Asia Pacific Vaccine Administration Devices Market

Market Size in USD Million

CAGR :

%

USD

669.56 Million

USD

1,141.86 Million

2024

2032

USD

669.56 Million

USD

1,141.86 Million

2024

2032

| 2025 –2032 | |

| USD 669.56 Million | |

| USD 1,141.86 Million | |

|

|

|

|

Asia-Pacific Vaccine Administration Devices Market Size

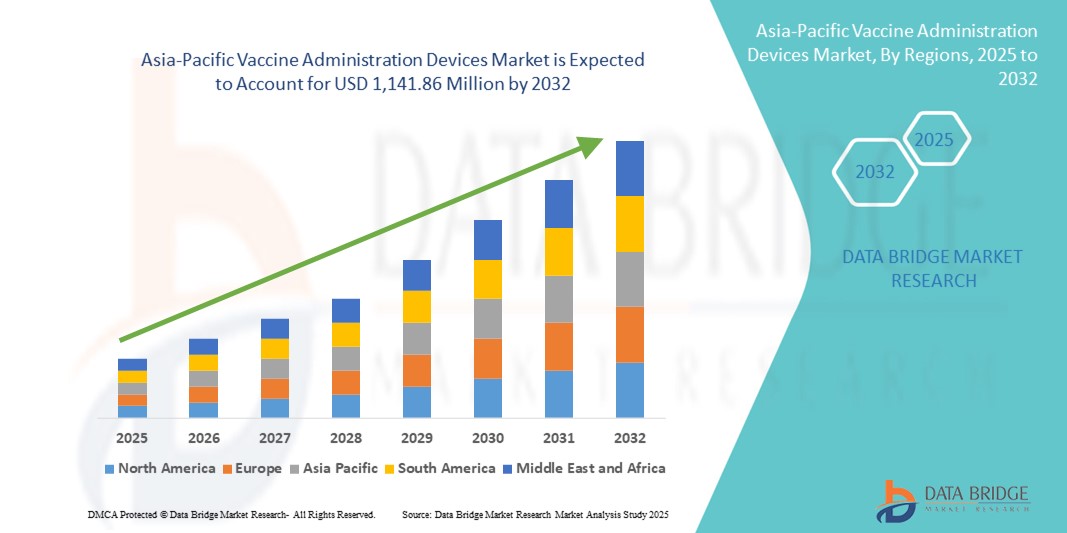

- The Asia-Pacific vaccine administration devices market size was valued at USD 669.56 million in 2024 and is expected to reach USD 1,141.86 million by 2032, at a CAGR of 6.90% during the forecast period

- The market growth of the Asia-Pacific vaccine administration devices market is largely fueled by increasing immunization programs, rising healthcare access, and advancements in medical device technologies across the region. These developments are enabling efficient, safe, and timely vaccine delivery for various populations, including pediatric, adult, and elderly patients. Rapid urbanization and rising awareness about preventive healthcare in countries such as India, China, and Indonesia are also contributing to the growing adoption of advanced vaccine administration devices

- Furthermore, escalating investments in healthcare infrastructure, expansion of vaccination centers in rural and semi-urban areas, and increasing public-private partnerships are driving innovation and improving the availability of specialized vaccine administration devices. Government immunization initiatives, coupled with the growing presence of international and local medical device manufacturers, are significantly boosting the growth of the Asia-Pacific Vaccine Administration Devices market

Asia-Pacific Vaccine Administration Devices Market Analysis

- The Asia-Pacific vaccine administration devices market is witnessing strong growth, propelled by the rapid expansion of pharmaceutical and biotechnology industries, as well as increasing healthcare infrastructure development across key countries including China, India, Japan, South Korea, Australia, Thailand, Indonesia, and Vietnam. The rising demand for vaccines, coupled with government initiatives to enhance immunization coverage, is further driving market adoption

- Increasing investments in R&D, a surge in clinical trials, stricter regulatory standards, and the rising emphasis on safe and efficient vaccine delivery are key factors fueling market expansion across the region. The integration of innovative delivery technologies, such as auto-disable syringes, needle-free injectors, and prefilled devices, is also contributing to enhanced patient compliance and operational efficiency

- China dominated the Asia-Pacific vaccine administration devices market, accounting for the largest revenue share of 19.6% in 2024. This leadership is supported by the country’s strong pharmaceutical manufacturing base, a high volume of vaccine approvals, widespread adoption of advanced vaccine delivery devices, and government initiatives aimed at modernizing healthcare infrastructure and ensuring immunization safety

- India is projected to register the fastest CAGR of 8.1% in the Asia-Pacific vaccine administration devices market during the forecast period, driven by factors such as expanding healthcare access, rising adoption of vaccination programs, increasing outsourcing of manufacturing and distribution, and government-led campaigns to strengthen immunization coverage in semi-urban and rural regions

- The disposable segment dominated the Asia-Pacific vaccine administration devices market with a share of 71.4% in 2024, driven by its enhanced safety profile, lower risk of cross-contamination, compliance with stringent infection control protocols, and the convenience it offers healthcare providers, particularly during large-scale immunization campaigns and routine vaccination programs

Report Scope and Asia-Pacific Vaccine Administration Devices Market Segmentation

|

Attributes |

Asia-Pacific Vaccine Administration Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Vaccine Administration Devices Market Trends

Rising Adoption of Innovative Vaccine Delivery Solutions

- A significant and accelerating trend in the Asia-Pacific vaccine administration devices market is the increasing focus on high-precision testing, method development, and regulatory compliance support. This includes efforts to improve analytical accuracy, device performance validation, and adherence to evolving international quality standards for vaccine delivery systems

- Major service providers and device manufacturers across the region are collaborating with pharmaceutical and biotechnology companies to deliver next-generation vaccine administration solutions, such as auto-injectors, micro-needle systems, and pre-filled syringes, which are validated for safety, sterility, and regulatory compliance. These innovations cater to the growing demand for reliable, audit-ready, and high-quality vaccine delivery devices

- Increasing adoption of advanced vaccine administration technologies in hospitals, community centers, and homecare settings is further accelerating market growth. These devices are being recognized for their ability to ensure accurate dosage, patient safety, and compliance with strict vaccination guidelines

- Academic institutions, research centers, and government laboratories in countries such as Japan, India, and Australia are conducting studies on innovative delivery systems, device validation techniques, and automation in vaccine administration workflows—leading to enhancements backed by scientific evidence and tailored to industry-specific requirements

- As the Asia-Pacific region continues to emphasize quality assurance, innovation, and public health efficiency, the Vaccine Administration Devices market is poised for sustained expansion—driven by regulatory stringency, technological advancements, and the increasing integration of R&D with device development and laboratory expertise

Asia-Pacific Vaccine Administration Devices Market Dynamics

Driver

Rising Demand Driven by Healthcare Expansion and Technological Advancements

- The Asia-Pacific vaccine administration devices market is witnessing accelerated growth, primarily fueled by the expansion of pharmaceutical manufacturing, biotechnology research, and advanced healthcare infrastructure across key countries such as China, India, Japan, South Korea, and Australia. Rising investments in drug discovery, biosimilar development, and personalized medicine are boosting the demand for high-quality vaccine administration devices that comply with international regulatory standards

- For instance, in March 2024, WuXi AppTec expanded its analytical and device testing facilities in China, enhancing capabilities in bioanalytical services, stability validation, and microbiological analysis to support both domestic and international clients in achieving faster regulatory approvals

- The rising prevalence of chronic and infectious diseases, coupled with a strong focus on ensuring product quality and safety, is driving pharmaceutical and biotech companies to adopt innovative vaccine administration devices from specialized providers equipped with advanced instrumentation and GMP-compliant production capabilities

- Government initiatives promoting local R&D capabilities, along with incentives for clinical trial activities, are further supporting market growth. Countries such as Singapore and South Korea are positioning themselves as regional hubs for vaccine device innovation, attracting global clients through strong IP protection, competitive service costs, and robust regulatory frameworks

- The integration of digital platforms and advanced laboratory information management systems (LIMS) is enabling service providers to manage large volumes of device testing and vaccination data efficiently, thereby improving accuracy, turnaround times, and compliance with regulatory requirements across multiple healthcare sectors

Restraint/Challenge

Challenges in Rural and Small-Scale Adoption Limiting Market Penetration

- Despite rapid urban and industrial development, the Asia-Pacific Vaccine Administration Devices market faces challenges in reaching small-scale manufacturers and rural-based healthcare providers, particularly in Southeast Asia and parts of South Asia. High device costs, limited awareness of advanced delivery systems, and budget constraints often prevent smaller clinics and organizations from adopting these technologies

- Infrastructure limitations, including inadequate cold chain systems, underdeveloped transportation networks, and restricted laboratory coverage in non-metropolitan regions, further hinder the timely distribution, deployment, and monitoring of vaccine administration devices

- Many rural and semi-urban healthcare centers continue to rely on basic, manual vaccination methods that do not meet international safety and efficiency standards, creating a gap between quality expectations and actual service capabilities

- Uneven distribution of accredited device testing and validation centers across the region forces remote healthcare providers to depend on long-distance logistics, increasing costs and slowing turnaround times

- To address these challenges, leading market players are exploring decentralized device deployment models, mobile vaccination units, and partnerships with local healthcare bodies to enhance accessibility. They are also introducing cost-effective device packages tailored for smaller clinics and rural centers, improving adoption in price-sensitive markets while maintaining compliance with stringent regulatory norms

Asia-Pacific Vaccine Administration Devices Market Scope

The market is segmented on the basis of product, route of administration, type, brand, dosage, vaccine type, modality, usability, end user, and distribution channel.

- By Product

On the basis of product, the Asia-Pacific vaccine administration devices market is segmented into syringes, auto injectors, jet injectors, micro-needles, inhalation/pulmonary delivery systems, microinjection systems, pen injector devices, biodegradable implants, electroporation-based needle-free injection systems, buccal/sublingual vaccine delivery systems, auto-injector trainer devices, and other devices. Among these, syringes dominated the market with a revenue share of 32.4% in 2024, reflecting their universal applicability, ease of use, and cost-effectiveness in mass vaccination programs across hospitals, clinics, and community centers.

Meanwhile, electroporation-based needle-free injection systems are anticipated to register the fastest CAGR of 9.2% from 2025 to 2032, reflecting the growing adoption of innovative, patient-friendly vaccination technologies in the Asia-Pacific region. These systems utilize short electrical pulses to temporarily increase cell membrane permeability, enabling efficient delivery of DNA or RNA vaccines without the need for traditional needles. This approach reduces patient discomfort, minimizes the risk of needle-stick injuries, and enhances compliance, particularly among pediatric and needle-averse populations.

- By Route of Administration

On the basis of route of administration, the Asia-Pacific vaccine administration devices market is segmented into intramuscular, subcutaneous, and intradermal delivery. The intramuscular segment held the largest share of 47.5% in 2024, reflecting its long-standing preference in standard immunization programs due to its compatibility with most marketed vaccines and well-established safety profile. This route is widely used in hospitals, clinics, and mass vaccination campaigns, ensuring consistent dosage delivery and broad public acceptance.

The intradermal segment is projected to register the fastest CAGR of 8.7% from 2025 to 2032, driven by the increasing demand for precise dermal delivery in modern vaccine platforms. Intradermal administration allows for smaller, targeted doses, making it a key strategy in dose-sparing approaches and enhancing the efficiency of vaccination programs. This minimally invasive method reduces patient discomfort compared to conventional intramuscular injections, improving overall compliance and acceptability, particularly in pediatric and needle-averse populations.

- By Type

On the basis of type, the Asia-Pacific vaccine administration devices market is divided into marketed vaccines and clinical-stage vaccines (electroporation). The marketed vaccines segment accounted for 68.2% of the revenue share in 2024, supported by the extensive adoption of established immunization programs, government-led vaccination initiatives, and widespread availability of these vaccines across healthcare facilities. This segment benefits from a strong base of routine immunizations and large-scale procurement campaigns.

Clinical-stage vaccines, particularly those delivered via electroporation, are expected to record a CAGR of 9.1% from 2025 to 2032, driven by the rising number of clinical trials targeting emerging infectious diseases and novel therapeutic indications. Electroporation technology enhances vaccine delivery by temporarily creating microscopic pores in cells, allowing efficient uptake of DNA or RNA-based vaccines, which improves immunogenicity and overall efficacy.

- By Brand

On the basis of brand, the Asia-Pacific vaccine administration devices market includes BD Accuspray Nasal Spray System, BD Hypak for Vaccines Glass Pre-Fillable Syringe System, BD Uniject Auto-Disable Pre-Fillable Injection System, Gx InnoSafe, Gx RTF ClearJect, Plajex, and others. The BD Uniject Auto-Disable Pre-Fillable Injection System led the market with a revenue share of 29.6% in 2024, primarily due to its integrated safety mechanisms, user-friendly design, and widespread adoption in large-scale public health immunization programs across the region. The pre-filled, auto-disable configuration significantly reduces the risk of contamination, prevents dosage errors, and ensures consistent and reliable vaccine delivery, making it a preferred choice in both government-led vaccination campaigns and private healthcare settings.

Among the other brands, BD Hypak for Vaccines Glass Pre-Fillable Syringe System is projected to be the fastest-growing segment during the forecast period, registering a CAGR of 8.7% from 2025 to 2032. The growth is driven by rising demand for high-precision, single-dose delivery systems, increasing government initiatives for immunization coverage, and growing awareness about safe and efficient vaccine administration. Advanced features such as improved sterility, compatibility with a wide range of vaccines, and simplified handling protocols further contribute to its increasing adoption in hospitals, clinics, and outreach immunization programs.

- By Dosage

On the basis of dosage, the Asia-Pacific vaccine administration devices market is segmented into fixed and variable. The fixed dosage segment dominated with a revenue share of 55.1% in 2024, reflecting its standardized use in routine immunization programs, simplicity of administration, and ability to consistently deliver accurate vaccine volumes. These devices are widely adopted in large-scale government immunization initiatives, school-based vaccination programs, and community healthcare drives due to their reliability, ease of use, and reduced risk of dosing errors. Healthcare professionals benefit from the predictability and streamlined workflow associated with fixed dosage devices, making them essential in high-volume vaccination campaigns.

Meanwhile, the variable dosage devices segment is projected to grow at the fastest pace during the forecast period. This growth is driven by their expanding use in clinical trials, precision medicine applications, and vaccines that require patient-specific tailored dosing. Variable dosage systems allow healthcare providers to optimize vaccine efficacy, minimize wastage, and implement flexible vaccination strategies across hospitals, research institutions, and mobile vaccination units, supporting both routine and specialized immunization programs.

- By Vaccine Type

On the basis of vaccine type, the Asia-Pacific vaccine administration devices market is segmented into bivalent oral polio vaccine, B.C.G. vaccine, tetanus-diphtheria vaccine, DTP-HEPB-HIB vaccine, influenza vaccine, pneumococcal conjugate vaccine, measles vaccine, and others. The influenza vaccine segment accounted for 25.8% of revenue in 2024, driven by extensive seasonal vaccination campaigns, growing public health awareness, and elevated demand during flu seasons. The segment’s growth is supported by targeted vaccination of high-risk populations, including children, elderly individuals, and patients with chronic conditions.

The pneumococcal conjugate vaccine segment is projected to grow at the fastest CAGR of 9.4% from 2025 to 2032, fueled by expanding pediatric immunization programs, government-funded vaccination initiatives, and increasing recognition of the health risks associated with pneumococcal infections. Enhanced focus on disease prevention, inclusion of this vaccine in national immunization schedules, and rising awareness among parents and healthcare providers are driving the adoption of precision delivery devices that ensure accurate and safe administration.

- By Modality

On the basis of modality, the Asia-Pacific vaccine administration devices market is segmented into automatic vaccine administration devices and manual vaccine administration devices. The manual devices segment dominated with a 60.3% revenue share in 2024, reflecting their widespread use in conventional vaccination settings, ease of operation, and lower cost of implementation. Manual devices are particularly favored in rural and resource-limited healthcare facilities, mobile outreach programs, and small clinics due to their portability, reliability, and minimal training requirements.

In contrast, the automatic devices segment is expected to register the fastest CAGR of 8.9% from 2025 to 2032, driven by the increasing need for high efficiency, precise dosing, and consistent vaccine delivery during large-scale immunization campaigns. These devices are gaining adoption in hospitals, community vaccination centers, and mass vaccination drives, offering benefits such as reduced human error, enhanced patient safety, and optimized workflow management. Integration of automatic devices in technologically advanced healthcare facilities and government programs is further supporting market growth and reinforcing their role in achieving reliable, high-volume vaccination coverage.

- By Usability

On the basis of usability, the Asia-Pacific vaccine administration devices market is segmented into disposable and reusable devices. The disposable segment accounted for the largest share of 71.4% in 2024, driven by its enhanced safety profile, lower risk of cross-contamination, compliance with stringent infection control protocols, and the convenience it offers healthcare providers, particularly during large-scale immunization campaigns and routine vaccination programs. Disposable devices also minimize the need for sterilization and reduce operational complexity in high-volume healthcare settings.

The reusable devices segment is projected to grow at a CAGR of 7.8% from 2025 to 2032, supported by growing sustainability initiatives, cost optimization strategies in large healthcare facilities, and increased adoption in controlled clinical or research environments where strict sterilization and maintenance practices can be ensured. Reusable devices are becoming increasingly relevant in specialized applications where long-term cost-effectiveness and durability are prioritized.

- By End User

On the basis of end user, the Asia-Pacific vaccine administration devices market is segmented into hospitals, community centers, homecare settings, research and academic institutes, ambulatory surgical centers, and others. The hospitals segment dominated with 46.7% of the revenue share in 2024, owing to the presence of centralized vaccination programs, high patient throughput, well-established infrastructure, and adherence to standardized administration protocols that ensure accurate dosing and patient safety. Hospitals remain the preferred setting for large-scale immunization campaigns due to their ability to manage substantial vaccine volumes efficiently while maintaining strict compliance with safety and regulatory standards.

The homecare settings segment is expected to register the fastest CAGR of 9.0% from 2025 to 2032, driven by the growing adoption of at-home vaccination initiatives, integration of telehealth services, and increasing patient preference for convenient, personalized healthcare solutions. This trend is further supported by government and private programs promoting home-based immunization, especially in semi-urban and rural areas where access to healthcare facilities may be limited.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific vaccine administration devices market is segmented into direct tender and retail sales. The direct tender segment held the largest revenue share of 52.1% in 2024, primarily supported by government-led procurement programs aimed at ensuring the availability of vaccines for mass immunization campaigns, bulk supply contracts, and strategic public health initiatives. This channel remains critical for the efficient distribution of vaccine administration devices across public hospitals, community clinics, and large-scale vaccination centers.

The retail sales segment is projected to grow at a CAGR of 8.2% from 2025 to 2032, fueled by increasing availability of vaccine administration devices in private clinics, pharmacies, and community healthcare centers. Expanding urban and semi-urban populations, coupled with rising awareness of preventive healthcare and over-the-counter vaccination solutions, are further driving adoption through the retail distribution channel.

Asia-Pacific Vaccine Administration Devices Market Regional Analysis

- Asia-Pacific held a revenue share in the global vaccine administration devices market in 2024. This leadership position is driven by the region’s large population base, the rapid expansion of healthcare, pharmaceutical, and biotechnology sectors, and the growing trend of outsourcing vaccine administration services and analytical testing to specialized laboratories

- A strong emphasis on product quality, regulatory compliance, and safety testing across multiple industries—including pharmaceuticals, medical research, and environmental monitoring—further supports market growth. The presence of advanced analytical facilities, combined with a skilled workforce, enables the region to cater to both domestic and international clients. In addition, the growth of contract research organizations (CROs), increased clinical trial activities, and adoption of digital laboratory solutions have reinforced Asia-Pacific’s dominant position in the market

- Public and private sector investments in laboratory infrastructure, advanced technologies, and workforce training continue to bolster demand for vaccine administration devices. Key growth drivers include rising prevalence of chronic diseases, expansion of personalized medicine initiatives, and stricter environmental and quality testing regulations. Rapid industrialization, a growing middle-class population with heightened awareness of product quality, and government-led R&D initiatives collectively contribute to market expansion. Strategic collaborations between regional laboratories and global players, along with cross-border testing partnerships, are further accelerating Asia-Pacific’s influence in the global market

China Vaccine Administration Devices Market Insight

The China vaccine administration devices market dominated the Asia-Pacific vaccine administration devices market in 2024, accounting for the largest revenue share of 19.6%. This leadership is supported by the country’s strong pharmaceutical manufacturing base, a high volume of vaccine approvals, widespread adoption of advanced vaccine delivery devices, and government initiatives aimed at modernizing healthcare infrastructure and ensuring immunization safety. The country benefits from substantial government funding for life sciences research, pharmaceutical innovation, and healthcare modernization. Rapid urbanization, industrial growth, and stringent regulatory frameworks have increased demand for chemical, biological, and environmental testing. China’s position as a global manufacturing hub has amplified the need for high-quality control and compliance testing, both for domestic consumption and exports. The presence of well-established local laboratories, along with foreign-invested analytical service providers, has created a competitive, innovation-driven market environment.

India Vaccine Administration Devices Market Insight

The India vaccine administration devices market is projected to register the fastest CAGR of 8.1% in the Asia-Pacific vaccine administration devices market during the forecast period, driven by expanding healthcare access, rising adoption of vaccination programs, increasing outsourcing of manufacturing and distribution, and government-led campaigns to strengthen immunization coverage in semi-urban and rural regions. The country’s rapid pharmaceutical and biotechnology sector growth, coupled with initiatives such as “Make in India” and increased R&D investments, has significantly enhanced domestic laboratory capabilities. Rising healthcare expenditure, foreign investment inflows, and the proliferation of diagnostic centers across tier 2 and tier 3 cities are further fueling service demand. Adoption of advanced technologies such as high-performance liquid chromatography (HPLC), mass spectrometry, and genomics-based testing is elevating the quality and scope of services in India. Strategic collaborations between Indian laboratories and global CROs, along with the expansion of export-oriented manufacturing in pharmaceuticals, chemicals, and food products, are positioning India as one of the fastest-growing analytical laboratory service markets in the Asia-Pacific region.

Asia-Pacific Vaccine Administration Devices Market Share

The Asia-Pacific Vaccine Administration Devices industry is primarily led by well-established companies, including:

- BD (U.S.)

- INOVIO Pharmaceuticals (U.S.)

- Vaxxas (U.S.)

- Gerresheimer AG (Germany)

- Corium Inc. (U.S.)

- Enesi (U.S.)

- Micropoint Technologies (Singapore)

- SCHOTT AG (Germany)

- 3M (U.S.)

- NanoPass Rev (U.S.)

- Terumo Asia-Pacific NV (Belgium)

- D'Antonio Consultants International, Inc. (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Mylan NV (U.S.)

- Medical International Technologies Inc. (Canada)

Latest Developments in Asia-Pacific Vaccine Administration Devices market

- In February 2024, Japan's Takeda Pharmaceutical entered into discussions with Indian regulators to introduce its dengue vaccine, Qdenga, in India. The company plans to initiate clinical trials and collaborate with Indian vaccine manufacturer Biological E. to scale up production capacity to 50 million doses annually, aiming for a total of 100 million doses per year by 2030

- In September 2024, the World Health Organization (WHO) completed the first technology transfer of its mRNA vaccine technology to Biovac in South Africa. This initiative is part of the mRNA Technology Transfer Programme, which aims to enhance local vaccine production capabilities in regions with limited infrastructure. The transfer includes innovations such as the synthesis of new lipids used in mRNA-based products

- In August 2025, China and Malaysia initiated reciprocal recognition of medical device approvals. This agreement allows Class B, C, and D medical devices approved by Malaysia's Medical Device Authority (MDA) to be recognized in China, and vice versa. The move is expected to streamline the approval process for vaccine administration devices and other medical equipment between the two countries

- In June 2025, Gavi, the Vaccine Alliance, and the Global Polio Eradication Initiative (GPEI) convened to discuss shared priorities, including delivering a polio-free world and strengthening immunization and health systems. This collaboration underscores the importance of coordinated efforts in vaccine delivery and administration across the Asia-Pacific region

- In August 2025, Guinea officially introduced the malaria vaccine into its routine immunization schedule. This initiative, supported by Gavi, the WHO, UNICEF, and PATH, marks a significant step in expanding vaccine administration programs in West Africa

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.