Asia Pacific Secondary Hyperoxaluria Drug Market

Market Size in USD Million

CAGR :

%

USD

63.80 Million

USD

112.10 Million

2024

2032

USD

63.80 Million

USD

112.10 Million

2024

2032

| 2025 –2032 | |

| USD 63.80 Million | |

| USD 112.10 Million | |

|

|

|

|

Asia-Pacific Secondary Hyperoxaluria Drug Market Size

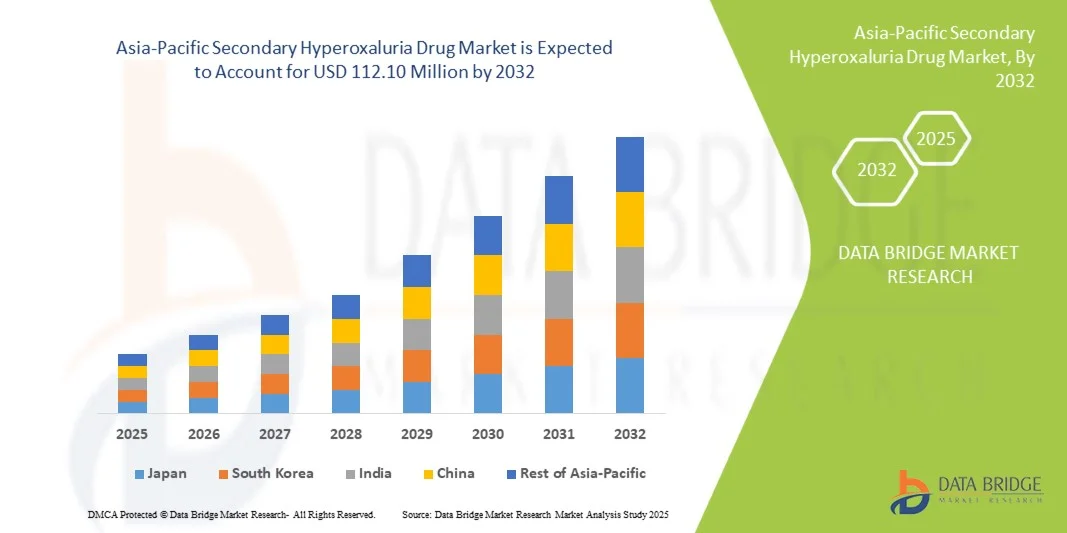

- The Asia-Pacific secondary hyperoxaluria drug market size was valued at USD 63.8 million in 2024 and is expected to reach USD 112.10 million by 2032, at a CAGR of 7.30% during the forecast period

- The market growth is largely fueled by the increasing prevalence of primary and secondary hyperoxaluria disorders, along with growing awareness of kidney-related complications and the importance of effective treatment in both clinical and outpatient settings

- Furthermore, rising demand for safe, targeted, and effective therapeutic options for reducing oxalate levels is establishing secondary hyperoxaluria drugs as essential interventions in disease management. These converging factors are accelerating the uptake of secondary hyperoxaluria drug solutions, thereby significantly boosting the industry’s growth

Asia-Pacific Secondary Hyperoxaluria Drug Market Analysis

- Secondary Hyperoxaluria Drugs, used to manage elevated oxalate levels and prevent kidney stone formation, are increasingly vital in treating metabolic and renal disorders in both adults and children due to their efficacy, safety profile, and availability in multiple formulations

- The escalating demand for secondary hyperoxaluria drugs is primarily fueled by the rising prevalence of kidney stones and related metabolic disorders, increasing patient awareness, and improvements in healthcare infrastructure and diagnostic capabilities

- China dominated the Asia-Pacific secondary hyperoxaluria drug market in 2024, contributing the largest revenue share of 36.4% within the region, fueled by rapid urbanization, high healthcare expenditure, and strong government initiatives promoting rare disease management

- India is expected to be the fastest-growing country in the Asia-Pacific secondary hyperoxaluria drug market during the forecast period, registering an approximate CAGR of 18.3% from 2025 to 2032, driven by rising patient awareness, improving healthcare infrastructure, and increasing adoption of enzyme-based and prescription therapies

- The Adult population segment dominated the Asia-Pacific secondary hyperoxaluria drug market with a share of 82% in 2024, owing to higher prevalence of kidney stones and secondary hyperoxaluria in adults

Report Scope and Asia-Pacific Secondary Hyperoxaluria Drug Market Segmentation

|

Attributes |

Asia-Pacific Secondary Hyperoxaluria Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Secondary Hyperoxaluria Drug Market Trends

“Enhanced Patient Outcomes Through Advanced Therapeutic and Digital Interventions”

- A significant and accelerating trend in the Asia Pacific secondary hyperoxaluria drug market is the integration of advanced therapeutic approaches with digital monitoring tools, enhancing patient adherence, real-time tracking, and personalized therapy adjustments

- AI-enabled platforms can provide tailored dosing schedules based on patient-specific metabolic and adherence data, optimizing therapy effectiveness while reducing the risk of recurrent oxalate accumulation

- For instance, NephroAI’s integrated digital platform allows patients to track daily oxalate intake, receive voice reminders for medication, and automatically report data to healthcare providers for timely interventions

- Integration with wearable health monitoring devices enables continuous measurement of metabolic markers, alerting clinicians to potential therapy adjustments or risk of kidney stone formation

- Digital interventions allow centralized patient management, enabling nephrologists and clinicians to monitor therapy adherence, side effects, and biochemical parameters in real time

- The combination of advanced drug formulations and AI-based adherence solutions is reshaping patient expectations, with increasing preference for therapies that are not only effective but also intuitive and supportive

- Pharmaceutical companies are increasingly developing secondary hyperoxaluria drugs with companion digital tools that track therapy outcomes and improve patient engagement across both adult and pediatric populations

- Adoption of AI-assisted monitoring is accelerating due to growing awareness of the importance of proactive kidney health management, as well as improved convenience and treatment personalization

- The convergence of advanced drug therapies with digital health platforms is setting new benchmarks for patient-centered care in the treatment of secondary hyperoxaluria

Asia-Pacific Secondary Hyperoxaluria Drug Market Dynamics

Driver

“Rising Clinical Awareness and Technological Integration”

- The increasing prevalence of kidney stone disorders and oxalate-related complications is significantly driving the adoption of Secondary Hyperoxaluria Drugs globally

- Growing awareness among nephrologists and patients about early intervention to prevent chronic kidney damage is promoting uptake of advanced therapies

- Innovations in drug formulations, including oral and parenteral options, are improving bioavailability, reducing side effects, and enhancing patient convenience

- Integration with AI-powered adherence and monitoring systems ensures optimized dosing and timely interventions, improving overall treatment outcomes

- Public health initiatives, awareness campaigns, and clinical guidelines are encouraging early detection and therapy initiation

- Evidence from clinical trials demonstrating significant reduction in recurrent oxalate levels strengthens confidence among healthcare providers in prescribing advanced therapies

- For instance, in 2024, OxThera’s European clinical trial program demonstrated superior oxalate control using their oral secondary hyperoxaluria drug combined with a digital monitoring platform, highlighting the benefits of integrated care solutions

- The expansion of telemedicine services is further boosting patient adherence and physician oversight, allowing better management of at-risk populations in both urban and remote settings

- Adoption of technology-assisted interventions is anticipated to continue driving revenue growth and market expansion over the forecast period

Restraint/Challenge

“High Costs, Regulatory Hurdles, and Access Limitations”

- Advanced Secondary Hyperoxaluria therapies involve complex formulations, leading to higher production costs, which may impact patient accessibility and affordability

- Limited awareness in general healthcare settings, delayed diagnosis, and underreporting of oxalate-related disorders can constrain market penetration

- Stringent regulatory requirements and the necessity of long-term safety and efficacy data increase operational complexity and cost burden for manufacturers

- Technological interventions, while improving adherence, require digital literacy and access to compatible devices, limiting adoption in certain demographics or regions

- Reimbursement and insurance coverage variability across regions can further restrict access to advanced therapies, particularly in developing countries

- While generic alternatives provide cost-effective options, premium formulations with enhanced efficacy and companion digital monitoring tools may see slower uptake among price-sensitive patients

- For instance, OxThera faced delayed regulatory approval in select markets, restricting access to their therapy despite robust efficacy data from clinical trials, highlighting the impact of regulatory challenges

- Ensuring robust pharmacovigilance, post-marketing surveillance, and patient education programs is critical to build trust and sustain market growth

- Collaborations between healthcare providers, pharmaceutical companies, and regulatory authorities are essential to ensure safe, equitable, and timely access to advanced Secondary Hyperoxaluria Drugs worldwide

Asia-Pacific Secondary Hyperoxaluria Drug Market Scope

The market is segmented on the basis of type, drug type, population type, end user, and distribution channel.

• By Type

On the basis of type, the secondary hyperoxaluria drug market is segmented into Reloxaliase, Thiazide Diuretics, and Supplements. The Reloxaliase segment dominated the largest market revenue share of 46% in 2024, driven by its proven efficacy in reducing oxalate levels in patients with both primary and secondary hyperoxaluria. Its oral administration and strong clinical trial backing have made it the preferred choice among nephrologists and hospitals. Reloxaliase is widely adopted in both inpatient and outpatient settings, and its safety profile ensures long-term patient compliance. Healthcare professionals favor this drug for its targeted mechanism of action and the ability to reduce recurrence of kidney stones. Reimbursement policies and inclusion in treatment guidelines further support its leading market position. The drug’s growing availability across hospital pharmacies and specialty clinics also contributes to market dominance. Awareness campaigns by pharmaceutical companies and partnerships with renal care centers have further strengthened its adoption. Patient preference for clinically validated therapies continues to drive sales, particularly in North America and Europe. Reloxaliase’s robust pipeline and ongoing research into combination therapies enhance its market leadership. Hospitals, specialty clinics, and home healthcare services frequently rely on this drug due to its predictable outcomes and low side-effect profile. Overall, its integration into standard hyperoxaluria management protocols underlines its dominant position.

The Thiazide Diuretics segment is anticipated to witness the fastest CAGR of 22% from 2025 to 2032, driven by increasing awareness of preventive therapies for kidney stone recurrence. Physicians recommend thiazide diuretics to manage calcium oxalate levels, particularly in patients with recurrent kidney stones. These drugs are cost-effective, widely available, and suitable for long-term therapy, making them increasingly popular in adult populations. Thiazide diuretics also benefit from inclusion in home healthcare programs, where patients prefer easy-to-administer medications. The segment’s growth is supported by rising adoption in outpatient clinics and specialty care centers. Patient awareness campaigns, online pharmacy availability, and increasing insurance coverage contribute to faster market uptake. Research demonstrating the drugs’ efficacy in reducing oxalate excretion further fuels adoption. In addition, the growing prevalence of metabolic disorders linked to secondary hyperoxaluria supports strong demand. Physicians increasingly integrate thiazide diuretics into preventive care regimens, enhancing their market growth. The drug’s compatibility with combination therapies for chronic management expands its potential user base. Accessibility in both developed and emerging regions boosts the CAGR significantly. Overall, the segment is poised for rapid expansion due to affordability, awareness, and clinical endorsement.

• By Drug Type

On the basis of drug type, the secondary hyperoxaluria drug market is segmented into Prescription and Over-the-Counter (OTC). The Prescription segment held the largest market revenue share of 72% in 2024, driven by the necessity for physician oversight in dosing, monitoring, and management of hyperoxaluria. Hospitals and specialty clinics are the primary points of prescription, ensuring correct administration and monitoring of adverse effects. Prescription drugs dominate because they are clinically validated, included in treatment guidelines, and often covered by insurance. Their adoption is strongest in North America and Europe, where patient awareness and healthcare infrastructure are advanced. Physicians prefer prescription drugs due to established efficacy, reliable supply chains, and standardized dosing protocols. Continuous research and development, along with regulatory approvals, reinforce the dominance of prescription therapies. Patient education programs by pharmaceutical companies improve adherence and repeat prescriptions. Prescription drugs also benefit from strong marketing and professional detailing efforts. Hospital pharmacies and specialty clinics maintain stable demand, ensuring steady revenue contribution. The segment’s dominance is strengthened by integration into chronic care programs and renal disease management protocols. Long-term efficacy data further solidifies market leadership.

The OTC segment is expected to witness the fastest CAGR of 18% from 2025 to 2032, fueled by rising awareness of kidney stone prevention and easier access to supplements and thiazide diuretics without physician prescriptions. Adult patients increasingly prefer self-managed care for mild or recurrent hyperoxaluria. OTC availability encourages use in home healthcare settings, and patients value convenience, affordability, and accessibility. Growing e-commerce platforms and online pharmacies further accelerate market penetration. OTC products are widely promoted for preventive health, particularly in regions with rising metabolic disorders. Marketing campaigns targeting at-risk populations boost consumer adoption. Educational initiatives highlight the importance of early intervention, further increasing demand. OTC drugs are increasingly included in wellness programs and preventive care plans. Rising disposable incomes and urbanization in Asia-Pacific support rapid growth. OTC supplements complement prescription regimens, enhancing their appeal. The segment benefits from minimal regulatory barriers and high patient preference. Overall, OTC therapies are projected to grow rapidly due to accessibility, affordability, and increasing self-care trends.

• By Population Type

On the basis of population type, the secondary hyperoxaluria drug market is segmented into Children and Adults. The Adult population segment dominated the market with a share of 82% in 2024, owing to higher prevalence of kidney stones and secondary hyperoxaluria in adults. Adults have broader access to diagnostic facilities, better healthcare awareness, and insurance coverage supporting therapy adoption. Clinical guidelines prioritize adults for preventive and therapeutic management. Hospitals and specialty clinics predominantly serve adult patients, reinforcing the segment’s dominance. Prescription therapies are widely used, supported by physician oversight and patient monitoring. Adult populations also participate in clinical trials and patient education programs. Urban populations drive most of the demand due to lifestyle-related kidney stone risks. Reimbursement policies further ensure widespread adoption. Awareness campaigns by pharmaceutical companies strengthen uptake. Chronic management protocols target adults, contributing to stable and large revenue shares. Adults’ adherence to therapy regimens ensures consistent market revenue. Overall, the adult segment remains the cornerstone of the market.

The Children population segment is expected to witness the fastest CAGR of 20% from 2025 to 2032, driven by increasing diagnosis of pediatric hyperoxaluria and greater emphasis on early intervention to prevent lifelong kidney complications. Pediatric formulations are gaining traction for ease of administration and palatability. Parents and caregivers are increasingly aware of early treatment benefits. Pediatric adoption is supported by specialty clinics and pediatric nephrologists. Research highlighting safe dosing in children encourages growth. Hospitals are increasingly integrating pediatric protocols into standard care. Awareness campaigns target schools and healthcare providers. Availability through hospital and retail pharmacies improves access. Insurance coverage and government health programs support expansion. Home healthcare adoption for children is rising. Clinical guidelines emphasize early monitoring and treatment. Overall, the segment demonstrates strong growth potential due to increasing diagnosis and preventive strategies.

• By End User

On the basis of end user, the secondary hyperoxaluria drug market is segmented into Hospitals, Specialty Clinics, Home Healthcare, and Others. The Hospital segment dominated with a market share of 55% in 2024, due to high patient influx, presence of specialized nephrology departments, and availability of advanced treatment protocols. Hospitals offer both initial diagnosis and ongoing therapy monitoring. Prescription drug adoption is highest in hospital settings, ensuring treatment compliance. Hospitals are equipped with advanced laboratories for oxalate testing. Multi-specialty care and integrated renal services reinforce the dominance. Reimbursement coverage in hospitals supports sustained demand. Urban hospital networks contribute the majority of revenue. Hospitals also play a key role in awareness campaigns. Pharmaceutical companies maintain strong partnerships with hospitals for training and distribution. Clinical research and trials predominantly occur in hospital settings. Continuous physician engagement ensures proper treatment protocols. Overall, hospitals remain the leading end users due to infrastructure and patient volume.

The Home Healthcare segment is expected to witness the fastest CAGR of 19% from 2025 to 2032, driven by rising adoption of home-based treatment for chronic conditions and growing patient preference for remote care. Portable medication options and monitoring devices enable safe administration at home. Patients with recurrent kidney stones increasingly opt for home care for convenience. Telemedicine support and digital health platforms accelerate adoption. Awareness campaigns educate patients on home therapy options. The segment benefits from increasing insurance reimbursement for home treatment. Pharmaceutical companies supply home healthcare providers with therapies and guidance. Urban and semi-urban populations are rapidly adopting this segment. Accessibility in remote areas supports growth. Collaboration between hospitals and home care services enhances adoption. Convenience, safety, and patient preference drive CAGR growth. Overall, home healthcare represents a rapidly expanding end-user segment.

• By Distribution Channel

On the basis of distribution channel, the secondary hyperoxaluria drug market is segmented into Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others. The Hospital Pharmacies segment held the largest market revenue share of 60% in 2024, supported by hospital-based prescriptions, bulk procurement for patient wards, and integration with insurance coverage. Hospitals remain primary points for prescription fulfillment. Patient trust and clinical validation reinforce revenue dominance. Distribution partnerships with pharmaceutical companies ensure consistent supply. Hospitals cater to both adult and pediatric populations, consolidating demand. Centralized purchasing supports large-scale adoption. Multi-specialty hospitals contribute significantly. Regulatory approvals facilitate consistent stock availability. Hospital pharmacies also support outpatient prescriptions. Clinical trials supply early access to hospital pharmacies. Overall, this channel remains dominant due to structured supply chains and patient dependence.

The Online Pharmacies segment is expected to witness the fastest CAGR of 21% from 2025 to 2032, fueled by increasing e-commerce penetration, rising preference for home delivery, and growing adoption of digital health platforms. Online access improves availability in remote and underserved areas. Patients benefit from convenience, privacy, and quick delivery. Marketing and awareness campaigns boost online purchases. OTC and prescription therapies increasingly leverage online channels. Telemedicine integration further supports this channel. Patient reviews and digital platforms enhance trust. Rising internet penetration in Asia-Pacific contributes to growth. E-pharmacies provide subscription models for chronic therapy. Insurance coverage for online fulfillment supports adoption. Home healthcare patients prefer online options. Overall, online pharmacies represent a rapidly growing distribution channel due to accessibility and convenience.

Asia-Pacific Secondary Hyperoxaluria Drug Market Regional Analysis

- China dominated the Asia-Pacific secondary hyperoxaluria drug market in 2024, contributing the largest revenue share of 36.4% within the region, fueled by rapid urbanization, high healthcare expenditure, and strong government initiatives promoting rare disease management

- India is expected to be the fastest-growing country in the Asia-Pacific secondary hyperoxaluria drug market during the forecast period, registering an approximate CAGR of 18.3% from 2025 to 2032, driven by rising patient awareness, improving healthcare infrastructure, and increasing adoption of enzyme-based and prescription therapies

- The region's growing focus on rare disease management and expanding access to prescription therapies are key factors propelling market growth

China Secondary Hyperoxaluria Drug Market Insight

The China secondary hyperoxaluria drug market dominated the Asia-Pacific region in 2024, contributing the largest revenue share of 36.4%%, fueled by raid urbanization, high healthcare expenditure, and strong government initiatives promoting rare disease management. China’s expanding middle class, increasing patient awareness, and robust healthcare infrastructure are driving widespread adoption of prescription therapies for hyperoxaluria.

India Secondary Hyperoxaluria Drug Market Insight

India secondary hyperoxaluria drug market is expected to be the fastest-growing country in the Asia-Pacific region during the forecast period, registering an approximate CAGR of 18.3% from 2025 to 2032, driven by rising patient awareness, improving healthcare infrastructure, and increasing adoption of enzyme-based and prescription therapies. Government initiatives supporting rare disease treatment and expanding access to specialty clinics are key factors contributing to market growth in India.

Asia-Pacific Secondary Hyperoxaluria Drug Market Share

The Secondary Hyperoxaluria Drug industry is primarily led by well-established companies, including:

- OxThera (Sweden)

- Alnylam Pharmaceuticals, Inc. (Ireland)

- Calliditas Therapeutics AB (Sweden)

- Thetis Pharmaceuticals LLC. (France)

- Biocodex (France)

- Sanofi (France)

- Bayer AG (Germany)

- Nestlé Health Science (Switzerland)

- Pfizer Inc. (U.K.)

- Intellia Therapeutics, Inc. (U.K.)

- Zhejiang Tianxin Pharmaceutical Co. (U.K.)

- Wuxi Further Pharmaceutical Co. Ltd (U.K.)

- Tecoland Corporation (U.K.)

- Calliditas Therapeutics AB (U.K.)

Latest Developments in Asia-Pacific Secondary Hyperoxaluria Drug Market

- In April 2022, Chinook Therapeutics initiated a Phase 1 trial of CHK-336, a small molecule LDH inhibitor designed to reduce endogenous oxalate production, with results showing favorable safety and tolerability in healthy volunteers

- In October 2023, the U.S. FDA approved Rivfloza (nedosiran), a once-monthly RNAi therapy, for children (9 years and older) and adults with Primary Hyperoxaluria Type 1 (PH1), highlighting progress in hyperoxaluria drug development that could extend insights into secondary hyperoxaluria

- In February 2025, reports confirmed that Reloxaliase (ALLN-177), previously in Phase II for enteric/secondary hyperoxaluria, faced development discontinuation following its sponsor’s liquidation, impacting the therapeutic pipeline

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.