Asia Pacific Trash Bags Market

Market Size in USD Billion

CAGR :

%

USD

5.89 Billion

USD

9.46 Billion

2024

2032

USD

5.89 Billion

USD

9.46 Billion

2024

2032

| 2025 –2032 | |

| USD 5.89 Billion | |

| USD 9.46 Billion | |

|

|

|

Trash Bags Market Analysis

The Asia-Pacific trash bags market is growing steadily, driven by increasing urbanization, rising waste generation, and heightened environmental awareness. Key segments include biodegradable and non-biodegradable bags, with demand for eco-friendly options surging due to stricter regulations and consumer preferences for sustainable products. Industries such as healthcare, hospitality, and retail contribute significantly to market growth. Asia-Pacific leads in volume due to population density. Key players focus on innovations, such as compostable materials and enhanced durability, to gain competitive edges. Challenges include fluctuating raw material costs and managing environmental impacts. The market outlook remains positive, bolstered by governmental initiatives and the adoption of circular economy practices.

Trash Bags Market Size

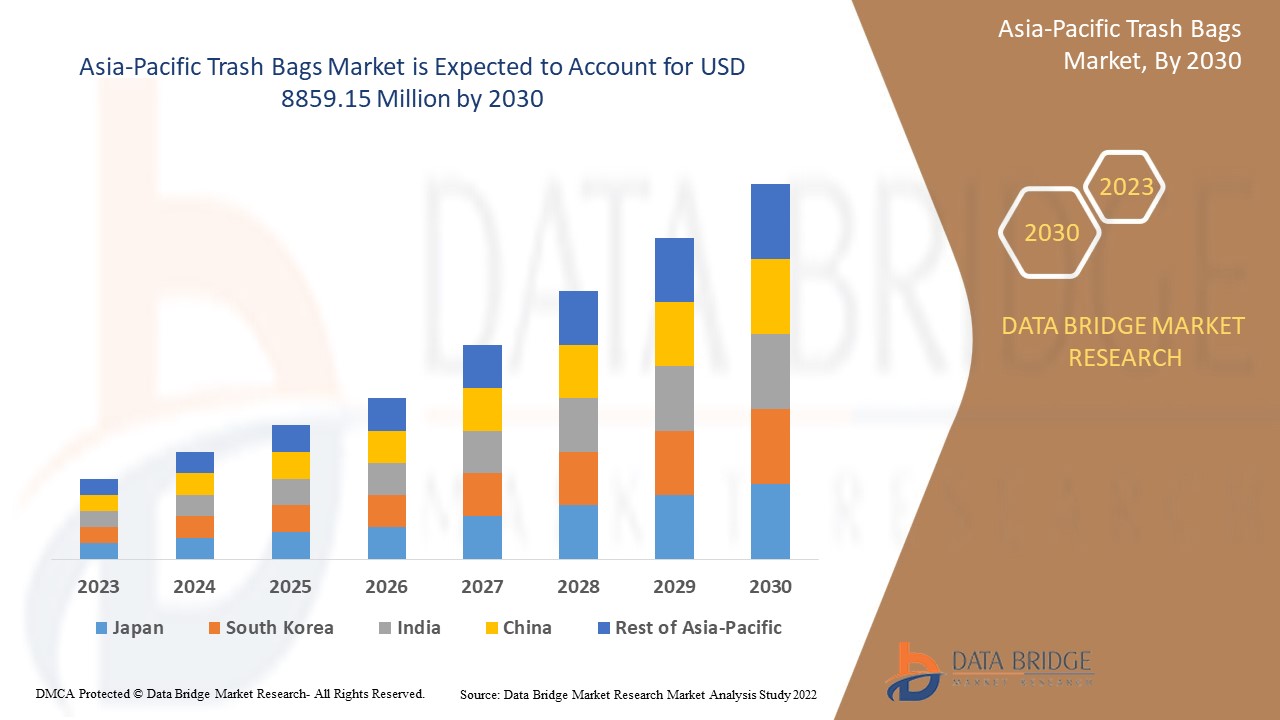

The Asia-Pacific trash bags market is expected to reach USD 9.46 billion by 2032 from USD 5.89 billion in 2024, growing with a substantial CAGR of 6.16% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Trash Bags Market Trends

“Rise in Demand for Premium Trash Bags”

There is a noticeable trend towards premiumization in the trash bags market, driven by factors such as rising disposable incomes, urbanization, and consumer preferences for quality and convenience. Consumers are increasingly willing to pay a premium for trash bags with advanced features and superior performance. Premium trash bags often offer benefits such as extra strength, leak-proof seals, odor control, and attractive designs.

Consumers are becoming aware of the importance of odor-resistant, eco-friendly, and durable waste disposal solutions. This is leading to a shift from traditional options to premium-quality garbage bags. Moreover, premium trash bags are perceived as a symbol of quality and reliability, influencing purchasing decisions among discerning consumers. As a result, manufacturers are investing in product innovation and differentiation to cater to this growing demand for premium trash bags, offering a wide range of options to meet varying consumer needs and preferences.

Report Scope and Trash Bags Market Segmentation

|

Attributes |

Trash Bags Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

China, Japan, India, South Korea, Australia, Singapore, Malaysia, Indonesia, Thailand, New Zealand, and Rest of Asia-Pacific |

|

Key Market Players |

Berry Global Inc. (U.S.), The Clorox Company (U.S.), Reynolds Consumer Products (U.S.), and NaturTrust (Subsidiary of Holostik group) (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Trash Bags Market Definition

Trash bags, also known as garbage bags or refuse sacks, are large, flexible bags primarily used for containing and disposing of waste materials. Typically made from durable plastic materials such as polyethylene, these bags are designed to securely hold various types of trash, including household, industrial, or commercial waste. They come in various sizes, thicknesses, and colors to accommodate different types and volumes of garbage. Trash bags often feature drawstrings, tie flaps, or twist ties to facilitate easy closure and transportation. They are an essential tool for maintaining cleanliness and sanitation in homes, workplaces, and public areas by providing a convenient means of waste disposal.

Trash Bags Market Dynamics

Drivers

- Rising Importance and Awareness Regarding Waste Management

Global attention towards waste management has intensified significantly due to growing environmental concerns, particularly related to plastic pollution. Improper waste management has a significant impact on the environment and human health. Waste that is not disposed of properly can pollute the air, water, and soil, leading to severe environmental degradation. It can also harm wildlife and marine life, which can have a cascading impact on the food chain. The release of greenhouse gases from waste decomposition contributes to climate change, which is one of the biggest challenges. Improper waste management can also have a significant impact on human health. Exposure to hazardous waste can cause respiratory problems, skin irritation, and other health issues

For instance,

In June 2022, as per a study published by Elsevier B.V., the rate of generation of solid waste from the major cities of the globe to 1.3 billion tons/year, and the figure is expected to reach 2.2 billion tons/year by 2025. This is equivalent to an increase from 1.2 kg/capita/day to 1.42 kg/capita/day, assuming a global urban population of 4.3 billion in 2025.

- Technological Advancements In Trash Bags Industry

Technological advancements have revolutionized the trash bags industry, enabling manufacturers to develop innovative products with enhanced properties and sustainability features. Advanced manufacturing techniques, such as blown film extrusion and multi-layer co-extrusion, allow for the production of trash bags with superior strength, puncture resistance, and tear resistance.

Furthermore, developments in polymer science have led to the creation of biodegradable and compostable plastics derived from renewable sources such as plant-based polymers and bio-based resins. Smart packaging solutions, incorporating technologies such as RFID tags and QR codes, enable real-time tracking of inventory, supply chain visibility, and product authentication.

For Instance,

In April 2023, Microban International and Berry Global announced a partnership to launch a line of Color Scents scented trash bags with antimicrobial technology. The partnership combines Microban’s market-leading expertise in antimicrobial technologies with Berry Global’s manufacturing capabilities. The new additions to the Color Scents family of products are available in three different sizes – catering for all household waste needs – and combine a choice of four subtle scents with Microban antimicrobial technology to protect against the growth of odor-causing bacteria.

Opportunities

- Demand for Biodegradable Solution Leads to Adoption of Compostable Trash Bags

The growing demand for biodegradable and environmentally friendly products presents significant opportunities for the adoption of compostable trash bags in the market. Consumers are increasingly seeking sustainable alternatives to traditional plastic bags, driven by environmental concerns and regulatory pressures. Compostable trash bags, made from renewable materials such as plant-based polymers, offer a viable solution to reduce plastic waste and promote circular economy principles. There is a growing consumer preference for compostable trash bags, particularly in North America and European regions, which have stringent waste management regulations and strong environmental awareness. Manufacturers can capitalize on this trend by expanding their product offerings to include compostable options, catering to the evolving needs and preferences of eco-conscious consumers.

For instance,

In August 2020, UNNI launched Compostable Trash Bags, which are 100% biodegradable trash bags made from plant starches that do not contain polyethylene. The product is certified by the Biodegradable Products Institute (BPI). This means that it can be disposed of in commercial compost sites.

- Rising Investments in Product Innovation and Differentiation

The trash bags market presents opportunities for manufacturers to differentiate their products through investments in product innovation and differentiation. With increasing competition and price pressures, innovation is key to gaining a competitive edge and sustaining growth in the market. Manufacturers are investing in research and development to develop new materials, formulations, and features that enhance the performance, durability, and sustainability of trash bags. This includes the development of advanced technologies such as biodegradable polymers, antimicrobial additives, and odor-control properties.

Trash bag manufacturers often engage in product innovation to differentiate themselves in the market. This may include the development of bags with specific features such as odor control, extra strength, drawstrings, recyclability, environmental sustainability, and ventilation holes. The market is heavily influenced by factors such as population growth, urbanization, waste management practices, and consumer preferences. Innovations like the Ventilated Trash Bag will inevitably enhance growth.

Restraints/Challenges

- Fluctuations in Raw Material Prices

Raw materials are considered one of the essential elements in the production process because the availability of raw materials at the appropriate cost and without price fluctuation makes the production process within the organization more flexible and more manageable. Raw materials prices can fluctuate greatly due to a variety of factors, including supply and demand, natural disasters, political instability, and currency fluctuations. The trash bags market is significantly influenced by fluctuations in raw material prices, primarily petroleum-based plastics such as Polyethylene (PE). The cost of polyethylene resin, which is a key raw material for trash bag manufacturing, is subject to volatility due to factors such as changes in crude oil prices, supply-demand imbalances, and geopolitical tensions.

For instance,

In January 2024, according to an article published by A-Pac Manufacturing Co., Inc., The U.S. government pushed consumers toward renewable resources, which limited supply and added costs to purchasing materials like polyethylene. This effort mostly caused polyethylene prices to rise, accommodating for added production costs.

- Inadequate Waste Management Infrastructure

Inadequate waste management infrastructure in certain regions is a major challenge for the trash bags market. Inadequate waste collection, segregation, and recycling facilities limit the effectiveness of waste management practices and impact the adoption of trash bags for proper waste disposal. Many developing countries lack sufficient infrastructure and resources for waste management, leading to issues such as littering, illegal dumping, and environmental pollution. In areas with poor waste management infrastructure, access to trash bags may be limited. Local stores may not stock a variety of options, and consumers may struggle to find suitable products. This scarcity can hinder the adoption of trash bags as consumers resort to alternative methods for waste containment.

Moreover, in regions where waste management infrastructure is lacking, the cost of trash bags may be higher due to supply chain challenges or the need for specialized distribution networks. Higher prices can discourage consumers from purchasing trash bags, leading them to opt for cheaper but less environmentally friendly alternatives or reuse existing bags, impacting adoption rates. Without adequate recycling facilities, consumers may be less inclined to use trash bags made from recyclable materials. Concerns about environmental impact and sustainability may lead consumers to avoid purchasing products that they cannot recycle or dispose of properly, further hindering adoption.

For instance,

In December 2020, according to a study published by Elsevier B.V., in India, approximately 143,449 MT of Municipal Solid Waste (MSW) was being generated daily, out of which only 111,000 Metric tonnes were collected, and about 35,602 Metric tonnes were treated.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Trash Bags Market Scope

The market is segmented on the basis of type, material, capacity, end-user, category, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Drawstring/Drawtape Trash Bags

- Flat Trash Bags

- Zipper Bags

- Star Sealed Trash Bags

- T-Shirt Trash Bags

- By Type

- Block T-Shirt Bags

- T-Shirt Knot Bags

- C-Fold T-Shirt Bags

- By Type

- Flat Star Sealed Trash Bags

- Others

Material

- Low Density Polyethylene

- High Density Polyethylene

- Linear Low Density Polyethylene

- Bio-Degradable Polyethylene

- Others

Capacity

- 10-25 Kg

- 25-50 Kg

- 50-75 Kg

- 75-100 Kg

- 100-150 Kg

- More Than 150kg

End-User

- Industries

- By Type

- Drawstring/Drawtape Trash Bags

- Flat Trash Bags

- Zipper Bags

- Star Sealed Trash Bags

- T-Shirt Trash Bags

- Flat Star Sealed Trash Bags

- Others

- By Type

- Corporate Offices

- By Type

- Drawstring/Drawtape Trash Bags

- Flat Trash Bags

- Zipper Bags

- Star Sealed Trash Bags

- T-Shirt Trash Bags

- Flat Star Sealed Trash Bags

- Others

- By Type

- Hospitals

- By Type

- Drawstring/Drawtape Trash Bags

- Flat Trash Bags

- Zipper Bags

- Star Sealed Trash Bags

- T-Shirt Trash Bags

- Flat Star Sealed Trash Bags

- Others

- By Type

- Residential

- By Type

- Drawstring/Drawtape Trash Bags

- Flat Trash Bags

- Zipper Bags

- Star Sealed Trash Bags

- T-Shirt Trash Bags

- Flat Star Sealed Trash Bags

- Others

- By Type

- Institutions

- By Type

- Drawstring/Drawtape Trash Bags

- Flat Trash Bags

- Zipper Bags

- Star Sealed Trash Bags

- T-Shirt Trash Bags

- Flat Star Sealed Trash Bags

- Others

- By Type

- Laboratories

- By Type

- Drawstring/Drawtape Trash Bags

- Flat Trash Bags

- Zipper Bags

- Star Sealed Trash Bags

- T-Shirt Trash Bags

- Flat Star Sealed Trash Bags

- Others

- By Type

- Others

- By Type

- Drawstring/Drawtape Trash Bags

- Flat Trash Bags

- Zipper Bags

- Star Sealed Trash Bags

- T-Shirt Trash Bags

- Flat Star Sealed Trash Bags

- Others

- By Type

Category

- Non-Biodegradable

- Biodegradable

Distribution Channel

- Indirect Sales

- Offline

- By Type

- Supermarkets / Hypermarkets

- Convenience Stores

- Specialty Stores

- Others

- By Type

- Online

- By Type

- E-Commerce

- Company Owned Websites

- By Type

- Offline

- Direct Sales

Trash Bags Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, material, capacity, end-user, category, and distribution channel as referenced above.

The countries covered in the market are China, Japan, India, South Korea, Australia, Singapore, Malaysia, Indonesia, Thailand, New Zealand, and Rest of Asia-Pacific.

China dominates the Asia-Pacific trash bags market due to its large population, rapid urbanization, and significant waste generation. Strong government initiatives promoting waste management, rising environmental awareness, and advancements in manufacturing capabilities further bolster China's leadership in the market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Trash Bags Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Trash Bags Market Leaders Operating in the Market Are:

- Berry Global Inc. (U.S.)

- The Clorox Company (U.S.)

- Reynolds Consumer Products (U.S.)

- NaturTrust (Subsidiary of Holostik group) (U.S.)

Latest Developments in Trash Bags Market

- In March 2024, Reynolds Consumer Products announced that Hefty Ultra Strong Fabuloso Scented tall kitchen trash bags have been recognized as one of the 2022 New Product Pacesetters of 2022. The 28th annual report, published by Circana, reveals the top new product launches across the food, beverage and non-food industries. It will attract customer base for the company and will eventually add in the revenue

- In March 2024, Inteplast Group received ISCC (International Sustainability & Carbon Certification) PLUS certification at the following facilities: Gray Court, SC; Lolita, TX; and Morristown, TN. Inteplast BOPP Films now will be able to produce and supply ISCC-certified materials that are attributed via a mass balance approach. This makes the company one of the first BOPP film manufacturers to hold the ISCC PLUS designation in North America

- In April 2023, Microban International and Berry Global partnered to launch Color Scents scented trash bags with antimicrobial technology. The collaboration combined Microban's expertise with Berry Global's manufacturing capabilities. The new bags, available in three sizes, featured four subtle scents and Microban antimicrobial technology to combat odor-causing bacteria

- In May 2022, Berry Global introduced a new range of high-strength refuse sacks made from recycled plastics. The sacks, produced from tough agricultural plastic waste, were manufactured at Berry Global's facility in Heanor, Derbyshire. Collected through the APE UK scheme, the aim was to increase recycling of non-packaging agricultural plastics to over 70% within five years. These RecyClass certified sacks, available in Tie Top and Tie Handle versions, are now sold in Sainsbury’s supermarkets

- In June 2020, Polykar, completed the expansion of its recycling department in June 2020. The upgrade increased recycling capacity to 10,000 tons annually, diverting more plastic waste from landfills. With state-of-the-art machines, Polykar can now recycle complex materials previously sent to landfills, contributing to its commitment to sustainability. This investment strengthens Polykar's position in the recycled garbage bag market, utilizing recycled resins across its product portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END-USER COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 BARGAINING POWER OF SUPPLIERS

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT-EXPORT SCENARIO

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.5.1 MATERIAL SOURCING AND QUALITY

4.5.2 MANUFACTURING CAPABILITIES

4.5.3 SUSTAINABILITY PRACTICES

4.5.4 SUPPLY CHAIN RELIABILITY

4.5.5 COST COMPETITIVENESS

4.5.6 FLEXIBILITY AND COLLABORATION

4.5.7 ETHICAL AND SOCIAL RESPONSIBILITY

4.5.8 TRACK RECORD AND REPUTATION

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 OVERVIEW

4.6.1.1 Raw Material Procurement

4.6.1.2 Manufacturing

4.6.1.3 Distribution

4.6.1.4 Retailing

4.6.2 LOGISTIC COST SCENARIO

4.6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.1.1 Raw Material Sourcing and Sustainability

4.7.1.2 Product Design and Eco-friendly Packaging

4.7.1.3 Manufacturing Processes and Energy Efficiency

4.7.1.4 Recycling and Circular Economy Initiatives

4.7.1.5 Regulatory Compliance and Emission Reduction Targets

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATION

4.8 PRICING ANALYSIS

4.9 RAW MATERIAL COVERAGE

4.9.1 POLYETHYLENE (PE)

4.9.2 RECYCLED PLASTICS

4.9.3 BIODEGRADABLE AND COMPOSTABLE MATERIALS

4.9.4 BIO-BASED PLASTICS

4.9.5 OTHER ADDITIVES AND FILLERS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.10.1 DEVELOPMENT OF SUSTAINABLE MATERIALS

4.10.2 IMPROVED MANUFACTURING PROCESSES

4.10.3 SMART PACKAGING SOLUTIONS

4.10.4 ANTIMICROBIAL AND ODOR-CONTROL TECHNOLOGIES

4.10.5 RECYCLING AND CIRCULAR ECONOMY INITIATIVES

4.10.6 BIODEGRADATION ENHANCEMENT

4.10.7 LIFE CYCLE ASSESSMENT (LCA) TOOLS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING IMPORTANCE AND AWARENESS REGARDING WASTE MANAGEMENT

6.1.2 TECHNOLOGICAL ADVANCEMENTS IN TRASH BAGS INDUSTRY

6.1.3 STRINGENT WASTE MANAGEMENT REGULATIONS ACROSS VARIOUS REGIONS

6.1.4 RISE IN DEMAND FOR PREMIUM TRASH BAGS

6.2 RESTRAINTS

6.2.1 FLUCTUATIONS IN RAW MATERIAL PRICES

6.2.2 INCREASING AVAILABILITY AND ADOPTION OF ALTERNATIVE WASTE MANAGEMENT SOLUTIONS

6.3 OPPORTUNITIES

6.3.1 DEMAND FOR BIODEGRADABLE SOLUTION LEADS TO ADOPTION OF COMPOSTABLE TRASH BAGS

6.3.2 RISING INVESTMENTS IN PRODUCT INNOVATION AND DIFFERENTIATION

6.3.3 GROWTH OF E-COMMERCE PLATFORMS AND ONLINE RETAILING

6.4 CHALLENGES

6.4.1 INADEQUATE WASTE MANAGEMENT INFRASTRUCTURE

6.4.2 LACK OF CONSUMER AWARENESS AND EDUCATION REGARDING APPLICATION OF TRASH BAGS

7 ASIA-PACIFIC TRASH BAGS MARKET, BY TYPE

7.1 OVERVIEW

7.2 DRAWSTRING/DRAWTAPE TRASH BAGS

7.3 FLAT TRASH BAGS

7.4 ZIPPER BAGS

7.5 STAR SEALED TRASH BAGS

7.6 T-SHIRT TRASH BAGS

7.7 FLAT STAR SEALED TRASH BAGS

7.8 OTHERS

8 ASIA-PACIFIC TRASH BAGS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 LOW DENSITY POLYETHYLENE

8.3 HIGH DENSITY POLYETHYLENE

8.4 LINEAR LOW DENSITY POLYETHYLENE

8.5 BIO-DEGRADABLE POLYETHYLENE

8.6 OTHERS

9 ASIA-PACIFIC TRASH BAGS MARKET, BY CAPACITY

9.1 OVERVIEW

9.2 10-25 KG

9.3 25-50 KG

9.4 50-75 KG

9.5 75-100 KG

9.6 100-150 KG

9.7 MORE THAN 150KG

10 ASIA-PACIFIC TRASH BAGS MARKET, BY END-USER

10.1 OVERVIEW

10.2 INDUSTRIES

10.3 CORPORATE OFFICES

10.4 HOSPITALS

10.5 RESIDENTIAL

10.6 INSTITUTIONS

10.7 LABORATORIES

10.8 OTHERS

11 ASIA-PACIFIC TRASH BAGS MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 NON-BIODEGRADABLE

11.3 BIODEGRADABLE

12 ASIA-PACIFIC TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 INDIRECT SALES

12.3 DIRECT SALES

13 ASIA-PACIFIC TRASH BAGS MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 INDIA

13.1.4 SOUTH KOREA

13.1.5 AUSTRALIA

13.1.6 SINGAPORE

13.1.7 MALAYSIA

13.1.8 INDONESIA

13.1.9 THAILAND

13.1.10 NEW ZEALAND

13.1.11 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC TRASH BAGS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BERRY GLOBAL INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 NOVOLEX

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 THE CLOROX COMPANY

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 REYNOLDS CONSUMER PRODUCTS

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 POLY-AMERICA, L.P.

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ALPHA OMEGA PLASTIC MANUFACTURING L.L.C.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ALUF PLASTICS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 BIOBAG INTERNATIONAL AS.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 COSMOPLAST UAE

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DUMIL

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 FOUR STAR PLASTICS

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

16.12 INTEPLAST GROUP

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 INTERNATIONAL PLASTICS INC.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 MAPCO PLASTIC

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 NATURTRUST (SUBSIDIARY OF HOLOSTIK GROUP)

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 NOVPLASTA CZ, S.R.O.

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 OX PLASTICS

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 POLYKAR INDUSTRIES INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 TERDEX GMBH

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 UNIVERSAL PLASTIC BAGS

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 ASIA-PACIFIC TRASH BAGS MARKET, BY REGION, 2018-2032, AVERAGE SELLING PRICE (USD/TON)

TABLE 2 ASIA-PACIFIC TRASH BAGS MARKET: BY TYPE, 2018-2032 (KILO TONS)

TABLE 3 ASIA-PACIFIC TRASH BAGS MARKET: BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC DRAWSTRING/DRAWTAPE TRASH BAGS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (KILO TONS)

TABLE 5 ASIA-PACIFIC DRAWSTRING/DRAWTAPE TRASH BAGS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 6 ASIA-PACIFIC FLAT TRASH BAGS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (KILO TONS)

TABLE 7 ASIA-PACIFIC FLAT TRASH BAGS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 8 ASIA-PACIFIC ZIPPER BAGS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (KILO TONS)

TABLE 9 ASIA-PACIFIC ZIPPER BAGS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 10 ASIA-PACIFIC STAR SEALED TRASH BAGS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (KILO TONS)

TABLE 11 ASIA-PACIFIC STAR SEALED TRASH BAGS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 12 ASIA-PACIFIC T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 13 ASIA-PACIFIC T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 14 ASIA-PACIFIC T-SHIRT TRASH BAGS IN TRASH BAG MARKET, BY T-SHIRT TRASH BAGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC FLAT STAR SEALED TRASH BAGS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (KILO TONS)

TABLE 16 ASIA-PACIFIC FLAT STAR SEALED TRASH BAGS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 17 ASIA-PACIFIC OTHERS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (KILO TONS)

TABLE 18 ASIA-PACIFIC OTHERS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 19 ASIA-PACIFIC TRASH BAG MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC LOW DENSITY POLYETHYLENE IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 21 ASIA-PACIFIC HIGH DENSITY POLYETHYLENE IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 22 ASIA-PACIFIC LINEAR LOW DENSITY POLYETHYLENE IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 23 ASIA-PACIFIC BIO-DEGRADABLE POLYETHYLENE IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 24 ASIA-PACIFIC OTHERS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 25 ASIA-PACIFIC TRASH BAG MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC 10-25 KG IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 27 ASIA-PACIFIC 25-50 KG IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 28 ASIA-PACIFIC 50-75 KG IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 29 ASIA-PACIFIC 75-100 KG IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 30 ASIA-PACIFIC 100-150 KG IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 31 ASIA-PACIFIC MORE THAN 150KG IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 32 ASIA-PACIFIC TRASH BAG MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC INDUSTRIES IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 34 ASIA-PACIFIC INDUSTRIES IN TRASH BAG MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC CORPORATE OFFICES IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 36 ASIA-PACIFIC CORPORATE OFFICES IN TRASH BAG MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC HOSPITALS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 38 ASIA-PACIFIC HOSPITALS IN TRASH BAG MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC RESIDENTIAL IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 40 ASIA-PACIFIC RESIDENTIAL IN TRASH BAG MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC INSTITUTIONS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 42 ASIA-PACIFIC INSTITUTIONS IN TRASH BAG MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC LABORATORIES IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 44 ASIA-PACIFIC LABORATORIES IN TRASH BAG MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC OTHERS IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 46 ASIA-PACIFIC OTHERS IN TRASH BAG MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC TRASH BAG MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC NON-BIODEGRADABLE IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 49 ASIA-PACIFIC BIODEGRADABLE IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 50 ASIA-PACIFIC TRASH BAG MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC INDIRECT SALES IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 52 ASIA-PACIFIC INDIRECT SALES IN TRASH BAG MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC OFFLINE IN TRASH BAG MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC ONLINE IN TRASH BAG MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC DIRECT SALES IN TRASH BAGS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 56 ASIA-PACIFIC TRASH BAGS MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 57 ASIA-PACIFIC TRASH BAGS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC TRASH BAGS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 59 ASIA-PACIFIC TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY T-SHIRT TRASH BAGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC TRASH BAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC TRASH BAGS MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC TRASH BAGS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC INDUSTRIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC CORPORATE OFFICES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC HOSPITALS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC RESIDENTIAL IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC INSTITUTIONS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC LABORATORIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC OTHERS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC TRASH BAGS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC INDIRECT SALES IN TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC OFFLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC ONLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 CHINA TRASH BAGS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 77 CHINA TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 CHINA T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY T-SHIRT TRASH BAGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 CHINA TRASH BAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 80 CHINA TRASH BAGS MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 81 CHINA TRASH BAGS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA INDUSTRIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA CORPORATE OFFICES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA HOSPITALS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 CHINA RESIDENTIAL IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 CHINA INSTITUTIONS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 CHINA LABORATORIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 CHINA OTHERS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 CHINA TRASH BAGS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 90 CHINA TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 91 CHINA INDIRECT SALES IN TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 92 CHINA OFFLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 CHINA ONLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 JAPAN TRASH BAGS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 95 JAPAN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 JAPAN T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY T-SHIRT TRASH BAGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 JAPAN TRASH BAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 98 JAPAN TRASH BAGS MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 99 JAPAN TRASH BAGS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 100 JAPAN INDUSTRIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 JAPAN CORPORATE OFFICES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 JAPAN HOSPITALS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 JAPAN RESIDENTIAL IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 JAPAN INSTITUTIONS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 JAPAN LABORATORIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 JAPAN OTHERS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 JAPAN TRASH BAGS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 108 JAPAN TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 109 JAPAN INDIRECT SALES IN TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 110 JAPAN OFFLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 JAPAN ONLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 INDIA TRASH BAGS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 113 INDIA TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 INDIA T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY T-SHIRT TRASH BAGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 INDIA TRASH BAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 116 INDIA TRASH BAGS MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 117 INDIA TRASH BAGS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 118 INDIA INDUSTRIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 INDIA CORPORATE OFFICES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 INDIA HOSPITALS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 INDIA RESIDENTIAL IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 INDIA INSTITUTIONS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 INDIA LABORATORIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 INDIA OTHERS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 INDIA TRASH BAGS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 126 INDIA TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 127 INDIA INDIRECT SALES IN TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 128 INDIA OFFLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 INDIA ONLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH KOREA TRASH BAGS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 131 SOUTH KOREA TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH KOREA T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY T-SHIRT TRASH BAGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH KOREA TRASH BAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH KOREA TRASH BAGS MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH KOREA TRASH BAGS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 136 SOUTH KOREA INDUSTRIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SOUTH KOREA CORPORATE OFFICES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SOUTH KOREA HOSPITALS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SOUTH KOREA RESIDENTIAL IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SOUTH KOREA INSTITUTIONS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SOUTH KOREA LABORATORIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 SOUTH KOREA OTHERS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 SOUTH KOREA TRASH BAGS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 144 SOUTH KOREA TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 145 SOUTH KOREA INDIRECT SALES IN TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 146 SOUTH KOREA OFFLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SOUTH KOREA ONLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 AUSTRALIA TRASH BAGS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 149 AUSTRALIA TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 AUSTRALIA T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY T-SHIRT TRASH BAGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 AUSTRALIA TRASH BAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 152 AUSTRALIA TRASH BAGS MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 153 AUSTRALIA TRASH BAGS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 154 AUSTRALIA INDUSTRIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 AUSTRALIA CORPORATE OFFICES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 AUSTRALIA HOSPITALS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 AUSTRALIA RESIDENTIAL IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 AUSTRALIA INSTITUTIONS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 AUSTRALIA LABORATORIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 AUSTRALIA OTHERS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 AUSTRALIA TRASH BAGS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 162 AUSTRALIA TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 163 AUSTRALIA INDIRECT SALES IN TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 164 AUSTRALIA OFFLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 AUSTRALIA ONLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 SINGAPORE TRASH BAGS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 167 SINGAPORE TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 SINGAPORE T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY T-SHIRT TRASH BAGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 SINGAPORE TRASH BAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 170 SINGAPORE TRASH BAGS MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 171 SINGAPORE TRASH BAGS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 172 SINGAPORE INDUSTRIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 SINGAPORE CORPORATE OFFICES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 SINGAPORE HOSPITALS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SINGAPORE RESIDENTIAL IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 SINGAPORE INSTITUTIONS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SINGAPORE LABORATORIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SINGAPORE OTHERS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 SINGAPORE TRASH BAGS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 180 SINGAPORE TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 181 SINGAPORE INDIRECT SALES IN TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 182 SINGAPORE OFFLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 SINGAPORE ONLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 MALAYSIA TRASH BAGS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 185 MALAYSIA TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 MALAYSIA T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY T-SHIRT TRASH BAGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 MALAYSIA TRASH BAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 188 MALAYSIA TRASH BAGS MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 189 MALAYSIA TRASH BAGS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 190 MALAYSIA INDUSTRIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 MALAYSIA CORPORATE OFFICES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 MALAYSIA HOSPITALS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 MALAYSIA RESIDENTIAL IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 MALAYSIA INSTITUTIONS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 MALAYSIA LABORATORIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 MALAYSIA OTHERS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 MALAYSIA TRASH BAGS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 198 MALAYSIA TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 199 MALAYSIA INDIRECT SALES IN TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 200 MALAYSIA OFFLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 MALAYSIA ONLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 INDONESIA TRASH BAGS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 203 INDONESIA TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 INDONESIA T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY T-SHIRT TRASH BAGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 INDONESIA TRASH BAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 206 INDONESIA TRASH BAGS MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 207 INDONESIA TRASH BAGS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 208 INDONESIA INDUSTRIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 INDONESIA CORPORATE OFFICES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 INDONESIA HOSPITALS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 INDONESIA RESIDENTIAL IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 212 INDONESIA INSTITUTIONS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 INDONESIA LABORATORIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 INDONESIA OTHERS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 INDONESIA TRASH BAGS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 216 INDONESIA TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 217 INDONESIA INDIRECT SALES IN TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 218 INDONESIA OFFLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 INDONESIA ONLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 THAILAND TRASH BAGS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 221 THAILAND TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 THAILAND T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY T-SHIRT TRASH BAGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 THAILAND TRASH BAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 224 THAILAND TRASH BAGS MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 225 THAILAND TRASH BAGS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 226 THAILAND INDUSTRIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 THAILAND CORPORATE OFFICES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 THAILAND HOSPITALS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 THAILAND RESIDENTIAL IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 THAILAND INSTITUTIONS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 THAILAND LABORATORIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 THAILAND OTHERS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 THAILAND TRASH BAGS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 234 THAILAND TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 235 THAILAND INDIRECT SALES IN TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 236 THAILAND OFFLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 THAILAND ONLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 NEW ZEALAND TRASH BAGS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 239 NEW ZEALAND TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 NEW ZEALAND T-SHIRT TRASH BAGS IN TRASH BAGS MARKET, BY T-SHIRT TRASH BAGS TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 NEW ZEALAND TRASH BAGS MARKET, BY MATERIAL, 2018-2032 (USD THOUSAND)

TABLE 242 NEW ZEALAND TRASH BAGS MARKET, BY CAPACITY, 2018-2032 (USD THOUSAND)

TABLE 243 NEW ZEALAND TRASH BAGS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 244 NEW ZEALAND INDUSTRIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 NEW ZEALAND CORPORATE OFFICES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 NEW ZEALAND HOSPITALS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 NEW ZEALAND RESIDENTIAL IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 NEW ZEALAND INSTITUTIONS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 NEW ZEALAND LABORATORIES IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 NEW ZEALAND OTHERS IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 NEW ZEALAND TRASH BAGS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 252 NEW ZEALAND TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 253 NEW ZEALAND INDIRECT SALES IN TRASH BAGS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 254 NEW ZEALAND OFFLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 NEW ZEALAND ONLINE IN TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 REST OF ASIA-PACIFIC TRASH BAGS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 257 REST OF ASIA-PACIFIC TRASH BAGS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 ASIA-PACIFIC TRASH BAGS MARKET

FIGURE 2 ASIA-PACIFIC TRASH BAGS MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC TRASH BAGS MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC TRASH BAGS MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC TRASH BAGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC TRASH BAGS MARKET: MULTIVARIATE MODELLING

FIGURE 7 ASIA-PACIFIC TRASH BAGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA-PACIFIC TRASH BAGS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA-PACIFIC TRASH BAGS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 ASIA-PACIFIC TRASH BAGS MARKET: SEGMENTATION

FIGURE 11 EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 SEVEN SEGMENTS COMPRISE THE ASIA-PACIFIC TRASH BAGS MARKET, BY TYPE

FIGURE 14 TECHNOLOGICAL ADVANCEMENTS IN TRASH BAGS INDUSTRY IS DRIVING THE GROWTH OF THE ASIA-PACIFIC TRASH BAGS MARKET IN THE FORECAST PERIOD 2025 TO 2032

FIGURE 15 THE DRAWSTRING/DRAWTAPE TRASH BAGS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC TRASH BAGS MARKET IN 2025 AND 2032

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 PRODUCTION CONSUMPTION ANALYSIS: ASIA-PACIFIC TRASH BAGS MARKET

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF ASIA-PACIFIC TRASH BAGS MARKET

FIGURE 21 ASIA-PACIFIC TRASH BAGS MARKET: BY TYPE, 2024

FIGURE 22 ASIA-PACIFIC TRASH BAGS MARKET: BY MATERIAL, 2024

FIGURE 23 ASIA-PACIFIC TRASH BAGS MARKET: BY CAPACITY, 2024

FIGURE 24 ASIA-PACIFIC TRASH BAGS MARKET: BY END-USER, 2024

FIGURE 25 ASIA-PACIFIC TRASH BAGS MARKET: BY CATEGORY, 2024

FIGURE 26 ASIA-PACIFIC TRASH BAGS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 27 ASIA-PACIFIC TRASH BAGS MARKET: SNAPSHOT (2024)

FIGURE 28 ASIA-PACIFIC TRASH BAGS MARKET: COMPANY SHARE 2024 (%)

Asia Pacific Trash Bags Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Trash Bags Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Trash Bags Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.