Asia Pacific Textured Butter Market

Market Size in USD Million

CAGR :

%

USD

364.21 Million

USD

465.27 Million

2024

2032

USD

364.21 Million

USD

465.27 Million

2024

2032

| 2025 –2032 | |

| USD 364.21 Million | |

| USD 465.27 Million | |

|

|

|

Textured Butter Market Size

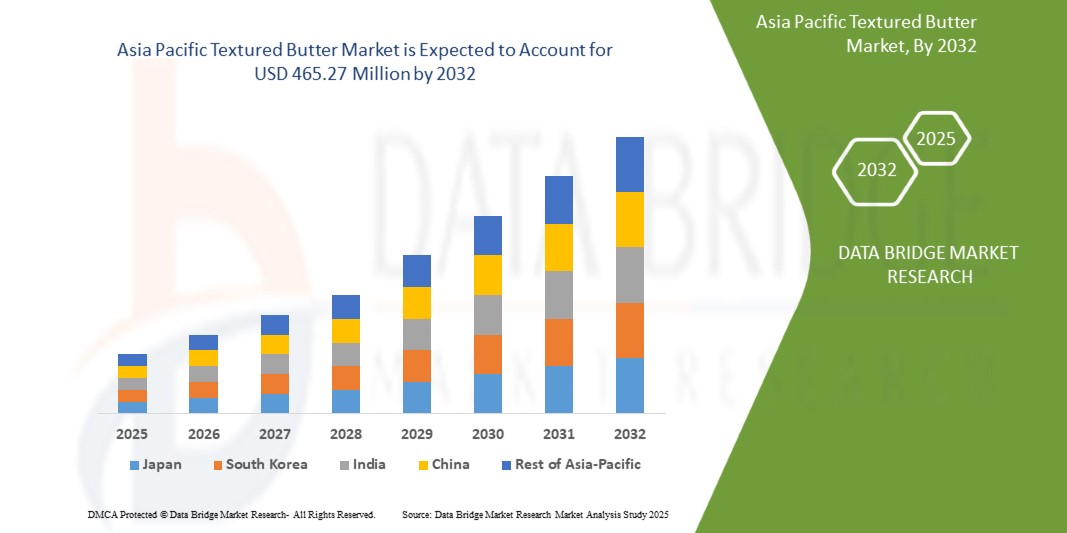

- The Asia-Pacific textured butter market was valued at USD 364.21 million in 2024 and is expected to reach USD 465.27 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.17%, primarily driven by rising consumer demand for enhanced sensory food experiences, clean label trends, and the growing preference for premium, spreadable butter options in both retail and foodservice sectors

- This growth is driven by factors such as rising demand for premium dairy products, increased consumer preference for clean-label and natural ingredients, and innovation in food processing and butter textures

Asia Pacific Textured Butter Market Analysis

- Rising consumer interest in artisanal and premium dairy products is driving the demand for textured butter. This trend is fueled by evolving taste preferences, health consciousness, and the appeal of rich, creamy textures in gourmet and home cooking applications, particularly in developed and urban markets

- Advancements in food processing technologies have enabled manufacturers to offer butter with improved texture, spreadability, and mouthfeel. These innovations cater to specific culinary uses, including baking and confectionery, boosting their appeal among both commercial food producers and household consumers

- The textured butter market is witnessing growth as consumers increasingly seek products with clean labels, organic certifications, and minimal processing. Butter, especially from grass-fed or organic sources, is perceived as a healthier fat option, boosting its popularity in both traditional and plant-based segments

- For instance, the resurgence of full-fat dairy products in the UK. Retailers like Marks & Spencer and Yeo Valley report rising sales of whole milk and butter, driven by consumer preference for creamier textures and skepticism toward low-fat, processed alternatives

- Textured butter is gaining popularity across various food segments such as bakery, confectionery, sauces, and ready-to-eat meals. Its versatility and ability to enhance flavor and consistency make it an essential ingredient in both domestic and industrial kitchens, expanding its market in Asia-Pacific region

Report Scope and Market Segmentation

|

Attributes |

Asia-Pacific Textured Butter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia Pacific Textured Butter Market Trends

“Rising Demand For Premium, Artisanal Dairy Products”

- The Asia-Pacific textured butter market is being shaped by increasing consumer demand for gourmet and artisanal products. As people shift toward premium food experiences, textured butter—with its rich taste and visual appeal—is finding favor in both household kitchens and high-end culinary establishments, especially in urban and developed markets where quality and aesthetics influence buying decisions

- Health-conscious consumers are driving the growth of the textured butter market, with a notable preference for organic and clean-label options. Rich in natural fats and often minimally processed, textured butter aligns with current nutritional trends that favor whole foods over low-fat alternatives, reinforcing its inclusion in balanced, high-quality diets

- The surge in home baking and cooking, accelerated by lifestyle changes post-pandemic, has boosted the demand for specialty ingredients like textured butter. Its enhanced flavor and consistency make it a preferred choice for bakery products, sauces, and spreads, contributing to the diversification of usage across food categories

- For instance, rising consumer preference for artisanal, locally-made products—indicating a broader trend toward gourmet food, including textured butter

- Manufacturers are innovating within the textured butter market by introducing plant-based and lactose-free alternatives to cater to vegan and lactose-intolerant consumers. These product innovations, combined with sustainable packaging and sourcing initiatives, are expanding the consumer base and supporting long-term market growth

Asia-Pacific Textured Butter Market Dynamics

Drivers

“Rising Demand For Premium Dairy Products”

- Consumers today are more conscious about the ingredients and processing methods used in their food, leading to a surge in demand for premium dairy products that offer superior taste, texture, and nutritional benefits

- Textured butter, known for its enhanced spreadability, smoothness, and consistency, is becoming a preferred choice among both home cooks and professional chefs. The rise of fine dining, bakery, and confectionery industries has further fueled this trend, as textured butter enhances the quality of pastries, desserts, and premium food offerings. In addition, health-conscious consumers are opting for high-quality butter alternatives that contain fewer additives and preservatives while retaining natural richness

- For instance, In October 2024, Danone announced a USD 21.60 million investment to expand its operations in Punjab, capitalizing on the rising demand for premium dairy products in India. As consumers increasingly seek healthier and high-quality dairy options, Danone aims to grow its market share, competing with established players such as Amul

- In August 2024,edairynews published an article which states that the demand for premium dairy products in India surged as health-conscious consumers prioritized quality over cost. Driven by a growing awareness of natural ingredients, organic, grass-fed, and hormone-free options, the market is seeing increasing consumer preference for products offering superior taste and health benefits, reshaping the dairy sector

- The growth of organic and grass-fed dairy products has contributed to the increasing demand for premium butter varieties. Consumers are willing to pay a premium for products that are ethically sourced, environmentally friendly, and free from artificial ingredients. As a result, dairy manufacturers are innovating with different textures, flavors, and organic certifications to cater to this expanding market segment, further driving the textured butter market’s growth

Opportunities

“Shifting Consumer Inclination Towards Sustainable And Ethical Sourced Products”

- Consumers are increasingly shifting towards sustainable and ethically sourced textured butter, creating significant opportunities for the market. With rising awareness of environmental impact and ethical farming, buyers prefer butter made from responsibly sourced dairy. They look for certifications such as organic, fair trade, and grass-fed, ensuring that the product aligns with their values

- Sustainable sourcing involves eco-friendly farming practices that protect natural resources, reduce carbon footprints, and support biodiversity. Ethical sourcing ensures fair wages for farmers and humane treatment of animals. Many brands are now adopting transparent supply chains to meet these consumer expectations

- The growing demand for such products encourages manufacturers to invest in responsible sourcing and sustainable production methods. Companies that focus on eco-friendly packaging, reduced waste, and ethical ingredient sourcing can gain a competitive edge in the Asia Pacific textured butter market. As consumer preferences continue to evolve, businesses that align with sustainability and ethical standards will likely experience increased brand loyalty and market growth. This trend presents a lucrative opportunity for manufacturers to expand their product range while meeting the demand for responsible food choices

For instance,

- In January 2023, a study published on Sustainably Produced Butter: The Effect of Product Knowledge, interest in Sustainability, and Consumer Characteristics on Purchase Frequency highlights that consumer knowledge, interest in sustainability, and product certifications such as organic and fair trade significantly influence the purchase frequency and preferences for ethically sourced butter. This trend emphasizes the growing demand for responsibly produced dairy products

- In August 2024, an article published by Ethical Consumer Research Association Ltd highlights that consumers are increasingly opting for butter and spreads with ethical certifications such as fair-trade and organic, prioritizing sustainability and responsible sourcing in their purchasing decisions

- An article published by the World Wildlife Fund states that sustainable agriculture practices, including eco-friendly dairy farming methods and responsible sourcing, are crucial for protecting natural resources, reducing carbon footprints, and promoting biodiversity

Consumers are increasingly demanding sustainably and ethically sourced textured butter, driving market opportunities. With rising awareness of environmental impact and ethical farming, brands focusing on responsible sourcing, eco-friendly packaging, and transparent supply chains gain a competitive edge. This trend boosts market growth, encouraging manufacturers to align with sustainability and ethical standards.

Restraints/Challenges

“High Production Costs Of Textured Butter”

- Textured butter, due to its specialized production process, requires more advanced technology and higher-quality raw materials, such as organic or grass-fed cream. These factors contribute to its increased cost compared to regular butter. The need for precise manufacturing techniques to achieve the desired consistency and texture further drives up production expenses

- For manufacturers, the higher costs associated with sourcing premium ingredients, maintaining quality control, and investing in specialized equipment can limit the scalability and affordability of textured butter, especially in price-sensitive markets. This, in turn, can restrict its widespread adoption, particularly among small and medium-sized businesses in the food industry that may struggle to absorb the added costs

For instance,

- In December 2024 a report from Fast Company highlighted the surge in butter prices due to supply chain disruptions, labor shortages, and increased production costs. These factors, especially for textured butter, have strained both chefs and consumers, further raising prices for high-quality butter and raw materials

- In April 2024, William Reed Ltd highlighted the rising butter prices are attributed to factors like extreme weather, political instability, and increased energy costs, which are elevating dairy prices and subsequently raising butter production costs. This surge is expected to persist due to sustained demand

The price sensitivity of consumers, especially in developing markets, can hinder the demand for textured butter, as consumers may opt for more affordable alternatives. As a result, the growth of the textured butter market faces challenges, particularly in competing with less expensive fats and oils in the broader food industry.

Asia Pacific Textured Butter Market Scope

The market is segmented on the basis of type, product type, category, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product Type |

|

|

By Category |

|

|

By Application |

|

Asia-Pacific Textured Butter Market Regional Analysis

“China is the Dominant country in the Asia-Pacific Textured Butter Market”

- China is poised to dominate the textured butter market due to its rapidly increasing consumer demand for dairy products, driven by the adoption of Western diets and a growing middle class. This shift has led to a significant rise in butter imports, particularly from New Zealand and the European Union, to meet the quality standards required by premium bakeries and food processors. Additionally, the expansion of the domestic bakery and confectionery sectors has further fueled the demand for high-quality butter.

“China is Projected to Register the Highest Growth Rate”

- China is projected to register the highest growth rate in the textured butter market due to increasing consumer demand for dairy products, driven by the adoption of Western diets and a growing middle class. This trend has led to a significant rise in butter imports, particularly from New Zealand and the European Union, to meet the quality standards required by premium bakeries and food processors. Additionally, the expansion of the domestic bakery and confectionery sectors has further fueled the demand for high-quality butter.

Textured Butter Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Asia-Pacific Textured Butter Market Leaders Operating in the Market Are:

- Flechard SAS (France)

- FrieslandCampina Professional (Netherlands)

- Royal VIVBuisman (Netherlands)

- Uelzena Ingredients (Germany)

- LACTALIS (France)

- NUMIDIA BV (Netherlands)

- Lakeland Dairies (Ireland)

- CORMAN (Belgium)

Latest Developments in Asia Pacific Textured Butter Market

- In January, Lactalis Ingredients is rolling out a new graphic identity for the packaging of its butter range. This update is part of the company's ongoing efforts to enhance brand visibility and modernize its product presentation. The new design aims to reflect Lactalis’ commitment to quality, innovation, and sustainability while making the packaging more appealing to consumers. This development helps Lactalis Ingredients strengthen brand recognition, improve consumer appeal, and reinforce its commitment to quality, innovation, and sustainability

- In March, Lakeland Dairies has completed the acquisition of De Brandt Dairy International NV, a Belgian-based butterfat business, aiming to enhance its value-added capabilities and expand its presence in the European market. And has strengthened its position in the European butter market, opening new markets and product categories. This strategic move is expected to deliver stronger returns to its farm families and further develop its world-class product offerings for both current and future customers

- In February, FrieslandCampina announced its intention to relocate butter production to Lochem, Netherlands, as part of efforts to enhance efficiency and sustainability. This move includes the planned closure of the Den Bosch facility by early 2025, impacting around 90 employees, for whom the company will provide support and alternative job opportunities. The relocation aims to optimize production processes while ensuring long-term operational improvements. FrieslandCampina emphasizes that the decision is still subject to employee consultations and regulatory approvals before final implementation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 DBMR VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.1.6 CONCLUSION

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO AND ITS IMPACT ON THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.7.1 ENVIRONMENTAL CONCERNS

4.7.1.1 RISING TEMPERATURES AND DAIRY PRODUCTIVITY

4.7.1.2 WATER SCARCITY AND RESOURCE USE

4.7.1.3 GREENHOUSE GAS (GHG) EMISSIONS FROM DAIRY FARMING

4.7.1.4 DEFORESTATION AND LAND USE

4.7.2 INDUSTRY RESPONSE

4.7.2.1 SUSTAINABLE DAIRY FARMING PRACTICES

4.7.2.2 RENEWABLE ENERGY INTEGRATION

4.7.2.3 SUSTAINABLE PACKAGING AND WASTE REDUCTION

4.7.3 GOVERNMENT’S ROLE

4.7.3.1 CLIMATE REGULATIONS AND CARBON TAXES

4.7.3.2 RESEARCH AND DEVELOPMENT (R&D) SUPPORT

4.7.3.3 TRADE POLICIES AND SUSTAINABILITY STANDARDS

4.7.4 ANALYST RECOMMENDATIONS

4.7.4.1 INVEST IN CLIMATE-RESILIENT SUPPLY CHAINS

4.7.4.2 PARTNER WITH SUSTAINABLE DAIRY FARMS

4.7.4.3 DIVERSIFY PRODUCT OFFERINGS

4.7.4.4 STRENGTHEN GOVERNMENT AND INDUSTRY COLLABORATION

4.7.5 CONCLUSION

4.8 CLIENT’S DATASET

4.8.1 LINDT & SPRÜNGLI

4.8.2 FERRERO GROUP

4.8.3 LANTMÄNNEN UNIBAKE

4.8.4 BRIDOR:

4.8.5 VANDEMOORTELE

4.8.6 MONDELEZ INTERNATIONAL

4.8.7 FRONERI

4.8.8 DÉLIFRANCE

4.8.9 WEWALKA

4.8.10 CÉRÉLIA

4.8.11 GRUPO BIMBO

4.8.12 LA LORRAINE BAKERY GROUP

4.8.13 ARYZTA AG

4.8.14 PHOON HUAT PTE LTD

4.8.15 CHEESE AND FOOD CO., LTD

4.8.16 AL-AHLAM COMPANY

4.8.17 UNILEVER

4.8.18 DEK SRL

4.8.19 NESTLÉ MEXICO S.A. DE C.V

4.8.20 PT TIRTA ALAM SEGAR

4.8.21 HAJI RAZAK HAJI HABIB JANOO

4.8.22 KELLAS INC.

4.8.23 WS WARMSENER SPEZIALITÄTEN GMBH

4.9 FACTORS INFLUENCING THE PURCHASING DECISION OF END-USERS FOR THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.9.1 QUALITY AND TEXTURE

4.9.2 HEALTH AND NUTRITIONAL BENEFITS

4.9.3 INGREDIENT TRANSPARENCY AND CLEAN LABELING

4.9.4 SUSTAINABILITY AND ETHICAL SOURCING

4.9.5 FLAVOR AND PRODUCT VARIETY

4.9.6 PRICE SENSITIVITY AND AFFORDABILITY

4.9.7 BRAND REPUTATION AND TRUST

4.9.8 CONVENIENCE AND ACCESSIBILITY

4.9.9 REGULATORY COMPLIANCE AND SAFETY STANDARDS

4.9.10 MARKETING AND PROMOTIONAL STRATEGIES

4.9.11 CONCLUSION

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS FOR THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.10.1 PRODUCT INNOVATION AND DIFFERENTIATION

4.10.2 EXPANSION INTO EMERGING MARKETS

4.10.3 SUSTAINABLE AND CLEAN LABEL PRODUCTS

4.10.4 STRENGTHENING DISTRIBUTION CHANNEL

4.10.5 STRATEGIC MERGERS AND ACQUISITIONS (M&A)

4.10.6 INVESTMENTS IN ADVANCED PROCESSING TECHNOLOGIES

4.10.7 MARKETING AND BRANDING STRATEGIES

4.10.8 FOCUS ON HEALTH AND WELLNESS TRENDS

4.10.9 CONCLUSION

4.11 IMPACT OF ECONOMIC SLOWDOWN ON THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.11.1 IMPACT ON PRICE

4.11.2 IMPACT ON SUPPLY CHAIN

4.11.3 IMPACT ON SHIPMENT

4.11.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.11.5 CONCLUSION

4.12 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.12.1 RISING DEMAND FOR PREMIUM AND ARTISANAL BUTTER

4.12.2 GROWING POPULARITY OF FUNCTIONAL AND FORTIFIED BUTTER

4.12.3 EXPANSION OF PLANT-BASED AND DAIRY-FREE ALTERNATIVES

4.12.4 TECHNOLOGICAL INNOVATIONS IN BUTTER PROCESSING

4.12.5 CLEAN LABEL AND TRANSPARENCY TRENDS

4.12.6 SUSTAINABILITY AND ETHICAL SOURCING

4.12.7 E-COMMERCE AND DIRECT-TO-CONSUMER GROWTH

4.12.8 EXPANDING APPLICATIONS IN THE FOOD INDUSTRY

4.12.9 CONCLUSION

4.13 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.13.1 ADVANCED PROCESSING TECHNIQUES

4.13.1.1 MICROENCAPSULATION FOR IMPROVED STABILITY

4.13.1.2 CONTROLLED CRYSTALLIZATION FOR OPTIMAL TEXTURE

4.13.1.3 HIGH-PRESSURE PROCESSING (HPP)

4.13.2 AUTOMATION AND ARTIFICIAL INTELLIGENCE (AI) IN BUTTER PRODUCTION

4.13.2.1 AI-POWERED QUALITY CONTROL

4.13.2.2 ROBOTICS AND SMART MANUFACTURING

4.13.2.3 PREDICTIVE MAINTENANCE IN DAIRY PROCESSING

4.13.3 INGREDIENT INNOVATIONS AND FUNCTIONAL ENHANCEMENTS

4.13.3.1 FORTIFIED AND FUNCTIONAL BUTTER

4.13.3.2 HYBRID BUTTER PRODUCTS

4.13.3.3 CLEAN-LABEL AND NATURAL INGREDIENTS

4.13.4 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.13.4.1 CARBON-NEUTRAL DAIRY PRODUCTION

4.13.4.2 BIODEGRADABLE AND RECYCLABLE PACKAGING

4.13.5 INNOVATIONS IN DISTRIBUTION AND CONSUMER ENGAGEMENT

4.13.5.1 BLOCKCHAIN FOR SUPPLY CHAIN TRANSPARENCY

4.13.5.2 DIRECT-TO-CONSUMER (DTC) SALES AND SUBSCRIPTION MODELS

4.13.5.3 SMART LABELING AND AUGMENTED REALITY (AR)

4.13.6 CONCLUSION

4.14 RAW MATERIAL SOURCING ANALYSIS

4.14.1 INTRODUCTION

4.14.2 DAIRY-BASED RAW MATERIAL SOURCING

4.14.3 PLANT-BASED FAT SOURCING FOR ALTERNATIVE BUTTER VARIETIES

4.14.4 ADDITIVES AND FUNCTIONAL INGREDIENTS SOURCING

4.14.5 SUPPLY CHAIN CHALLENGES AND RISKS

4.14.6 SUSTAINABILITY AND ETHICAL SOURCING INITIATIVES

4.14.7 FUTURE TRENDS IN RAW MATERIAL SOURCING

4.14.8 CONCLUSION

4.15 SUPPLY CHAIN ANALYSIS OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET

4.15.1 LOGISTICS COST SCENARIO

4.15.1.1 RISING TRANSPORTATION COSTS

4.15.1.2 WAREHOUSING AND STORAGE EXPENSES

4.15.1.3 CUSTOMS AND TARIFFS IMPACTING COSTS

4.15.1.4 LAST-MILE DELIVERY CHALLENGES

4.15.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS IN THE TEXTURED BUTTER MARKET

4.15.2.1 ENSURING COLD CHAIN MANAGEMENT

4.15.3 ENHANCING SUPPLY CHAIN EFFICIENCY

4.15.3.1 MANAGING INTERNATIONAL TRADE COMPLIANCE

4.15.3.2 COST OPTIMIZATION STRATEGIES

4.15.3.3 ADAPTING TO MARKET CHANGES

4.15.4 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR PREMIUM DAIRY PRODUCTS

6.1.2 RAPIDLY EXPANDING BAKERY AND CONFECTIONERY INDUSTRY

6.1.3 INCREASED DEMAND FOR NATURAL AND ORGANIC PRODUCTS

6.1.4 INCREASED USAGE OF BUTTER IN FOOD PROCESSING AND FOOD SERVICE INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION COSTS OF TEXTURED BUTTER

6.2.2 COMPLIANCE WITH FOOD SAFETY AND DAIRY PRODUCT REGULATIONS LIMITING MARKET EXPANSION

6.3 OPPORTUNITIES

6.3.1 SHIFTING CONSUMER INCLINATION TOWARDS SUSTAINABLE AND ETHICAL SOURCED PRODUCTS

6.3.2 RISING URBANIZATION AND CHANGING DIETARY HABITS

6.3.3 DEVELOPMENT OF FLAVORED, ORGANIC, AND FUNCTIONAL BUTTER VARIANTS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION FROM CONVENTIONAL BUTTER

6.4.2 STORAGE AND SHELF-LIFE CONSTRAINTS

7 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE

7.1 OVERVIEW

7.2 UNSALTED TEXTURED BUTTER

7.3 SALTED TEXTURED BUTTER

8 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 ANIMAL BASED (MILK) BUTTER

8.3 PLANT-BASED BUTTER

9 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 ORGANIC

9.3 CONVENTIONAL

10 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BAKERY

10.3 ICE CREAMS

10.4 SAUCES AND CONDIMENTS

10.5 CONFECTIONERY

10.6 OTHERS

11 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 SOUTH KOREA

11.1.5 AUSTRALIA

11.1.6 NEW ZEALAND

11.1.7 SINGAPORE

11.1.8 THAILAND

11.1.9 MALAYSIA

11.1.10 PHILIPPINES

11.1.11 VIETNAM

11.1.12 INDONESIA

11.1.13 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 LACTALIS

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 LAKELAND DAIRIES

14.2.1 COMPANY SNAPSHOTS

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT/NEWS

14.3 UELZENA INGREDIENTS

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 FRIESLANDCAMPINA PROFESSIONAL

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 FLECHARD SAS

14.5.1. COMPANY SNAPSHOT

14.5.2. COMPANY SHARE ANALYSIS

14.5.3. PRODUCT PORTFOLIO

14.5.4. RECENT DEVELOPMENT

14.6. CORMAN

14.6.1. COMPANY SNAPSHOT

14.6.2. PRODUCT PORTFOLIO

14.6.3. RECENT DEVELOPMENT

14.7. NUMIDIA BV

14.7.1. COMPANY SNAPSHOTS

14.7.2. PRODUCT PORTFOLIO

14.7.3. RECENT DEVELOPMENT/NEWS

14.8. ROYAL VIVBUISMAN

14.8.1. COMPANY SNAPSHOT

14.8.2. PRODUCT PORTFOLIO

14.8.3. RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 COMPARATIVE BRAND ANALYSIS

TABLE 3 REGULATORY COVERAGE

TABLE 4 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 6 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 8 ASIA-PACIFIC SALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC SALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 10 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 12 ASIA-PACIFIC ANIMAL BASED (MILK) BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC ANIMAL BASED (MILK) BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 14 ASIA-PACIFIC PLANT-BASED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC PLANT-BASED BUTTER IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 16 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 18 ASIA-PACIFIC ORGANIC IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC ORGANIC IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 20 ASIA-PACIFIC CONVENTIONAL IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC CONVENTIONAL IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 22 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 24 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 26 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 31 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 35 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY REGION, 2018-2032 (TONS)

TABLE 43 ASIA-PACIFIC UNSALTED TEXTURED BUTTER IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 47 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 49 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 51 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 53 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 55 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 CHINA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 CHINA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 68 CHINA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 CHINA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 70 CHINA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 71 CHINA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 72 CHINA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 73 CHINA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 74 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 CHINA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 CHINA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 CHINA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CHINA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 CHINA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 CHINA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 JAPAN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 JAPAN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 87 JAPAN TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 JAPAN TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 89 JAPAN TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 90 JAPAN TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 91 JAPAN TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 JAPAN TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 93 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 JAPAN BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 JAPAN ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 JAPAN ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 JAPAN SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 JAPAN SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 JAPAN CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 JAPAN CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 JAPAN OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 JAPAN OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 INDIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 INDIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 106 INDIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 INDIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 108 INDIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 109 INDIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 110 INDIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 111 INDIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 112 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 INDIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 INDIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 INDIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 INDIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 INDIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 INDIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 INDIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 INDIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 INDIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 SOUTH KOREA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SOUTH KOREA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 125 SOUTH KOREA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 SOUTH KOREA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 127 SOUTH KOREA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH KOREA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 129 SOUTH KOREA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH KOREA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 131 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH KOREA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH KOREA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH KOREA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SOUTH KOREA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SOUTH KOREA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SOUTH KOREA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SOUTH KOREA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SOUTH KOREA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SOUTH KOREA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 AUSTRALIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 AUSTRALIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 144 AUSTRALIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 AUSTRALIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 146 AUSTRALIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 147 AUSTRALIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 148 AUSTRALIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 149 AUSTRALIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 150 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 AUSTRALIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 AUSTRALIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 AUSTRALIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 AUSTRALIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 AUSTRALIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 AUSTRALIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 AUSTRALIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 AUSTRALIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 AUSTRALIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 NEW ZEALAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 NEW ZEALAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 163 NEW ZEALAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 NEW ZEALAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 165 NEW ZEALAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 166 NEW ZEALAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 167 NEW ZEALAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 168 NEW ZEALAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 169 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 NEW ZEALAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 NEW ZEALAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 NEW ZEALAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 NEW ZEALAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 NEW ZEALAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 NEW ZEALAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 NEW ZEALAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 NEW ZEALAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 NEW ZEALAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SINGAPORE TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 SINGAPORE TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 182 SINGAPORE TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SINGAPORE TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 184 SINGAPORE TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 185 SINGAPORE TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 186 SINGAPORE TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 SINGAPORE TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 188 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SINGAPORE BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SINGAPORE ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SINGAPORE ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SINGAPORE SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SINGAPORE SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SINGAPORE CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SINGAPORE CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SINGAPORE OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SINGAPORE OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 THAILAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 THAILAND TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 201 THAILAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 THAILAND TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 203 THAILAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 204 THAILAND TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 205 THAILAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 206 THAILAND TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 207 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 THAILAND BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 THAILAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 THAILAND ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 THAILAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 THAILAND SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 THAILAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 THAILAND CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 THAILAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 THAILAND OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MALAYSIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 MALAYSIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 220 MALAYSIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 MALAYSIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 222 MALAYSIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 223 MALAYSIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 224 MALAYSIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 225 MALAYSIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 226 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 MALAYSIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MALAYSIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 MALAYSIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 MALAYSIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MALAYSIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 MALAYSIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 MALAYSIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 MALAYSIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 MALAYSIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 PHILIPPINES TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 PHILIPPINES TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 239 PHILIPPINES TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 PHILIPPINES TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 241 PHILIPPINES TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 242 PHILIPPINES TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 243 PHILIPPINES TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 244 PHILIPPINES TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 245 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 PHILIPPINES BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 PHILIPPINES ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 PHILIPPINES ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 PHILIPPINES SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 PHILIPPINES SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 PHILIPPINES CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 PHILIPPINES CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 PHILIPPINES OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 PHILIPPINES OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 VIETNAM TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 VIETNAM TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 258 VIETNAM TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 VIETNAM TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 260 VIETNAM TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 261 VIETNAM TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 262 VIETNAM TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 263 VIETNAM TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 264 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 VIETNAM BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 VIETNAM ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 VIETNAM ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 VIETNAM SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 VIETNAM SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 VIETNAM CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 VIETNAM CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 VIETNAM OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 VIETNAM OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 INDONESIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 INDONESIA TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 277 INDONESIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 INDONESIA TEXTURED BUTTER MARKET, BY PRODUCT TYPE, 2018-2032 (TONS)

TABLE 279 INDONESIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 280 INDONESIA TEXTURED BUTTER MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 281 INDONESIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 282 INDONESIA TEXTURED BUTTER MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 283 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 INDONESIA BAKERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 INDONESIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 INDONESIA ICE CREAMS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 288 INDONESIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 289 INDONESIA SAUCES AND CONDIMENTS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 INDONESIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 291 INDONESIA CONFECTIONERY IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 292 INDONESIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 INDONESIA OTHERS IN TEXTURED BUTTER MARKET, BY BUTTER PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 REST OF ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 2 ASIA-PACIFIC TEXTURED BUTTER MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC TEXTURED BUTTER MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC TEXTURED BUTTER MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC TEXTURED BUTTER MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC TEXTURED BUTTER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC TEXTURED BUTTER MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MARKET APPLICATION COVERAGE GRID: ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 10 ASIA-PACIFIC TEXTURED BUTTER MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC TEXTURED BUTTER MARKET: SEGMENTATION

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE THE ASIA-PACIFIC TEXTURED BUTTER MARKET, BY TYPE (2024)

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING DEMAND FOR PREMIUM DAIRY PRODUCTS IS EXPECTED TO DRIVE THE ASIA-PACIFIC TEXTURED BUTTER MARKET IN THE FORECAST PERIOD

FIGURE 16 THE UNSALTED TEXTURED BUTTER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC TEXTURED BUTTER MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 19 ASIA-PACIFIC TEXTURED BUTTER MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/KG)

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC TEXTURED BUTTER MARKET

FIGURE 21 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY TYPE, 2024

FIGURE 22 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY PRODUCT TYPE, 2024

FIGURE 23 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY CATEGORY, 2024

FIGURE 24 ASIA-PACIFIC TEXTURED BUTTER MARKET: BY APPLICATION, 2024

FIGURE 25 ASIA-PACIFIC TEXTURED BUTTER MARKET: SNAPSHOT, 2024

FIGURE 26 ASIA-PACIFIC TEXTURED BUTTER MARKET: COMPANY SHARE 2024 (%)

Asia Pacific Textured Butter Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Textured Butter Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Textured Butter Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.