Asia Pacific Safety Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.18 Billion

USD

2.07 Billion

2024

2032

USD

1.18 Billion

USD

2.07 Billion

2024

2032

| 2025 –2032 | |

| USD 1.18 Billion | |

| USD 2.07 Billion | |

|

|

|

|

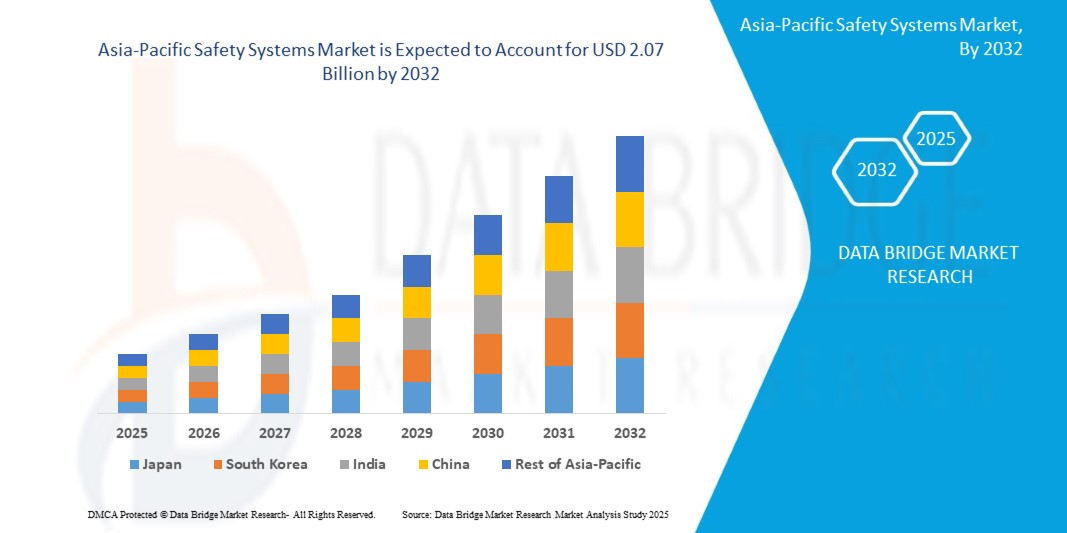

Asia-Pacific Safety Systems Market Size

- The Asia-Pacific Safety Systems Market size was valued at USD 1.18 billion in 2024 and is expected to reach USD 2.07 billion by 2032, at a CAGR of 7.3% during the forecast period

- The market growth is largely fueled by the increasing implementation of automation and stringent workplace safety regulations across industries, driving demand for advanced safety systems to protect machinery, workers, and operations

- Furthermore, rising adoption of smart sensors, machine vision, and IoT-enabled monitoring solutions is enabling real-time safety management, predictive maintenance, and compliance, thereby accelerating the uptake of safety systems and significantly boosting market expansion

Asia-Pacific Safety Systems Market Analysis

- Safety systems are integrated solutions that include sensors, controllers, relays, and monitoring devices designed to protect equipment, processes, and human operators from hazardous conditions across industries such as automotive, oil & gas, manufacturing, and healthcare

- The escalating demand for safety systems is primarily driven by stricter regulatory frameworks, growing focus on operational efficiency, and the increasing need to minimize downtime and workplace accidents through automated, intelligent safety technologies

- China dominated the Asia-Pacific Safety Systems Market in 2024, due to its expansive manufacturing base, strong automotive production, and rising adoption of industrial automation across multiple sectors

- India is expected to be the fastest growing country in the Asia-Pacific Safety Systems Market during the forecast period due to rapid industrial expansion in automotive, construction, and manufacturing sectors

- Smart sensor segment dominated the market with a market share of 42% in 2024, due to its ability to deliver precise data, connectivity with IoT platforms, and real-time monitoring capabilities. These sensors are widely preferred for predictive maintenance and enhancing operational efficiency in industries such as aerospace, healthcare, and automotive. Their adaptability to advanced automation systems and integration with cloud-based analytics ensures reliable protection and streamlined processes. The increasing demand for intelligent data interpretation and self-diagnosis in safety systems further underpins their leadership

Report Scope and Asia-Pacific Safety Systems Market Segmentation

|

Attributes |

Asia-Pacific Safety Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Asia-Pacific Safety Systems Market Trends

Rising Adoption of Smart Machine and Industry 4.0

- The Asia-Pacific Safety Systems Market is witnessing significant growth with the rising adoption of Industry 4.0 and smart machine technologies. Advanced automation and digitalization require integrated safety mechanisms to ensure seamless operation in increasingly complex industrial environments

- For instance, Rockwell Automation has been incorporating smart safety technologies into its industrial automation solutions. Their systems are designed to integrate safety with digital operations, providing predictive analytics that improve worker protection and reduce downtime in manufacturing plants

- The combination of smart sensors, IoT connectivity, and machine learning is enhancing safety systems by making them more proactive. These advancements enable real-time monitoring, predictive maintenance, and automated shutdowns in hazardous environments, which significantly improves workplace safety

- In addition, the demand for collaborative robotics and autonomous industrial equipment is pressing for advanced safety integration. Safety systems are critical in enabling machines and humans to work side by side without accidents, supporting productivity and operational resilience

- The growing importance of data-driven decision-making in factories highlights the need for safety systems that connect with centralized platforms. These systems provide real-time incident reporting and compliance data, aligning industrial safety with digital transformation strategies

- Altogether, the adoption of Industry 4.0 is placing safety systems at the forefront of modern manufacturing and operations. Their integration with smart technology ensures that industrial advancement is balanced with stronger protection for assets, processes, and human capital

Asia-Pacific Safety Systems Market Dynamics

Driver

Advancements in Safety System Technology

- Technological advancements in safety systems are significantly driving growth in the market as manufacturers incorporate innovative solutions to align with modern industrial needs. Enhanced efficiency, digital connectivity, and intelligent automation are becoming defining features of next-generation safety solutions

- For instance, Siemens has developed safety-integrated automation systems that combine productivity with advanced safety layers. These platforms allow businesses to meet stringent standards while improving flexibility and reducing time-to-market for new products

- New safety system technologies, such as programmable safety controllers, advanced machine vision, and fail-safe communication networks, are ensuring faster responsiveness and higher accuracy. These innovations minimize risks and provide customized safety for different industrial operations

- In addition, integration with IIoT platforms enhances data analytics capabilities, enabling companies to detect risks proactively. Safety systems now function not just as reactive measures but as predictive and preventive tools, making them central to operational excellence

- These technological advancements demonstrate the sector’s continuous innovation. By aligning safety with digital modernization, organizations are ensuring greater reliability, compliance, and efficiency in industrial environments, reinforcing safety systems as a long-term growth driver

Restraint/Challenge

Increasing Regulatory Requirements and Compliance Standards

- The Asia-Pacific Safety Systems Market faces challenges from constantly evolving regulatory frameworks and stringent compliance requirements across industries. Companies must regularly upgrade systems to meet diverse regional standards, which increases costs and operational complexity

- For instance, firms such as ABB and Honeywell face continuous pressure to align their safety solutions with varying safety directives such as ISO 13849 and OSHA regulations. Compliance with these international and national standards often requires substantial investment in system design and certification

- The pace of regulatory evolution outstrips the ability of smaller companies to adapt, creating disparities in industry adoption. For many businesses, the costs associated with continuous updates hinder widespread implementation of advanced safety technologies

- In addition, fragmented safety regulations across global markets lead to complications in product development and deployment. Companies must navigate overlapping requirements, prolonging product launches and slowing down adoption rates in certain regions

- Addressing these compliance challenges demands closer collaboration between companies and regulators, as well as investment in flexible and scalable safety solutions. Building systems adaptable to multiple regulatory conditions will be essential for sustaining growth in the Asia-Pacific Safety Systems Market

Asia-Pacific Safety Systems Market Scope

The market is segmented on the basis of type, technology, function, organization size, end user, and distribution channel.

• By Type

On the basis of type, the Asia-Pacific Safety Systems Market is segmented into safety controllers & relays, safety machine vision, safety sensors, and safety switches. The safety controllers & relays segment dominated the largest market revenue share in 2024, driven by their central role in managing and coordinating safety operations across industrial machinery and production lines. These devices ensure compliance with stringent international safety standards, particularly in sectors such as automotive manufacturing and heavy engineering. Their ease of integration into existing automation infrastructure, combined with their proven reliability in minimizing workplace hazards, reinforces their dominance. Increasing demand for functional safety certifications and the growing focus on safeguarding human operators further drive adoption.

The safety machine vision segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rapid advancements in AI-driven image recognition and automation. Machine vision systems are increasingly deployed for real-time monitoring, defect detection, and automated inspection to prevent equipment malfunctions and accidents. The rising adoption of Industry 4.0 practices and smart factories amplifies the use of safety machine vision for predictive analytics and process optimization. Moreover, their scalability across diverse applications, including pharmaceuticals, food processing, and electronics assembly, positions this segment for accelerated growth.

• By Technology

On the basis of technology, the Asia-Pacific Safety Systems Market is segmented into digital sensor, smart sensor, and analog sensor. The smart sensor segment dominated the market with a share of 42% in 2024, owing to its ability to deliver precise data, connectivity with IoT platforms, and real-time monitoring capabilities. These sensors are widely preferred for predictive maintenance and enhancing operational efficiency in industries such as aerospace, healthcare, and automotive. Their adaptability to advanced automation systems and integration with cloud-based analytics ensures reliable protection and streamlined processes. The increasing demand for intelligent data interpretation and self-diagnosis in safety systems further underpins their leadership.

The digital sensor segment is expected to witness the fastest CAGR from 2025 to 2032, supported by its cost-effectiveness, compact design, and energy-efficient operation. Digital sensors are being increasingly deployed for monitoring temperature, vibration, and pressure in industrial environments where quick responses are critical to prevent failures. Their ease of integration into automated control systems and compatibility with embedded technologies make them highly attractive for SMEs. The growing adoption of digital twins and real-time simulation further accelerates demand for digital sensors across modern safety systems.

• By Function

On the basis of function, the market is segmented into machine protection, process monitoring, energy management, parking assistance, collision avoidance, vibration monitoring systems, emergency stop systems, and others. The machine protection segment dominated the market in 2024, supported by its critical role in safeguarding high-value industrial machinery against mechanical failures and human errors. Manufacturers prioritize machine protection systems due to their ability to reduce downtime, improve operational efficiency, and extend equipment lifespan. Adoption is strong in automotive, aerospace, and heavy industries, where equipment reliability directly impacts productivity. The enforcement of international safety regulations and the rising cost of workplace accidents further strengthen demand.

The collision avoidance segment is projected to grow at the fastest rate from 2025 to 2032, driven by increasing deployment in autonomous vehicles, warehouse robotics, and aviation applications. Collision avoidance systems leverage advanced sensors, LiDAR, and AI algorithms to detect potential hazards and prevent accidents in real-time. The rising adoption of driver-assistance systems in automotive and logistics industries contributes significantly to their growth. With governments mandating advanced safety features in vehicles and industries adopting automation, collision avoidance systems are becoming an essential component in reducing operational risks.

• By Organization Size

On the basis of organization size, the market is segmented into small & medium-size organizations and large-scale organizations. Large-scale organizations dominated the market in 2024, driven by their higher investment capacity, extensive automation adoption, and strict compliance with safety standards. Enterprises in industries such as oil & gas, automotive, and aerospace prioritize advanced safety systems to protect assets, employees, and ensure uninterrupted operations. Their large-scale deployment of robotics and connected machinery necessitates sophisticated, integrated safety solutions, strengthening this segment’s market share.

The small & medium-size organization segment is projected to record the fastest growth from 2025 to 2032, fueled by increasing awareness of workplace safety, cost-effective solutions, and regulatory compliance requirements. SMEs are increasingly adopting modular and scalable safety systems that align with their budgets and allow gradual upgrades. Government incentives for adopting safety solutions and the availability of affordable, easy-to-install technologies are further encouraging adoption. This shift is particularly visible in emerging economies where SMEs form the backbone of industrial activity.

• By End User

On the basis of end user, the market is segmented into automotive, aerospace & defense, healthcare, oil & gas, transportation & logistics, consumer electronics, food and beverages, construction industry, and others. The automotive segment dominated the market in 2024, owing to the growing emphasis on driver and passenger safety, coupled with the rising adoption of advanced driver-assistance systems (ADAS). Automotive manufacturers are heavily investing in integrating safety sensors, machine vision, and collision avoidance systems to meet safety regulations and enhance vehicle reliability. The growing electric vehicle sector further boosts demand for advanced safety systems.

The healthcare segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the need for precision, real-time monitoring, and patient safety in critical care environments. Safety systems in healthcare settings are vital for ensuring accurate diagnostics, monitoring equipment health, and safeguarding medical staff from hazardous exposure. The rapid digitalization of hospitals, adoption of IoT-enabled monitoring systems, and increasing investment in smart healthcare infrastructure amplify growth. Demand is further supported by regulatory focus on medical device safety and error prevention.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales and indirect sales. The direct sales segment dominated the market in 2024, supported by manufacturers’ preference for direct engagement with clients to provide tailored solutions, after-sales services, and long-term contracts. Direct sales channels are especially prominent in industries such as aerospace, automotive, and oil & gas, where high-value customized safety solutions are deployed. This channel’s strength lies in building strong client relationships and offering end-to-end technical expertise.

The indirect sales segment is expected to grow at the fastest pace from 2025 to 2032, propelled by the increasing role of distributors, system integrators, and e-commerce platforms. Indirect channels provide broader market reach, especially for SMEs and emerging markets where clients rely on third-party vendors for cost-effective solutions. The rising demand for modular plug-and-play safety devices and the expansion of digital distribution platforms further enhance the indirect sales channel’s growth potential.

Asia-Pacific Safety Systems Market Regional Analysis

- China dominated the Asia-Pacific Safety Systems Market with the largest revenue share in 2024, driven by its expansive manufacturing base, strong automotive production, and rising adoption of industrial automation across multiple sectors

- Robust government regulations on workplace safety, combined with increasing investments in smart factories and digital infrastructure, reinforce China’s leadership in the regional market

- The integration of IoT-enabled monitoring systems, AI-driven machine vision, and advanced safety sensors enhances operational efficiency and compliance, consolidating its dominant position. The presence of leading domestic safety solution providers and collaborations with global manufacturers ensure China’s continued dominance during the forecast period

Japan Asia-Pacific Safety Systems Market Insight

The Japan market is anticipated to grow steadily from 2025 to 2032, supported by its advanced industrial automation sector and strong emphasis on worker protection and operational reliability. Japanese industries are rapidly integrating smart sensors, machine protection systems, and predictive maintenance tools to align with Industry 4.0 practices. The country’s focus on robotics, automotive safety, and healthcare technology drives consistent adoption of advanced safety systems. Strategic partnerships between domestic manufacturers and global technology leaders, along with continuous R&D investments, reinforce Japan’s innovation-driven position in the Asia Pacific market.

India Asia-Pacific Safety Systems Market Insight

India is projected to register the fastest CAGR in the Asia Pacific Asia-Pacific Safety Systems Market during 2025–2032, fueled by rapid industrial expansion in automotive, construction, and manufacturing sectors. Government initiatives aimed at improving workplace safety standards and promoting adoption of automation technologies are accelerating market growth. Increasing demand for cost-effective and scalable safety systems among small- and medium-sized enterprises strengthens India’s trajectory. Expanding distribution networks, rising investments in industrial modernization, and collaborations with global safety solution providers further support India’s emergence as the fastest-growing market in the region.

Asia-Pacific Safety Systems Market Share

The safety systems industry is primarily led by well-established companies, including:

- Siemens (Germany)

- Panasonic Corporation (Japan)

- ABB (Switzerland)

- Honeywell International Inc. (U.S.)

- Rockwell Automation (U.S.)

- Festo SE & Co. KG (Germany)

- Schneider Electric (France)

- SICK AG (Germany)

- KEYENCE CORPORATION (Japan)

- OMRON Corporation (Japan)

- Sensata Technologies, Inc. (U.S.)

- Pepperl+Fuchs SE (Germany)

- Balluff GmbH (Germany)

- TankScan (U.S.)

- Autonics Corporation (South Korea)

- Hans Turck GmbH & Co. KG (Germany)

Latest Developments in Asia-Pacific Safety Systems Market

- In August 2024, Siemens Smart Infrastructure introduced the SICAM Enhanced Grid Sensor (EGS), significantly advancing the digitalization of distribution networks. By providing continuous monitoring and preventing overloading, this plug-and-play solution enables grid operators to maximize the use of existing infrastructure while ensuring greater efficiency and stability. The innovation supports the integration of renewable energy sources into the grid, a growing necessity in the global energy transition. This launch has strengthened Siemens’ leadership in the smart energy solutions market, positioning it as a preferred partner for utilities seeking digital transformation and resilient infrastructure

- In December 2023, Panasonic Holdings Corporation unveiled a 6-in-1 inertial sensor designed to boost automotive safety and performance. By combining multiple sensing functionalities into a single compact unit, the innovation enhances vehicle stability and driver assistance systems, meeting rising demand for advanced automotive safety technologies. This development has reinforced Panasonic’s position in the automotive sensors market, enabling the company to expand its market share and strengthen collaborations with automakers focused on intelligent mobility solutions

- In May 2023, ABB completed the acquisition of Siemens' low-voltage NEMA motor business, a strategic move that broadened ABB’s industrial motor portfolio. With this acquisition, ABB bolstered its manufacturing capabilities and enhanced its service reach for global customers across industries such as automation, energy, and manufacturing. This development reinforced ABB’s leadership in the industrial motors market, enabling the company to address growing demand for energy-efficient and reliable motor solutions in both developed and emerging markets

- In January 2023, Honeywell International Inc. deepened its partnership with Nexceris to deliver enhanced safety solutions for electric vehicles. By integrating Honeywell’s battery sensor technology with Nexceris’ Li-Ion Tamer gas detection system, the collaboration focused on mitigating thermal runaway risks that lead to EV battery fires. This strengthened Honeywell’s market position in the automotive safety solutions space, particularly within the fast-growing EV sector, and showcased its ability to deliver innovative, life-saving technologies that meet the industry’s rising safety demands

- In August 2022, Rockwell Automation launched its Allen-Bradley 42EA RightSight S18 and 42JA VisiSight M20A photoelectric sensors, catering to industries requiring compact, reliable, and versatile sensing solutions. These economical sensors simplify installation and maintenance while delivering high performance in space-constrained environments. The launch reinforced Rockwell’s standing in the industrial automation and sensor markets by addressing the demand for cost-effective yet advanced sensing technologies, thereby expanding its customer base across diverse industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Safety Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Safety Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Safety Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.