Asia Pacific Swabs Collection Kits Market

Market Size in USD Million

CAGR :

%

USD

351.84 Million

USD

782.06 Million

2025

2033

USD

351.84 Million

USD

782.06 Million

2025

2033

| 2026 –2033 | |

| USD 351.84 Million | |

| USD 782.06 Million | |

|

|

|

|

Asia-Pacific Swabs Collection Kits Market Size

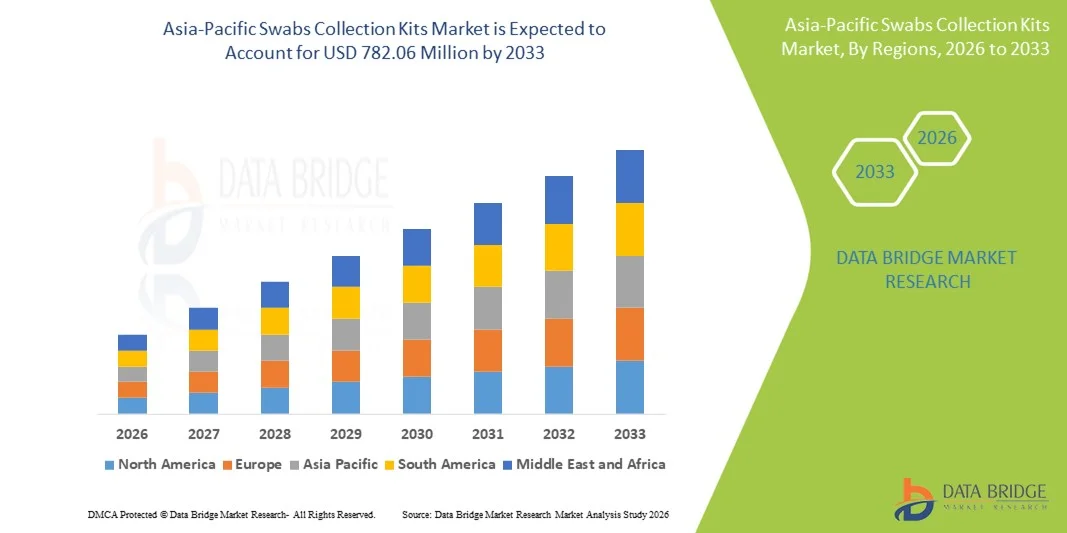

- The Asia-Pacific swabs collection kits market size was valued at USD 351.84 million in 2025 and is expected to reach USD 782.06 million by 2033, at a CAGR of 10.5% during the forecast period

- The market growth is largely driven by expanding healthcare infrastructure, rising awareness of early disease diagnosis, and increased investment in diagnostic and laboratory technologies, which are enhancing demand for accurate and reliable sample collection tools

- Furthermore, government initiatives for infectious disease surveillance, growing adoption of advanced swab materials, and increasing use of swab kits in clinical and home healthcare settings are positioning swabs collection kits as essential diagnostic consumables across healthcare ecosystems, thereby significantly boosting industry expansion

Asia-Pacific Swabs Collection Kits Market Analysis

- Swabs collection kits, used for accurate clinical sample collection from nasal, throat, and oral specimens, are increasingly vital in modern diagnostics, laboratories, and infectious disease surveillance due to their reliability, ease of use, and compatibility with automated testing systems

- The growing demand is primarily driven by rising awareness of early disease detection, expanding healthcare infrastructure, and the surge in home-based and point-of-care testing

- China dominated the Asia-Pacific market with the largest revenue share of 36.5% in 2025, supported by its massive population, government-led infectious disease monitoring programs, and rapid adoption of advanced diagnostic technologies in hospitals and labs

- India is expected to be the fastest-growing country in the market due to increasing healthcare spending, urbanization, rising disposable incomes, and expanded access to diagnostic services in both urban and rural regions

- The nasopharyngeal segment dominated the Asia-Pacific market in 2025, with a market share of 42.7%, owing to its proven reliability in viral and bacterial testing and broad compatibility with molecular and antigen-based diagnostic assays

Report Scope and Asia-Pacific Swabs Collection Kits Market Segmentation

|

Attributes |

Asia-Pacific Swabs Collection Kits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Swabs Collection Kits Market Trends

Advancements in Rapid Testing and Automation

- A key and accelerating trend in the Asia-Pacific swabs collection kits market is the increasing integration with rapid diagnostic testing platforms and automated laboratory systems, enhancing the speed, accuracy, and efficiency of sample collection and processing

- For instance, nasopharyngeal swab kits compatible with automated RT-PCR systems can directly interface with lab analyzers, reducing manual handling and turnaround time for diagnostic results

- Automation integration in swabs kits allows features such as barcoded sample tracking, real-time error alerts, and optimized workflow routing, improving overall diagnostic reliability. For instance, some Copan and Puritan swabs kits now support robotic processing and lab information system integration

- The seamless integration of swabs collection kits with laboratory automation facilitates centralized sample management and streamlined testing workflows, allowing technicians to process larger volumes of samples with reduced human error

- This trend toward faster, more reliable, and integrated swabs collection solutions is fundamentally transforming laboratory operations and expectations for sample quality. Consequently, companies such as BD and Thermo Fisher are developing kits with automation-friendly designs and enhanced sample stability

- The demand for swabs collection kits that support rapid testing and automation is growing strongly across hospitals, diagnostic labs, and home testing services as healthcare providers prioritize efficiency and reliable sample handling

- Increasing adoption of multi-purpose swabs kits compatible with multiple sample types, such as saliva and throat swabs, is enhancing flexibility and reducing inventory requirements for healthcare facilities

Asia-Pacific Swabs Collection Kits Market Dynamics

Driver

Rising Demand Due to Increased Testing and Healthcare Awareness

- The growing need for accurate diagnostic testing, coupled with rising healthcare awareness and proactive disease management, is a significant driver for the expansion of the swabs collection kits market

- For instance, in March 2025, Copan Diagnostics launched advanced swabs kits designed for mass testing campaigns, aiming to improve throughput and sample accuracy

- As governments and healthcare providers expand infectious disease surveillance and routine testing programs, swabs collection kits enable faster detection and containment of illnesses, enhancing public health outcomes

- Furthermore, the proliferation of home-based testing, point-of-care diagnostics, and large-scale clinical testing is making swabs collection kits an essential tool in healthcare operations

- Ease of use, compatibility with multiple assay types, and growing availability of user-friendly kits are key factors propelling adoption in hospitals, labs, and community health initiatives

- For instance, rising awareness of early disease detection in countries such as India and China is driving higher adoption of swabs kits in schools, workplaces, and community health center

- Integration of swabs kits with digital health apps and telemedicine platforms is enabling remote diagnostics and patient monitoring, further boosting market demand

- Growing investment by governments and private players in diagnostic infrastructure is accelerating swabs collection kit deployment, especially in urban and semi-urban regions

Restraint/Challenge

Supply Chain Limitations and Quality Assurance Hurdles

- Concerns surrounding the consistent quality of swabs kits and the availability of raw materials pose a notable challenge to market expansion, particularly during periods of high demand

- For instance, delays in procuring sterile flocked swabs or transport media can disrupt testing programs, limiting timely sample collection

- Ensuring strict compliance with regulatory standards and quality certifications is essential for manufacturers to maintain trust and acceptance in healthcare markets. For instance, companies such as Puritan and Copan emphasize ISO-certified production and batch testing to reassure buyers

- High costs for advanced swabs kits, especially those designed for automated or high-throughput testing, can be a barrier to adoption for budget-conscious labs and clinics in developing countries

- Overcoming these challenges through strengthened supply chains, consistent quality assurance, and affordable yet reliable kit options will be vital for sustained growth across the Asia-Pacific region

- For instance, shortages of transport media during peak outbreak periods can temporarily limit kit availability, impacting testing efficiency and revenue growth

- Variability in regulatory approvals across Asia-Pacific countries can delay market entry for new products, increasing operational costs and slowing expansion

- Dependence on imported raw materials for swab production in certain countries exposes manufacturers to price fluctuations and geopolitical risks, potentially affecting supply and affordability

Asia-Pacific Swabs Collection Kits Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Type

On the basis of type, the Asia-Pacific swabs collection kits market is segmented into nasopharyngeal, oropharyngeal, and nares. The nasopharyngeal swabs segment dominated the market with the largest revenue share of 42.7% in 2025, driven by its high sensitivity and accuracy for viral and bacterial diagnostics. Nasopharyngeal swabs are widely used in hospitals and diagnostic labs for respiratory infections, including COVID-19, influenza, and other pathogens. They are compatible with PCR and antigen-based testing, making them a preferred choice for laboratories and field testing. The segment also benefits from established regulatory approvals and broad clinician familiarity. Increasing demand for mass testing programs and centralized lab workflows further supports nasopharyngeal swab adoption. Their proven reliability in sample collection ensures consistent diagnostic outcomes across healthcare facilities, strengthening their market dominance.

The nares swabs segment is expected to witness the fastest growth rate of 19.8% from 2026 to 2033, fueled by increasing use in self-testing and home-based diagnostics. Nares swabs are minimally invasive and more comfortable for patients, encouraging repeat testing and large-scale screening programs. They are compatible with rapid antigen kits and mobile diagnostic platforms, making them popular in schools, workplaces, and rural healthcare settings. Growing consumer awareness of early detection and increasing telemedicine adoption also drive nares swab usage. Companies are developing user-friendly kits specifically designed for home collection. The flexibility and convenience of nares swabs are key factors propelling their rapid adoption in the Asia-Pacific region.

- By Configuration

On the basis of configuration, the market is segmented into regular swab, flocked swab, and others. The flocked swabs segment dominated the market with 47.5% revenue share in 2025, driven by superior sample collection efficiency, enhanced release of biological material, and reduced patient discomfort. Flocked swabs are extensively used in molecular diagnostics, particularly in PCR and antigen-based assays, and are preferred in both clinical laboratories and home testing kits. Their compatibility with automation and barcoding systems further strengthens adoption in high-throughput testing. Flocked swabs are also highly regulated and approved across key Asia-Pacific countries, ensuring quality and reliability. Growing hospital and laboratory testing volumes support continued demand. The widespread use of flocked swabs in infectious disease testing reinforces their dominant market position.

The regular swabs segment is anticipated to witness the fastest CAGR of 18.6% from 2026 to 2033, owing to lower production costs and broad availability across healthcare settings. Regular swabs are widely used in rural hospitals, primary care clinics, and educational institutions for routine diagnostic screening. Their cost-effectiveness and accessibility make them ideal for mass testing campaigns in developing countries. Technological improvements in sterility and sample retention enhance their performance. Manufacturers are increasingly focusing on affordable kits to expand reach. The convenience and familiarity of regular swabs are accelerating their adoption.

- By Tip Material

On the basis of tip material, the market is segmented into rayon, polyester, nylon, foam, cotton, calcium alginate, and others. The nylon tip swabs segment dominated the market with 38.9% share in 2025, due to its high sample recovery efficiency, compatibility with nucleic acid testing, and low interference in molecular assays. Nylon tips are preferred in PCR testing and automated lab workflows for their consistency and regulatory compliance. The segment is supported by widespread hospital adoption and clinical trust. Increasing testing volumes for infectious diseases further strengthen its dominance. The segment also benefits from integration with automated and high-throughput laboratory instruments. Manufacturers focus on precision and reproducibility to maintain reliability in critical diagnostics.

The foam tip swabs segment is expected to witness the fastest CAGR of 20.1% from 2026 to 2033, driven by increasing use in viral transport systems, home testing kits, and pediatric sample collection. Foam swabs are gentle on tissues, reducing discomfort and improving patient compliance. They are compatible with PCR, antigen, and culture-based assays, increasing versatility. Rising awareness of home diagnostics drives foam swab adoption in Asia-Pacific. New kit designs improve sample preservation during transport. Companies are innovating foam swabs for both professional and consumer applications. The comfort, flexibility, and multi-use capabilities accelerate their rapid growth.

- By Shaft

On the basis of shaft, the market is segmented into plastic shafts, aluminum, wooden shafts, resins, and others. The plastic shaft segment dominated the market with a revenue share of 51.2% in 2025, owing to its low cost, lightweight nature, and compatibility with automated laboratory instruments. Plastic shafts are widely used in hospitals, diagnostic labs, and mass testing campaigns. They are durable and meet regulatory standards across multiple countries. The segment benefits from high availability and manufacturing scalability. Large-scale procurement by government and private labs supports dominance. The convenience of single-use plastic shafts reduces cross-contamination risks and supports workflow efficiency.

The resin shaft segment is expected to witness the fastest growth rate of 17.9% from 2026 to 2033, driven by its durability, chemical resistance, and compatibility with specialized applications such as molecular diagnostics and automated processing. Resin shafts are increasingly used in high-end diagnostic kits and research applications. They provide stability for transportation and handling. Manufacturers are adopting resin shafts for precision applications. Growing adoption in automated laboratories accelerates demand. Innovation in lightweight and cost-efficient resin shafts supports expansion. The segment benefits from increasing testing volumes in clinical and research settings.

- By Specimen

On the basis of specimen type, the market is segmented into throat swab, vaginal swab, penile meatal swab, rectal swab, and others. The throat swab specimen segment dominated the market with 44.6% revenue share in 2025, due to its routine use in microbiological and molecular diagnostics for respiratory and bacterial infections. Throat swabs are employed in hospitals, diagnostic labs, and school health programs. They provide high accuracy and are compatible with PCR, antigen, and culture-based tests. Established regulatory approvals and clinician familiarity support dominance. Large-scale respiratory testing campaigns drive consistent demand. The segment benefits from integration with automated lab systems and barcoding for efficiency.

The vaginal swab specimen segment is expected to witness the fastest CAGR of 21.2% from 2026 to 2033, fueled by increasing gynecological screening programs, rising awareness of STIs, and adoption of self-testing kits. Vaginal swabs are critical in reproductive health diagnostics and preventive care. They are increasingly used in home-testing applications for convenience and privacy. Innovation in kit design enhances patient comfort and sample preservation. Manufacturers are expanding capacity to meet growing demand. Adoption in hospitals, clinics, and research institutes accelerates growth. Regulatory approvals and ease of use support market expansion.

- By Application

On the basis of application, the market is segmented into pharmaceutical, microbiological, laboratory, and disinfection. The laboratory segment dominated the market with 46.8% revenue share in 2025, driven by the high demand for molecular testing, PCR diagnostics, and high-throughput sample processing. Laboratories prefer swabs that are compatible with automation and barcoding systems. High testing volumes across hospitals and central labs support dominance. Compliance with ISO and quality standards further strengthens adoption. Integration with laboratory information systems enhances workflow efficiency. Laboratory applications drive innovation and investment in premium swab kits.

The pharmaceutical segment is expected to witness the fastest CAGR of 19.5% from 2026 to 2033, fueled by increasing use of swabs in drug development, clinical trials, and quality control testing. Pharmaceutical applications require sterile, reproducible, and contamination-free swabs. Growth in biopharmaceutical R&D in Asia-Pacific boosts segment expansion. Companies develop specialized swabs to meet strict regulatory guidelines. Rising investment in clinical trials accelerates adoption. Compatibility with automated lab workflows supports high-throughput testing. The need for precise and reliable sampling drives continued growth.

- By End User

On the basis of end user, the market is segmented into diagnostic laboratories, hospitals & clinics, research & academic institutes, home healthcare, and others. The diagnostic laboratories segment dominated the market with 42.3% revenue share in 2025, due to centralized high-volume testing, automation adoption, and regulatory compliance requirements. Labs require high-quality swabs for accurate and reproducible results. Established lab networks and government testing programs support dominance. Large-scale procurement ensures supply reliability. Compatibility with multiple assay types strengthens adoption. Continuous testing programs in hospitals and clinics drive sustained demand.

The home healthcare segment is expected to witness the fastest CAGR of 22.0% from 2026 to 2033, driven by rising adoption of self-testing kits, telemedicine, and awareness of home-based diagnostics. Convenience, minimal invasiveness, and rapid results boost adoption. Online retail channels accelerate market penetration. Integration with smartphone apps and telehealth services enhances usability. Government initiatives promoting home diagnostics support growth. Rising awareness of early disease detection increases adoption. Manufacturers focus on user-friendly kits designed for patient compliance.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market with 48.7% revenue share in 2025, driven by bulk procurement by hospitals, laboratories, and government programs. Direct tender ensures reliable supply, regulatory compliance, and standardized kit quality. Large-scale testing campaigns rely on direct tender procurement. Partnerships with governments and healthcare providers strengthen market position. Repeat orders for high-volume testing maintain dominance. Integration with public health programs accelerates adoption.

The retail sales segment is expected to witness the fastest CAGR of 20.8% from 2026 to 2033, fueled by growing demand for home testing kits, pharmacy sales, and online platforms offering swabs kits for personal use. Convenience, accessibility, and awareness drive retail growth. Adoption in urban and semi-urban households is increasing. Online retail platforms expand reach to remote areas. Self-testing trends and telehealth integration accelerate adoption. Manufacturers are focusing on affordable, ready-to-use kits. Consumer preference for convenient testing solutions drives segment expansion.

Asia-Pacific Swabs Collection Kits Market Regional Analysis

- China dominated the Asia-Pacific market with the largest revenue share of 36.5% in 2025, supported by its massive population, government-led infectious disease monitoring programs, and rapid adoption of advanced diagnostic technologies in hospitals and labs

- Healthcare providers and laboratories in the region prioritize swabs collection kits for their reliability, compatibility with PCR and antigen-based testing, and ability to support large-scale testing programs efficiently

- The widespread adoption is further supported by a massive patient population, rapid urbanization, and growing awareness of early disease detection, establishing swabs collection kits as essential tools for clinical diagnostics and public health management

The China Swabs Collection Kits Market Insight

The China swabs collection kits market captured the largest revenue share of 36.5% in 2025, driven by the country’s extensive healthcare infrastructure, government-led infectious disease surveillance programs, and large-scale diagnostic testing initiatives. Hospitals, diagnostic laboratories, and community health centers are increasingly adopting swabs kits for PCR, antigen, and culture-based testing. Rising awareness of early disease detection and rapid urbanization further contribute to market growth. The country’s robust manufacturing base for diagnostic consumables also ensures affordability and widespread accessibility. Furthermore, increasing integration with automated lab systems and high-throughput workflows is enhancing efficiency in sample collection and processing.

India Swabs Collection Kits Market Insight

The India swabs collection kits market is expected to grow at the fastest CAGR during the forecast period, fueled by rapid urbanization, expanding middle-class healthcare access, and rising awareness of preventive diagnostics. Hospitals, clinics, and home healthcare providers are adopting swabs kits for both routine and large-scale testing programs. The proliferation of telemedicine and point-of-care diagnostics is accelerating demand. Government initiatives promoting public health and infectious disease screening further support adoption. Affordable, user-friendly kits are encouraging home-based and self-testing. Increasing investment in diagnostic laboratories across urban and semi-urban regions continues to drive growth.

Japan Swabs Collection Kits Market Insight

The Japan swabs collection kits market is gaining momentum due to the country’s advanced healthcare system, high standards of clinical diagnostics, and widespread adoption of molecular testing technologies. Diagnostic laboratories and hospitals prioritize high-quality, reliable swabs kits for accurate sample collection in PCR and antigen testing. Automation-friendly and barcoded swabs are increasingly used for high-throughput workflows. Public health programs and routine screening initiatives further boost demand. Growing interest in home-based testing kits complements laboratory adoption. Japan’s focus on precision and safety in healthcare drives steady market expansion.

South Korea Swabs Collection Kits Market Insight

The South Korea swabs collection kits market is expected to expand at a significant CAGR during the forecast period, fueled by rapid adoption of advanced diagnostic technologies and increasing government support for infectious disease monitoring. Hospitals and diagnostic laboratories emphasize high-quality swabs kits for PCR, microbial, and rapid antigen testing. Integration with automated laboratory systems enhances testing efficiency and reliability. Rising awareness of early disease detection drives adoption in clinical and home settings. Domestic manufacturers provide cost-effective solutions, supporting market growth. South Korea’s robust healthcare infrastructure and digital health initiatives further accelerate market expansion.

Asia-Pacific Swabs Collection Kits Market Share

The Asia-Pacific Swabs Collection Kits industry is primarily led by well-established companies, including:

- Puritan Medical Products (U.S.)

- BD (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Copan Diagnostics Inc. (U.S.)

- HiMedia Laboratories (India)

- Titan Biotech Ltd (India)

- VIRCELL S.L. (Spain)

- BTNX Inc. (Canada)

- Lucence Health Inc. (U.S.)

- QuidelOrtho Corporation (U.S.)

- DiaSorin S.p.A (Italy)

- Norgen Biotek Corp. (Canada)

- Hologic Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Hardy Diagnostics (U.S.)

- Medical Wire & Equipment (U.K.)

- BioCat GmbH (Germany)

- Miraclean Technology Co., Ltd. (China)

- Medico Technology Co., Ltd. (China)

- SD Biosensor Inc. (South Korea)

What are the Recent Developments in Asia-Pacific Swabs Collection Kits Market?

- In September 2025, Singapore’s biotech and medical manufacturing sector expanded its custom swab production capabilities to serve regional diagnostic and research needs, with companies in Singapore designing tailored swabs for diverse sample types that are sterile, compatible with PCR/ELISA workflows, and optimized for ergonomic, safe sampling, reflecting growing demand for high-quality swab consumables in APAC diagnostics and research applications

- In June 2025, MGI Tech partnered with Asia Pathogen Genomics Initiative to advance pathogen genomics and strengthen infectious disease detection infrastructure in Asia, indirectly bolstering sample collection capabilities and use of swab kits in public health settings

- In June 2025, a press release reported growth in saliva DNA and swab‑derived collection kits such as the GeneFiX and SaliFix kits, which use swab‑based specimen collection methods demonstrating expanded interest in diverse collection formats in Asia and globally

- In April 2025, Copan Diagnostics launched an AI‑driven self‑sampling nasal swab kit designed for at‑home testing with enhanced digital traceability and integration with telehealth platforms reflecting innovation in decentralized specimen collection that can impact APAC demand and adoption

- In July 2021, Abbott launched the Panbio COVID-19 Antigen Self-Test in India, a nasal swab-based rapid test kit designed for at-home use to detect SARS-CoV-2 in symptomatic and asymptomatic individuals, aligning with India’s health advisory to expand self-collection testing. This release marked a key step in swab-based home testing availability in a major Asia-Pacific market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.