Asia Pacific Transradial Access Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

3.22 Billion

2024

2032

USD

1.70 Billion

USD

3.22 Billion

2024

2032

| 2025 –2032 | |

| USD 1.70 Billion | |

| USD 3.22 Billion | |

|

|

|

|

Asia-Pacific Transradial Access Market Size

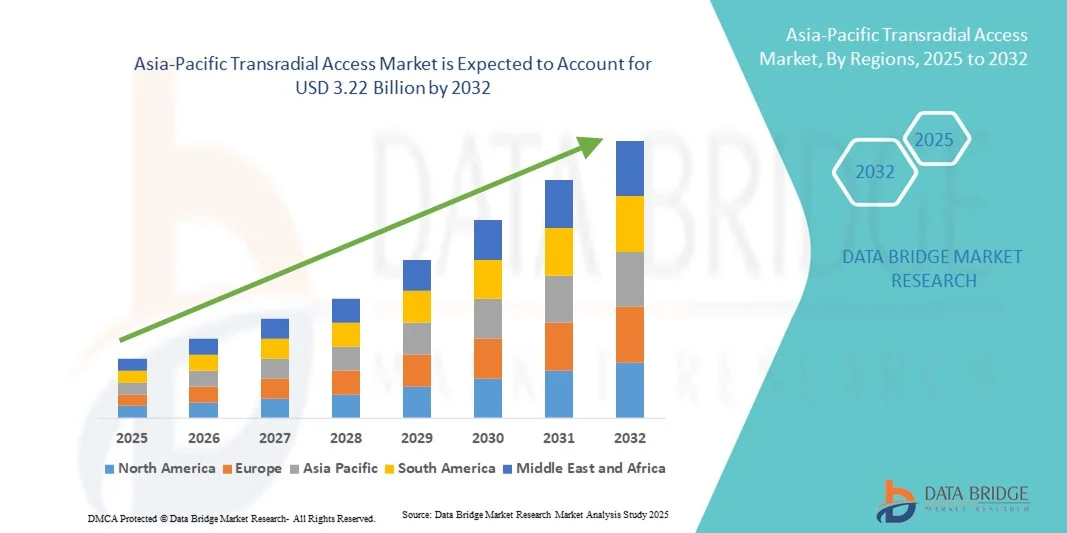

- The Asia-Pacific transradial access market size was valued at USD 1.70 billion in 2024 and is expected to reach USD 3.22 billion by 2032, at a CAGR of 8.35% during the forecast period

- The market growth is largely fueled by the rising prevalence of cardiovascular diseases, growing adoption of minimally invasive procedures, and technological advancements in vascular access devices, leading to increased preference for transradial procedures across hospitals and clinics

- Furthermore, increasing patient awareness, demand for safer and more efficient procedures, and expansion of healthcare infrastructure in countries such as China, Japan, India, and South Korea are positioning transradial access as the preferred method for interventional cardiology and neurovascular interventions. These converging factors are accelerating the uptake of transradial access procedures, thereby significantly boosting the industry's growth

Asia-Pacific Transradial Access Market Analysis

- Transradial access, providing arterial entry through the wrist for interventional cardiology and neurovascular procedures, is increasingly becoming the preferred approach in hospitals and clinics across Asia-Pacific due to its lower complication rates, faster patient recovery, and compatibility with minimally invasive techniques

- The rising demand for transradial procedures is primarily fueled by the increasing prevalence of cardiovascular diseases, growing awareness of patient safety, and the adoption of advanced catheterization technologies that improve procedural efficiency and outcomes

- Japan dominated the Asia-Pacific transradial access market with the largest revenue share of 33% in 2024, driven by well-established healthcare infrastructure, high procedural volumes, and early adoption of innovative interventional technologies

- China is expected to be the fastest-growing country in the transradial access market during the forecast period, due to rising healthcare expenditures, increasing patient awareness, and expansion of minimally invasive cardiology and neurovascular intervention centers

- The guidewires segment dominated the transradial access market with a significant share of 41.2% in 2024, driven by their critical role in procedural success, ease of use, and continuous technological advancements enhancing safety and performance

Report Scope and Asia-Pacific Transradial Access Market Segmentation

|

Attributes |

Asia-Pacific Transradial Access Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Transradial Access Market Trends

Minimally Invasive Procedure Preference and Technological Integration

- A significant and accelerating trend in the Asia-Pacific transradial access market is the growing preference for minimally invasive procedures combined with advanced catheterization technologies, improving patient safety and procedural efficiency

- For instance, the Terumo Radial 6F Sheath System integrates advanced material design and hydrophilic coating, allowing smoother arterial access and reduced complication rates

- Technological advancements, such as AI-assisted catheter navigation and imaging-guided interventions, enable precise device placement, reduced procedure time, and enhanced operator confidence

- The integration of digital imaging, pressure sensors, and ergonomic catheter designs is enabling hospitals to adopt transradial access more efficiently while enhancing patient outcomes and reducing hospital stays

- This trend towards safer, faster, and more technologically advanced procedures is reshaping clinician and patient expectations, prompting device manufacturers such as Terumo and Cordis to develop next-generation guidewires, catheters, and sheaths

- The demand for transradial access solutions with advanced safety and procedural optimization features is rapidly growing across interventional cardiology and neurovascular centers in Asia-Pacific

Asia-Pacific Transradial Access Market Dynamics

Driver

Increasing Cardiovascular Disease Burden and Minimally Invasive Adoption

- The rising prevalence of cardiovascular diseases and the increasing adoption of minimally invasive procedures are significant drivers for the growth of the transradial access market

- For instance, in March 2024, Terumo Corporation launched a new AI-assisted guidewire system in Japan to enhance procedural accuracy and reduce complications, expected to drive regional adoption

- As patient awareness of safer access methods grows, transradial procedures are preferred over femoral approaches due to lower bleeding risks and shorter recovery times

- Moreover, the expanding network of hospitals and catheterization labs in Asia-Pacific, especially in urban centers, is facilitating broader adoption of transradial access technique

- Rising collaboration between device manufacturers and hospitals for clinical training programs is enhancing procedural adoption rates and market penetration

- Increasing healthcare expenditure, government initiatives promoting cardiovascular care, and rising demand for advanced procedural solutions are key factors propelling market growth in both developed and emerging Asia-Pacific countries

Restraint/Challenge

High Device Costs and Regulatory Compliance Hurdles

- The relatively high cost of advanced transradial access devices and associated equipment poses a significant challenge for broader market penetration, particularly in developing countries

- For instance, reports of expensive sheath-catheter combinations in India and Southeast Asia have slowed adoption in smaller hospitals and clinics with budget constraints

- Stringent regulatory approvals and varying compliance standards across Asia-Pacific countries further complicate market entry for new devices and technologies

- Addressing these cost and regulatory challenges through localized manufacturing, affordable device options, and faster regulatory pathways is crucial for encouraging wider adoption

- While technological advancements are improving procedural efficiency, the perceived high cost of next-generation devices and procedural training requirements can hinder widespread uptake, especially in tier-2 and tier-3 cities

- Overcoming these obstacles through strategic pricing, regulatory alignment, and clinician training programs will be vital for sustained growth of the transradial access market in Asia-Pacific

Asia-Pacific Transradial Access Market Scope

The market is segmented on the basis of product, application, usage, and end-user.

- By Product

On the basis of product, the market is segmented into guidewires, guiding catheters, sheaths & sheath introducers, microcatheters, intermediate catheters, and accessories. The guidewires segment dominated the market with the largest revenue share of 41.2% in 2024, driven by their critical role in procedural success and compatibility with multiple intervention types. Guidewires are essential for navigating complex vascular pathways safely and efficiently, reducing procedural complications. Their continuous innovation, such as hydrophilic coatings and enhanced flexibility, has further reinforced adoption. Hospitals prioritize guidewires for their reliability in both cardiology and neurovascular procedures. The market also sees strong demand due to the growing prevalence of cardiovascular diseases and increasing minimally invasive interventions across Asia-Pacific. Furthermore, the availability of specialized guidewires for high-risk or complex procedures enhances their dominance in the region.

The sheaths & sheath introducers segment is expected to witness the fastest CAGR of 9.5% during 2025–2032, driven by increasing adoption in hospitals and clinics offering transradial procedures. Sheaths provide a safe conduit for guidewires and catheters while reducing arterial trauma. Their improved designs with hydrophilic coatings and ergonomic handles facilitate smoother procedures and faster patient recovery. Hospitals in urban centers are increasingly adopting advanced sheath systems to support high procedural volumes and improve outcomes. The segment also benefits from rising procedural standardization and clinician training programs. Increasing awareness about procedural safety and patient comfort is boosting demand for these devices.

- By Application

On the basis of application, the market is segmented into neurovascular and cardiology peripheral vascular procedures. The cardiology segment dominated with the largest revenue share of 57% in 2024, due to the higher prevalence of cardiovascular diseases and widespread adoption of minimally invasive interventions. Cardiology procedures often rely on transradial access to reduce bleeding risks and shorten patient recovery times, making it the preferred approach in hospitals. The dominance is supported by increasing procedural volumes in urban hospitals and government initiatives promoting cardiovascular care. Advanced catheters and guidewires enhance procedural success, further boosting adoption. The segment also benefits from strong clinical evidence supporting safety and efficacy. Rising investments in interventional cardiology infrastructure are further accelerating growth in this segment.

The neurovascular segment is expected to witness the fastest CAGR of 10.1% from 2025 to 2032, driven by increasing demand for minimally invasive treatments for stroke, aneurysms, and other neurovascular conditions. Neurovascular interventions require precision devices such as microcatheters and intermediate catheters, which are gaining adoption in specialized hospitals. Technological advancements, including AI-assisted navigation, support the growing market. Rising awareness about stroke management and early interventions is expanding the neurovascular procedure base. Increased training for neurointerventionalists in Asia-Pacific is also driving adoption of transradial access in neurovascular applications.

- By Usage

On the basis of usage, the market is segmented into drug administration, fluid & nutrition administration, blood transfusion, and diagnostics & testing. The drug administration segment dominated the market with the largest revenue share of 38% in 2024, owing to its widespread use in interventional cardiology and neurovascular procedures for delivering anticoagulants, contrast media, or therapeutic agents. The dominance is supported by the need for precise, controlled drug delivery to minimize complications. Transradial access enables efficient drug administration while allowing patient mobility and comfort. Rising procedural volumes and increasing preference for minimally invasive techniques further strengthen this segment. Hospitals prioritize drug administration devices that are compatible with existing guidewires and catheters. Continuous product innovation, such as safer infusion pumps and pressure-controlled devices, reinforces market dominance.

The blood transfusion segment is expected to witness the fastest CAGR of 9.2% during 2025–2032, driven by increasing adoption of transradial access for procedures that require perioperative or intra-procedural transfusions. Efficient blood administration through transradial access reduces risks and improves patient outcomes. Rising cardiovascular surgeries and interventional procedures increase demand. Hospitals in high-volume centers are adopting specialized transfusion-compatible sheaths and catheters. Technological improvements ensuring safety and minimal hemolysis are boosting adoption. Training programs for clinicians in safe transfusion techniques are also supporting growth.

- By End-User

On the basis of end-user, the market is segmented into hospitals, clinics, and ambulatory care centers. The hospitals segment dominated with the largest revenue share of 64% in 2024, due to the high procedural volumes, availability of specialized cath labs, and presence of trained interventional cardiologists. Hospitals serve as the primary centers for both cardiology and neurovascular interventions, creating strong demand for a full range of transradial access products. The segment benefits from advanced infrastructure, government funding, and increasing patient inflow. Adoption of minimally invasive procedures is higher in hospitals compared to clinics or ambulatory care centers. Partnerships between device manufacturers and hospitals for training and support further reinforce dominance. Rising healthcare awareness and insurance coverage also contribute to growth.

The clinics segment is expected to witness the fastest CAGR of 10% during 2025–2032, driven by increasing outpatient interventional procedures and expansion of smaller cardiology and neurovascular centers. Clinics are adopting transradial access devices to offer minimally invasive treatments with shorter recovery times. The segment benefits from the rising trend of ambulatory interventions and patient preference for convenience. Affordable device options and clinician training initiatives are accelerating adoption. Clinics in tier-2 and tier-3 cities are increasingly offering procedures previously limited to hospitals. Technological advancements making procedures safer and easier are also supporting rapid growth.

Asia-Pacific Transradial Access Market Regional Analysis

- Japan dominated the Asia-Pacific transradial access market with the largest revenue share of 33% in 2024, driven by well-established healthcare infrastructure, high procedural volumes, and early adoption of innovative interventional technologies

- Hospitals and clinics in Japan prioritize minimally invasive procedures due to lower complication rates and faster patient recovery, supporting widespread adoption of transradial access devices across cardiology and neurovascular interventions

- This dominance is further strengthened by government initiatives promoting cardiovascular care, advanced catheterization labs, and collaboration between device manufacturers and hospitals for clinician training programs, establishing transradial access as the preferred method for interventions

The Japan Transradial Access Market Insight

The Japan transradial access market is gaining momentum due to the country’s advanced healthcare infrastructure, high procedural volumes, and early adoption of innovative interventional technologies. Hospitals in Japan emphasize minimally invasive approaches to reduce complication rates and shorten recovery times, fueling adoption. The integration of advanced devices such as AI-assisted guidewires and hydrophilic-coated sheaths further drives growth. In addition, government initiatives promoting cardiovascular care and training programs for clinicians are supporting widespread procedural adoption in both cardiology and neurovascular interventions.

China Transradial Access Market Insight

The China transradial access market is expected to witness the fastest growth during the forecast period, fueled by increasing healthcare expenditure, rising patient awareness, and expansion of catheterization labs across urban and semi-urban areas. The growing incidence of cardiovascular diseases and rising demand for minimally invasive interventions are key growth drivers. In addition, collaborations between device manufacturers and hospitals for clinical training programs, along with localized manufacturing reducing device costs, are further boosting adoption. China’s focus on developing modern healthcare infrastructure is enhancing the accessibility of transradial procedures in both public and private hospitals.

India Transradial Access Market Insight

The India transradial access market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s rapidly expanding healthcare infrastructure, high patient population, and increasing procedural volumes. Hospitals and clinics are increasingly adopting transradial access for cardiology and neurovascular interventions due to its safety, efficiency, and lower complication rates. Government initiatives promoting cardiovascular care and rising awareness among patients are further propelling market growth. In addition, the presence of domestic device manufacturers and the availability of affordable guidewires, catheters, and sheath systems support broader adoption in both urban and tier-2 cities.

South Korea Transradial Access Market Insight

The South Korea transradial access market is witnessing steady growth due to the country’s advanced healthcare system, high adoption of minimally invasive procedures, and rising prevalence of cardiovascular diseases. Hospitals in South Korea are increasingly incorporating transradial techniques in both cardiology and neurovascular procedures to reduce procedural complications and improve patient recovery. The market growth is supported by continuous technological advancements, such as enhanced guidewires, sheaths, and microcatheters, alongside government initiatives promoting advanced cardiovascular care. In addition, clinician training programs and hospital collaborations with device manufacturers are encouraging broader adoption of transradial access solutions across the country.

Asia-Pacific Transradial Access Market Share

The Asia-Pacific Transradial Access industry is primarily led by well-established companies, including:

- Terumo Corporation (Japan)

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- BD (U.S.)

- Cordis (U.S.)

- AngioDynamics, (U.S.)

- Merit Medical Systems. (U.S.)

- Edwards Lifesciences Corporation (U.S.)

- NIPRO CORPORATION (Japan)

- Abbott (U.S.)

- Teleflex Incorporated (U.S.)

- Surmodics, Inc. (U.S.)

- Stryker (U.S.)

- Cardinal Health (U.S.)

- Ameco Medical Industries (Egypt)

- Penumbra, Inc. (U.S.)

- Smiths Group plc (U.K.)

- Alvimedica (Turkey)

- ICU Medical, Inc. (U.S.)

- InnoMedica (Italy)

What are the Recent Developments in Asia-Pacific Transradial Access Market?

- In May 2024, Demax Group received CE certification for eleven lines of interventional products, including catheters and radial artery compression tourniquets. This certification under the EU's Medical Devices Regulation (MDR) signals the increasing sophistication and global market readiness of a major China-based manufacturer's portfolio, which is vital for competition and supply in the Asia-Pacific region

- In April 2024, Medtronic Japan announced that the company began selling the Rist Radial Access Guide Catheter in Japan. This is the first device in Japan specifically designed for radial artery puncture in cerebrovascular (brain blood vessel) treatment, offering an alternative to the traditional transfemoral artery puncture approach. This development expands the use of transradial access from cardiology to neurovascular procedures in a key Asia-Pacific market

- In September 2023, Terumo Corporation launched a comprehensive training program for healthcare professionals focused on transradial access techniques. While the program is often global, such structured training initiatives are crucial for the widespread adoption and proficiency of the technique in the rapidly expanding Asia-Pacific markets such as Japan, South Korea, China, and India

- In July 2023, ALVIMEDICA announced the launch of its new Alvision KAPLAN curves radial portfolio for diagnostic procedures, following CE Mark approval from European authorities. This new line of diagnostic catheters is designed with unique structural technologies (Flat Wire section Braiding) for outstanding torque response, aiming to ease coronary artery angiography from a transradial approach and improve patient outcomes

- In September 2021, Medtronic plc announced that its radial artery access portfolio, which includes the Rist 079 Radial Access Guide Catheter and Rist Radial Access Selective Catheter, obtained CE Mark approval. The Rist 079 catheter is noted as the first catheter specifically designed for neurovasculature access via the radial artery. This approval paved the way for the marketing and later launch of this specialized technology in CE-mark accepting countries, including certain regions in the Asia-Pacific

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.