Market Analysis and Insights

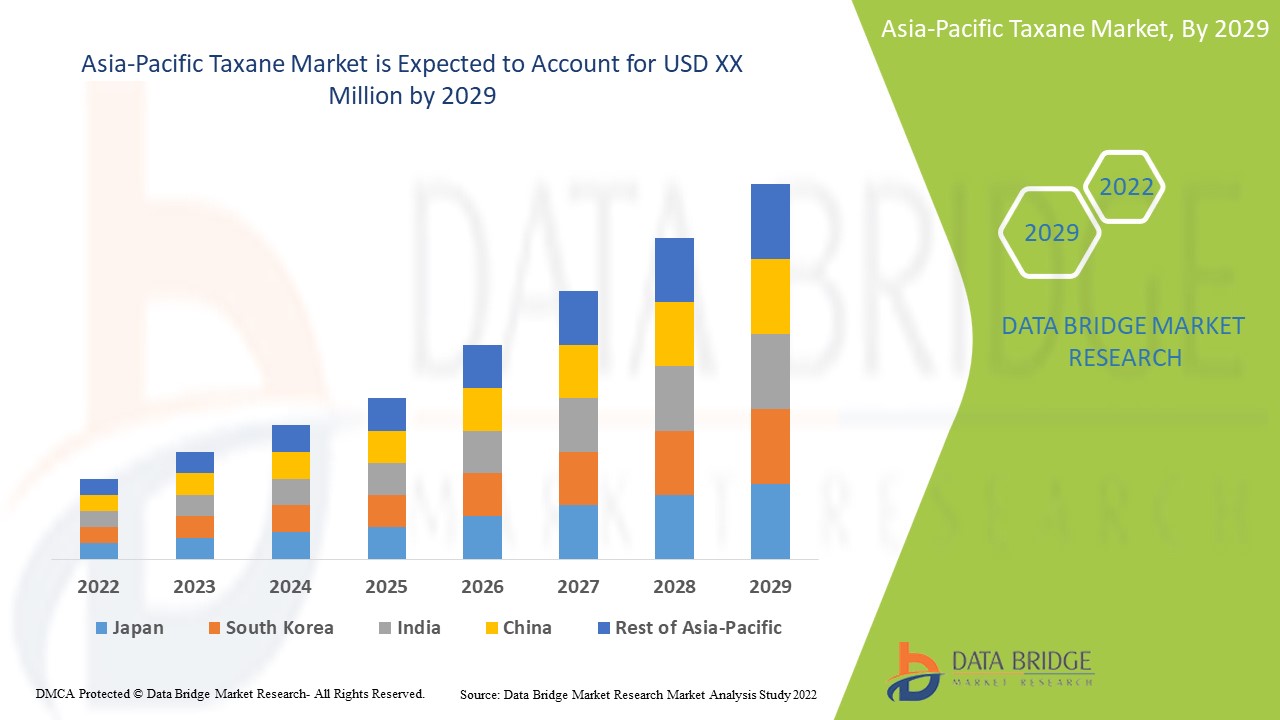

Asia-Pacific taxane market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 8.7% in the forecast period of 2022 to 2029. Technological advancements in taxane drug treatments, coupled with rising applications of computer-aided diagnosis, are other factors driving the taxane market growth in the forecast period.

However, the high cost associated with the drug and side effects such as blood clots, leucopenia, allergy, diarrhea, and weight loss will restrain the market's growth. Adoption of strategic alliances like partnerships and acquisitions by key market players act as an opportunity for the growth of taxane market.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Type (Paclitaxel, Docetaxel and Cabazitaxel), Drug Type (Branded and Generics), Formulation (Liposomes and Polymeric Micelles Containing Taxanes, Hydrogel Formulations Of Taxanes, Nanoparticle Formulation and Others), Age Group (Adults and Geriatric), Application (Ovarian Cancer, Breast Cancer, Prostate Cancer, Non-Small Cell Lung Cancer and Other), End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others), Distribution Channel (Direct Tender, Retail Sales) |

|

Countries Covered |

China, Japan, India, South Korea, Australia, Singapore, Thailand, Vietnam, Malaysia, Indonesia, Philippines and rest of Asia-Pacific |

|

Market Players Covered |

Viatris Inc., Sandoz International GmbH ( A Novartis Division), sanofi-aventis U.S. LLC , Hikma Pharmaceuticals PLC, Pfizer Inc., Dr. Reddy’s Laboratories Ltd., Taxane Healthcare, Bristol-Myers Squibb Company, Fresenius Kabi AG (Subsidiary of Fresenius SE & Co. KGaA ), SAMYANG HOLDINGS CORPORATION., Luye Pharma Group, Elevar Therapeutics, Huiang Pharmaceutical Co Ltd., Shenzhen Main Luck Phar maceuticals Inc., Accord Healthcare, Torrent Pharmaceuticals Ltd., Panacea Biotec, RPG Life Sciences Limited., Aureate Healthcare, Samarth Life Sciences Pvt. Ltd., Cipla Inc., Hetero Healthcare Limited., AqVida GmbH, Ingenus Pharmaceuticals, LLC among others. |

Taxane Market Definition

The taxanes or taxoids are a closely related group of antineoplastic agents that have a unique mechanism of action as mitosis inhibitors and are widely used in the therapy of ovarian, breast, lung, esophageal, prostate, bladder and head and neck cancers. Three taxanes are in clinical use, paclitaxel (Taxol: 1992), docetaxel (Taxotere: 1996) and cabazitaxel (Jevtana: 2010). Taxanes are anticancer drugs that interfere with microtubule function, causing changes in mitosis and cellular death. Paclitaxel (Taxol) was first isolated from a yew tree, a small evergreen coniferous tree with a slow growth rate. As paclitaxel was initially scarce, docetaxel (Taxotere), a semisynthetic analogue of paclitaxel derived from the needles of the European yew tree Taxus baccata, was created. Docetaxel differs from paclitaxel in two chemical locations, making it more water soluble. Cabazitaxel is also a semisynthetic analogue of natural taxoids and was developed for its lack of affinity for P-glycoprotein, a common mediator of docetaxel resistance.

Furthermore, increasing use of taxane drugs due to rising prevalence of chronic diseases, surging prevalence of cancer, and increasing investment for healthcare infrastructure. These factors increase in the demand for taxane market has encouraged the key market players to implement newer technologies and strategies through product launches, acquisition, strategies and agreements.

Taxane Market Dynamics

Drivers

- The rise in incidence of cancer

Cancer has a major impact on society in the United States and worldwide. Cancer statistics describe what happens in large groups of people and provide a picture in time of the burden of cancer on society. Taxol, an antimitotic agent, used to treat cancer, blocks cancer cell growth by stopping cell division, resulting in cell death.

According to National Cancer Institute (NCI), a funded clinical trial found that 30 percent of patients with advanced ovarian cancer responded positively to taxane treatment. In clinical practice, the taxane is now standard therapy in metastatic breast cancer. Today, taxol is on the World Health Organization's Model List of Essential Medicines, a cytotoxic drug that kills cancer cells. It treats breast cancer, ovarian cancer, non-small cell lung cancer, pancreatic cancer, and AIDS-related Kaposi sarcoma.

- The funding by the government and investment in research and development

Despite the established effectiveness of pharmacotherapies for treating opioid use and alcohol disorders, limitations to the implementation of taxane by specialty treatment programs have been observed. Certain attention needs to be paid to specific sources for funding, organizational structure, and workforce resources, making a long-term investment that aligns the payment with the potential future beneficiaries. The issues around sustainability, productivity, and patient impact of drug development have never been and will not simply be a product of industry.

The funding by the government would result in the patient's safety, cost-savings. In addition, hospitals and healthcare agencies would administer this treatment at a lower price through collaboration with government organizations. Hence the advancements in research and development activities and funding by the government are expected to drive the market growth.

Restraint

-

Side effects of drugs incurred with the taxane drugs

Taxanes belong to a class of diterpenes. Taxane drugs (paclitaxel and docetaxel) are used as chemotherapeutic agents. Due to ongoing clinical trials, research studies, type of cancer, type of treatment plan, and drug dosage, the present high cost is expected to show a descending trend in the future. Taxane drugs are most effective for treating breast and prostate cancer. However, certain side effects have been reported. The adverse complications or side effects reported would lead to a decline in sales of the taxane drugs, which would limit the sales of the drugs. In addition, it would affect the reliability of manufacturers involved in this market and hence be expected to restrain the market growth.

Opportunity

-

Strategic initiative by market players

The demand for taxane market has increased in the U.S. and Europe owing to the timely treatment of alcohol and opioid disorders. These favorable factors enhance the need for taxane, and to achieve the market demand, minor and major market players are utilizing various strategies.

The major players are also trying to devise specific strategies, such as product launches, acquisitions, approvals, expansions, and partnerships, to ensure the smooth running of the business, avoid risks, and increase the long-term growth in the sales of the market.

These strategic initiatives by the market players, including acquisition, conferences, and focused segment product launches, are helping the companies grow and improve the company's product portfolios, ultimately leading to more revenue generation. Hence, these strategic initiatives by the market players provide an opportunity to help in future growth and drive market growth.

Challenge

- The lack of skilled professionals required for taxane drug treatment

The lack or shortage of skilled expertise would challenge the pace of recovery and growth in one place. Often the unemployed people in one place have skills that are in short supply elsewhere. Moreover, rapid technological advancement in this field also leads to a lack of expertise.

Physician supply is a term used to describe the number of trained physicians working in a healthcare system or labor market. It is dependent on the number of graduates and the retention rates of the profession. The physician shortage is a growing concern in many countries around the world.

The World Health Organization (WHO) estimated a global shortage of 4.3 million physicians, nurses, and other health professionals. Despite the strong evidence for the effectiveness of drugs in reducing morbidity and mortality, increasing treatment retention, and improving well-being for individuals with taxane, numerous barriers prevent broader access to taxane drug-based treatment.

Moreover, technological advancement is another aspect that leads to the increased demand for skilled professionals. Neurologists report significant unmet supportive care needs and barriers in their centers, with only a small minority rating themselves as competently providing supportive care. There is an urgent need for the education of professionals for the treatment of dementia and procuring available supportive care resources. Lack of trained and experienced professionals and persistent skill gaps limit the employability prospects and access to quality jobs. Therefore, it is apparent that the availability of professionals with adequate skills is challenging the market growth.

Post COVID-19 Impact on Taxane Market

COVID-19 has resulted in a substantial increase in demand for medical supplies from healthcare professionals and the general public for precautionary measures. Manufacturers of these items have an opportunity to take advantage of the increased demand for medical supplies by ensuring a steady supply of personal protective equipment on the market. COVID-19 is anticipated to have a big impact on the taxane market.

Recent Developments

- In November 2022, Viatris Inc. and Biocon Biologics Ltd. announced the U.S. launch of interchangeable biosimilars SEMGLEE (insulin glargine-yfgn) injection, a branded product, and Insulin Glargine (insulin glargine-yfgn) injection, an unbranded product, to help control high blood sugar in adult and pediatric patients with type 1 diabetes and adults with type 2 diabetes. Both biosimilar products are available in vial and prefilled pen presentations and are interchangeable for the reference brand, LANTUS (insulin glargine), allowing for substitution at the pharmacy counter. Viatris is committed to improving patient access to sustainable, quality and more affordable healthcare. This has helped the company to grow their product portfolio.

- In May 2022, Sandoz, a global leader in generic and biosimilar medicines, announced the U.S. launch of its generic pirfenidone, the first AB-rated (fully substitutable) equivalent to Genentech’s Esbriet, to treat patients with idiopathic pulmonary fibrosis (IPF). This prescription oral medicine is immediately available to patients via specialty pharmacies, with a $0 co-pay program for eligible patients. Sandoz is putting patients first by expanding access to generic pirfenidone for those with this rare disease, who will benefit from a more affordable, yet equally effective treatment. This has helped the company to grow its market position and business.

Taxane Scope and Market Size

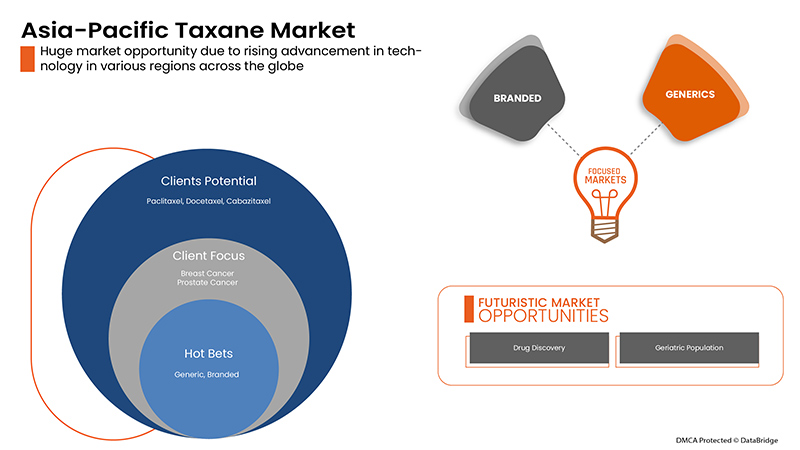

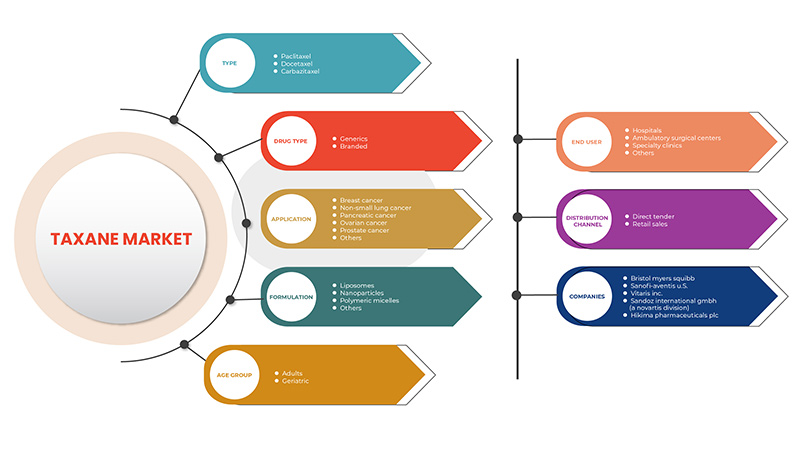

Taxane market is segmented based on type, drug type, formulation, age group, application, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the Difference in your target markets.

By Type

- Paclitaxel

- Docetaxel

- Cabazitaxel

On the basis of type, the Asia-Pacific taxane market is segmented into paclitaxel, docetaxel and cabazitaxel.

By Application

- Ovarian Cancer

- Breast Cancer

- Prostate Cancer

- Non-small Cell Lung Cancer

- Other

On the basis of application, the Asia-Pacific taxane market is segmented into ovarian cancer, breast cancer, prostate cancer, non-small cell lung cancer and others.

By Drug Type

- Generics

- Branded

On the basis of drug type, the Asia-Pacific taxane market is segmented into branded and generics.

By Formulation

- Liposomes

- Nanoparticles

- Polymeric Micelles

- Others

On the basis of formulation, the Asia-Pacific taxane market is segmented into liposomes, nanoparticles, polymeric micelles and others.

By Age Group

- Adult

- Geriatric

On the basis of age group, the Asia-Pacific taxane market is segmented into adults and geriatric.

By End User

- Hospitals

- Ambulatory surgical centers

- Specialty clinics

- Others

On the basis of end user, the Asia-Pacific taxane market is segmented into hospitals, ambulatory surgical centers, specialty clinics, and others.

By Distribution Channel

- Direct tender

- Retail Sales

On the basis of distribution channel, the Asia-Pacific taxane market is segmented into direct tender, retail sales.

Asia-Pacific Taxane Market Regional Analysis

The taxane market is analyzed and market size information is provided by type, drug type, formulation, age group, application, end user and distribution channel.

The countries covered in the Taxane Market report are China, Japan, India, South Korea, Australia, Singapore, Thailand, Vietnam, Malaysia, Indonesia, Philippines and rest of Asia-Pacific.

In 2022, China is dominating due to the presence of key market players along the largest consumer market with high GDP. China is expected to grow due to rise in technological advancement in drug treatments.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Taxane market also provides you with detailed market analysis for every country growth in healthcare industry. Moreover, it provides detailed information regarding healthcare services and treatments, impact of regulatory scenarios, and trending parameters regarding Taxane Market.

Competitive Landscape and Taxane Market Share Analysis

Taxane market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to taxane drugs.

The major companies which are dealing in the Taxane Market are Viatris Inc., Sandoz International GmbH (A Novartis Division), sanofi-aventis U.S. LLC , Hikma Pharmaceuticals PLC, Pfizer Inc., Dr. Reddy’s Laboratories Ltd., Taxane Healthcare, Bristol-Myers Squibb Company, Fresenius Kabi AG (Subsidiary of Fresenius SE & Co. KGaA ), SAMYANG HOLDINGS CORPORATION., Luye Pharma Group, Elevar Therapeutics, Huiang Pharmaceutical Co Ltd., Shenzhen Main Luck Phar maceuticals Inc., Accord Healthcare, Torrent Pharmaceuticals Ltd., Panacea Biotec, RPG Life Sciences Limited., Aureate Healthcare, Samarth Life Sciences Pvt. Ltd., Cipla Inc., Hetero Healthcare Limited., AqVida GmbH, Ingenus Pharmaceuticals, LLC among others.

Strategic alliances like mergers, acquisitions and agreement by the key market players are further expected to accelerate the growth of taxane drugs.

Collaboration, product launch, business expansion, award and recognition, joint ventures and other strategies by the market player is enhancing the company footprints in the Taxane Market which also provides the benefit for organization’s profit growth.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TAXANE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL_ANALYSIS

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 INDUSTRIAL INSIGHTS

6.1 CONCLUSION

7 ASIA PACIFIC TAXANE MARKET: REGULATIONS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 THE RISE IN INCIDENCE OF CANCER

8.1.2 THE FUNDING BY THE GOVERNMENT AND INVESTMENT IN RESEARCH AND DEVELOPMENT

8.1.3 RISE IN PIPELINE OR CLINICAL TRIALS OF TAXANE TREATMENTS

8.1.4 USE OF REIMBURSEMENT FOR TAXANE

8.2 RESTRAINTS

8.2.1 SIDE EFFECTS OF DRUGS INCURRED WITH THE TAXANE DRUGS

8.2.2 ETHICAL ISSUES RELATED TO THE USE OF TAXANE TREATMENT

8.2.3 RISE IN PRODUCT RECALLS

8.3 OPPORTUNITIES

8.3.1 STRATEGIC INITIATIVE BY MARKET PLAYERS

8.3.2 RISE IN HEALTHCARE EXPENDITURE

8.4 CHALLENGES

8.4.1 THE LACK OF SKILLED PROFESSIONALS REQUIRED FOR TAXANE DRUG TREATMENT

8.4.2 STRINGENT GOVERNMENT REGULATIONS ON TAXANE DRUG TREATMENT

9 ASIA PACIFIC TAXANE MARKET, BY TYPE

9.1 OVERVIEW

9.2 PACLITAXEL

9.2.1 BY TYPE

9.2.1.1 SEMI-SYNTHETIC

9.2.1.2 NATURAL

9.2.2 BY STRENGTH

9.2.2.1 100MG

9.2.2.2 200MG

9.2.2.3 250MG

9.2.2.4 30MG

9.2.2.5 260MG

9.2.2.6 300MG

9.3 DOCETAXEL

9.3.1 120MG

9.3.2 80MG

9.3.3 20MG

9.3.4 40MG

9.3.5 60MG

9.4 CABAZITAXEL

9.4.1 60MG

10 ASIA PACIFIC TAXANE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BREAST CANCER

10.3 NON-SMALL CELL LUNG CANCER

10.4 PANCREATIC CANCER

10.5 OVARIAN CANCER

10.6 PROSTATE CANCER

10.7 OTHERS

11 ASIA PACIFIC TAXANE MARKET, BY DRUG TYPE

11.1 OVERVIEW

11.2 GENERICS

11.3 BRANDED

12 ASIA PACIFIC TAXANE MARKET, BY FORMULATION

12.1 OVERVIEW

12.2 LIPOSOMES

12.3 NANOPARTICLES

12.4 POLYMERIC MICELLES

12.5 OTHERS

13 ASIA PACIFIC TAXANE MARKET, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULT

13.2.1 FEMALE

13.2.2 MALE

13.3 GERIATRIC

13.3.1 FEMALE

13.3.2 MALE

14 ASIA PACIFIC TAXANE MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 AMBULATORY SURGICAL CENTERS

14.4 SPECIALTY CLINICS

14.5 OTHERS

15 ASIA PACIFIC TAXANE MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL SALES

15.2.1 HOSPITAL PHARMACY

15.2.2 RETAIL PHARMACY

15.2.3 ONLINE PHARMACY

15.3 DIRECT TENDER

16 ASIA PACIFIC TAXANE MARKET, BY REGION

16.1 ASIA-PACIFIC

16.1.1 CHINA

16.1.2 JAPAN

16.1.3 INDIA

16.1.4 SOUTH KOREA

16.1.5 AUSTRALIA

16.1.6 INDONESIA

16.1.7 THAILAND

16.1.8 PHILIPPINES

16.1.9 VIETNAM

16.1.10 SINGAPORE

16.1.11 MALAYSIA

16.1.12 REST OF ASIA-PACIFIC

17 ASIA PACIFIC TAXANE MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 BRISTOL-MYERS SQUIBB COMPANY

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 SANOFI-AVENTIS U.S. LLC

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 VIATRIS INC.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 SANDOZ INTERNATIONAL GMBH (A NOVARTIS DIVISION)

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 FRESENIUS KABI AG (SUBSIDIARY OF FRESENIUS SE & CO. KGAA )

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 HIKMA PHARMACEUTICALS PLC

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 ACCORD HEALTHCARE

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 AQVIDA GMBH

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 AUREATE HEALTHCARE

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 CIPLA INC.

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 PRODUCT PORTFOLIO

19.10.4 RECENT DEVELOPMENTS

19.11 DR. REDDY’S LABORATORIES LTD.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 ELEVAR THERAPEUTICS

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT DEVELOPMENTS

19.13 HETERO HEALTHCARE LIMITED.

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 HUIANG PHARMACEUTICAL CO LTD

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 INGENUS PHARMACEUTICALS, LLC

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 LUYE PHARMA GROUP

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENTS

19.17 PANACEA BIOTEC

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 PFIZER INC.

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 PRODUCT PORTFOLIO

19.18.4 RECENT DEVELOPMENTS

19.19 RPG LIFE SCIENCES LIMITED

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENTS

19.2 SAMARTH LIFE SCIENCES PVT. LTD.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENTS

19.21 SAMYANG HOLDINGS CORPORATION.

19.21.1 COMPANY SNAPSHOT

19.21.2 REVENUE ANALYSIS

19.21.3 PRODUCT PORTFOLIO

19.21.4 RECENT DEVELOPMENTS

19.22 SHENZHEN MAIN LUCK PHAR MACEUTICALS INC.

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENTS

19.23 TORRENT PHARMACEUTICALS LTD

19.23.1 COMPANY SNAPSHOT

19.23.2 REVENUE ANALYSIS

19.23.3 PRODUCT PORTFOLIO

19.23.4 RECENT DEVELOPMENTS

19.24 TAXANE HEALTHCARE

19.24.1 COMPANY SNAPSHOT

19.24.2 PRODUCT PORTFOLIO

19.24.3 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 ASIA PACIFIC TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC PACLITAXEL IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC DOCETAXEL IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC CABAZITAXEL IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC BREAST CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC NON-SMALL LUNG CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC PANCREATIC CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC OVARIAN CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC PROSTATE CANCER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC OTHERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC GENERICS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC BRANDED IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC LIPOSOMES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC NANOPARTICLES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC POLYMERIC MICELLES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC OTHERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC ADULT IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC GERIATRIC IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC HOSPITALS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC AMBULATORY SURGICAL CENTERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC SPECIALTY CLINICS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC OTHERS IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC RETAIL SALES IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC DIRECT TENDER IN TAXANE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC TAXANE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 CHINA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 CHINA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CHINA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 CHINA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 57 CHINA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 58 CHINA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 59 CHINA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 60 CHINA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 61 CHINA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 62 CHINA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 63 CHINA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 64 CHINA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 CHINA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 CHINA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 JAPAN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 JAPAN PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 JAPAN TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 JAPAN TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 71 JAPAN TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 72 JAPAN PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 73 JAPAN DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 74 JAPAN CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 75 JAPAN TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 76 JAPAN ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 77 JAPAN GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 78 JAPAN TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 JAPAN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 JAPAN RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 81 INDIA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 INDIA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 INDIA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 INDIA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 85 INDIA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 86 INDIA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 87 INDIA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 88 INDIA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 89 INDIA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 90 INDIA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 91 INDIA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 92 INDIA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 INDIA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 INDIA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH KOREA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 105 SOUTH KOREA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 106 SOUTH KOREA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 SOUTH KOREA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 108 SOUTH KOREA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 AUSTRALIA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 AUSTRALIA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 AUSTRALIA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 AUSTRALIA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 113 AUSTRALIA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 114 AUSTRALIA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 115 AUSTRALIA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 123 INDONESIA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 INDONESIA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 INDONESIA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 INDONESIA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 127 INDONESIA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 128 INDONESIA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 129 INDONESIA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 130 INDONESIA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 131 INDONESIA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 132 INDONESIA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 133 INDONESIA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 134 INDONESIA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 135 INDONESIA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 136 INDONESIA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 137 THAILAND TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 THAILAND PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 THAILAND TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 140 THAILAND TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 141 THAILAND TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 142 THAILAND PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 143 THAILAND DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 144 THAILAND CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 145 THAILAND TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 146 THAILAND ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 147 THAILAND GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 148 THAILAND TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 149 THAILAND TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 150 THAILAND RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 151 PHILIPPINES TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 PHILIPPINES PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 PHILIPPINES TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 PHILIPPINES TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 155 PHILIPPINES TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 156 PHILIPPINES PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 157 PHILIPPINES DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 158 PHILIPPINES CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 159 PHILIPPINES TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 160 PHILIPPINES ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 161 PHILIPPINES GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 162 PHILIPPINES TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 163 PHILIPPINES TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 164 PHILIPPINES RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 165 VIETNAM TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 166 VIETNAM PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 VIETNAM TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 168 VIETNAM TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 169 VIETNAM TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 170 VIETNAM PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 171 VIETNAM DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 172 VIETNAM CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 173 VIETNAM TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 174 VIETNAM ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 175 VIETNAM GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 176 VIETNAM TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 177 VIETNAM TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 178 VIETNAM RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 179 SINGAPORE TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 SINGAPORE PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 SINGAPORE TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 182 SINGAPORE TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 183 SINGAPORE TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 184 SINGAPORE PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 185 SINGAPORE DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 186 SINGAPORE CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 187 SINGAPORE TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 188 SINGAPORE ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 189 SINGAPORE GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 190 SINGAPORE TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 191 SINGAPORE TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 192 SINGAPORE RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 193 MALAYSIA TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 MALAYSIA PACLITAXEL IN TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 MALAYSIA TAXANE MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 196 MALAYSIA TAXANE MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 197 MALAYSIA TAXANE MARKET, BY FORMULATION, 2020-2029 (USD MILLION)

TABLE 198 MALAYSIA PACLITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 199 MALAYSIA DOCETAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 200 MALAYSIA CABAZITAXEL IN TAXANE MARKET, BY STRENGTH, 2020-2029 (USD MILLION)

TABLE 201 MALAYSIA TAXANE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 202 MALAYSIA ADULT IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 203 MALAYSIA GERIATRIC IN TAXANE MARKET, BY GENDER, 2020-2029 (USD MILLION)

TABLE 204 MALAYSIA TAXANE MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 205 MALAYSIA TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 206 MALAYSIA RETAIL SALES IN TAXANE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 207 REST OF ASIA-PACIFIC TAXANE MARKET, BY TYPE, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 ASIA PACIFIC TAXANE MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TAXANE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TAXANE MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TAXANE MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC TAXANE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TAXANE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC TAXANE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 ASIA PACIFIC TAXANE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC TAXANE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC TAXANE MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE ASIA PACIFIC TAXANE MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASING INVESTMENT FOR HEALTHCARE INFRASTRUCTURE IS EXPECTED TO DRIVE THE ASIA PACIFIC TAXANE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC TAXANE MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC TAXANE MARKET

FIGURE 15 INCIDENCE OF BREAST CANCER IN 2020

FIGURE 16 ASIA PACIFIC TAXANE MARKET: BY TYPE, 2021

FIGURE 17 ASIA PACIFIC TAXANE MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC TAXANE MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC TAXANE MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 ASIA PACIFIC TAXANE MARKET: BY APPLICATION, 2021

FIGURE 21 ASIA PACIFIC TAXANE MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 22 ASIA PACIFIC TAXANE MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 23 ASIA PACIFIC TAXANE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 24 ASIA PACIFIC TAXANE MARKET: BY DRUG TYPE, 2021

FIGURE 25 ASIA PACIFIC TAXANE MARKET: BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 26 ASIA PACIFIC TAXANE MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 27 ASIA PACIFIC TAXANE MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 28 ASIA PACIFIC TAXANE MARKET: BY FORMULATION, 2021

FIGURE 29 ASIA PACIFIC TAXANE MARKET: BY FORMULATION, 2022-2029 (USD MILLION)

FIGURE 30 ASIA PACIFIC TAXANE MARKET: BY FORMULATION, CAGR (2022-2029)

FIGURE 31 ASIA PACIFIC TAXANE MARKET: BY FORMULATION, LIFELINE CURVE

FIGURE 32 ASIA PACIFIC TAXANE MARKET: BY AGE GROUP, 2021

FIGURE 33 ASIA PACIFIC TAXANE MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 34 ASIA PACIFIC TAXANE MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 35 ASIA PACIFIC TAXANE MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 36 ASIA PACIFIC TAXANE MARKET: BY END USER, 2021

FIGURE 37 ASIA PACIFIC TAXANE MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 38 ASIA PACIFIC TAXANE MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 ASIA PACIFIC TAXANE MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 ASIA PACIFIC TAXANE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 ASIA PACIFIC TAXANE MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 ASIA PACIFIC TAXANE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 ASIA PACIFIC TAXANE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC TAXANE MARKET: SNAPSHOT (2021)

FIGURE 45 ASIA-PACIFIC TAXANE MARKET: BY COUNTRY (2021)

FIGURE 46 ASIA-PACIFIC TAXANE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 ASIA-PACIFIC TAXANE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 ASIA-PACIFIC TAXANE MARKET: BY TYPE (2022-2029)

FIGURE 49 ASIA PACIFIC TAXANE MARKET: COMPANY SHARE 2021 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.