleanliness”

- The growing emphasis on hygiene and cleanliness across multiple industries is a major driver for the antimicrobial powder coatings market, as organizations and consumers seek to minimize the risk of microbial contamination and transmission

- For instance, manufacturers such as AkzoNobel, PPG Industries, and Axalta are supplying antimicrobial powder coatings to healthcare facilities, food and beverage plants, HVAC systems, and public infrastructure to provide surfaces that resist microbial growth and support safer environments

- The COVID-19 pandemic has further heightened awareness of the importance of antimicrobial protection, accelerating the adoption of these coatings in both institutional and consumer applications

- Regulatory requirements and industry standards are increasingly mandating the use of antimicrobial finishes in critical sectors, supporting sustained demand for these products. The market is also benefiting from technological advancements that enhance the effectiveness, durability, and eco-friendliness of antimicrobial powder coatings, making them suitable for a wider range of applications and environments

- The expanding use of these coatings in building materials, transportation, and consumer goods reflects a broader societal shift toward prioritizing health and safety in everyday life

Restraint/Challenge

“High Initial Cost”

- High initial cost remains a significant challenge in the antimicrobial powder coatings market, as the specialized antimicrobial additives and rigorous testing requirements can substantially increase the price compared to conventional coatings

- For instance, the cost of incorporating silver-based or other advanced antimicrobial agents into powder coatings, along with the need for compliance with stringent regulatory standards, can make these products less accessible for price-sensitive industries or regions

- Manufacturers face additional expenses related to research, development, and certification, which can further drive up costs and limit adoption, particularly in developing markets or for applications with tight budget constraints

- The higher upfront investment required for antimicrobial powder coatings may deter some end users from switching from traditional coatings, despite the long-term benefits of improved hygiene and reduced maintenance

- Overcoming this challenge will require continued innovation to reduce material and production costs, as well as increased education about the long-term value and performance advantages of antimicrobial solutions

Antimicrobial Powder Coatings Market Scope

The market is segmented on the basis of antimicrobial agent and application.

- By Antimicrobial Agent

On the basis of antimicrobial agent, the antimicrobial powder coatings market is segmented into silver-based, copper-based, and organic-based. The silver-based segment dominated the largest market revenue share of 61.8% in 2024, primarily due to its superior antimicrobial efficacy, long-lasting protection, and broad-spectrum activity against bacteria, viruses, and fungi. Silver ions disrupt microbial cellular function, making them effective even at low concentrations. These coatings are widely used in high-touch environments such as hospitals, food processing units, and public infrastructure where hygiene is critical. Their thermal stability and compatibility with various substrates also enhance their applicability across industries.

The organic-based segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing demand for eco-friendly and non-metallic alternatives. Organic antimicrobial agents, including quaternary ammonium compounds and naturally derived biocides, are gaining preference due to regulatory push towards sustainability and reduced metal content in consumer-facing products. Their safer environmental profile and potential use in applications involving close human contact, such as textiles and furniture, are accelerating adoption.

- By Application

On the basis of application, the antimicrobial powder coatings market is segmented into healthcare, food and beverages, textile, air conditioning and ventilation system, paints and coatings, building and construction, and others. The healthcare segment accounted for the largest revenue share in 2024, driven by stringent hygiene standards and infection control protocols in hospitals, clinics, and medical device manufacturing. Antimicrobial coatings are widely applied on hospital beds, surgical equipment, door handles, and walls to reduce the spread of hospital-acquired infections (HAIs). The rising focus on patient safety and the increased deployment of antimicrobial technologies in post-pandemic healthcare infrastructures further reinforce this segment’s dominance.

The air conditioning and ventilation system segment is expected to register the fastest CAGR from 2025 to 2032, owing to growing awareness about indoor air quality and the role of HVAC systems in harboring and spreading microbes. Antimicrobial coatings prevent the growth of mold, mildew, and bacteria on HVAC surfaces, improving operational efficiency and ensuring healthier air circulation. The surge in commercial and residential HVAC installations and increasing regulatory standards for clean indoor environments are key drivers for the rapid growth of this application segment.

Antimicrobial Powder Coatings Market Regional Analysis

- North America dominated the antimicrobial powder coatings market with the largest revenue share of 45.2% in 2024, driven by stringent hygiene regulations across healthcare, food processing, and public infrastructure sectors

- The region's demand is fueled by the rising prevalence of hospital-acquired infections, strong industrial safety standards, and increased awareness around antimicrobial protection in high-touch surfaces

- The widespread use of powder coatings across building materials, HVAC systems, and medical equipment, coupled with rapid adoption of surface protection technologies, supports sustained regional growth

U.S. Antimicrobial Powder Coatings Market Insight

The U.S. antimicrobial powder coatings market captured the largest share in North America in 2024, led by a well-established healthcare infrastructure and growing demand for infection-resistant surfaces in hospitals and public spaces. Federal and state-level health and safety guidelines mandate the use of antimicrobial materials in critical environments, supporting broader deployment. Rising demand from food and beverage packaging and HVAC manufacturing also contributes to robust market performance. Technological innovations and investment in R&D by leading manufacturers further strengthen the U.S. position in this market.

Europe Antimicrobial Powder Coatings Market Insight

Europe is projected to witness stable growth in the antimicrobial powder coatings market, supported by stringent environmental regulations and widespread adoption across healthcare, construction, and food industries. The European market is characterized by high consumer awareness and strict compliance with REACH and biocide directives, encouraging the use of effective, non-toxic antimicrobial additives in powder coatings. Growing construction activity, especially in Western Europe, along with the renovation of healthcare facilities and institutional buildings, is driving demand for antimicrobial surface treatments

Germany Antimicrobial Powder Coatings Market Insight

The Germany market is anticipated to grow at a steady CAGR, driven by its leadership in healthcare infrastructure and manufacturing innovation. Hospitals and eldercare facilities increasingly apply antimicrobial coatings to prevent pathogen transmission, while demand in HVAC and cleanroom systems supports industrial uptake. Regulatory emphasis on eco-friendly and durable materials also aligns well with powder coating technologies, reinforcing their market position across Germany’s industrial and architectural sectors.

U.K. Antimicrobial Powder Coatings Market Insight

The U.K. market is expected to grow steadily due to increasing investments in healthcare and construction sectors. Rising concerns over infection control in hospitals and public spaces, especially post-COVID-19, are accelerating the adoption of antimicrobial coatings. Public health agencies and building code mandates further reinforce market demand, while the U.K.’s focus on sustainable, high-performance coatings fuels innovation and adoption of powder-based antimicrobial solutions.

Asia-Pacific Antimicrobial Powder Coatings Market Insight

Asia-Pacific is anticipated to register the fastest CAGR from 2025 to 2032, driven by expanding industrialization, rapid urban development, and growing demand for antimicrobial protection in densely populated countries such as China and India. The rising construction of hospitals, commercial buildings, and food manufacturing units, coupled with increasing awareness of hygiene and product durability, is catalyzing adoption of powder coatings with antimicrobial properties. Government regulations supporting improved sanitation standards and the region's strength in manufacturing are also contributing to rapid market expansion

China Antimicrobial Powder Coatings Market Insight

China accounted for the largest share in the Asia-Pacific market in 2024, propelled by large-scale urban development, rising healthcare infrastructure, and government-backed sanitation drives. The availability of cost-effective raw materials and a strong domestic manufacturing base for coatings are fostering supply-side growth. Increasing demand from building construction, HVAC systems, and public transport infrastructure reinforces the country’s leadership in this market.

Japan Antimicrobial Powder Coatings Market Insight

Japan’s market is growing steadily, influenced by its advanced technology base and focus on infection control across healthcare, public transportation, and aging infrastructure. Hospitals, schools, and commercial facilities are incorporating antimicrobial powder coatings to maintain hygiene and reduce maintenance. Japan's regulatory framework and consumer emphasis on clean, long-lasting surfaces support sustained adoption, particularly in public and healthcare-related projects.

Antimicrobial Powder Coatings Market Share

The antimicrobial powder coatings industry is primarily led by well-established companies, including:

- The Sherwin-Williams Company (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Axalta Coating Systems, LLC (U.S.)

- Berger Paints India (India)

- Pulver Inc. (Turkey)

- IGP Pulvertechnik AG (Switzerland)

- Protech Group (Canada)

- Rapid Engineering Co. Pvt. Ltd. (India)

- PPG Industries, Inc. (U.S.)

- Lonza (Switzerland)

- IFS Coatings (U.S.)

- BASF (Germany)

- DSM (Netherlands)

- Microban International (U.S.)

- Tulip Paints (India)

- APCL (India)

Latest Developments in Global Antimicrobial Powder Coatings Market

- In June 2024, NEI Corporation introduced NANOMYTE AM-100EC, a micron-thick coating that combines easy-to-clean and antimicrobial functionalities, significantly strengthening the value proposition for high-touch surfaces across sectors such as healthcare, food service, education, and public transportation. This innovation is expected to positively influence the antimicrobial powder coatings market by expanding application versatility and addressing growing hygiene demands in critical industries

- In 2023, Sherwin-Williams Company and BASF SE forged a partnership to create innovative antimicrobial powder coating tailored for the healthcare sector. This collaboration aims to enhance infection control and surface hygiene in medical environments by integrating advanced antimicrobial technology into powder coatings

- In 2023, AkzoNobel partnered with BioCote to broaden the scope of their antimicrobial powder coatings under the “Interpon” brand. This strategic alliance allows the application of these coatings across various internal surfaces, including ceiling tiles, window frames, metal doors, office partitions, and elevator doors, promoting enhanced hygiene and durability

- In 2022, PPG Industries, Inc. acquired AkzoNobel's powder coatings business, solidifying its presence in the European market. This acquisition enabled PPG Industries to strengthen its position and expand its portfolio in the antimicrobial powder coatings sector, leveraging AkzoNobel’s established expertise and market share

- In May 2020, AkzoNobel N.V. enhanced its Interpon D1000 and D2000 architectural powder coating lines with antimicrobial properties in response to heightened hygiene awareness following the COVID-19 pandemic. This strategic move accelerated the adoption of antimicrobial coatings in the construction and architectural sectors, supporting market expansion by aligning with consumer and regulatory demand for surfaces that contribute to safer, cleaner environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Antimicrobial Powder Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Antimicrobial Powder Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Antimicrobial Powder Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.