Global Gasoline Market

Market Size in USD Billion

CAGR :

%

USD

132.67 Billion

USD

147.24 Billion

2024

2032

USD

132.67 Billion

USD

147.24 Billion

2024

2032

| 2025 –2032 | |

| USD 132.67 Billion | |

| USD 147.24 Billion | |

|

|

|

|

Gasoline Market Size

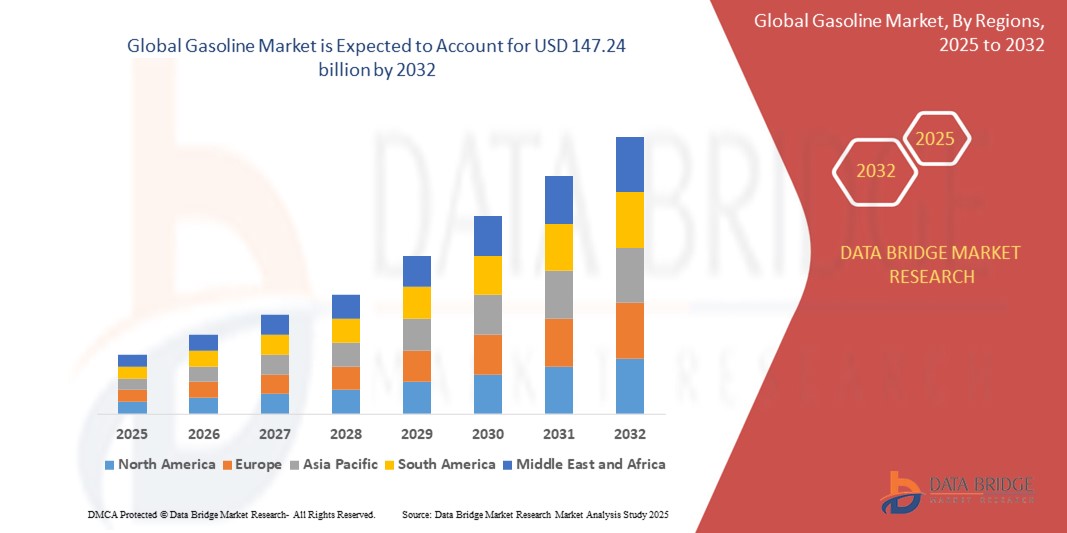

- The global Gasoline market was valued at USD 132.67 billion in 2024 and is expected to reach USD 147.24 billion by 2032

- During the forecast period of 2025 to 2032 the market is such as to grow at a CAGR of 1.5%, primarily driven by rising global demand for fuel

- This growth is driven by factors such as the increasing vehicle production and consumption in emerging economies, along with a steady rise in transportation needs

Gasoline Market Analysis

- The global gasoline market is currently experiencing steady growth, driven by consistent demand in the transportation sector, where gasoline remains one of the primary fuel sources for vehicles, including cars, trucks, and motorcycles

- This trend is expected to continue as gasoline-powered vehicles remain prevalent in many parts of the world

- Technological advancements in gasoline production and refining processes are contributing to increased efficiency and product quality, allowing for higher-performance fuels that meet modern emission standards. This progress is particularly evident in the development of cleaner-burning gasoline variants designed to reduce environmental impacts

- The gasoline market is seeing increased competition among key players as they strive to meet consumer demand and navigate the evolving landscape of energy sources. Companies are investing in improving infrastructure to enhance the distribution and availability of gasoline, which is helping to ensure its continued relevance in global markets

- The shift towards hybrid and electric vehicles may pose challenges for the gasoline industry, but it also provides opportunities for innovation, as manufacturers explore ways to integrate traditional gasoline engines with newer technologies

- For instance, some companies are investing in research to create more efficient hybrid engines that use both gasoline and electric power

- The gasoline market is being shaped by evolving regulations aimed at reducing carbon emissions and promoting more sustainable fuel alternatives. However, gasoline continues to play a key role in transportation, especially in regions with limited infrastructure for electric vehicles

Report Scope and Gasoline Market Segmentation

|

Attributes |

Gasoline Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Gasoline Market Trends

“Innovations in Cleaner and More Sustainable Fuel Options.”

- The gasoline market is witnessing a trend toward the development of high-efficiency gasoline products aimed at enhancing engine performance while reducing fuel consumption, as consumers and industries seek more fuel-efficient options

- The introduction of smart fuel technologies is becoming more prominent, with fuel retailers and manufacturers incorporating digital and advanced tracking systems into their operations to optimize fuel quality and usage in real-time

- Gasoline manufacturers are increasingly focusing on diversifying their fuel offerings to cater to both traditional internal combustion engine vehicles and newer energy-efficient models, ensuring compatibility with evolving automotive technologies

- Another notable trend is the shift toward strategic partnerships and collaborations within the gasoline supply chain, including alliances between fuel producers and electric vehicle manufacturers to explore hybrid fuel solutions

- For instance, major gasoline companies are collaborating with tech firms to integrate blockchain and IoT technologies into fuel distribution networks, ensuring transparency, efficiency, and enhanced quality control across the entire gasoline supply chain

Gasoline Market Dynamics

Driver

“Increasing Global Transportation Demand”

- The increasing demand for gasoline is driven by the rising vehicle ownership in emerging economies such as India, China, and Brazil, where urbanization and growing middle-class populations fuel the need for personal vehicles

- In developed countries, gasoline remains the dominant fuel due to the established infrastructure, affordability of gasoline-powered vehicles, and the need to fuel internal combustion engine vehicles despite the rise of electric vehicles

- Commercial transportation, including trucks, vans, and logistics vehicles, is a significant contributor to gasoline consumption, as these sectors rely heavily on gasoline and diesel to maintain operations

- The global trade and logistics industries also drive gasoline demand, with goods transportation largely dependent on vehicles that require gasoline for fueling, ensuring the ongoing need for this fuel

- As electric vehicle adoption faces challenges due to infrastructure limitations, especially in emerging regions, gasoline remains the primary fuel source for transportation, sustaining its demand in personal and commercial sectors

Opportunity

“Advancements in Cleaner Gasoline Technologies”

- An emerging opportunity within the gasoline market is the development of cleaner, more efficient gasoline technologies in response to growing environmental concerns and stricter regulations on carbon emissions

- Gasoline manufacturers are focusing on creating cleaner-burning variants of gasoline that reduce harmful emissions such as carbon dioxide, nitrogen oxides, and particulate matter to meet the demands of environmental sustainability

- Innovations in low-sulfur gasoline and other advanced formulations are helping refiners meet stringent emissions standards, allowing the industry to stay compliant with governmental regulations

- Bio-based gasoline, derived from renewable sources such as algae or plant materials, is gaining traction as a way to reduce dependency on fossil fuels while still providing a viable alternative to conventional gasoline

- Companies in the gasoline industry have the opportunity to explore various research and development avenues to create next-generation gasoline products that align with both consumer demand for cleaner energy and the global push for sustainability in the energy sector

Restraint/Challenge

“The Shift Toward Electric Vehicles”

- One of the major challenges in the gasoline market is the accelerating shift toward electric vehicles, which is significantly impacting gasoline demand

- Governments worldwide are tightening regulations on carbon emissions and offering incentives for electric vehicle adoption, such as tax rebates and subsidies, leading to increased electric vehicle sales

- Countries such as Norway, the Netherlands, and the United Kingdom are particularly active in encouraging electric vehicle usage through policies such as the development of charging infrastructure and financial incentives

- The growing affordability and availability of electric vehicles, combined with advancements in battery technology, make them a more attractive alternative to gasoline-powered vehicles

- The gasoline industry is facing the dual challenge of adapting to a changing market while complying with stricter environmental regulations, which may lead to a decline in gasoline's dominance in transportation and force producers to explore alternative solutions such as biofuels or hybrid models to stay competitive

Gasoline Market Scope

The market is segmented on the basis of game type, component type, product type, and by application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

Gasoline Market Regional Analysis

“North America is the Dominant Region in the Gasoline Market”

- North America is the dominant region in the global gasoline market, owing to the high consumption of gasoline across both personal and commercial transportation sectors

- The United States leads this dominance, with a significant number of gasoline-powered vehicles and a well-established infrastructure that supports the ongoing demand for gasoline

- In this region, gasoline continues to be the primary fuel source for internal combustion engine vehicles, with a large portion of the market reliant on gasoline for transportation, logistics, and trade

- While the shift toward electric vehicles is accelerating, gasoline remains the fuel of choice due to the widespread availability of gasoline stations and lower upfront costs of gasoline-powered vehicles compared to electric ones

- In addition, the North American market benefits from the development of cleaner, more efficient gasoline variants, which aligns with the region’s increasing push for more sustainable energy options while maintaining its reliance on gasoline

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia Pacific region is emerging as the fastest-growing market for gasoline, driven by the rapid urbanization, growing middle class, and increasing vehicle ownership in countries such as China, India, and Indonesia

- In China, a rising demand for gasoline to fuel both personal vehicles and commercial transportation contributes significantly to the market’s growth, supported by the country’s expanding industrial base

- India also presents a huge growth opportunity, with a rising population, increased vehicle sales, and a growing middle class fueling the demand for gasoline in urban centers

- The growing availability of gasoline infrastructure in Southeast Asia and the expansion of gasoline-powered vehicle fleets are key drivers for growth in the region

- Moreover, the region’s increasing focus on blending gasoline with biofuels to meet both environmental and energy demands is contributing to the market’s expansion, especially in countries such as India, where government policies encourage the use of ethanol and other renewable fuels

Gasoline Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Saudi Arabian Oil Co. (Saudi Arabia)

- Exxon Mobil Corporation (U.S.)

- BP p.l.c (U.K.)

- Shell plc (U.K.)

- PDVSA - Petróleos de Venezuela

- S.A. (Venezuela)

- Gazprom Energoholding LLC (Russia)

- Chevron Corporation (U.S.)

- Kuwait Petroleum Corporation (Kuwait)

- Petrobras (Brazil)

- LUKOIL (Russia)

- ROSNEFT (Russia)

- ADNOC (U.A.E.)

- China Petrochemical Corporation (China)

- Petroliam Nasional Berhad (PETRONAS) (Malaysia)

- Eni (Italy)

- ENOC Company (U.A.E.)

Latest Developments in Global Gasoline Market

- In March 2025, Indian Oil Corporation (IOCL) announced updates regarding its petrol (gasoline) offerings, emphasizing the company’s commitment to providing high-quality fuels to meet the growing demand in India. IOCL's petrol is designed to enhance engine performance, reduce emissions, and comply with stringent environmental regulations, ensuring a cleaner and more efficient fuel option for consumers

- In April 2025, Hindustan Petroleum Corporation Limited (HPCL) introduced new products through its HP Gas Research and Development Centre (HPGRDC), aimed at enhancing fuel efficiency and reducing emissions. The center focuses on developing innovative fuel solutions, including advanced gasoline blends, designed to meet the evolving demands of the automotive sector and comply with stringent environmental standards

- In January 2024, BASF launched its new Keropur gasoline in Taiwan, designed to enhance fuel efficiency and reduce emissions. This advanced fuel additive is formulated to improve engine performance, providing a cleaner and more efficient combustion process, aligning with the growing demand for eco-friendly solutions in the automotive industry

- In January 2024, Indian Oil launched the country’s first reference fuel to fully meet domestic demand. This new fuel is designed to ensure uniform fuel quality across the country, supporting the need for high-performance fuels in the Indian market. The initiative aims to enhance fuel efficiency, reduce emissions, and align with the country’s evolving environmental standards

- In January 2024, Renewable Energy Group launched a new branded fuel product line aimed at helping customers transition to sustainable fuels with lower emissions. This initiative is designed to support the growing demand for cleaner energy solutions by offering renewable diesel and other eco-friendly fuel options. The move reflects the company’s commitment to reducing environmental impacts and meeting regulatory standards for cleaner energy in the transportation sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Gasoline Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Gasoline Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Gasoline Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.