Asia Pacific Spunbond Market

Market Size in USD Billion

CAGR :

%

USD

42.49 Billion

USD

56.82 Billion

2024

2032

USD

42.49 Billion

USD

56.82 Billion

2024

2032

| 2025 –2032 | |

| USD 42.49 Billion | |

| USD 56.82 Billion | |

|

|

|

|

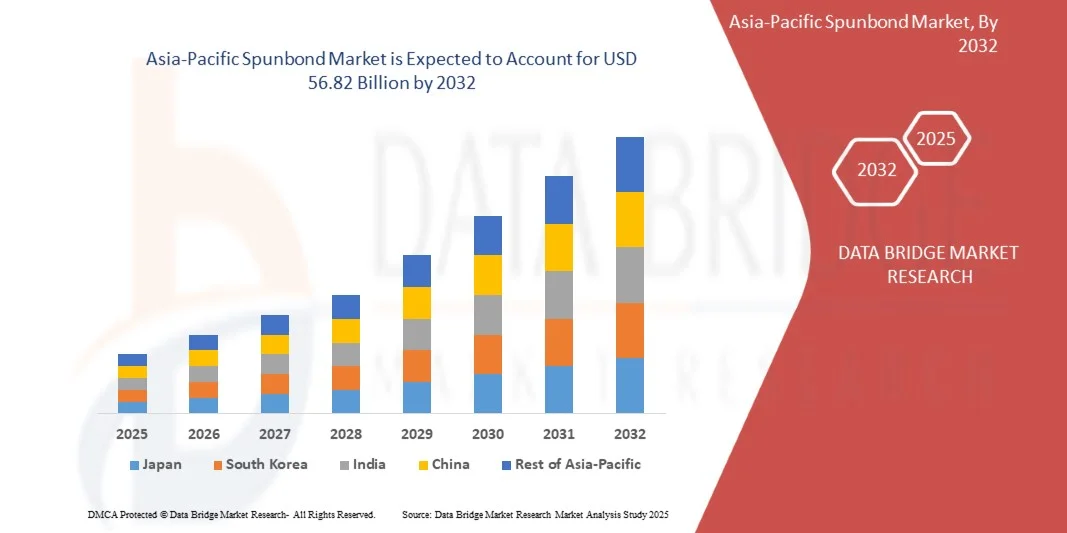

What is the Asia-Pacific Spunbond Market Size and Growth Rate?

- The Asia-Pacific Spunbond Market size was valued at USD 42.49 billion in 2024 and is expected to reach USD 56.82 billion by 2032, at a CAGR of 3.70% during the forecast period

- The market growth is largely fueled by the increasing demand for lightweight, durable, and high-performance materials across industries such as automotive, hygiene, filtration, and agriculture, coupled with technological advancements in nonwoven fabric production enhancing efficiency and versatility

- Furthermore, rising adoption of sustainable manufacturing practices and growing utilization of spunbond fabrics in disposable and medical applications are accelerating market expansion, positioning spunbond materials as essential components in industrial and consumer applications

What are the Major Takeaways of Asia-Pacific Spunbond Market?

- Spunbond, produced through a continuous filament process, is extensively used in hygiene products, geotextiles, filtration systems, and automotive components due to its superior strength, breathability, and cost-effectiveness

- The market’s growth trajectory is supported by increasing demand for eco-friendly and high-performance materials, continuous innovation in polymer technology, and expanding application areas across both industrial and consumer sectors, reinforcing spunbond’s position as a critical material in modern manufacturing

- China dominated the Asia-Pacific Spunbond Market with the largest revenue share of 62.5% in 2024, driven by rising demand for advanced optical devices, outdoor recreation products, and defense-grade equipment

- The India Asia-Pacific Spunbond Market is expected to be the fastest-growing in the Asia-Pacific region, with a CAGR of 12.5%, supported by government initiatives promoting defense modernization, smart surveillance programs, and adoption of high-performance optical devices

- Fine denier PET segment dominated the market with a market share of 71.95% in 2024, due to its superior mechanical properties, lightweight structure, and excellent breathability. These characteristics make it highly suitable for hygiene and medical applications, including surgical gowns, face masks, and disposable diapers

Report Scope and Asia-Pacific Spunbond Market Segmentation

|

Attributes |

Spunbond Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Asia-Pacific Spunbond Market?

“Growing Shift Toward Sustainable Spunbond Materials”

- The Asia-Pacific Spunbond Market is undergoing a transformative shift as manufacturers increasingly adopt sustainable materials and eco-friendly production processes to meet the rising demand for environmentally responsible products. Growing consumer awareness, stricter environmental regulations, and brand commitments to circular economy principles are driving the move toward greener spunbond fabrics

- For instance, Berry Global and Toray Industries have launched spunbond nonwovens produced from bio-based and recycled polymers for applications in hygiene, agriculture, and medical products. These solutions reduce reliance on virgin petrochemical feedstocks while maintaining high performance and durability standards required for end-use industries

- Advancements in polymer technology are enabling the commercial-scale production of spunbond fabrics from polylactic acid (PLA) and recycled polypropylene. These sustainable variants degrade faster under specific conditions or extend the product lifecycle through reuse, aligning with global waste reduction initiatives

- The shift toward sustainable spunbond materials also supports corporate ESG strategies, as leading manufacturers invest in closed-loop production systems to minimize waste and energy consumption. This includes integrating renewable energy sources in manufacturing and optimizing resin recovery processes

- As consumers and industry buyers increasingly prioritize eco-conscious sourcing, sustainable spunbond products are finding broader acceptance in packaging, agriculture, furniture, and filtration markets. Their compatibility with biodegradable coatings and compostable packaging further broadens their application scope

- The growing shift toward sustainable spunbond materials marks a pivotal change in the nonwovens industry. Balancing cost-efficiency, performance, and environmental credentials will remain central to driving adoption across diverse applications, reinforcing sustainability as a core market growth driver

What are the Key Drivers of Asia-Pacific Spunbond Market?

- The hygiene and medical sectors represent significant demand drivers for spunbond nonwovens due to their lightweight properties, breathability, and high tensile strength. The pandemic aftermath has further highlighted the importance of spunbond materials in manufacturing essential medical products and hygiene disposables

- For instance, Kimberly-Clark Corporation utilizes spunbond polypropylene in the production of surgical gowns, face masks, and disposable hygiene products, ensuring infection protection while maintaining user comfort. This illustrates their critical role in high-volume, high-safety applications

- In the hygiene sector, spunbond fabrics are used extensively in baby diapers, feminine hygiene products, and adult incontinence items due to their softness, absorbency compatibility, and structural integrity. Their ability to function as a top sheet or back sheet material ensures product reliability and consumer satisfaction

- The medical industry benefits from spunbond’s superior barrier properties when combined with meltblown layers, creating SMS and SMMS fabrics used in sterile packaging and protective clothing. This supports hospitals and clinics in meeting stringent infection control protocols

- Rising healthcare expenditure, expanding hygiene awareness in emerging economies, and the continuous introduction of advanced, comfort-enhancing nonwoven technologies ensure sustained demand for spunbond fabrics in these critical sectors. Their versatility and scalability make them indispensable in modern medical and hygiene supply chains

Which Factor is Challenging the Growth of the Asia-Pacific Spunbond Market?

- Volatility in raw material prices, particularly polypropylene and other petroleum-derived polymers, poses a major challenge for the Asia-Pacific Spunbond Market. Price fluctuations directly impact production costs and can disrupt profitability for manufacturers operating on tight margins

- For instance, significant spikes in polypropylene prices during supply chain disruptions have forced companies such as Avgol Nonwovens and Mitsui Chemicals to adjust product pricing or absorb temporary losses, affecting their competitive positioning in global markets

- The industry’s dependence on petrochemical feedstocks links it closely to crude oil price volatility, geopolitical tensions, and refinery output variations. This exposure creates uncertainty in procurement planning and contract negotiations for large-volume buyers and suppliers

- Fluctuating input costs also hinder long-term strategic investment in capacity expansion and sustainability initiatives, as unpredictable resin prices can offset the benefits of operational efficiencies or eco-friendly product development

- To address this challenge, manufacturers are increasingly exploring supply diversification, raw material recycling, and bio-based polymer alternatives. Strengthening procurement strategies and investing in supply chain resilience will be essential to reduce vulnerability to raw material price volatility while ensuring stable market growth

How is the Asia-Pacific Spunbond Market Segmented?

The market is segmented on the basis of type, nylon raw material, and application.

• By Type

On the basis of type, the Asia-Pacific Spunbond Market is segmented into fine denier PET and nylon. The fine denier PET segment dominated the market with the largest revenue share of 71.95% in 2024, owing to its superior mechanical properties, lightweight structure, and excellent breathability. These characteristics make it highly suitable for hygiene and medical applications, including surgical gowns, face masks, and disposable diapers. Its softness and comfort enhance user experience, particularly in wearable products. In addition, fine denier PET is compatible with high-speed production processes, enabling efficient mass manufacturing. Its cost-effectiveness further encourages adoption across both commercial and healthcare sectors. The material also supports recyclability, aligning with sustainability trends in nonwoven fabrics.

The nylon segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its high tensile strength, elasticity, and resistance to abrasion. Nylon spunbond fabrics are preferred in industrial and automotive applications due to their durability, flexibility, and ability to withstand harsh operating conditions. They are increasingly used in automotive interiors, acoustic insulation, and reinforcement materials. The segment is also gaining traction in specialty applications such as composites and technical textiles, where performance, resilience, and dimensional stability are critical. Rising demand for high-performance, long-lasting fabrics is expected to further accelerate the growth of this segment.

• By Nylon Raw Material

On the basis of nylon raw material, the Asia-Pacific Spunbond Market is segmented into adipic acid and caprolactam. The caprolactam segment held the largest revenue share in 2024, primarily due to its widespread use in producing nylon 6. Nylon 6 is highly valued in applications that demand durability, chemical resistance, and dimensional stability. Its versatility allows it to be used in automotive components, industrial filters, and packaging materials. The mature production processes and cost-effectiveness of caprolactam-based nylon further reinforce its dominance. In addition, its ability to be processed into strong, lightweight spunbond fabrics makes it suitable for both technical and consumer applications. Caprolactam also supports high-speed manufacturing, catering to large-scale production demands.

The adipic acid segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its role in producing nylon 66. Nylon 66 offers superior heat resistance, higher tensile strength, and excellent mechanical properties, making it suitable for high-performance applications. It is increasingly used in industrial, automotive, and technical textile sectors where durability under extreme conditions is essential. The segment’s growth is supported by rising demand for robust, long-lasting spunbond fabrics that can withstand chemical, thermal, and mechanical stress. Adipic acid-derived nylon also enables innovations in specialty nonwoven fabrics, further expanding its market potential.

• By Application

On the basis of application, the Asia-Pacific Spunbond Market is segmented into automotive, filtration, rubber belting/hoses, rubber transfer molding, embroidery/apparel, composites, carpet/rugs, agriculture, electrical and electronics, textile, home furnishing, tapes/adhesives, and others. The hygiene and filtration segments lead the market due to rising demand for single-use and protective products. Spunbond fabrics are widely used in face masks, surgical gowns, diapers, and industrial filters because of their breathability, liquid resistance, and strength. Their ability to provide a barrier against contaminants while remaining lightweight makes them ideal for medical and sanitation applications. Growing awareness of health and safety, coupled with regulatory requirements, continues to drive adoption. In addition, advancements in fabric treatments enhance filtration efficiency and product longevity, further boosting market demand.

The automotive and composites segments are expected to witness the fastest growth from 2025 to 2032, fueled by the need for lightweight, high-performance materials. Spunbond fabrics are increasingly used in car interiors for acoustic insulation, seat reinforcement, trunk liners, and door panels. In composites, they serve as reinforcement layers in automotive and industrial components, offering strength and dimensional stability. The push for fuel efficiency, reduced emissions, and enhanced safety in vehicles is driving the adoption of these fabrics. Their durability, flexibility, and ease of integration into manufacturing processes make them essential in high-performance applications.

Which Region Holds the Largest Share of the Asia-Pacific Spunbond Market?

- China dominated the Asia-Pacific Spunbond Market with the largest revenue share of 62.5% in 2024, driven by rising demand for advanced optical devices, outdoor recreation products, and defense-grade equipment

- Local manufacturers offer cost-effective binoculars, scopes, and spotting devices, while investments in AI and IoT-enabled technologies improve accuracy, usability, and performance

- China’s expanding production capabilities, coupled with growing interest in outdoor sports and recreational activities, make it a key market fueling growth across the Asia-Pacific region

India Asia-Pacific Spunbond Market Insight

The India Asia-Pacific Spunbond Market is expected to be the fastest-growing in the Asia-Pacific region, with a CAGR of 12.5%, supported by government initiatives promoting defense modernization, smart surveillance programs, and adoption of high-performance optical devices. Affordable locally manufactured products, increasing participation in outdoor activities, and rising awareness of optical technologies are driving adoption. India’s growing role as a production and innovation hub is strengthening market penetration across both recreational and professional applications.

Japan Asia-Pacific Spunbond Market Insight

Japan’s Asia-Pacific Spunbond Market is experiencing steady growth due to its high-tech culture, focus on precision optics, and demand for outdoor and sports-related products. The market benefits from AI-assisted targeting, cloud-enabled functionality, and customizable solutions for both recreational and professional users. In addition, Japan’s aging population and preference for easy-to-use, automated technologies are promoting adoption in commercial and small-scale applications, positioning the country as a strategic growth market in the Asia-Pacific region.

Which are the Top Companies in Asia-Pacific Spunbond Market?

The Spunbond industry is primarily led by well-established companies, including:

- Huahao Nonwovens Co., Ltd. (China)

- DuPont (U.S.)

- Asahi Kasei Corporation (Japan)

- Mogul Co., Ltd. (Turkey)

- Yaolong Spun bonded Nonwoven Technology Co., Ltd. (China)

- Quanzhou Golden Nonwoven Co., Ltd. (China)

- TORAY INDUSTRIES, INC. (Japan)

- Berry Global Inc. (U.S.)

- Cerex Advanced Fabrics, Inc. (U.S.)

- Radici Partecipazioni SpA (Italy)

- Kolon Industries, Inc. (South Korea)

- APEX Nonwovens (U.S.)

- SHINKONG SYNTHETIC FIBERS CORP (Taiwan)

- Wenzhou Superteng Nonwoven Technology Co., Ltd. (China)

- Hadtex (Turkey)

What are the Recent Developments in Asia-Pacific Spunbond Market?

- In February 2025, Avgol (Indorama Ventures) inaugurated a new high-speed spunbond nonwoven production line at its North Carolina facility, supported by a USD 100 billion investment. This expansion strengthens its production capacity for hygiene and medical applications, addressing growing global demand for lightweight and high-performance nonwovens. The initiative enhances Avgol’s competitiveness in advanced material supply and reinforces its foothold in North American and global markets

- In November 2024, Fibertex Nonwovens announced the installation of a second high-performance spunlace line at its Czech Republic facility, scheduled for completion in early 2026. This expansion boosts output of specialty nonwovens and enhances product versatility for hygiene and industrial applications. The move strengthens Fibertex’s position in the premium spunbond segment by improving production flexibility and meeting diverse customer needs across Europe

- In September 2024, Toray Industries revealed plans to expand its spunbond nonwoven production capacity at its facility in Indonesia. This investment aims to cater to rising regional demand for hygiene, medical, and industrial nonwovens. By increasing output and localizing supply, Toray enhances its operational efficiency and strengthens its market presence in the rapidly growing Asia-Pacific region

- In June 2024, Fibertex Nonwovens began large-scale production of nanofiber-based nonwoven products designed for advanced filtration and specialty applications. This milestone followed years of research and development, enabling the company to deliver high-performance materials with improved filtration efficiency and sustainability. The initiative marks a strategic shift toward innovation-driven growth in technical nonwovens

- In March 2024, Fibertex Nonwovens, a subsidiary of Schouw & Co., announced a USD 47.82 billion investment to expand production capacity at its U.S. facilities. A similar investment was allocated to enhance its European plants in the Czech Republic and Turkey. This strategic initiative strengthens the company’s global presence and ensures it meets the surging demand for high-quality spunbond nonwoven materials across multiple industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Spunbond Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Spunbond Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Spunbond Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.