Asia Pacific Self Adhesive Vinyl Films Market

Market Size in USD Billion

CAGR :

%

USD

1.57 Billion

USD

2.34 Billion

2024

2032

USD

1.57 Billion

USD

2.34 Billion

2024

2032

| 2025 –2032 | |

| USD 1.57 Billion | |

| USD 2.34 Billion | |

|

|

|

|

Asia-Pacific Self Adhesive Vinyl Films Market Size

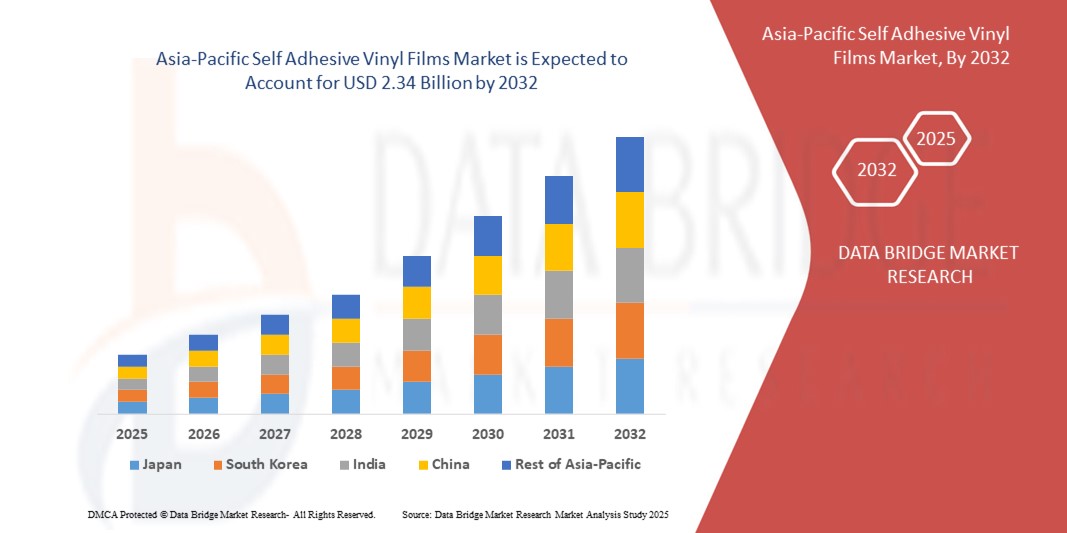

- The Asia-Pacific self adhesive vinyl films market size was valued at USD 1.57 billion in 2024 and is expected to reach USD 2.34 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by the rising demand for durable and cost-effective advertising and promotional materials, coupled with the increasing adoption of vinyl films in automotive wraps, building graphics, and interior décor applications

- The expansion of the e-commerce and retail sectors is further accelerating the use of self adhesive vinyl films for packaging, labeling, and product branding, thereby strengthening their role in enhancing visual appeal and consumer engagement

Asia-Pacific Self Adhesive Vinyl Films Market Analysis

- The growing popularity of digital printing and customization trends is boosting the adoption of self adhesive vinyl films across industries, as they provide high-quality, versatile, and flexible solutions for both indoor and outdoor use

- In addition, increasing investments in construction, retail branding, and transportation infrastructure are creating lucrative opportunities for the market, while the eco-friendly product developments in vinyl films are further enhancing their demand globally

- China self adhesive vinyl films market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s strong manufacturing base and expanding urban infrastructure projects

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific self adhesive vinyl films market due to focus on advanced technology, sustainability, high-quality design aesthetics, and growing demand for eco-friendly and recyclable vinyl options. Increasing adoption in advertising, retail displays, automotive applications, and low-maintenance decorative solutions across residential and commercial sectors is fueling growth

- The opaque segment held the largest market revenue share in 2024, driven by its extensive use in outdoor advertising, signage, and branding applications where high visibility and durability are required. Opaque films offer excellent color vibrancy, UV resistance, and long-term outdoor performance, making them the preferred choice for commercial advertising campaigns

Report Scope and Asia-Pacific Self Adhesive Vinyl Films Market Segmentation

|

Attributes |

Asia-Pacific Self Adhesive Vinyl Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Self Adhesive Vinyl Films Market Trends

Rising Adoption Of Vinyl Films In Advertising And Vehicle Wrapping

- The increasing demand for attractive and durable advertising solutions is driving the adoption of self-adhesive vinyl films across Asia-Pacific. Their flexibility, weather resistance, and ease of application make them ideal for outdoor banners, billboards, and retail displays. This is significantly boosting their use in the commercial advertising sector

- Vehicle wrapping is emerging as a major trend, with businesses leveraging vinyl films for cost-effective branding and customization. The ability to apply and remove wraps without damaging surfaces has made them popular in automotive and fleet marketing across urban centers

- The growing e-commerce and retail expansion in developing economies is accelerating the use of vinyl films for packaging, promotional displays, and interior décor. Brands are focusing on eye-catching designs to attract consumers, driving higher market adoption

- For instance, in 2023, in 2023, several retail chains adopted eco-friendly self-adhesive vinyl films for in-store branding campaigns, improving visibility while reducing printing waste. This shift enhanced brand recall and supported sustainable marketing practices

- While adoption is rising, continued innovation in recyclable and PVC-free vinyl films is critical. Manufacturers must focus on cost optimization, localized supply chains, and environmentally compliant solutions to fully capitalize on this growing demand

Asia-Pacific Self Adhesive Vinyl Films Market Dynamics

Driver

Expanding Construction And Infrastructure Development Across The Region

- Rapid urbanization and infrastructure projects in countries like China, India, and Southeast Asia are boosting the use of self-adhesive vinyl films in interior decoration, wall graphics, and surface protection. Their ability to provide aesthetic appeal and long-lasting performance is highly valued in both commercial complexes and residential housing developments. The rising demand for visually appealing, durable, and low-maintenance solutions continues to drive adoption across the construction sector

- Builders and architects are increasingly turning to vinyl films as cost-effective alternatives to paints and laminates. Their durability, ease of installation, and variety of finishes support modern design requirements and improve project efficiency, especially in high-volume developments. In addition, vinyl films help reduce renovation downtime, making them a preferred choice for fast-paced urban projects

- Government initiatives supporting smart cities and infrastructure modernization are creating a strong market pull. From public transport branding to commercial signage, vinyl films are playing a crucial role in large-scale urban projects that demand cost-effective and long-lasting solutions. The growing use of digital printing technologies further enhances customization, expanding market opportunities

- For instance, in 2022, major infrastructure projects utilized self-adhesive vinyl films for signage and branding, enhancing user experience and promoting consistent visual identity across facilities. Similar adoption is being observed in transportation hubs and commercial complexes, where vinyl films are applied to balance aesthetics and durability. This sets a precedent for broader infrastructure-driven adoption

- While demand is growing, manufacturers must address supply reliability and ensure compliance with stringent regional environmental standards to maintain strong growth momentum. Companies focusing on localized production and sustainable product lines are better positioned to capture rising opportunities. A proactive approach toward green certifications will further strengthen market competitiveness

Restraint/Challenge

Environmental Concerns And Fluctuating Raw Material Costs

- The rising concerns around plastic waste and PVC-based materials are creating regulatory pressures on the self-adhesive vinyl films market. Restrictions on single-use plastics are prompting industries to seek more eco-friendly alternatives, limiting growth in certain applications and increasing compliance costs. As sustainability becomes a purchase driver, traditional PVC-based films face significant challenges

- Volatility in raw material prices, especially polymers and adhesives, significantly impacts production costs. Manufacturers face challenges in maintaining competitive pricing while ensuring product quality and durability, particularly in cost-sensitive markets such as India and Southeast Asia. These fluctuations often result in reduced profit margins and pricing instability, slowing long-term contracts

- Lack of consumer awareness regarding recyclable and sustainable vinyl options further slows adoption of green alternatives. Many small businesses still rely on conventional vinyl products due to cost advantages, despite shorter lifespans and environmental drawbacks. This knowledge gap hinders market transformation and limits the penetration of advanced eco-friendly solutions

- For instance, in 2023 regulations on PVC waste management prompted companies to explore bio-based and recyclable vinyl solutions. This increased compliance costs but also encouraged innovation in sustainable products. Pilot projects are showcasing the potential of PVC-free films in mainstream applications

- Overcoming these challenges requires strong R&D investments, partnerships for circular recycling models, and education campaigns to promote eco-friendly alternatives across the value chain. Companies that align product innovation with regional regulations and sustainability targets will not only mitigate risks but also unlock new opportunities in premium markets

Asia-Pacific Self Adhesive Vinyl Films Market Scope

The market is segmented on the basis of type, category, width, manufacturing process, adhesive type, substrate, thickness, and application.

- By Type

On the basis of type, the Asia-Pacific self adhesive vinyl films market is segmented into opaque, transparent, and translucent. The opaque segment held the largest market revenue share in 2024, driven by its extensive use in outdoor advertising, signage, and branding applications where high visibility and durability are required. Opaque films offer excellent color vibrancy, UV resistance, and long-term outdoor performance, making them the preferred choice for commercial advertising campaigns.

The transparent segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its increasing demand in window graphics, decorative surfaces, and promotional displays. Transparent films allow creative layering and versatile applications, providing a seamless finish while enhancing aesthetics in retail and interior decoration projects.

- By Category

On the basis of category, the Asia-Pacific self adhesive vinyl films market is segmented into printable and non-printable films. The printable segment dominated the market share in 2024, owing to its widespread adoption in digital printing for banners, signage, and vehicle wraps. Printable films provide excellent ink adhesion and compatibility with a wide range of printers, fueling their use in branding and advertising.

The non-printable segment is expected to witness the fastest growth rate from 2025 to 2032, primarily due to rising applications in protective layering, surface covering, and decorative finishes. These films are valued for their cost-effectiveness and utility across industrial and household uses.

- By Width

On the basis of width, the Asia-Pacific self adhesive vinyl films market is segmented into middle size width (approx. 137 cm), big size width (152–160 cm), and small size width (below 110 cm). The middle size width segment held the largest share in 2024, as it is widely compatible with standard printing machines and suitable for most commercial and decorative applications.

The big size width segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its increasing use in large-scale outdoor advertising, vehicle wrapping, and exhibition graphics. Its ability to cover wider areas with minimal seams enhances efficiency and visual appeal.

- By Manufacturing Process

On the basis of manufacturing process, the Asia-Pacific self adhesive vinyl films market is segmented into calendered films and cast films. The calendered films segment captured the highest revenue share in 2024, attributed to their affordability and suitability for short- to medium-term applications in advertising and decoration. Their cost-effectiveness and good durability make them a preferred choice for small businesses.

The cast films segment is expected to witness the fastest growth rate from 2025 to 2032, supported by their premium quality, longer lifespan, and superior flexibility for complex surfaces. These films are highly demanded in vehicle wrapping and high-performance outdoor graphics.

- By Adhesive Type

On the basis of adhesive type, the Asia-Pacific self adhesive vinyl films market is segmented into removable self adhesive vinyl films and permanent self adhesive vinyl films. The permanent segment accounted for the largest market share in 2024, owing to its strong bonding properties and suitability for long-lasting applications such as outdoor signage and branding.

The removable segment is expected to witness the fastest growth rate from 2025 to 2032, as it is increasingly adopted for short-term campaigns, seasonal advertising, and exhibition graphics. Its ease of removal without surface damage makes it highly attractive for retailers and advertisers.

- By Substrate

On the basis of substrate, the Asia-Pacific self adhesive vinyl films market is segmented into plastics, glass, floor, and others. The plastics segment led the market in 2024, with extensive applications in advertising, furniture decoration, and product labeling. Its versatility, durability, and compatibility with different adhesives drive its strong adoption.

The glass segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing use of transparent and decorative films in windows, partitions, and storefronts. Rising demand for aesthetic interiors in both commercial and residential spaces is further boosting this segment.

- By Thickness

On the basis of thickness, the Asia-Pacific self adhesive vinyl films market is segmented into thin (2–3 mils) and thick (more than 3 mils). The thin segment held the dominant revenue share in 2024, attributed to its flexibility, ease of application, and cost-effectiveness for temporary and medium-term uses in advertising and displays.

The thick segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its higher durability and resistance to wear, making it suitable for floor graphics, furniture decoration, and heavy-duty applications.

- By Application

On the basis of application, the Asia-Pacific self adhesive vinyl films market is segmented into fleet graphics, floor graphics, window graphics, car wrapping, labels & stickers, exhibition & stickers, outdoor advertising, furniture decoration, advertising & branding, wallcovering, and others. The outdoor advertising segment dominated the market in 2024, fueled by rising demand for visually impactful, cost-efficient, and durable promotional materials across urban centers.

The car wrapping segment is expected to witness the fastest growth rate from 2025 to 2032, as vehicle customization and branding gain momentum across the region. The growing use of high-quality cast films for full and partial wraps enhances both aesthetics and marketing visibility.

Asia-Pacific Self Adhesive Vinyl Films Market Regional Analysis

- The China self adhesive vinyl films market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s strong manufacturing base and expanding urban infrastructure projects

- China is one of the biggest consumers of vinyl films, with extensive use in advertising, retail displays, vehicle graphics, and construction applications. The push toward smart cities and the availability of competitively priced products from domestic manufacturers are further driving growth

- In addition, the rising middle class and their preference for modern interior decoration solutions continue to strengthen demand across both residential and commercial sectors

Japan Self Adhesive Vinyl Films Market Insight

The Japan self adhesive vinyl films market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s emphasis on advanced technology, sustainability, and high-quality design aesthetics. The growing demand for eco-friendly and recyclable vinyl film options aligns with Japan’s focus on environmental responsibility. Widespread adoption in advertising, retail displays, and automotive applications is fueling market growth. Additionally, Japan’s aging population and preference for low-maintenance, durable decorative solutions are driving usage in both residential and commercial projects. The integration of vinyl films with innovative printing technologies is also enhancing product appeal and driving demand across industries.

Asia-Pacific Self Adhesive Vinyl Films Market Share

The Asia-Pacific self adhesive vinyl films industry is primarily led by well-established companies, including:

- Lintec Corporation (Japan)

- Nitto Denko Corporation (Japan)

- LG Hausys (South Korea)

- Shenzhen Sun Tone New Material Co., Ltd. (Sun Tone) (China)

- Signapex Technology Co., Ltd. (China)

- Haining Comax New Material Co., Ltd. (China)

- Sino Group (China)

- Great K2 Industry Co., Ltd. (China)

- Item Plastic Corp. (Taiwan)

- Sinovinyl (China)

Latest Developments in Asia-Pacific Self Adhesive Vinyl Films Market

- In September 2021, iarigai highlighted innovations in conductive inks using hybrids of reduced graphene oxide (rGO) and carbon black (CB). These enhancements improved conductivity, flow characteristics, and dispersibility, enabling more reliable and stable printing processes. The development supports the production of high-quality vinyl films for electronics and specialty applications, expanding market potential and encouraging adoption of advanced printed materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Self Adhesive Vinyl Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Self Adhesive Vinyl Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Self Adhesive Vinyl Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.