Asia Pacific Rolling Stock Market

Market Size in USD Billion

CAGR :

%

USD

11.93 Billion

USD

17.76 Billion

2021

2029

USD

11.93 Billion

USD

17.76 Billion

2021

2029

| 2022 –2029 | |

| USD 11.93 Billion | |

| USD 17.76 Billion | |

|

|

|

|

Asia-Pacific Rolling Stock Market Analysis and Size

Rolling stock has grown in popularity in a variety of industries, including automotive, mining, and oil and gas, where tank waggons are commonly used to transport industrial chemicals, gasoline and diesel, and a variety of deliverables.

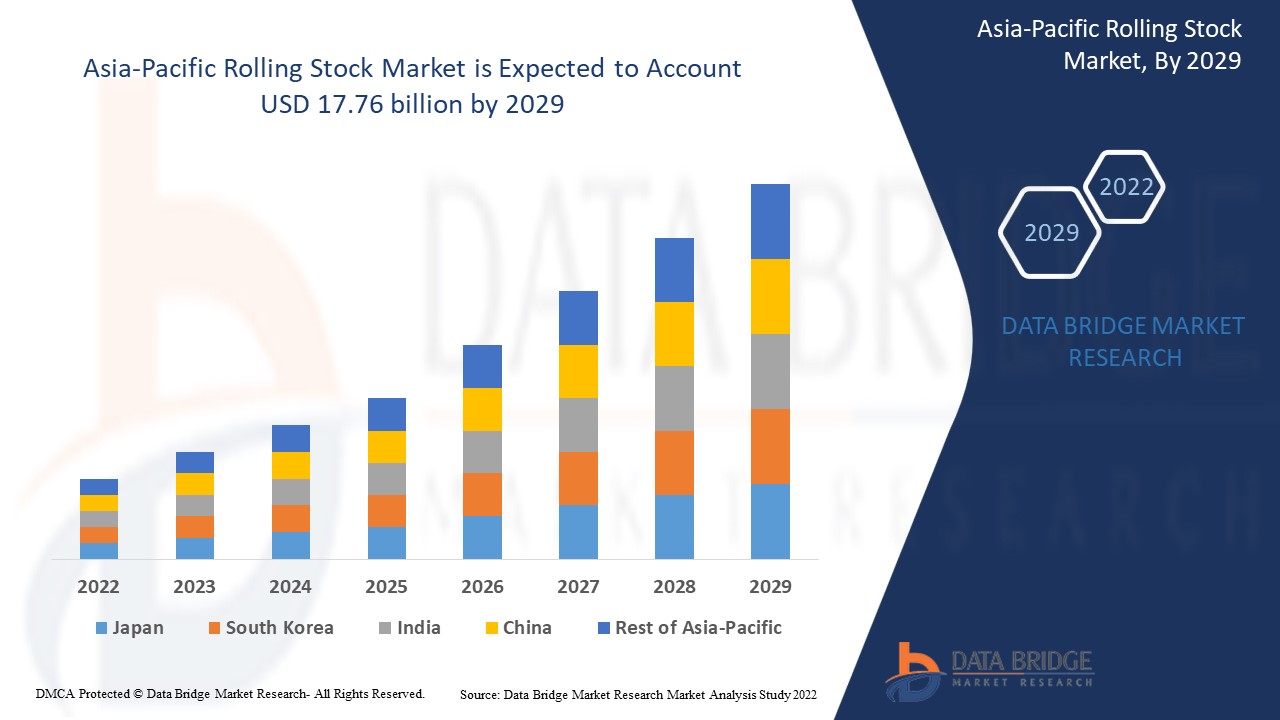

Data Bridge Market Research analyses that the rolling stock market was valued at USD 11.93 billion in 2021 and is expected to reach the value of USD 17.76 billion by 2029, at a CAGR of 5.10%% during the forecast period of 2022-2029. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Asia-Pacific Rolling Stock Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Product Type (Wagons, Coaches, Locomotives, Rapid Transit), Locomotive Technology (Turbocharged Locomotives, Conventional Locomotives, Maglev), Components (Traction Motor, Auxiliary Power System, Wheelset, Axle, Pantograph, Air Conditioning System, Passenger Information System), Application (Passenger Transportation, Freight Transportation), |

|

Countries Covered |

China, India, South Korea, Australia, Japan, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific |

|

Market Players Covered |

ABB (Sweden), Alstom (France), American Industrial Transport, Inc. (U.S.), Bombardier (Canada), CAF (U.K.), Construcciones y Auxiliar de Ferrocarriles, S.A. (Spain), Caterpillar (U.S.), CRRC Corporation Limited (China), Hitachi, Ltd. (Japan), HYUNDAI ROTEM COMPANY (South Korea), JAPAN TRANSPORT ENGINEERING COMPANY (Japan), Kawasaki Heavy Industries, Ltd. (Japan), Mitsubishi Electric Corporation (Japan), National Steel Car Limited (Canada), Niigata Transys Co.,Ltd. (Japan), PATENTES TALGO S.L.U. (Spain), Siemens (Germany), Stadler Rail AG (Switzerland), Toshiba Infrastructure Systems & Solutions Corporation (Japan), Wabtec Corporation (U.S.), and Woojin Industrial Systems, Co, Ltd. (South Korea), among others |

|

Market Opportunities |

|

Market Definition

All wheeled vehicles that run on railway tracks are referred to as rolling stock, and this includes both powered and unpowered coaches, carriages, passenger cars, and freight waggons. It is regarded as one of the most cost-effective modes of transportation for commuters and for transporting heavy or bulky goods over long distances. It can also be easily customised to meet the exact needs of the end user and has a higher carrying capacity than other modes of transportation.

Drivers

- High scale public transportation in the region

The growing urban population and industrial mining activities around the world, which have driven demand for rapid trams, local passenger trains, and fast metro trains, are key factors driving the Asia-Pacific rolling stock market. People are increasingly choosing public transportation because it reduces on-road congestion and offers a time-saving, comfortable, and cost-effective mode of transportation.

- Advance technological innovations

Big data and analytics innovations have aided industrial OEMs and suppliers in streamlining their operations and providing digital solutions, real-time monitoring, and predictive maintenance solutions to rolling stock users. Furthermore, technological advancements such as magnetic levitation trains (Maglev Trains), the use of IoT in communications, signalling, engineering, and improving on board passenger experience have catalysed the Asia-Pacific rolling stock market's growth.

Opportunities

- Upgradation of railway infrastructure

Increasing initiatives to improve rail infrastructure and services for customers, such as offering faster, safer, and more comfortable services, are creating opportunities for the rolling stock market.

Restraints

- High cost will restrain the growth

The high capital investment required for research activities is limiting the growth of rolling stock market players as well as rolling stock market growth.

This rolling stock market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the rolling stock market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Rolling Stock Market

COVID-19 had a negative impact on the market in 2020. Travel and tourism were halted as a result of the pandemic. During the COVID pandemic, major rolling stock manufacturers such as Alstom (France) and Bombardier (US) announced the suspension of production due to supply chain bottlenecks, a drop in demand, and to protect the safety of their employees in Spain, the United States, Italy, Germany, and France. Furthermore, R&D budget allocations were significantly reduced, impeding the advancement of innovative rail development. The demand for rolling stock is primarily driven by government budgets and the needs of rail operators.

Recent Developments

- In January 2022 Wabtec Corporation acquired MASU, a leading manufacturer of friction products for the rail and automotive industries,. This acquisition will assist Wabtec Corporation in expanding its installed base and accelerating growth across its brake product portfolio.

- In May 2021, France's national state-owned railway company SNCF and its partners, the Railenium Technology Research Institute, Thales, Spirops, Bosch, and Alstom, began testing an autonomous regional train prototype, a customised Regio 2N regional train for France's rail network.

Asia-Pacific Rolling Stock Market Scope

The rolling stock market is segmented on the basis of application, product type, locomotive technology and components. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product type

- Wagons

- Coaches

- Locomotives

- Rapid Transit

Application

- Passenger Transportation

- Freight Transportation

Component

- Traction Motor

- Auxiliary Power System

- Wheelset

- Axle

- Pantograph

- Air Conditioning System

- Passenger Information System

Locomotive Technology

- Turbocharged Locomotives

- Conventional Locomotives

- Maglev

Rolling Stock Market Regional Analysis/Insights

The rolling stock market is analysed and market size insights and trends are provided by country of application, product type, locomotive technology and components as referenced above.

The countries covered in the rolling stock market report are China, India, South Korea, Australia, Japan, Singapore, Malaysia, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific

Due to the increasing adoption of digital technologies in rolling stock manufacturing industries and the region's increasing prevalence of rail industries, China dominates the Asia-Pacific rolling stock market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Rolling Stock Market Share Analysis

The rolling stock market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to rolling stock market.

Some of the major players operating in the rolling stock market are:

- ABB (Sweden)

- Alstom (France)

- American Industrial Transport, Inc. (U.S.)

- Bombardier (Canada)

- CAF (U.K.)

- Construcciones y Auxiliar de Ferrocarriles, S.A. (Spain)

- Caterpillar (U.S.)

- CRRC Corporation Limited (China)

- Hitachi, Ltd. (Japan)

- HYUNDAI ROTEM COMPANY (South Korea)

- JAPAN TRANSPORT ENGINEERING COMPANY (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- National Steel Car Limited (Canada)

- Niigata Transys Co.,Ltd. (Japan)

- PATENTES TALGO S.L.U. (Spain)

- Siemens (Germany)

- Stadler Rail AG (Switzerland)

- Toshiba Infrastructure Systems & Solutions Corporation (Japan)

- Wabtec Corporation (U.S.)

- Woojin Industrial Systems, Co, Ltd. (South Korea)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.