Asia Pacific Skin Packaging For Fresh Meat Market

Market Size in USD Million

CAGR :

%

USD

390.25 Million

USD

559.25 Million

2025

2033

USD

390.25 Million

USD

559.25 Million

2025

2033

| 2026 –2033 | |

| USD 390.25 Million | |

| USD 559.25 Million | |

|

|

|

|

Asia-Pacific Skin Packaging for Fresh Meat Market Size

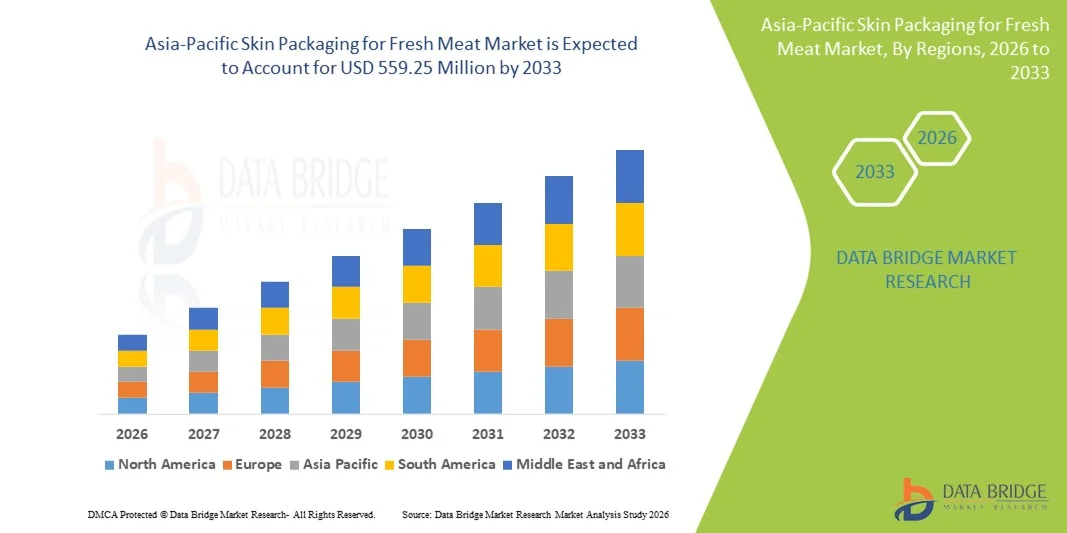

- The Asia-Pacific skin packaging for fresh meat market size was valued at USD 390.25 million in 2025 and is expected to reach USD 559.25 million by 2033, at a CAGR of 4.60% during the forecast period

- The market growth is largely fuelled by rising demand for extended shelf life and improved product visibility in fresh meat packaging, as skin packaging helps preserve freshness while enhancing on-shelf appeal

- Increasing consumption of fresh and premium meat products, along with growing preference for leak-proof and vacuum-sealed packaging formats, is supporting steady market expansion

Asia-Pacific Skin Packaging for Fresh Meat Market Analysis

- The market is witnessing consistent growth due to the ability of skin packaging to tightly conform to meat products, reducing oxygen exposure and maintaining product quality over longer periods

- Skin packaging is increasingly preferred over conventional packaging formats as it enhances hygiene, minimizes drip loss, and improves consumer confidence in product safety and freshness

- China dominated the skin packaging for fresh meat market in 2025, driven by high meat consumption and rapid expansion of modern retail and cold chain networks. Growing consumer concern regarding food safety and freshness has accelerated adoption of vacuum and skin packaging solutions

- Japan is expected to witness the highest compound annual growth rate (CAGR) in the Asia-Pacific skin packaging for fresh meat market due to strong demand for premium, fresh, and visually appealing meat products, rising adoption of convenience-oriented and ready-to-cook meat formats, and increasing use of advanced skin packaging technologies in modern retail and foodservice channels

- The non-carded thermoformable skin packaging segment held the largest market revenue share in 2025 driven by its extensive use in fresh meat packaging, cost efficiency, and strong compatibility with automated packaging lines. This type enables tight film adhesion around meat cuts, improving freshness retention and reducing purge. It is widely adopted by large meat processors and retailers due to its scalability and consistent sealing performance. In addition, non-carded formats support high-volume production while maintaining product visibility and hygiene

Report Scope and Asia-Pacific Skin Packaging for Fresh Meat Market Segmentation

|

Attributes |

Asia-Pacific Skin Packaging for Fresh Meat Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Skin Packaging for Fresh Meat Market Trends

Rising Demand for Extended Shelf Life and Premium Product Presentation

- The increasing focus on maintaining freshness and visual appeal of fresh meat products is significantly shaping the skin packaging for fresh meat market, as retailers and consumers prefer packaging solutions that preserve quality while enhancing product appearance. Skin packaging is gaining strong adoption due to its ability to tightly seal meat products, reduce oxygen exposure, and extend shelf life without the use of preservatives. This trend is strengthening its use across retail and foodservice channels, encouraging packaging manufacturers to develop advanced films and sealing technologies

- Growing consumption of fresh, chilled, and premium meat products is accelerating the demand for skin packaging in supermarkets and specialty meat stores. Consumers are increasingly drawn to leak-proof, vacuum-sealed packs that offer clear visibility of meat cuts while ensuring hygiene and safety. This has prompted meat processors to adopt skin packaging to meet evolving consumer expectations and reduce spoilage-related losses

- Premiumization trends in the meat industry are influencing purchasing decisions, with brands emphasizing quality, freshness, and aesthetic appeal. Skin packaging supports these objectives by improving on-shelf differentiation and enabling branding opportunities through clear films and attractive tray designs. These factors are helping manufacturers strengthen brand positioning, increase consumer trust, and improve repeat purchase rates in competitive retail environments

- For instance, in 2024, major meat processors and retail chains in developed markets expanded the use of skin packaging for fresh beef, poultry, and pork products to improve shelf presentation and reduce food waste. These packaging upgrades were introduced in response to rising demand for premium fresh meat, with products distributed through large-format retailers and specialty outlets. The enhanced packaging also supported sustainability messaging by lowering product spoilage and return rates

- While adoption of skin packaging for fresh meat continues to rise, sustained market growth depends on cost optimization, material innovation, and compatibility with existing processing lines. Packaging manufacturers are focusing on developing recyclable and thinner films, improving sealing efficiency, and ensuring performance consistency to support wider adoption across small and large meat processors

Asia-Pacific Skin Packaging for Fresh Meat Market Dynamics

Driver

Growing Demand for Freshness Preservation and Leak-Proof Packaging

- Rising demand for packaging solutions that extend shelf life and maintain meat quality is a major driver for the skin packaging for fresh meat market. Skin packaging minimizes air contact and securely holds products in place, reducing microbial growth and drip loss. This helps meat processors and retailers meet food safety standards while improving product durability during storage and transportation

- Expanding retail distribution of fresh meat through supermarkets and hypermarkets is supporting market growth, as these channels require packaging formats that enhance product visibility and reduce handling losses. Skin packaging allows retailers to display fresh meat for longer periods without compromising appearance, supporting efficient inventory management and reduced waste

- Meat processors and packaging companies are actively promoting skin-packaged fresh meat through product innovation, improved tray designs, and compatibility with automated packing lines. These efforts are supported by retailer demand for high-performance packaging and increasing consumer preference for hygienic, tamper-resistant formats, encouraging collaboration between packaging suppliers and meat processors

- For instance, in 2023, leading packaging solution providers partnered with fresh meat processors to introduce high-barrier skin packaging films for beef and poultry products. These solutions helped improve shelf life and visual appeal, resulting in higher sales conversion and reduced product returns for retailers. Sustainability benefits such as lower food waste were also highlighted to strengthen adoption

- Although strong demand for freshness-preserving packaging supports market growth, continued expansion depends on balancing performance with cost efficiency. Investments in advanced materials, scalable production, and integration with high-speed packaging equipment will be essential to maintain competitiveness and meet rising global demand

Restraint/Challenge

Higher Packaging Costs And Material Sustainability Concerns

- The relatively higher cost of skin packaging systems and specialized films compared to conventional tray and overwrap packaging remains a key challenge for market growth. Advanced materials, vacuum equipment, and sealing technologies contribute to increased upfront and operational costs, which can limit adoption among small and mid-sized meat processors

- Sustainability concerns related to plastic usage and recyclability also pose challenges, as skin packaging often relies on multi-layer films that are difficult to recycle. Increasing regulatory scrutiny and consumer pressure for eco-friendly packaging solutions are pushing manufacturers to rethink material choices, adding complexity to product development

- Operational and technical challenges further impact adoption, as skin packaging requires precise temperature control, film compatibility, and skilled handling to ensure consistent sealing and product quality. Any deviation can result in seal failure, reduced shelf life, or product rejection, increasing operational risk for processors

- For instance, in 2024, several small-scale meat processors reported slower adoption of skin packaging due to high equipment costs and limited access to recyclable film options. Concerns around compliance with emerging sustainability regulations and the need for technical expertise also affected investment decisions, particularly among cost-sensitive operators

- Addressing these challenges will require innovation in recyclable and mono-material films, cost-effective machinery, and technical support for processors. Collaboration between packaging manufacturers, meat processors, and material suppliers will be critical to reduce costs, improve sustainability, and unlock the long-term growth potential of the skin packaging for fresh meat market

Asia-Pacific Skin Packaging for Fresh Meat Market Scope

The market is segmented on the basis of type, material, heat seal coating, air-fill, function, nature, and end use.

- By Type

On the basis of type, the Asia-Pacific skin packaging for fresh meat market is segmented into Carded Thermoformable Skin Packaging and Non-carded Thermoformable Skin Packaging. The non-carded thermoformable skin packaging segment held the largest market revenue share in 2025 driven by its extensive use in fresh meat packaging, cost efficiency, and strong compatibility with automated packaging lines. This type enables tight film adhesion around meat cuts, improving freshness retention and reducing purge. It is widely adopted by large meat processors and retailers due to its scalability and consistent sealing performance. In addition, non-carded formats support high-volume production while maintaining product visibility and hygiene.

The carded thermoformable skin packaging segment is expected to witness steady growth from 2026 to 2033 supported by rising demand for premium and branded fresh meat products. This format offers enhanced presentation and additional space for branding and regulatory information. It is increasingly used in specialty retail and value-added meat offerings where visual differentiation is important. Growing focus on premiumization and product storytelling is further supporting adoption of carded formats.

- By Material

On the basis of material, the Asia-Pacific skin packaging for fresh meat market is segmented into Plastic, Paper and Paperboard, and Others. The plastic segment accounted for the largest share in 2025 owing to its excellent barrier properties, flexibility, and durability. Plastic materials provide strong oxygen and moisture barriers, which are critical for extending shelf life of fresh meat products. Their transparency also enhances product visibility, supporting consumer purchasing decisions. In addition, plastic materials are compatible with vacuum skin packaging systems and high-speed processing lines.

The paper and paperboard segment is expected to witness the fastest growth from 2026 to 2033 driven by increasing emphasis on sustainable and recyclable packaging solutions. Manufacturers are developing paper-based trays with barrier coatings to reduce plastic usage while maintaining functional performance. Rising regulatory pressure and consumer preference for eco-friendly packaging are further encouraging innovation in this segment. These materials are gaining traction particularly in premium and sustainability-focused retail channels.

- By Heat Seal Coating

On the basis of heat seal coating, the Asia-Pacific skin packaging for fresh meat market is segmented into Water-Based, Solvent-Based, and Others. The water-based heat seal coating segment dominated the market in 2025 due to its low environmental impact and suitability for food-contact applications. These coatings offer effective sealing performance while supporting sustainability goals and regulatory compliance. They are widely preferred by packaging manufacturers aiming to reduce VOC emissions. In addition, water-based coatings provide good adhesion across various packaging substrates.

The solvent-based segment is expected to witness the fastest growth from 2026 to 2033 supported by its strong bonding strength and performance in high-barrier applications. However, its adoption is increasingly influenced by environmental regulations and sustainability concerns. Manufacturers are selectively using solvent-based coatings in applications where higher sealing strength is required. Ongoing innovation is focused on reducing environmental impact while maintaining performance.

- By Air-Fill

On the basis of air-fill, the Asia-Pacific skin packaging for fresh meat market is segmented into Vacuum Fill and Non-Vacuum Fill. The vacuum fill segment held the largest market share in 2025 driven by its effectiveness in removing oxygen and extending shelf life of fresh meat products. Vacuum skin packaging helps inhibit microbial growth and reduce drip loss, improving overall product quality. This format is widely used in retail and foodservice channels to ensure freshness during distribution and storage. It also supports reduced food waste and improved inventory management.

The non-vacuum fill segment is expected to witness the fastest growth from 2026 to 2033, particularly in applications with shorter shelf life requirements. This segment benefits from lower packaging and equipment costs, making it suitable for smaller processors. It is commonly used in local and regional distribution channels where rapid product turnover is expected. Ease of processing and cost efficiency continue to support its adoption.

- By Function

On the basis of function, the Asia-Pacific skin packaging for fresh meat market is segmented into Preserve & Protect, Fit For Purpose, Regulatory Labelling, Presentation, and Others. The preserve & protect segment accounted for the largest share in 2025 as maintaining freshness and safety is the primary objective in fresh meat packaging. Skin packaging provides strong protection against contamination, physical damage, and moisture loss. This function is critical for meeting food safety standards and extending product shelf life. It also supports efficient cold chain management.

The presentation segment is expected to witness the fastest growth from 2026 to 2033 driven by increasing emphasis on visual appeal and premium positioning. Skin packaging enhances product aesthetics by clearly displaying meat cuts and reducing package clutter. This function supports brand differentiation and improves on-shelf visibility in competitive retail environments. Growing consumer preference for visually appealing fresh meat products is further driving this segment.

- By Nature

On the basis of nature, the Asia-Pacific skin packaging for fresh meat market is segmented into Microwavable and Non-Microwavable. The non-microwavable segment dominated the market in 2025 as most fresh meat products are intended for cooking after removal from packaging. This segment benefits from simpler material structures and lower production costs. It is widely adopted across traditional fresh meat retail formats. Strong demand for raw and minimally processed meat products continues to support this segment.

The microwavable segment is expected to witness the fastest growth from 2026 to 2033 supported by rising demand for convenience-oriented and ready-to-cook meat products. Urbanization and changing lifestyles are encouraging adoption of packaging that supports quick meal preparation. Packaging manufacturers are developing heat-resistant materials compatible with microwave heating. This segment is gaining traction particularly among younger consumers and working households.

- By End Use

On the basis of end use, the Asia-Pacific skin packaging for fresh meat market is segmented into Meat, Poultry, and Seafood. The meat segment held the largest revenue share in 2025 driven by high global consumption of beef, pork, and lamb. Skin packaging is extensively used to enhance freshness, reduce spoilage, and improve presentation of red meat products. The segment benefits from strong retail demand and established cold chain infrastructure. Premium meat offerings further support adoption of advanced skin packaging solutions.

The poultry segment is expected to witness the fastest growth from 2026 to 2033 supported by rising consumption of chicken and turkey. Poultry products have shorter shelf life, increasing the need for effective packaging solutions such as vacuum skin packaging. Growing demand for hygienic and leak-proof packaging is driving adoption in this segment. Expansion of organized retail and foodservice channels is further supporting market growth.

Asia-Pacific Skin Packaging for Fresh Meat Market Regional Analysis

- China dominated the skin packaging for fresh meat market in 2025, driven by high meat consumption and rapid expansion of modern retail and cold chain networks. Growing consumer concern regarding food safety and freshness has accelerated adoption of vacuum and skin packaging solutions

- Large-scale meat processing operations and strong investments in packaging technology further support market leadership

- The focus on reducing food waste and improving supply chain efficiency also contributes to sustained dominance

Japan Skin Packaging for Fresh Meat Market Insight

Japan is expected to witness the fastest growth from 2026 to 2033, supported by strong demand for high-quality, fresh, and visually appealing meat products. Consumers place significant importance on hygiene, portion control, and premium presentation, driving adoption of skin packaging. Advanced packaging technologies and convenience-oriented retail formats further support growth. In addition, rising demand for premium and ready-to-cook meat products is accelerating market expansion.

Asia-Pacific Skin Packaging for Fresh Meat Market Share

The Asia-Pacific skin packaging for fresh meat industry is primarily led by well-established companies, including:

- Toyo Seikan Group Holdings (Japan)

- Rengo Co., Ltd. (Japan)

- Dai Nippon Printing Co., Ltd. (Japan)

- Toppan Holdings Inc. (Japan)

- Mitsubishi Chemical Group (Japan)

- SCG Packaging (Thailand)

- Indorama Ventures (Thailand)

- Thai Plastic Packaging Group (Thailand)

- Amcor Asia (Australia)

- Visy Industries (Australia)

- Uflex Ltd. (India)

- Ester Industries Ltd. (India)

- Jindal Poly Films (India)

- Shandong Huatai Paper (China)

- Zhejiang Great Southeast Corp. (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Skin Packaging For Fresh Meat Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Skin Packaging For Fresh Meat Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Skin Packaging For Fresh Meat Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.