Asia Pacific Pulse Protein Market

Market Size in USD Billion

CAGR :

%

USD

7.27 Billion

USD

12.87 Billion

2025

2033

USD

7.27 Billion

USD

12.87 Billion

2025

2033

| 2026 –2033 | |

| USD 7.27 Billion | |

| USD 12.87 Billion | |

|

|

|

|

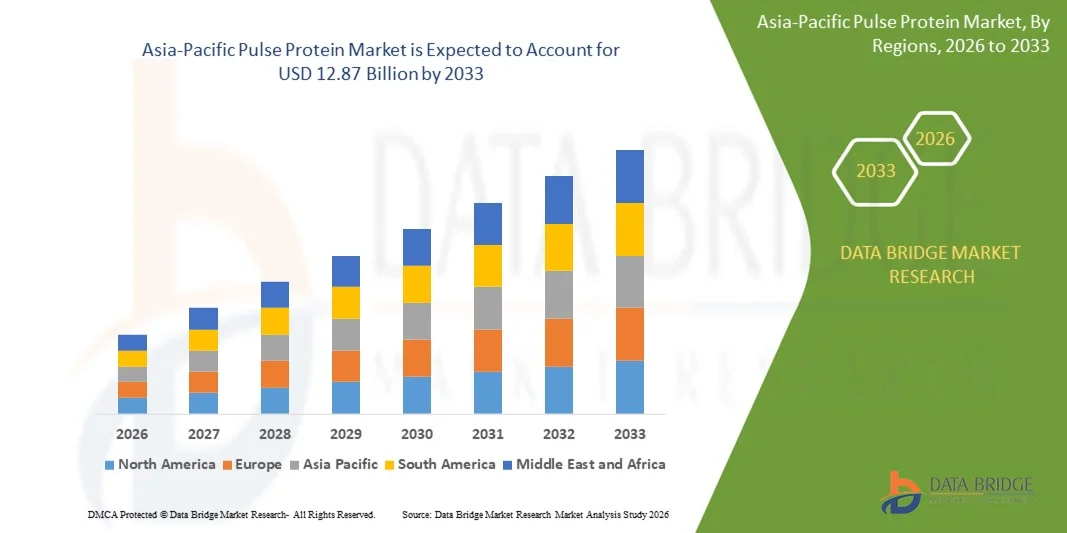

What is the Asia-Pacific Pulse Protein Market Size and Growth Rate?

- The Asia-Pacific pulse protein market size was valued at USD 7.27 billion in 2025 and is expected to reach USD 12.87 billion by 2033, at a CAGR of 7.40% during the forecast period

- The rise in demand of gluten and allergen free products is boosting the growth of the pulse protein market. High cost of organic pulse protein is restricting the growth of the pulse protein market

What are the Major Takeaways of Pulse Protein Market?

- The use of pulse proteins has increased as pulse protein plants helps in biodiversity and improves soil quality. Pulse protein can be available to the individuals by two extraction process which are wet processing and dry processing

- China dominated the Asia-Pacific pulse protein market with an estimated 41.87% revenue share in 2025, driven by strong demand from processed food manufacturing, bakery, dairy, and meat & poultry processing industries

- India is projected to register the fastest CAGR of 8.45% from 2026 to 2033, supported by rapid growth in food processing facilities, high reliance on plant-based protein consumption, and expanding bakery, dairy, and meat processing industries

- The Peas segment dominated the market with an estimated 28.4% share in 2025, supported by high protein content, neutral flavor, and versatile functional properties, making it ideal for bakery, beverages, snacks, and meat alternatives

Report Scope and Pulse Protein Market Segmentation

|

Attributes |

Pulse Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Pulse Protein Market?

Rising Shift Toward High-Quality, Functional, and Application-Specific Pulse Proteins

- The pulse protein market is witnessing growing adoption of high-purity, contaminant-controlled, and standardized protein isolates and concentrates to meet strict food safety and nutritional standards

- Manufacturers are expanding portfolios with fortified and functional pulse proteins, including blends enriched with essential amino acids, fiber, or plant-based nutrients for food and beverage applications

- Increasing demand for consistent solubility, digestibility, and functional performance is driving adoption across food processing, plant-based products, and nutritional supplements

- For instance, companies such as Cargill, Ingredion, ADM, Kerry, and AGT Food and Ingredients are scaling production of high-quality pulse protein isolates and concentrates for clean-label foods and beverages

- Rising focus on plant-based diets, protein fortification, and sports nutrition is accelerating demand for versatile pulse protein ingredients

- As regulatory compliance, nutritional awareness, and consumer preference for plant-based diets grow, Pulse Proteins remain essential inputs across food, beverage, and supplement industries

What are the Key Drivers of Pulse Protein Market?

- Increasing demand for plant-based, clean-label, and high-protein ingredients in packaged foods, dairy alternatives, nutritional bars, and sports supplements

- For instance, during 2024–2025, leading companies such as Cargill, ADM, Kerry, and AGT Food and Ingredients expanded capacity for high-purity pulse protein isolates and concentrates to meet growing global demand

- Growth in plant-based food consumption, protein-enriched products, and functional nutrition trends across the U.S., Europe, and Asia-Pacific is boosting market expansion

- Advancements in extraction technologies, protein purification, and functionalization enhance solubility, taste, and applicability in multiple food formats

- Rising inclusion of pulse proteins in meat alternatives, dairy-free beverages, bakery, and snack applications further supports adoption

- Supported by growing health-conscious consumer trends and rising plant-based diet adoption, the Pulse Protein market is projected to witness strong long-term growth

Which Factor is Challenging the Growth of the Pulse Protein Market?

- High costs associated with advanced extraction, purification, and protein fortification can restrict adoption among small-scale food manufacturers

- For instance, during 2024–2025, fluctuations in raw pulse availability, logistic costs, and energy prices impacted production efficiency and margins for key manufacturers

- Variation in functional properties, taste, and solubility between different pulse protein sources can pose formulation challenges for food developers

- Consumer preference for animal-based proteins in certain regions may limit plant-based protein penetration

- Competition from other plant proteins such as soy, pea, or rice proteins creates pricing and market share pressures

- To overcome these challenges, companies are focusing on R&D-driven functional protein development, cost optimization, sustainable sourcing, and product diversification to increase global adoption of pulse proteins

How is the Pulse Protein Market Segmented?

The market is segmented on the basis of pulse type, category, extraction process, form, function, and application.

- By Pulse Type

On the basis of pulse type, the pulse protein market is segmented into Black Lentils, Green Lentils, Peas, Navy Beans, Chickpeas, Black Beans, Kidney Beans, Lupins, Faba Bean, and Others. The Peas segment dominated the market with an estimated 28.4% share in 2025, supported by high protein content, neutral flavor, and versatile functional properties, making it ideal for bakery, beverages, snacks, and meat alternatives. Pea proteins are widely adopted due to clean-label appeal, hypoallergenic properties, and ease of processing into isolates, concentrates, and hydrolysates.

The Chickpeas segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for plant-based protein in functional foods, beverages, and dietary supplements. Rising consumer preference for gluten-free, high-fiber, and nutrient-rich pulse proteins accelerates adoption in developed and emerging markets globally.

- By Category

On the basis of category, the market is segmented into Organic and Conventional. The Conventional segment dominated with a 62.1% share in 2025, owing to large-scale production, stable pricing, and wide availability across food, beverage, and feed applications. Conventional pulse proteins are widely used in bakery, dairy alternatives, meat analogs, and nutritional bars due to consistent protein content and functional performance.

The Organic segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising consumer awareness about sustainability, clean-label ingredients, and chemical-free cultivation. Increased adoption in premium snacks, plant-based products, and fortified functional foods supports long-term growth in North America, Europe, and Asia-Pacific.

- By Extraction Process

On the basis of extraction process, the pulse protein market is segmented into Dry Processing and Wet Processing. The Wet Processing segment dominated with an estimated 54.7% share in 2025, due to its ability to produce high-purity isolates with superior solubility, emulsification, and neutral flavor, making it suitable for beverages, protein bars, and bakery products. Wet processing ensures higher functional performance and lower anti-nutritional factors compared to dry processing.

The Dry Processing segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by cost-efficient production, reduced water usage, and increasing adoption in large-scale feed applications, bulk protein powders, and functional ingredient formulations.

- By Form

On the basis of form, the market is segmented into Isolates, Concentrates, and Hydrolysates. The Isolates segment dominated the market with a 46.2% share in 2025, driven by high protein content, low fat, and versatility in food and beverage formulations. Protein isolates are preferred in functional beverages, nutritional bars, bakery, and dairy alternatives due to superior solubility, neutral taste, and consistent performance.

The Hydrolysates segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing demand for pre-digested, bioactive proteins in infant nutrition, sports supplements, and clinical nutrition products. Rising awareness of faster absorption and functional health benefits accelerates hydrolysate adoption globally.

- By Function

On the basis of function, the market is segmented into Solubility, Hydration, Emulsification, Foaming, and Others. The Solubility segment dominated with an estimated 38.5% share in 2025, owing to its critical role in beverage formulations, protein shakes, dairy alternatives, and liquid functional foods. High solubility ensures better dispersion, texture, and mouthfeel in ready-to-drink and instant formulations.

The Emulsification segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising use of pulse proteins in plant-based dairy, mayonnaise, sauces, and dressings. Increasing demand for multifunctional ingredients that improve texture, stability, and shelf life supports growth across food and beverage applications.

- By Application

On the basis of application, the market is segmented into Food & Beverage, Feed and Pharmaceuticals, and Cosmetics. The Food & Beverage segment dominated with an estimated 59.8% share in 2025, supported by rising consumption of plant-based foods, protein-fortified snacks, bakery products, and beverages. Strong adoption in sports nutrition, functional foods, and clean-label products fuels continuous demand.

The Feed and Pharmaceuticals segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing use of pulse protein in animal nutrition, nutraceutical formulations, and dietary supplements. Expansion of functional and health-focused product portfolios accelerates adoption in both developed and emerging markets.

Which Region Holds the Largest Share of the Pulse Protein Market?

- China dominated the Asia-Pacific pulse protein market with an estimated 41.87% revenue share in 2025, driven by strong demand from processed food manufacturing, bakery, dairy, and meat & poultry processing industries. Rapid expansion of packaged food production, robust domestic manufacturing infrastructure, and increasing consumption of protein-rich diets support widespread adoption of pulse proteins across the country

- Leading protein producers and ingredient suppliers in the region are investing in advanced extraction technologies, fortified and functional pulse protein variants, and sustainable production practices, reinforcing China’s leadership. Growth in large-scale food manufacturing and efficient distribution networks further strengthens regional market dominance

- Government initiatives promoting food security, nutritional standards, and industrial modernization continue to consolidate China’s leading role in the Asia-Pacific Pulse Protein market

India Pulse Protein Market Insight

India is projected to register the fastest CAGR of 8.45% from 2026 to 2033, supported by rapid growth in food processing facilities, high reliance on plant-based protein consumption, and expanding bakery, dairy, and meat processing industries. Rising adoption of fortified and standardized pulse protein ingredients in food and feed applications underpins steady market growth.

Japan Pulse Protein Market Insight

Japan contributes significantly to regional demand, driven by a mature processed food sector, increasing functional food consumption, and rising incorporation of pulse proteins in bakery, dairy, and nutraceutical products.

Australia Pulse Protein Market Insight

Australia shows steady growth, supported by strong meat and poultry processing industries, expanding bakery and dairy sectors, and increasing demand for high-protein, plant-based ingredients in food and feed applications. Investments in advanced processing technologies and regulatory compliance reinforce long-term market expansion.

South Korea Pulse Protein Market Insight

South Korea contributes to regional growth due to increasing consumer awareness of plant-based diets, rising functional food consumption, and expanding adoption of pulse proteins in bakery, dairy, and beverage applications.

Which are the Top Companies in Pulse Protein Market?

The pulse protein industry is primarily led by well-established companies, including:

- Ingredion Incorporated (U.S.)

- Cargill, Incorporated (U.S.)

- AGT Food and Ingredients (Canada)

- ADM (U.S.)

- Kerry (Ireland)

- DuPont (U.S.)

- Axiom Foods, Inc. (U.S.)

- Emsland Group (Germany)

- ET-Chem (China)

What are the Recent Developments in Global Pulse Protein Market?

- In June 2025, Roquette launched NUTRALYS T Pea 700XC, a large-chunk textured pea protein with 70% protein content and high thermal resistance. This innovation addresses the growing demand for hearty, meat-like textures in plant-based ready meals, sauces, and traditional dishes, making it easier for food manufacturers to create appealing, high-protein alternatives. Its minimal hydration requirement and simplified formulation process enhance efficiency in production, while offering consumers improved sensory experience. By introducing this product, Roquette strengthened its portfolio in the pulse protein market, meeting the rising trend for sustainable and versatile plant-based ingredients

- In February 2024, Roquette expanded its NUTRALYS plant protein range with four multi-functional pea proteins designed to improve taste, texture, and functionality in plant-based foods and nutritional products. This expansion enables food manufacturers to innovate and diversify product offerings while meeting increasing consumer demand for high-protein, plant-based solutions. The move reinforces Roquette's leadership in the pulse protein market by providing versatile ingredients suitable for beverages, bakery, and protein-enriched snacks, addressing evolving consumer preferences for clean-label and sustainable protein options

- In October 2022, Roquette introduced a new line of organic pea ingredients, including organic pea starch and organic pea protein, produced at its Canadian plant. This launch catered to the rising consumer demand for organic and plant-based ingredients, providing manufacturers with high-quality, sustainable protein sources. By offering organic alternatives, Roquette strengthened its competitive position in the pulse protein market and supported the shift toward healthier, environmentally conscious food products. This move also allowed the company to target emerging markets where organic and clean-label ingredients are becoming increasingly important

- In June 2022, Roquette launched the NUTRALYS range, featuring organic textured proteins derived from peas and fava beans. This strategic introduction broadened Roquette’s customer base by offering clean-label, sustainable, and high-protein solutions for food manufacturers. The launch responded to increasing consumer interest in plant-based diets and functional foods, helping brands deliver protein-rich products with improved texture and nutritional value. By reinforcing its focus on plant-based innovation, Roquette consolidated its presence in the growing pulse protein market

- In June 2021, Roquette launched the textured pea protein P6511C at FI Europe, positioned as a sustainable alternative to meat. The product targeted the growing consumer preference for plant-based foods with robust nutritional profiles, enabling manufacturers to create innovative protein-rich products with improved texture and versatility. By entering this niche, Roquette strengthened its competitive edge in the pulse protein market and supported the industry’s transition toward sustainable and functional ingredients

- In July 2020, Ingredion Incorporated EMEA launched an organic instant functional native starch to meet industry demand for high-quality, versatile plant-based ingredients. This innovation provided food and beverage manufacturers with functional starches suitable for clean-label and health-focused products. The launch helped Ingredion anticipate increased sales and strengthen its presence in the pulse protein and plant-based ingredient market, supporting the broader trend toward sustainable, protein-enriched food solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Pulse Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Pulse Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Pulse Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.