Asia Pacific Protective Films Market

Market Size in USD Million

CAGR :

%

USD

875.07 Million

USD

1,332.81 Million

2022

2030

USD

875.07 Million

USD

1,332.81 Million

2022

2030

| 2023 –2030 | |

| USD 875.07 Million | |

| USD 1,332.81 Million | |

|

|

|

Asia-Pacific Protective Films Market Analysis and Size

Protective films are in higher demand since they extend the durability and useful life of the material by shielding it from scuffs and abrasions. In order to increase the size of the protective film market, technology developments are also anticipated to offer a sustainable product with protection against environmental damage.

Typically, surface protection films are applied to surfaces to shield them from dust particles and prevent surface scratches. They give products a usable life, are used to safeguard expensive items in an economical manner, and are unaffected by the penetration of environmental elements like chemicals.

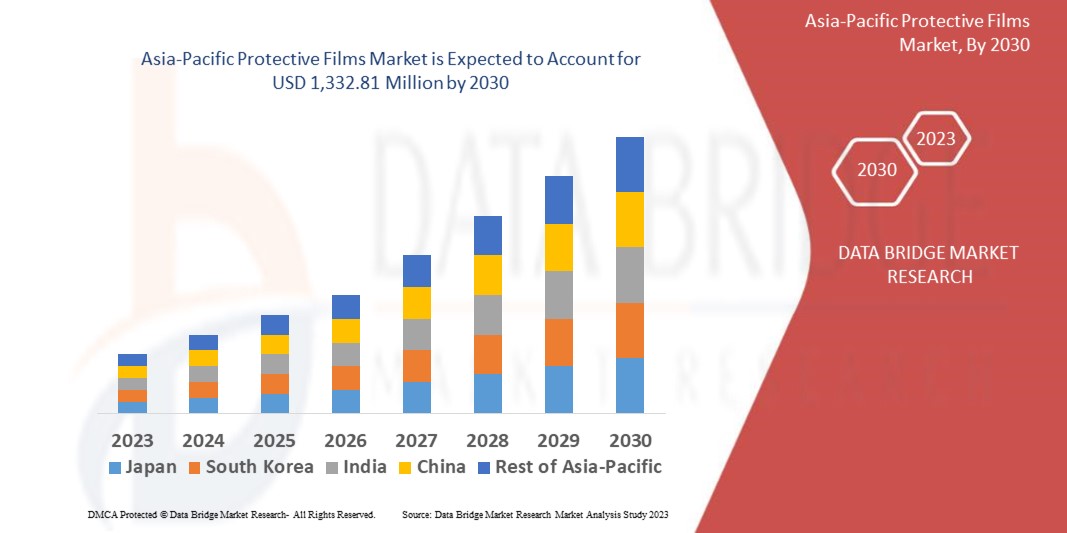

Data Bridge Market Research analyses that the Asia-Pacific protective films market, which was USD 875.07 million in 2022, would rocket up to USD 1,332.81 million by 2030 and is expected to undergo a CAGR of 5.4% during the forecast period of 2023 to 2030. Rising global demand from several end-use industries, including building and construction, transportation, and electronics. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Asia-Pacific Protective Films Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Tons, Pricing in USD |

|

Segments Covered |

Class (Adhesive-Coated, Self-Adhesive), Material (Polyethylene, Polypropylene, Polyethylene Terephthalate, Polyvinyl Chloride, Polyurethane, Polyamide, Polyester, Paper, Others), Thickness (0 - 2 Mm, 2 - 4 Mm, 4 - 6 Mm, 6 - 8 Mm, 8 - 10 Mm, Others), Surface (Metals, Glass, Textiles, Wood, Marbles, Molded Plastics, Others), Texture (Opaque, Transparent, Glossy, Matte, Others), End-User (Building & Construction, Automotive, Electronics, Life Science, Aerospace, Packaging, Industrial, Marine, Others) |

|

Countries Covered |

Japan, China, India, South Korea, Australia, New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest Of Asia-Pacific |

|

Market Players Covered |

Nitto Denko Corporation. (Japan), Saint-Gobain S.A. (France), The 3M Company (U.S.), Chargeurs Reunis (France), DuPont. (U.S.), Eastman Chemical Company or its subsidiaries. (U.S.), HEXIS S.A.S. (France), AVERY DENNISON CORPORATION. (U.S.), Reflek Technologies Corporation (U.S.), ORAFOL Group (U.S.) |

|

Market Opportunities |

|

Market Definition

Surface protection films are most frequently used to shield surfaces from dust and prevent surface scratches. The structure of these films comprises an adhesive layer that is placed on top of a polymer substrate layer. They are easy to peel off once operations are finished, ensuring a spotless surface free of any stains or leftover residue. Protective films can be sliced, wrapped, or rolled up as required. The growing demand for contemporary smartphones and touchscreens, which require polyester-based protective films to shield sensors and touchscreens from damage during production and shipment, is anticipated to boost the market for protective films.

Asia-Pacific Protective Films Market Dynamics

Drivers

- Growing demand from various industries

The increasing demand for protective films across industries such as electronics, automotive, construction, and packaging is a key driver. These films provide protection against scratches, abrasion, dust, and other damages during transportation, storage, and handling.

- Expanding construction sector

The booming construction industry in countries like China, India, and Southeast Asian nations creates a significant demand for protective films to protect surfaces during construction, renovation, and maintenance activities.

Opportunities

- Diversification of customer base

Protective film producers in the Asia-Pacific area should concentrate on discovering new markets and diversifying their clientele in other nations as a result of a projected drop in demand from Germany. This offers a chance to increase their footprint and reach rising economies with expanding sectors.

- Technological advancements

There are prospects for market expansion due to developments in protective film technology, such as the creation of high-performance films with sophisticated adhesive systems, antimicrobial qualities, and features for simple application.

Restraints/Challenges

- Regulatory constraints

Compliance with various regulations and standards related to product safety, environmental impact, and labeling requirements can pose challenges for manufacturers, particularly in terms of additional costs and compliance procedures.

- Raw material price volatility

Fluctuations in the prices of raw materials used in protective films, such as polyethylene, polypropylene, and adhesive components, is expected to pose challenges for manufacturers in managing costs and pricing strategies.

Recent Development

- On September, 2022, Surface solution specialist Novacel teamed with polymer producer LyondellBasell, converter Granger Frères SAS, and polymer manufacturer LyondellBasell to develop protective films using polyethylene (PE) polymers generated from sustainable resources. This project used a mass balancing approach

- On August 2022, BASF Paint Protection Film, a paint-related product company, released its new invisible Themoplastic Polyurethane Paint Protection Film in Asia-Pacific. It protects vehicle coatings in a variety of ways and for a long time. This will broaden the company's product offering

Asia-Pacific Protective Films Market Scope

The Asia-Pacific protective films market is segmented on the basis of class, material, thickness, surface, texture, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Asia-Pacific Protective Films Market, By Class

- Adhesive-Coated

- Self-Adhesive

Asia-Pacific Protective Films Market, By Material

- Polyethylene

- Polypropylene

- Polyethylene Terephthalate

- Polyvinyl Chloride

- Polyurethane

- Polyamide

- Polyester

- Paper

- Others

Asia-Pacific Protective Films Market, By Thickness

- 0 - 2 MM

- 2 - 4 MM

- 4 - 6 MM

- 6 - 8 MM

- 8 - 10 MM

- Others

Asia-Pacific Protective Films Market, By Surface

- Metals

- Glass

- Textiles

- Wood

- Marbles

- Molded Plastics

- Others

Asia-Pacific Protective Films Market, By Texture

- Opaque

- Transparent

- Glossy

- Matte

- Others

Asia-Pacific Protective Films Market, By End-User

- Cosmetic & Personal Care

- Building & Construction

- Automotive

- Electronics

- Life Science

- Aerospace

- Packaging

- Industrial

- Marine

- Others

Asia-Pacific Protective Films Market Regional Analysis/Insights

Asia-Pacific protective films market is analysed, and market size insights and trends are provided by country, type, price range, application as referenced above.

The countries covered in the Asia-Pacific protective films market report are Japan, China, India, South Korea, Australia, New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific.

China is expected to dominate the protective films market due to the high availability of plastic raw materials in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific protective films market Share Analysis

The Asia-Pacific protective films market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the nucleating and clarifying agents market.

Some of the major players operating in the Asia-Pacific protective films market are:

- Nitto Denko Corporation. (Japan)

- Saint-Gobain S.A. (France)

- The 3M Company (U.S.)

- Chargeurs Reunis (France)

- DuPont. (U.S.)

- Eastman Chemical Company or its subsidiaries. (U.S.)

- HEXIS S.A.S. (France)

- AVERY DENNISON CORPORATION. (U.S.)

- Reflek Technologies Corporation (U.S.)

- ORAFOL Group (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Protective Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Protective Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Protective Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.