Asia Pacific Protein Hydrolysates For Animal Feed Application Market

Market Size in USD Million

CAGR :

%

USD

278.71 Million

USD

457.82 Million

2024

2032

USD

278.71 Million

USD

457.82 Million

2024

2032

| 2025 –2032 | |

| USD 278.71 Million | |

| USD 457.82 Million | |

|

|

|

|

Protein Hydrolysates for Animal Feed Application Market Size

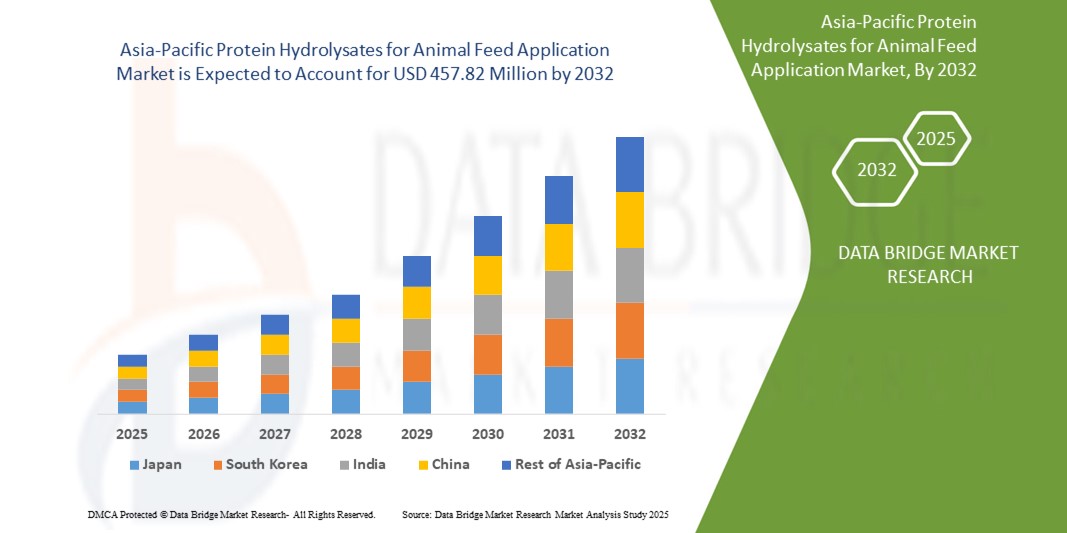

- The Asia-Pacific protein hydrolysates for animal feed application market size was valued at USD 278.71 million in 2024 and is expected to reach USD 457.82 million by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely fueled by the increasing awareness among livestock and aquaculture farmers about the advantages of protein hydrolysates, such as enhanced animal health, better digestibility, and improved growth performance

- Furthermore, rising demand for high-quality, nutrient-dense feed ingredients in the region's rapidly expanding livestock and aquaculture industries is significantly boosting the industry's growth

Protein Hydrolysates for Animal Feed Application Market Analysis

- Protein hydrolysates for animal feed applications, offering easily digestible and highly bioavailable amino acids and peptides, are increasingly vital components of modern animal nutrition. They improve feed palatability, support muscle development, enhance immune function, and overall animal health across various livestock

- The escalating demand for protein hydrolysates is primarily fueled by the growing livestock and aquaculture industries in the Asia-Pacific region, coupled with a heightened focus on improving animal health, productivity, and feed efficiency

- China dominated the Asia-Pacific Protein Hydrolysates for Animal Feed Application market with the largest revenue share of 66.6% in 2024, characterized by its substantial livestock and aquaculture production, large consumer base, and significant demand for high-quality feed ingredients, particularly in infant nutrition

- Japan is expected to be the fastest-growing country in the Asia-Pacific Protein Hydrolysates for Animal Feed Application market during the forecast period, driven by its commitment to advancing livestock nutrition and health, steady growth in meat and poultry consumption, and technological advancements in feed production

- The animal protein hydrolysate segment dominated the largest market revenue share of 38.2% in 2024, driven by its rich amino acid profiles sourced from poultry, swine, and cattle, which are essential for livestock growth and development

Report Scope and Protein Hydrolysates for Animal Feed Application Market Segmentation

|

Attributes |

Protein Hydrolysates for Animal Feed Application Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Protein Hydrolysates for Animal Feed Application Market Trends

“Increasing Adoption of Sustainable and Plant-Based Protein Hydrolysates”

- The Asia-Pacific protein hydrolysates for animal feed application market is experiencing a notable trend toward the use of sustainable and plant-based protein hydrolysates

- These hydrolysates, derived from sources like soy, wheat, and other botanical materials, are gaining traction due to growing environmental concerns and the demand for eco-friendly feed solutions

- Advanced processing technologies, such as enzymatic hydrolysis, are enhancing the efficiency and nutritional value of plant-based hydrolysates, making them competitive with animal-derived alternatives

- For instances, companies are developing innovative plant-based hydrolysate formulations to cater to the rising demand for sustainable aquaculture and livestock feed, particularly in countries like China and India

- This trend aligns with the region’s increasing focus on reducing the environmental footprint of animal farming and meeting consumer preferences for sustainable practices

- Data analytics and precision nutrition are also being integrated to optimize feed formulations, ensuring better nutrient absorption and animal health outcomes

Protein Hydrolysates for Animal Feed Application Market Dynamics

Driver

“Growing Demand for High-Quality Animal Nutrition and Aquaculture Expansion”

- The rising demand for high-quality, nutrient-dense animal feed to support livestock and aquaculture growth is a key driver for the Asia-Pacific protein hydrolysates market

- Protein hydrolysates enhance feed efficiency by providing highly digestible peptides and amino acids, which improve animal growth, health, and productivity

- Government initiatives in countries like China, India, and Vietnam to boost aquaculture and livestock production are increasing the adoption of advanced feed ingredients like protein hydrolysates

- The proliferation of large-scale aquaculture industries, particularly in Asia-Pacific, which accounts for a significant share of global seafood production, further fuels demand for fish and plant protein hydrolysates

- Feed manufacturers are increasingly incorporating hydrolysates as standard ingredients to meet the nutritional needs of diverse livestock, including poultry, swine, and aquatic species

Restraint/Challenge

“High Production Costs and Regulatory Complexities”

- The high cost of producing protein hydrolysates, particularly through advanced technologies like enzymatic hydrolysis, poses a significant barrier to widespread adoption, especially for small-scale farmers in emerging markets

- The complex and costly processes involved in sourcing, processing, and purifying protein hydrolysates can make them less competitive compared to traditional protein sources

- In addition, regulatory challenges related to feed safety, quality standards, and environmental impact create hurdles for manufacturers. The Asia-Pacific region has a diverse regulatory landscape, with varying standards across countries, complicating compliance for international players

- Concerns about the sustainability of raw material sourcing, particularly for fish protein hydrolysates, and potential environmental impacts further challenge market growth

- These factors can limit market expansion in price-sensitive markets and regions with stringent regulatory frameworks

Protein Hydrolysates for Animal Feed Application market Scope

The market is segmented on the basis of source, form, livestock, technology, and application.

- By Source

On the basis of source, the Asia-Pacific protein hydrolysates for animal feed application market is segmented into animal protein hydrolysate, fish protein hydrolysate, plant protein hydrolysate, and milk protein hydrolysate. The animal protein hydrolysate segment dominated the largest market revenue share of 38.2% in 2024, driven by its rich amino acid profiles sourced from poultry, swine, and cattle, which are essential for livestock growth and development. Its widespread use in poultry and swine feed formulations supports its dominance in the region, particularly in the U.S., where high consumer spending on animal feed products fuels demand.

The plant protein hydrolysate segment is expected to witness the fastest growth rate of 6.8% from 2025 to 2032. Increasing consumer demand for sustainable and environmentally friendly feed ingredients, coupled with advancements in plant-based protein processing, is driving adoption. This segment is gaining traction in Canada, where growing awareness of eco-friendly feed solutions aligns with the region's focus on sustainable agriculture.

- By Form

On the basis of form, the Asia-Pacific protein hydrolysates for animal feed application market is segmented into powder and paste forms. The powder segment dominated with a market revenue share of 62.8% in 2024, attributed to its ease of handling, longer shelf life, and versatility in feed formulations. Powdered hydrolysates are preferred in large-scale feed production, particularly in the U.S., due to their consistent mixing and cost-effectiveness.

The paste segment is anticipated to experience significant growth from 2025 to 2032, driven by its high nutritional value and increasing application in specialized feed for aquaculture and pet nutrition. The segment’s growth is supported by innovations in paste formulations that enhance digestibility, particularly in Canada’s expanding aquaculture sector.

- By Livestock

On the basis of livestock, the Asia-Pacific protein hydrolysates for animal feed application market is segmented into poultry, swine, cattle, calves, aquaculture, equine, and pet. The poultry segment held the largest market revenue share of 34.8% in 2024, driven by the high demand for poultry products such as meat and eggs in the U.S., where protein hydrolysates enhance feed efficiency and growth rates. The segment benefits from the region’s large poultry industry and consumer focus on high-quality animal nutrition.

The aquaculture segment is expected to witness the fastest growth rate of 7.2% from 2025 to 2032. The rising demand for high-quality seafood products and sustainable aquafeed formulations in Canada, coupled with the use of fish protein hydrolysates for their rich amino acid profiles and omega-3 fatty acids, drives this segment’s rapid expansion.

- By Technology

On the basis of technology, the Asia-Pacific protein hydrolysates for animal feed application market is segmented into acid hydrolysis and enzymatic hydrolysis. The enzymatic hydrolysis segment held the largest market revenue share of 58.6% in 2024, owing to its ability to produce high-quality, bioavailable protein hydrolysates with precise control over peptide size. This technology is widely adopted in the U.S. for its superior digestibility and nutritional retention, particularly in poultry and aquaculture feed.

The acid hydrolysis segment is anticipated to grow significantly from 2025 to 2032, driven by its cost-effectiveness and efficiency in large-scale production. In Canada, where the market is growing rapidly, acid hydrolysis is gaining traction for its ability to meet the increasing demand for affordable protein hydrolysates in livestock and aquaculture feed.

- By Application

On the basis of application, the Asia-Pacific protein hydrolysates for animal feed application market is segmented into industrial and commercial applications. The industrial application segment dominated with a market revenue share of 60.4% in 2024, driven by the widespread use of protein hydrolysates in large-scale feed manufacturing for livestock and aquaculture in the U.S. The segment benefits from the region’s advanced feed production infrastructure and high demand for efficient, nutrient-dense feed solutions.

The commercial application segment is expected to witness robust growth from 2025 to 2032, fueled by increasing adoption in pet food and specialized livestock feed. In Canada, the fastest-growing market, rising consumer awareness of pet health and premium nutrition drives demand for protein hydrolysates in commercial feed formulations.

Protein Hydrolysates for Animal Feed Application Market Regional Analysis

- China dominated the Asia-Pacific Protein Hydrolysates for Animal Feed Application market with the largest revenue share of 66.6% in 2024, characterized by its substantial livestock and aquaculture production, large consumer base, and significant demand for high-quality feed ingredients, particularly in infant nutrition

- Japan is expected to be the fastest-growing country in the Asia-Pacific Protein Hydrolysates for Animal Feed Application market during the forecast period, driven by its commitment to advancing livestock nutrition and health, steady growth in meat and poultry consumption, and technological advancements in feed production

China Protein Hydrolysates for Animal Feed Application Market Insight

China dominated the largest share of the Asia-Pacific Protein Hydrolysates for Animal Feed Application market share of 77.9% in 2024, propelled by rapid urbanization, increasing animal protein consumption, and a large and growing livestock and aquaculture industry. The country's strong domestic manufacturing capabilities and increasing awareness among farmers about the benefits of protein hydrolysates for animal health and growth further enhance market accessibility and demand.

Japan Protein Hydrolysates for Animal Feed Application Market Insight

Japan's Protein Hydrolysates for Animal Feed Application market is expected to witness the fastest growth rate, due to strong consumer preference for high-quality, technologically advanced feed ingredients that enhance animal health and productivity. The presence of major animal feed manufacturers and increasing research and development activities to integrate protein hydrolysates in various livestock feeds accelerate market penetration. Rising interest in sustainable and efficient animal farming practices also contributes to growth.

Protein Hydrolysates for Animal Feed Application Market Share

The protein hydrolysates for animal feed application industry is primarily led by well-established companies, including:

- Titan Biotech Limited (India)

- BRF Ingredients (Brazil)

- Eco Agri (Cambodia)

- Bioibérica (Spain)

- Kemin Industries, Inc. (U.S.)

- Janatha Fish Meal & Oil Products. (India)

- Bio-marine Ingredients Ireland Ltd. (Ireland)

- ZXCHEM U.S. INC (U.S.)

- Nutrifish (Tunisia)

- Sampi, A. Costantino & C. S.P.A (Italy)

- CRESCENT BIOTECH (India)

- Interra International (U.S.)

- Tessenderlo Group (Belgium)

- Cargill, Incorporated (U.S.)

- Kerry Group Plc (Ireland)

What are the Recent Developments in Asia-Pacific Protein Hydrolysates for Animal Feed Application Market?

- In July 2023, Bio-Marine Ingredients Ireland Ltd. launched a new fish protein hydrolysate product specifically designed for aquaculture feed applications. Derived from sustainable fish by-products, this high-quality ingredient offers enhanced digestibility and a rich amino acid profile, supporting optimal growth and health in farmed fish. The product aligns with the increasing demand for eco-friendly, protein-rich feed solutions in the Asia-Pacific aquaculture sector, a region experiencing rapid expansion in seafood production. This launch reinforces Bio-Marine’s commitment to sustainability and innovation in marine-based nutrition

- In June 2023, Symrise AG, through its Diana Aqua division (now operating as Symrise Aqua Feed), entered into a strategic partnership with a prominent Chinese aquaculture feed manufacturer to co-develop species-specific fish protein hydrolysates. This collaboration focuses on addressing the unique nutritional requirements of aquatic species in China’s rapidly expanding aquaculture sector. By leveraging Symrise’s advanced enzymatic hydrolysis technology, the partnership aims to deliver high-performance, sustainable feed ingredients that enhance fish growth, health, and feed efficiency. The initiative underscores Symrise’s commitment to innovation and tailored nutrition solutions in global aquafeed markets

- In April 2023, SOPROPECHE, a French marine ingredient specialist, acquired a minority stake in a Vietnamese fish protein hydrolysate producer to bolster its production capacity in the Asia-Pacific region. This strategic move enhances SOPROPECHE’s supply chain resilience and distribution network, enabling the company to better serve the rising demand for sustainable, high-quality aquafeed ingredients in Vietnam and surrounding markets. The investment aligns with SOPROPECHE’s commitment to expanding its global footprint and supporting the aquaculture industry with nutrient-rich, marine-based protein solutions

- In March 2023, Kemin Industries Inc. introduced a plant-based protein hydrolysate tailored for poultry feed applications in India, developed using advanced enzymatic hydrolysis. This innovation supports the growing shift toward sustainable, plant-centric animal nutrition, offering benefits such as enhanced feed efficiency, improved digestibility, and better animal health outcomes. The launch aligns with increasing demand for clean-label, high-performance feed ingredients that reduce reliance on traditional animal-based proteins while maintaining nutritional integrity

- In February 2023, Azelis S.A. entered into a distribution agreement with an Indian plant protein hydrolysate manufacturer to expand its animal feed ingredient portfolio across the Asia-Pacific region. This strategic partnership strengthens Azelis’s regional presence and aligns with the rising demand for sustainable, high-quality feed solutions in India’s livestock sector. By leveraging local manufacturing capabilities and Azelis’s global distribution network, the collaboration aims to deliver innovative, plant-based nutrition solutions that support animal health and environmental sustainability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Protein Hydrolysates For Animal Feed Application Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Protein Hydrolysates For Animal Feed Application Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Protein Hydrolysates For Animal Feed Application Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.