Asia Pacific Soil Health Market

Market Size in USD Billion

CAGR :

%

USD

6.63 Billion

USD

13.78 Billion

2025

2033

USD

6.63 Billion

USD

13.78 Billion

2025

2033

| 2026 –2033 | |

| USD 6.63 Billion | |

| USD 13.78 Billion | |

|

|

|

|

Asia-Pacific Soil Health Market Size

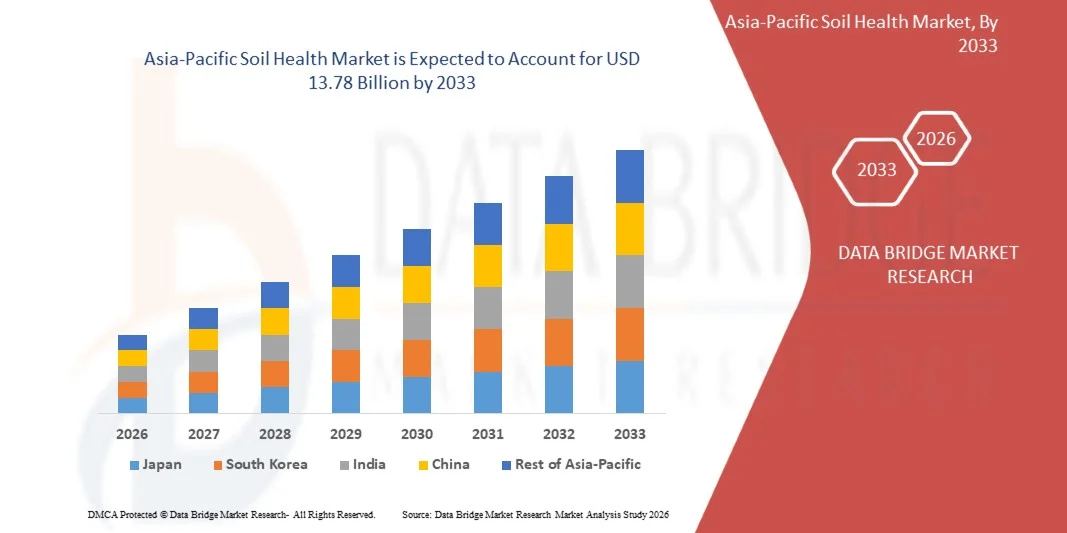

- The Asia-Pacific Soil Health Market size was valued at USD 6.63 Billion in 2025 and is expected to reach USD 13.78 Billion by 2033, at a CAGR of 9.6% during the forecast period

- The Asia-Pacific Soil Health (UGV) Market refers to the comprehensive market comprising products, technologies, and services designed to assess, protect, enhance, and manage the biological, physical, and chemical properties of soil to sustain productivity, support ecosystem functions, and improve agricultural and environmental outcomes.

Asia-Pacific Soil Health Market Analysis

- The Asia-Pacific Soil Health Market represents a critical segment within the Asia-Pacific agricultural and agri-technology landscape, supporting applications across crop production, precision farming, sustainable agriculture, carbon sequestration, and land restoration. Soil health solutions focus on improving soil structure, nutrient availability, microbial activity, and long-term productivity through biological, chemical, and digital interventions.

- Market growth is driven by rising adoption of sustainable farming practices, increasing awareness of soil degradation, and strong government initiatives promoting regenerative agriculture. Advancements in soil testing technologies, biological inputs, digital soil analytics, and precision nutrient management are accelerating adoption across both commercial and smallholder farming systems.

- The agriculture sector is expected to remain the dominant end-use segment, supported by growing investments in yield optimization, soil fertility management, and climate-resilient farming. Farmers benefit from soil health solutions through improved crop productivity, reduced input costs, enhanced water retention, and long-term land sustainability.

- China is projected to lead the Asia-Pacific Soil Health Market with a share of 26.54% in 2026, driven by large-scale agricultural output, government-led soil restoration programs, and increasing use of soil conditioners and biological inputs. Growth in Japan is supported by precision agriculture adoption, advanced soil diagnostics, and strong focus on high-value crop cultivation. Is driven by rising demand for sustainable agriculture, government initiatives like soil health cards, increasing awareness of nutrient management, declining soil fertility, growing adoption of precision farming, and the need to improve crop yield and farm profitability.

- India is anticipated to show the fastest growth during the forecast period.

- The Soil Enhancement Products segment is anticipated to hold the largest market share of 88.94% by 2025, driven by widespread use of soil conditioners, organic amendments, biofertilizers, and microbial products. These solutions are favored for their cost-effectiveness, ease of application, and ability to improve soil fertility, structure, and microbial balance across diverse crop types.

Report Scope and Asia-Pacific Soil Health Market Segmentation

|

Attributes |

Asia-Pacific Soil Health Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Asia-Pacific Soil Health Market Trends

“Growing Need For Monitoring, Reporting, And Verification (MRV) Systems For Soil Health”

- The increasing emphasis on accountability, transparency, and performance-based environmental outcomes is creating strong opportunities for soil health MRV systems. Governments, development banks, and climate programs require credible, standardized soil data to track progress toward sustainability, climate, and land restoration targets. This need is accelerating investment in integrated MRV platforms combining field sampling, digital tools, and geospatial analytics, expanding the role of soil health data services across agriculture and land-use sectors.

- In March 2022, the United Nations Convention to Combat Desertification (UNCCD) emphasized the need for standardized soil monitoring systems to track land degradation neutrality targets, increasing demand for soil health data frameworks.

- In October 2023, the European Environment Agency (EEA) highlighted that consistent soil health monitoring is essential to evaluate progress under EU environmental and agricultural policies, reinforcing investment in soil MRV infrastructure.

- In December 2023, the Global Soil Partnership (FAO-led) reported that reliable soil data is critical for national reporting on soil organic carbon, erosion, and nutrient balance, supporting broader adoption of soil monitoring technologies.

Asia-Pacific Soil Health Market Dynamics

Driver

Rising Adoption Of Regenerative Agriculture And Sustainable Farming Practices

- The global Asia-Pacific Soil Health Market is being driven by the accelerating transition toward regenerative and sustainable farming systems that prioritize long-term soil productivity, ecosystem resilience, and climate adaptation. Governments and international institutions increasingly recognize that conventional input-intensive agriculture has led to soil organic matter depletion, erosion, and declining nutrient efficiency. Regenerative practices such as cover cropping, reduced tillage, organic amendments, and crop diversification are therefore being promoted to restore soil structure, microbial activity, and carbon content. This paradigm shift positions soil health management as a foundational requirement for sustainable agricultural output, directly driving demand for soil assessment, amendment products, and advisory services.

- In March 2021, the Food and Agriculture Organization (FAO) reported that approximately one-third of the world’s soils are degraded, largely due to erosion, nutrient loss, and organic carbon decline. The agency emphasized regenerative land management as a core solution, accelerating national soil restoration programs under the Global Soil Partnership.

- In November 2022, FAO and UNEP jointly highlighted that regenerative agriculture practices can simultaneously improve soil fertility, enhance biodiversity, and strengthen climate resilience. The report noted that countries integrating soil restoration into agricultural policy frameworks are seeing improved yield stability under climate stress.

Restraint/Challenge

High Cost And Limited Access To Comprehensive Soil Testing And Monitoring Infrastructure

- The global Asia-Pacific Soil Health Market faces restraint from the high cost and uneven accessibility of comprehensive soil testing, laboratory analysis, and monitoring infrastructure, particularly in developing and agrarian economies. While soil diagnostics are essential for informed soil management, many farmers lack affordable access to accredited laboratories, digital tools, and extension services. In low-income and smallholder-dominated regions, soil testing services are often centralized, underfunded, or absent, resulting in delayed adoption of soil health practices. This cost and infrastructure gap restricts the scalability of soil health solutions despite growing awareness of soil degradation.

- In April 2021, the Food and Agriculture Organization (FAO) reported that many low- and middle-income countries lack adequate soil laboratories and trained personnel, limiting farmers’ ability to assess soil fertility and implement site-specific soil health interventions.

- In September 2022, the World Bank highlighted that insufficient soil diagnostic infrastructure remains a key bottleneck in Sub-Saharan Africa, where the majority of farmers rely on blanket fertilizer recommendations due to the absence of affordable soil testing services.

Asia-Pacific Soil Health Market Scope

The global Asia-Pacific Soil Health Market is segmented into six segments based on type, soil type, technology, application, end-user, distribution channel.

• By Type

On the basis of type, the market is segmented into Soil Enhancement Products and Testing & Monitoring Products. In 2026, the Soil Enhancement Products segment is expected to dominate the market with a market share of 88.98% It is anticipated to show the fastest growth during the forecast period. The Soil Enhancement Products segment is driven by increasing soil degradation, declining organic matter, and the need to improve long-term soil fertility. Rising adoption of biofertilizers, soil conditioners, organic amendments, and microbial solutions supports sustainable yield improvement while reducing dependence on chemical fertilizers. Government initiatives promoting regenerative agriculture and carbon farming further accelerate demand. These products enhance nutrient availability, soil structure, water retention, and microbial activity, making them essential inputs across intensive and climate-resilient farming systems.

• By Soil Type

On the basis of Soil type, the market is segmented into Alluvial Soils, Red Soils, Loams, Black Soils, Arid Soils, Sandy Soils, Silt Soils, Clay Soils, Yellow Soils, Laterite Soils, Saline/Alkaline Soils, Peat Soils, Chalky Soils, Others. In 2026, the Alluvial Soils segment is expected to dominate the market with a market share of 16.25%. Demand for soil health solutions in alluvial soils is driven by their widespread use in high-intensity agricultural regions and susceptibility to nutrient depletion due to continuous cropping. Although naturally fertile, intensive cultivation leads to declining organic carbon and micronutrient imbalance. Farmers increasingly adopt soil enhancers, organic inputs, and precision nutrient management to maintain productivity. Expanding cereal, rice, and vegetable cultivation in river-basin regions further supports sustained demand for soil health products in alluvial soils.

The Sandy Soils It is anticipated to show the fastest growth during the forecast period. Sandy soils in Australia, Southeast Asia, and coastal Asia-Pacific, creating demand for soil health solutions. Low water retention and nutrient leaching in sandy soils drive the use of soil conditioners, organic amendments, and microbial products to improve structure, moisture retention, and crop productivity.

• By Technology

On the basis of Technology, the market is segmented into Conventional Soil Management, Integrated Soil Fertility Management (ISFM), Precision Soil Health Management, Regenerative Agriculture Practices, Others. In 2026, the Conventional Soil Management segment is expected to dominate the market with a market share of 31.44%. Conventional soil management remains dominant due to established farming practices, existing input supply chains, and farmer familiarity with chemical fertilizers. However, rising input costs, declining soil fertility, and yield stagnation are driving integration of soil health products within conventional systems. Farmers are increasingly combining traditional fertilizers with soil conditioners and biological inputs to improve nutrient efficiency. This hybrid approach supports gradual transition toward sustainable practices while maintaining yield stability and operational reliability.

The Regenerative Agriculture Practices It is anticipated to show the fastest growth during the forecast period. The adoption of regenerative agriculture practices such as cover cropping, reduced tillage, and organic amendments is driving soil health inputs in Asia-Pacific. These practices enhance soil organic matter, microbial activity, and carbon sequestration, aligning with climate-resilient farming goals and increasing long-term farm profitability.

• By Application

On the basis of Application, the market is segmented into Crop Soil and Non-Crop Soil. In 2026, the Crop Soil segment is expected to dominate the market with a market share of 70.57% and it is anticipated to show the fastest growth during the forecast period. The Crop Soil segment is driven by increasing pressure to maximize yields from limited arable land and improve crop resilience under climate variability. Soil health solutions tailored for crop-specific nutrient requirements enhance root development, nutrient uptake, and stress tolerance. Expansion of high-value crops, cereals, and horticulture increases demand for customized soil improvement solutions. Additionally, growing adoption of precision agriculture encourages targeted soil health interventions to improve productivity and reduce input wastage across crop cycles.

• By End-User

On the basis of End-User, the market is segmented into Farmers & Growers, Agribusiness Companies, Landscaping & Forestry Companies, Government & Regulatory Bodies, Research Institutes, Universities, Others. In 2026, the Farmers & Growers segment is expected to dominate the market with a market share of 53.11%. Farmers and growers represent the largest end-user group, driven by the need to improve soil productivity, reduce fertilizer dependency, and stabilize yields. Increasing awareness of soil degradation, water stress, and long-term land sustainability encourages adoption of soil health products. Support from government subsidies, extension programs, and agribusiness partnerships further accelerates uptake. Farmers benefit through improved soil structure, higher nutrient efficiency, better crop quality, and enhanced resilience against climatic and environmental stresses.

The Agribusiness Companies It is anticipated to show the fastest growth during the forecast period. Agribusiness companies are driving soil health adoption by integrating biologicals, precision nutrients, and digital soil diagnostics into crop programs. Firms such as BASF and Syngenta are investing in sustainable soil solutions to support yield stability, regulatory compliance, and environmental stewardship.

• By Distribution Channel

On the basis of Distribution Channel, the market is segmented into Direct Sales and Aftermarket. In 2026, the Direct Sales segment is expected to dominate the market with a market share of 69.86% and it is anticipated to shaw the fastest growth during the forecast period. The Direct Sales channel is driven by growing demand for technical guidance, customized soil solutions, and assured product quality. Direct engagement enables manufacturers to provide soil testing, advisory services, and tailored product recommendations, enhancing farmer confidence and adoption rates. This channel is particularly effective for biologicals and specialty soil enhancers that require application knowledge. Increasing penetration of agri-input companies in rural regions and expansion of on-ground sales networks further support growth of direct sales.

Asia-Pacific Soil Health Market Regional Analysis

- China dominates the Asia-Pacific Soil Health Market with the largest revenue share of 26.54% in 2026, China’s Asia-Pacific Soil Health Market growth is driven by widespread soil degradation, declining organic matter, and government-led soil restoration initiatives.

- Strong policy focus on sustainable agriculture, reduced chemical fertilizer use, and soil pollution control accelerates adoption of soil enhancers and biological inputs. Large-scale commercial farming, rising food security concerns, and increased investment in precision agriculture and soil testing technologies further support sustained demand across major crop-producing regions.

India Asia-Pacific Soil Health Market Insight

The India Asia-Pacific Soil Health Market is anticipated to show the fastest growth during the forecast period, India’s Asia-Pacific Soil Health Market is driven by declining soil fertility, nutrient imbalance, and increasing pressure to improve agricultural productivity. Government programs promoting soil testing, organic inputs, and balanced fertilizer use support market expansion. High dependence on agriculture, expansion of cash crops, and rising awareness among farmers about soil sustainability boost adoption. Additionally, climate variability and water stress encourage use of soil conditioners and bio-based solutions to enhance resilience and yields.

Japan Asia-Pacific Soil Health Market Insight

The Japan Asia-Pacific Soil Health Market is witnessing robust growth, supported by expanding crop production, rising adoption of soil conditioning and bio-stimulant products, and increasing use of advanced soil management solutions in high-value agriculture. Government programs promoting sustainable farming, soil fertility improvement, and industrial-scale soil enhancement continue to enhance market momentum.

Asia-Pacific Soil Health Market Share

The Asia-Pacific Soil Health Market is primarily led by well-established companies, including:

- BASF (Germany)

- Bayer AG (Germany)

- Corteva (U.S.)

- Mosaic India (India)

- UPL (India)

- FMC Corporation (U.S.)

- Syngenta Crop Protection AG (Switzerland)

- EarthOptics (U.S.)

- Miraterra Technologies Corporation (U.S.)

- Soil Scout Oy (Finland)

- Stevens Water Monitoring Systems Inc. (U.S.)

- METER (U.S.)

- Campbell Scientific, Inc. (U.S.)

- Sentek Technologies (Australia)

- Tecsoil, Inc. (U.S., estimate; verify)

- Nutrien Ag Solutions, Inc. (Canada)

- ICL (Israel)

- CropX Inc. (Israel)

- AgroCares (Netherlands)

- Soilwiz Ltd (UK/Europe)

- Growindigo / Indigo Ag (U.S.)

- Langley Fertilizers (U.K.)

- Humintech (Germany)

- Coromandel International Ltd. (India)

- Evonik (Germany)

- ADM (Archer Daniels Midland Company) (U.S.)

- HUMA GRO (U.S.)

- The Scotts Company LLC (U.S.)

Latest Developments in Asia-Pacific Soil Health Market

- In April 2025, Corteva published its Impact & Sustainability Report, outlining progress in soil health initiatives such as regenerative agriculture adoption, soil carbon improvement, and biological product expansion. The report reinforces Corteva’s long-term commitment to improving soil resilience and farm sustainability.

- In September 2024, Bayer launched a ForwardFarm in India demonstrating regenerative agriculture techniques to improve soil health, resilience, and sustainability for smallholder farmers through innovative practices and stakeholder collaboration.

- In March 2025, Bayer Crop Science teamed with UK agritech Elaniti to explore soil-microbiome insights and use ML/AI to help farmers optimise soil biology for better crop performance and regenerative practices.

- In December 2025, BASF partnered with ADAMA Ltd. to co-develop and commercialize breakthrough fungicide technology. While the primary focus is disease management, stronger crop protection can indirectly support soil health by reducing crop stress and improving plant vigor.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS – MODERATE

4.1.1.1 Capital Requirement – Moderate

4.1.1.2 Product Knowledge – Moderate to High

4.1.1.3 Technical Knowledge – High

4.1.1.4 Customer Relationship – High

4.1.1.5 Access to Application and Technology – Moderate

4.1.2 THREAT OF SUBSTITUTES – MODERATE

4.1.2.1 Cost – High

4.1.2.2 Performance – Moderate

4.1.2.3 Availability – High

4.1.2.4 Technical Knowledge – Low to Moderate

4.1.2.5 Durability – Low

4.1.3 BARGAINING POWER OF BUYERS – MODERATE TO HIGH

4.1.3.1 Number of Buyers Relative to Suppliers – High

4.1.3.2 Product Differentiation – Moderate

4.1.3.3 Threat of Forward Integration – Low

4.1.3.4 Buyer Volume – High

4.1.4 BARGAINING POWER OF SUPPLIERS – MODERATE

4.1.4.1 Supplier Concentration – Moderate to High

4.1.4.2 Buyer Switching Cost to Other Suppliers – Moderate

4.1.4.3 Threat of Backward Integration – Low to Moderate

4.1.5 COMPETITIVE RIVALRY WITHIN THE INDUSTRY – HIGH

4.1.5.1 Industry Concentration – Moderate

4.1.5.2 Industry Growth Rate – High

4.1.5.3 Product Differentiation – Moderate

4.1.6 STRATEGIC SUMMARY

4.2 BRAND OUTLOOK

4.3 CONSUMER BUYING BEHAVIOUR

4.3.1 GROUP 1: LARGE COMMERCIAL & CORPORATE FARMING OPERATIONS

4.3.2 GROUP 2: PROGRESSIVE MEDIUM-TO-LARGE FARMERS AND AGRIBUSINESS CLIENTS

4.3.3 GROUP 3: COST-CONSCIOUS COMMERCIAL FARMERS

4.3.4 GROUP 4: SMALLHOLDER AND TRADITIONAL FARMERS

4.3.5 GROUP 5: INPUT-DEPENDENT AND SUBSIDY-ORIENTED BUYERS

4.3.6 GROUP 6: SPECIALIZED, HIGH-VALUE CROP GROWERS AND INNOVATORS

4.3.7 STRATEGIC INSIGHT

4.4 COMPANY PRODUCTION CAPACITY ANALYSIS

4.5 PRICING ANALYSIS

4.5.1 PRICES OF NITROGEN-FIXING BACTERIA

4.5.2 PHOSPHATE-SOLUBILIZING MICROORGANISMS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.2 LOGISTIC COST SCENARIO

4.6.2.1 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 VALUE CHAIN ANALYSIS – ASIA-PACIFIC SOIL HEALTH MARKET

4.7.1 RAW MATERIAL SOURCING & INPUT GENERATION

4.7.2 PROCESSING & FORMULATION

4.7.3 QUALITY CONTROL, CERTIFICATION & REGULATORY COMPLIANCE

4.7.4 DISTRIBUTION & SUPPLY CHAIN LOGISTICS

4.7.5 APPLICATION, TESTING & MONITORING (END USE)

4.7.6 FEEDBACK LOOP & VALUE REINFORCEMENT

4.7.7 VALUE CHAIN INSIGHT

4.8 SUPPLY CHAIN ANALYSIS – ASIA-PACIFIC SOIL HEALTH MARKET

4.8.1 CORE SUPPLY-CHAIN STAGES (FLOW + KEY ACTORS)

4.8.1.1 Raw-material sourcing

4.8.1.2 Processing & formulation

4.8.1.3 Quality control & compliance

4.8.1.4 Distribution & logistics

4.8.1.5 Retail & advisory

4.8.1.6 End use & monitoring

4.8.2 KEY CONSTRAINTS & BOTTLENECKS

4.8.2.1 Logistics & last-mile delivery

4.8.2.2 Cold-chain & shelf-life for biologicals

4.8.2.3 Raw-material seasonality & feedstock quality —

4.8.2.4 Regulatory fragmentation

4.8.2.5 Concentration & geopolitical exposure in mineral supply

4.8.3 OPERATIONAL & COMMERCIAL RISKS

4.8.4 ENABLERS

4.8.4.1 Public programmes & procurement

4.8.4.2 Digital platforms & logistics aggregation

4.8.4.3 Circular-economy feedstock integration

4.8.4.4 Harmonized standards & MRV

4.8.5 STRATEGIC OPPORTUNITIES

4.8.6 PRACTICAL RECOMMENDATIONS (FOR SUPPLIERS, INVESTORS, POLICY MAKERS)

4.9 RAW MATERIAL COVERAGE

4.9.1 ORGANIC AND BIOMASS-DERIVED RAW MATERIALS

4.9.1.1 Livestock Manure: Reactive Organic–Mineral Complexes

4.9.2 CROP RESIDUES AND GREEN BIOMASS

4.9.3 COMPOST FEEDSTOCKS AND STABILIZED ORGANIC MATTER

4.9.4 THERMOCHEMICAL CARBON MATERIALS

4.9.5 MINERAL AND GEOLOGICAL RAW MATERIALS

4.9.6 GYPSUM AND SULFUR MINERALS

4.9.7 PHOSPHATE ROCK AND SILICATE MINERALS

4.9.8 HUMIC SUBSTANCES AND CARBON EXTRACTS

4.9.8.1 Leonardite, Lignite, and Peat Resources

4.9.9 MICROBIAL AND BIOLOGICAL RAW MATERIALS

4.9.9.1 Microbial Biomass and Fermentation Inputs

4.9.10 CARRIER AND STABILIZATION MATERIALS

4.9.11 MARINE AND AQUATIC BIOMASS RESOURCES

4.9.11.1 Seaweed and Algal Feedstocks

4.9.12 RAW MATERIALS FOR SOIL TESTING AND DIGITAL MONITORING

4.9.12.1 Chemical and Biological Analytical Inputs

4.9.13 ELECTRONIC AND SENSOR MATERIALS

4.9.14 STRATEGIC IMPLICATIONS AND CONCLUSION

4.1 TECHNOLOGICAL ADVANCEMENTS

4.10.1 TECHNOLOGICAL ADVANCEMENTS IN RAW MATERIAL SOURCING AND CHARACTERIZATION

4.10.2 MANUFACTURING-CENTRIC TECHNOLOGICAL ADVANCEMENTS

4.10.3 MATERIAL ENGINEERING IN ORGANIC–MINERAL AND CARBON-BASED INPUTS

4.10.4 EXTRACTION AND REFINEMENT OF HUMIC SUBSTANCES

4.10.5 QUALITY CONTROL, AUTOMATION, AND DIGITAL MANUFACTURING INTEGRATION

4.10.6 PACKAGING, STABILITY, AND LOGISTICS TECHNOLOGIES

4.10.7 SMART LOGISTICS AND TRACEABILITY SYSTEMS

4.10.8 CUSTOMER DELIVERY, PRECISION APPLICATION, AND FEEDBACK LOOPS

4.10.9 DATA-ENABLED ADVISORY AND CONTINUOUS IMPROVEMENT

4.10.10 STRATEGIC IMPLICATIONS AND CONCLUSION

4.11 VENDOR SELECTION CRITERIA

4.11.1 RAW MATERIAL GOVERNANCE AS THE FIRST FILTER OF VENDOR CREDIBILITY

4.11.2 MANUFACTURING DEPTH AND PROCESS ENGINEERING CAPABILITY

4.11.3 SCIENTIFIC VALIDATION AS A MEASURE OF TECHNICAL INTEGRITY

4.11.4 REGULATORY READINESS AND STEWARDSHIP DISCIPLINE

4.11.5 SUPPLY CHAIN RESILIENCE AND SCALABILITY

4.11.6 DIGITAL CAPABILITY, DATA INTEGRITY, AND VALUE EXPANSION

4.11.7 FINANCIAL STRENGTH, UNIT ECONOMICS, AND CAPITAL EFFICIENCY

4.11.8 STRATEGIC ALIGNMENT AND LONG-TERM PARTNERSHIP VALUE

4.11.9 CONCLUSION: VENDOR SELECTION AS A LONG-TERM VALUE SAFEGUARD

5 TARIFFS & IMPACT ON THE MARKET

5.1 CURRENT TARIFF RATE (S) IN TOP-5 COUNTRY MARKETS

5.1.1 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

5.1.2 VENDOR SELECTION CRITERIA DYNAMICS

5.1.3 IMPACT ON SUPPLY CHAIN

5.1.3.1 RAW MATERIAL PROCUREMENT

5.1.3.2 MANUFACTURING AND PRODUCTION

5.1.3.3 LOGISTICS AND DISTRIBUTION

5.1.3.4 PRICE PITCHING AND MARKET POSITIONING

5.1.4 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

5.1.4.1 SUPPLY CHAIN OPTIMIZATION

5.1.4.2 JOINT VENTURE ESTABLISHMENTS

5.1.5 MPACT ON PRICES

5.1.6 REGULATORY INCLINATION

5.1.7 GEOPOLITICAL SITUATION

5.1.8 TRADE PARTNERSHIPS BETWEEN COUNTRIES

5.1.8.1 FREE TRADE AGREEMENTS

5.1.9 ALLIANCES ESTABLISHMENTS

5.1.9.1 STATUS ACCREDITATION (INCLUDING MFTN)

5.1.9.2 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

5.1.9.3 SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

6 REGULATION COVERAGE

6.1 REGULATORY FRAMEWORK COVERAGE – MACRO & MICRO ANALYSIS

6.1.1 PRODUCT CODES – CLASSIFICATION LOGIC & COMPLIANCE CONSEQUENCES

6.1.2 CERTIFIED STANDARDS – MARKET ACCESS & QUALITY CONTROL

6.1.3 SAFETY STANDARDS – OPERATIONAL RISK MANAGEMENT

6.1.3.1 MATERIAL HANDLING & STORAGE – DETAILED ANALYSIS

6.1.3.2 TRANSPORT & PRECAUTIONS – REGULATORY DEPTH

6.1.3.3 HAZARD IDENTIFICATION – RISK DISCLOSURE & LIABILITY

6.1.4 REGULATORY ENFORCEMENT & MONITORING

6.1.5 REGULATORY IMPACT ON COST STRUCTURE

6.1.6 REGULATORY TRENDS & FUTURE OUTLOOK

6.1.7 STRATEGIC IMPLICATIONS FOR MARKET PARTICIPANTS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING ADOPTION OF REGENERATIVE AGRICULTURE AND SUSTAINABLE FARMING PRACTICES

7.1.2 INCREASING DEPLOYMENT OF PRECISION SOIL MONITORING AND DIGITAL AGRICULTURE TECHNOLOGIES

7.1.3 GOVERNMENT POLICIES AND CONSUMER DEMAND SUPPORTING SUSTAINABLE FOOD SYSTEMS

7.2 RESTRAINTS

7.2.1 HIGH COST AND LIMITED ACCESS TO COMPREHENSIVE SOIL TESTING AND MONITORING INFRASTRUCTURE

7.2.2 LIMITED FARMER AWARENESS AND TECHNICAL CAPACITY TO INTERPRET SOIL HEALTH DATA

7.3 OPPORTUNITIES

7.3.1 EMERGENCE OF SOIL CARBON AND CLIMATE FINANCE PROGRAMS CREATING NEW REVENUE STREAMS

7.3.2 GROWING NEED FOR MONITORING, REPORTING, AND VERIFICATION (MRV) SYSTEMS FOR SOIL HEALTH

7.3.3 EXPANSION OF BIO-BASED AND NATURE-BASED SOIL AMENDMENTS

7.4 CHALLENGES

7.4.1 LACK OF STANDARDIZATION AND REGULATORY CONSENSUS IN SOIL HEALTH AND SOIL CARBON MEASUREMENT

7.4.2 SCIENTIFIC VARIABILITY AND INCONSISTENT FIELD PERFORMANCE OF BIOLOGICAL SOIL SOLUTIONS

8 ASIA-PACIFIC SOIL HEALTH MARKET, BY TYPE

8.1 OVERVIEW

8.2 SOIL ENHANCEMENT PRODUCTS

8.3 TESTING & MONITORING PRODUCTS

8.4 ASIA-PACIFIC SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.4.1 SOIL AMENDMENTS

8.4.2 SOIL FERTILITY ENHANCERS

8.4.3 BIOLOGICALS / MICROBIAL SOLUTIONS

8.4.4 SOIL CONDITIONERS

8.4.5 PEAT

8.4.6 OTHERS

8.5 ASIA-PACIFIC SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

8.6 ASIA-PACIFIC SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 ORGANIC AMENDMENTS

8.6.2 INORGANIC AMENDMENTS

8.7 ASIA-PACIFIC ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.7.1 MANURE

8.7.2 COMPOST

8.7.3 GREEN MANURE

8.7.4 BIOCHAR

8.7.5 OTHERS

8.8 ASIA-PACIFIC INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 LIME

8.8.2 GYPSUM

8.8.3 MINERAL ADDITIVES

8.8.4 OTHERS

8.9 ASIA-PACIFIC SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.9.1 BIOFERTILIZERS

8.9.2 ORGANIC-MINERAL FERTILIZERS

8.1 ASIA-PACIFIC BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.10.1 NITROGEN-FIXING BACTERIA

8.10.2 PHOSPHATE-SOLUBILIZING MICROORGANISMS

8.10.3 POTASH-MOBILIZING MICROORGANISMS

8.11 ASIA-PACIFIC ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.11.1 NPK-ENRICHED ORGANIC FERTILIZERS

8.11.2 COMPOST-BASED MINERAL FORTIFIED PRODUCTS

8.11.3 HUMIC ACID AND NPK BLENDS

8.12 ASIA-PACIFIC NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.12.1 COMPOST + NPK BLENDS

8.12.2 BIO-ORGANIC NPK GRANULES / PELLETS

8.12.3 LIQUID ORGANIC + NPK FORMULATIONS

8.12.4 SLOW-RELEASE / CONTROLLED RELEASE ORGANIC-MINERAL NPKS

8.12.5 SPECIALTY / CROP-SPECIFIC ENRICHED ORGANIC NPKS

8.13 ASIA-PACIFIC COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.13.1 BIO-COMPOST + MINERAL BLENDS

8.13.2 GRANULATED COMPOST-BASED FERTILIZERS

8.13.3 VERMICOMPOST FORTIFIED WITH MINERALS

8.13.4 CO-COMPOSTED MINERAL + WASTE BLENDS

8.13.5 LIQUID COMPOST EXTRACTS FORTIFIED WITH NUTRIENTS

8.14 ASIA-PACIFIC HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.14.1 HUMIC + NPK SOLID BLENDS

8.14.2 LIQUID HUMIC + NPK FORMULATIONS

8.14.3 POTASSIUM HUMATE ENRICHED BLENDS

8.14.4 HIGH HUMIC FRACTION BLENDS

8.14.5 HUMIC + FULVIC + MINERAL BLENDS

8.15 ASIA-PACIFIC BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.15.1 TRICHODERMA

8.15.2 BACILLUS SPECIES

8.15.3 MYCORRHIZAL FUNGI

8.15.4 RHIZOBIA

8.15.5 OTHERS

8.16 ASIA-PACIFIC SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.16.1 HUMIC ACID

8.16.2 SEAWEED EXTRACTS

8.16.3 FULVIC ACID

8.16.4 POTASSIUM HUMATE ENRICHED BLENDS

8.16.5 HUMIC + FULVIC + MINERAL BLENDS

8.16.6 HIGH HUMIC FRACTION BLENDS

8.16.7 LIQUID HUMIC + NPK FORMULATIONS

8.17 ASIA-PACIFIC SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.17.1 ASIA-PACIFIC

8.17.2 NORTH AMERICA

8.17.3 EUROPE

8.17.4 SOUTH AMERICA

8.17.5 MIDDLE EAST & AFRICA

8.18 ASIA-PACIFIC SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (TONS)

8.19 ASIA-PACIFIC TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.19.1 SOIL TESTING KITS

8.19.2 LABORATORY ANALYTICAL SOLUTIONS (BIOLOGICAL ANALYSIS)

8.19.3 DIGITAL AND REMOTE MONITORING

8.2 ASIA-PACIFIC TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

8.21 ASIA-PACIFIC SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.21.1 PH KITS

8.21.2 NUTRIENT TEST KITS

8.22 ASIA-PACIFIC DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.22.1 IOT SENSORS

8.22.2 REMOTE SENSING & DRONES

8.22.3 GIS & MAPPING TOOLS

8.23 ASIA-PACIFIC TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

8.23.1 ASIA-PACIFIC

8.23.2 NORTH AMERICA

8.23.3 EUROPE

8.23.4 SOUTH AMERICA

8.23.5 MIDDLE EAST & AFRICA

8.24 ASIA-PACIFIC TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

9 ASIA-PACIFIC SOIL HEALTH MARKET, BY SOIL TYPE

9.1 OVERVIEW

9.2 ALLUVIAL SOILS

9.3 RED SOILS

9.4 LOAMS

9.5 BLACK SOILS

9.6 ARID SOILS

9.7 SANDY SOILS

9.8 SILT SOILS

9.9 CLAY SOILS

9.1 YELLOW SOILS

9.11 LATERITE SOILS

9.12 SALINE/ALKALINE SOILS

9.13 PEAT SOILS

9.14 CHALKY SOILS

9.15 OTHERS

9.16 ASIA-PACIFIC ALLUVIAL SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.16.1 ASIA-PACIFIC

9.16.2 NORTH AMERICA

9.16.3 EUROPE

9.16.4 SOUTH AMERICA

9.16.5 MIDDLE EAST & AFRICA

9.17 ASIA-PACIFIC RED SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.17.1 ASIA-PACIFIC

9.17.2 NORTH AMERICA

9.17.3 EUROPE

9.17.4 SOUTH AMERICA

9.17.5 MIDDLE EAST & AFRICA

9.18 ASIA-PACIFIC LOAMS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.18.1 ASIA-PACIFIC

9.18.2 NORTH AMERICA

9.18.3 EUROPE

9.18.4 SOUTH AMERICA

9.18.5 MIDDLE EAST & AFRICA

9.19 ASIA-PACIFIC BLACK SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.19.1 ASIA-PACIFIC

9.19.2 NORTH AMERICA

9.19.3 EUROPE

9.19.4 SOUTH AMERICA

9.19.5 MIDDLE EAST & AFRICA

9.2 ASIA-PACIFIC ARID SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.20.1 ASIA-PACIFIC

9.20.2 NORTH AMERICA

9.20.3 EUROPE

9.20.4 SOUTH AMERICA

9.20.5 MIDDLE EAST & AFRICA

9.21 ASIA-PACIFIC SANDY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.21.1 ASIA-PACIFIC

9.21.2 NORTH AMERICA

9.21.3 EUROPE

9.21.4 SOUTH AMERICA

9.21.5 MIDDLE EAST & AFRICA

9.22 ASIA-PACIFIC SILT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.22.1 ASIA-PACIFIC

9.22.2 NORTH AMERICA

9.22.3 EUROPE

9.22.4 SOUTH AMERICA

9.22.5 MIDDLE EAST & AFRICA

9.23 ASIA-PACIFIC CLAY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.23.1 ASIA-PACIFIC

9.23.2 NORTH AMERICA

9.23.3 EUROPE

9.23.4 SOUTH AMERICA

9.23.5 MIDDLE EAST & AFRICA

9.24 ASIA-PACIFIC YELLOW SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.24.1 ASIA-PACIFIC

9.24.2 NORTH AMERICA

9.24.3 EUROPE

9.24.4 SOUTH AMERICA

9.24.5 MIDDLE EAST & AFRICA

9.25 ASIA-PACIFIC LATERITE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.25.1 ASIA-PACIFIC

9.25.2 NORTH AMERICA

9.25.3 EUROPE

9.25.4 SOUTH AMERICA

9.25.5 MIDDLE EAST & AFRICA

9.26 ASIA-PACIFIC SALINE/ALKALINE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.26.1 ASIA-PACIFIC

9.26.2 NORTH AMERICA

9.26.3 EUROPE

9.26.4 SOUTH AMERICA

9.26.5 MIDDLE EAST & AFRICA

9.27 ASIA-PACIFIC PEAT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.27.1 ASIA-PACIFIC

9.27.2 NORTH AMERICA

9.27.3 EUROPE

9.27.4 SOUTH AMERICA

9.27.5 MIDDLE EAST & AFRICA

9.28 ASIA-PACIFIC CHALKY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.28.1 ASIA-PACIFIC

9.28.2 NORTH AMERICA

9.28.3 EUROPE

9.28.4 SOUTH AMERICA

9.28.5 MIDDLE EAST & AFRICA

9.29 ASIA-PACIFIC OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

9.29.1 ASIA-PACIFIC

9.29.2 NORTH AMERICA

9.29.3 EUROPE

9.29.4 SOUTH AMERICA

9.29.5 MIDDLE EAST & AFRICA

10 ASIA-PACIFIC SOIL HEALTH MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 CONVENTIONAL SOIL MANAGEMENT

10.3 INTEGRATED SOIL FERTILITY MANAGEMENT (ISFM)

10.4 PRECISION SOIL HEALTH MANAGEMENT

10.5 REGENERATIVE AGRICULTURE PRACTICES

10.6 OTHERS

10.7 ASIA-PACIFIC CONVENTIONAL SOIL MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.7.1 ASIA-PACIFIC

10.7.2 NORTH AMERICA

10.7.3 EUROPE

10.7.4 SOUTH AMERICA

10.7.5 MIDDLE EAST & AFRICA

10.8 ASIA-PACIFIC INTEGRATED SOIL FERTILITY MANAGEMENT (ISFM) IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.8.1 ASIA-PACIFIC

10.8.2 NORTH AMERICA

10.8.3 EUROPE

10.8.4 SOUTH AMERICA

10.8.5 MIDDLE EAST & AFRICA

10.9 ASIA-PACIFIC PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

10.9.1 REMOTE SENSING & DRONES

10.9.2 VARIABLE RATE TECHNOLOGY (VRT)

10.9.3 GPS & GIS MAPPING

10.1 ASIA-PACIFIC PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.10.1 ASIA-PACIFIC

10.10.2 NORTH AMERICA

10.10.3 EUROPE

10.10.4 SOUTH AMERICA

10.10.5 MIDDLE EAST & AFRICA

10.11 ASIA-PACIFIC REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

10.11.1 GPS & GIS MAPPING

10.11.2 VARIABLE RATE TECHNOLOGY (VRT)

10.11.3 REMOTE SENSING & DRONES

10.12 ASIA-PACIFIC PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.12.1 ASIA-PACIFIC

10.12.2 NORTH AMERICA

10.12.3 EUROPE

10.12.4 SOUTH AMERICA

10.12.5 MIDDLE EAST & AFRICA

10.13 ASIA-PACIFIC OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

10.13.1 ASIA-PACIFIC

10.13.2 NORTH AMERICA

10.13.3 EUROPE

10.13.4 SOUTH AMERICA

10.13.5 MIDDLE EAST & AFRICA

11 ASIA-PACIFIC SOIL HEALTH MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CROP SOIL

11.3 NON-CROP SOIL

11.4 ASIA-PACIFIC CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

11.4.1 CEREALS & GRAINS

11.4.2 OILSEEDS & PULSES

11.4.3 FRUITS & VEGETABLES

11.4.4 COMMERCIAL CROPS

11.4.5 PLANTATION CROPS

11.4.6 OTHERS

11.5 ASIA-PACIFIC CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.5.1 CORN

11.5.2 WHEAT

11.5.3 RICE

11.5.4 BARLEY

11.5.5 OATS

11.5.6 OTHERS

11.6 ASIA-PACIFIC OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.6.1 SOYBEAN

11.6.2 RAPESEED/CANOLA

11.6.3 SUNFLOWER

11.6.4 CHICKPEAS

11.6.5 GROUNDNUT

11.6.6 LENTILS

11.6.7 OTHERS

11.7 ASIA-PACIFIC FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.7.1 FRUIT CROPS

11.7.2 ROOT CROPS

11.7.3 LEAFY GREENS

11.7.4 NIGHTSHADES

11.7.5 CUCURBITS

11.7.6 OTHERS

11.8 ASIA-PACIFIC COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.8.1 SUGARCANE

11.8.2 COTTON

11.8.3 COFFEE

11.8.4 COCOA

11.8.5 TEA

11.8.6 TOBACCO

11.8.7 OTHERS

11.9 ASIA-PACIFIC PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.9.1 PALM OIL

11.9.2 RUBBER

11.9.3 COCONUT

11.9.4 OTHERS

11.1 ASIA-PACIFIC CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.10.1 ASIA-PACIFIC

11.10.2 NORTH AMERICA

11.10.3 EUROPE

11.10.4 SOUTH AMERICA

11.10.5 MIDDLE EAST & AFRICA

11.11 ASIA-PACIFIC NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

11.11.1 TURF & LANDSCAPING

11.11.2 FORESTRY

11.11.3 SOIL RECLAMATION & RESTORATION

11.11.4 OTHERS

11.12 ASIA-PACIFIC NON-CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

11.12.1 ASIA-PACIFIC

11.12.2 NORTH AMERICA

11.12.3 EUROPE

11.12.4 SOUTH AMERICA

11.12.5 MIDDLE EAST & AFRICA

12 ASIA-PACIFIC SOIL HEALTH MARKET, BY END-USER

12.1 OVERVIEW

12.2 FARMERS & GROWERS

12.3 AGRIBUSINESS COMPANIES

12.4 LANDSCAPING & FORESTRY COMPANIES

12.5 GOVERNMENT & REGULATORY BODIES

12.6 RESEARCH INSTITUTES

12.7 UNIVERSITIES

12.8 OTHERS

12.9 ASIA-PACIFIC FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.9.1 SOIL AMENDMENTS

12.9.2 SOIL FERTILITY ENHANCERS

12.9.3 SOIL CONDITIONERS

12.9.4 BIOLOGICALS / MICROBIAL SOLUTIONS

12.9.5 TESTING & MONITORING PRODUCTS

12.9.6 PEAT

12.9.7 OTHERS

12.1 ASIA-PACIFIC FARMERS & GROWERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.10.1 ASIA-PACIFIC

12.10.2 NORTH AMERICA

12.10.3 EUROPE

12.10.4 SOUTH AMERICA

12.10.5 MIDDLE EAST & AFRICA

12.11 ASIA-PACIFIC AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.11.1 SOIL AMENDMENTS

12.11.2 SOIL FERTILITY ENHANCERS

12.11.3 BIOLOGICALS / MICROBIAL SOLUTIONS

12.11.4 SOIL CONDITIONERS

12.11.5 TESTING & MONITORING PRODUCTS

12.11.6 PEAT

12.11.7 OTHERS

12.12 ASIA-PACIFIC AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.12.1 ASIA-PACIFIC

12.12.2 NORTH AMERICA

12.12.3 EUROPE

12.12.4 SOUTH AMERICA

12.12.5 MIDDLE EAST & AFRICA

12.13 ASIA-PACIFIC LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.13.1 SOIL AMENDMENTS

12.13.2 SOIL CONDITIONERS

12.13.3 PEAT

12.13.4 BIOLOGICALS / MICROBIAL SOLUTIONS

12.13.5 SOIL FERTILITY ENHANCERS

12.13.6 TESTING & MONITORING PRODUCTS

12.13.7 OTHERS

12.14 ASIA-PACIFIC LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.14.1 ASIA-PACIFIC

12.14.2 NORTH AMERICA

12.14.3 EUROPE

12.14.4 SOUTH AMERICA

12.14.5 MIDDLE EAST & AFRICA

12.15 ASIA-PACIFIC GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.15.1 SOIL AMENDMENTS

12.15.2 TESTING & MONITORING PRODUCTS

12.15.3 SOIL CONDITIONERS

12.15.4 BIOLOGICALS / MICROBIAL SOLUTIONS

12.15.5 SOIL FERTILITY ENHANCERS

12.15.6 PEAT

12.15.7 OTHERS

12.16 ASIA-PACIFIC GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.16.1 ASIA-PACIFIC

12.16.2 NORTH AMERICA

12.16.3 EUROPE

12.16.4 SOUTH AMERICA

12.16.5 MIDDLE EAST & AFRICA

12.17 ASIA-PACIFIC RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.17.1 TESTING & MONITORING PRODUCTS

12.17.2 BIOLOGICALS / MICROBIAL SOLUTIONS

12.17.3 SOIL AMENDMENTS

12.17.4 SOIL FERTILITY ENHANCERS

12.17.5 SOIL CONDITIONERS

12.17.6 PEAT

12.17.7 OTHERS

12.18 ASIA-PACIFIC RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.18.1 ASIA-PACIFIC

12.18.2 NORTH AMERICA

12.18.3 EUROPE

12.18.4 SOUTH AMERICA

12.18.5 MIDDLE EAST & AFRICA

12.19 ASIA-PACIFIC UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.19.1 TESTING & MONITORING PRODUCTS

12.19.2 SOIL AMENDMENTS

12.19.3 BIOLOGICALS / MICROBIAL SOLUTIONS

12.19.4 SOIL FERTILITY ENHANCERS

12.19.5 SOIL CONDITIONERS

12.19.6 PEAT

12.19.7 OTHERS

12.2 ASIA-PACIFIC UNIVERSITIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.20.1 ASIA-PACIFIC

12.20.2 NORTH AMERICA

12.20.3 EUROPE

12.20.4 SOUTH AMERICA

12.20.5 MIDDLE EAST & AFRICA

12.21 ASIA-PACIFIC OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

12.21.1 TESTING & MONITORING PRODUCTS

12.21.2 BIOLOGICALS / MICROBIAL SOLUTIONS

12.21.3 SOIL AMENDMENTS

12.21.4 SOIL CONDITIONERS

12.21.5 SOIL FERTILITY ENHANCERS

12.21.6 PEAT

12.21.7 OTHERS

12.22 ASIA-PACIFIC OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

12.22.1 ASIA-PACIFIC

12.22.2 NORTH AMERICA

12.22.3 EUROPE

12.22.4 SOUTH AMERICA

12.22.5 MIDDLE EAST & AFRICA

13 ASIA-PACIFIC SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT SALES

13.3 AFTERMARKET

13.4 ASIA-PACIFIC DIRECT SALES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.4.1 ASIA-PACIFIC

13.4.2 NORTH AMERICA

13.4.3 EUROPE

13.4.4 SOUTH AMERICA

13.4.5 MIDDLE EAST & AFRICA

13.5 ASIA-PACIFIC AFTERMARKET IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

13.5.1 ASIA-PACIFIC

13.5.2 NORTH AMERICA

13.5.3 EUROPE

13.5.4 SOUTH AMERICA

13.5.5 MIDDLE EAST & AFRICA

14 ASIA-PACIFIC SOIL HEALTH MARKET, BY REGION

14.1 ASIA PACIFIC

14.1.1 CHINA

14.1.2 INDIA

14.1.3 JAPAN

14.1.4 AUSTRALIA

14.1.5 INDONESIA

14.1.6 VIETNAM

14.1.7 THAILAND

14.1.8 SOUTH KOREA

14.1.9 PHILIPPINES

14.1.10 MALAYSIA

14.1.11 TAIWAN

14.1.12 NEW ZEALAND

14.1.13 SINGAPORE

14.1.14 HONG KONG

14.1.15 REST OF ASIA-PACIFIC

15 ASIA-PACIFIC SOIL HEALTH MARKET: COMPANY LANDSCAPE

15.1 MANUFACTURER COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 MANUFACTURER COMPANY PROFILE

17.1 BASF

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 BAYER AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 CORTEVA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 SYNGENTA

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 NUTRIEN AG SOLUTIONS, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 ADM

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 AGROCARES

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 CAMPBELL SCIENTIFIC, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 COROMANDEL INTERNATIONAL LTD

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 CROPX INC

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 EARTHOPTICS.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 EVONIK

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 FMC CORPORATION

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 INDIGO AG, INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVEOPMENT

17.15 HUMA GRO

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 HUMINTECH

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 ICL

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 METER GROUP.

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 MIRATERRA TECHNOLOGIES CORPORATION

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 MOSAIC INDIA

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 PLANTBIOTIX

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 SENTEK TECHNOLOGIES.

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 SOIL SCOUT.

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 SOILWIZ LT

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 STEVENS WATER MONITORING SYSTEMS INC.

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENT

17.26 SUNPALM AUSTRALIA

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 TECSOIL, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 THE SCOTTS COMPANY LLC

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENT

17.29 UPL

17.29.1 COMPANY SNAPSHOT

17.29.2 REVENUE ANALYSIS

17.29.3 PRODUCT PORTFOLIO

17.29.4 RECENT DEVELOPMENT

17.3 UTKARSH AGROCHEM PVT LTD

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

18 DISTRIBUTOR COMPANY PROFILE

18.1 CALIFORNIA AG SOLUTIONS

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.2 ENLIGHTENED SOIL CORP

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCT PORTFOLIO

18.2.3 RECENT DEVELOPMENT

18.3 GETDISTRIBUTORS.COM

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENT

18.4 ORGANIC DISTRIBUTORS, INC.

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 RECENT DEVELOPMENT

18.5 SEACOLE

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 BRAND OUTLOOK BY PRODUCT CATEGORY

TABLE 2 CONSUMER PREFERENCES BY DECISION PARAMETER

TABLE 3 ESTIMATED OUTPUT

TABLE 4 EFFECTIVE TARIFF BURDEN (NOT JUST NOMINAL)

TABLE 5 PRODUCT-LEVEL IMPORT DEPENDENCY

TABLE 6 WEIGHTED DECISION MATRIX (INDICATIVE)

TABLE 7 MANUFACTURING ECONOMICS

TABLE 8 PRICE SEGMENTATION

TABLE 9 COST STACK CONTRIBUTION

TABLE 10 ASIA-PACIFIC SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 13 ASIA-PACIFIC SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (TONS)

TABLE 26 ASIA-PACIFIC TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 28 ASIA-PACIFIC SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (THOUSAND UNITS)

TABLE 32 ASIA-PACIFIC SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC ALLUVIAL SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC RED SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC LOAMS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC BLACK SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC ARID SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC SANDY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC SILT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC CLAY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC YELLOW SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC LATERITE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC SALINE/ALKALINE SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC PEAT SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC CHALKY SOILS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC CONVENTIONAL SOIL MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC INTEGRATED SOIL FERTILITY MANAGEMENT (ISFM) IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC NON-CROP SOIL IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC SOIL HEALTH MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC FARMERS & GROWERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC UNIVERSITIES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 78 ASIA-PACIFIC OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 79 ASIA-PACIFIC OTHERS IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 80 ASIA-PACIFIC SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 81 ASIA-PACIFIC DIRECT SALES IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 82 ASIA-PACIFIC AFTERMARKET IN SOIL HEALTH MARKET, BY REGION, 2018-2033 (USD THOUSAND)

TABLE 83 ASIA-PACIFIC SOIL HEALTH MARKET, 2018-2033 (USD THOUSAND)

TABLE 84 ASIA-PACIFIC SOIL HEALTH MARKET, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 85 ASIA-PACIFIC SOIL HEALTH MARKET FOR SOIL ENHANCEMENT PRODUCTS, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 86 ASIA-PACIFIC SOIL HEALTH MARKET FOR TESTING & MONITORING PRODUCTS, BY COUNTRY, 2018-2033 (USD THOUSAND)

TABLE 87 ASIA-PACIFIC SOIL HEALTH MARKET, BY COUNTRY, 2018-2033 (TONS)

TABLE 88 ASIA-PACIFIC SOIL HEALTH MARKET FOR TESTING & MONITORING PRODUCTS, BY COUNTRY, 2018-2033 (THOUSAND UNITS)

TABLE 89 ASIA-PACIFIC

TABLE 90 ASIA-PACIFIC SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 91 ASIA-PACIFIC SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 92 ASIA-PACIFIC SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 93 ASIA-PACIFIC SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 94 ASIA-PACIFIC ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 95 ASIA-PACIFIC INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 96 ASIA-PACIFIC SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 97 ASIA-PACIFIC BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 98 ASIA-PACIFIC ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 99 ASIA-PACIFIC NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 100 ASIA-PACIFIC COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 101 ASIA-PACIFIC HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 102 ASIA-PACIFIC BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 103 ASIA-PACIFIC SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 104 ASIA-PACIFIC TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 105 ASIA-PACIFIC TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 106 ASIA-PACIFIC SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 107 ASIA-PACIFIC DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 108 ASIA-PACIFIC SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 109 ASIA-PACIFIC SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 110 ASIA-PACIFIC PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 111 ASIA-PACIFIC REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 112 ASIA-PACIFIC SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 113 ASIA-PACIFIC CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 114 ASIA-PACIFIC CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 115 ASIA-PACIFIC OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 116 ASIA-PACIFIC FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 117 ASIA-PACIFIC COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 118 ASIA-PACIFIC PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 119 ASIA-PACIFIC NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 120 ASIA-PACIFIC SOIL HEALTH MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 121 ASIA-PACIFIC FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 122 ASIA-PACIFIC AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 123 ASIA-PACIFIC LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 124 ASIA-PACIFIC GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 125 ASIA-PACIFIC RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 126 ASIA-PACIFIC UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 127 ASIA-PACIFIC OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 128 ASIA-PACIFIC SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 129 CHINA SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 130 CHINA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 131 CHINA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 132 CHINA SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 133 CHINA ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 134 CHINA INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 135 CHINA SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 136 CHINA BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 137 CHINA ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 138 CHINA NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 139 CHINA COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 140 CHINA HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 141 CHINA BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 142 CHINA SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 143 CHINA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 144 CHINA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 145 CHINA SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 146 CHINA DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 147 CHINA SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 148 CHINA SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 149 CHINA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 150 CHINA REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 151 CHINA SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 152 CHINA CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 153 CHINA CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 154 CHINA OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 155 CHINA FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 156 CHINA COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 157 CHINA PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 158 CHINA NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 159 CHINA SOIL HEALTH MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 160 CHINA FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 161 CHINA AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 162 CHINA LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 163 CHINA GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 164 CHINA RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 165 CHINA UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 166 CHINA OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 167 CHINA SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 168 INDIA SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 169 INDIA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 170 INDIA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 171 INDIA SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 172 INDIA ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 173 INDIA INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 174 INDIA SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 175 INDIA BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 176 INDIA ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 177 INDIA NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 178 INDIA COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 179 INDIA HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 180 INDIA BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 181 INDIA SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 182 INDIA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 183 INDIA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 184 INDIA SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 185 INDIA DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 186 INDIA SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 187 INDIA SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 188 INDIA PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 189 INDIA REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 190 INDIA SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 191 INDIA CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 192 INDIA CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 193 INDIA OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 194 INDIA FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 195 INDIA COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 196 INDIA PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 197 INDIA NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 198 INDIA SOIL HEALTH MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 199 INDIA FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 200 INDIA AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 201 INDIA LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 202 INDIA GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 203 INDIA RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 204 INDIA UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 205 INDIA OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 206 INDIA SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 207 JAPAN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 208 JAPAN SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 209 JAPAN SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 210 JAPAN SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 211 JAPAN ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 212 JAPAN INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 213 JAPAN SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 214 JAPAN BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 215 JAPAN ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 216 JAPAN NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 217 JAPAN COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 218 JAPAN HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 219 JAPAN BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 220 JAPAN SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 221 JAPAN TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 222 JAPAN TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 223 JAPAN SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 224 JAPAN DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 225 JAPAN SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 226 JAPAN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 227 JAPAN PRECISION SOIL HEALTH MANAGEMENT IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 228 JAPAN REGENERATIVE AGRICULTURE PRACTICES IN SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 229 JAPAN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 230 JAPAN CROP SOIL IN SOIL HEALTH MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 231 JAPAN CEREALS & GRAINS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 232 JAPAN OILSEEDS & PULSES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 233 JAPAN FRUITS & VEGETABLES, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 234 JAPAN COMMERCIAL CROPS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 235 JAPAN PLANTATION CROPS, CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 236 JAPAN NON-CROP SOIL IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 237 JAPAN SOIL HEALTH MARKET, BY END-USER, 2018-2033 (USD THOUSAND)

TABLE 238 JAPAN FARMERS & GROWERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 239 JAPAN AGRIBUSINESS COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 240 JAPAN LANDSCAPING & FORESTRY COMPANIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 241 JAPAN GOVERNMENT & REGULATORY BODIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 242 JAPAN RESEARCH INSTITUTES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 243 JAPAN UNIVERSITIES IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 244 JAPAN OTHERS IN SOIL HEALTH MARKET, BY PRODUCT TYPE, 2018-2033 (USD THOUSAND)

TABLE 245 JAPAN SOIL HEALTH MARKET, BY DISTRIBUTION CHANNEL, 2018-2033 (USD THOUSAND)

TABLE 246 AUSTRALIA SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 247 AUSTRALIA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 248 AUSTRALIA SOIL ENHANCEMENT PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 249 AUSTRALIA SOIL AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 250 AUSTRALIA ORGANIC AMENDMENTSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 251 AUSTRALIA INORGANIC AMENDMENTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 252 AUSTRALIA SOIL FERTILITY ENHANCERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 253 AUSTRALIA BIOFERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 254 AUSTRALIA ORGANIC-MINERAL FERTILIZERSIN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 255 AUSTRALIA NPK-ENRICHED ORGANIC FERTILIZERS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 256 AUSTRALIA COMPOST-BASED MINERAL FORTIFIED PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 257 AUSTRALIA HUMIC ACID AND NPK BLENDS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 258 AUSTRALIA BIOLOGICALS / MICROBIAL SOLUTIONS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 259 AUSTRALIA SOIL CONDITIONERS (ORGANIC) IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 260 AUSTRALIA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 261 AUSTRALIA TESTING & MONITORING PRODUCTS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (THOUSAND UNITS)

TABLE 262 AUSTRALIA SOIL TESTING KITS IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 263 AUSTRALIA DIGITAL AND REMOTE MONITORING IN SOIL HEALTH MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 264 AUSTRALIA SOIL HEALTH MARKET, BY SOIL TYPE, 2018-2033 (USD THOUSAND)

TABLE 265 AUSTRALIA SOIL HEALTH MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)