Asia Pacific Smart Lighting Market

Market Size in USD Billion

CAGR :

%

USD

4.90 Billion

USD

15.40 Billion

2024

2032

USD

4.90 Billion

USD

15.40 Billion

2024

2032

| 2025 –2032 | |

| USD 4.90 Billion | |

| USD 15.40 Billion | |

|

|

|

|

Asia Pacific Smart Lighting Market Size

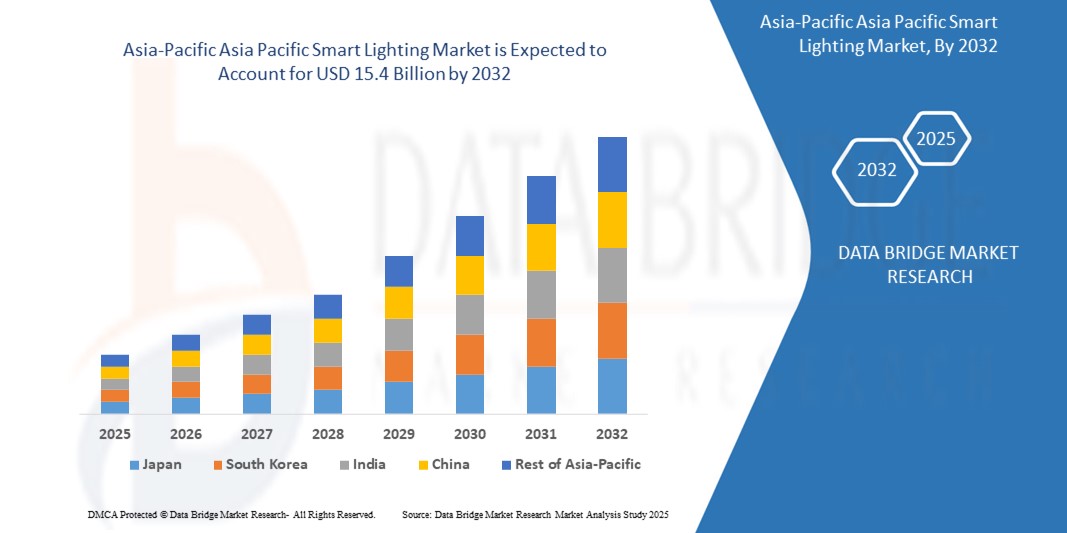

- The Asia Pacific Smart Lighting Market size was valued at USD 4.9 billion in 2024 and is expected to reach USD 15.4 billion by 2032, at a CAGR of 17.8% during the forecast period.

- This growth is driven by Increased awareness of sustainability and cost-saving on energy bills is pushing residential and commercial adoption.

Asia Pacific Smart Lighting Market Analysis

- Smart lighting is integral to smart cities for adaptive illumination, energy savings, and safety. Cities like Los Angeles and New York are rapidly deploying connected street lighting systems.

- Federal and state-level policies in the CHINA and Canada offer tax rebates and subsidies for energy-efficient retrofits.

- CHINA holds a significant market share due to Technological Advancements.

- CHINA is expected to register the fastest growth, fuelled by IoT and Wireless Control Integration.

- The Software segment is projected to account for a significant market share of approximately 32.2% in 2025, driven by Government Incentives for Energy Efficiency.

Report Scope and Asia Pacific Smart Lighting Market Segmentation

|

Attributes |

Asia Pacific Smart Lighting Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia Pacific Smart Lighting Market Trends

“Cloud computing”

- Cloud computing adoption in IoT for public safety enhances scalability, flexibility, and cost-efficiency. Cloud platforms facilitate real-time data analysis and remote access, improving emergency coordination.

- IoT technologies are increasingly being integrated into smart city infrastructures, supporting enhanced surveillance, traffic management, and emergency response. This fosters better resource management during critical events.

- In April 23, 2024, Luminar introduced its new compact lidar sensor named Halo and announced a partnership with auto software maker Applied Intuition. This collaboration aims to help automakers test their assisted driving systems more effectively by integrating Applied Intuition's sensor simulator with Luminar's lidar sensor models.

- Cloud-based platforms offer scalability and real-time data processing capabilities, enhancing coordination between agencies during emergencies.

Asia Pacific Smart Lighting Market Dynamics

Driver

“Simplified Data Management”

- Modern IoT platforms allow non-technical personnel to analyze and manage data independently, speeding up decision-making.

- Growing regulatory demands push for IoT solutions that meet data protection and public safety standards, fostering trust and operational efficiency.

- For instance, In May 23, 2019, Aurora, a developer of self-driving car technology, announced its acquisition of Blackmore, a lidar company specializing in a Doppler lidar system capable of detecting both the distance and velocity of objects. This acquisition is a strategic move to enhance Aurora's perception capabilities, which are critical to the success of autonomous vehicles.

- Philips Hue partnered with Nobilia to introduce integrated smart lighting solutions for kitchen furniture, featuring custom Hue lights designed exclusively for Nobilia.

Opportunity

“Predictive Analytics & Data Mining”

- These tools help agencies anticipate incidents, allocate resources more efficiently, and take proactive measures.

- Increasing digitalization in North American cities opens doors for IoT vendors to provide advanced public safety solutions.

- For instance, as of February 2023, Velodyne Lidar, a Silicon Valley–based lidar technology company, merged with Ouster, consolidating their operations to strengthen their position in the lidar market

- Hexagon Safety & Infrastructure deployed integrated IoT dashboards across several China states to unify operations among police, fire, and EMS units.

Restraint/Challenge

“Capital Intensive Deployments”

- Initial costs for hardware, software, and system integration pose barriers, especially for small and mid-sized municipalities.

- High upfront costs of deploying IoT systems, including hardware, software, and services, are significant barriers for smaller municipalities.

- For instance, In April 29, 2025, Mercedes-Benz entered a new agreement with Luminar Technologies to co-develop and integrate Luminar’s next-generation Halo lidar sensors into its vehicles. This marks the first development contract for Halo and may lead to a future supply agreement.

- Full-scale IoT deployments involving sensors, analytics, and infrastructure remain financially challenging for smaller jurisdictions.

Asia Pacific Smart Lighting Market Scope

The market is segmented based on Offering, Installation Type, and Communication Technology, Application Type.

|

Segmentation |

Sub-Segmentation |

|

By Offering |

|

|

By Installation Type |

|

|

By Communication Technology |

|

|

By Application Type |

|

In 2025, Software segment is projected to dominate the End User segment

The Software segment is expected to hold a market share of approximately 31.1% in 2025, driven by Advanced 5G and Edge Connectivity.

The Surveillance and Security segment is expected to account for the largest share during the forecast period in the Road Type market

In 2025, the Cities segment is projected to account for a market share of 29.8%, driven by Growing regulatory demands push for IoT solutions that meet data protection and public safety standards, fostering trust and operational efficiency.

“China Holds the Largest Share in the Asia Pacific Smart Lighting Market”

- China dominates the market due to Growing regulatory demands push for IoT solutions that meet data protection and public safety standards, fostering trust and operational efficiency.

- The China holds a significant share, driven by Modern IoT platforms allow non-technical personnel to analyze and manage data independently, speeding up decision-making.

- Increasing digitalization in North American cities opens doors for IoT vendors to provide advanced public safety solutions.

“China is Projected to Register the Highest CAGR in the Asia Pacific Smart Lighting Market”

- China growth is driven by Predictive Analytics & Data Mining.

- China is projected to exhibit the highest CAGR due to there's growing adoption of SaaS platforms tailored for government use, including those offered by Amazon Web Services (AWS).

- Analytics tools like predictive analytics and data mining allow agencies to extract actionable insights from IoT data, aiding proactive responses and efficient resource deployment.

Asia Pacific Smart Lighting Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Philips Lighting Holding B.V.

- Acuity Brands Lighting, Inc.

- Hafele,

- Honeywell International Inc.,

- Cree, Inc.

- Digital Lumens, Inc.

- OSRAM GmbH.,

- Lutron Electronics Co., Inc,

- Legrand SA,

- Seiko Epson Corporation,

- Encelium technologies,

- Virtual Extension,

- Zumtobel Group AG,

- Wipro Consumer Care & Lighting,

- Schneider Electric SE,

- Eaton,

- Leviton Manufacturing Co., Inc.,

- Syska LED

- Beam Labs B.V.

Latest Developments in Asia Pacific Smart Lighting Market

- In February 28, 2024, Shares of Luminar Technologies fell by about 10% after the company reported fourth-quarter results that missed expectations due to a delay in the production schedule of Volvo Cars' new EX90 electric SUVs.

- In September 2019, SmartDrive Systems secured $90 million of new capital in an investment round led by global investment company Sixth Street Partners. The funding aimed to enhance SmartDrive's video telematics solutions for safety and fuel efficiency in commercial fleets.

- In July 2011, Sensor Dynamics, known for its inertial sensors and automotive MEMS, was acquired by Maxim Integrated for $164 million. This acquisition aimed to expand Maxim's offerings in automotive sensor technologies.

- As of May 2025, Brilliant introduced its second-generation smart home control panels, featuring higher-resolution screens and improved responsiveness, following its acquisition by Almeida Strategic Investments and Cullinan Holdings in 2024.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC SMART LIGHTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE ASIA-PACIFIC SMART LIGHTING MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 MULTIVARIATE MODELLING

2.7 TOP TO BOTTOM ANALYSIS

2.8 STANDARDS OF MEASUREMENT

2.9 VENDOR SHARE ANALYSIS

2.1 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.12 ASIA-PACIFIC SMART LIGHTING MARKET: RESEARCH SNAPSHOT

2.13 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 STANDARDS

5.2 VALUE CHAIN ANALYSIS

5.3 TRADE ANALYSIS

5.4 CASE STUDY

5.5 ECOSYSTEMS ANALYSIS

5.6 REGULATORY LANDSCAPE

5.6.1 IEC60950, IEC 61000, AND IP RATING

5.6.2 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS)

5.6.3 SEMI STANDARDS

5.6.4 FOOD AND DRUG ADMINISTRATION (FDA)

5.6.5 FEDERAL COMMUNICATION COMMISSION (FCC)

5.7 TECHNOLOGY ANALYSIS

5.7.1 AI AND MACHINE LEARNING

5.7.2 3D PRINTING

5.7.3 INDUSTRIAL IOT

5.7.4 CYBERSECURITY

5.7.5 ADVANCED COMPUTING

6 ASIA-PACIFIC SMART LIGHTING MARKET, BY OFFERING

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 LIGHTS AND LUMINAIRES

6.2.1.1. SMART BULBS

6.2.1.2. FIXTURES

6.2.1.3. OTHERS

6.2.2 LIGHTING CONTROLS

6.2.2.1. LEDS DRIVERS AND BALLASTS

6.2.2.2. SENSORS

6.2.2.3. SWITCHES

6.2.2.4. DIMMERS

6.2.2.4.1. WIRED DIMMERS

6.2.2.4.2. WIRELESS DIMMERS

6.2.2.5. RELAY UNITS

6.2.2.6. GATEWAYS

6.3 SOFTWARE

6.3.1 CLOUD-BASED SOFTWARE

6.3.2 LOCAL/WEB-BASED SOFTWARE

6.4 SERVICES

6.4.1 TRAINING

6.4.2 INSTALLATION

6.4.3 ENGINEERING & COMMISSIONING

7 ASIA-PACIFIC SMART LIGHTING MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 NEW INSTALLATIONS

7.3 RETROFIT INSTALLATIONS

8 ASIA-PACIFIC SMART LIGHTING MARKET, BY LIGHTING TECHNOLOGY

8.1 OVERVIEW

8.2 LED

8.3 HALOGEN

8.4 INCANDESCENT

8.5 FLUORESCENT

8.6 CFL

8.7 OTHERS

9 ASIA-PACIFIC SMART LIGHTING MARKET, BY WATTAGE

9.1 OVERVIEW

9.2 LESS THAN 5 WATT

9.3 5 WATT- 30 WATT

9.4 30 WATT -60 WATT

9.5 MORE THAN 6O WATT

10 ASIA-PACIFIC SMART LIGHTING MARKET, BY COMMUNICATION TECHNOLOGY

10.1 OVERVIEW

10.2 WIRED

10.2.1 POWER OVER ETHERNET (POE)

10.2.2 DALI

10.2.3 WIRED HYBRID PROTOCOLS

10.2.4 POWER LINE COMMUNICATIONS (PLC)

10.3 WIRELESS

10.3.1 WI-FI

10.3.2 BLE

10.3.3 ZIGBEE

10.3.4 WIRELESS HYBRID PROTOCOLS

10.3.5 ENOCEAN

10.3.6 NFC

10.3.7 6LOWPAN

10.3.8 OTHERS

11 ASIA-PACIFIC SMART LIGHTING MARKET, BY MOUNTING TYPE

11.1 OVERVIEW

11.2 WALL MOUNTED

11.3 SURFACE MOUNTED

12 ASIA-PACIFIC SMART LIGHTING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 WHOLESALE/RETAIL

12.4 ONLINE

13 ASIA-PACIFIC SMART LIGHTING MARKET, BY END USE APPLICATION

13.1 OVERVIEW

13.2 INDOOR

13.2.1 RESIDENTIAL

13.2.2 COMMERCIAL

13.2.2.1. RETAIL

13.2.2.2. HOSPITALITY

13.2.2.3. OFFICE LIGHTING

13.2.2.4. EDUCATION

13.2.2.5. BANK

13.2.2.6. HEALTHCARE FACILITIES

13.2.2.7. OTHERS

13.2.3 INDUSTRIAL

13.2.4 OTHERS

13.3 OUTDOOR

13.3.1 ROADWAYS & HIGHWAYS

13.3.1.1. STREET & ROADWAYS

13.3.1.2. HIGHWAYS

13.3.1.3. TUNNELS & BRIDGES

13.3.2 ARCHITECTURAL

13.3.3 PUBLIC PLACES

13.3.3.1. LARGE AREAS

13.3.3.2. PARKING AREA

13.3.3.3. RECREATION & PUBLIC VENUE

13.3.3.4. AIRPORT

14 ASIA-PACIFIC SMART LIGHTING MARKET, BY COUNTRY

14.1 ASIA-PACIFIC SMART LIGHTING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1.1 ASIA-PACIFIC

14.1.1.1. CHINA

14.1.1.2. JAPAN

14.1.1.3. INDIA

14.1.1.4. SOUTH KOREA

14.1.1.5. AUSTRALIA

14.1.1.6. MALAYSIA

14.1.1.7. THAILAND

14.1.1.8. PHILIPPINES

14.1.1.9. INDONESIA

14.1.1.10. REST OF ASIA-PACIFIC

14.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 ASIA-PACIFIC SMART LIGHTING MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.2 MERGERS & ACQUISITIONS

15.3 NEW PRODUCT DEVELOPMENT & APPROVALS

15.4 EXPANSIONS

15.5 REGULATORY CHANGES

15.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 ASIA-PACIFIC SMART LIGHTING MARKET, SWOT ANALYSIS

17 ASIA-PACIFIC SMART LIGHTING MARKET, COMPANY PROFILE

17.1 SIGNIFY

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHIC PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 OSRAM LICHT AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHIC PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 ABB LTD.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHIC PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 SCHNEIDER ELECTRIC SE

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHIC PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 PANASONIC GROUP

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHIC PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 SYSKA LED

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHIC PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 GENERAL ELECTRIC COMPANY

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHIC PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 LEGRAND S.A.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHIC PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENTS

17.9 ACUITY BRAND INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHIC PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENTS

17.1 LEVITON MANUFACTURING COMPANY, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHIC PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENTS

17.11 HUBBELL INCORPORATED

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHIC PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 CREE, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHIC PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENTS

17.13 TRILUX GMBH & CO. KG

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHIC PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 ZUMTOBEL

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHIC PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENTS

17.15 LUTRON ELECTRONICS CO. INC.

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHIC PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

17.16 WIPRO LIGHTING LIMITED

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 GEOGRAPHIC PRESENCE

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENTS

17.17 EATON

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 GEOGRAPHIC PRESENCE

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 QUESTIONNAIRE

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.