Asia Pacific Stroke Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

5.06 Billion

USD

11.83 Billion

2025

2033

USD

5.06 Billion

USD

11.83 Billion

2025

2033

| 2026 –2033 | |

| USD 5.06 Billion | |

| USD 11.83 Billion | |

|

|

|

|

Asia-Pacific Stroke Diagnostics Market Size

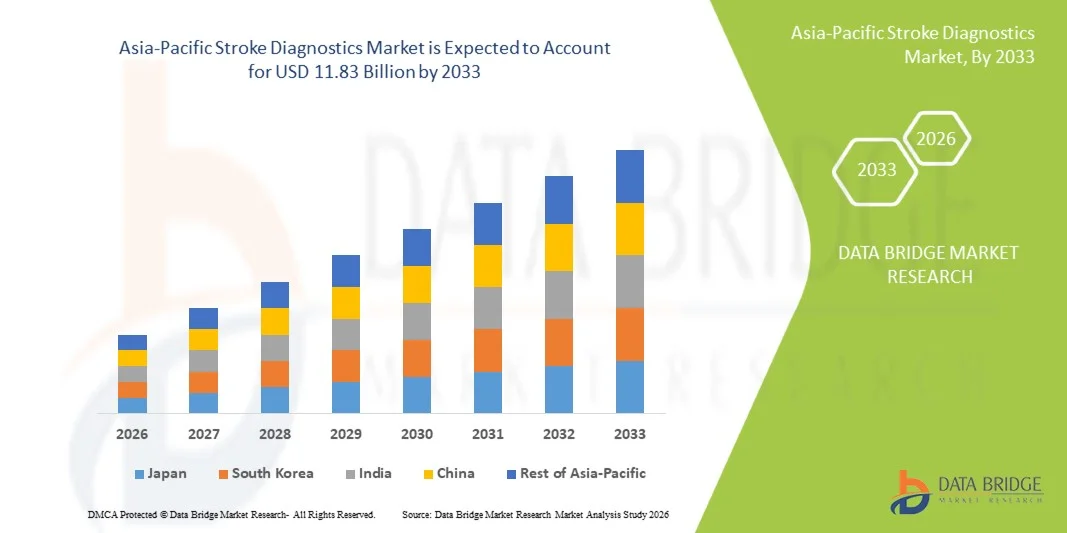

- The Asia-Pacific stroke diagnostics market size was valued at USD 5.06 billion in 2025 and is expected to reach USD 11.83 billion by 2033, at a CAGR of 11.2% during the forecast period

- The market growth in the region is primarily driven by increasing stroke incidence, rising geriatric population, ongoing advancements in diagnostic imaging technologies and expanding healthcare infrastructure, which are improving early detection and diagnosis capabilities across hospitals and diagnostic centers

- Furthermore, greater investment in healthcare, supportive government initiatives to enhance diagnostic services, and heightened demand for accurate, rapid stroke diagnostics are propelling the adoption of advanced diagnostic solutions in countries such as China, India, Japan, and South Korea. These converging factors are amplifying demand for stroke diagnostics across both urban and underserved areas, thereby significantly boosting market growth

Asia-Pacific Stroke Diagnostics Market Analysis

- Stroke diagnostics, encompassing imaging technologies such as CT, MRI, and AI-enabled diagnostic tools, are becoming increasingly critical in the Asia-Pacific healthcare landscape for early detection, accurate diagnosis, and timely treatment of stroke, improving patient outcomes across hospitals, clinics, and diagnostic centers

- The rising demand for stroke diagnostics is largely driven by increasing stroke prevalence, growing geriatric populations, heightened awareness of stroke symptoms, and advancements in rapid, non-invasive diagnostic technologies that enable faster and more accurate assessments

- China dominated the Asia-Pacific stroke diagnostics market with a market share of 38.5% in 2025, supported by expanding healthcare infrastructure, government initiatives to improve diagnostic services, and increased adoption of advanced imaging systems in both urban hospitals and regional diagnostic centers

- India is expected to be the fastest-growing country in the Asia-Pacific region fueled by rising healthcare expenditure, growing private healthcare sector, increased availability of advanced diagnostic solutions, and strong government focus on early stroke detection and management programs

- The Computed Tomography (CT Scan) segment dominated the market with a market share of 46.7% in 2025, driven by its established role in rapid, accurate stroke detection and widespread integration into hospital diagnostic workflows across the region

Report Scope and Asia-Pacific Stroke Diagnostics Market Segmentation

|

Attributes |

Asia-Pacific Stroke Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Stroke Diagnostics Market Trends

“Enhanced Accuracy and Speed Through AI-Enabled Imaging”

- A significant and accelerating trend in the Asia-Pacific stroke diagnostics market is the growing integration of artificial intelligence (AI) with imaging technologies such as CT and MRI, enabling faster and more accurate stroke detection across hospitals and diagnostic centers

- For instance, AI-enabled CT software can automatically detect ischemic regions in the brain within minutes, assisting radiologists in prioritizing urgent cases and reducing time to treatment

- AI integration in stroke diagnostics allows predictive analytics, helping clinicians assess risk patterns and recommend optimized treatment plans, while also sending automated alerts for abnormal findings. For instance, some Aidoc and Viz.ai models use AI to enhance detection accuracy and alert neurologists of potential large vessel occlusions in real time

- The seamless integration of AI diagnostics with hospital information systems and telemedicine platforms facilitates centralized patient management, allowing physicians to review images, patient data, and treatment recommendations through a single interface

- This trend toward faster, AI-driven, and interconnected diagnostic workflows is reshaping expectations for stroke care. Consequently, companies such as Niramai and Qure.ai are developing AI-powered imaging tools capable of rapid detection, triage, and integration with hospital workflows

- The demand for stroke diagnostic solutions that offer AI-enabled speed and accuracy is growing rapidly across both urban hospitals and regional diagnostic centers, as healthcare providers prioritize timely intervention and improved patient outcomes

- Collaborations between hospitals, AI software developers, and government health programs are promoting integrated stroke care solutions, creating a comprehensive ecosystem for early detection and intervention

Asia-Pacific Stroke Diagnostics Market Dynamics

Driver

“Increasing Stroke Incidence and Healthcare Investment”

- The rising prevalence of stroke cases in aging populations, combined with growing investments in healthcare infrastructure, is a major driver for the expanding adoption of stroke diagnostics in the Asia-Pacific region

- For instance, in March 2025, Apollo Hospitals in India implemented AI-based CT imaging systems to enhance early stroke detection, improving treatment efficiency and patient prognosis

- As awareness of stroke symptoms and the need for rapid diagnosis increases, healthcare providers are adopting advanced imaging systems with AI assistance, improving outcomes and reducing hospital stays

- Furthermore, government initiatives supporting early stroke detection programs and private investment in diagnostic centers are accelerating market adoption, particularly in emerging economies such as India and Indonesia

- The availability of portable imaging devices, tele-radiology integration, and remote monitoring capabilities, along with a focus on timely intervention, is driving demand for stroke diagnostics across hospitals, diagnostic chains, and clinics in both metropolitan and semi-urban areas

- Rising partnerships between diagnostic technology providers and local healthcare systems are facilitating faster deployment of advanced imaging equipment and training for medical personnel

- Increasing public awareness campaigns about stroke symptoms and the importance of early intervention are motivating patients to seek timely diagnostic services, indirectly boosting market adoption

Restraint/Challenge

“High Costs and Regulatory Compliance Hurdles”

- The high costs of advanced imaging equipment such as AI-enabled CT and MRI systems pose a challenge to widespread adoption in price-sensitive regions, limiting access in smaller hospitals or rural healthcare centers

- For instance, smaller diagnostic clinics in Southeast Asia may delay adoption due to the high upfront investment required for AI-integrated stroke imaging solutions

- Strict regulatory approvals and compliance requirements for medical imaging devices, including AI software validation, can slow down product launches and adoption across countries in the region

- While prices are gradually decreasing for some portable or simplified imaging solutions, the premium associated with advanced AI diagnostics remains a barrier for some healthcare providers

- Overcoming these challenges through government subsidies, cost-effective device offerings, and faster regulatory clearances will be critical for sustained growth of stroke diagnostics in the Asia-Pacific region

- Limited technical expertise and shortage of trained radiologists to operate AI-enabled diagnostic systems in remote areas can hinder adoption despite availability of advanced technology

- Integration challenges with existing hospital IT systems and electronic health records can delay the deployment of new diagnostic tools, requiring additional investment in software compatibility and staff training

Asia-Pacific Stroke Diagnostics Market Scope

The market is segmented on the basis of severity, type, application, end user, distribution channel, and stage.

- By Severity

On the basis of severity, the Asia-Pacific stroke diagnostics market is segmented into mild, moderate, and severe. The severe stroke segment dominated the market in 2025 with the largest revenue share, driven by the urgent need for accurate and rapid diagnosis to prevent life-threatening complications. Hospitals and advanced diagnostic centers prioritize immediate imaging using CT or MRI for severe stroke cases to determine treatment strategies such as thrombolysis or surgery. The higher risk associated with severe strokes leads to more frequent utilization of advanced diagnostic solutions, contributing to the segment’s dominance. In addition, government healthcare programs and insurance coverage often support comprehensive diagnostic procedures for severe cases, further enhancing market revenue. Clinicians prefer AI-assisted imaging for severe stroke patients to ensure timely intervention and reduce mortality rates.

The mild stroke segment is expected to witness the fastest growth from 2026 to 2033, fueled by rising awareness of early stroke symptoms and increasing adoption of routine screening in hospitals and clinics. Early detection in mild cases is critical to prevent progression to severe conditions, driving demand for imaging solutions such as CT angiography and MRI. Portable imaging units and tele-radiology services also support rapid diagnosis of mild strokes in smaller healthcare centers. Preventive health initiatives and patient education campaigns are encouraging early check-ups, boosting the growth of this segment.

- By Type

On the basis of type, the market is segmented into Computed Tomography (CT Scan), Computed Tomography Angiography (CTA), Magnetic Resonance Imaging (MRI), Magnetic Resonance Angiography (MRA), Transcranial Doppler Ultrasound, Video Head Impulse Test (VHIT), and Others. The CT Scan segment dominated the market in 2025 with the largest revenue share of 46.7%, attributed to its widespread availability, rapid imaging capability, and established reliability in detecting ischemic and hemorrhagic strokes. Hospitals prefer CT scans for initial stroke assessment because they provide quick results, aiding in timely treatment decisions. Integration of AI with CT imaging further improves detection accuracy and workflow efficiency. CT scans are also cost-effective compared to advanced MRI solutions, making them accessible across urban and semi-urban hospitals. Emergency departments frequently rely on CT technology for acute stroke cases, reinforcing its market dominance.

The MRI segment is expected to witness the fastest growth during 2026–2033, driven by its superior imaging resolution and ability to detect subtle ischemic changes that CT scans may miss. Advanced MRI techniques such as diffusion-weighted imaging (DWI) and functional MRI are gaining traction for precise stroke diagnosis. Increasing investment in MRI infrastructure, AI-assisted image analysis, and growing awareness of non-invasive diagnostic benefits are supporting this segment. Hospitals in India, Japan, and China are expanding MRI capabilities for stroke care, contributing to the segment’s rapid growth.

- By Application

On the basis of application, the market is segmented into ischemic stroke, hemorrhagic stroke, and transient ischemic attacks (TIAs). The ischemic stroke segment dominated the market in 2025 with the largest revenue share due to its high prevalence in the Asia-Pacific region and the urgent need for accurate diagnostics to guide thrombolytic and endovascular therapies. Hospitals extensively use CT, CTA, and MRI for ischemic stroke detection, supported by AI-enabled imaging tools that reduce diagnosis time. Growing awareness of stroke symptoms and government initiatives promoting rapid intervention contribute to high adoption of diagnostic solutions in this segment. Diagnostic centers focus on early detection and risk assessment, enhancing patient outcomes. Insurance coverage for ischemic stroke diagnostics in several countries also supports this segment’s market dominance.

The TIA segment is expected to witness the fastest growth during 2026–2033, fueled by increasing preventive healthcare initiatives and rising patient awareness about minor stroke episodes. TIAs often require advanced imaging such as MRI or MRA to detect subtle vascular abnormalities. Early diagnosis prevents progression to major strokes, increasing demand for diagnostic solutions in both urban hospitals and smaller clinics. Telemedicine integration and portable diagnostic tools are supporting TIA detection in remote areas, further driving growth.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, ambulatory surgical centers, and home healthcare. The hospitals segment dominated the market in 2025 with the largest revenue share due to the availability of advanced imaging infrastructure, skilled radiologists, and emergency care units capable of handling acute stroke cases. Hospitals are the primary point of care for stroke diagnosis, especially for severe and moderate cases, requiring immediate imaging and intervention. Partnerships with AI diagnostic software providers and government-funded stroke programs further boost adoption in hospitals. Emergency departments prioritize rapid imaging and workflow efficiency, making hospitals the key revenue contributor. Large multi-specialty hospitals invest heavily in CT and MRI infrastructure, reinforcing market dominance.

The home healthcare segment is expected to witness the fastest growth during 2026–2033, driven by rising demand for remote patient monitoring, tele-radiology, and portable diagnostic devices that allow stroke risk assessment and follow-up at home. Growth in chronic care management, wearable sensor technologies, and AI-assisted portable imaging units enables early detection and continuous monitoring. Increasing awareness among patients and caregivers about early stroke signs is promoting home-based diagnostic adoption. Private healthcare startups and telemedicine companies are actively expanding home healthcare stroke solutions in India and Southeast Asia.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, third-party distributors, and others. The direct tender segment dominated the market in 2025 with the largest revenue share, driven by hospitals and large diagnostic chains procuring imaging equipment directly from manufacturers for cost efficiency and guaranteed service support. Direct tender agreements often include maintenance contracts and software updates, ensuring long-term reliability of CT, MRI, and AI systems. Hospitals prefer direct procurement to customize configurations, receive training, and integrate imaging solutions into existing IT infrastructure. Government hospitals and large private networks typically favor this channel for bulk procurement. Manufacturer support for AI software and hardware integration reinforces market dominance.

The third-party distributors segment is expected to witness the fastest growth during 2026–2033, fueled by increasing penetration of imaging equipment in small clinics, ambulatory centers, and semi-urban hospitals. Distributors enable faster deployment of portable devices, leasing models, and flexible financing options. They also provide training, software support, and supply chain efficiency, facilitating adoption in smaller healthcare setups. Growing partnerships between distributors and AI imaging technology providers are supporting market expansion in emerging countries.

- By Stage

On the basis of stage, the market is segmented into pre-operative, peri-operative, and post-operative. The pre-operative segment dominated the market in 2025 with the largest revenue share, as accurate stroke diagnosis prior to intervention is critical for planning treatments such as thrombolysis, thrombectomy, or surgical procedures. Imaging tools such as CT, CTA, and MRI are heavily utilized in pre-operative evaluation to assess occlusion, infarct size, and hemorrhage risk. Hospitals prioritize AI-assisted imaging for pre-operative decision-making to minimize complications and improve patient outcomes. Government stroke programs and insurance coverage encourage comprehensive pre-operative diagnostics, supporting market dominance.

The post-operative segment is expected to witness the fastest growth during 2026–2033, fueled by increasing adoption of follow-up imaging and monitoring to track recovery, detect complications, and guide rehabilitation. AI-enabled imaging supports accurate post-operative assessment, while home healthcare and telemedicine services enable remote monitoring. Rising patient awareness and preventive care programs contribute to the expansion of post-operative diagnostics across hospitals and clinics.

Asia-Pacific Stroke Diagnostics Market Regional Analysis

- China dominated the Asia-Pacific stroke diagnostics market with a market share of 38.5% in 2025, supported by expanding healthcare infrastructure, government initiatives to improve diagnostic services, and increased adoption of advanced imaging systems in both urban hospitals and regional diagnostic centers

- Hospitals and diagnostic centers in China prioritize early and accurate stroke detection using CT, MRI, and AI-enabled imaging technologies to improve patient outcomes and reduce time-to-treatment

- The widespread adoption of stroke diagnostics is further supported by government initiatives for early stroke detection, increasing awareness of stroke symptoms among the population, and growing demand for timely intervention, establishing China as the key market leader in the region

The China Stroke Diagnostics Market Insight

The China stroke diagnostics market captured the largest revenue share in 2025, driven by the high prevalence of stroke, rapid urbanization, and extensive investments in advanced healthcare infrastructure. Hospitals and diagnostic centers prioritize early and accurate detection using CT, MRI, CTA, and AI-enabled imaging technologies to improve patient outcomes. Government initiatives promoting early stroke detection, coupled with rising awareness of stroke symptoms among the population, are further boosting market adoption. The availability of skilled radiologists and integration of tele-radiology services are facilitating rapid diagnosis across urban and semi-urban regions. In addition, domestic manufacturers of imaging equipment and AI software are supporting affordability and accessibility, further strengthening China’s market leadership.

Japan Stroke Diagnostics Market Insight

The Japan stroke diagnostics market is witnessing steady growth, fueled by the country’s aging population, high-tech healthcare infrastructure, and focus on preventive care. Hospitals are increasingly adopting advanced imaging modalities such as MRI, MRA, and AI-assisted CT to detect strokes at an early stage. Integration of stroke diagnostics with hospital IT systems and telemedicine platforms enhances workflow efficiency and patient monitoring. Rising awareness of stroke risk factors and government programs promoting early intervention are encouraging routine screenings. Japan’s strong focus on research and development in medical imaging also contributes to higher adoption of innovative diagnostic tools. The growing number of smart hospitals and connected healthcare facilities is further driving the demand for accurate stroke diagnostics.

India Stroke Diagnostics Market Insight

The India stroke diagnostics market accounted for the fastest growth in Asia-Pacific during 2025, driven by rapid urbanization, rising geriatric population, and increasing investments in healthcare infrastructure. Hospitals, clinics, and diagnostic centers are expanding access to CT, MRI, and AI-assisted imaging to manage the rising incidence of strokes. Government initiatives supporting early stroke detection, coupled with telemedicine and portable diagnostic solutions, are improving reach in semi-urban and rural areas. Rising awareness campaigns about stroke symptoms and preventive care are increasing patient uptake of diagnostic services. Domestic manufacturing of imaging devices and AI software is enhancing affordability, while public-private partnerships are accelerating adoption across hospitals and diagnostic chains. The growing focus on home healthcare and remote monitoring is also contributing to India’s rapid market growth.

South Korea Stroke Diagnostics Market Insight

The South Korea stroke diagnostics market is experiencing significant growth, driven by advanced healthcare infrastructure, government-supported preventive care programs, and high adoption of AI-enabled imaging technologies. Hospitals and specialty clinics are increasingly integrating CT, MRI, CTA, and MRA solutions for early stroke detection and intervention. The country’s focus on research, innovation, and telemedicine is promoting rapid deployment of portable and AI-assisted diagnostic tools. Public awareness campaigns about stroke symptoms and rehabilitation programs are encouraging timely diagnostics. Strong regulatory standards and healthcare funding ensure quality and accessibility across both urban and semi-urban regions. In addition, collaborations between hospitals and technology providers are accelerating adoption and improving diagnostic accuracy.

Asia-Pacific Stroke Diagnostics Market Share

The Asia-Pacific Stroke Diagnostics industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- GE HealthCare (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Shenzhen Mindray Bio Medical Electronics Co., Ltd. (China)

- FUJIFILM Holdings Corporation (Japan)

- Analogic Corporation (U.S.)

- Aspect Imaging Ltd (Israel)

- Carestream Health (U.S.)

- Esaote S.p.A (Italy)

- Hologic, Inc. (U.S.)

- IMRIS Inc. (Canada)

- Fonar Corporation (U.S.)

- Medfield Diagnostics AB (Sweden)

- MEDTRON AG (Germany)

- SAMSUNG Medison (South Korea)

- Shenzhen Anke High Tech Co., Ltd. (China)

- Shimadzu Corporation (Japan)

- ALPINION MEDICAL SYSTEMS Co., Ltd. (South Korea)

- BPL Medical Technologies (India)

What are the Recent Developments in Asia-Pacific Stroke Diagnostics Market?

- In December 2025, Hallym University Sacred Heart Hospital (South Korea) implemented a suite of AI‑based imaging software from local company JLK to analyse CT and MRI perfusion images for faster detection of ischemic stroke and large vessel occlusions, aiming to speed emergency stroke diagnoses and improve workflow efficiency

- In October 2025, the Punjab Government (India) launched an AI‑Driven Stroke Screening Project, which screened over 700 suspected stroke patients using AI‑assisted CT scan analysis from Qure.ai. The initiative enabled urgent cases to be identified quickly and transferred for advanced care, including life‑saving thrombectomy procedures offered free of cost

- In January 2025, Siemens Healthineers showcased a suite of cutting‑edge diagnostic tools at the Asian Oceanian Congress of Radiology (AOCR 2025) in Chennai, including next‑generation MRI, dual‑source CT scanners, and AI‑powered ultrasound systems, reflecting substantial advancements in imaging precision and workflow efficiency used in stroke diagnosis and neurological care

- In August 2023, AsiaMedic in Singapore announced the installation of the first SIGNA™ Hero 3.0T MRI scanner in the Asia‑Pacific region, a next‑generation system offering enhanced imaging quality and faster scan times that improves precision diagnostics including for neurological conditions such as stroke and reduces clinician workload through AI‑based reconstruction techniques

- In May 2023, Singapore’s National University Hospital (NUH) began using RapidAI, an AI‑based imaging solution that processes CT scans in under a minute to help clinicians rapidly detect and quantify stroke damage significantly reducing critical diagnosis time compared with manual interpretation.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.