Asia Pacific Replaceable Filter Dust Masks Market

Market Size in USD Million

CAGR :

%

USD

656.79 Million

USD

1,142.76 Million

2025

2033

USD

656.79 Million

USD

1,142.76 Million

2025

2033

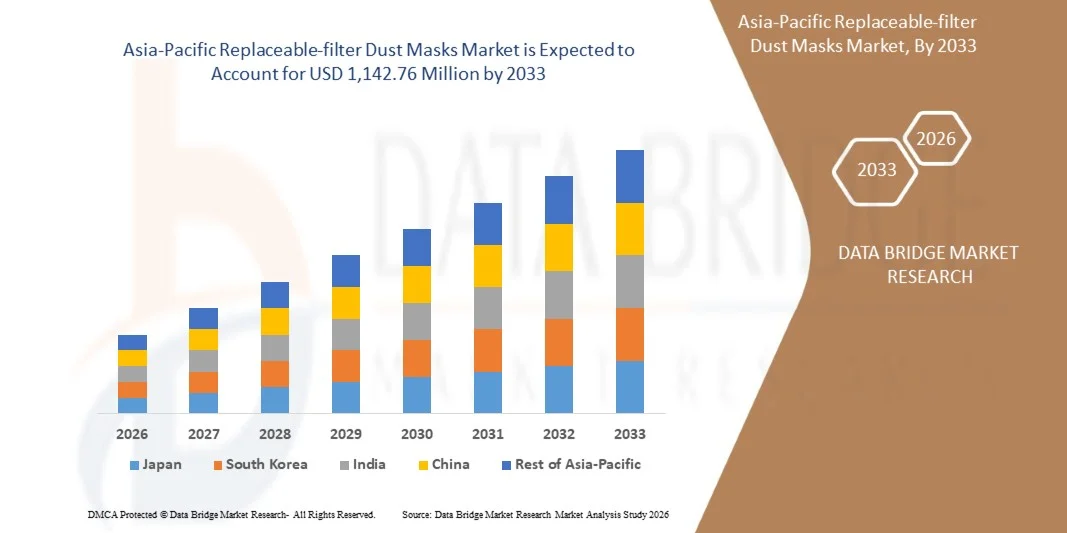

| 2026 –2033 | |

| USD 656.79 Million | |

| USD 1,142.76 Million | |

|

|

|

|

Asia-Pacific Replaceable-filter Dust Masks Market Size

- The Asia-Pacific Replaceable-filter Dust Masks Market was valued at USD 656.79 Million in 2025 and is expected to reach USD 1,142.76 Million by 2033

- During the forecast period of 2026 to 2033 the market is likely to grow at a CAGR of 7.3% primarily driven by growing inclination toward lightweight corrugated boxes

- This growth is driven by factors such continued industrialization demanding unique cartons & materials, rising demand for sustainable & aesthetic packaging, and others.

Asia-Pacific Replaceable-filter Dust Masks Market Analysis

- The Asia Pacific Replaceable-filter Dust Masks Market is experiencing steady expansion, supported by rising awareness of occupational health, stricter workplace safety regulations, and growing exposure to airborne particulates across industrial and urban environments. Replaceable-filter dust masks provide advantages such as cost efficiency, extended product lifespan, consistent filtration performance, and reduced waste compared to disposable alternatives. Their adoption is increasing across construction, manufacturing, mining, chemicals, pharmaceuticals, agriculture, and infrastructure development projects. However, challenges persist in the form of inconsistent regulatory enforcement across developing economies, limited awareness among small enterprises, price sensitivity, and the need for proper training on filter replacement and maintenance.

- The construction and industrial sectors remain primary growth drivers, as workers in these environments face continuous exposure to dust, fumes, and fine particulates, necessitating reliable and reusable respiratory protection. Rapid industrialization, infrastructure expansion, and urban development across major Asia Pacific economies are reinforcing demand. In parallel, manufacturing activities, mining operations, and chemical processing facilities are increasingly prioritizing certified respiratory protection to comply with evolving occupational safety norms. Growing concerns around air pollution and workplace health risks are further encouraging the shift toward replaceable-filter dust masks.

- Indonesia country is playing a critical role in shaping regional market dynamics, with large-scale manufacturing hubs and expanding construction activity accelerating product adoption. At the same time, alignment with international safety standards—driven by export-oriented industries and multinational presence—is influencing product specifications and quality benchmarks. Emerging economies within Southeast Asia and South Asia are also gaining traction as growth markets, supported by rising industrial employment and gradual improvements in worker safety awareness.

- Key manufacturers are focusing on product innovation, including advanced filtration materials, ergonomic mask designs, lightweight reusable shells, and improved sealing mechanisms to enhance comfort and protection. Developments such as multi-layer replaceable filters, compatibility with various particulate standards, and improved breathability are gaining prominence. Among product categories, reusable masks with replaceable filters hold a significant share due to their widespread use in high-exposure industries. Strategic collaborations with industrial distributors, safety equipment suppliers, and regulatory bodies are influencing market penetration. As workplace safety regulations continue to tighten across the region, sustained investment in quality, certification, and user education will be critical for long-term competitiveness..

- In 2026, the Elastomeric Half-Mask Respirators (EHMR) segment is anticipated to hold the largest market share at approximately 37.36% driven largely by the region’s growing industrial activity and increasing adoption of long-term, cost-efficient respiratory equipment. Expanding construction, manufacturing, and mining operations in countries such as China, India, and Southeast Asia are generating higher demand for durable respirators with replaceable filters. These masks are preferred because they provide strong protection, reduce long-term procurement costs, and can be easily maintained through periodic filter replacement. Their modular design—allowing filters to be swapped quickly based on particulate levels or chemical exposure—makes them the default choice for workplaces requiring both protection and operational convenience..

Report Scope and Asia-Pacific Replaceable-filter Dust Masks Market Segmentation

|

Attributes |

Corrugated Board Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Replaceable-filter Dust Masks Market Trends

“Increasing Strategic Acquisitions and Collaborations Among Key Market Players”

- The Asia-Pacific replaceable-filter dust mask industry is witnessing a notable rise in mergers, acquisitions, and collaborative partnerships among leading manufacturers. Major companies are strengthening their market presence by acquiring regional players, forming joint ventures, and expanding production capabilities across emerging high-demand countries. These strategic movements are primarily driven by the need to enhance product portfolios, broaden distribution networks, and increase responsiveness to evolving safety and regulatory requirements.

Such collaborations are also enabling faster adoption of advanced filtration technologies, improved ergonomic designs, and sustainable material innovations within the sector. By pooling technical expertise and manufacturing resources, companies are accelerating product development cycles and enhancing the overall efficiency of their supply chains..

Asia-Pacific Replaceable-filter Dust Masks Market Dynamics

Driver

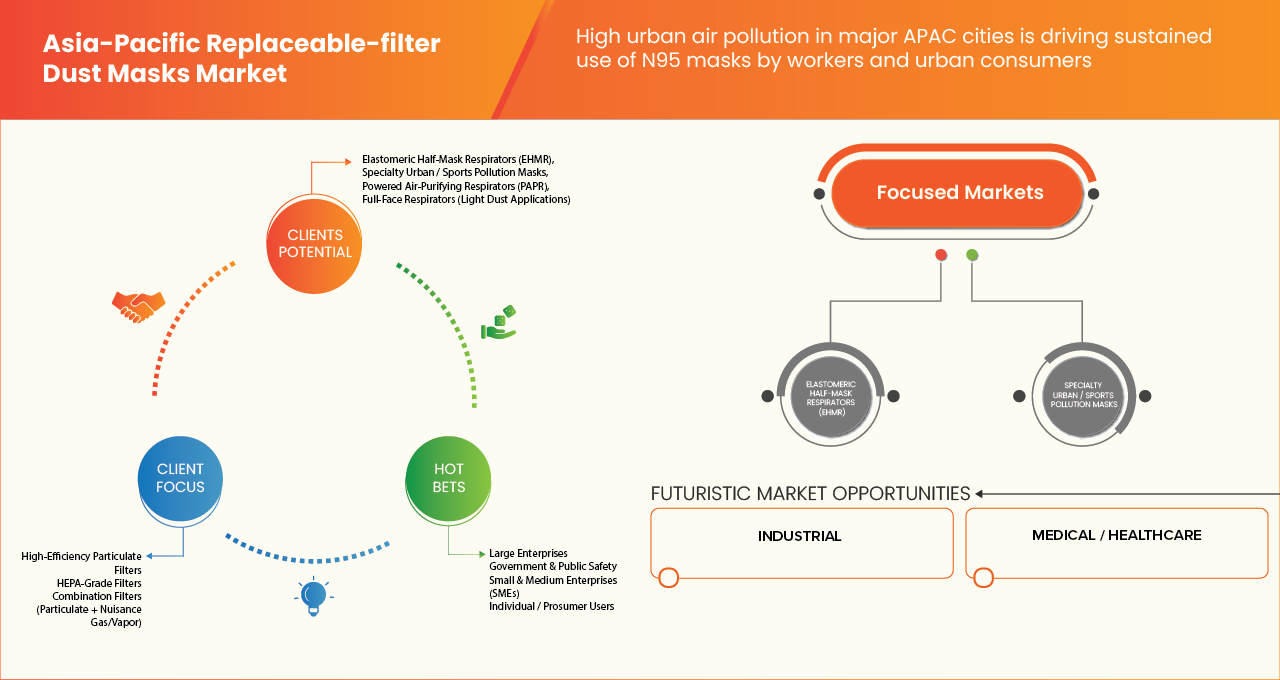

“Persistent high pollution levels across major APAC cities are strengthening long-term reliance on replaceable-filter dust masks”

- Rising urban air pollution across major metropolitan hubs in the Asia-Pacific region is reinforcing a sustained need for high-efficiency respiratory protection, increasingly including replaceable-filter dust masks. Recurring smog events, rapid industrial growth, dense vehicular traffic, construction expansion and seasonal haze have created chronic poor-air-quality conditions that prompt frequent public-health advisories. As governments and medical experts continue recommending particulate-filter respirators during periods of “poor” to “severe” ambient air quality, both workers and urban residents are seeking more durable, reusable options that provide consistent filtration while lowering long-term waste and replacement costs.

- This shift is strengthening structural demand for replaceable-filter respirators, which offer extended usability and effective particulate protection during recurring pollution episodes. Over time, the use of such masks is becoming an ongoing health-management behaviour rather than a short-lived response to episodic pollution spikes.

- In November 2025, India Today reported that health specialists in Delhi advised citizens to wear N95 or N99-grade masks amid hazardous smog conditions. Such repeated advisories highlight the persistent need for high-performance particulate filtration, encouraging adoption of replaceable-filter dust masks that offer durable protection during extended pollution periods.

- In July 2024,Under the National Clean Air Programme, the Ministry of Environment, Forest and Climate Change( MoEF&CC ) identified 131 Indian cities requiring targeted pollution-control initiatives, acknowledging chronic air-quality challenges. Rising recognition of long-term pollution risks bolsters everyday use of replaceable-filter respirators, particularly in urban populations seeking sustainable and reusable protective options.

- In November 2023, World Resources Institute news article highlighted abput a regional environmental analysis for major Southeast Asian cities explicitly noted that during high-pollution days — driven by vehicular emissions and industrial activity — health agencies in cities such as Jakarta and Bangkok routinely issue public advisories urging residents to remain indoors where possible or use masks when outdoors, underscoring that respirator use has become a recurring protective behavior.

Restraint/Challenge

“Presence of counterfeit products undermining trust and squeezing margins of compliant manufacturers”

- The sustained presence of counterfeit and non-compliant respiratory masks across several Asia-Pacific economies has become a material restraint for the replaceable-filter dust masks market. Low-priced, illicit alternatives frequently penetrate informal and grey-market distribution channels, undermining the competitive position of certified manufacturers that invest in validated filtration cartridges, regulatory clearances, and rigorous quality-control processes. This influx of unregulated substitutes not only compresses margins for legitimate producers but also diminishes consumer confidence in premium, replaceable-filter respirator systems. Ongoing enforcement actions, including product seizures, counterfeit crackdowns, and compliance notices issued by regional authorities, indicate that counterfeit infiltration remains a structural barrier that slows market formalization, constrains adoption of higher-grade replaceable-filter designs, and elevates the compliance and monitoring burden on established industry participants.

- In February 2025, the National Institute for Occupational Safety and Health (NIOSH) published a warning titled “Misrepresented Masks and Other Face-Worn Products,” highlighting that counterfeit and misrepresented masks may not provide adequate respiratory protection to workers and consumers. This official advisory underscores the ongoing challenge that substandard, low-cost masks pose to mask-manufacturer margins.

- In February 2022, Hong Kong Customs conducted a special operation and seized about 15,000 suspected counterfeit medical-grade face masks — many labelled as N95 or medical-grade — from a temporary stall at a shopping mall in Ho Man Tin; a 41-year-old woman was arrested in connection with the case.

Asia-Pacific Replaceable-filter Dust Masks Market Scope

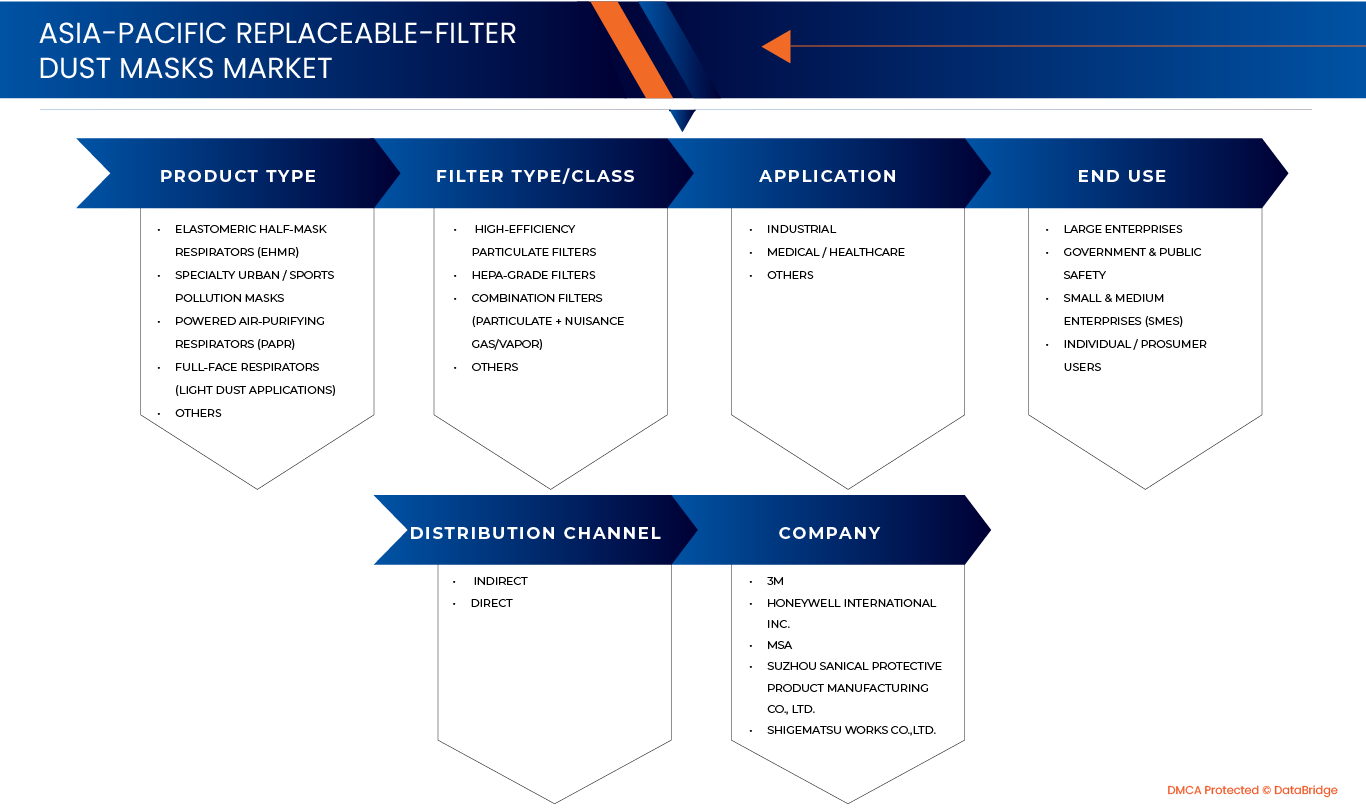

The Asia-Pacific Replaceable-filter Dust Masks market is segmented into five notable segments which are based on Product Type, Filter Type/Class, Application, End Use, Distribution Channel.

- By Product Type

On the basis of product type, the market is segmented into Elastomeric Half-Mask Respirators (EHMR), Specialty Urban / Sports Pollution Masks, Powered Air-Purifying Respirators (PAPR), Full-Face Respirators (Light Dust Applications), Others. In 2026, Elastomeric Half-Mask Respirators (EHMR) segment holds the largest share Demand for EHMRs in Asia-Pacific is driven by rising industrial safety compliance, improved durability preferences, and cost-effectiveness for long-term use. Increased adoption across manufacturing, mining, and construction sectors, along with respiratory protection mandates, significantly boosts EHMR penetration across regional workplaces.

- By Filter Type/Class

On the basis of Filter Type/Class, the market is segmented into High-Efficiency Particulate Filters , HEPA-Grade Filters, Combination Filters (Particulate + Nuisance Gas/Vapor), Others. In 2026, High-Efficiency Particulate Filters segment is dominated due to Growth of high-efficiency particulate filters is supported by stricter air quality standards, heightened occupational hazard awareness, and expanding chemical, pharmaceutical, and electronics industries. Increasing need for filtration efficiency against fine dust, fumes, and hazardous particulates accelerates adoption across industrial and healthcare applications.

- By Application

On the basis of application, the market is segmented into Industrial , Medical / Healthcare, Others. In 2026, Industrial due to due to intensified safety regulations, large-scale manufacturing expansion, and higher exposure to dust and chemical particulates. Growing investments in worker protection programs and increased audits in factories, refineries, and construction projects strengthen the requirement for replaceable-filter respirators across APAC industries.

- By End User

On the basis of end use, the market is segmented into Large Enterprises, Government & Public Safety, Small & Medium Enterprises (SMEs), Individual / Prosumer Users. In 2026, Large Enterprises segment is dominated by drive adoption through standardized safety protocols, bulk procurement practices, and stronger emphasis on compliance with global occupational health norms. Their structured EHS programs, stable budgets, and preference for high-quality respirators fuel higher consumption across manufacturing hubs in Asia-Pacific.

- By Distribution Channel

On the basis of distribution Channel, the market is segmented into direct, indirect. Indirect segment is further segmented E‑Commerce Marketplaces, Industrial Distributors, Retail. In 2026, indirect segment dominates due to strong distributor networks, wider market coverage, and availability of diverse brands through safety product suppliers. Industrial buyers prefer distributors for inventory reliability, quick delivery, and competitive pricing, which collectively boosts indirect sales of replaceable-filter dust masks in APAC.

Asia-Pacific Replaceable-filter Dust Masks Market Share

The competitive landscape of the Asia-Pacific Replaceable-Filter Dust Masks Market offers a comprehensive view of how key manufacturers position themselves within the industry. This section outlines essential insights for each competitor, including their corporate background, financial performance, overall revenue profile, and market potential. It also highlights the extent of their investment in research and development, recent strategic initiatives, regional presence, and the scale of their production infrastructure.

The Major Market Leaders Operating in the Market Are:

- Shigematsu Works Co., Ltd. (Japan)

- KOKEN LTD. (Japan)

- Cambridge Mask Co. (U.K)

- Suzhou Sanical Protective Product Manufacturing Co., Ltd. (China)

- Shanghai Dasheng Health Products Manufacturing Co., Ltd. (China)

- 3M Company (U.S)

- Honeywell International Inc. (U.S)

- MSA Safety Incorporated (U.S)

- Drägerwerk AG & Co. KGaA (Germany)

- Moldex-Metric, Inc. (U.S)

- GVS S.p.A. (Italy)

- Markrite (China)

Latest Developments in Asia-Pacific Replaceable-filter Dust Masks Market

- In April 2024, manufacturers in key Asia-Pacific production hubs reported a significant rise in demand for lightweight and cost-efficient packaging solutions for replaceable-filter dust masks. This shift was driven largely by e-commerce and fast-moving consumer goods (FMCG) companies that were focusing on reducing logistics and last-mile delivery costs, especially in high-volume markets.

- In December 2023, several leading mask producers in the region strengthened collaborations with packaging suppliers located within major industrial zones. These partnerships enabled the development of heavy-duty and customized protective packaging specifically designed for bulk shipments of reusable respirators and replaceable filter units, improving product safety during long-distance transportation.

- In March 2024, dust mask manufacturers catering to the agricultural and export sectors engaged with packaging providers to secure moisture-resistant and durable carton solutions. These enhanced packaging materials were essential for ensuring the quality and shelf-life of masks transported through humid climates and storage environments common across Asia-Pacific agribusiness markets.

- In September 2023, companies serving chemical, pharmaceutical, and industrial safety applications expanded their packaging lines to include high-strength, impact-resistant solutions. This expansion supported the safe distribution of premium-grade respirators and filter cartridges used in hazardous operational settings, reflecting growing demand from sectors prioritizing worker safety and regulatory compliance.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 CONSUMER BUYING BEHAVIOUR IN THE ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.2.1 HEALTH AND SAFETY CONSCIOUSNESS

4.2.2 BRAND TRUST AND REPUTATION

4.2.3 PRODUCT FEATURES AND INNOVATION

4.2.4 PRICE SENSITIVITY AND VALUE PERCEPTION

4.2.5 AWARENESS OF CERTIFICATIONS AND COMPLIANCE

4.2.6 ACCESSIBILITY AND DISTRIBUTION CHANNELS

4.2.7 SOCIAL INFLUENCE AND RECOMMENDATIONS

4.2.8 ENVIRONMENTAL AND SUSTAINABILITY CONSIDERATIONS

4.2.9 PURCHASE FREQUENCY AND USAGE PATTERNS

4.2.10 CONCLUSION

4.3 VENDOR SELECTION CRITERIA – ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.3.1 PRODUCT QUALITY & TECHNICAL COMPETENCE

4.3.1.1 MATERIAL INTEGRITY AND FILTRATION EFFICIENCY

4.3.1.2 DESIGN ADAPTABILITY AND USER COMFORT

4.3.1.3 BATCH CONSISTENCY AND QUALITY TESTING MECHANISMS

4.3.2 REGULATORY COMPLIANCE AND CERTIFICATION STANDARDS

4.3.2.1 ADHERENCE TO REGIONAL STANDARDS

4.3.2.2 PARTICIPATION IN VOLUNTARY CERTIFICATIONS

4.3.2.3 REGULATORY TRANSPARENCY

4.3.3 COST EFFICIENCY AND COMMERCIAL VIABILITY

4.3.3.1 PRICING STRUCTURE AND LONG-TERM AFFORDABILITY

4.3.3.2 COST-TO-PERFORMANCE RATIO

4.3.3.3 FLEXIBILITY IN CONTRACT TERMS

4.3.4 PRODUCTION CAPACITY AND SUPPLY RELIABILITY

4.3.4.1 MANUFACTURING FOOTPRINT AND AUTOMATION LEVEL

4.3.4.2 LEAD TIME AND ON-TIME DELIVERY PERFORMANCE

4.3.4.3 INVENTORY PLANNING AND EMERGENCY ALLOCATION

4.3.5 INNOVATION CAPABILITY AND PRODUCT DEVELOPMENT STRENGTH

4.3.5.1 R&D INVESTMENTS AND PATENT OWNERSHIP

4.3.5.2 SPEED OF PRODUCT CUSTOMIZATION

4.3.5.3 TREND ALIGNMENT

4.3.6 SUPPLY CHAIN TRANSPARENCY AND ETHICAL PRACTICES

4.3.6.1 TRACEABILITY OF RAW MATERIALS

4.3.6.2 ENVIRONMENTAL AND SOCIAL COMPLIANCE

4.3.6.3 VENDOR GOVERNANCE AND POLICY DOCUMENTATION

4.3.7 MARKET REPUTATION AND CLIENT FEEDBACK

4.3.7.1 INDUSTRY FEEDBACK AND PEER ENDORSEMENTS

4.3.7.2 AFTER-SALES RESPONSIVENESS

4.3.7.3 LONGEVITY IN THE MARKET

4.3.8 TECHNOLOGICAL INTEGRATION AND DIGITAL CAPABILITY

4.3.8.1 INTEGRATION OF DIGITAL QUALITY MONITORING SYSTEMS

4.3.8.2 USE OF ERP AND LOGISTICS PLATFORMS

4.3.8.3 DATA-SHARING WILLINGNESS

4.3.9 CONCLUSION

4.4 RAW MATERIAL COVERAGE – ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.4.1 FILTRATION MEDIA (MELT-BLOWN & ELECTROSTATIC LAYERS)

4.4.1.1 TECHNICAL RELEVANCE

4.4.1.2 ELECTROSTATIC ENHANCEMENT

4.4.1.3 SUPPLY RELIABILITY

4.4.2 NONWOVEN OUTER AND INNER LAYERS (SPUN-BOND FABRICS)

4.4.2.1 FUNCTIONAL CHARACTERISTICS

4.4.2.2 REAL-WORLD APPLICABILITY

4.4.2.3 REGIONAL PRODUCTION STRENGTH

4.4.3 ELASTOMERS AND HEAD STRAPS

4.4.3.1 USER-CENTRIC IMPORTANCE

4.4.3.2 MATERIAL ADAPTABILITY

4.4.3.3 SUSTAINABILITY SHIFTS

4.4.4 NOSE CLIPS AND STRUCTURAL SUPPORT COMPONENTS

4.4.4.1 PERFORMANCE SIGNIFICANCE

4.4.4.2 COMFORT ENHANCEMENTS

4.4.4.3 EMERGENCE OF POLYMER-BASED ALTERNATIVES

4.4.5 EXHALATION VALVES AND FILTER CARTRIDGES

4.4.5.1 OPERATIONAL ROLE

4.4.5.2 MATERIAL INNOVATIONS

4.4.5.3 CARTRIDGE HOUSING

4.4.6 ACTIVATED CARBON LAYERS

4.4.6.1 PRACTICAL USE CASES

4.4.6.2 MATERIAL ADVANTAGES

4.4.7 PACKAGING MATERIALS

4.4.7.1 INDUSTRY PRACTICE

4.4.7.2 LOGISTICAL IMPORTANCE

4.4.8 CONCLUSION

4.5 BRAND OUTLOOK – ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.5.1 TRUST AND SAFETY ASSURANCE

4.5.2 DESIGN AND COMFORT AS DIFFERENTIATORS

4.5.3 INNOVATION AND VALUE-ADDED FUNCTIONALITY

4.5.4 LOCALIZATION AND REGIONAL RELEVANCE

4.5.5 DIGITAL ENGAGEMENT AND BRAND VISIBILITY

4.5.6 INDUSTRIAL AND INSTITUTIONAL ENDORSEMENT

4.5.7 PRICING STRATEGY AND PERCEIVED VALUE

4.5.8 CONCLUSION

4.6 SUPPLY CHAIN EXPLANATION FOR THE ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

4.6.1 RAW MATERIAL SOURCING AND PREPARATION

4.6.2 MANUFACTURING AND ASSEMBLY

4.6.3 PACKAGING AND LABELLING

4.6.4 DISTRIBUTION AND LOGISTICS

4.6.5 RETAIL ACCESS AND END-USER ENGAGEMENT

4.6.6 POST-PURCHASE SUPPORT AND DISPOSAL MECHANISMS

4.6.7 CONCLUSION

4.7 COST ANALYSIS BREAKDOWN

4.7.1 KEY COST COMPONENTS

4.7.1.1 RAW MATERIALS

4.7.1.2 COMPONENTS & REPLACEABLE FILTERS

4.7.1.3 LABOR COSTS

4.7.1.4 MANUFACTURING & EQUIPMENT (DEPRECIATION/OVERHEADS)

4.7.1.5 TESTING, CERTIFICATION & QUALITY ASSURANCE

4.7.1.6 PACKAGING & ACCESSORIES

4.7.1.7 DISTRIBUTION, LOGISTICS & SUPPLY CHAIN

4.7.1.8 OVERHEADS, SG&A, R&D, AND COMPLIANCE

4.8 INNOVATION TRACKER AND STRATEGIC ANALYSIS

4.8.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

4.8.2 ACTIVE DEVELOPMENT

4.8.3 STAGE OF DEVELOPMENT

4.8.4 TIMELINES AND MILESTONES

4.8.5 INNOVATION STRATEGIES AND METHODOLOGIES

4.8.6 RISK ASSESSMENT AND MITIGATION

4.8.6.1 RISKS

4.8.6.2 MITIGATION STRATEGIES

4.8.7 FUTURE OUTLOOK

4.9 VALUE CHAIN ANALYSIS

4.9.1 RAW MATERIALS & PRIMARY COMPONENTS

4.9.2 COMPONENT MANUFACTURING & MASK/FILTER CONVERSION

4.9.3 EQUIPMENT & TECHNOLOGY PROVIDERS

4.9.4 QUALITY, STANDARDS & REGULATORY INTERFACE

4.9.5 DISTRIBUTION & INDUSTRIAL SUPPLY LOGISTICS

4.9.6 OEMS, CDMOS, TESTING LABS & SERVICE LAYER

4.9.7 CONCLUSION

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE(S)

5.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.3 VENDOR SELECTION CRITERIA DYNAMICS

5.4 IMPACT ON SUPPLY CHAIN

5.4.1 RAW MATERIAL PROCUREMENT

5.4.2 MANUFACTURING AND PRODUCTION

5.4.3 LOGISTICS AND DISTRIBUTION

5.4.4 PRICE PITCHING AND POSITION OF MARKET

5.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.5.1 SUPPLY CHAIN OPTIMIZATION

5.5.2 JOINT VENTURE ESTABLISHMENTS

5.6 IMPACT ON PRICES

5.7 REGULATORY INCLINATION

5.7.1 GEOPOLITICAL SITUATION

5.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.7.2.1 FREE TRADE AGREEMENTS

5.7.2.2 ALLIANCES ESTABLISHMENTS

5.7.3 STATUS ACCREDITATION (INCLUDING MFN)

5.7.4 DOMESTIC COURSE OF CORRECTION

5.7.4.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.7.4.2 ESTABLISHMENT OF SEZS/INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 PRODUCT CODES

6.2 CERTIFIED STANDARDS

6.3 SAFETY STANDARDS

6.3.1 MATERIAL HANDLING & STORAGE

6.3.2 TRANSPORT & PRECAUTIONS

6.3.3 HAZARD IDENTIFICATION

7 MARKET OVERVIEW

7.1 DRIVER

7.1.1 PERSISTENT HIGH POLLUTION LEVELS ACROSS MAJOR APAC CITIES ARE STRENGTHENING LONG-TERM RELIANCE ON REPLACEABLE-FILTER DUST MASKS

7.1.2 STRENGTHENING OCCUPATIONAL SAFETY REGULATIONS IN CONSTRUCTION AND MINING, MANDATING CERTIFIED RESPIRATORY PROTECTION

7.1.3 GROWING CONSUMER HEALTH CONSCIOUSNESS FAVORING HIGHER-GRADE RESPIRATORS

7.2 RESTRAINT

7.2.1 PRESENCE OF COUNTERFEIT PRODUCTS UNDERMINING TRUST AND SQUEEZING MARGINS OF COMPLIANT MANUFACTURERS

7.2.2 COMFORT AND FIT ISSUES REDUCING CONSISTENT MASK USAGE

7.3 OPPORTUNITES

7.3.1 SMART RESPIRATORS CREATING PREMIUM TECHNOLOGY-DRIVEN MARKET NICHES

7.3.2 EXPANDING HEALTHCARE INFRASTRUCTURE IN CHINA, INDIA, AND SOUTHEAST ASIA DRIVING HIGHER INSTITUTIONAL DEMAND FOR ADVANCED REPLACEABLE-FILTER RESPIRATORS

7.3.3 RISING ADOPTION OF INDUSTRIAL-GRADE AND SECTOR-SPECIFIC REPLACEABLE-FILTER MASK VARIANTS

7.4 CHALLENGES

7.4.1 NAVIGATING HETEROGENEOUS REGULATORY AND CERTIFICATION FRAMEWORKS

7.4.2 MANAGING INVENTORY PLANNING AND DEMAND VOLATILITY, WITH SUDDEN SPIKES DURING OUTBREAKS, POLLUTION EPISODES, OR DISASTERS

8 TABLE

9 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

9.2.1 ELASTOMERIC HALF-MASK RESPIRATORS (EHMR)

9.2.2 SPECIALTY URBAN / SPORTS POLLUTION MASKS

9.2.3 POWERED AIR-PURIFYING RESPIRATORS (PAPR)

9.2.4 FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS)

9.2.5 OTHERS

9.3 ASIA-PACIFIC ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 DUAL-FILTER PORT

9.3.2 SINGLE-FILTER PORT

9.4 ASIA-PACIFIC FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 STANDARD FULL-FACE

9.4.2 LOW-PROFILE / PANORAMIC

9.4.3 CHEMICAL-RESISTANT FULL FACE

10 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS

10.1 OVERVIEW

10.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

10.2.1 HIGH-EFFICIENCY PARTICULATE FILTERS

10.2.2 HEPA-GRADE FILTERS

10.2.3 COMBINATION FILTERS (PARTICULATE + NUISANCE GAS/VAPOR)

10.2.4 OTHERS

11 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.2.1 INDUSTRIAL

11.2.2 MEDICAL / HEALTHCARE

11.2.3 OTHERS

11.3 ASIA-PACIFIC INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.3.1 CONSTRUCTION

11.3.2 MINING

11.3.3 AUTOMOTIVE

11.3.4 SMELTING / METALLURGY

11.3.5 SHIPBUILDING

11.3.6 AGRICULTURE & FORESTRY

11.3.7 OTHERS

12 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, END USE

12.1 OVERVIEW

12.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

12.2.1 LARGE ENTERPRISES

12.2.2 GOVERNMENT & PUBLIC SAFETY

12.2.3 SMALL & MEDIUM ENTERPRISES (SMES)

12.2.4 INDIVIDUAL / PROSUMER USERS

13 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

13.2.1 INDIRECT

13.2.2 DIRECT

13.3 ASIA-PACIFIC INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

13.3.1 E‑COMMERCE MARKETPLACES

13.3.2 INDUSTRIAL DISTRIBUTORS

13.3.3 RETAIL

14 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY COUNTRY

14.1 ASIA PACIFIC

14.1.1 INDONESIA

14.1.2 VIETNAM

14.1.3 THAILAND

15 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET

15.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 3M

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 HONEYWELL INTERNATIONAL INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 MSA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 SUZHOU SANICAL PROTECTIVE PRODUCT MANUFACTURING CO., LTD

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 SHIGEMATSU WORKS CO., LTD.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 CAMBRIDGE MASK CO.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 DRÄGERWERK AG & CO. KGAA

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 GVS S.P.A.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 KOKEN LTD.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 MARKRITE

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 MOLDEX-METRIC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 SHANGHAI DASHENG HEALTH PRODUCTS MANUFACTURING CO., LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 CONSUMER PROFILES AND PURCHASING BEHAVIOR FOR RESPIRATORY PROTECTION PRODUCTS

TABLE 2 SUMMARY OF KEY RAW MATERIALS AND THEIR FUNCTIONAL IMPACT

TABLE 3 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET – BRAND OUTLOOK

TABLE 4 KEY PRODUCTS AND COMPETITIVE LANDSCAPE OF TOP GLOBAL RESPIRATOR AND DUST MASK BRANDS

TABLE 5 TYPICAL COST SHARES OF ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET:

TABLE 6 DETAILS ON MOST COMMON MASKED, BY COUNTRY, 2024

TABLE 7 PRICING/MARGIN ANALYSIS, AT MANUFACTURER’S & DISTRIBUTION LEVEL, BY COUNTRY, 2024

TABLE 8 DETAILS ON MOST COMMON MASKED, BY COUNTRY, 2024

TABLE 9 PRICING/MARGIN ANALYSIS, AT MANUFACTURER’S & DISTRIBUTION LEVEL, BY COUNTRY, 2024

TABLE 10 DETAILS ON MOST COMMON MASKED, BY COUNTRY, 2024

TABLE 11 PRICING/MARGIN ANALYSIS, AT MANUFACTURER’S & DISTRIBUTION LEVEL, BY COUNTRY, 2024

TABLE 12 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC

TABLE 24 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 INDONESIA ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 INDONESIA FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 37 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 38 INDONESIA INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 40 INDONESIA REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 41 INDONESIA INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 VIETNAM ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 VIETNAM FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 46 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 47 VIETNAM INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 49 VIETNAM REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 50 VIETNAM INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 51 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 52 THAILAND ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 53 THAILAND FULL-FACE RESPIRATORS (LIGHT DUST APPLICATIONS) IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 54 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2018-2032 (USD THOUSAND)

TABLE 55 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 56 THAILAND INDUSTRIAL IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 57 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2018-2033 (USD THOUSAND)

TABLE 58 THAILAND REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 59 THAILAND INDIRECT IN REPLACEABLE-FILTER DUST MASKS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 FIVE SEGMENTS COMPRISE THE ASIA-PACIFIC REPLACEABLE-FILTER DUST MARKET, BY PRODUCT TYPE (2025)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING CONSUMER HEALTH CONSCIOUSNESS FAVORING HIGHER-GRADE RESPIRATORS IS A MAJOR FACTOR BOOSTING THE ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 ELASTOMERIC HALF-MASK RESPIRATORS (EHMR) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET IN 2026 & 2033

FIGURE 16 DROC

FIGURE 17 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY PRODUCT TYPE, 2025

FIGURE 18 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY FILTER TYPE/CLASS, 2025

FIGURE 19 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY APPLICATION, 2025

FIGURE 20 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY END USE, 2025

FIGURE 21 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, BY DISTRIBUTION CHANNEL, 2025

FIGURE 22 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET, SNAPSHOT (2025)

FIGURE 23 ASIA-PACIFIC REPLACEABLE-FILTER DUST MASKS MARKET: COMPANY SHARE 2025 (%)

Asia Pacific Replaceable Filter Dust Masks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Replaceable Filter Dust Masks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Replaceable Filter Dust Masks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.