Asia Pacific Viral Vector Purification Market

Market Size in USD Billion

CAGR :

%

USD

420.00 Billion

USD

1,132.45 Billion

2025

2033

USD

420.00 Billion

USD

1,132.45 Billion

2025

2033

| 2026 –2033 | |

| USD 420.00 Billion | |

| USD 1,132.45 Billion | |

|

|

|

|

Asia-Pacific Viral Vector Purification Market Size

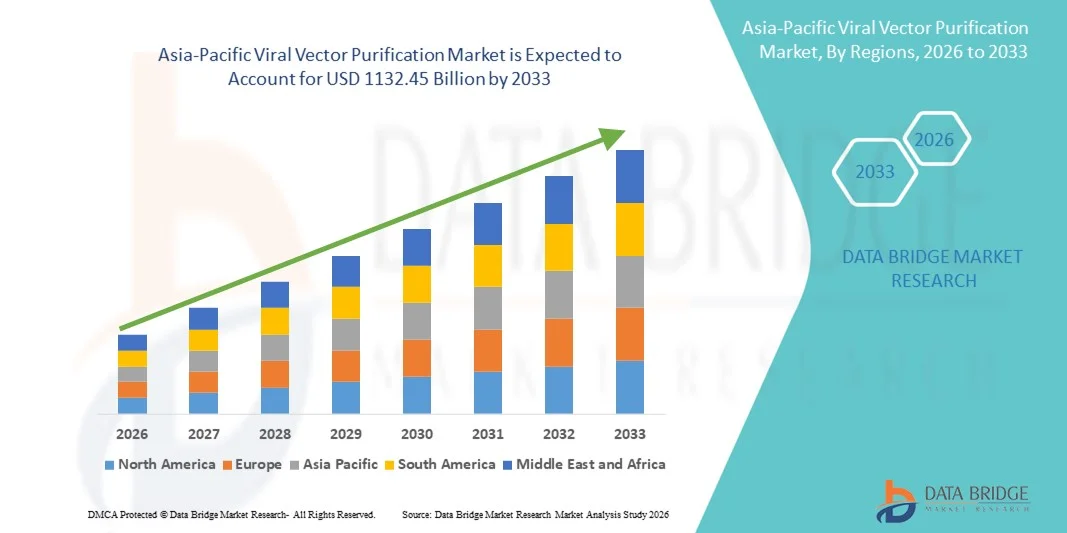

- The Asia-Pacific Viral Vector Purification market size was valued at USD 420 billion in 2025 and is expected to reach USD 1132.45 billion by 2033, at a CAGR of 13.20% during the forecast period

- The market growth is largely fueled by the increasing development and commercialization of gene therapies, vaccines, and cell-based therapeutics, which require highly efficient and scalable viral vector purification solutions. Technological advancements in chromatography, filtration, and downstream processing methods are driving higher adoption across biopharmaceutical companies and contract development and manufacturing organizations (CDMOs)

- Furthermore, rising demand for high-purity viral vectors, regulatory requirements for safety and quality, and the growing focus on process optimization and cost reduction are establishing viral vector purification as a critical component in biopharmaceutical manufacturing. These converging factors are accelerating the uptake of viral vector purification solutions, thereby significantly boosting overall market growth

Asia-Pacific Viral Vector Purification Market Analysis

- Viral vector purification solutions are increasingly critical for the production of gene therapies, vaccines, and cell-based therapeutics. The market growth is largely fueled by technological advancements in chromatography, filtration, and downstream processing, which enable higher purity, efficiency, and scalability in viral vector manufacturing

- The escalating demand for viral vector purification is primarily driven by the rising number of clinical trials, commercialization of gene therapies, and increasing regulatory emphasis on quality and safety. These converging factors are accelerating the uptake of viral vector purification solutions, thereby significantly boosting overall market growth

- China dominated the viral vector purification market with the largest revenue share of approximately 42.3% in 2025, supported by rapid expansion of biopharmaceutical manufacturing, strong government support for advanced therapies, high R&D investment, and the presence of major viral vector technology providers. The country accounted for the majority of regional demand due to widespread adoption in biotech companies and CDMOs

- India is expected to be the fastest-growing country in the viral vector purification market during the forecast period, registering a CAGR driven by increasing gene therapy research, expansion of contract development and manufacturing facilities, rising healthcare expenditure, and growing government initiatives to promote advanced therapeutics and biotechnology

- The downstream processing segment dominated the largest market revenue share of 63.1% in 2025, driven by the critical need for high-purity viral vectors for clinical applications

Report Scope and Viral Vector Purification Market Segmentation

|

Attributes |

Viral Vector Purification Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Asia-Pacific Viral Vector Purification Market Trends

Rising Adoption of Advanced Purification Technologies for Gene and Cell Therapies

- A significant and accelerating trend in the global viral vector purification market is the increasing adoption of high-efficiency purification platforms and next-generation chromatographic and filtration technologies. These advancements are improving the yield, purity, and safety of viral vectors used in gene therapy and vaccine development

- For instance, in 2022, Cytiva launched an upgraded version of its ÄKTA Ready system for viral vector purification, providing automated, high-throughput processing that reduces impurities and enhances reproducibility for clinical and commercial manufacturing. This highlights the growing emphasis on process optimization in the field

- The trend is further supported by the demand for scalable solutions to meet the expanding production needs of gene therapies, mRNA vaccines, and other advanced biologics

- In addition, increasing focus on regulatory compliance and process standardization is driving adoption of validated purification platforms that ensure consistent quality and minimize risk of contamination

- This shift toward advanced and reliable purification systems is reshaping biopharmaceutical manufacturing strategies, encouraging investment in innovative solutions that enhance process efficiency and therapeutic outcomes

Asia-Pacific Viral Vector Purification Market Dynamics

Driver

Growing Demand for Gene and Cell Therapies

- The rapid growth of gene therapy, viral vaccines, and cell therapy markets worldwide is a key driver for the viral vector purification market. Viral vectors are central to these therapies, and their safe and effective purification is critical for clinical success

- For instance, in 2023, Lonza expanded its viral vector manufacturing and purification services for gene therapies, reflecting the rising demand for high-quality, GMP-compliant purification solutions. This expansion illustrates how increasing therapy pipelines are boosting the need for robust purification platforms

- Furthermore, increasing global investment in biopharmaceutical R&D, especially in oncology and rare diseases, is driving the need for efficient viral vector purification processes to accelerate clinical trial timelines

- Collaborations between biotechnology firms, contract development and manufacturing organizations (CDMOs), and academic institutions are further expanding access to advanced purification technologies

- The growing emphasis on process efficiency, product safety, and scalability ensures continued demand for viral vector purification systems in both commercial and research applications worldwide

Restraint/Challenge

High Costs and Complex Manufacturing Processes

- The relatively high cost of advanced viral vector purification equipment and consumables, combined with complex manufacturing requirements, continues to be a major challenge for market growth, particularly in small biotech firms and emerging markets

- For instance, several gene therapy startups in Asia and Latin America reported limited access to high-throughput purification platforms due to cost constraints and technical expertise requirements, slowing their process development timelines

- Variability in regulatory requirements across regions also poses a challenge, as purification methods must comply with stringent GMP guidelines and local health authority standards

- In addition, the need for skilled operators and the technical complexity of viral vector purification processes can create barriers for widespread adoption in smaller manufacturing setups

- Overcoming these challenges through process standardization, scalable cost-effective solutions, workforce training, and harmonized regulatory frameworks will be essential to sustain global market growth in viral vector purification

Asia-Pacific Viral Vector Purification Market Scope

The market is segmented on the basis of product & services, type, workflow, purification technique, scale of operation, delivery method, disease indication, application, and end-user.

- By Product & Services

On the basis of product & services, the market is segmented into products and services. The products segment dominated the largest market revenue share of 58.3% in 2025, driven by the increasing demand for standardized viral vectors, reagents, and consumables for purification workflows. Biopharma companies rely heavily on high-quality viral vector products to ensure reproducibility and efficiency in gene therapy, cell therapy, and vaccine development. Products such as adenoviral, lentiviral, and AAV vectors are widely used across preclinical and clinical research. Regulatory compliance, lot-to-lot consistency, and validated performance further boost adoption. The growth of gene therapy pipelines and viral vaccine development programs globally supports sustained product demand. Increasing clinical trials in oncology, infectious diseases, and genetic disorders reinforce product utilization. Academic research institutes also prefer off-the-shelf viral vectors for experimental work. Growing adoption in commercial-scale manufacturing enhances revenue. Partnerships between biopharma companies and vector suppliers strengthen the product segment. Streamlined supply chains improve accessibility. These factors collectively establish products as the leading segment.

The services segment is expected to witness the fastest CAGR of 11.5% from 2026 to 2033, driven by outsourcing of viral vector purification to CDMOs, CROs, and specialized service providers. Biopharma companies increasingly rely on external expertise to reduce operational complexity and accelerate time-to-clinic. Services include vector production, process optimization, downstream purification, quality control, and analytical testing. Growing adoption of gene and cell therapies in emerging markets boosts service demand. Contract services allow companies to access advanced purification techniques without investing in infrastructure. Regulatory support for outsourcing in clinical-grade vector production encourages growth. Service providers offer scalability for both preclinical and commercial applications. High demand for high-purity and high-titer vectors further accelerates market growth. Partnerships between service providers and pharma enhance global reach. Customized workflow solutions drive adoption. These factors collectively position services as the fastest-growing segment.

- By Type

On the basis of type, the market is segmented into retroviral vectors, vaccine virus, adenoviral vectors, adeno-associated viral (AAV) vectors, lentivirus, and others. The Adeno-Associated Viral (AAV) vectors segment dominated the largest market revenue share of 36.7% in 2025, driven by their wide adoption in gene therapy and rare disease treatment pipelines. AAV vectors are favored due to low immunogenicity, long-term gene expression, and proven safety profile. Their versatility in targeting different tissues makes them ideal for both preclinical and clinical applications. Major biotech and pharmaceutical companies invest heavily in AAV-based platforms for oncology, genetic disorders, and cardiovascular therapy. Robust regulatory approvals and established clinical protocols support adoption. The growing number of clinical trials using AAV vectors strengthens market presence. Academic research institutes also widely use AAV vectors for experimental gene therapy. High demand for high-quality purified AAV vectors drives revenue. Technological advancements in vector design and production enhance efficiency. Increasing commercial-scale adoption further reinforces market dominance. These factors collectively position AAV vectors as the leading type segment.

The lentivirus segment is expected to witness the fastest CAGR of 12.1% from 2026 to 2033, fueled by their broad applicability in ex vivo gene and cell therapy, including CAR-T therapies. Lentiviral vectors enable stable integration and long-term expression of therapeutic genes in dividing cells, making them ideal for advanced cell therapy programs. Increasing investments in CAR-T, TCR-T, and hematopoietic stem cell therapies drive growth. Rising outsourcing of lentiviral vector purification to CDMOs accelerates adoption. Technological improvements in viral production and purification enhance safety and yield. Growing demand for commercial-scale manufacturing of lentiviral vectors supports CAGR expansion. Partnerships between biotech and service providers enable rapid deployment. Expansion of clinical trials globally increases need for purified lentiviral vectors. Rising focus on personalized medicine fuels adoption. Regulatory guidance supporting safe ex vivo applications strengthens growth. These factors position lentiviral vectors as the fastest-growing type segment.

- By Workflow

On the basis of workflow, the market is segmented into upstream processing and downstream processing. The downstream processing segment dominated the largest market revenue share of 63.1% in 2025, driven by the critical need for high-purity viral vectors for clinical applications. Downstream processing includes filtration, chromatography, ultracentrifugation, and concentration steps, ensuring vectors meet stringent regulatory standards. Biopharma companies increasingly focus on purification efficiency to enhance yield and reduce production costs. High-purity vectors are essential for gene therapy, cell therapy, and vaccine development. The growth of gene therapy pipelines and expansion of commercial manufacturing facilities reinforce downstream dominance. Advanced purification equipment and process automation support high throughput. CROs and CDMOs offer specialized downstream processing services. Clinical safety and efficacy requirements mandate rigorous downstream purification. Rising investments in scalable purification processes support revenue leadership. Technology advancements such as continuous purification improve efficiency. These factors collectively establish downstream processing as the leading workflow segment.

The upstream processing segment is expected to witness the fastest CAGR of 11.7% from 2026 to 2033, fueled by increasing demand for large-scale viral vector production. Upstream processing includes cell culture, viral transfection, and viral vector amplification. Innovations in bioreactors, cell line development, and media optimization enhance yield. Rising preclinical and clinical trials increase upstream production requirements. Companies prefer outsourcing upstream operations to specialized service providers to reduce capital expenditure. High demand for commercial-scale vector production in emerging markets accelerates growth. Integration with downstream purification ensures high-quality vectors. Growth of viral vector-based vaccines for infectious diseases drives upstream expansion. Advancements in continuous and perfusion culture systems increase throughput. Collaboration between biotech firms and academic institutions enhances workflow efficiency. Increasing government and private funding for gene therapy production supports CAGR expansion. These factors collectively position upstream processing as the fastest-growing workflow segment.

- By Purification Technique

On the basis of purification technique, the Viral Vector Purification market is segmented into density-gradient ultracentrifugation, ultrafiltration, precipitation, two-phase extraction systems, and chromatography. The chromatography segment dominated the largest market revenue share of 41.6% in 2025, driven by its high efficiency, scalability, and ability to deliver clinical-grade viral vectors. Chromatography techniques such as ion exchange, affinity, and size-exclusion chromatography are widely adopted in downstream purification workflows. These methods ensure high purity, reduced contamination, and regulatory compliance, making them ideal for gene and cell therapy applications. Biopharmaceutical manufacturers favor chromatography due to its reproducibility and compatibility with large-scale commercial production. Growing adoption of AAV and lentiviral vectors further supports demand. Chromatography systems integrate well with automated manufacturing platforms. Regulatory agencies increasingly recommend chromatography-based purification. CDMOs heavily invest in advanced chromatography solutions. Improved resin technologies enhance yield and throughput. Reduced batch variability further strengthens adoption. These factors collectively position chromatography as the leading purification technique.

The ultrafiltration segment is expected to witness the fastest CAGR of 12.4% from 2026 to 2033, driven by its cost-effectiveness and suitability for concentration and buffer exchange steps. Ultrafiltration offers rapid processing and reduced operational complexity compared to traditional methods. It is increasingly adopted in both upstream and downstream workflows. Growing preference for scalable and disposable filtration systems accelerates growth. Biopharma companies leverage ultrafiltration to improve process efficiency. Technological advancements in membrane materials enhance selectivity and yield. Rising commercial-scale manufacturing drives demand. Integration with continuous processing supports faster adoption. CROs and CDMOs increasingly offer ultrafiltration-based services. Reduced processing time lowers production costs. These factors collectively establish ultrafiltration as the fastest-growing purification technique.

- By Scale of Operation

On the basis of scale of operation, the market is segmented into preclinical/clinical and commercial. The preclinical/clinical segment dominated the largest market revenue share of 57.8% in 2025, driven by the growing number of gene therapy and vaccine clinical trials worldwide. Academic institutions and biotech firms heavily invest in viral vector purification at early development stages. Regulatory requirements necessitate high-quality vectors even during preclinical phases. Rising research funding supports small-batch purification demand. CROs play a key role in supporting early-stage studies. The increasing pipeline of rare disease and oncology therapies boosts utilization. Preclinical studies require multiple vector iterations, increasing purification frequency. Flexible purification workflows are preferred at this stage. Advanced research infrastructure supports adoption. Government grants and innovation programs accelerate research activity. These factors collectively position preclinical/clinical operations as the dominant segment.

The commercial segment is expected to witness the fastest CAGR of 13.2% from 2026 to 2033, driven by the approval and commercialization of gene and cell therapies. Biopharmaceutical companies are scaling up viral vector manufacturing to meet market demand. Commercial production requires high-volume, GMP-compliant purification solutions. Increasing approvals of CAR-T and AAV-based therapies accelerate growth. Expansion of manufacturing facilities worldwide supports adoption. Strategic investments by pharma giants boost capacity. Long-term therapy demand drives sustained commercial operations. Automation and continuous purification technologies enhance efficiency. CDMOs expand commercial-grade offerings. Global patient access initiatives further stimulate growth. These factors establish commercial scale as the fastest-growing segment.

- By Delivery Method

On the basis of delivery method, the market is segmented into in vivo and ex vivo. The in vivo segment dominated the largest market revenue share of 54.9% in 2025, driven by its extensive use in gene therapy for neurological, cardiovascular, and genetic disorders. In vivo delivery enables direct administration of viral vectors into patients. AAV vectors are predominantly used for in vivo applications. High demand for minimally invasive therapies supports growth. Regulatory approvals favor in vivo gene therapy products. Expanding rare disease treatment pipelines reinforce adoption. Simplified treatment protocols improve patient compliance. Biopharma companies prioritize in vivo approaches for scalability. Increasing success rates boost confidence. Global clinical trial expansion supports demand. These factors position in vivo delivery as the leading segment.

The ex vivo segment is expected to witness the fastest CAGR of 12.8% from 2026 to 2033, driven by the rapid growth of cell therapies such as CAR-T and stem cell therapies. Ex vivo methods involve genetic modification outside the body, ensuring precise control. Rising cancer immunotherapy adoption accelerates growth. Lentiviral vectors dominate ex vivo applications. High efficacy and safety profiles drive demand. Increasing oncology approvals support expansion. Advanced laboratory infrastructure enables adoption. Personalized medicine trends further boost growth. Strong investment in cell therapy manufacturing accelerates CAGR. Regulatory clarity enhances confidence. These factors establish ex vivo delivery as the fastest-growing segment.

- By Disease Indication

On the basis of disease indication, the market is segmented into cancer, genetic disorders, infectious diseases, veterinary disease, and others. The genetic disorders segment dominated the largest market revenue share of 39.4% in 2025, driven by increasing prevalence of inherited diseases and rising adoption of gene therapy. AAV-based therapies are widely used for rare genetic conditions. Government incentives support orphan drug development. Growing awareness improves diagnosis rates. Expanding newborn screening programs drive early treatment. Strong clinical trial pipeline supports demand. High unmet medical need accelerates adoption. Biotech firms focus heavily on genetic disease portfolios. Long-term therapeutic benefits strengthen market presence. Regulatory approvals boost confidence. These factors establish genetic disorders as the leading indication.

The cancer segment is expected to witness the fastest CAGR of 13.5% from 2026 to 2033, driven by the surge in cancer immunotherapy and cell therapy development. Viral vectors are critical in CAR-T and oncolytic virus therapies. Rising global cancer burden fuels growth. Increasing R&D investments accelerate innovation. Expansion of oncology clinical trials supports adoption. Strong pharma pipelines boost demand. Improved survival outcomes enhance acceptance. Regulatory fast-track approvals encourage development. Growing hospital adoption supports expansion. These factors position cancer as the fastest-growing disease segment.

- By Application

On the basis of application, the market is segmented into antisense & RNAi, gene therapy, cell therapy, and vaccinology. The gene therapy segment dominated the largest market revenue share of 44.2% in 2025, driven by widespread adoption of viral vectors for therapeutic gene delivery. Increasing regulatory approvals strengthen growth. Strong investment in rare and chronic disease treatment fuels demand. AAV and lentiviral vectors dominate this application. Growing patient success stories boost confidence. Expanding clinical pipelines support sustained demand. Technological advancements enhance safety and efficacy. Biopharma companies prioritize gene therapy platforms. Long-term treatment benefits reinforce adoption. Government funding accelerates innovation. These factors establish gene therapy as the dominant application.

The cell therapy segment is expected to witness the fastest CAGR of 14.1% from 2026 to 2033, driven by rapid growth of CAR-T and stem cell therapies. Increasing oncology applications fuel adoption. Lentiviral vectors play a crucial role. Strong clinical outcomes accelerate demand. Expanding manufacturing capacity supports growth. Personalized medicine trends boost acceptance. Regulatory support encourages innovation. Rising healthcare investment accelerates adoption. Global expansion of cell therapy centers supports CAGR growth. These factors position cell therapy as the fastest-growing application.

- By End User

On the basis of end user, the market is segmented into biotechnology companies, pharmaceutical companies, CROs, CDMOs, and academic/research institutes. The biotechnology companies segment dominated the largest market revenue share of 37.9% in 2025, driven by strong innovation in gene and cell therapy pipelines. Biotech firms lead early-stage development and clinical trials. High R&D spending supports purification demand. Flexible manufacturing models enhance adoption. Strong venture capital funding fuels growth. Strategic collaborations strengthen capabilities. Focus on rare diseases drives demand. Rapid technology adoption boosts efficiency. Growing global presence supports scale. These factors establish biotechnology companies as the leading end user.

The CDMO segment is expected to witness the fastest CAGR of 13.9% from 2026 to 2033, driven by increased outsourcing of viral vector purification. Pharma and biotech companies prefer CDMOs to reduce capital investment. CDMOs offer scalable, GMP-compliant solutions. Growing clinical trial volume fuels demand. Global expansion of CDMO facilities supports growth. Expertise in regulatory compliance accelerates adoption. Long-term manufacturing contracts enhance stability. Increasing commercial-scale production boosts CAGR. Strategic partnerships strengthen service offerings. These factors position CDMOs as the fastest-growing end user segment.

Asia-Pacific Viral Vector Purification Market Regional Analysis

- The Asia-Pacific Viral Vector Purification market is poised to grow at the fastest CAGR during the forecast period

- Driven by increasing government support for advanced therapies, expansion of biopharmaceutical manufacturing, rising healthcare expenditure, and growing adoption of viral vector technologies in biotech companies and CDMOs across the region

- Countries such as China, Japan, and India are witnessing significant investments in R&D and infrastructure, supporting rapid market growth

China Viral Vector Purification Market Insight

China viral vector purification market dominated the viral vector purification market, accounting for approximately 42.3% of the regional revenue share in 2025. Market growth is supported by rapid expansion of biopharmaceutical manufacturing, strong government support for advanced therapies, high R&D investment, and the presence of major viral vector technology providers. Widespread adoption in biotech companies and contract development and manufacturing organizations (CDMOs) drives the majority of regional demand.

India Viral Vector Purification Market Insight

India viral vector purification market is expected to be the fastest-growing country in the Viral Vector Purification market during the forecast period, driven by increasing gene therapy research, expansion of contract development and manufacturing facilities, rising healthcare expenditure, and supportive government initiatives to promote advanced therapeutics and biotechnology.

Asia-Pacific Viral Vector Purification Market Share

The Viral Vector Purification industry is primarily led by well-established companies, including:

• Thermo Fisher Scientific (U.S.)

• Merck KGaA (Germany)

• GE Healthcare (U.K.)

• Cytiva (Sweden)

• Pall Corporation (U.S.)

• Sartorius AG (Germany)

• Takara Bio Inc. (Japan)

• Lonza Group AG (Switzerland)

• Danaher Corporation (U.S.)

• WuXi AppTec (China)

• Brammer Bio (U.S.)

• Catalent, Inc. (U.S.)

• Fujifilm Diosynth Biotechnologies (Japan)

• Samsung Biologics (South Korea)

• Vector Laboratories (U.S.)

• Cobra Biologics (U.K.)

• Miltenyi Biotec (Germany)

• Bio-Rad Laboratories (U.S.)

• Novasep (France)

Latest Developments in Asia-Pacific Viral Vector Purification Market

- In December 2021, GenScript ProBio launched China’s largest commercial GMP plasmid manufacturing facility, designed to support plasmid and viral vector production services including purification, enabling enhanced support for cell and gene therapy development and downstream processing in the Asia‑Pacific region

- In November 2023, Takara Bio introduced “SonuAAV,” a novel adeno‑associated virus (AAV) vector developed with Japanese academic collaborators that demonstrated more than ten‑fold improved gene transfer efficiency in inner ear tissues compared to conventional AAV2. Although primarily a vector development announcement, this advancement has implications for purification workflows and vector quality demands in regional manufacturing

- In March 2024, GenScript ProBio expanded its Nanjing manufacturing facility to include high‑capacity downstream purification suites dedicated to AAV and plasmid DNA processing. This expansion was aimed at meeting growing global demand for gene therapy vectors and improving purification throughput and quality for clinical and commercial applications in Asia‑Pacific

- In February 2025, Thermo Fisher Scientific announced the acquisition of Solventum’s purification and filtration business for approximately $4.1 billion, significantly strengthening its viral vector purification portfolio. While this was a global move, it directly benefits bioprocess and purification capabilities available to Asia‑Pacific manufacturers and CDMOs involved in downstream vector purification

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.