Asia Pacific Retail Analytics Market

Market Size in USD Billion

CAGR :

%

USD

2.53 Billion

USD

5.71 Billion

2025

2033

USD

2.53 Billion

USD

5.71 Billion

2025

2033

| 2026 –2033 | |

| USD 2.53 Billion | |

| USD 5.71 Billion | |

|

|

|

|

Asia-Pacific Retail Analytics Market Size

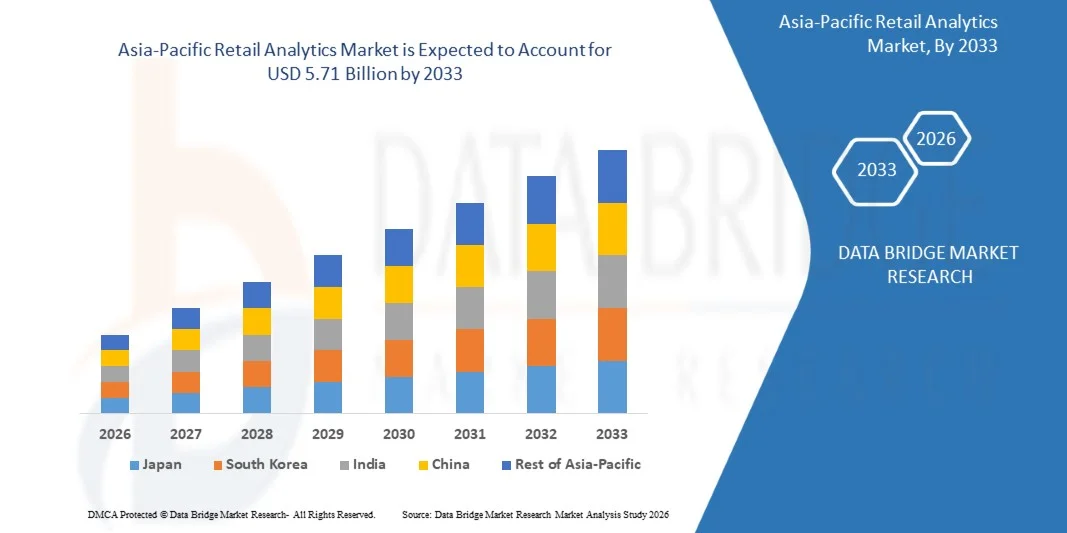

- The Asia-Pacific Retail Analytics Market size was valued at USD 2.53 billion in 2025 and is projected to reach USD 5.71 billion by 2033, growing at a CAGR of 10.69% during the forecast period.

- The market growth is primarily driven by the increasing adoption of advanced analytics solutions and AI-powered tools in retail, enabling businesses to gain actionable insights, optimize operations, and enhance customer experiences.

- Additionally, the surge in e-commerce, omnichannel retail strategies, and the growing focus on personalized marketing and inventory management are propelling demand for retail analytics solutions, thereby accelerating market expansion across the region.

Asia-Pacific Retail Analytics Market Analysis

- Retail analytics, leveraging data-driven insights to optimize operations, personalize customer experiences, and enhance decision-making, is becoming an essential tool for retailers across both physical and digital channels due to its ability to improve efficiency, drive sales, and predict consumer behavior.

- The growing demand for retail analytics is primarily fueled by the rapid digital transformation in the retail sector, the rise of e-commerce, and the increasing focus on customer-centric strategies to enhance engagement and loyalty.

- China dominated the Asia-Pacific Retail Analytics Market with the largest revenue share of 34.3% in 2025, driven by early adoption of advanced analytics solutions, high technology investment, and a mature retail ecosystem, with the U.S. witnessing significant implementation of AI and big data tools in retail operations to optimize pricing, inventory, and marketing campaigns.

- India is expected to be the fastest-growing region in the Asia-Pacific Retail Analytics Market during the forecast period due to rapid urbanization, the expansion of e-commerce platforms, and increasing adoption of AI-driven analytics solutions by both large retailers and small-to-medium enterprises.

- The software segment dominated the market with a revenue share of 61.5% in 2025, driven by the increasing adoption of advanced analytics platforms, predictive modeling tools, and AI-powered applications that enable retailers to gain actionable insights and optimize operations.

Report Scope and Asia-Pacific Retail Analytics Market Segmentation

|

Attributes |

Retail Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Asia-Pacific Retail Analytics Market Trends

“Enhanced Convenience Through AI and Predictive Analytics”

- A significant and accelerating trend in the Asia-Pacific Retail Analytics Market is the deepening integration of artificial intelligence (AI) and machine learning (ML) with advanced analytics platforms. This combination is enabling retailers to gain actionable insights, automate decision-making, and deliver highly personalized shopping experiences.

- For instance, retailers using predictive analytics platforms can forecast demand for specific products with high accuracy, optimize pricing strategies in real time, and reduce inventory waste. Similarly, AI-powered recommendation engines, such as those implemented by Alibaba and JD.com, can suggest personalized products to shoppers, boosting engagement and sales.

- AI integration in retail analytics allows features such as analyzing customer behavior patterns to provide tailored promotions, detecting fraud or unusual transaction activity, and optimizing supply chain operations. For example, some platforms leverage machine learning to dynamically adjust inventory allocation across multiple store locations based on predicted demand fluctuations.

- The seamless integration of retail analytics with omnichannel platforms and CRM systems facilitates centralized management of sales, marketing, and customer engagement strategies. Through a single interface, retailers can monitor in-store traffic, online behavior, and customer feedback, creating a unified, data-driven approach to business operations.

- This trend toward more intelligent, predictive, and interconnected analytics solutions is fundamentally reshaping retailer expectations for operational efficiency and customer experience. Consequently, companies such as Microsoft, SAP, and Alibaba Cloud are developing AI-enabled analytics solutions with features such as real-time insights, personalized recommendations, and predictive demand modeling.

- The demand for retail analytics solutions that offer seamless AI and predictive analytics integration is growing rapidly across both large-scale and small-to-medium retailers, as businesses increasingly prioritize efficiency, customer personalization, and data-driven decision-making.

Asia-Pacific Retail Analytics Market Dynamics

Driver

“Growing Need Due to Increasing Competition and Digital Transformation in Retail”

- The rising competition in the retail sector, combined with the accelerating digital transformation across Asia-Pacific, is a major driver for the heightened demand for retail analytics solutions.

- For instance, in 2025, Alibaba Cloud introduced advanced AI-powered retail analytics tools to help brick-and-mortar stores optimize inventory management and improve personalized customer engagement. Such initiatives by key companies are expected to fuel market growth during the forecast period.

- As retailers face pressure to enhance operational efficiency and deliver superior customer experiences, retail analytics platforms offer advanced features such as predictive demand forecasting, customer segmentation, and real-time sales tracking, providing a compelling advantage over traditional decision-making methods.

- Furthermore, the growing adoption of omnichannel retail strategies and the integration of e-commerce with physical stores are making analytics solutions indispensable for monitoring customer behavior across multiple touchpoints, optimizing promotions, and streamlining supply chains.

- The ability to analyze consumer preferences, predict trends, and implement data-driven marketing strategies is propelling the adoption of retail analytics across both large enterprises and SMEs. The trend towards cloud-based solutions and the increasing availability of user-friendly analytics platforms further contribute to market expansion.

Restraint/Challenge

“Concerns Regarding Data Privacy and High Implementation Costs”

- Concerns surrounding data privacy and security of customer information pose a significant challenge to broader adoption of retail analytics solutions. As these platforms collect and process large volumes of consumer data, retailers must ensure compliance with regional data protection regulations, raising operational complexity and costs.

- For instance, reports of data breaches in retail systems have made some companies hesitant to fully adopt analytics-driven strategies, fearing reputational damage and regulatory penalties.

- Addressing these concerns through robust data encryption, secure cloud infrastructure, and compliance with privacy regulations such as GDPR or local data protection laws is crucial for building trust. Companies like Microsoft, SAP, and Oracle emphasize their secure analytics frameworks to reassure potential clients.

- Additionally, the relatively high initial cost of implementing advanced analytics platforms, including AI and predictive tools, can be a barrier for small and medium-sized retailers, particularly in developing economies. While cloud-based solutions are lowering entry costs, premium features such as real-time predictive modeling and advanced customer insights often come with higher subscription fees.

- Overcoming these challenges through improved data security, affordable and scalable analytics solutions, and retailer education on the benefits of data-driven strategies will be vital for sustained growth in the Asia-Pacific retail analytics market.

Asia-Pacific Retail Analytics Market Scope

Retail analytics market is segmented on the basis of offering, deployment model, organization size, business functionality, application, and end user.

• By Offering

On the basis of offering, the Asia-Pacific Retail Analytics Market is segmented into software and services. The software segment dominated the market with a revenue share of 61.5% in 2025, driven by the increasing adoption of advanced analytics platforms, predictive modeling tools, and AI-powered applications that enable retailers to gain actionable insights and optimize operations. Software solutions allow seamless integration with multiple data sources, providing real-time visibility into customer behavior, inventory management, and sales trends.

The services segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, fueled by growing demand for implementation, consulting, training, and support services that help retailers maximize the value of their analytics investments. Managed and professional services, in particular, are gaining traction among small and medium enterprises that require expert guidance to deploy analytics solutions efficiently.

• By Deployment Model

On the basis of deployment model, the market is segmented into cloud and on-premises. The cloud segment held the largest market revenue share of 57.8% in 2025, owing to the flexibility, scalability, and cost-effectiveness offered by cloud-based retail analytics solutions. Cloud deployment enables retailers to access data remotely, supports real-time analytics, and reduces the need for heavy IT infrastructure, making it particularly appealing for e-commerce and omnichannel retailers.

The on-premises segment is projected to witness the fastest CAGR of 21.5% from 2026 to 2033, driven by large enterprises in highly regulated sectors that prefer enhanced data control, customization, and security. Hybrid deployment models are also emerging, combining the advantages of cloud scalability with the data sovereignty offered by on-premises systems.

• By Organization Size

On the basis of organization size, the market is segmented into large enterprises and SMEs. Large enterprises dominated the market with a revenue share of 64.0% in 2025, attributed to their higher IT budgets, extensive retail networks, and early adoption of advanced analytics technologies to optimize supply chains, marketing campaigns, and customer engagement.

SMEs are expected to witness the fastest CAGR of 23.0% from 2026 to 2033, supported by the availability of cost-effective, cloud-based analytics platforms and services that allow smaller retailers to leverage data-driven decision-making. The growing focus on personalized marketing, inventory optimization, and operational efficiency is driving SMEs to adopt analytics solutions at an accelerated pace.

• By Business Functionality

On the basis of business functionality, the market is segmented into sales and marketing, supply chain, finance, operations, procurement, and human resource. The sales and marketing segment dominated the market with a revenue share of 45.6% in 2025, driven by retailers’ focus on customer acquisition, personalized promotions, and targeted campaigns to boost revenue and customer loyalty.

The supply chain segment is expected to witness the fastest CAGR of 22.8% from 2026 to 2033, fueled by the need to optimize inventory, reduce stockouts, and enhance delivery efficiency. Analytics solutions are increasingly applied to forecast demand, streamline logistics, and improve overall operational efficiency across both physical and online retail channels.

• By Application

On the basis of application, the market is segmented into multiple areas, including customer management, merchandising analysis, inventory analysis, performance analysis, pricing analysis, yield analysis, order and fulfillment management, and cluster planning. The customer management segment held the largest revenue share of 38.9% in 2025, driven by the rising importance of personalization, loyalty programs, and real-time engagement strategies to retain customers.

Inventory analysis is expected to witness the fastest CAGR of 24.1% from 2026 to 2033, as retailers increasingly adopt predictive analytics to optimize stock levels, minimize wastage, and improve supply chain efficiency. Advanced applications such as pricing optimization and transportation management are also gaining traction in omnichannel retail environments.

• By End User

On the basis of end user, the market is segmented into offline retail and online (e-commerce) channels. The offline retail segment dominated the market with a revenue share of 52.4% in 2025, supported by the modernization of brick-and-mortar stores with analytics-driven solutions to improve in-store experiences, optimize layouts, and personalize customer engagement.

The online (e-commerce) segment is expected to witness the fastest CAGR of 25.0% from 2026 to 2033, fueled by the exponential growth of online shopping, expanding digital payment adoption, and the critical role of analytics in enhancing website personalization, recommendation engines, and targeted marketing campaigns. Retailers are increasingly integrating online and offline analytics to deliver a seamless omnichannel experience.

Asia-Pacific Retail Analytics Market Regional Analysis

- China dominated the Asia-Pacific Retail Analytics Market with the largest revenue share of 34.3% in 2025, driven by early adoption of advanced analytics solutions, a strong presence of global technology providers, and high investments in digital transformation initiatives.

- Businesses in the region prioritize data-driven decision-making to optimize sales, marketing, supply chain, and customer engagement, leveraging AI and cloud-based analytics platforms for real-time insights and operational efficiency.

- This widespread adoption is further supported by high IT spending, a digitally savvy workforce, and robust infrastructure for cloud computing and data management, positioning North America as a key market for retail analytics solutions across both large enterprises and SMEs.

China Retail Analytics Market Insight

The China retail analytics market accounted for the largest revenue share in the Asia-Pacific region in 2025, driven by the rapid expansion of e-commerce, modern retail chains, and the adoption of AI and big data solutions for customer insights. Government initiatives supporting smart retail and digitalization are accelerating the deployment of analytics platforms. Moreover, China’s large consumer base and high smartphone penetration are fueling demand for personalized marketing, inventory optimization, and predictive analytics, making it the dominant country in the APAC retail analytics market.

Japan Retail Analytics Market Insight

The Japan retail analytics market is witnessing steady growth due to the country’s tech-savvy population, increasing digital adoption in retail, and emphasis on operational efficiency. Retailers are leveraging advanced analytics for customer behavior tracking, merchandising optimization, and demand forecasting. Additionally, the aging population and growing interest in personalized services are driving the adoption of predictive analytics and AI-driven insights across both physical stores and online channels.

India Retail Analytics Market Insight

The India retail analytics market is poised to register the fastest CAGR in the Asia-Pacific region from 2026 to 2033, propelled by the digital transformation of retail, rising smartphone penetration, and increased adoption of cloud-based analytics solutions. Retailers are investing heavily in customer analytics, inventory management, and sales performance monitoring to enhance competitiveness. Government initiatives promoting smart cities and digital payments further support the market’s expansion.

South Korea Retail Analytics Market Insight

The South Korea retail analytics market is expanding steadily, driven by high digital adoption, widespread use of mobile commerce, and the growing integration of AI and big data in retail operations. Retailers are increasingly implementing analytics solutions to optimize supply chain efficiency, enhance customer engagement, and improve marketing ROI. South Korea’s advanced IT infrastructure and strong e-commerce ecosystem further facilitate the adoption of smart retail analytics technologies.

Singapore Retail Analytics Market Insight

The Singapore retail analytics market is experiencing significant growth, fueled by the country’s well-developed retail infrastructure, high technology adoption, and the emphasis on data-driven decision-making. Retailers are leveraging analytics to improve customer experience, optimize inventory, and enhance operational efficiency. Additionally, government initiatives supporting digital transformation and smart city projects are accelerating the deployment of analytics platforms, making Singapore a key growth market in the Asia-Pacific region.

Asia-Pacific Retail Analytics Market Share

The Retail Analytics industry is primarily led by well-established companies, including:

- SAP SE (Germany)

- Oracle Corporation (U.S.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- NielsenIQ (U.S.)

- Infosys Ltd. (India)

- Tata Consultancy Services (TCS) (India)

- Wipro Ltd. (India)

- Alibaba Cloud (China)

- Tencent Cloud (China)

- Baidu AI Cloud (China)

- Huawei Technologies (China)

- SAS Institute Inc. (U.S.)

- Zoho Corporation (India)

- FICO (U.S.)

- QlikTech International AB (Sweden)

- Tableau Software (U.S.)

- CloudWalk Technology (China)

- Fractal Analytics (India)

- EXL Service (U.S.)

What are the Recent Developments in Asia-Pacific Retail Analytics Market?

- In April 2024, SAP SE, a global leader in enterprise software and analytics solutions, launched a strategic initiative in Singapore aimed at enhancing retail data intelligence for both large enterprises and SMEs. The initiative focuses on deploying advanced retail analytics platforms to optimize inventory, improve customer engagement, and streamline supply chain operations. By leveraging its global expertise and cloud-based solutions, SAP SE is addressing the unique demands of the Asia-Pacific retail market, reinforcing its position in the rapidly growing regional analytics industry.

- In March 2024, Oracle Corporation introduced the Oracle Retail Customer Intelligence Cloud Service across India, providing retailers with AI-powered insights into customer behavior and purchasing patterns. This advanced platform enables businesses to make data-driven decisions for marketing, sales, and merchandising strategies. The rollout highlights Oracle’s commitment to delivering innovative analytics solutions that enhance operational efficiency and customer experiences in the Asia-Pacific retail sector.

- In March 2024, Microsoft Corporation successfully deployed its Dynamics 365 Retail Analytics solution in major Australian retail chains to drive smarter decision-making through real-time sales, inventory, and customer data insights. This initiative underscores Microsoft’s focus on integrating AI and cloud-based analytics into retail operations, fostering data-driven strategies that improve efficiency and profitability in the region.

- In February 2024, IBM Corporation announced a strategic partnership with leading e-commerce platforms in Japan to implement IBM Watson Analytics for retail. This collaboration is designed to provide retailers with predictive insights, streamline merchandising decisions, and enhance overall customer experience. The initiative emphasizes IBM’s dedication to advancing analytics adoption and operational effectiveness in the Asia-Pacific retail ecosystem.

- In January 2024, NielsenIQ unveiled its Retail Analytics 360 platform in China, offering a comprehensive solution for sales performance tracking, inventory management, and consumer insights. The platform integrates AI-driven analytics with cloud-based reporting tools, enabling retailers to optimize pricing, promotions, and supply chain operations. This launch highlights NielsenIQ’s commitment to empowering Asia-Pacific retailers with actionable intelligence to enhance competitiveness and drive growth.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.