Asia Pacific Tank Insulation Market

Market Size in USD Billion

CAGR :

%

USD

1.32 Billion

USD

1.95 Billion

2024

2032

USD

1.32 Billion

USD

1.95 Billion

2024

2032

| 2025 –2032 | |

| USD 1.32 Billion | |

| USD 1.95 Billion | |

|

|

|

|

Tank Insulation Market Size

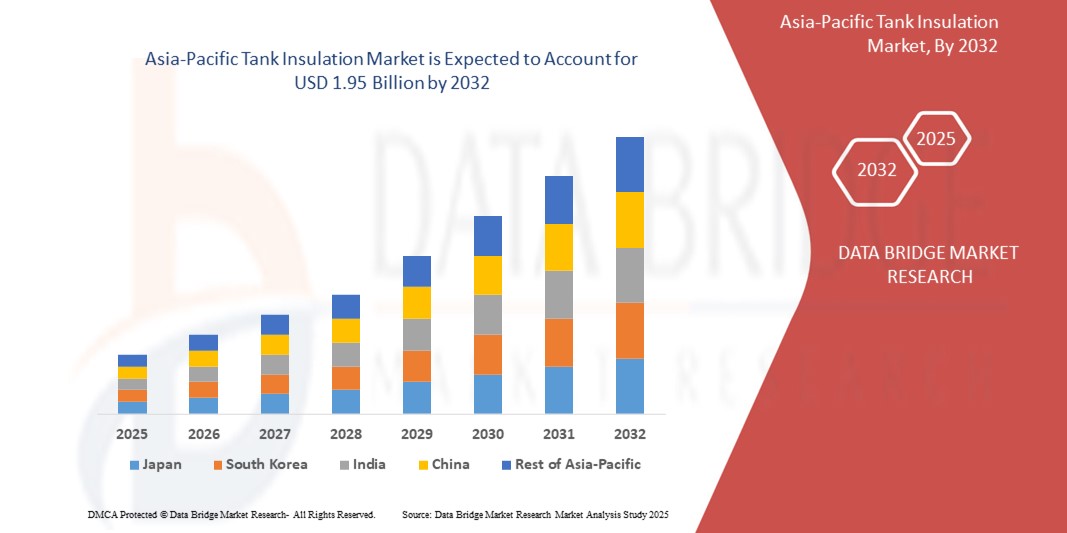

- The Asia Pacific Tank Insulation market size was valued at USD 1.32 billion in 2024 and is expected to reach USD 1.95 billion by 2032, at a CAGR of 5.1% during the forecast period

- The market growth is primarily driven by increasing industrialization, expanding oil & gas and petrochemical sectors, and rising investments in energy-efficient storage and process infrastructure across key economies such as the United States, Canada, and Mexico

- Additionally, growing regulatory focus on thermal efficiency, coupled with the adoption of advanced insulation materials and technologies, is enhancing demand for high-performance tank insulation solutions in both industrial and commercial applications, accelerating overall market expansion

Tank Insulation Market Analysis

- Tank insulation is a process that helps preserve the temperature inside the tank throughout its usage period. Various chemicals and materials are applied inside and on the surface of tanks to minimize heat loss

- Factors such as rising demand from the oil & gas and chemical industries, surging demand for cryogenic insulation, rapid industrialization across Asia Pacific, and growing adoption of renewable insulation materials are fueling the tank insulation market growth

- China dominates the Tank Insulation market in Asia Pacific with the largest revenue share of around 55.65% in 2025, driven by its well-established oil & gas, petrochemical, and power generation sectors. Federal and state government initiatives focused on energy efficiency and environmental sustainability are further boosting demand

- China is also expected to be the fastest-growing country in the Asia Pacific Tank Insulation market during the forecast period, with a projected CAGR of approximately 6.1% from 2025 to 2032. This growth is fueled by expanding LNG infrastructure, cold storage logistics, and increasing investments in sustainable construction and industrial efficiency

- The storage segment dominates the Tank Insulation market, accounting for the largest market revenue share of 63.45% in 2025. This is driven by its widespread application in industrial and utility-based stationary tanks, especially in sectors like oil & gas, chemicals, and food processing, where maintaining consistent temperature and energy efficiency is crucial

Report Scope and Tank Insulation Market Segmentation

|

Attributes |

Tank Insulation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Tank Insulation Market Trends

“Sustainability-Driven Insulation Materials”

- A significant and accelerating trend in the Asia Pacific Tank Insulation market is the increasing shift toward sustainable and eco-friendly insulation materials. Driven by environmental regulations, energy efficiency mandates, and growing corporate ESG commitments, manufacturers and industries are adopting greener alternatives like mineral wool, recycled fiberglass, and bio-based polyurethane

- For instance, ROCKWOOL International A/S promotes its stone wool insulation as a sustainable option with high recyclability and excellent thermal performance, suitable for high-temperature industrial tanks. Similarly, Kingspan offers low-GWP (Global Warming Potential) insulation solutions specifically designed for thermal efficiency and reduced carbon emissions in tank applications

- These sustainable materials not only reduce operational energy consumption but also help meet LEED and other green building certification standards. The use of such materials aligns with the region’s long-term goals of reducing carbon footprints in infrastructure and industrial sectors

- Governments in the GCC, such as the UAE and Saudi Arabia, are emphasizing greener construction practices under national visions like Saudi Vision 2030 and UAE’s Energy Strategy 2050, encouraging adoption of environmentally friendly insulation technologies

- This sustainability-focused shift is prompting R&D investments and product innovation in the tank insulation industry, as companies strive to offer solutions that balance thermal performance with environmental impact

- The growing demand for sustainable insulation solutions is reshaping the competitive landscape, pushing manufacturers to prioritize low-emission, recyclable, and energy-efficient products for both hot and cold tank applications across oil & gas, chemical, and construction industries

Tank Insulation Market Dynamics

Driver

“Rising Demand for Energy Efficiency and Regulatory Compliance”

- The Asia Pacific tank insulation market is being propelled by growing emphasis on energy efficiency, sustainability goals, and evolving regulatory frameworks led by the U.S. Environmental Protection Agency (EPA) and the Department of Energy (DOE).

- For instance, the U.S. Department of Energy’s Better Plants Program is encouraging manufacturers to adopt energy-saving technologies—including advanced thermal insulation—to enhance energy performance and reduce carbon footprints

- States like California and New York have rolled out strict building energy codes and industrial efficiency mandates, prompting widespread adoption of advanced insulation materials in sectors such as oil & gas, petrochemicals, food processing, and chemicals.

- Industrial players are increasingly investing in high-performance tank insulation to cut down energy losses, maintain thermal integrity, and reduce GHG emissions in line with corporate ESG commitments.

- U.S.-based companies like Johns Manville, Dow, and Commercial Thermal Solutions are actively developing next-gen solutions like polyurethane foam, fiberglass, and cellular glass to meet these emerging needs.

- The drive toward net-zero targets and operational cost reductions is encouraging facility owners to upgrade legacy systems with insulation that offers superior thermal resistance, fire safety, and regulatory compliance.

Restraint/Challenge

“High Initial Investment and Limited Skilled Workforce”

- The Asia Pacific tank insulation market is challenged by high upfront costs associated with advanced insulation materials and specialized installation processes, which can pose a hurdle—especially for small and mid-sized enterprises in sectors like chemical processing and food storage

- Premium materials such as polyurethane foam, mineral wool, and cellular glass offer superior performance but come with higher capital expenditure compared to conventional alternatives, often delaying adoption in cost-sensitive or budget-constrained operations

- For example, In 2023, Thermacon Service Company based in Texas, reported rising project delays and budget overruns due to a shortage of certified tank insulation technicians, highlighting the growing impact of skilled labor constraints on project timelines and costs in the U.S. Gulf Coast region

- The shortage of certified technicians and insulation specialists can lead to inconsistent application quality, operational inefficiencies, and even safety risks, undermining the benefits of premium solutions

- Many companies must invest in technical training programs, safety certifications, and experienced contractors to ensure optimal system performance—further inflating project budgets and timelines

- To mitigate this challenge, government-backed workforce development programs, tax incentives, and public-private partnerships focused on skilled labor development are critical to supporting broader industry adoption

Tank Insulation Market Scope

The market is segmented on the basis of type, material type, temperature type, tank type, tank ends and end-user.

- By Type

On the basis of type, the Tank Insulation market is segmented into storage and transportation. The storage segment dominates the largest market revenue share of 63.45% in 2025, driven by the growing demand for stationary thermal insulation in industrial and utility-based tanks. These systems are critical for maintaining temperature stability in large-volume storage tanks across the oil & gas, chemical, and food processing sectors. The need to reduce heat loss and ensure energy efficiency in bulk liquid storage significantly contributes to the dominance of this segment.

The transportation segment is anticipated to witness the fastest CAGR of 6.8% from 2025 to 2032, owing to the increasing logistics of temperature-sensitive materials including LNG, chemicals, and pharmaceuticals. As international trade expands and regulations tighten around thermal control, demand for high-performance tank insulation for mobile containers is accelerating.

- By Material Type

On the basis of material type, the Tank Insulation market is segmented into expanded polystyrene (EPS), rockwool, cellular glass, fiberglass, elastomeric foam, polyurethane (PU), and others. The polyurethane (PU) segment held the largest market revenue share in 2025, driven by its excellent thermal resistance, mechanical strength, and moisture protection. PU foam is widely used in both hot and cold insulation applications due to its high R-value and compatibility with different tank designs.

The elastomeric foam segment is expected to witness the fastest CAGR from 2025 to 2032, due to its flexibility, durability, and strong performance in cold insulation scenarios. With rising demand in pharmaceuticals, food logistics, and LNG storage, elastomeric foam offers advantages in curved or irregular tank surfaces, providing seamless thermal protection and condensation control.

- By Temperature Type

On the basis of temperature type, the Tank Insulation market is segmented into hot insulation and cold insulation. The hot insulation segment dominates the market share in 2025, primarily due to its vital role in energy conservation and personnel protection in power generation, refineries, and chemical plants. Effective hot insulation minimizes energy loss and ensures operational safety in high-temperature systems.

Cold insulation is expected to register the fastest growth from 2025 to 2032, supported by the expanding cold chain logistics and increased use of cryogenic tanks for LNG and industrial gases. Its demand is particularly pronounced in industries requiring strict temperature maintenance and condensation prevention.

- By Tank Type

On the basis of tank type, the Tank Insulation market is segmented into vertical tank, horizontal tank, fixed tank, and mounted tank. Vertical tanks accounted for the largest market revenue share in 2025, largely due to their widespread use in industrial storage of liquids and gases. Their structural efficiency and compatibility with various insulation systems contribute to their strong adoption.

Mounted tanks are projected to witness the highest growth rate from 2025 to 2032, driven by the increasing need for insulated tanks in mobile transport units such as trailers, ships, and special purpose vehicles in logistics and defense sectors.

- By Tank Ends

On the basis of tank ends, the Tank Insulation market is segmented into parabolic dish and flat. The flat segment holds the largest market share in 2025, attributed to the standardization of flat-ended tanks in industrial applications, which simplifies insulation panel installation and maintenance.

The parabolic dish segment is expected to grow at the fastest CAGR through 2032, due to its increasing use in specialized storage systems, particularly in cryogenic and solar thermal energy applications, where enhanced structural integrity and thermal efficiency are crucial.

- By End User

On the basis of end user, the Tank Insulation market is segmented into automotive, construction, marine, power generation, and others. The power generation segment dominates the market in 2025, fueled by the critical need to maintain temperature control in steam systems, fuel tanks, and heat exchangers to improve efficiency and safety.

The marine segment is projected to grow at the fastest CAGR from 2025 to 2032, due to the growing adoption of LNG-powered ships and increasing regulations on energy efficiency and emissions. Insulated marine tanks are essential for fuel handling, ballast water, and cargo systems, driving significant demand.

Tank Insulation Market Regional Analysis

- China dominates the Asia Pacific Tank Insulation market with the largest revenue share of approximately 52.21% in 2024, driven by its extensive oil & gas infrastructure, petrochemical industry, and stringent energy efficiency regulations. Key regions include Texas, Louisiana, and Alberta (Canada)

- The growing number of refineries, chemical plants, and energy storage facilities supports the demand for advanced insulation solutions

- Federal and state government incentives, including tax credits and sustainability mandates, further encourage market growth

- Japan, India, and South Kora also contribute significant growth, driven by LNG export infrastructure expansion and industrial modernization

China Tank Insulation Market Insight

China Tank Insulation market accounted for the largest revenue share of approximately 55.65% in 2025 within the Asia Pacific region. This dominance is fueled by a mature industrial base, including extensive oil & gas, petrochemical, power generation, and chemical sectors. With stringent energy efficiency regulations and federal incentives aimed at reducing carbon emissions, industries are investing heavily in advanced tank insulation solutions to improve thermal stability and reduce energy costs.

India Tank Insulation Market Insight

India is expected to witness the CAGR of around 5.8% from 2025 to 2032 in the Asia Pacific Tank Insulation market. The country’s rapid expansion in LNG export terminals, cold chain logistics, and industrial infrastructure modernization is significantly boosting demand. Government policies focused on clean energy and emissions reduction provide strong incentives for adopting energy-efficient insulation technologies. The increasing use of sustainable insulation materials and smart industrial practices further accelerates adoption, making Canada a high-growth market in the region

Tank Insulation Market Share

The Tank Insulation industry is primarily led by well-established companies, including:

- Commercial Thermal Solutions, Inc. (U.S.)

- Dow (U.S.)

- GILSULATE INTERNATIONAL, INC. (U.S.)

- Johns Manville (U.S.)

- J.H. Ziegler GmbH (Germany)

- Knauf Insulation (Germany)

- PolarClad Tank Insulation (U.S.)

- ARMACELL (Germany)

- Kingspan Group (Ireland)

- Thermacon Service Company (U.S.)

- Gulf Cool Therm Factory LTD (Saudi Arabia)

- ROCKWOOL International A/S (Denmark)

- Cabot Corporation (U.S.)

- SPX Transformer Solutions Inc. (U.S.)

- DUNMORE (U.S.)

- T.F.WARREN GROUP (Canada)

- Saint-Gobain (France)

- Huntsman International LLC (U.S.)

- Corrosion Resistant Technologies, Inc. (U.S.)

- Röchling SE & Co. KG (Germany)

Latest Developments in Asia Pacific Tank Insulation Market

- In April 2024, Johns Manville, a Berkshire Hathaway company, announced the expansion of its thermal insulation manufacturing capabilities with the opening of a new facility in Asia Pacific. This move aims to meet the growing demand for thermal insulation products in the region

- In May 2024, Owens Corning completed the acquisition of Masonite International, a provider of interior and exterior door systems, for USD 3.9 billion. This strategic acquisition is expected to enhance Owens Corning's product portfolio and market reach in the building materials sector

- In July 2024, Rheem Manufacturing Company highlighted its sustainability initiatives at its Fort Smith facility, focusing on reducing energy consumption and minimizing waste. These efforts are part of the company's commitment to environmental responsibility and efficiency in manufacturing practices

- In September 2024, Rheem Manufacturing Company acquired Nortek Global HVAC, expanding its product offerings and strengthening its position in the HVAC market. This acquisition aligns with Rheem's strategy to provide comprehensive heating and cooling solutions

- In 2024, Kingspan Group acquired STEICO SE, a German manufacturer of wood-fiber insulation materials. This acquisition is expected to enhance Kingspan's insulation product range and support its growth in sustainable building solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Tank Insulation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Tank Insulation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Tank Insulation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.