Asia Pacific Third Party Logistics Market

Market Size in USD Billion

CAGR :

%

USD

450.46 Billion

USD

675.75 Billion

2024

2032

USD

450.46 Billion

USD

675.75 Billion

2024

2032

| 2025 –2032 | |

| USD 450.46 Billion | |

| USD 675.75 Billion | |

|

|

|

|

Third Party Logistics Market Size

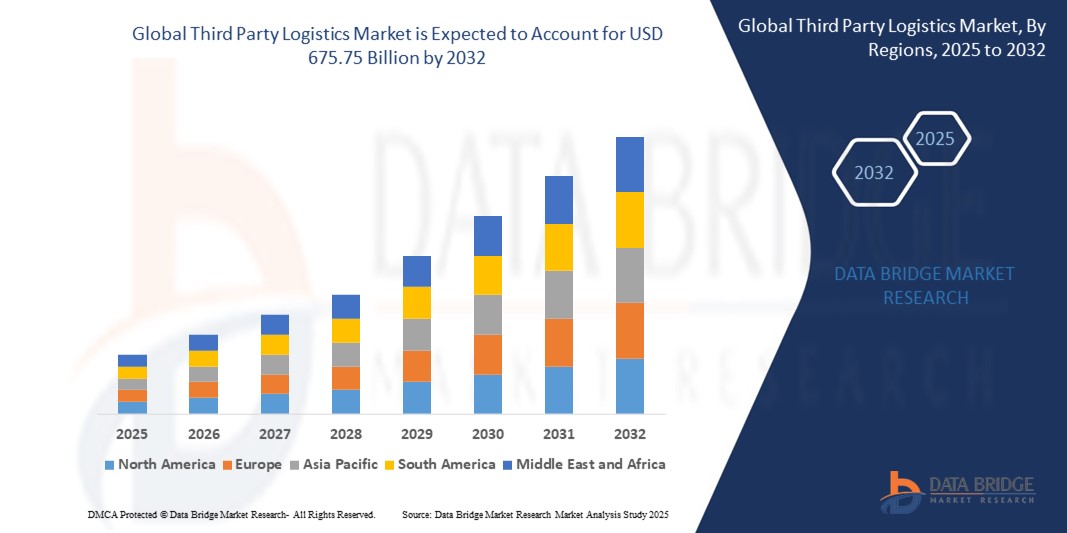

- The Asia-Pacific third party logistics market size was valued at USD 450.46 billion in 2024 and is expected to reach USD 675.75 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by increasing globalization of trade, rising complexity in supply chains, and the growing reliance on outsourced logistics services to manage transportation, warehousing, and distribution functions efficiently across diverse regions

- Furthermore, the adoption of advanced digital tools such as transportation management systems (TMS), warehouse automation, and real-time tracking platforms is enabling greater visibility, speed, and cost-effectiveness, accelerating the uptake of third party logistics solutions across industries

Third Party Logistics Market Analysis

- Third party logistics (3PL) providers offer outsourced logistics services including transportation, warehousing, inventory management, order fulfillment, and freight forwarding, allowing companies to focus on core competencies while improving supply chain efficiency and scalability

- The growing demand for flexible and integrated logistics operations, fueled by the expansion of e-commerce, globalization of manufacturing, and increasing consumer expectations for rapid delivery, is driving strong adoption of 3PL services across verticals such as retail, automotive, healthcare, and consumer goods

- China dominated the third party logistics market with a share of 62% in 2024, due to its position as the global manufacturing hub and strong infrastructure for freight and warehousing

- Japan is expected to be the fastest growing country in the third party logistics market during the forecast period due to rising demand for value-added logistics services and increasing automation across distribution networks

- International Transportation Management (ITM) segment dominated the market with a market share of 36.4% in 2024, due to the surge in cross-border trade, growing globalization of supply chains, and rising demand for efficient freight forwarding and customs brokerage services. Businesses increasingly rely on ITM providers to navigate complex international regulations, optimize multimodal shipping routes, and ensure timely delivery across global markets. The ability of ITM solutions to provide end-to-end visibility, cost control, and real-time tracking for international shipments further strengthens their adoption among enterprises operating in diverse geographies

Report Scope and Third Party Logistics Market Segmentation

|

Attributes |

Third Party Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Third Party Logistics Market Trends

“Increasing Demand for Integrated Logistics Solutions”

- The 3PL market is experiencing a major shift toward integrated logistics solutions that combine transportation, warehousing, inventory management, and supply chain analytics in a single, technology-driven platform to meet the complex needs of modern commerce

- For instance, major players such as DHL Supply Chain and DB Schenker are expanding their service portfolios to offer fully integrated, end-to-end logistics solutions—leveraging advanced software for real-time tracking, automated warehousing, and seamless multi-modal transportation

- Adoption of automation, AI, Internet of Things (IoT), and advanced data analytics by 3PL providers is enhancing supply chain visibility, improving route optimization, and enabling predictive decision-making to minimize costs and delays

- The expanding e-commerce and omni-channel retail sectors are amplifying the need for reverse logistics, last-mile delivery, and order customization, making integrated solutions increasingly attractive for retailers and manufacturers

- Nearshoring and regionalization trends, partially driven by geopolitical tensions and the need for more resilient supply chains, are prompting companies to seek 3PL providers with robust domestic and cross-border capabilities

- Sustainability and regulatory compliance requirements are rising, with 3PLs investing in eco-friendly fleets, green warehousing, and reporting tools to meet client and legislative expectations

Third Party Logistics Market Dynamics

Driver

“Growing Adoption of Smart Glass in Automobiles”

- The adoption of smart glass technology is rapidly expanding in the automotive sector, particularly in SUV and premium car models, as manufacturers compete to enhance vehicle comfort, energy efficiency, and luxury appeal

- For instance, leading automakers such as Mercedes-Benz, BMW, and Audi are integrating advanced smart glass features—such as electrochromic sunroofs and SPD (Suspended Particle Device) smart glass—into their flagship models, offering benefits such as dynamic light control, significant cabin temperature reduction, improved energy management, and distinctive styling

- The increasing popularity of electric and autonomous vehicles, which often feature large glass surfaces including panoramic sunroofs and AR windshields, is further driving demand for innovative smart glass solutions with enhanced thermal, optical, and safety performance

- Technological advancements in smart glass—including faster switching times, AI-enabled tint control, and integration with in-vehicle sensor networks—are making these features more user-friendly and adaptable to varying driving conditions and user preferences

- Sustainability mandates and the pursuit of lower vehicle emissions are encouraging manufacturers to use smart glass for better climate control, enabling reductions in air conditioning reliance, lower fuel consumption, and extended range for electric vehicles

Restraint/Challenge

“High Cost Associated with Raw Material of Glass”

- Despite technological progress, the high cost of raw materials required for manufacturing automotive smart glass remains a notable barrier to wider adoption, especially in price-sensitive vehicle segments

- For instance, premium materials and advanced coatings—such as high-grade polymers for PDLC (Polymer Dispersed Liquid Crystal) glass or suspended particle devices—raise the production expenses compared to traditional automotive glass, making it challenging for mainstream automakers to integrate these technologies outside luxury models

- The need for specialized manufacturing processes, strict quality standards, and customized integration with vehicle electronics contributes to overall higher costs throughout the supply chain

- Volatility in the global supply of key raw materials, as well as logistics and compliance with evolving environmental regulations, adds further complexity and expense to the production of smart glass components

- As a result, the market for smart glass in automobiles is currently strongest in the high-end and electric vehicle segments, while broader market penetration will depend on future reductions in material and production costs

Third Party Logistics Market Scope

The market is segmented on the basis of service, product, providers, application, business type, function, and vertical.

- By Service

On the basis of service, the third party logistics market is segmented into International Transportation Management (ITM), Domestic Transportation Management (DTM), Warehousing, Fulfilment & Distribution (W&D), Dedicated Contract Carriage (DCC)/Freight Forwarders, and Value-Added Services (VALS). The International Transportation Management (ITM) segment dominated the largest market revenue share of 36.4% in 2024, driven by the surge in cross-border trade, growing globalization of supply chains, and rising demand for efficient freight forwarding and customs brokerage services. Businesses increasingly rely on ITM providers to navigate complex international regulations, optimize multimodal shipping routes, and ensure timely delivery across global markets. The ability of ITM solutions to provide end-to-end visibility, cost control, and real-time tracking for international shipments further strengthens their adoption among enterprises operating in diverse geographies.

The Value-Added Services (VALS) segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing demand for specialized logistics capabilities such as kitting, assembly, packaging, and product customization. As companies strive to differentiate their offerings and enhance customer satisfaction, 3PL providers are evolving from basic transport facilitators to strategic partners delivering tailored, end-to-end solutions.

- By Product

On the basis of product, the market is segmented into Air Freight, Ocean Freight, Land Transport, and Contract Logistics. The Land Transport segment accounted for the largest market revenue share in 2024 due to its central role in domestic supply chains and its cost-effectiveness for short- to mid-range distribution. The rise of regional trade agreements and robust road infrastructure in key economies has further cemented land transport’s role in ensuring time-definite delivery and flexible routing.

Air Freight is projected to witness the fastest growth from 2025 to 2032, driven by the increasing demand for expedited shipping, especially for high-value, time-sensitive, and perishable goods. Growing cross-border e-commerce and rising expectations for rapid delivery have amplified the need for air freight services, particularly in sectors such as healthcare, consumer electronics, and luxury goods.

- By Providers

On the basis of providers, the market is segmented into Companies Integrating & Offering Subcontracted Logistics, Courier Companies, Small Freight Forwarders, and Transportation Services. The Companies Integrating & Offering Subcontracted Logistics segment held the largest market revenue share in 2024, owing to their ability to offer end-to-end visibility, economies of scale, and value-added integration across transportation, warehousing, and distribution functions. These firms are increasingly preferred by large enterprises seeking to streamline operations and leverage advanced logistics technologies such as real-time tracking, automation, and predictive analytics.

Courier Companies are expected to record the fastest growth rate over the forecast period due to the surge in B2C parcel deliveries stemming from online retail. Their strength in last-mile logistics, flexible delivery windows, and advanced tracking systems position them as key enablers of the e-commerce boom.

- By Application

On the basis of application, the market is segmented into Shipping, Receiving, Returns, and Packing. The Shipping segment dominated the market in 2024, driven by the increased cross-border movement of goods and the growing complexity of distribution networks. Businesses are increasingly outsourcing their shipping operations to 3PLs to manage rising freight costs, optimize transit times, and ensure compliance with international trade regulations.

Returns are expected to witness the highest CAGR from 2025 to 2032, supported by the rapid growth of online shopping and increasing customer expectations for hassle-free reverse logistics. Managing product returns efficiently has become a strategic priority for retailers, prompting strong demand for 3PL partners that offer streamlined, cost-effective return solutions.

- By Business Type

On the basis of business type, the market is segmented into B2C and B2B. The B2B segment accounted for the largest revenue share in 2024, reflecting its critical role in industrial supply chains and enterprise-level logistics outsourcing. B2B logistics involve bulk shipments, long-term contracts, and more complex routing and scheduling, making them heavily reliant on reliable 3PL providers.

The B2C segment is projected to grow at the fastest pace through 2032, driven by the proliferation of direct-to-consumer brands and the rising penetration of online retail. The demand for flexible, scalable, and real-time delivery solutions in the consumer market continues to accelerate the adoption of 3PL services tailored for B2C operations.

- By Function

On the basis of function, the market is segmented into Supply Chain Management, Customer Management, In-Store Operations, Strategy and Planning, and Merchandising. Supply Chain Management emerged as the largest segment in 2024, as companies aim to enhance operational efficiency and resilience amid global disruptions. 3PLs play a critical role in supply chain optimization by leveraging advanced technologies and integrated platforms to manage inventory, transportation, and warehousing.

Customer Management is expected to register the fastest growth rate from 2025 to 2032, driven by growing emphasis on improving end-customer experience. Companies are relying on 3PLs to provide personalized services, accurate delivery timelines, and responsive support that drive satisfaction and brand loyalty.

- By Vertical

On the basis of vertical, the market is segmented into Retail & Ecommerce, Manufacturing, Consumer Electronics, Healthcare, Automotive, Semicon/Solar, Aerospace & Defense, and Others. The Retail & Ecommerce segment held the largest market revenue share in 2024, fueled by the explosive rise of online shopping and the need for agile, omnichannel logistics solutions. Retailers increasingly depend on 3PLs to manage fulfillment centers, coordinate deliveries, and scale operations during peak demand periods.

The Healthcare segment is expected to experience the fastest growth over the forecast period, driven by the rising need for temperature-sensitive and regulatory-compliant logistics services. The growing global distribution of pharmaceuticals, medical devices, and vaccines has placed greater importance on 3PL providers with capabilities in cold chain logistics and secure transportation.

Third Party Logistics Market Regional Analysis

- China dominated the third party logistics market with the largest revenue share of 62% in 2024, driven by its position as the global manufacturing hub and strong infrastructure for freight and warehousing

- High-volume exports, rapid growth in e-commerce, and strategic government investments in Belt and Road logistics corridors have solidified China’s leadership in cross-border and domestic 3PL operations

- The presence of major 3PL providers, robust digital logistics platforms, and integrated transportation networks further enhance China’s logistics efficiency and service capabilities

Japan Third Party Logistics Market Insight

The Japan third party logistics market is projected to register the fastest CAGR in the Asia-Pacific third party logistics market during the forecast period of 2025 to 2032, driven by rising demand for value-added logistics services and increasing automation across distribution networks. The country's emphasis on just-in-time delivery, precision logistics, and energy-efficient operations has made 3PL partnerships essential across industries such as automotive, electronics, and retail. In addition, Japan’s aging population and labor shortage are accelerating the adoption of outsourced logistics and technology-driven solutions to ensure supply chain resilience and scalability.

India Third Party Logistics Market Insight

India Third Party Logistics Market is anticipated to grow steadily from 2025 to 2032. The surge is driven by rapid urbanization, booming e-commerce, and digital transformation in logistics management. Government initiatives such as the National Logistics Policy and infrastructure development under Gati Shakti are enhancing multimodal connectivity and warehousing capacity. The growing presence of domestic 3PL players, rising demand from Tier II and Tier III cities, and increased focus on supply chain optimization by businesses are fueling market expansion.

Third Party Logistics Market Share

The third party logistics industry is primarily led by well-established companies, including:

- DHL international GMBH (Germany)

- FedEx (U.S.)

- XPO Logistics, Inc. (U.S.)

- Kuehne+Nagel (Switzerland)

- Schenker AG (Germany)

- DSV (Denmark)

- Expeditors International of Washington, Inc. (U.S.)

- C.H. Robinson Worldwide, Inc. (U.S.)

- SNCF (France)

- Nippon Express Co., Ltd. (Japan)

- Toll Holdings Limited (Australia)

- CJ Logistics Corporation (South Korea)

- Kintetsu World Express, Inc. (Japan)

- Samudera Shipping Line Ltd (Singapore)

- PT. Cipta Mapan Logistic (Indonesia)

- KERRY LOGISTICS NETWORK LIMITED (Hong Kong)

- SINOTRANS Limited (China)

- Hitachi Transport System, Ltd. (Japan)

- NYK Line (Japan)

Latest Developments in Asia-Pacific Third Party Logistics Market

- In May 2023, BDP International, Inc. and PSA Cargo Solutions introduced their joint brand, PSA BDP, marking a strategic consolidation aimed at strengthening global third party logistics capabilities. By combining PSA’s port-centric logistics expertise with BDP’s strong presence in supply chain management, the partnership enables broader service offerings across multimodal transportation, warehousing, and end-to-end supply chain visibility. This rebranding enhances competitiveness in integrated logistics solutions, especially for customers in chemicals, life sciences, and industrial manufacturing

- In March 2023, Americold Logistics LLC announced an investment in RSA Cold Chain, a Dubai-based cold storage company, to establish a scalable logistics platform across the Middle East and India. This expansion supports Americold’s global growth strategy and positions it to serve growing demand in temperature-sensitive sectors such as food, pharmaceuticals, and retail. The move also enhances Americold’s capabilities in emerging markets, where rising population and e-commerce activity are driving the need for advanced cold chain infrastructure

- In December 2022, Corning Incorporated collaborated with LG Electronics to co-develop curved display modules for vehicle interiors using cold-form technology. This manufacturing innovation reduces carbon emissions by 25% compared to conventional glass shaping methods, aligning with automotive OEMs’ sustainability targets. The partnership supports the rising trend toward immersive and high-tech in-car user experiences, and positions Corning as a key supplier in the evolving automotive display ecosystem

- In April 2022, Fuyao Group, through its U.S. subsidiary Fuyao Glass America Inc., expanded its operations in Greenville County, South Carolina, with a $34.5 million investment, generating 121 new jobs. This expansion reinforces Fuyao’s commitment to serving the North American automotive market locally, reducing dependency on imports, and improving supply chain responsiveness. The investment strengthens Fuyao’s manufacturing footprint in the U.S., supporting rising demand for high-performance automotive glass solutions amid increased vehicle production and OEM localization efforts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.