Asia Pacific Recycled Plastic Market

Market Size in USD Billion

CAGR :

%

USD

16.97 Billion

USD

28.93 Billion

2022

2030

USD

16.97 Billion

USD

28.93 Billion

2022

2030

| 2023 –2030 | |

| USD 16.97 Billion | |

| USD 28.93 Billion | |

|

|

|

|

Asia-Pacific Recycled Plastic Market Analysis and Size

Plastic recycling is defined as reprocessing scrap or waste from plastic products into useful products. As a result, because plastic is not biodegradable, it is recycled in order to mitigate the negative effects of dumping plastic products in the soil.

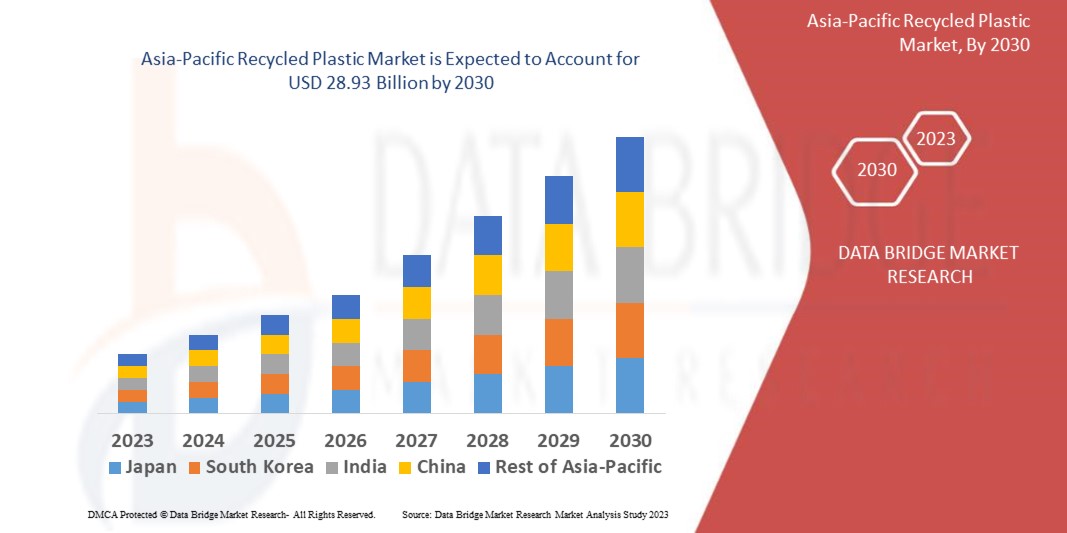

Data Bridge Market Research analyses that the Asia Pacific Protective Films Market which was USD 16.97 billion 2022, would rocket up to USD 28.93 billion by 2030, and is expected to undergo a CAGR of 6.9% during the forecast period of 2023 to 2030. Growing environmental concerns is one of the driving factor for the luxury leather goods market in Africa. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Asia-Pacific Recycled Plastic Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion , Volumes in Tons, Pricing in USD |

|

Segments Covered |

Type (Polyethylene Terephthalate, Polyethylene, Polypropylene, Polyvinyl Chloride, Polystyrene and Others), Source (Bottles, Bags, Films, Fibres, Foams and Others), Industry (Packaging, Building and Construction, Textile, Automotive, Electrical and Electronics, Household Goods, Agriculture, Healthcare and Others) |

|

Countries Covered |

China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC) |

|

Market Players Covered |

Indorama Ventures Public Company Limited (Thailand), LOTTE Chemical Corporation (South Korea), China Resources (Holdings) Co., Ltd (China), China Petrochemical Corporation (China), Formosa Plastics Corporation (Taiwan), Mitsui Chemicals, Inc. (Japan), Reliance Industries Limited (India), Hanwha Chemical Corporation (South Korea), SCG Chemicals Co., Ltd. (Thailand), LG Chem (South Korea) |

|

Market Opportunities |

|

Market Definition

Plastic recycling is the processing of plastic waste into other products. Recycling can reduce dependence on landfill, conserve resources and protect the environment from plastic pollution and greenhouse gas emissions. Recycling rates lag those of other recoverable materials, such as aluminium, glass and paper.

Asia-Pacific Recycled Plastic Market Dynamics

Drivers

- Growing Environmental Concerns

The growing awareness of environmental sustainability and the need to reduce plastic waste has been a major driving force in the Asia-Pacific recycled plastic market. To reduce the environmental impact of plastic waste, governments and organisations are enacting stringent regulations and promoting recycling initiatives.

- Demand from End-Use Industries

The Asia-Pacific recycled plastic market is expanding due to rising demand for recycled plastic in various end-use industries such as packaging, automotive, construction, and consumer goods. Consumer preferences and corporate sustainability goals are driving companies to use recycled plastic as a sustainable alternative to virgin plastics.

Opportunities

- Growing Consumer Awareness and Demand

Increasing consumer awareness of the environmental impact of plastic waste and the benefits of using recycled plastics presents a market growth opportunity. Consumers are actively seeking environmentally friendly and sustainable products, including those made from recycled plastics. Companies that offer recycled plastic products and effectively communicate their environmental benefits can tap into this growing consumer demand and gain a competitive edge in the market.

- Technological Advancements and Innovation

Continuous technological advancements in recycling processes, such as advanced sorting and purification techniques, have the potential to improve the quality and value of recycled plastics. Chemical recycling and the development of new materials from recycled plastics, for example, can open up new possibilities and applications for recycled plastics in a variety of industries. These technological advancements contribute to the overall growth and market potential of the Asia-Pacific recycled plastic industry.

Restraints/Challenges

- Quality and Performance Concerns

Recycled plastics may face challenges in terms of quality and performance compared to virgin plastics. Contamination, inconsistent material properties, and limited compatibility with certain applications can restrain the adoption of recycled plastic in some industries. Quality control measures and technological advancements are needed for these concerns and improve the acceptance of recycled plastics.

- Cost Competitiveness

The cost competitiveness of recycled plastic versus virgin plastic is a market growth challenge. The cost of recycled plastic is influenced by factors such as raw material availability and price, processing technologies, and economies of scale. Achieving cost parity or cost advantages over virgin plastics is crucial to drive wider adoption of recycled plastic in various industries.

Recent Developments

- On 4 May, 2023, LOTTE Chemical has expanded its "Project LOOP" initiative to promote proper recycling and the culture of resource circulation. They will collaborate on the construction of a recycling system and the expansion of waste plastic collection points in Incheon through an MOU with LOTTE Aluminum, Michuhol-gu, Inha University, Incheon Federation for Environmental Movement, and AO2. The goal is to promote proper recycling and contribute to the circular economy

- On 18 February, 2022, Indorama Ventures, the world's largest producer of recycled PET for beverage bottles, has purchased an 85 percent stake in UCY Polymers CZ, a Czech Republic-based PET plastic recycler. This investment will allow for the recycling of an additional 1.12 billion post-consumer PET bottles per year by 2025, contributing to Europe's plastic collection and recycling goals. Indorama Ventures intends to increase its recycling capacity to 750,000 tonnes per year by 2025, contributing to the region's growing demand for recycled PET

Asia-Pacific Recycled Plastic Market Scope

The Asia-Pacific recycled plastic market is segmented on the basis of type, source and industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

TYPE

- POLYETHYLENE TEREPHTHALATE

- POLYETHYLENE

- POLYPROPYLENE

- POLYVINYL CHLORIDE

- POLYSTYRENE

- OTHERS

SOURCE

- BOTTLES

- BAGS

- FILMS

- FIBERS

- FOAMS

- OTHERS

INDUSTRY

- PACKAGING

- BUILDING AND CONSTRUCTION

- TEXTILE

- AUTOMOTIVE

- ELECTRICAL AND ELECTRONICS

- HOUSEHOLD GOODS

- AGRICULTURE

- HEALTHCARE

- OTHERS

Asia-Pacific Recycled Plastic Market Regional Analysis/Insights

Asia-Pacific recycled plastic market is analysed and market size insights and trends are provided by country, type, price range, application as referenced above.

The countries covered in the Asia-Pacific recycled plastic market report are China, India, Japan, South Korea, Australia, Indonesia, Taiwan, Singapore, Thailand, Malaysia, Philippines, Vietnam, Rest of Asia-Pacific.

China dominates the Asia-Pacific Recycled Plastic Market due to its large population, expanding industrial sectors, and proactive government initiatives for plastic waste management and recycling.

India is expected to witness significant growth during the forecast period of 2022 to 2030 due country's increasing population, rapid urbanization, and government initiatives promoting recycling and sustainable practices contribute to its high growth potential and market influence in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Asia-Pacific Recycled Plastic industry growth and new technology penetration

The Asia-Pacific Recycled Plastic Market also provides you with detailed market analysis for every country growth in Asia-Pacific protective films industry, installed new production plant, impact of technology using life line curves and changes in Asia-Pacific recycled plastic regulatory scenarios and their impact on the Asia-Pacific Recycled Plastic Market. The data is available for historic period 2015-2020.

Competitive Landscape and Asia-Pacific Recycled Plastic Market Share Analysis

The Asia-Pacific Recycled Plastic Market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Asia-Pacific Recycled Plastic Market.

Some of the major players operating in the Asia-Pacific recycled plastic market are:

- Indorama Ventures Public Company Limited (Thailand)

- LOTTEChemical Corporation (South Korea)

- China Resources (Holdings) (China)

- China Petrochemical Corporation (China)

- Formosa Plastics Corporation (Taiwan)

- Mitsui Chemicals, Inc. (Japan)

- Reliance Industries Limited (India)

- Hanwha Chemical Corporation (South Korea)

- SCG Chemicals Co., Ltd. (Thailand)

- LG Chem (South Korea)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC RECYCLED PLASTIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE ASIA PACIFIC RECYCLED PLASTIC MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.7 COMPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 TOP TO BOTTOM ANALYSIS

2.1 STANDARDS OF MEASUREMENT

2.11 VENDOR SHARE ANALYSIS

2.12 IMPORT DATA

2.13 EXPORT DATA

2.14 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.15 DATA POINTS FROM KEY SECONDARY DATABASES

2.16 ASIA PACIFIC RECYCLED PLASTIC MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRODUCTION CONSUMPTION ANALYSIS

5.2 IMPORT EXPORT SCENARIO

5.3 PRICE TREND ANALYSIS

5.4 RAW MATERIAL PRODUCTION COVERAGE

5.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.6 LIST OF KEY BUYERS

5.7 PORTER’S FIVE FORCES

5.8 VENDOR SELECTION CRITERIA

5.9 PESTEL ANALYSIS

5.1 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8 ASIA PACIFIC RECYCLED PLASTIC MARKET, BY SOURCE, 2022-2031 (USD MILLION)

8.1 OVERVIEW

8.2 BOTTLES

8.2.1 BY CAPACITY

8.2.1.1. LESS THAN 100 ML

8.2.1.2. 100-500 ML

8.2.1.3. 500-1000 ML

8.2.1.4. 1000-1500 ML

8.2.1.5. 1500-2000 ML

8.2.1.6. MORE THAN 2000 ML

8.3 FILMS

8.4 FIBERS

8.5 FOAMS

8.6 OTHERS

9 ASIA PACIFIC RECYCLED PLASTIC MARKET, BY POLYMER TYPE, 2022-2031 (USD MILLION)

9.1 OVERVIEW

9.2 POLYETHYLENE TEREPHTHALATE (PET)

9.2.1 BY TYPE

9.2.1.1. FLAKES

9.2.1.2. CHIPS

9.2.2 BY GRADE

9.2.2.1. POST-CONSUMER RESIN

9.2.2.2. POST-COMMERCIAL RESIN

9.2.2.3. POST-INDUSTRIAL RESI

9.2.3 BY COLOR

9.2.3.1. CLEAR

9.2.3.2. COLORED

9.3 HIGH-DENSITY POLYETHYLENE (HDPE)

9.4 LOW-DENSITY POLYETHYLENE (LDPE)

9.5 POLYPROPYLENE (PP)

9.5.1 NATURAL

9.5.2 WHITE/COLORABLE

9.5.3 GREY

9.5.4 BLACK

9.5.5 OTHERS

9.6 POLYVINYL CHLORIDE (PVC)

9.7 POLYURETHANE (PUR)

9.8 POLYSTYRENE (PS)

9.9 OTHERS

10 ASIA PACIFIC RECYCLED PLASTIC MARKET, BY PLASTIC RECYCLING METHOD, 2022-2031 (USD MILLION)

10.1 OVERVIEW

10.2 THERMAL DECOMPOSITION

10.3 HEAT COMPRESSION

10.4 DISTRIBUTED RECYCLING

10.5 PYROLYSIS

10.6 OTHERS

11 ASIA PACIFIC RECYCLED PLASTIC MARKET, BY INDUSTRY, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 PACKAGING

11.2.1 PACKAGING, BY END-USE

11.2.1.1. BOTTLES

11.2.1.2. CONTAINERS

11.2.1.3. BAGS & FILM

11.2.1.4. STRAPPING

11.2.1.5. OTHERS

11.2.2 PACKAGING, BY POLYMER TYPE

11.2.2.1. POLYETHYLENE TEREPHTHALATE (PET)

11.2.2.2. HIGH-DENSITY POLYETHYLENE (HDPE)

11.2.2.3. LOW-DENSITY POLYETHYLENE (LDPE)

11.2.2.4. POLYPROPYLENE (PP)

11.2.2.5. POLYVINYL CHLORIDE (PVC)

11.2.2.6. POLYURETHANE (PUR)

11.2.2.7. POLYSTYRENE (PS)

11.2.2.8. OTHERS

11.3 BUILDING & CONSTRUCTION

11.3.1 BUILDING AND CONSTRUCTION, BY END-USE

11.3.1.1. CARPETS & RUGS

11.3.1.2. LUMBER

11.3.1.3. PIPE

11.3.1.4. FURNISHINGS

11.3.1.5. OTHERS

11.3.2 BUILDING AND CONSTRUCTION, BY POLYMER TYPE

11.3.2.1. POLYETHYLENE TEREPHTHALATE (PET)

11.3.2.2. HIGH-DENSITY POLYETHYLENE (HDPE)

11.3.2.3. LOW-DENSITY POLYETHYLENE (LDPE)

11.3.2.4. POLYPROPYLENE (PP)

11.3.2.5. POLYVINYL CHLORIDE (PVC)

11.3.2.6. POLYURETHANE (PUR)

11.3.2.7. POLYSTYRENE (PS)

11.3.2.8. OTHERS

11.4 AUTOMOTIVE

11.4.1 AUTOMOTIVE, BY END-USE

11.4.1.1. BATTERIES

11.4.1.2. OTHERS

11.4.2 AUTOMOTIVE, BY POLYMER TYPE

11.4.2.1. POLYETHYLENE TEREPHTHALATE (PET)

11.4.2.2. HIGH-DENSITY POLYETHYLENE (HDPE)

11.4.2.3. LOW-DENSITY POLYETHYLENE (LDPE)

11.4.2.4. POLYPROPYLENE (PP)

11.4.2.5. POLYVINYL CHLORIDE (PVC)

11.4.2.6. POLYURETHANE (PUR)

11.4.2.7. POLYSTYRENE (PS)

11.4.2.8. OTHERS

11.5 FURNITURE

11.5.1 FURNITURE, BY POLYMER TYPE

11.5.1.1. POLYETHYLENE TEREPHTHALATE (PET)

11.5.1.2. HIGH-DENSITY POLYETHYLENE (HDPE)

11.5.1.3. LOW-DENSITY POLYETHYLENE (LDPE)

11.5.1.4. POLYPROPYLENE (PP)

11.5.1.5. POLYVINYL CHLORIDE (PVC)

11.5.1.6. POLYURETHANE (PUR)

11.5.1.7. POLYSTYRENE (PS)

11.5.1.8. OTHERS

11.6 TEXTILE AND CLOTHING

11.6.1 TEXTILE AND CLOTHING, BY POLYMER TYPE

11.6.1.1. POLYETHYLENE TEREPHTHALATE (PET)

11.6.1.2. HIGH-DENSITY POLYETHYLENE (HDPE)

11.6.1.3. LOW-DENSITY POLYETHYLENE (LDPE)

11.6.1.4. POLYPROPYLENE (PP)

11.6.1.5. POLYVINYL CHLORIDE (PVC)

11.6.1.6. POLYURETHANE (PUR)

11.6.1.7. POLYSTYRENE (PS)

11.6.1.8. OTHERS

11.7 ELECTRICAL AND ELECTRONICS

11.7.1 ELECTRICAL AND ELECTRONICS, BY POLYMER TYPE

11.7.1.1. POLYETHYLENE TEREPHTHALATE (PET)

11.7.1.2. HIGH-DENSITY POLYETHYLENE (HDPE)

11.7.1.3. LOW-DENSITY POLYETHYLENE (LDPE)

11.7.1.4. POLYPROPYLENE (PP)

11.7.1.5. POLYVINYL CHLORIDE (PVC)

11.7.1.6. POLYURETHANE (PUR)

11.7.1.7. POLYSTYRENE (PS)

11.7.1.8. OTHERS

11.8 AEROSPACE AND DEFENCE

11.8.1 AEROSPACE AND DEFENCE, BY POLYMER TYPE

11.8.1.1. POLYETHYLENE TEREPHTHALATE (PET)

11.8.1.2. HIGH-DENSITY POLYETHYLENE (HDPE)

11.8.1.3. LOW-DENSITY POLYETHYLENE (LDPE)

11.8.1.4. POLYPROPYLENE (PP)

11.8.1.5. POLYVINYL CHLORIDE (PVC)

11.8.1.6. POLYURETHANE (PUR)

11.8.1.7. POLYSTYRENE (PS)

11.8.1.8. OTHERS

11.9 OTHERS

12 ASIA PACIFIC RECYCLED PLASTIC MARKET, BY GEOGRAPHY, 2022-2031 (USD MIILION)

ASIA PACIFIC RECYCLED PLASTIC MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.1 ASIA-PACIFIC

12.1.1 JAPAN

12.1.2 CHINA

12.1.3 SOUTH KOREA

12.1.4 INDIA

12.1.5 AUSTRALIA & NEW ZEALAND

12.1.6 HONG KONG

12.1.7 TAIWAN

12.1.8 SINGAPORE

12.1.9 THAILAND

12.1.10 INDONESIA

12.1.11 MALAYSIA

12.1.12 PHILIPPINES

12.1.13 REST OF ASIA-PACIFIC

13 ASIA PACIFIC RECYCLED PLASTIC MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.2 MERGERS & ACQUISITIONS

13.3 NEW PRODUCT DEVELOPMENT & APPROVALS

13.4 EXPANSIONS

13.5 REGULATORY CHANGES

13.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

15 ASIA PACIFIC RECYCLED PLASTIC MARKET, COMPANY PROFILES

(NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST)

15.1 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 VEOLIA

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 INDORAMA VENTURES PUBLIC COMPANY LIMITED

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 DOW

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 REPSOL

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATES

15.6 BOREALIS AG

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT UPDATES

15.7 CUSTOM POLYMERS

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 FAR EASTERN NEW CENTURY CORPORATION (FENC)

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 K K ASIA (HK) LTD.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT UPDATES

15.1 MBA POLYMERS INC

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATES

15.11 PLASTIPAK HOLDINGS, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATES

15.12 LOTTE CHEMICAL CORPORATION.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT UPDATES

15.13 MITSUI CHEMICALS, INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATES

15.14 RELIANCE INDUSTRIES LIMITED

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATES

15.15 HANWHA GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATES

15.16 LG CHEM

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

16 RELATED REPORTS

17 QUESTIONNAIRE

18 ABOUT DATA BRIDGE MARKET RESEARCH

Asia Pacific Recycled Plastic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Recycled Plastic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Recycled Plastic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.