Asia Pacific Rapid Diagnostic Tests Rdt Market

Market Size in USD Billion

CAGR :

%

USD

15.78 Billion

USD

34.02 Billion

2025

2033

USD

15.78 Billion

USD

34.02 Billion

2025

2033

| 2026 –2033 | |

| USD 15.78 Billion | |

| USD 34.02 Billion | |

|

|

|

|

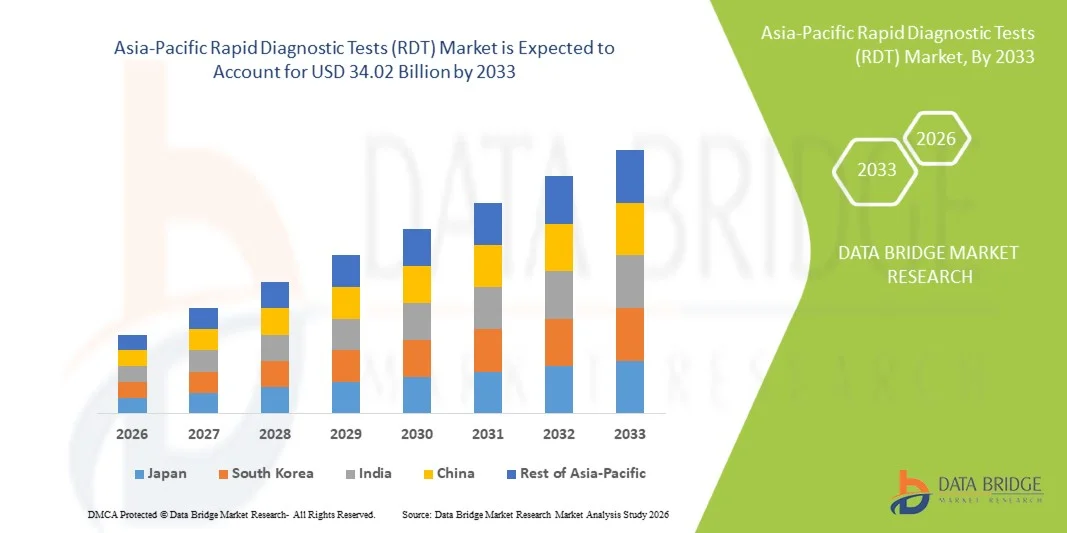

Asia-Pacific Rapid Diagnostic Tests (RDT) Market Size

- The Asia-Pacific Rapid Diagnostic Tests (RDT) market was valued at USD 15.78 billion in 2025 and is expected to reach USD 34.02 billion by 2033

- During the forecast period of 2026 to 2033 the market is likely to grow at a CAGR of 10.1%, supported primarily driven by increasing demand for cost-effective and eco-friendly transportation solutions and the growing adoption of electric low-speed vehicles (LSVs). The use of LSVs is rising across gated communities, golf courses, campuses, resorts, industrial sites, and urban last-mile mobility applications.

- Sustained market growth is further supported by continuous innovations in electric powertrains, battery technologies, vehicle safety systems, and connectivity features. Additionally, the expansion of direct-to-consumer and dealer-based distribution channels is enhancing market penetration. Favorable regulatory policies for low-speed electric vehicles, increasing investments in sustainable mobility infrastructure, and the rising focus on reducing urban congestion and controlling carbon emissions are strengthening the overall market outlook for LSVs in the region.

Asia-Pacific Rapid Diagnostic Tests (RDT) Market Analysis

- The Asia-Pacific Rapid Diagnostic Tests (RDT) market is witnessing steady advancement as manufacturers increasingly focus on technological innovation, diagnostic accuracy, and application-specific optimization to meet evolving healthcare and point-of-care testing needs. RDT developers are leveraging advanced assay techniques, improved sensitivity and specificity, portable testing formats, and multiplex platforms to enhance detection speed, reliability, and usability across hospitals, clinics, laboratories, and home-care applications. Integration of digital readouts, connectivity features, and telemedicine-enabled reporting is further shaping product development strategies across the market.

- These advancements are strengthening the regional RDT value chain by improving manufacturing efficiency, scalability, and product reliability, while reducing overall testing costs. Expanding direct-to-consumer sales models, distributor networks, and partnerships with healthcare providers are enabling faster market penetration and improved patient access. Rising adoption of RDTs across hospitals, diagnostic centers, community clinics, and home-based testing, supported by favorable regulations, government healthcare initiatives, and sustainability-focused healthcare infrastructure, is further increasing overall market accessibility.

- China is expected to dominate the Asia-Pacific Rapid Diagnostic Tests (RDT) Market with the largest revenue share of 34.58% in 2026, supported by increasing healthcare awareness, a strong point-of-care diagnostics ecosystem, and continuous investments by manufacturers in product innovation, scalable production capabilities, and brand development.

- China is projected to be the fastest-growing market, registering a CAGR of 10.6%, driven by rising demand for rapid, convenient, and accurate diagnostic solutions, expanding telemedicine adoption, and the growing availability of RDTs through hospitals, pharmacies, e-commerce channels, and direct-to-consumer platforms.

- In 2026, the professional rapid diagnostic test – visual read segment is expected to dominate the Asia-Pacific Rapid Diagnostic Tests (RDT) market with a 42.92% share, reflecting strong demand for compact, easy-to-use, and cost-efficient diagnostic solutions suitable for decentralized and point-of-care testing. Widespread use across hospitals, community clinics, diagnostic laboratories, and home-based settings, combined with ongoing innovation and digital integration, continues to reinforce the segment’s leadership within the Asia-Pacific RDT market.

Report Scope and Asia-Pacific Rapid Diagnostic Tests (RDT) Market Segmentation

|

Attributes |

Asia-Pacific Rapid Diagnostic Tests (RDT) Key Market Insights |

|

Segments Covered |

|

|

Country Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asia-Pacific Rapid Diagnostic Tests (RDT) Market Trends

“Technological Advancements Driving Accuracy And Accessibility”

- Technological advancements are creating significant opportunities in the Asia-Pacific Rapid Diagnostic Tests (RDT) market by enhancing both accuracy and accessibility. Innovations such as CRISPR-based assays, multiplex molecular tests, and advanced lateral flow immunoassays enable rapid, highly sensitive, and specific detection of multiple pathogens from minimal sample volumes. Portable and user-friendly devices allow point-of-care testing in remote or resource-limited settings, reducing dependency on centralized laboratories. Integration with digital health platforms further improves result tracking, data analytics, and disease surveillance. These technological improvements not only increase diagnostic reliability but also expand the reach of healthcare services, facilitating early detection, better treatment outcomes, and broader adoption of RDTs across the Asia-Pacific region.

- In July 2025, the World Health Organization (WHO) prequalified the first bundled triple rapid diagnostic test (RDT) capable of simultaneously detecting HIV, hepatitis B, and syphilis. This innovative test enhances diagnostic accuracy and efficiency by consolidating multiple screenings into a single assay, which is particularly valuable in maternal and antenatal health programs across the Asia‑Pacific region. The triple RDT reduces testing time, simplifies logistics, and expands accessibility in resource-limited settings, supporting early detection and improved healthcare outcomes.

- In October 2025, Visgene launched VisCheck Dengue NS1 RDT in Thailand, the world’s first rapid diagnostic test capable of simultaneously identifying dengue virus serotypes and predicting severe disease within 15 minutes. Approved by the Thai FDA for sales starting January 2025, this advanced RDT enhances diagnostic precision, reduces time to intervention, and supports timely clinical decision-making. Its rapid, serotype-specific results improve accessibility of high-quality diagnostics in hospitals and community clinics, particularly in dengue-endemic regions, representing a significant technological advancement for the Asia‑Pacific RDT market.

- In July 2025, the Global Health Innovative Technology (GHIT) Fund invested USD 0.4 million in a collaborative project between Ehime University, Japan, and Universiti Malaysia Sabah to develop novel ZOO-RDT biomarker reagents for malaria. This initiative aims to enhance the sensitivity and specificity of malaria rapid diagnostic tests, enabling more accurate detection of infections even in low-parasitemia cases by supporting the development of advanced biomarkers and next-generation RDTs, this funding promotes technological innovation, improves diagnostic accuracy, and expands access to reliable malaria testing across the Asia‑Pacific region.

Asia-Pacific Rapid Diagnostic Tests (RDT) Market Dynamics

Driver

“Rising Disease Burden And Expanding Healthcare Access”

- Rising disease burden and expanding healthcare access are high and growing prevalence of infectious diseases such as dengue, malaria, tuberculosis, and COVID-19, alongside a steady increase in chronic conditions like diabetes and cardiovascular diseases. This creates strong demand for fast, accurate, and affordable diagnostic solutions. At the same time, governments across Asia-Pacific are investing in healthcare infrastructure, primary care facilities, and universal health coverage programs, especially in rural and underserved areas. RDTs are well suited to these settings due to their low cost, minimal equipment needs, and quick results, accelerating their adoption across hospitals, clinics, and community health programs.

- In June 2024, the World Health Organization (WHO) announced its backing of a Regional Consultative Meeting on National Essential Diagnostic Lists (NEDLs) for ASEAN countries, organized by ASEAN and the Economic Research Institute for ASEAN and East Asia (ERIA). The meeting focused on enhancing access to high-quality diagnostic testing throughout the region. According to the WHO, this initiative is closely connected to the rising disease burden and expanding healthcare access, key factors driving growth in the Asia‑Pacific rapid diagnostic test (RDT) market.

- In November 2025 by the Vajiram Mains Team, India’s efforts to tackle tuberculosis (TB) were explained against the backdrop of the WHO Global TB Report 2025 enabling early TB detection in slums and tribal regions to combat the country’s high disease burden, is related to both the rising disease burden and expanding healthcare access drivers for the Asia‑Pacific Rapid Diagnostic Tests (RDT) market. This expansion reflects India’s response to a high burden of tuberculosis, which remains one of the country’s most significant public health challenges with millions of cases annually, and demonstrates efforts to bring rapid molecular diagnostic testing closer to underserved and high‑risk populations.

- In summary, the rising prevalence of infectious and chronic diseases in Asia‑Pacific is driving strong demand for rapid diagnostic tests (RDTs). Governments’ investments in healthcare infrastructure, primary care, and universal health coverage, especially in rural and underserved areas, are expanding access to diagnostics. Due to their low cost, ease of use, and quick results, RDTs are increasingly adopted across hospitals, clinics, and community health programs, making them a key tool in addressing the region’s growing disease burden

Restraints/Challenges

“High Cost Of Advanced Rapid Diagnostic Tests (Rdt)”

- High cost of advanced rapid diagnostic tests (RDTs) continues to act as a major restraint in the Asia‑Pacific RDT market. Advanced RDTs such as CRISPR-based rapid diagnostic tests (RDTs) used for detecting viral and bacterial pathogens such as COVID-19, dengue, and Zika require precisely engineered CRISPR-Cas reagents, high-quality nucleic acid amplification components, and strict compliance with regulatory standards. The production and quality control costs for these tests are often substantial, particularly for kits designed for high sensitivity, multiplex detection, or point-of-care deployment in remote areas. This high initial cost, coupled with the need for trained personnel and specialized equipment, limits adoption in low-resource healthcare centers and rural clinics, thereby constraining large-scale utilization and slowing market growth across the Asia‑Pacific region.

- In August 2025, as per the report pharmaceutical and diagnostic firms in China were increasingly procuring critical reagents from local manufacturers instead of relying on imported supplies from companies like Thermo Fisher and Merck. This change was driven by high import tariffs and cost concerns, which made foreign reagents more expensive and slower to deliver, prompting greater interest in locally sourced alternatives to cut costs and improve timeliness. The development highlights broader cost pressures faced by advanced diagnostic and laboratory testing sectors, illustrating how high input costs can constrain the scalability and affordability of advanced RDTs in markets across the Asia‑Pacific region.

- In June 2024, WHO-supported partners ASEAN and ERIA convened a regional meeting in Thailand to promote National Essential Diagnostics Lists (NEDLs) and address gaps in diagnostic services across ASEAN member states. During discussions, officials emphasized that, although the WHO Model List of Essential In Vitro Diagnostics includes many advanced tests and point-of-care technologies, limited budgets and affordability challenges in several countries meant these tools remain underutilized in practice, slowing efforts to improve disease detection and surveillance. This situation illustrates how the high cost of advanced RDTs can constrain their wider implementation and adoption in parts of the Asia-Pacific healthcare landscape.

- In April 2024, the World Health Organization (WHO), together with Gavi and UNICEF, announced the deployment of over 1.2 million cholera rapid diagnostic tests to 14 countries to enhance outbreak surveillance. The initiative relied on external funding and pooled procurement due to budget constraints in many health systems. This highlights how cost barriers limit access to RDTs, a challenge also relevant to the Asia-Pacific RDT market.

- In summary, the high cost of advanced rapid diagnostic tests (RDTs) remains a significant restraint on the growth of the Asia-Pacific RDT market. Cutting-edge technologies such as CRISPR-based diagnostics involve expensive reagents, complex manufacturing processes, and stringent regulatory compliance, which drive up production and quality-assurance costs. These tests are often designed for high sensitivity, multiplex detection, and rapid point-of-care use, further increasing their price. As a result, affordability becomes a major challenge for low-resource healthcare settings, rural clinics, and smaller laboratories. The need for specialized equipment and trained personnel adds to the financial burden, limiting large-scale deployment and slowing the widespread adoption of advanced RDT solutions across the region

Asia-Pacific Rapid Diagnostic Tests (RDT) Market Scope

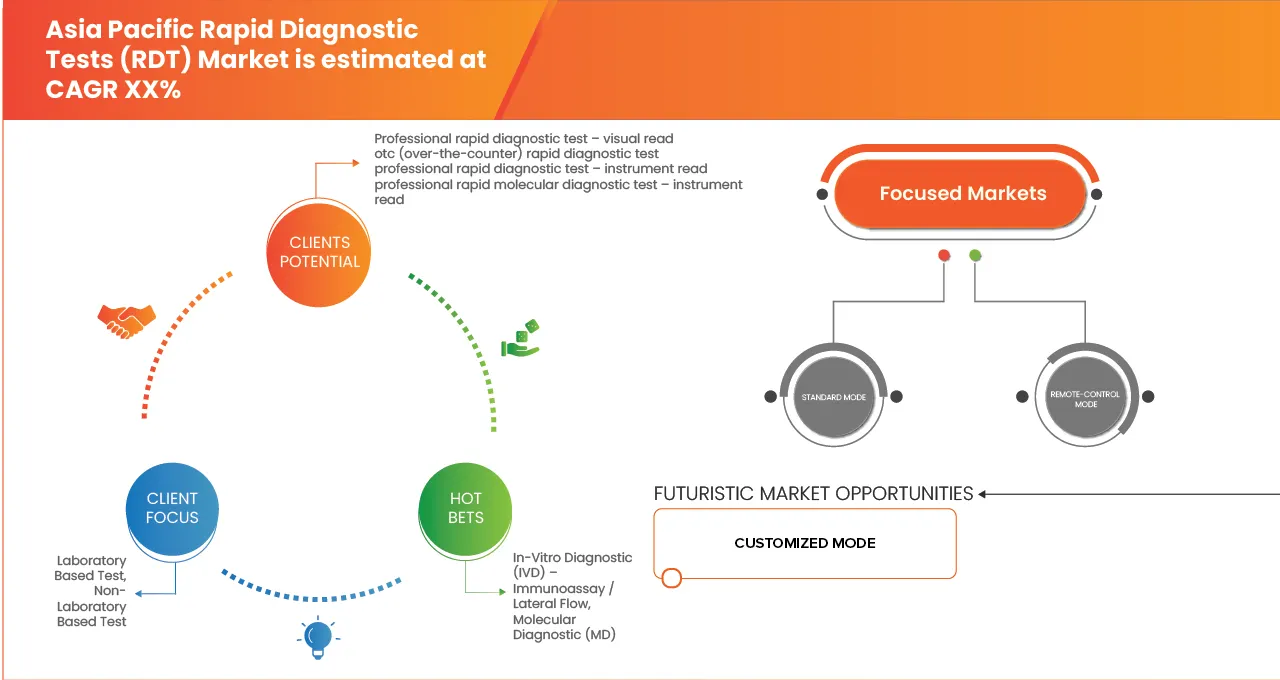

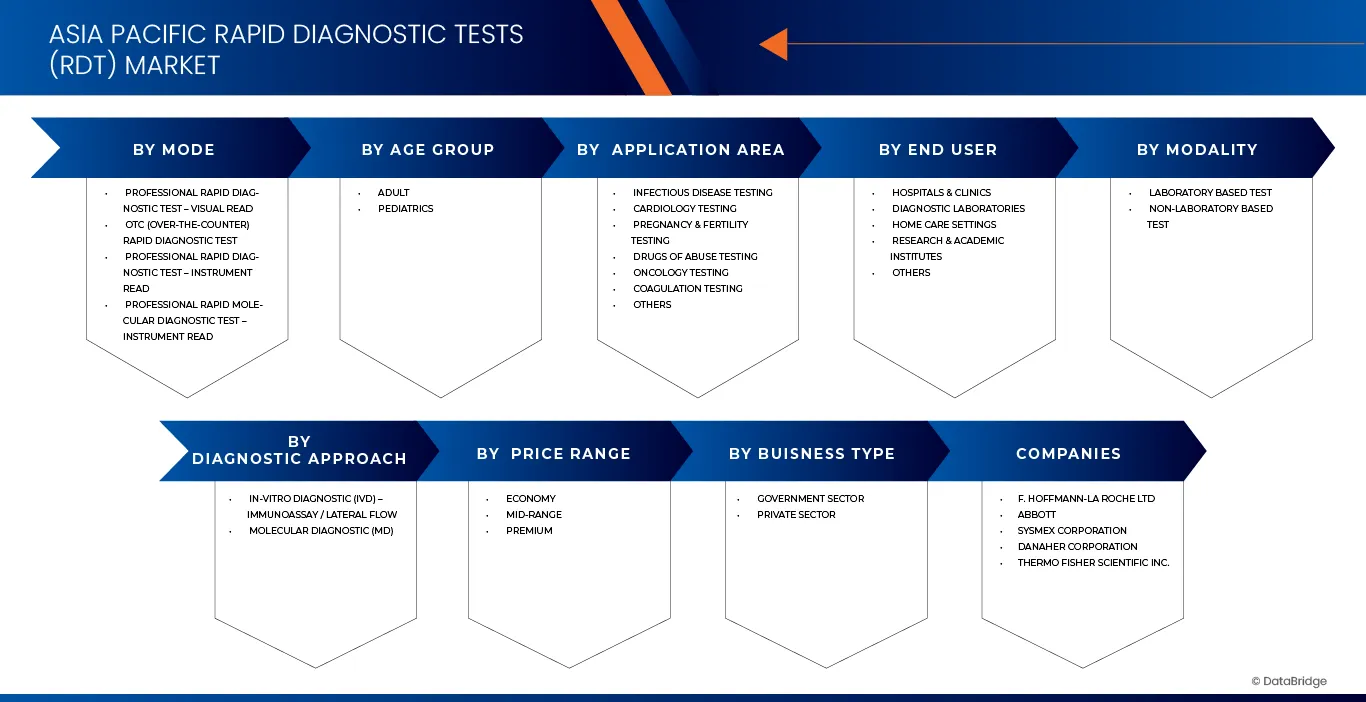

Asia-Pacific rapid diagnostic tests (RDT) market is categorized into eight notable segments which are based on mode, modality, age group, diagnostic approach, application area, price range, end user, business type.

- By Mode

On the basis of Mode, Asia-Pacific rapid diagnostic tests (RDT) Market is segmented into Professional Rapid Diagnostic Test – Visual Read, Otc (Over-The-Counter) Rapid Diagnostic Test, Professional Rapid Diagnostic Test – Instrument Read, Professional Rapid Molecular Diagnostic Test – Instrument Read. In 2026, the Professional Rapid Diagnostic Test – Visual Read segment is expected to dominate the market with a 42.92% market share, driven by widespread use across hospitals, community clinics, diagnostic laboratories, and home-based settings. Strong replacement demand, expansion of applications beyond traditional clinical use, and growing adoption of portable, easy-to-use RDT solutions are further reinforcing the segment’s market position.

The OTC (Over-The-Counter) Rapid Diagnostic Test segment is the fastest-growing in the Asia-Pacific rapid diagnostic tests (RDT) Market, with a CAGR of 11.0%, driven by rising demand for versatile, user-friendly, and low-maintenance diagnostic kits, increasing adoption across home-based, residential, and institutional settings, and the expansion of direct-to-consumer distribution, e-pharmacy channels, and retail networks. Technological advancements in test sensitivity, digital readouts, and connectivity-enabled reporting are expected to further accelerate adoption across key markets in the region.

- By Modality

On the basis of modality, the Asia-Pacific rapid diagnostic tests (RDT) market is segmented into Laboratory Based Tests and Non-Laboratory Based Tests. In 2026, the Laboratory Based Test segment is expected to dominate with a 62.83% market share, driven by its widespread use in hospitals, diagnostic laboratories, clinics, and community healthcare centers. Its strong adoption is supported by high accuracy, moderate operating costs, scalability for high-volume testing, and growing demand for centralized, reliable diagnostic solutions.

The Non-Laboratory Based Tests segment is the fastest-growing segment in the Asia-Pacific rapid diagnostic tests (RDT) Market, with a CAGR of 10.6%, driven by increasing demand for convenient, portable, and low-maintenance diagnostic solutions suitable for point-of-care and home-based testing. Rising adoption of digital readouts, connectivity-enabled reporting, and advanced test chemistries, along with expansion of direct-to-consumer distribution channels and telemedicine initiatives, is expected to further accelerate the segment’s growth across key regional markets.

- By Age Group

On the basis of Age Group, the Asia-Pacific rapid diagnostic tests (RDT) Market is segmented into Adult, Pediatrics. In 2026, the adult segment is expected to dominate the market with 80.76% market share, driven by its suitability for personal and short-distance diagnostic applications. Its compact design, ease of use, lower operating and maintenance costs, and widespread deployment across hospitals, clinics, residential communities, and community health programs contribute to its leading position in the market

Pediatrics is the fastest-growing segment with a CAGR of 10.6% in the Asia-Pacific rapid diagnostic tests market driven by rising demand for child-friendly, portable, and easy-to-administer diagnostic solutions in pediatric clinics, schools, and home-care settings. Increased preference for non-invasive, low-maintenance tests, coupled with the expansion of telemedicine and point-of-care programs, is further accelerating adoption across key regional markets.

- By Diagnostic Approach

On the basis of diagnostic approach, the Asia-Pacific rapid diagnostic tests (RDT) market is segmented into In-Vitro Diagnostic (IVD) – Immunoassay / Lateral Flow and Molecular Diagnostic (MD). In 2026, the In-Vitro Diagnostic (IVD) – Immunoassay / Lateral Flow segment is expected to dominate the market with 76.28% market share, driven by its ease of use, rapid results, and growing preference for user-friendly diagnostic solutions. These tests are widely adopted across hospitals, clinics, community health centers, and home-care settings, where fast, reliable, and repeatable testing is essential.

Molecular Diagnostic (MD) is the fastest-growing segment with CAGR of 10.7% in the Asia-Pacific rapid diagnostic tests (RDT) Market driven by increasing demand for convenient, low-complexity testing among first-time users, elderly populations, and commercial healthcare operators. Expanding adoption of MD solutions in hospitals, laboratories, and institutional settings, combined with continuous advancements in assay sensitivity, throughput, and automation, is further accelerating market penetration across key Asia-Pacific countries.

- By Application

On the basis of Application Area, the Asia-Pacific rapid diagnostic tests (RDT) market is segmented into Infectious Disease Testing, Cardiology Testing, Pregnancy & Fertility Testing, Drugs of Abuse Testing, Oncology Testing, Coagulation Testing, and Others. In 2026, the Infectious Disease Testing segment is expected to dominate the market with 43.80% market share, driven by high demand for rapid, accurate, and cost-efficient testing solutions. Widespread adoption across hospitals, community health centers, clinics, and home-care settings, coupled with continuous advancements in assay speed, portability, and connectivity, reinforces the segment’s leadership in the region.

Oncology Testing is the fastest-growing segment with CAGR of 11.4% in the Asia-Pacific rapid diagnostic tests (RDT) Market driven by increasing demand for specialized, high-sensitivity diagnostic solutions in cancer detection and monitoring, along with expanding adoption in hospitals, diagnostic laboratories, and research institutions. Continuous technological improvements, streamlined workflows, and rising focus on early-stage cancer detection are further accelerating adoption of oncology-focused RDTs across key Asia-Pacific markets.

- By Price Range

On the basis of Price Range, the Asia-Pacific rapid diagnostic tests (RDT) Market is segmented into Economy, Mid-Range, Premium. In 2026, the Economy segment is expected to dominate the market with 53.25% market share, driven by high affordability, ease of use, and widespread applicability across hospitals, clinics, diagnostic laboratories, and community health centers. Its cost-effectiveness, reliable performance, and compatibility with standard testing protocols reinforce its adoption in both urban and rural healthcare settings.

Premium is the fastest-growing segment with CAGR of 10.8% in the Asia-Pacific rapid diagnostic tests (RDT) Market driven by increasing demand for high-performance, rapid, and highly accurate diagnostic solutions, coupled with advanced features such as connectivity-enabled reporting, multiplex testing capabilities, and automated result interpretation. Rising focus on specialized healthcare diagnostics, sustainability initiatives, and adoption in private hospitals, research institutions, and advanced point-of-care applications are further accelerating market penetration for premium RDT products across key Asia-Pacific countries.

- By End User

On the basis of End User, the Asia-Pacific rapid diagnostic tests (RDT) market is segmented into Hospitals & Clinics, Diagnostic Laboratories, Home Care Settings, Research & Academic Institutes, and Others. In 2026, the Hospitals & Clinics segment is expected to dominate the market with 49.90% market share, driven by widespread adoption of RDT solutions for routine diagnostics, patient monitoring, and rapid point-of-care testing. Ease of operation, reliable performance, and cost-efficiency, combined with growing demand for compact, user-friendly devices, support the segment’s market leadership across urban and semi-urban healthcare facilities.

Home Care Settings is the fastest-growing segment with CAGR of 11.1% in the Asia-Pacific rapid diagnostic tests (RDT) Market driven by increasing adoption of portable and easy-to-use diagnostic kits for home-based testing, rising healthcare awareness, and expansion of telemedicine services. The growing preference for user-friendly, low-maintenance RDT solutions that enable early detection, chronic disease monitoring, and preventive healthcare is further accelerating market penetration in key Asia-Pacific countries.

- By Business Type

On the basis of Business Type, the Asia-Pacific rapid diagnostic tests (RDT) Market is segmented into Government Sector, Private Sector. In 2026, the Government Sector segment is expected to dominate the market with 57.48% market share, driven by widespread adoption of RDT solutions in public hospitals, community healthcare programs, and government-led health initiatives. Key factors such as ease of operation, reliability, low maintenance requirements, and cost-efficiency, combined with growing investments in public healthcare infrastructure, support the segment’s leadership in the region.

Private Sector is the fastest-growing segment with CAGR of 11.0% in the Asia-Pacific rapid diagnostic tests (RDT) Market driven by increasing deployment of RDT solutions in private hospitals, clinics, diagnostic chains, and home-care services. Rising focus on operational efficiency, adoption of advanced, user-friendly diagnostic kits, and growing preference for innovative, high-accuracy solutions are accelerating market penetration across key Asia-Pacific private healthcare markets

Asia-Pacific Rapid Diagnostic Tests (RDT) Market Regional Analysis

- China is expected to dominate the rapid diagnostic tests (RDT) Market with the largest revenue share of 24.58% in 2026, supported by substantial investments in healthcare infrastructure, expanding diagnostic manufacturing capabilities, and a well-established point-of-care testing ecosystem. Rising awareness of preventive healthcare, growing demand for rapid and reliable diagnostic solutions, and widespread availability across hospitals, clinics, laboratories, and home-care channels continue to strengthen China’s position within the regional market.

- U.S. is expected to be the fastest-growing region in the rapid diagnostic tests (RDT) market during the forecast period with a CAGR of 10.6%, fueled by increasing adoption of home-based and point-of-care testing solutions, rising healthcare awareness, and expanding telemedicine and e-pharmacy channels. The growing emphasis on early detection, convenience, and user-friendly diagnostics, coupled with continuous product innovations and automation, is further accelerating market penetration.

- Additionally, sustained focus on high-accuracy, low-cost, and easy-to-use RDT solutions, combined with investments in digital integration, telemedicine-enabled reporting, and sustainable diagnostic technologies, is expected to support long-term expansion of the market across both urban and semi-urban healthcare settings in the Asia-Pacific region.

Japan Rapid Diagnostic Tests (RDT) Market Insight

The Japan rapid diagnostic tests (RDT) market is steadily growing, driven by increasing healthcare awareness, rising demand for point-of-care and home-based testing, and a well-established healthcare infrastructure. Widespread availability of RDT solutions across hospitals, clinics, diagnostic laboratories, and retail pharmacy channels is improving accessibility and adoption rates. Additionally, strong focus on high-accuracy, user-friendly, and rapid diagnostic solutions, coupled with digital integration and telemedicine initiatives, continues to reinforce Japan’s strategic position within the Asia-Pacific RDT market.

India Rapid Diagnostic Tests (RDT) Market Insight

The India RDT market is expected to expand steadily, supported by rising healthcare awareness, increasing demand for preventive diagnostics, and growing adoption of point-of-care and home-based testing solutions. Expansion of modern healthcare facilities, rising presence of private diagnostic providers, and gradual penetration of e-pharmacy and direct-to-consumer channels are supporting market development. Furthermore, increasing emphasis on affordable, reliable, and easy-to-use diagnostic solutions is contributing to sustained growth across both urban and semi-urban regions in India.

The Major Market Leaders Operating in the Market Are:

- F. Hoffmann‑La Roche Ltd (Switzerland)

- Abbott (U.S.)

- Sysmex Corporation (Japan)

- Danaher Corporation (U.S.)

- Bio‑Rad Laboratories, Inc (U.S.)

- BD (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Siemens Healthcare Private Limited (Germany)

- Meril Diagnostics (India)

- QIAGEN (Netherlands)

- Wondfo (China)

- QuidelOrtho Corporation (U.S.)

- Werfen (Spain/Germany)

- bioMérieux (France)

- Fujirebio (Japan)

- ACCESS BIO (U.S.)

- SD Biosensor, INC (South Korea)

- Trinity Biotech (Ireland)

- J. Mitra & Co. Pvt. Ltd. (India)

- Chembio Diagnostics, Inc. (U.S.)

- GENBODY INC. (South Korea)

- Precision Biomed Pvt Ltd (India)

- BIOGENIX INC. PVT. LTD (India)

Latest Developments in Asia-Pacific Rapid Diagnostic Tests (RDT) Market

- In December 2024, Roche announced the CE Mark approval of its cobas BV/CV PCR assay, designed to accurately detect bacteria causing bacterial vaginosis and yeast linked to candida vaginitis. The test uses a single vaginal swab to deliver faster and more precise results compared to traditional diagnostic methods, which often lack accuracy and delay treatment. By enabling targeted therapies, the assay helps reduce complications and improve care for millions of women affected annually. The launch strengthens Roche Diagnostics’ sexual health portfolio, expands testing capabilities on cobas systems, and supports revenue growth through faster, efficient, and accurate molecular diagnostics.

- In November 2025, Abbott Fast diagnosis as the strongest defense against pneumonia. Pneumonia continues to be a leading infectious cause of death worldwide, especially among children, older adults, and high-risk populations. Delays in diagnosis can lead to severe complications, longer recovery times, and increased antibiotic resistance. Abbott’s rapid urine-based antigen tests enable detection of key pathogens such as Streptococcus pneumoniae and Legionella pneumophila within minutes, supporting timely and targeted treatment. These connected diagnostic solutions help clinicians provide faster, more accurate care, reduce hospital stays, minimize unnecessary antibiotic use, and improve patient outcomes globally

- On May 2025, Danaher Corporation (NYSE: DHR) announced a strategic partnership with AstraZeneca (LSE/STO/Nasdaq: AZN) to accelerate the development and commercialization of next-generation diagnostic tools that support precision medicine. The collaboration is designed to establish a scalable framework for diagnostics research, development, and market deployment, enabling clinicians to more accurately identify patients likely to benefit from targeted therapeutic regimens.

- In December 2020, Access Bio, Inc. announced strategic distribution agreements with Concordance Healthcare Solutions and NDC, Inc. to support the nationwide supply and commercialization of its CareStart™ COVID‑19 diagnostic test portfolio across the United States.

- In October 2025, Bio-Rad extended its partnership with Gencurix through a strategic agreement under which Bio-Rad became the exclusive distributor of Gencurix’s CE-IVD droplet digital PCR (ddPCR) oncology kits across Europe. This development strengthens Bio-Rad’s oncology diagnostics portfolio by expanding access to highly sensitive ddPCR-based assays compatible with its QXDx™ systems, supporting precise mutation detection in solid tumors and liquid biopsy applications for European clinical laboratories

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 ENVIRONMENTAL FACTORS

4.2.6 LEGAL FACTORS

4.2.7 QUALITY ASSURANCE & POST MARKET OBLIGATIONS

4.3 PATENT ANALYSIS

4.3.1 PATENT NUMBER AND EXPIRY

4.3.2 COUNTRY-LEVEL APPROVAL

4.3.3 LIST OF PRODUCTS REACHING EXPIRY IN NEXT 3 YEARS

4.3.4 DRUGS PATENT IN SPECIFIC COUNTRIES

4.4 COMPANY EVALUATION QUADRANT

4.5 SUPPLY CHAIN ECOSYSTEM

4.5.1 PROMINENT COMPANIES

4.5.2 SMALL & MEDIUM SIZE COMPANIES

4.5.3 END USERS

4.6 TOP TESTS RANKING & MARKET OPPORTUNITY SECTION

4.6.1 CHINA

4.6.2 JAPAN

4.6.3 INDIA

4.6.4 SOUTH KOREA

4.6.5 SINGAPORE

4.6.6 MALAYSIA

4.6.7 THAILAND

4.6.8 INDONESIA

4.6.9 PHILIPPINES

4.6.10 VIETNAM

4.6.11 REST OF ASIA–PACIFIC

4.7 CUSTOMER BUYING DRIVERS – QUALITY, ASP, SPEED, REPUTATION OTHERS

4.7.1 QUALITY

4.7.2 AVERAGE SELLING PRICE (ASP)

4.7.3 SPEED

4.7.4 REPUTATION

4.7.5 OTHER INFLUENTIAL FACTORS

4.8 INDUSTRY INSIGHTS

4.8.1 MICRO AND MACRO ECONOMIC FACTORS

4.8.2 MICROECONOMIC FACTORS

4.8.3 MACROECONOMIC FACTORS

4.8.4 PENETRATION AND GROWTH PROSPECT MAPPING

4.8.5 MARKET PENETRATION & GROWTH BY COUNTRY

4.8.6 BASED ON MODE (TYPE OF RAPID DIAGNOSTIC TEST)

4.8.7 BASED ON DIAGNOSTIC APPROACH

4.8.8 BASED ON END‑USER

4.9 KEY PRICING STRATEGIES

4.9.1 STRATEGIC PRICING APPROACHES FOR RDTS IN APAC

4.9.2 INTERVIEWS WITH SPECIALIST

4.9.3 MARKET PENETRATION AND TECHNOLOGY ADOPTION

4.1 GROWTH DRIVERS AND CHALLENGES

4.10.1 PRICING AND PROCUREMENT

4.10.2 END-USER PREFERENCES AND INSIGHTS

4.10.3 STRATEGIC IMPLICATIONS DERIVED FROM SPECIALIST INSIGHTS:

4.10.4 ANALYSIS AND RECOMMENDATION

4.10.5 MARKET ANALYSIS

4.10.6 STRATEGIC RECOMMENDATIONS

4.10.7 CONCLUSION

5 REGULATORY FRAMEWORK

5.1 REGULATORY APPROVAL PROCESS

5.2 GENERAL PROCESS STEPS (APAC):

5.3 VARIATIONS BY MARKET

5.4 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

5.5 REGULATORY APPROVAL PATHWAYS

5.6 STANDARD APPROVAL PATHWAY

5.7 RELIANCE / ABRIDGED APPROVAL PATHWAY

5.8 EXPEDITED / PRIORITY REVIEW PATHWAY

5.9 EMERGENCY USE AUTHORIZATION (EUA)

5.1 COUNTRY-SPECIFIC PATHWAY OVERVIEW

5.11 LICENSING AND REGISTRATION

5.12 INDIA — CDSCO LICENSING & REGISTRATION

5.13 SINGAPORE — HEALTH SCIENCES AUTHORITY (HSA)

5.14 AUSTRALIA — THERAPEUTIC GOODS ADMINISTRATION (TGA)

5.15 OTHER APAC MARKETS (SUMMARY)

5.16 POST-MARKETING SURVEILLANCE

5.17 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

6 EPIDEMIOLOGY

6.1 INCIDENCE OF ALL BY GENDER

6.2 TREATMENT RATE

6.3 MORTALITY RATE

6.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

6.5 PATIENT TREATMENT SUCCESS RATES

7 HEALTHCARE TARIFFS IMPACT ANALYSIS

7.1 OVERVIEW

7.2 TARIFF STRUCTURES.

7.2.1 ASIA-PACIFIC: GOVERNMENT-IMPOSED TARIFFS ON IMPORTED MEDICAL PRODUCTS

7.2.2 EMERGING MARKETS: CHALLENGES IN TARIFF IMPLEMENTATION

7.3 PHARMACEUTICAL TARIFFS AND TRADE BARRIERS

7.3.1 IMPORT DUTIES ON PRESCRIPTION DRUGS VS. GENERICS

7.3.2 IMPACT ON DRUG AFFORDABILITY AND ACCESS

7.3.3 KEY TRADE AGREEMENTS AFFECTING PHARMACEUTICAL TARIFFS

7.4 IMPACT OF HEALTHCARE TARIFFS ON PROVIDERS AND PATIENTS

7.4.1 COST BURDEN ON HOSPITALS AND HEALTHCARE FACILITIES

7.4.2 EFFECT ON PATIENT AFFORDABILITY AND INSURANCE COVERAGE

7.4.3 TARIFFS AND THEIR ROLE IN MEDICAL TOURISM

7.5 TRADE AGREEMENTS AND HEALTHCARE TARIFFS

7.5.1 WTO REGULATIONS ON HEALTHCARE TARIFFS

7.5.2 IMPACT OF TRADE WARS ON THE HEALTHCARE SUPPLY CHAIN

7.5.3 ROLE OF FREE TRADE AGREEMENTS (FTAS) IN REDUCING TARIFFS

7.6 IMPACT OF TARIFFS ON HEALTHCARE COSTS AND ACCESSIBILITY

7.7 IMPORTANCE OF TARIFFS IN THE HEALTHCARE SECTOR

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING DISEASE BURDEN AND EXPANDING HEALTHCARE ACCESS

8.1.2 INCREASING ADOPTION OF LATERAL FLOW ASSAY AND IMMUNOLOGY BASED RAPID TEST

8.1.3 INTEGRATION OF DIGITAL HEALTH PLATFORM WITH RAPID DIAGNOSTICS FOR RESULT TRACKING

8.1.4 INCREASING GOVERNMENT INITIATIVES AND FUNDING FOR HEALTHCARE SCREENING PROGRAMS

8.2 RESTRAINTS

8.2.1 HIGH COST OF ADVANCED RAPID DIAGNOSTIC TESTS (RDT)

8.2.2 SHORT SHELF LIFE AND STRINGENT STORAGE CONDITIONS OF (RDTS)

8.3 OPPORTUNITIES

8.3.1 TECHNOLOGICAL ADVANCEMENTS DRIVING ACCURACY AND ACCESSIBILITY

8.3.2 GROWTH POTENTIAL IN PANDEMIC PREPAREDNESS AND OUTBREAK SURVEILLANCE PROGRAM

8.3.3 GROWING OVER-THE-COUNTER (OTC) CONSUMER ADOPTION AND RETAIL DISTRIBUTION GROWTH

8.4 CHALLENEGS

8.4.1 REGULATORY BARRIERS AND QUALITY ASSURANCE CONCERNS

8.4.2 INCONSISTENT QUALITY STANDARDS AMONG LOW-COST TEST MANUFACTURERS

9 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE

9.1 OVERVIEW

9.2 PROFESSIONAL RAPID DIAGNOSTIC TEST – VISUAL READ

9.3 OTC (OVER-THE-COUNTER) RAPID DIAGNOSTIC TEST

9.4 PROFESSIONAL RAPID DIAGNOSTIC TEST – INSTRUMENT READ

9.5 PROFESSIONAL RAPID MOLECULAR DIAGNOSTIC TEST – INSTRUMENT READ

10 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY

10.1 OVERVIEW

10.2 LABORATORY BASED TEST

10.3 NON-LABORATORY BASED TEST

11 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 ADULT

11.3 PEDIATRICS

12 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH

12.1 OVERVIEW

12.2 IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW

12.3 MOLECULAR DIAGNOSTIC (MD)

12.4 ASIA-PACIFIC IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.4.1 LATERAL FLOW IMMUNOASSAY (LFIA)

12.4.2 VISUAL READ RDTS (CASSETTE/STRIP FORM)

12.4.3 COLORIMETRIC

12.4.4 OTHERS

12.5 ASIA-PACIFIC MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

12.5.1 NAAT-BASED RAPID

12.5.2 RAPID PCR

12.5.3 ISOTHERMAL AMPLIFICATION

12.5.4 OTHERS

13 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA

13.1 OVERVIEW

13.2 INFECTIOUS DISEASE TESTING

13.3 ASIA-PACIFIC INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.3.1 RESPIRATORY INFECTION TESTS

13.3.2 HEPATITIS

13.3.3 HIV

13.3.4 MALARIA

13.3.5 DENGUE

13.3.6 SEXUALLY TRANSMITTED DISEASES

13.3.7 GASTROINTESTINAL INFECTIONS

13.3.8 CHIKUNGUNYA

13.3.9 OTHERS

13.4 ASIA-PACIFIC RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.4.1 INFLUENZA A+B / A+B+C

13.4.2 RSV

13.4.3 STREP A

13.4.4 MYCOPLASMA

13.4.5 S. PNEUMONIA

13.4.6 LEGIONELLA

13.4.7 OTHERS

13.5 ASIA-PACIFIC SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.5.1 CHLAMYDIA

13.5.2 GONORRHEA

13.5.3 SYPHILIS

13.5.4 OTHERS

13.6 ASIA-PACIFIC INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.6.1 H. PYLORI AB/AG

13.6.2 TYPHOID

13.6.3 ROTAVIRUS

13.6.4 C. DIFFICILE

13.6.5 E. COLI

13.6.6 NOROVIRUS

13.6.7 CAMPYLOBACTER

13.6.8 ADENOVIRUS

13.6.9 E71

13.6.10 OTHERS

13.7 CARDIOLOGY TESTING

13.8 ASIA-PACIFIC CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.8.1 HS-TROPONIN I

13.8.2 BNP / NT PROBNP

13.8.3 D DIMER

13.8.4 S-TROPONIN T

13.8.5 CK MB

13.8.6 HSCRP

13.8.7 MYOGLOBIN

13.8.8 PCT

13.8.9 ST2

13.8.10 HOMOCYSTEINE

13.8.11 GALECTIN 3

13.9 PREGNANCY & FERTILITY TESTING

13.1 ASIA-PACIFIC PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.10.1 HCG

13.10.2 LH

13.10.3 COMBINED FERTILITY PANELS

13.11 DRUGS OF ABUSE TESTING

13.12 ASIA-PACIFIC DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.12.1 MULTI-PANEL URINE TESTS

13.12.2 ORAL FLUID DRUG TESTS

13.13 ONCOLOGY TESTING

13.14 ASIA-PACIFIC ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.14.1 AFP

13.14.2 CEA

13.14.3 PSA

13.14.4 CA19 9

13.14.5 CA125

13.14.6 CA15 3

13.14.7 OTHERS

13.15 COAGULATION TESTING

13.16 ASIA-PACIFIC COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.16.1 PT

13.16.2 PTT

13.16.3 ACT

13.16.4 FIB

13.16.5 TT

13.17 OTHERS

14 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE

14.1 OVERVIEW

14.2 ECONOMY

14.3 MID-RANGE

14.4 PREMIUM

15 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITALS & CLINICS

15.3 ASIA-PACIFIC HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

15.3.1 PUBLIC

15.3.2 PRIVATE

15.4 DIAGNOSTIC LABORATORIES

15.5 HOME CARE SETTINGS

15.6 RESEARCH & ACADEMIC INSTITUTES

15.7 OTHERS

16 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE

16.1 OVERVIEW

16.2 GOVERNMENT SECTOR

16.3 PRIVATE SECTOR

17 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY COUNTRY

17.1 ASIA-PACIFIC

17.1.1 CHINA

17.1.2 JAPAN

17.1.3 INDIA

17.1.4 SOUTH KOREA

17.1.5 AUSTRALIA

17.1.6 INDONESIA

17.1.7 THAILAND

17.1.8 SINGAPORE

17.1.9 MALAYSIA

17.1.10 PHILIPPINES

17.1.11 VIETNAM

17.1.12 PAKISTAN

17.1.13 BANGLADESH

17.1.14 SRI LANKA

17.1.15 NEPAL

17.1.16 AFGHANISTAN

17.1.17 MALDIVES

17.1.18 BHUTAN

17.1.19 REST OF ASIA-PACIFIC

18 GERMANY SAFETY FOOTWEAR MARKET, COMPANY LANDSCAPE

18.1 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.2 COMPANY SHARE ANALYSIS BY MODE

18.2.1 PROFESSIONAL RAPID DIAGNOSTIC TEST – VISUAL READ

18.2.2 PROFESSIONAL RAPID DIAGNOSTIC TEST – INSTRUMENT READ

18.2.3 PROFESSIONAL RAPID MOLECULAR DIAGNOSTIC TEST – INSTRUMENT READ

18.2.4 OTC (OVER-THE-COUNTER) RAPID DIAGNOSTIC TEST

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 F. HOFFMANN-LA ROCHE LTD

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVEOPMENT

20.2 ABBOTT

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVEOPMENT

20.3 SYSMEX CORPORATION

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVEOPMENT

20.4 DANAHER CORPORATION

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 THERMO FISHER SCIENTIFIC

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVEOPMENT

20.6 ACCESS BIO

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 BECTON, DICKINSON (BD)

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVEOPMENT

20.8 BIOGENIX INC. PVT. LTD.

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 BIOSCI HEALTHCARE

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 BIOMERIEUX

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVEOPMENT

20.11 BIO-RAD LABORATORIES, INC.

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENT

20.12 CHEMBIO DIAGNOSTICS, INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 FUJIREBIO

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVEOPMENT

20.14 GENBODY INC.

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 INTEC PRODUCTS, INC.

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

20.16 J. MITRA & CO. PVT. LTD.

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENT

20.17 MERIL DIAGNOSTICS

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENT

20.18 PRECISION BIOMED PVT LTD.

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 QIAGEN

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVEOPMENT

20.2 QUIDELORTHO CORPORATION

20.20.1 COMPANY SNAPSHOT

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT DEVELOPMENT

20.21 SD BIOSENSOR, INC.

20.21.1 COMPANY SNAPSHOT

20.21.2 REVENUE ANALYSIS

20.21.3 PRODUCT PORTFOLIO

20.21.4 RECENT DEVELOPMENT

20.22 SIEMENS HEALTHINEERS

20.22.1 COMPANY SNAPSHOT

20.22.2 REVENUE ANALYSIS

20.22.3 PRODUCT PORTFOLIO

20.22.4 RECENT DEVEOPMENT

20.23 TRINITY BIOTECH

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVEOPMENT

20.24 WERFEN

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT DEVELOPMENT

20.25 WONDFO

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA PACIFIC

TABLE 24 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 CHINA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 45 CHINA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 46 CHINA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 47 CHINA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 48 CHINA IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 49 CHINA MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 50 CHINA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 51 CHINA INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 CHINA RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 CHINA SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 CHINA INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 55 CHINA CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 56 CHINA PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 CHINA DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 CHINA ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 CHINA COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 CHINA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 61 CHINA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 62 CHINA HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 63 CHINA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 JAPAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 65 JAPAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 66 JAPAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 67 JAPAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 68 JAPAN IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 JAPAN MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 70 JAPAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 71 JAPAN INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 72 JAPAN RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 JAPAN SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 74 JAPAN INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 JAPAN CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 76 JAPAN PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 JAPAN DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 78 JAPAN ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 JAPAN COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 80 JAPAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 81 JAPAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 82 JAPAN HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 83 JAPAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 84 INDIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 85 INDIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 86 INDIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 87 INDIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 88 INDIA IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 89 INDIA MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 90 INDIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 91 INDIA INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 INDIA RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 93 INDIA SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 INDIA INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 INDIA CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 INDIA PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 INDIA DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 INDIA ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 INDIA COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 INDIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 101 INDIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 102 INDIA HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 INDIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 SOUTH KOREA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 105 SOUTH KOREA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 106 SOUTH KOREA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 107 SOUTH KOREA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 108 SOUTH KOREA IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 SOUTH KOREA MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 110 SOUTH KOREA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 111 SOUTH KOREA INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 112 SOUTH KOREA RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 113 SOUTH KOREA SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 114 SOUTH KOREA INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 SOUTH KOREA CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 116 SOUTH KOREA PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 SOUTH KOREA DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 SOUTH KOREA ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 SOUTH KOREA COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 SOUTH KOREA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 121 SOUTH KOREA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 122 SOUTH KOREA HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 SOUTH KOREA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 AUSTRALIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 125 AUSTRALIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 126 AUSTRALIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 127 AUSTRALIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 128 AUSTRALIA IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 129 AUSTRALIA MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 AUSTRALIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 131 AUSTRALIA INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 132 AUSTRALIA RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 AUSTRALIA SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 AUSTRALIA INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 AUSTRALIA CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 AUSTRALIA PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 AUSTRALIA DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 AUSTRALIA ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 AUSTRALIA COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 AUSTRALIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 141 AUSTRALIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 142 AUSTRALIA HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 AUSTRALIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 INDONESIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 145 INDONESIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 146 INDONESIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 147 INDONESIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 148 INDONESIA IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 149 INDONESIA MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 150 INDONESIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 151 INDONESIA INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 152 INDONESIA RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 153 INDONESIA SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 INDONESIA INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 INDONESIA CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 INDONESIA PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 INDONESIA DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 INDONESIA ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 INDONESIA COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 160 INDONESIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 161 INDONESIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 162 INDONESIA HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 INDONESIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 THAILAND RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 165 THAILAND RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 166 THAILAND RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 167 THAILAND RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 168 THAILAND IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 THAILAND MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 THAILAND RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 171 THAILAND INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 THAILAND RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 THAILAND SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 THAILAND INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 THAILAND CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 THAILAND PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 THAILAND DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 THAILAND ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 THAILAND COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 THAILAND RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 181 THAILAND RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 182 THAILAND HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 THAILAND RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 184 SINGAPORE RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 185 SINGAPORE RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 186 SINGAPORE RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 187 SINGAPORE RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 188 SINGAPORE IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 189 SINGAPORE MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 190 SINGAPORE RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 191 SINGAPORE INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 192 SINGAPORE RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 SINGAPORE SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 SINGAPORE INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 SINGAPORE CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 SINGAPORE PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 SINGAPORE DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 SINGAPORE ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 199 SINGAPORE COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 SINGAPORE RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 201 SINGAPORE RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 202 SINGAPORE HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 SINGAPORE RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 MALAYSIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 205 MALAYSIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 206 MALAYSIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 207 MALAYSIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 208 MALAYSIA IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 MALAYSIA MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 210 MALAYSIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 211 MALAYSIA INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 MALAYSIA RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 MALAYSIA SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 MALAYSIA INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 MALAYSIA CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 MALAYSIA PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 MALAYSIA DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 MALAYSIA ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 MALAYSIA COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 MALAYSIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 221 MALAYSIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 222 MALAYSIA HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 223 MALAYSIA RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 PHILIPPINES RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 225 PHILIPPINES RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 226 PHILIPPINES RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 227 PHILIPPINES RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 228 PHILIPPINES IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 229 PHILIPPINES MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 230 PHILIPPINES RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 231 PHILIPPINES INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 PHILIPPINES RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 PHILIPPINES SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 PHILIPPINES INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 PHILIPPINES CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 PHILIPPINES PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 PHILIPPINES DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 238 PHILIPPINES ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 PHILIPPINES COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 PHILIPPINES RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 241 PHILIPPINES RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 242 PHILIPPINES HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 PHILIPPINES RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 244 VIETNAM RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 245 VIETNAM RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 246 VIETNAM RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 247 VIETNAM RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 248 VIETNAM IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 249 VIETNAM MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 250 VIETNAM RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 251 VIETNAM INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 VIETNAM RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 VIETNAM SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 VIETNAM INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 VIETNAM CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 VIETNAM PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 VIETNAM DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 VIETNAM ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 VIETNAM COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 VIETNAM RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 261 VIETNAM RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 262 VIETNAM HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 VIETNAM RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 PAKISTAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 265 PAKISTAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 266 PAKISTAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 267 PAKISTAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 268 PAKISTAN IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 269 PAKISTAN MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 270 PAKISTAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY APPLICATION AREA, 2018-2033 (USD THOUSAND)

TABLE 271 PAKISTAN INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 272 PAKISTAN RESPIRATORY INFECTION TESTS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 273 PAKISTAN SEXUALLY TRANSMITTED DISEASES IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 274 PAKISTAN INFECTIOUS DISEASE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 275 PAKISTAN CARDIOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 276 PAKISTAN PREGNANCY & FERTILITY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 277 PAKISTAN DRUGS OF ABUSE TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 278 PAKISTAN ONCOLOGY TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 279 PAKISTAN COAGULATION TESTING IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 280 PAKISTAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY PRICE RANGE, 2018-2033 (USD THOUSAND)

TABLE 281 PAKISTAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 282 PAKISTAN HOSPITALS & CLINICS IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 283 PAKISTAN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY BUSINESS TYPE, 2018-2033 (USD THOUSAND)

TABLE 284 BANGLADESH RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODE, 2018-2033 (USD THOUSAND)

TABLE 285 BANGLADESH RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY MODALITY, 2018-2033 (USD THOUSAND)

TABLE 286 BANGLADESH RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY AGE GROUP, 2018-2033 (USD THOUSAND)

TABLE 287 BANGLADESH RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY DIAGNOSTIC APPROACH, 2018-2033 (USD THOUSAND)

TABLE 288 BANGLADESH IN-VITRO DIAGNOSTIC (IVD) – IMMUNOASSAY / LATERAL FLOW IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 289 BANGLADESH MOLECULAR DIAGNOSTIC (MD) IN RAPID DIAGNOSTIC TESTS (RDT) MARKET, BY TYPE, 2018-2033 (USD THOUSAND)