Asia Pacific Thin And Ultra Thin Market

Market Size in USD Million

CAGR :

%

USD

4.83 Million

USD

16.28 Million

2024

2032

USD

4.83 Million

USD

16.28 Million

2024

2032

| 2025 –2032 | |

| USD 4.83 Million | |

| USD 16.28 Million | |

|

|

|

|

Thin and Ultra-Thin Market Size

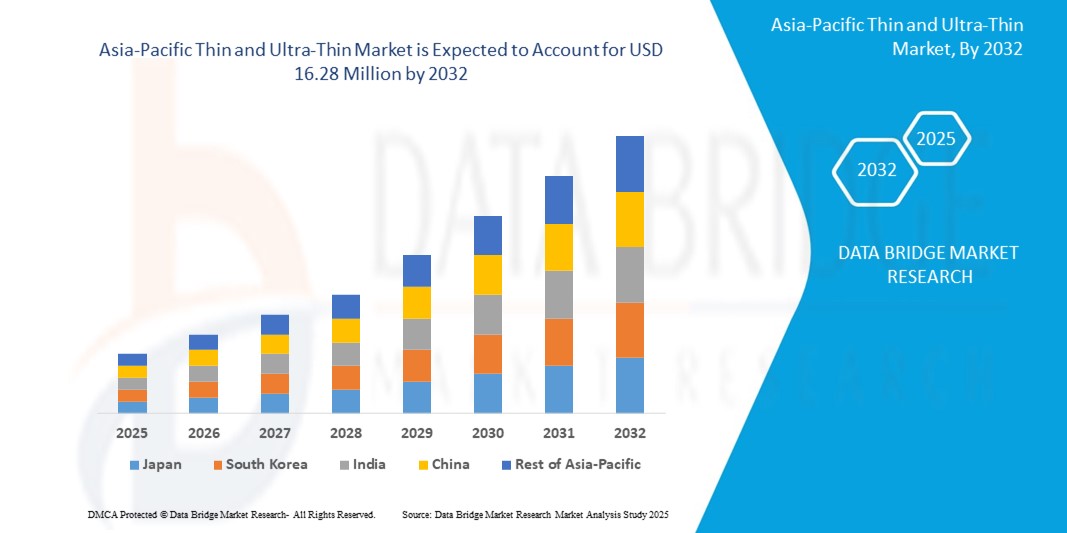

- The Asia-Pacific thin and ultra-thin market size was valued at USD 4.83 million in 2024 and is expected to reach USD 16.28 million by 2032, at a CAGR of 16.4% during the forecast period

- The market growth is primarily driven by rapid advancements in electronics and semiconductor industries, increasing demand for lightweight and high-performance materials, and growing adoption of renewable energy technologies across the region

- Rising investments in research and development, coupled with the expanding automotive and healthcare sectors, are further accelerating the demand for thin and ultra-thin films, positioning them as critical components in next-generation technologies

Thin and Ultra-Thin Market Analysis

- Thin and ultra-thin films, characterized by their nanoscale or microscale thickness, are integral to advanced applications in electronics, renewable energy, healthcare, and other high-tech industries due to their superior electrical, optical, and mechanical properties

- The surging demand for these materials is fueled by the proliferation of consumer electronics, increasing focus on sustainable energy solutions, and advancements in medical device manufacturing

- China dominated the Asia-Pacific thin and ultra-thin market with the largest revenue share of 38.5% in 2024, driven by its robust electronics manufacturing ecosystem, significant government support for renewable energy, and a strong presence of key industry players

- Japan is expected to be the fastest-growing country in the Asia-Pacific thin and ultra-thin market during the forecast period, propelled by rapid technological innovation, increasing adoption of advanced materials in automotive and aerospace sectors, and growing investments in biomedical applications

- The gaseous state segment dominated the largest market revenue share of 45.2% in 2024, driven by its compatibility with widely used deposition techniques such as Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), which are critical for high-precision applications in electronics and semiconductors

Report Scope and Thin and Ultra-Thin Market Segmentation

|

Attributes |

Thin and Ultra-Thin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Thin and Ultra-Thin Market Trends

“Increasing Integration of Advanced Nanotechnologies and Smart Coatings”

- The Asia-Pacific thin and ultra-thin market is experiencing a significant trend toward the integration of advanced nanotechnologies and smart coatings

- These technologies enable precise material deposition and enhanced functionality, providing improved performance in applications such as electronics, renewable energy, and healthcare

- Nanotechnology-driven thin-film solutions allow for proactive innovation, enabling the development of coatings with superior properties like self-healing, anti-corrosion, or enhanced conductivity

- For instance, companies in China and Japan are developing smart coating platforms that optimize energy efficiency in solar panels or enhance the durability of biomedical implants based on real-time environmental conditions

- This trend is increasing the value proposition of thin and ultra-thin films, making them more appealing to industries ranging from consumer electronics to aerospace

- Advanced algorithms are being used to analyze coating performance metrics, such as adhesion strength, thermal resistance, and optical clarity, driving innovation in product development

Thin and Ultra-Thin Market Dynamics

Driver

“Rising Demand for High-Performance Electronics and Renewable Energy Solutions”

- The growing consumer and industrial demand for high-performance electronics, such as flexible displays, wearable devices, and advanced semiconductors, is a major driver for the Asia-Pacific thin and ultra-thin market

- Thin and ultra-thin films enhance device performance by providing features such as lightweight coatings, improved energy efficiency, and enhanced durability

- Government initiatives, particularly in China, which dominates the market, are promoting the adoption of thin-film technologies in renewable energy applications like solar panels and energy storage systems

- The proliferation of IoT and the rollout of 5G technology across the Asia-Pacific region are further enabling the expansion of thin-film applications, offering faster data processing and improved connectivity for smart devices

- Manufacturers in Japan, the fastest-growing country in the market, are increasingly incorporating factory-applied thin-film coatings as standard features to meet consumer expectations and enhance product value

Restraint/Challenge

“High Production Costs and Technical Complexity”

- The significant initial investment required for advanced coating equipment, deposition technologies, and skilled labor can be a major barrier to adoption, particularly for small and medium enterprises in emerging markets

- Implementing thin and ultra-thin coating processes, such as physical or chemical deposition, is technically complex and requires precise control, increasing production costs

- In addition, concerns about scalability and reproducibility of advanced coating methods pose challenges, as achieving consistent quality across large-scale production can be difficult

- The diverse regulatory standards across Asia-Pacific countries regarding material safety, environmental impact, and waste management further complicate operations for manufacturers and service providers

- These factors can deter potential adopters and limit market expansion, particularly in regions where cost sensitivity is high or where technical expertise is limited

Thin and Ultra-Thin market Scope

The market is segmented on the basis of coating methods, type, deposition techniques, and application.

- By Coating Methods

On the basis of coating methods, the Asia-Pacific thin and ultra-thin films market is segmented into gaseous state, solutions state, and molten or semi-molten state. The gaseous state segment dominated the largest market revenue share of 45.2% in 2024, driven by its compatibility with widely used deposition techniques such as Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), which are critical for high-precision applications in electronics and semiconductors. The segment's dominance is supported by its ability to produce uniform and high-quality films, particularly in China's extensive manufacturing ecosystem.

The solutions state segment is expected to witness the fastest growth rate of 18.7% from 2025 to 2032, propelled by its cost-effectiveness and scalability for large-scale production. The increasing adoption of solution-based processes like spin coating and dip coating in Japan's renewable energy and biomedical sectors further accelerates this growth.

- By Type

On the basis of type, the Asia-Pacific thin and ultra-thin films market is segmented into thin and ultra-thin. The thin films segment dominated the market with a revenue share of 68.3% in 2024, attributed to their widespread use in applications such as semiconductors, solar panels, and optical coatings, particularly in China’s well-established electronics industry.

The ultra-thin films segment is anticipated to experience the fastest growth rate of 20.1% from 2025 to 2032, driven by rapid adoption in Japan’s solar panel manufacturing and nanotechnology applications. Ultra-thin films are increasingly favored for their ability to enable miniaturized, high-performance devices.

- By Deposition Techniques

On the basis of deposition techniques, the Asia-Pacific thin and ultra-thin films market is segmented into physical deposition and chemical deposition. The physical deposition segment held the largest market revenue share of 62.4% in 2024, owing to its versatility in depositing metals, oxides, and other materials for applications in electronics and renewable energy. China’s leadership in semiconductor production significantly contributes to this segment’s dominance.

The chemical deposition segment is expected to witness the fastest growth rate of 19.3% from 2025 to 2032, fueled by advancements in Chemical Vapor Deposition (CVD) and Atomic Layer Deposition (ALD) technologies. Japan’s focus on precision manufacturing for next-generation semiconductors and solar cells drives this segment’s rapid expansion.

- By Application

On the basis of application, the Asia-Pacific thin and ultra-thin films market is segmented into electronics & semiconductor, renewable energy, healthcare and biomedical applications, automotive, aerospace and defense, and others. The electronics & semiconductor segment dominated the market with a revenue share of 48.7% in 2024, driven by the high demand for thin films in integrated circuits, displays, and microelectronics, particularly in China’s deep-rooted electronics manufacturing base.

The renewable energy segment is anticipated to witness the fastest growth rate of 21.8% from 2025 to 2032, propelled by Japan’s increasing investment in solar energy and the essential role of thin and ultra-thin films in photovoltaic cells. The push for sustainable energy solutions and government initiatives to reduce carbon emissions further boost this segment’s growth.

Thin and Ultra-Thin Market Regional Analysis

- China dominated the Asia-Pacific thin and ultra-thin market with the largest revenue share of 38.5% in 2024, driven by its robust electronics manufacturing ecosystem, significant government support for renewable energy, and a strong presence of key industry players

- Japan is expected to be the fastest-growing country in the Asia-Pacific thin and ultra-thin market during the forecast period, propelled by rapid technological innovation, increasing adoption of advanced materials in automotive and aerospace sectors, and growing investments in biomedical applications

China Thin and Ultra-Thin Market Insight

China dominated the Asia-Pacific thin and ultra-thin market with the highest revenue share of 87.8% in 2024, fueled by its massive electronics and semiconductor manufacturing base and growing demand for advanced coating solutions. Rapid urbanization, increasing investments in renewable energy, and a focus on smart technology drive market expansion. Strong domestic production capabilities and competitive pricing further enhance market accessibility, supporting both OEM and aftermarket segments.

Japan Thin and Ultra-Thin Market Insight

Japan’s thin and ultra-thin market is expected to witness the fastest growth rate, driven by strong consumer and industrial demand for high-performance, technologically advanced films that enhance product efficiency and durability. The presence of leading electronics and automotive manufacturers, coupled with the integration of thin films in OEM products, accelerates market penetration. Growing interest in aftermarket applications and R&D investments also contribute to sustained growth.

Thin and Ultra-Thin Market Share

The thin and ultra-thin industry is primarily led by well-established companies, including:

- American Elements (U.S.)

- LEW TECHNIQUES LTD (U.K.)

- Denton Vacuum (U.S.)

- KANEKA CORPORATION (Japan)

- Umicore (Belgium)

- Materion Corporation (U.S.)

- AIXTRON (Germany)

- Kurt J. Lesker Company (U.S.)

- Vital Materials Co., Limited (China)

- AJA INTERNATIONAL, Inc. (U.S.)

- Praxair S.T. Technology, Inc. (U.S.)

- PVD Products, Inc. (U.S.)

- GEOMATEC Co., Ltd. (Japan)

- INTEVAC, INC. (U.S.)

- Plasma-Therm (U.S.)

What are the Recent Developments in Asia-Pacific Thin and Ultra-Thin Market?

- In September 2024, Corning Incorporated and Optiemus Infracom Ltd. launched a joint venture named Bharat Innovative Glass (BIG) Technologies to establish India’s first cover-glass finishing facility for mobile consumer electronics. Located at the SIPCOT-Pillaipakkam Industrial Estate in Tamil Nadu, greenfield project will manufacture high-quality protective front glass for smartphones and other devices. Production is expected to begin in the second half of 2025, creating around 840 jobs and introducing precision glass-processing technology to India for the first time. This move aligns with the Make in India initiative and strengthens Corning’s footprint in the Asia-Pacific region

- In August 2024, Nippon Electric Glass Co., Ltd. (NEG) announced that its Dinorex UTG™—an ultra-thin glass designed for chemical strengthening—was selected as the display cover glass for the Motorola Razr 50 series of foldable smartphones. Despite being glass, Dinorex UTG™ can bend to a radius of 3mm or less, offering both durability and flexibility essential for foldable devices. This innovation highlights NEG’s leadership in specialty glass solutions and its commitment to supporting the evolving needs of the consumer electronics market, particularly in the fast-growing foldables segment

- In June 2023, Saint-Gobain India launched the production of India’s first low-carbon glass, marking a major milestone in sustainable construction. Developed to meet the rising demand for eco-friendly building materials, this innovative glass achieves a 40% reduction in carbon emissions compared to conventional products. The lower footprint is made possible by using two-thirds recycled content, natural gas, and renewable electricity. Despite its environmental benefits, the glass retains the technical, aesthetic, and performance qualities of standard glass, making it ideal for energy-efficient buildings. This initiative supports India’s Net Zero by 2070 goals and reflects a broader shift toward low-embodied carbon materials in the Asia-Pacific region

- In March 2023, Corning Incorporated and Samsung Electronics announced a collaboration to co-develop ultra-thin glass substrates tailored for foldable displays in next-generation smartphones and tablets. This partnership focuses on enhancing durability, flexibility, and optical performance, addressing the growing demand for foldable and slidable devices in the consumer electronics market. Corning’s expertise in bendable glass innovation—including its proprietary ion-exchange strengthening process—complements Samsung’s leadership in OLED and foldable display technologies, aiming to deliver more robust and reliable foldable form factors

- In February 2023, Samsung Display returned to MWC after a five-year hiatus, unveiling the lightweight, durable, and water-resistant properties of its OLED technology through a series of interactive demonstrations at its booth themed “Hyper-Connected through OLED.” Visitors explored hands-on experiments at Dr. OLED’s Weird LAB, including dunking OLED panels in water, testing impact resistance with steel marbles, and comparing weight with LCDs using helium balloons. The showcase also featured foldable and slidable displays, QD-OLED monitors, and automotive OLED panels, underscoring the growing role of ultra-thin glass in next-gen consumer electronics across the Asia-Pacific market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Thin And Ultra Thin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Thin And Ultra Thin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Thin And Ultra Thin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.