Asia Pacific Sweet Brown Flavor And Extract Market

Market Size in USD Billion

CAGR :

%

USD

1.54 Billion

USD

2.29 Billion

2024

2032

USD

1.54 Billion

USD

2.29 Billion

2024

2032

| 2025 –2032 | |

| USD 1.54 Billion | |

| USD 2.29 Billion | |

|

|

|

|

Asia-Pacific Sweet Brown Flavor and Extract Market Size

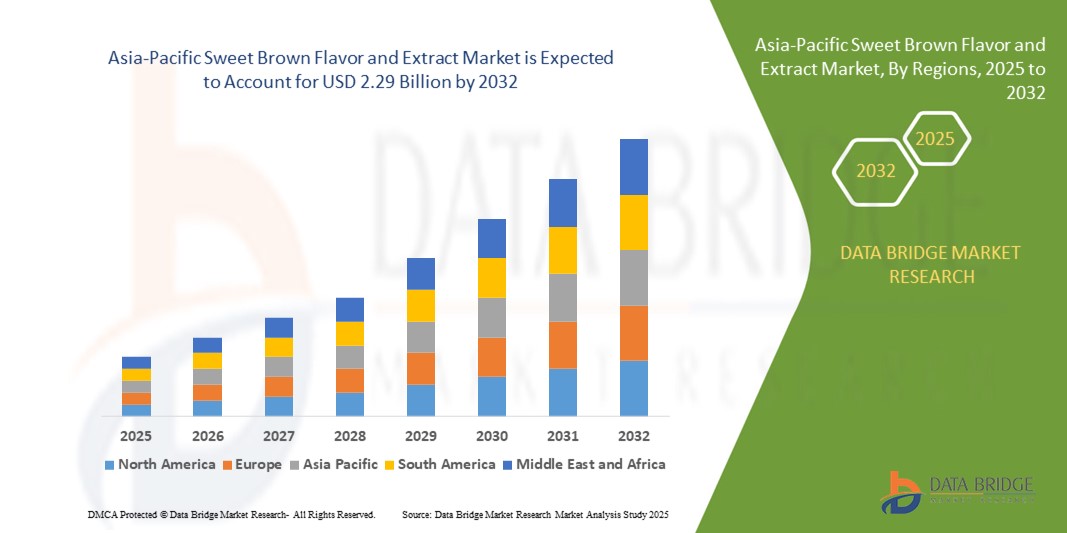

- The Asia-Pacific sweet brown flavor and extract market size was valued at USD 1.54 billion in 2024 and is expected to reach USD 2.29 billion by 2032, at a CAGR of 5.1% during the forecast period

- The market growth is largely fueled by the rising demand for premium, clean-label, and naturally sourced ingredients across the food and beverage industry, particularly within bakery, confectionery, dairy, and beverage segments. This shift toward health-conscious consumption and authentic flavor experiences is propelling the use of sweet brown flavors and extracts globally

- Furthermore, increasing consumer preference for indulgent yet functional food products and the expansion of product offerings by manufacturers into flavored nutraceuticals, baby food, and ready-to-eat snacks are accelerating market adoption. These converging trends are strengthening the role of sweet brown flavors and extracts as essential components in modern food formulations, significantly boosting industry growth

Asia-Pacific Sweet Brown Flavor and Extract Market Analysis

- Sweet brown flavors and extracts include natural and synthetic compounds derived from ingredients such as vanilla, caramel, cocoa, coffee, nuts, and dairy. These are used to impart warm, rich, and sweet profiles in a wide array of food and beverage applications, enhancing both taste and sensory appeal

- The increasing demand for these flavor profiles is primarily driven by their versatility, consumer familiarity, and compatibility with clean-label and health-oriented product positioning across multiple categories including bakery, dairy, beverages, and nutritional products

- Japan dominated the sweet brown flavor and extract market in 2024, due to its well-established food processing industry, high consumer demand for premium bakery and confectionery products, and a strong preference for clean-label and natural ingredients

- India is expected to be the fastest growing country in the sweet brown flavor and extract market during the forecast period due to rapid urbanization, growing middle-class consumption, and rising demand for packaged and bakery foods

- Natural extract segment dominated the market with a market share of 48.1% in 2024, due to shifting consumer preferences toward authenticity, sustainability, and transparency. Brands continue to reformulate using natural-origin flavors to align with regulatory trends and premiumization strategies across the food and beverage sector

Report Scope and Asia-Pacific Sweet Brown Flavor and Extract Market Segmentation

|

Attributes |

Asia-Pacific Sweet Brown Flavor and Extract Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Sweet Brown Flavor and Extract Market Trends

Growing Use of Sweet Brown Flavors in Plant-Based Foods

- The sweet brown flavor and extract market is expanding rapidly as plant-based food manufacturers increasingly incorporate these flavors to enhance the taste profile of meat alternatives, dairy-free products, and confectioneries, replicating caramelized, toasty, and nutty notes

- For instance, companies such as Firmenich, International Flavors & Fragrances (IFF), and Givaudan have developed specialized sweet brown flavor solutions tailored for plant-based proteins, dairy analogs, and vegan desserts, helping brands achieve authentic flavor experiences

- Rising consumer preference for natural flavor profiles combined with texture innovations in plant-based categories is encouraging formulation of clean-label and allergen-friendly sweet brown flavors

- Advances in extraction and encapsulation technologies improve flavor stability and release, enhancing shelf life and sensory characteristics in complex food matrices

- Growing application of sweet brown flavors in beverages, bakery, snacks, and spice blends further diversifies the market usage and spurs innovation around customized blends

- Increased R&D collaboration between flavor houses and food manufacturers drives development of multifunctional sweet brown extracts that also provide color, aroma, and masking agents for off-notes in formulations

Asia-Pacific Sweet Brown Flavor and Extract Market Dynamics

Driver

Rising Demand for Clean-Label Ingredients

- Consumers’ growing focus on health, wellness, and transparency is driving demand for clean-label flavor ingredients, including sweet brown flavors derived from natural, minimally processed sources with clear origin and safety profiles

- For instance, flavor companies such as Sensient Technologies and Symrise supply natural sweet brown flavors made through clean extraction processes that comply with organic, non-GMO, and vegan certification requirements, catering to premium brand portfolios

- Increasing regulatory scrutiny on synthetic additives and artificial flavors encourages food producers to reformulate products with natural flavor extracts that meet clean-label criteria without compromising taste

- Market trends in functional foods and beverages push manufacturers to choose flavor ingredients that align with health-forward narratives, such as low sugar formulations and plant-based authentication

- Social media and influencer marketing amplify consumer demand for ingredients perceived as wholesome and authentic, accelerating adoption of specialty sweet brown flavors in diverse product lines

Restraint/Challenge

Side Effects Associated with Synthetic Flavor

- Concerns regarding potential health side effects and allergenic reactions associated with some synthetic flavor compounds pose challenges for the wider acceptance of certain sweet brown flavor formulations

- For instance, consumer backlash against synthetic caramel colors and flavor enhancers has forced companies such as McCormick & Company and Kerry Group to emphasize natural flavor development and transparent labeling to maintain consumer trust

- Regulatory restrictions around maximum allowable limits for synthetic flavor constituents require ongoing reformulation and compliance monitoring, increasing product development costs and timelines

- Negative impact on brand reputation due to adverse consumer perceptions creates pressure on manufacturers to invest in safer, naturally derived alternatives without compromising flavor profile or cost

- Variability in sensory performance and shelf stability between synthetic and natural flavor forms further complicates product formulation and acceptance challenges in highly competitive food sectors

Asia-Pacific Sweet Brown Flavor and Extract Market Scope

The market is segmented on the basis of product type, type, origin, category, solubility, form, and application.

- By Product Type

On the basis of product type, the market is segmented into natural extract and flavor. The natural extract segment accounted for the largest revenue share in 2024, driven by growing consumer inclination toward clean-label and plant-based ingredients. The demand for natural sweet brown extracts is particularly strong in premium bakery, chocolate, and dairy formulations, where authenticity and traceability are critical. Regulatory support for natural labeling and heightened awareness about synthetic ingredient avoidance are further solidifying the segment’s dominance.

The flavor segment is expected to record the fastest growth rate from 2025 to 2032, owing to its versatility, cost-effectiveness, and ability to replicate complex flavor notes. This growth is supported by food manufacturers seeking scalable flavor solutions with consistent sensory profiles, especially in nutraceuticals, beverages, and functional food categories.

- By Type

On the basis of type, the market is segmented into vanilla, cocoa/chocolate, caramels, dairy, nuts, coffee, desserts/pastry, and functional solutions. The vanilla segment held the largest revenue share in 2024 due to its wide applicability across multiple product categories and its perception as a timeless and universally liked flavor. Vanilla remains a key base note in both sweet and complex formulations, with rising demand in dairy, chocolate, and beverages enhancing its dominance.

The functional solutions segment is projected to witness the highest growth rate during 2025–2032, driven by increasing demand for flavor systems that also offer technical benefits such as masking, stability in high-temperature processing, or enhancement of nutritional profiles. These solutions are gaining traction in health-oriented foods and alternative dairy products, supporting both innovation and label-friendly claims.

- By Origin

On the basis of origin, the market is divided into natural, nature-identical compounds (NI), and artificial. The natural segment dominated the market with a share of 48.1% in 2024, favored by shifting consumer preferences toward authenticity, sustainability, and transparency. Brands continue to reformulate using natural-origin flavors to align with regulatory trends and premiumization strategies across the food and beverage sector.

The nature-identical compounds segment is forecasted to grow at the fastest CAGR through 2032, benefiting from their balance of cost-efficiency and structural similarity to naturally occurring flavors. These compounds offer manufacturers consistent supply, quality control, and long-term stability, especially useful in confectionery and nutraceutical applications.

- By Category

On the basis of category, the market is segmented into green label, heat stable, regular, non-allergenic, and others. The heat stable segment led the market in 2024, driven by high demand from baking, chocolate, and UHT beverage industries that require flavor integrity during thermal processing. Heat stability ensures consistent flavor performance across shelf-life, making it critical for manufacturers of long-storage goods.

The green label segment is projected to exhibit the fastest growth over the forecast period, fueled by consumer awareness around clean-label ingredients and rising adoption in baby food, cereal, and plant-based categories. Green label flavors that meet strict natural, allergen-free, and additive-free standards are increasingly being used to position products as healthy and transparent.

- By Solubility

On the basis of solubility, the market is categorized into water, oil, fats, and others. Water-soluble flavors dominated the market share in 2024 due to their compatibility with a broad range of formulations including beverages, baby food, and dairy. The ease of dispersion, stability in emulsions, and clarity in liquid systems make water-soluble extracts a preferred choice.

The fat-soluble segment is anticipated to grow at the fastest pace from 2025 to 2032, led by the rising consumption of chocolate, nut-based spreads, and fat-rich confectionery items. Fat-soluble extracts provide deeper, lingering flavor notes and are essential in lipid-rich systems requiring high aroma retention.

- By Form

On the basis of form, the market is segmented into liquid, powder, and syrup. The liquid form accounted for the largest revenue share in 2024, supported by its easy integration in high-volume processing lines, especially in dairy and beverages. Liquid extracts provide accurate dosing, fast dispersion, and excellent flavor release, making them ideal for industrial-scale use.

Powdered extracts are projected to grow the fastest from 2025 to 2032, driven by demand for dry mixes, instant beverages, and bakery premixes. Their extended shelf life, lightweight nature, and stability under varied storage conditions position them well for e-commerce and global distribution models.

- By Application

On the basis of application, the market is segmented into confectionery, bakery, chocolate, dairy, beverages, nutraceutical, baby food, cereal, and others. The bakery segment dominated the market share in 2024 due to the extensive use of vanilla, caramel, and nut flavors in breads, cakes, and pastries. Demand is propelled by artisanal and premiumization trends in baked goods globally.

The nutraceutical segment is expected to register the fastest CAGR from 2025 to 2032, as health and wellness products increasingly incorporate sweet brown flavors to enhance palatability without synthetic additives. The incorporation of functional yet indulgent flavors in protein bars, gummies, and supplements is driving innovation and rapid expansion in this segment.

Asia-Pacific Sweet Brown Flavor and Extract Market Regional Analysis

- Japan dominated the sweet brown flavor and extract market with the largest revenue share in 2024, driven by its well-established food processing industry, high consumer demand for premium bakery and confectionery products, and a strong preference for clean-label and natural ingredients

- The country’s advanced regulatory frameworks around food safety and flavor use, combined with deep-rooted cultural appreciation for nuanced flavor profiles such as caramel, vanilla, and nut-based extracts, continue to reinforce Japan’s leadership in the market

- Japan’s mature retail landscape, widespread consumption of convenience foods, and continuous innovation by domestic flavor houses and multinational F&B players support sustained market growth and product diversification

India Sweet Brown Flavor and Extract Market Insight

India is expected to register the fastest CAGR in the Asia-Pacific market from 2025 to 2032, fueled by rapid urbanization, growing middle-class consumption, and rising demand for packaged and bakery foods. The shift toward premium, Western-style confectionery and rising awareness of natural and functional ingredients are stimulating new flavor development. Expanding foodservice chains and investments in food processing infrastructure are further enhancing the demand for scalable, shelf-stable, and locally adaptable sweet brown flavor solutions.

China Sweet Brown Flavor and Extract Market Insight

China's sweet brown flavor and extract market is witnessing strong momentum, backed by evolving consumer tastes, increasing bakery consumption, and rising demand for flavored dairy and beverage products. The integration of sweet brown flavors in domestic snack innovations and the preference for indulgent-yet-functional flavor combinations are accelerating adoption. China's large-scale production capacity, growing e-commerce distribution, and presence of major flavor manufacturers are solidifying its role as a key production and consumption hub in the region.

Asia-Pacific Sweet Brown Flavor and Extract Market Share

The sweet brown flavor and extract industry is primarily led by well-established companies, including:

- Takasago International Corporation (Japan)

- Kerry Group plc. (Ireland)

- Cargill, Incorporated (U.S.)

- Firmenich SA (Switzerland)

- ADM (U.S.)

- Givaudan (Switzerland)

- MANE (France)

- Döhler GmbH (Germany)

- PROVA (France)

- Sensient Technologies Corporation (U.S.)

- TASTE MASTER FLAVOURS PVT LTD (India)

- San-Ei Gen F.F.I., Inc. (Japan)

- Golden Kelly Pat. Flavor Co., Ltd. (China)

- Keva Flavours Pvt. Ltd. (India)

Latest Developments in Asia-Pacific Sweet Brown Flavor and Extract Market

- In November 2023, Cargill, Incorporated introduced the inaugural Cocoa Development Center in Gresik, Indonesia, aiming to drive innovation aligned with changing consumer tastes in Asia. Positioned as a strategic venture in the fourth-largest cocoa-producing nation globally, the center streamlines small-scale product development. It serves as a platform for collaboratively preparing personalized cocoa recipes. This move enhances its worldwide proficiency in sustainable cocoa solutions, inviting customers to engage in collaborative endeavors for pioneering innovations

- In May 2023, Firmenich SA merged with DSM to form DSM-Firmenich AG, a leading innovation partner in nutrition, health, and beauty. The finalized merger followed the fulfillment of customary conditions and the share exchange offer. Firmenich directors have resigned, and Jane Sinclair, Geraldine Matchett, and Dimitiri de Vreeze have been appointed to the new board. The completion solidified the strategic alliance in pursuing advancements in various sectors

- In November 2022, Takasago International Corporation announced that it had been selected by the New Energy and Industrial Technology Development Organization (NEDO) to participate in the "Development of BioProduction Technology to Accelerate the Realization of Carbon Recycling" project. Under Vision 2040, "Care for People, Respect the Environment. This helped the organization develop a market image

- In September 2022, ADM expanded its global nutrition capabilities with a new flavor production facility in Pinghu, China. The 27,000+ square meter facility, strategically located near Shanghai, boasts advanced dosing technology and labs dedicated to flavor production. The Pinghu facility is part of the company's broader growth investments in its global Nutrition business, including acquisitions and stake holdings in the Asia-Pacific region. This helped the company to become a premier global nutrition company, enhancing its ability to meet customer demands for healthy and delicious foods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Sweet Brown Flavor And Extract Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Sweet Brown Flavor And Extract Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Sweet Brown Flavor And Extract Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.