Asia Pacific Tunable Laser Market

Market Size in USD Billion

CAGR :

%

USD

4.46 Billion

USD

9.28 Billion

2025

2033

USD

4.46 Billion

USD

9.28 Billion

2025

2033

| 2026 –2033 | |

| USD 4.46 Billion | |

| USD 9.28 Billion | |

|

|

|

|

Asia-Pacific Tunable Laser Market Size

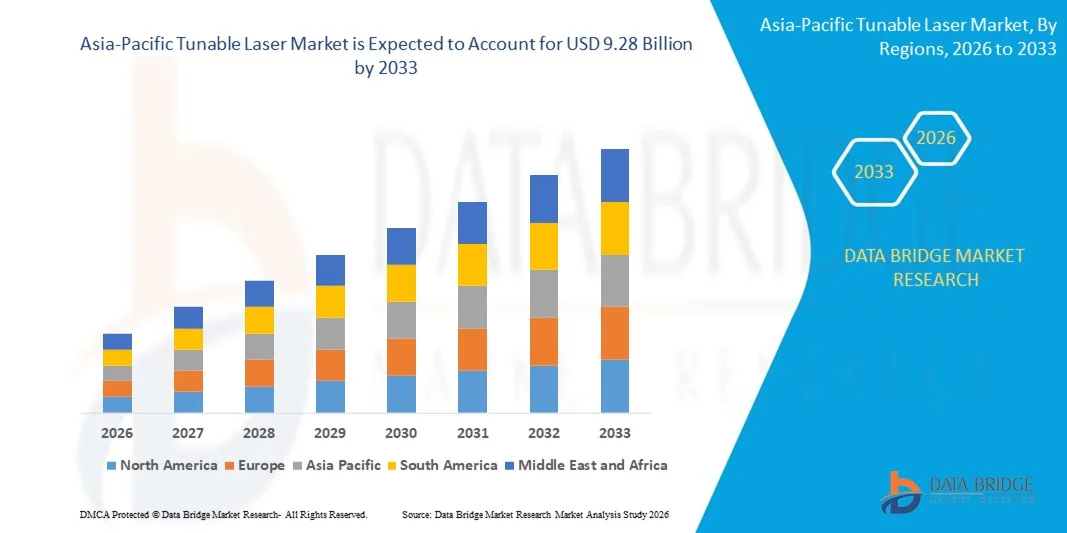

- The Asia-Pacific tunable laser market size was valued at USD 4.46 billion in 2025 and is expected to reach USD 9.28 billion by 2033, at a CAGR of 9.6% during the forecast period

- The market growth is largely fueled by the increasing adoption of tunable lasers across high-precision applications in telecommunications, industrial processing, and scientific research, driven by technological advancements in laser stability, wavelength range, and beam quality

- Furthermore, rising demand for versatile, compact, and energy-efficient laser systems in sectors such as medical diagnostics, micro-processing, and optical communications is accelerating the adoption of tunable laser solutions, thereby significantly boosting market expansion

Asia-Pacific Tunable Laser Market Analysis

- Tunable lasers, offering precise wavelength control, narrow linewidth, and high output stability, are increasingly critical in applications such as optical communication, spectroscopy, sensing, and industrial micro-processing due to their enhanced accuracy, flexibility, and performance

- The escalating demand for tunable lasers is primarily driven by growth in telecommunications infrastructure, expanding industrial automation, advancements in photonics research, and the need for high-precision laser systems across diverse end-use industries

- China dominated the tunable laser market in 2025, due to its strong manufacturing capabilities, growing electronics and telecommunications sectors, and increasing investments in research and development for photonics technologies

- India is expected to be the fastest growing region in the tunable laser market during the forecast period due to rapid industrialization, expanding telecommunications networks, and growing adoption of high-tech manufacturing solutions

- 1000nm-1500nm segment dominated the market with a market share of 45.8% in 2025, due to its widespread use in fiber optic communications, medical applications, and industrial laser systems requiring low attenuation and high precision. This wavelength range is preferred in spectroscopy and sensing due to its compatibility with widely used photonic components and detectors. For instance, NKT Photonics offers tunable lasers in this wavelength range for telecom testing and industrial sensing, enhancing adoption

Report Scope and Tunable Laser Market Segmentation

|

Attributes |

Tunable Laser Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Asia-Pacific Tunable Laser Market Trends

Rising Use of Tunable Lasers in Communication and Sensing

- A significant trend in the tunable laser market is the increasing adoption of these lasers across communication, sensing, and industrial applications, driven by the need for precise wavelength control, high spectral purity, and versatile tunability. This adoption is elevating the role of tunable lasers as critical components for optical networks, spectroscopy, and precision industrial processes

- For instance, TOPTICA Photonics AG supplies narrow-linewidth tunable lasers that are widely used in quantum sensing and optical communication systems. Such lasers enable highly accurate measurements and stable signal generation in applications requiring continuous wavelength adjustment

- The use of tunable lasers in telecom networks is growing as wavelength-division multiplexing (WDM) and fiber-optic communication require precise, adaptable laser sources. This positions tunable lasers as essential for next-generation communication infrastructures that demand high performance, reliability, and low noise

- In the industrial sector, tunable lasers are being integrated into micro-processing, cutting, and engraving systems, where fine control over wavelength improves precision and efficiency. This integration is strengthening the role of tunable lasers in automated and high-accuracy manufacturing environments

- The healthcare and life sciences sectors are increasingly leveraging tunable lasers for spectroscopy, imaging, and diagnostics, where precise wavelength selection supports sensitive measurements and advanced analysis. This trend is accelerating the development of non-invasive diagnostic tools and enhancing real-time biomedical research

- The market is witnessing strong growth in advanced communication and sensing systems, where tunable lasers contribute to higher data throughput, improved signal quality, and versatile operational capabilities. This rising adoption is driving technological advancements and positioning tunable lasers as indispensable for modern optical and industrial systems

Asia-Pacific Tunable Laser Market Dynamics

Driver

Growing Demand for Precise and Versatile Laser Systems

- The rising need for high-precision, tunable, and energy-efficient laser sources across telecommunications, industrial processing, and research is driving market growth. These lasers provide flexibility in wavelength selection, narrow linewidth, and stable output, meeting critical application requirements

- For instance, Coherent Inc. offers tunable laser systems for optical communications and spectroscopy that deliver high accuracy and repeatability. Such systems enable enhanced performance in research and industrial applications where exact wavelength control is essential

- The expansion of high-speed fiber-optic networks is fueling demand for tunable lasers that support wavelength-division multiplexing and efficient data transmission. These systems improve network capacity and performance while reducing operational complexity

- Advanced industrial processes such as micro-machining, cutting, and welding increasingly rely on tunable lasers for precise material interaction, leading to better quality and reduced waste. The flexibility to adjust wavelengths for different materials enhances their industrial value

- The ongoing need for compact, reliable, and multifunctional laser solutions in emerging sectors continues to reinforce this driver. Industries are increasingly investing in tunable lasers to optimize performance, achieve operational efficiency, and enable new applications

Restraint/Challenge

High Cost and Complexity of Tunable Lasers

- The tunable laser market faces challenges due to the high cost and technical complexity of developing precision laser systems, which require advanced optical components, sophisticated tuning mechanisms, and stringent quality control

- For instance, companies such as EKSPLA employ specialized assembly techniques and precision optics to produce high-performance tunable lasers. These processes demand skilled labor, advanced equipment, and extended production timelines, contributing to elevated costs

- Designing tunable lasers with broad wavelength ranges and narrow linewidths involves intricate engineering and careful calibration to ensure stability, reliability, and repeatability under diverse operating conditions. This complexity increases both manufacturing difficulty and operational expenses

- The reliance on rare or high-grade optical materials and custom components adds to supply chain vulnerability and cost fluctuations. Manufacturers must balance performance requirements with economic feasibility to remain competitive

- Scaling production while maintaining stringent performance standards remains challenging, particularly for lasers used in telecom, scientific research, and industrial applications. These factors collectively constrain market growth and require manufacturers to optimize processes to reduce costs without compromising quality

Asia-Pacific Tunable Laser Market Scope

The market is segmented on the basis of type, technology, wavelength, application, end user, and sales channel.

- By Type

On the basis of type, the tunable laser market is segmented into solid-state tunable lasers, gas tunable lasers, fiber tunable lasers, liquid tunable lasers, free-electron lasers (FEL), nanosecond pulsed OPO, and others. The fiber tunable lasers segment dominated the market with the largest revenue share in 2025, driven by their high spectral purity, stability, and wide wavelength tuning range, which makes them suitable for applications in telecommunications, sensing, and spectroscopy. Fiber tunable lasers are highly valued in research and industrial setups due to their low maintenance, long operational life, and compatibility with advanced photonic systems. The demand for fiber tunable lasers is also supported by their integration with automated and high-precision instrumentation, enhancing efficiency and accuracy in critical processes.

The solid-state tunable lasers segment is expected to witness the fastest CAGR from 2026 to 2033, driven by their compact design, high output power, and versatility across medical, industrial, and defense applications. For instance, companies such as Coherent Inc. are investing in solid-state tunable laser solutions for micro-processing and precision manufacturing, which boosts adoption. The segment also benefits from technological advancements that improve wavelength tunability and beam quality. Increasing demand in emerging applications such as LiDAR and spectroscopy further accelerates the growth of solid-state tunable lasers, positioning them as a key focus area for market expansion.

- By Technology

On the basis of technology, the tunable laser market is segmented into external cavity diode lasers, distributed Bragg reflector (DBR) lasers, distributed feedback (DFB) lasers, vertical cavity surface emitting lasers (VCSELs), micro electro mechanical system (MEMS), and others. The external cavity diode laser segment dominated the market in 2025, attributed to its broad tunability, stable output, and precise wavelength control, which is essential for applications in optical communications, spectroscopy, and sensing. External cavity diode lasers offer enhanced performance with reduced linewidth, making them suitable for high-resolution measurement systems and scientific research applications. For instance, TOPTICA Photonics provides advanced external cavity diode lasers widely used in atomic physics and quantum technology research.

The MEMS-based tunable lasers segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by miniaturization, low power consumption, and integration capabilities for portable and on-chip photonics devices. MEMS tunable lasers are increasingly adopted in LIDAR systems, optical coherence tomography, and data communication applications, where compactness and precision are critical. In addition, ongoing R&D for enhancing MEMS laser reliability and tunability supports its rapid market expansion, especially in emerging photonic technologies.

- By Wavelength

On the basis of wavelength, the tunable laser market is segmented into less than 1000 nm, 1000–1500 nm, and more than 1500 nm. The 1000–1500 nm wavelength segment dominated the market with the largest share of 45.8% in 2025, driven by its widespread use in fiber optic communications, medical applications, and industrial laser systems requiring low attenuation and high precision. This wavelength range is preferred in spectroscopy and sensing due to its compatibility with widely used photonic components and detectors. For instance, NKT Photonics offers tunable lasers in this wavelength range for telecom testing and industrial sensing, enhancing adoption.

The less than 1000 nm wavelength segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its application in biomedical imaging, microscopy, and high-precision micro-processing. Shorter wavelengths offer better resolution and focus for precision applications, supporting adoption in research laboratories and medical diagnostic tools. In addition, advancements in compact tunable laser designs for visible and near-infrared applications further drive growth in this segment, particularly for life sciences and semiconductor inspection markets.

- By Application

On the basis of application, the tunable laser market is segmented into micro-processing, drilling, cutting, welding, engraving and marking, communication, and others. The communication segment dominated the market in 2025, driven by the critical role of tunable lasers in high-speed optical fiber networks, wavelength-division multiplexing (WDM), and data center connectivity. Communication applications require tunable lasers with high stability, low phase noise, and precise wavelength control, which supports network efficiency and signal integrity. For instance, II-VI Incorporated provides tunable laser solutions for optical communication testing and network deployment, reinforcing market dominance.

The micro-processing segment is projected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for precision laser processing in electronics, medical device manufacturing, and fine material structuring. Micro-processing applications benefit from the high power, narrow linewidth, and tunability of modern laser systems, enhancing accuracy and reducing material waste. In addition, integration with automated and robotic systems accelerates adoption in industrial micro-machining and additive manufacturing processes.

- By End User

On the basis of end user, the tunable laser market is segmented into electronics and semiconductors, automotive, aerospace, telecommunication and networking devices, medical, manufacturing, packaging, and others. The telecommunication and networking devices segment dominated the market in 2025, due to the heavy reliance on tunable lasers for optical network testing, DWDM systems, and high-speed data transfer infrastructure. Tunable lasers enable flexibility and efficiency in network design, supporting expanding internet bandwidth and 5G infrastructure deployment. For instance, Finisar Corporation supplies tunable lasers extensively for optical networking and data communication applications.

The medical segment is expected to witness the fastest CAGR from 2026 to 2033, driven by growing use of tunable lasers in diagnostic imaging, laser therapy, and surgical applications. Medical applications benefit from precise wavelength control, high beam quality, and low thermal effects, which improve patient outcomes and procedural accuracy. In addition, the rising prevalence of minimally invasive procedures and photonics-based diagnostics supports rapid market adoption in healthcare.

- By Sales Channel

On the basis of sales channel, the tunable laser market is segmented into OEM and aftermarket. The OEM segment dominated the market in 2025, driven by partnerships between laser manufacturers and end users for custom-designed solutions integrated into industrial, medical, and telecommunication systems. OEM channels provide tailored laser solutions with higher reliability, technical support, and long-term service agreements, which are critical for mission-critical applications. For instance, Coherent Inc. collaborates with OEM partners to supply tunable lasers for precision manufacturing and telecom systems, ensuring product adoption.

The aftermarket segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing upgrades and replacements in existing laser systems across industries. Aftermarket sales provide cost-effective options for end users seeking improved performance, tunability, or compatibility with evolving applications. In addition, growing awareness of performance optimization and laser maintenance drives aftermarket adoption, particularly in industrial and laboratory environments.

Asia-Pacific Tunable Laser Market Regional Analysis

- China dominated the tunable laser market with the largest revenue share in 2025, driven by its strong manufacturing capabilities, growing electronics and telecommunications sectors, and increasing investments in research and development for photonics technologies

- Robust government initiatives promoting advanced manufacturing, optical communications infrastructure, and precision instrumentation reinforce China’s leadership in the regional market. The presence of leading domestic laser manufacturers, collaborations with global photonics companies, and the introduction of high-performance, cost-effective tunable laser solutions continue to consolidate China’s dominant position

- Expanding industrial adoption, rising demand for telecommunications upgrades, and increasing focus on scientific research further strengthen market penetration across urban and industrial hubs

Japan Tunable Laser Market Insight

The Japan market is anticipated to grow steadily from 2026 to 2033, supported by its advanced semiconductor and optical instrumentation industries and strong focus on precision and reliability. Japanese companies are increasingly adopting high-performance tunable lasers for applications in micro-processing, communication, and research, reflecting the country’s emphasis on technological innovation. Demand for compact, versatile, and energy-efficient laser systems is rising due to space-constrained industrial setups. Continuous R&D investments and collaborations between Japanese manufacturers and global technology providers reinforce the market’s steady growth outlook. Japan’s focus on quality, precision, and innovation underpins its strong regional positioning.

India Tunable Laser Market Insight

India is projected to register the fastest CAGR in the Asia Pacific tunable laser market during 2026–2033, fueled by rapid industrialization, expanding telecommunications networks, and growing adoption of high-tech manufacturing solutions. Increasing investments in research, awareness of advanced photonics applications, and rising electronics and medical device production are accelerating market growth. The demand for affordable, reliable, and compact tunable laser systems is particularly strong among emerging enterprises and research institutions. Expanding distribution channels, growing collaborations with global laser manufacturers, and supportive government initiatives in optics and photonics ensure India’s emergence as the fastest-growing market in the region.

Asia-Pacific Tunable Laser Market Share

The tunable laser industry is primarily led by well-established companies, including:

- Daylight Solutions (U.S.)

- EKSPLA (Lithuania)

- HÜBNER Photonics (Germany)

- TOPTICA Photonics AG (Germany)

- Keysight Technologies (U.S.)

- Luna Innovations Incorporated (U.S.)

- LUMIBIRD (France)

- II-VI Incorporated (U.S.)

- NeoPhotonics Corporation (U.S.)

- SANTEC CORPORATION (Japan)

- EXFO Inc. (Canada)

- Thorlabs, Inc. (U.S.)

- VIAVI Solutions Inc. (U.S.)

- Newport Corporation (U.S.)

- Lumentum Operations LLC (U.S.)

- Radiant Light S.L. (Spain)

- Freedom Photonics LLC (U.S.)

- Changchun New Industries Optoelectronics Tech. Co., Ltd. (China)

- Sacher Lasertechnik GmbH (Germany)

- AMETEK, Inc. (U.S.)

- Coherent, Inc. (U.S.)

Latest Developments in Asia-Pacific Tunable Laser Market

- In August 2025, Chilas expanded its lineup with three tunable narrow-linewidth lasers: the ATLAS wavelength-tunable laser, the COMET swept-source laser, and the POLARIS frequency-stabilized laser. The ATLAS series offers broad tunability across 685 nm, 850 nm, 1550 nm, 1600 nm, and 1700 nm. These compact OEM modules target high-end applications in optical testing, quantum technologies, and sensing, strengthening Chilas’ market position and supporting wider adoption in telecommunications, precision sensing, and research

- In April 2024, II-VI Incorporated reported significant sales growth in its tunable laser product line, reflecting the rising demand for high-performance photonic solutions across telecommunications, industrial, and scientific research sectors. This growth highlights the increasing adoption of tunable lasers driven by advancements in optical networking and precision measurement technologies. The company’s expanded product portfolio and enhanced manufacturing capabilities are expected to strengthen market presence and support overall market expansion

- In February 2024, Opton Laser introduced a new range of tunable dye and Ti:sapphire lasers, offering improved wavelength tunability and stability for precision applications. These lasers cater to growing demand in spectroscopy, microscopy, and material processing, providing reliable performance for both research and industrial use. The launch strengthens Opton Laser’s competitive position and addresses evolving requirements for advanced tunable laser systems

- In October 2023, EFFECT Photonics announced the successful validation of its fully integrated InP-based tunable laser photonic integrated circuit, powering its digital Pico integrated tunable laser assembly (pITLA). Tunable lasers from EFFECT Photonics are essential to coherent optical systems enabling Dense Wavelength Division Multiplexing (DWDM), which allows network operators to significantly increase capacity without expanding fiber infrastructure. This innovation enhances network efficiency and supports broader adoption of advanced optical communication solutions

- In October 2023, NIRRIN Technologies showcased three at-line/in-line applications of its HPTLS tunable laser system, including buffer validation, ultrafiber/de-fiber endpoint detection, and dilution-free protein quantification. By combining near-infrared spectral technology with tunable laser sources, NIRRIN delivers precise, quantifiable protein signatures with high accuracy and dynamic range. This advancement is expected to boost adoption in bio-processing and analytical applications, strengthening the role of tunable lasers in life sciences and industrial biotechnology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Tunable Laser Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Tunable Laser Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Tunable Laser Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.