Asia Pacific Surgical Sealants Adhesives Market

Market Size in USD Million

CAGR :

%

USD

300.16 Million

USD

549.42 Million

2024

2032

USD

300.16 Million

USD

549.42 Million

2024

2032

| 2025 –2032 | |

| USD 300.16 Million | |

| USD 549.42 Million | |

|

|

|

|

Asia-Pacific Surgical Sealants and Adhesive Market Size

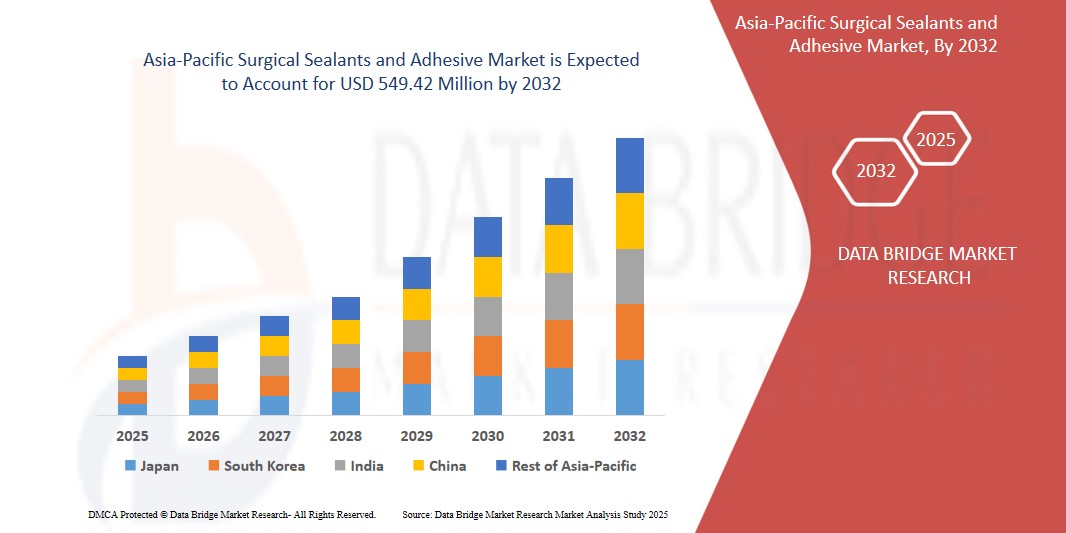

- The Asia Pacific Surgical Sealants and Adhesive Market was valued at USD 300.16 million in 2024 and is expected to reach USD 549.42 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.9%, primarily driven by the significant rise in surgical procedures across the region, driven by aging populations, increasing lifestyle diseases, and expanded access to healthcare infrastructure

- This growth is driven by factors such as rising surgical procedures across the region and rising surgical volume and demand for faster post-operative recovery.

Asia-Pacific Surgical Sealants and Adhesive Market Analysis

- The Asia-Pacific surgical sealants and adhesives market is witnessing robust growth, fueled by the increasing volume of surgeries, rising healthcare expenditures, and the growing focus on minimally invasive procedures. As patient outcomes and reduced recovery time gain importance, the adoption of effective wound closure materials is expanding rapidly.

- Technological advancements are enhancing the performance of surgical adhesives by improving their biocompatibility, adhesion strength, and biodegradability. Innovations like polyethylene glycol (PEG)-based sealants and fibrin glues are being widely adopted for internal and external surgical applications.

- Major countries in the region—including China, Japan, India, and South Korea—are investing in healthcare infrastructure and expanding their surgical facilities, leading to increased demand for advanced hemostatic agents and surgical sealants.

- For instance, in January 2024, India's Health Ministry announced an initiative to upgrade 157 district hospitals with advanced surgical care units under the PM-Ayushman Bharat Health Infrastructure Mission. This move is expected to drive demand for high-performance surgical adhesives used in wound management and post-operative care.

Report Scope and Surgical Sealants and Adhesive Market Segmentation

|

Attributes |

Surgical Sealants and Adhesive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Surgical Sealants and Adhesive Market Trends

“Surge in Minimally Invasive and Laparoscopic Surgeries Driving Demand for Advanced Adhesive Solutions ”

- A major trend in the Asia-Pacific surgical sealants and adhesives market is the growing preference for minimally invasive and laparoscopic surgeries, which require precise, fast-acting, and biocompatible adhesive solutions for optimal healing and reduced recovery time.

- There is increasing adoption of synthetic sealants, such as polyethylene glycol (PEG)-based and cyanoacrylate-based adhesives, which offer strong adhesion and controlled degradation, making them suitable for complex procedures.

- Bio-based sealants such as fibrin and collagen-based products are gaining popularity due to their excellent biocompatibility and natural healing support.

- For instance, in September 2023, Japan-based Terumo Corporation introduced a new PEG-based surgical sealant for cardiovascular surgeries, claiming faster sealing and reduced post-operative complications. The product launch reflects the region's push for innovative wound closure technologies aligned with the demand for safer and quicker surgical outcomes.

Surgical Sealants and Adhesive Market Dynamics

Driver

“Rising Surgical Volume and Demand for Faster Post-Operative Recovery ”

- A key factor shaping the Asia-Pacific Surgical Sealants and Adhesives market is the significant rise in surgical procedures across the region, driven by aging populations, increasing lifestyle diseases, and expanded access to healthcare infrastructure

- With more patients undergoing complex surgeries, there is growing demand for advanced wound closure solutions like surgical sealants and adhesives that reduce the need for sutures, minimize trauma, and enhance healing

- Hospitals and surgical centers are increasingly prioritizing enhanced recovery protocols (ERPs) to reduce hospital stays, improve patient outcomes, and lower healthcare costs—creating higher demand for fast-acting and efficient sealant technologies

- Post-operative complications such as infections, bleeding, and tissue adhesion are being tackled through innovative bio-based and synthetic adhesives, which support quicker recovery and reduce readmission rates

- For instance, In April 2023, Baxter International announced the expansion of its sealant product line in Asia, including fibrin sealants aimed at supporting cardiovascular and spinal surgeries, as part of its regional growth strategy.

Opportunity

“Rising Investments in Healthcare Infrastructure and Medical Technology ”

- Governments across the Asia-Pacific region are significantly increasing investment in healthcare infrastructure, particularly in emerging markets such as India, Vietnam, and Indonesia, to enhance access to surgical care.

- Expansion of public and private hospitals is driving the adoption of advanced surgical technologies, including sealants and adhesives for improved outcomes and efficiency.

- Medical tourism is on the rise in APAC, especially in countries like Thailand and Malaysia, leading to a growing demand for innovative surgical solutions to ensure faster recovery and patient satisfaction.

- Supportive government initiatives, such as India’s Production Linked Incentive (PLI) scheme for medical devices, are encouraging Asia Pacific and local players to invest in manufacturing surgical adhesives within the region.

- For instance, In May 2023, B. Braun Medical Industries Sdn Bhd announced plans to expand its operations in Penang, Malaysia. The expansion includes enlarging production lines, introducing new product portfolios, and strengthening automation to meet the evolving needs of the healthcare industry.

Restraint/Challenge

“Stringent Regulatory Pathways and Approval Delays ”

- Regulatory approvals for surgical sealants and adhesives in many APAC countries are time-consuming due to varying local guidelines, causing delays in market entry for new and innovative products.

- Companies must navigate country-specific requirements for clinical trials and safety documentation, which can increase both time and cost.

- The absence of harmonized regulatory frameworks across countries like India, Indonesia, and the Philippines makes cross-border product launches more complex.

- These challenges often discourage smaller players from entering the APAC market or scaling up operations quickly.

- For instance, The Asia Pacific Medical Technology Association (APACMed) actively advocates for harmonized regulatory requirements across Asia-Pacific countries to streamline approval processes and facilitate quicker access to medical innovations.

Surgical Sealants and Adhesive Market Scope

The market is segmented on the basis of product, indication, application, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Indication |

|

|

By Application |

|

|

By End User |

|

|

By Distribution Channel |

|

Surgical Sealants and Adhesive Market Regional Analysis

“Japan is the Dominant Country in the Surgical Sealants and Adhesive Market”

- Japan leads the Asia-Pacific surgical sealants and adhesives market, driven by advanced healthcare infrastructure, a strong presence of medical technology companies, and a high demand for surgical adhesives in surgeries such as orthopedics, cardiac, and general surgery.

- The country’s well-established healthcare system, focused on cutting-edge technology and high-quality care, supports the increased usage of surgical sealants and adhesives to reduce post-operative complications and enhance recovery.

- Japan is home to some of the world’s leading medical device manufacturers, such as Terumo Corporation and JACE, which are innovating in the surgical adhesive space.

- Japan’s aging population, along with the government’s emphasis on healthcare innovation and patient recovery, contributes to its dominance in the market.

“China is Projected to Register the Highest Growth Rate”

- China is expected to experience the highest growth rate in the Asia-Pacific surgical sealants and adhesives market due to the country’s expanding healthcare infrastructure and rising surgical procedures across various specialties.

- The Chinese government’s investment in healthcare modernization, coupled with the rapid increase in healthcare expenditure, is supporting the demand for advanced surgical sealants and adhesives.

- Rising awareness of minimally invasive procedures, paired with the growing aging population, is fueling the demand for innovative surgical solutions in China.

Surgical Sealants and Adhesive Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Johnson & Johnson (U.S.)

- Artivion Inc (U.S.)

- BD (U.S.)

- Medtronic PLC (Ireland)

- B. Braun (Germany)

- Mallinckrodt PLC Ordinary Shares - New (U.K.)

- Cardinal Health Inc (U.S.)

- Baxter International Inc (U.S.)

- Integra Lifesciences Holdings Corp (U.S.)

- Stryker Corp (U.S.)

- CryoLife (U.S.)

- Baxter (U.S.)

- BD (U.S.)

- B. Braun Melsungen AG (Germany)

- Vivostat A/S (Denmark)

Latest Developments in Asia Pacific Surgical Sealants and Adhesive Market

- In February 2022, Arkema announced plans to acquire Shanghai Zhiguan Polymer Materials, a Chinese company that produced adhesives and sealants.

- 3M introduced a new line of sustainable construction adhesives, backed by a USD 280 million investment in research and development centers across Singapore and Shanghai. This initiative aligns with the industry's shift towards environmentally friendly products and positions 3M as a leader in sustainable adhesive solutions in the Asia-Pacific market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Surgical Sealants Adhesives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Surgical Sealants Adhesives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Surgical Sealants Adhesives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.