Asia Pacific Transfection Reagents And Equipment Market

Market Size in USD Million

CAGR :

%

USD

194.68 Million

USD

439.05 Million

2024

2032

USD

194.68 Million

USD

439.05 Million

2024

2032

| 2025 –2032 | |

| USD 194.68 Million | |

| USD 439.05 Million | |

|

|

|

|

Asia-Pacific Transfection Reagent and Equipment Market Size

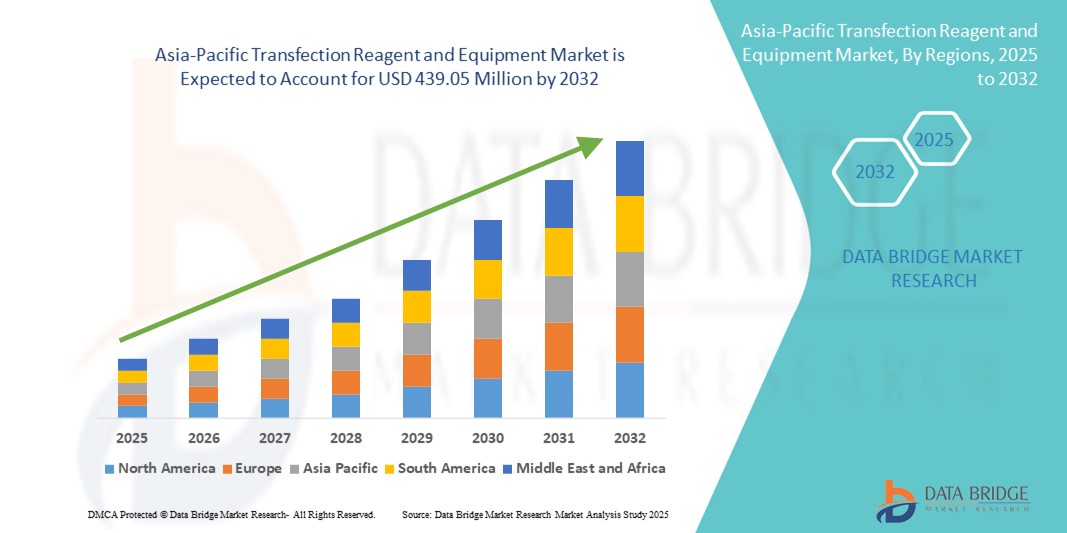

- The Asia-Pacific transfection reagent and equipment market size was valued at USD 194.68 million in 2024 and is expected to reach USD 439.05 million by 2032, at a CAGR of 10.70% during the forecast period

- The market growth in Asia-Pacific Transfection Reagent and Equipment is largely fueled by increasing demand for reliable gene delivery solutions, rising healthcare access, and advancements in molecular biology and cell-based research, enabling accurate and efficient transfection for applications in drug discovery, genomics, and proteomics. The region is witnessing a surge in research outsourcing and biopharmaceutical activities, particularly in rapidly developing countries such as India, China, and Indonesia, contributing to the growing adoption of transfection reagents and equipment

- Furthermore, escalating investments in biotechnology infrastructure, expansion of research facilities in academic and clinical settings, and increasing public-private collaborations are driving innovation and the availability of specialized transfection technologies. Government initiatives supporting life sciences research, coupled with the growing presence of international reagent providers and strengthening local manufacturing capabilities, are significantly boosting the growth of the Asia-Pacific transfection reagent and equipment market

Asia-Pacific Transfection Reagent and Equipment Market Analysis

- The Asia-Pacific transfection reagent and equipment market is witnessing strong growth, driven by the rapid expansion of the pharmaceutical, biotechnology, and academic research sectors across countries such as China, India, Japan, South Korea, Australia, Thailand, Indonesia, and Vietnam

- Increasing R&D investments in genomics, proteomics, and cell biology, rising adoption of advanced gene delivery technologies, a surge in clinical trials, and growing demand for precision medicine are fueling market expansion across the region

- China dominated the Asia-Pacific transfection reagent and equipment market, accounting for the largest revenue share of 42.6% in 2024, supported by its strong biopharmaceutical manufacturing base, growing pipeline of gene and cell therapy trials, well-established research institutions, and government initiatives to strengthen biotechnology innovation

- India is projected to register the fastest CAGR of 19.4% in the Asia-Pacific transfection reagent and equipment market during the forecast period, driven by an expanding biotechnology sector, increasing outsourcing of preclinical and clinical research, rising adoption of transfection technologies in academic and contract research organizations, and government support for biopharma innovation

- Non-viral methods dominated the Asia-Pacific transfection reagent and equipment market with a share of 63.2% in 2024, supported by their safety profile, ease of implementation, and cost advantages. Techniques such as electroporation, lipid nanoparticles, and chemical-based reagents are increasingly used in both research and preclinical workflows, as they minimize biosafety risks while offering reproducible results

Report Scope and Asia-Pacific Transfection Reagent and Equipment Market Segmentation

|

Attributes |

Asia-Pacific Transfection Reagent and Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Transfection Reagent and Equipment Market Trends

Growing Demand for Advanced Transfection Solutions and Regulatory Compliance Support

- A significant and accelerating trend in the Asia-Pacific transfection reagent and equipment market is the increasing focus on high-efficiency, reproducible transfection methods and strong regulatory compliance support. This includes efforts to improve transfection accuracy, scalability, turnaround times, and adherence to evolving international quality and GMP standards

- Leading suppliers and service providers across the region are collaborating with pharmaceutical, biotechnology, and academic research organizations to deliver next-generation transfection platforms such as automated electroporation systems, lipid nanoparticle (LNP) technologies, and viral vector–compatible reagents. These innovations cater to the growing demand for validated, reliable, and audit-ready solutions that support preclinical, clinical, and manufacturing workflows

- Increasing adoption of advanced transfection reagents and equipment in areas such as cell & gene therapy, mRNA vaccine development, oncology research, and biosimilar production is further accelerating market growth. These solutions are recognized for their ability to ensure high transfection efficiency, product consistency, and compliance with strict regulatory guidelines

- Academic institutions, research centers, and government-funded laboratories in countries such as Japan, China, India, and Australia are actively conducting studies on new transfection chemistries, gene delivery technologies, and automation of cell engineering workflows—leading to continuous service and product enhancements tailored to industry-specific need

- As the Asia-Pacific region continues to emphasize quality assurance, biomanufacturing innovation, and global export competitiveness, the Transfection Reagent and Equipment market is poised for sustained expansion—driven by regulatory stringency, technological advancements, and deeper integration of R&D with laboratory expertise

Asia-Pacific Transfection Reagent and Equipment Market Dynamics

Driver

Growing Demand Driven by Advancements in Gene Therapy, Cell Research, and Biotechnology

- The Asia-Pacific transfection reagent and equipment market is experiencing rapid and sustained growth, primarily fueled by the expansion of biotechnology research, pharmaceutical innovation, and the development of advanced healthcare infrastructure across major economies such as China, India, Japan, South Korea, and Australia. The surge in investments directed toward cell therapy, vaccine production, biosimilars, and personalized medicine is significantly increasing the adoption of high-quality, efficient, and reliable transfection technologies across both academic and industrial research environments

- For instance, in March 2024, Takara Bio Inc. announced the expansion of its R&D operations in Japan, aimed at strengthening its transfection technology portfolio. This expansion is expected to accelerate the company’s capabilities in supporting gene therapy pipelines, stem cell applications, and advanced cell-based research studies, thereby reinforcing the regional market’s growth trajectory

- The rising incidence of chronic and genetic diseases across Asia-Pacific is creating a strong demand for next-generation therapeutic solutions. This growing disease burden, coupled with the increasing focus on precision and personalized medicine, is driving widespread adoption of advanced transfection methods across research laboratories, preclinical studies, and clinical trial phases, where reliable gene delivery is critical to successful outcomes

- Supportive government initiatives encouraging biotechnology innovation, along with incentives for clinical trial activities, are playing a pivotal role in strengthening the market ecosystem. Countries such as Singapore and South Korea are emerging as regional hubs for molecular and cellular research excellence, offering robust IP frameworks, high-quality infrastructure, and competitive research costs, thereby attracting global biopharmaceutical players to establish partnerships and expand their operation

- The integration of digital laboratory management platforms, automation technologies, and next-generation transfection instruments is enabling laboratories and biopharma companies to streamline experimental workflows. These advancements are improving reproducibility, accuracy, and scalability of transfection procedures, while also reducing human error. Consequently, the region is seeing increasing adoption of automated and digitalized systems, which are enhancing the overall efficiency and regulatory compliance of large-scale experiments and clinical research programs

Restraint/Challenge

High Costs and Limited Accessibility in Emerging Regions

- Despite significant scientific progress, the Asia-Pacific Transfection Reagent and Equipment market continues to face notable challenges in penetrating smaller-scale laboratories, resource-limited academic institutes, and research facilities located in rural or semi-urban regions. High costs of specialized reagents, lack of awareness about the advantages of modern transfection technologies, and persistent infrastructure limitations act as major barriers to adoption, restricting these institutions from accessing state-of-the-art solutions

- Logistics-related hurdles, including underdeveloped cold chain systems and limited access to advanced laboratory infrastructure outside metropolitan hubs, further constrain the availability of transfection products and equipment. These limitations delay the efficient delivery and utilization of sensitive reagents and instruments, thereby impacting the pace and quality of ongoing research in less-developed areas

- A considerable number of smaller institutions still rely on conventional, low-efficiency transfection methods such as chemical or mechanical approaches that lack the precision and scalability of newer technologies. This dependence reduces the reproducibility of experiments and hampers their ability to perform high-throughput studies, limiting both research outcomes and potential clinical translation

- The uneven geographic distribution of suppliers and distributors across Asia-Pacific creates additional challenges for remote laboratories. In many cases, institutions must transport samples or source reagents from distant urban centers, leading to longer turnaround times, higher operational costs, and disruptions in research timelines

- To overcome these obstacles, leading market players are actively developing and introducing cost-effective reagent kits, portable electroporation and nucleofection systems, and user-friendly instruments that require minimal infrastructure. Furthermore, companies are increasingly forming partnerships with regional distributors and local biotech associations to extend their market reach. These initiatives aim to improve accessibility, reduce costs, and encourage adoption among smaller research organizations, academic laboratories, and biotech start-ups, thereby bridging the gap between advanced research capabilities and underserved regions

Asia-Pacific Transfection Reagent and Equipment Market Scope

The market is segmented on the basis of products, stage, type, methods, types of molecule, organism, end user and distribution channel

- By Products

On the basis of products, the Asia-Pacific transfection reagent and equipment market is segmented into reagents & kits and instruments. The reagents & kits segment dominated the market with a revenue share of 61.4% in 2024, attributed to their indispensable role in ensuring high efficiency, reproducibility, and versatility across a broad spectrum of research and therapeutic workflows. These products are integral in applications such as gene delivery, functional genomics, cell-based assays, and drug development, with their popularity further reinforced by ease of use, standardized protocols, and cost-effectiveness.

In contrast, the instruments segment is projected to register the fastest CAGR of 10.5% between 2025 and 2032, driven by the increasing demand for automated electroporation platforms, high-throughput systems, and precision-engineered transfection devices. These advanced instruments are particularly valued for their ability to support scalable, clinical-grade manufacturing, enabling seamless transitions from small-scale laboratory experiments to large-scale commercial production.

- By Stage

On the basis of stage, the Asia-Pacific transfection reagent and equipment market is segmented into research, preclinical, clinical phases, and commercial. The research stage held the largest share of 39.8% in 2024, supported by widespread use in academic institutions, research laboratories, and early-stage drug discovery projects. This dominance is largely due to the growing emphasis on functional genomics, gene expression studies, and early proof-of-concept experiments that heavily depend on efficient transfection methods.

The commercial stage segment is anticipated to expand at the fastest CAGR of 11.1% from 2025 to 2032, fueled by the increasing need for GMP-compliant, large-scale transfection solutions. Expansion in cell and gene therapy manufacturing, mRNA-based vaccine production, and biologics development is accelerating demand for reliable commercial-scale workflows that meet stringent regulatory standards.

- By Type

On the basis of type, the Asia-Pacific transfection reagent and equipment market is segmented into transient transfection reagents and equipment and stable transfection reagents and equipment. The transient transfection segment dominated with a revenue share of 58.6% in 2024, owing to its broad use in short-term protein expression studies, assay development, and rapid target validation. It remains a preferred choice for laboratories that require speed, flexibility, and cost-effectiveness in experimental setups.

Meanwhile, the stable transfection segment is projected to grow at the fastest CAGR of 9.9% from 2025 to 2032, reflecting its critical importance in long-term cell line generation, biomanufacturing workflows, and therapeutic research. The growing reliance on sustained gene expression models for drug development and production is driving the adoption of stable transfection technologies across both research and commercial settings.

- By Methods

On the basis of methods, the Asia-Pacific transfection reagent and equipment market is segmented into non-viral methods and viral methods. Non-viral methods held the dominant market share of 63.2% in 2024, supported by their safety profile, ease of implementation, and cost advantages. Techniques such as electroporation, lipid nanoparticles, and chemical-based reagents are increasingly used in both research and preclinical workflows, as they minimize biosafety risks while offering reproducible results.

On the other hand, viral methods are expected to grow at a robust CAGR of 10.4% from 2025 to 2032, owing to their high delivery efficiency and ability to stably integrate genetic material. These methods are indispensable in advanced therapeutic areas such as CAR-T cell therapies, AAV-based gene therapies, and lentiviral-mediated gene editing, where reliability and long-term expression are paramount.

- By Types of Molecule

On the basis of molecule type, the Asia-Pacific transfection reagent and equipment market is segmented into plasmid DNA, small interfering RNA (siRNA), proteins, DNA oligonucleotides, ribonucleoprotein complexes (RNPs), and others. Plasmid DNA led the segment with a 37.5% revenue share in 2024, reflecting its central role in molecular cloning, vaccine development, and gene therapy pipelines. Its versatility and cost efficiency have ensured its continued dominance in both academic and industrial applications.

However, the RNP complexes segment is forecasted to expand at the fastest CAGR of 11.3% through 2032, fueled by the rising adoption of CRISPR-Cas9 genome editing technologies. RNP-based systems are valued for their ability to deliver precise and efficient gene modifications, positioning them as a transformative tool in next-generation therapeutic development.

- By Organism

On the basis of organism, the Asia-Pacific transfection reagent and equipment market is segmented into mammalian cells, plants, fungi, viruses, and bacteria. Mammalian cells dominated with a 54.7% share in 2024, as they are the gold standard for protein expression, therapeutic discovery, and translational research. Their genetic similarity to humans and ability to produce complex proteins make them the preferred system in both preclinical and clinical applications.

The plant segment, however, is projected to record the fastest CAGR of 9.8% from 2025 to 2032, supported by advancements in molecular farming, plant-based biologics, and agricultural biotechnology. Growing interest in cost-effective and scalable biologic production from plant systems is expected to further propel this segment’s growth.

- By Application

On the basis of application, the Asia-Pacific transfection reagent and equipment market is segmented into in vitro applications, in vivo applications, bioproduction, and others. The in vitro application segment held the largest share of 46.1% in 2024, primarily due to its widespread use in cell-based assays, pathway mapping, drug screening, and functional genomics. It continues to be a cornerstone of research laboratories across the region.

The bioproduction segment is forecasted to grow at the fastest CAGR of 10.7% from 2025 to 2032, as transfection technologies play a crucial role in large-scale biologics, biosimilars, and mRNA vaccine manufacturing. The focus on scalable, regulatory-compliant production systems is expected to drive strong growth in this segment over the forecast period.

- By End User

On the basis of end user, the Asia-Pacific transfection reagent and equipment market is segmented into biopharma, CROs, CMOs/CDMOs, academia, hospitals, clinical labs, and others. The biopharma segment dominated the market with a 43.9% revenue share in 2024, reflecting their significant investments in drug discovery, therapeutic R&D, and production of novel biologics. Biopharmaceutical companies rely heavily on transfection technologies for cell line development, target validation, and manufacturing optimization.

The CMOs/CDMOs segment is projected to post the fastest CAGR of 10.2% between 2025 and 2032, driven by the growing trend of outsourcing biomanufacturing and specialized transfection services. Their investment in high-throughput, cost-efficient, and GMP-grade platforms positions them as key enablers in the region’s biopharmaceutical value chain.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific Transfection Reagent and Equipment market is segmented into direct tender, retail sales, and others. The direct tender segment dominated with the largest share of 57.8% in 2024, supported by bulk procurement by pharmaceutical and biopharmaceutical firms, academic institutions, and government-backed research organizations. This channel ensures cost efficiency and long-term supply security for large-scale users.

The retail sales segment is projected to expand at the fastest CAGR of 9.5% during 2025–2032, buoyed by the rapid growth of online platforms, distributor networks, and specialized life science suppliers. Increasing demand for ready-to-use transfection kits, smaller-scale instruments, and consumables is boosting the uptake of retail distribution across the region.

Asia-Pacific Transfection Reagent and Equipment Market Regional Analysis

- Asia-Pacific held a revenue share of 20.7% in the global transfection reagent and equipment market in 2024. This leadership is underpinned by the region’s vast population base, rapid expansion of its biotechnology and pharmaceutical sectors, and the increasing adoption of advanced gene delivery methods in both research and clinical applications. The region’s strong position is further supported by significant growth in academic research, cell and gene therapy trials, and rising collaborations between global biopharma companies and regional institutions

- A heightened focus on precision medicine, personalized therapies, and next-generation biologics is accelerating demand for innovative transfection reagents and automated equipment. The expansion of contract research organizations (CROs), increasing preclinical and clinical trial activity, and the integration of digital laboratory platforms are reinforcing Asia-Pacific’s importance as a global hub for advanced life sciences research

- The demand for transfection solutions is further driven by large-scale investments from both public and private sectors aimed at strengthening biotechnology infrastructure, academic research facilities, and translational medicine programs. Key contributors include the rising prevalence of chronic and genetic diseases, a surge in vaccine and biosimilar development, and the growing role of bioproduction facilities across the region. Strategic alliances between regional laboratories and international transfection technology providers are also accelerating technology transfer, innovation, and regional accessibility

China Asia-Pacific Transfection Reagent and Equipment Market Insight

The China transfection reagent and equipment market held the largest market share in the Asia-Pacific region at 42.6% in 2024, reaffirming its leadership through a strong biopharmaceutical manufacturing base and robust R&D infrastructure. The country’s rapidly growing pipeline of gene and cell therapy trials, combined with well-established academic and clinical research institutions, is creating sustained demand for advanced transfection reagents and electroporation systems. Government initiatives aimed at strengthening biotechnology innovation, alongside heavy investments in genomic research and precision medicine programs, are further propelling market growth. Additionally, China’s position as a leading hub for biologics and vaccine production continues to enhance the adoption of efficient transfection technologies for large-scale applications.

India Asia-Pacific Transfection Reagent and Equipment Market Insight

The India transfection reagent and equipment market is projected to record the fastest CAGR of 19.4% during the forecast period, driven by an expanding biotechnology sector and rising adoption of advanced molecular biology tools. Increasing outsourcing of preclinical and clinical research to India, combined with the growth of academic and contract research organizations (CROs), is significantly boosting demand for high-efficiency transfection methods. Government initiatives such as “Make in India” and targeted investments in biotechnology R&D infrastructure are strengthening domestic innovation capabilities. Moreover, the rapid establishment of research centers and diagnostic facilities in tier 2 and tier 3 cities, coupled with collaborations between Indian institutions and global biopharma players, is positioning India as one of the fastest-growing and most dynamic markets in the Asia-Pacific transfection landscape.

Asia-Pacific Transfection Reagent and Equipment Market Share

The Asia-Pacific Transfection Reagent and Equipment industry is primarily led by well-established companies, including:

-

- Mirus Bio LLC (U.S.)

- Promega Corporation (U.S.)

- Polyplus Transfection (France)

- Bio-Rad Laboratories, Inc. (U.S.)

- Merck KGaA (Germany)

- Lonza (Switzerland)

- MaxCyte, Inc. (U.S.)

- Altogen Biosystems (U.S.)

- SBS Genetech (China)

- FUJIFILM Irvine Scientific (Japan)

- Cytiva (U.S.)

- Geno Technology Inc., USA (U.S.)

- R&D Systems, Inc. (U.S.)

- Takara Bio Inc. (Japan)

- Thermo Fisher Scientific Inc. (U.S.)

- QIAGEN (Germany)

- OriGene Technologies, Inc. (U.S.)

- Applied Biological Materials Inc. (abm) (Canada)

- Beckman Coulter, Inc. (U.S.)

- Amyris (U.S.)

- Codexis (U.S.)

- Autolus (U.K.)

- SignaGen Laboratories (U.S.)

- Impossible Foods Inc. (U.S.)

- Genlantis Inc. (U.S.)

- Ginkgo Bioworks (U.S.)

- Verve Therapeutics, Inc. (U.S.)

- Conagen, Inc. (U.S.)

- Poseida Therapeutics, Inc. (U.S.)

- Twist Bioscience (U.S.)

Latest Developments in Asia-Pacific Transfection Reagent and Equipment market

- In March 2021, Polyplus-transfection SA announced the acquisition of the main assets of Biowire to strengthen its global delivery solutions for gene & cell therapy and accelerate its expansion into Asia-Pacific markets

- In July 2021, Polyplus opened/expanded commercial offices in Shanghai to localize supply and support for the China / APAC cell & gene therapy sector

- In August 2021, Polyplus launched FectoVIR AAV GMP, a GMP-grade transfection reagent for large-scale AAV (viral vector) production, addressing growing demand for scalable viral vector manufacturing for gene therapies

- In September 2022, Polyplus launched in vivo-jetRNA+ (an in vivo mRNA delivery transfection reagent) to support in vivo mRNA delivery research and applications

- In May 2023, Thermo Fisher Scientific opened a new sterile drug facility in Singapore, expanding Asia-Pacific manufacturing and research capabilities that support biologics, vaccines and downstream workflows used alongside transfection and cell-based process development

- In January 2024, MaxCyte announced a strategic partnership (with Lion TCR) that included steps to enhance its presence and commercial operations in Asia, supporting broader adoption of non-viral cell engineering platforms across APAC

- In March 2024, Takara Bio released new reagents (for example PrimeCap T7 RNA Polymerase with low dsRNA) and announced R&D expansions, strengthening its reagent portfolio that supports mRNA work and transfection workflows across Japan and the APAC research community

- In May 2024, Merck KGaA signed a definitive agreement to acquire Mirus Bio (a specialist transfection reagents company) — a move that consolidates transfection reagent IP and increases scale for APAC supply and global distribution

- In November 2024, Thermo Fisher further expanded its India footprint by announcing a bioprocess design center in Hyderabad, underscoring continued investment in APAC bioprocess and cell-therapy enabling infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.