Asia Pacific Walk In Refrigerators And Freezers Market

Market Size in USD Billion

CAGR :

%

USD

7.77 Billion

USD

12.20 Billion

2025

2033

USD

7.77 Billion

USD

12.20 Billion

2025

2033

| 2026 –2033 | |

| USD 7.77 Billion | |

| USD 12.20 Billion | |

|

|

|

|

Asia-Pacific Walk-In Refrigerators and Freezers Market Size

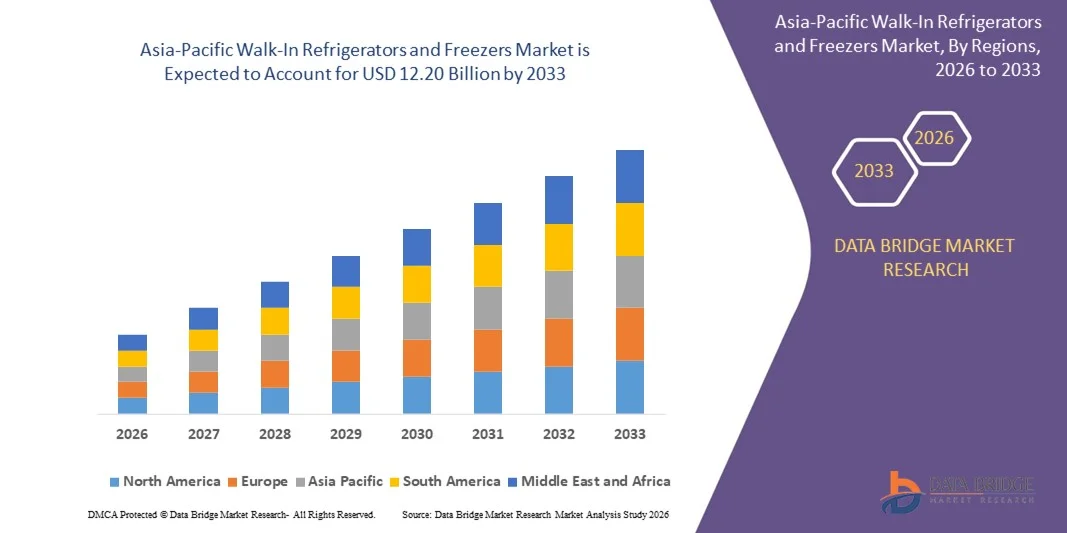

- The Asia-Pacific walk-in refrigerators and freezers market size was valued at USD 7.77 billion in 2025 and is expected to reach USD 12.20 billion by 2033, at a CAGR of 5.8% during the forecast period

- The market growth is largely driven by the expanding food and beverage industry and the rising need for reliable cold storage solutions to maintain product freshness, safety, and quality across the supply chain in commercial and industrial settings

- Furthermore, increasing regulatory emphasis on food safety standards, growing pharmaceutical cold chain requirements, and rising adoption of energy-efficient refrigeration systems are accelerating demand for walk-in refrigerators and freezers, thereby supporting sustained market growth

Asia-Pacific Walk-In Refrigerators and Freezers Market Analysis

- Walk-in refrigerators and freezers, designed to provide large-scale temperature-controlled storage, play a critical role in food service, retail, healthcare, and pharmaceutical sectors by ensuring consistent cooling, inventory protection, and regulatory compliance

- The increasing demand for these systems is primarily fueled by growth in commercial kitchens, supermarkets, cold storage warehouses, and pharmaceutical distribution, along with rising focus on energy efficiency, automation, and sustainable refrigeration technologies

- China dominated walk-in refrigerators and freezers market in 2025, due to its extensive food processing industry, expanding cold storage infrastructure, and rapid growth of organized retail and food service sectors

- India is expected to be the fastest growing country in the walk-in refrigerators and freezers market during the forecast period due to rapid expansion of cold-chain infrastructure and growing consumption of perishable and frozen foods

- Floor segment dominated the market with a market share of 68.9% in 2025, due to its robust structural support and suitability for heavy-duty storage applications. These systems are widely used in industrial cold storage and distribution centers handling large volumes. Floor-mounted designs also support better insulation and load-bearing capacity

Report Scope and Walk-In Refrigerators and Freezers Market Segmentation

|

Attributes |

Walk-In Refrigerators and Freezers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Walk-In Refrigerators and Freezers Market Trends

Adoption of Energy-Efficient and Low-GWP Refrigeration Technologies

- A key trend in the walk-in refrigerators and freezers market is the increasing adoption of energy-efficient systems that use low-GWP refrigerants to reduce environmental impact and operating costs. This trend is driven by stricter environmental regulations and growing awareness among commercial operators regarding sustainability and energy consumption

- For instance, manufacturers such as Hussmann are introducing refrigeration solutions that utilize natural refrigerants to meet regulatory requirements while maintaining reliable cooling performance. These systems help businesses lower carbon emissions and align with evolving environmental standards

- Commercial food service operators and cold storage facilities are increasingly upgrading older refrigeration infrastructure to newer energy-efficient walk-in systems. This transition supports improved temperature stability and reduces long-term energy expenses

- The retail and food processing sectors are prioritizing refrigeration technologies that offer consistent performance with lower power usage. This is strengthening demand for advanced compressors, insulation materials, and intelligent control systems

- Healthcare and pharmaceutical facilities are also adopting energy-efficient walk-in refrigeration to ensure precise temperature control for sensitive products. This trend is reinforcing the role of sustainable technologies across diverse end-use industries

- Overall, the growing focus on efficiency, regulatory compliance, and sustainability is shaping the evolution of walk-in refrigerators and freezers toward more environmentally responsible refrigeration solutions

Asia-Pacific Walk-In Refrigerators and Freezers Market Dynamics

Driver

Rising Demand for Temperature-Controlled Storage in Food and Pharma Supply Chains

- The expanding food and pharmaceutical supply chains are driving demand for reliable temperature-controlled storage to preserve product quality and safety. Walk-in refrigerators and freezers support large-scale storage needs across processing, distribution, and retail operations

- For instance, food and beverage companies rely on walk-in refrigeration to maintain freshness during storage and distribution, while pharmaceutical firms depend on precise cooling for vaccines and biologics. This widespread dependence strengthens consistent market demand

- Growth in supermarkets, cold storage warehouses, and commercial kitchens is increasing the installation of walk-in refrigeration systems. These facilities require dependable cooling solutions to manage high inventory volumes

- Rising global consumption of frozen and perishable foods is further supporting demand for advanced cold storage infrastructure. This is reinforcing the importance of walk-in refrigerators and freezers across supply chains

- The continuous expansion of temperature-sensitive logistics is sustaining this driver and contributing to steady market growth over the forecast period

Restraint/Challenge

High Initial Installation and Maintenance Costs

- The walk-in refrigerators and freezers market faces challenges due to high upfront installation costs associated with equipment, insulation, and system integration. These costs can be a barrier for small and mid-sized businesses

- For instance, installing large-capacity walk-in units often requires customized layouts, electrical upgrades, and professional labor, increasing overall project expenses. This limits rapid adoption among cost-sensitive end users

- Ongoing maintenance requirements, including compressor servicing and refrigerant management, add to long-term operational costs. These factors affect total cost of ownership for operators

- Energy consumption and repair costs further contribute to financial burden if systems are not optimized or regularly maintained. This creates hesitation among potential buyers

- As a result, balancing performance, compliance, and affordability remains a key challenge influencing purchasing decisions in the market

Asia-Pacific Walk-In Refrigerators and Freezers Market Scope

The market is segmented on the basis of type, system type, door type, technology, curtain type, mounting type, distribution channel, and end-user.

- By Type

On the basis of type, the Walk-In Refrigerators and Freezers market is segmented into self-contained, remote condensing, multiplex condensing, and others. The remote condensing segment dominated the market with the largest revenue share in 2025, driven by its ability to handle large cooling loads and maintain consistent temperature control across expansive commercial and industrial facilities. These systems are widely preferred in supermarkets, food processing units, and cold storage warehouses due to reduced heat and noise inside storage areas. Remote condensing units also support higher energy efficiency and easier maintenance by locating compressors outside the refrigerated space. Their scalability and long operational life further strengthen adoption among high-capacity users. In addition, regulatory emphasis on food safety and temperature compliance continues to reinforce demand for this segment.

The self-contained segment is expected to witness the fastest growth from 2026 to 2033, supported by rising adoption among small restaurants, cafés, and specialty food outlets. These systems offer compact design, easier installation, and lower upfront costs, making them suitable for space-constrained environments. Increasing growth of quick-service restaurants and independent food retailers further accelerates demand. Their plug-and-play nature and reduced installation complexity also appeal to first-time buyers. Advancements in energy-efficient compressors and eco-friendly refrigerants are enhancing their market attractiveness.

- By System Type

On the basis of system type, the market is segmented into remote systems, pre-assembled remote systems, standard top-mount, side-mount refrigeration system, saddle mount refrigeration systems, penthouse refrigeration system, roll up refrigeration system, and others. The remote systems segment dominated the market in 2025, driven by its widespread use in large-scale cold storage, food distribution centers, and pharmaceutical facilities. These systems deliver stable cooling performance while minimizing internal heat gain, supporting strict temperature-sensitive storage needs. Their flexibility in configuration and compatibility with large walk-in units contribute to higher adoption. Enhanced system durability and serviceability further support long-term operational efficiency.

The pre-assembled remote systems segment is projected to grow at the fastest rate during 2026–2033, owing to reduced installation time and lower labor dependency. These systems are increasingly preferred by operators seeking faster deployment and predictable performance. Growing demand from expanding retail chains and foodservice operators supports growth. Factory-tested designs also improve reliability and compliance with energy regulations.

- By Door Type

On the basis of door type, the market is segmented into single door, double door, triple door, hinged, manual sliding, power sliding, and others. The double door segment accounted for the largest market share in 2025, supported by its suitability for medium to large walk-in units requiring frequent access. Double doors improve workflow efficiency by enabling smoother movement of goods and personnel. They also help minimize temperature loss during loading and unloading operations. Widespread adoption in food processing and hospitality sectors reinforces their dominance.

The power sliding door segment is expected to register the fastest growth from 2026 to 2033, driven by rising automation in cold storage facilities. These doors enhance operational efficiency, reduce manual effort, and improve hygiene standards. Increasing focus on worker safety and energy conservation further supports adoption. Integration with smart sensors and access controls adds to their growing appeal.

- By Technology

On the basis of technology, the market is segmented into manual, semi-automatic, and fully automatic. The manual segment dominated the market in 2025, owing to its lower cost, simple operation, and widespread use in small and mid-sized facilities. Manual systems remain popular in developing regions where budget constraints influence purchasing decisions. Their ease of maintenance and minimal reliance on electronic components further support demand.

The fully automatic segment is anticipated to witness the fastest growth during 2026–2033, driven by increasing adoption of smart cold storage solutions. These systems enable precise temperature control, energy optimization, and reduced human intervention. Growing investments in advanced food logistics and pharmaceutical storage accelerate adoption. Integration with monitoring and alarm systems further enhances reliability.

- By Curtain Type

On the basis of curtain type, the market is segmented into strip curtains and air curtains. The strip curtains segment held the largest revenue share in 2025, supported by its cost-effectiveness and ease of installation. Strip curtains are widely used to reduce cold air loss while allowing frequent movement of personnel and equipment. Their durability and low maintenance requirements further strengthen adoption across food and beverage facilities.

The air curtains segment is expected to grow at the fastest pace from 2026 to 2033, driven by rising demand for energy-efficient solutions. Air curtains help maintain internal temperatures without physical barriers, improving hygiene and operational efficiency. Increasing adoption in high-traffic commercial kitchens and cold warehouses supports growth.

- By Mounting Type

On the basis of mounting type, the market is segmented into floor and non-floor. The floor-mounted segment dominated the market with the largest share of 68.9% in 2025, driven by its robust structural support and suitability for heavy-duty storage applications. These systems are widely used in industrial cold storage and distribution centers handling large volumes. Floor-mounted designs also support better insulation and load-bearing capacity.

The non-floor segment is projected to witness the fastest growth during 2026–2033, owing to easier cleaning and compliance with hygiene regulations. Increasing adoption in pharmaceutical and food processing facilities supports demand. Space optimization and improved sanitation standards further enhance market growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales/B2B, e-commerce, specialty stores, and others. The direct sales/B2B segment accounted for the largest market share in 2025, driven by customized system requirements and large-volume purchases by commercial clients. Direct engagement enables tailored solutions, technical support, and long-term service contracts. Strong relationships with manufacturers further reinforce dominance.

The e-commerce segment is expected to grow at the fastest rate from 2026 to 2033, supported by increasing digital procurement and standardized product offerings. Online platforms provide wider product visibility and competitive pricing. Growing adoption by small businesses and independent operators accelerates growth.

- By End-User

On the basis of end-user, the market is segmented into breweries, chemicals, cold storage warehouse, commercial kitchen and restaurants, floral storage, food and beverage, hospitals and mortuaries, mobile refrigeration system, pharmaceuticals, and research laboratories. The food and beverage segment dominated the market in 2025, driven by stringent food safety regulations and high demand for temperature-controlled storage. Expansion of food processing, retail, and distribution networks supports sustained demand. Consistent need for reliable refrigeration across supply chains reinforces segment leadership.

The pharmaceuticals segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing demand for vaccine storage and biologics. Strict temperature compliance requirements drive adoption of advanced walk-in refrigeration systems. Growth in healthcare infrastructure and pharmaceutical research further accelerates market expansion.

Asia-Pacific Walk-In Refrigerators and Freezers Market Regional Analysis

- China dominated the walk-in refrigerators and freezers market with the largest revenue share in 2025, driven by its extensive food processing industry, expanding cold storage infrastructure, and rapid growth of organized retail and food service sectors

- Strong government support for cold-chain development, combined with rising demand for temperature-controlled storage for food, pharmaceuticals, and agricultural produce, reinforces China’s leadership in the regional market

- The presence of large domestic refrigeration manufacturers, continuous capacity expansion of cold storage warehouses, and adoption of energy-efficient walk-in refrigeration systems continue to consolidate China’s dominant position during the forecast period. Growth of e-commerce grocery platforms and modernization of food logistics further strengthen market penetration across urban and semi-urban regions

Japan Walk-In Refrigerators and Freezers Market Insight

Japan is anticipated to grow steadily from 2026 to 2033, supported by its advanced food retail infrastructure, high food safety standards, and strong demand for reliable cold storage solutions. Food service operators and retailers prioritize high-performance walk-in refrigeration systems that offer precise temperature control and energy efficiency. The demand for compact and technologically advanced systems is rising due to space constraints in urban environments. Continuous innovation, automation, and replacement of aging refrigeration infrastructure reinforce Japan’s steady market growth.

India Walk-In Refrigerators and Freezers Market Insight

India is projected to register the fastest CAGR in the Asia Pacific walk-in refrigerators and freezers market during 2026–2033, fueled by rapid expansion of cold-chain infrastructure and growing consumption of perishable and frozen foods. Increasing investments in food processing, pharmaceutical storage, and organized retail are accelerating adoption of walk-in refrigeration systems. The demand for cost-effective and scalable cold storage solutions is particularly strong among small and mid-sized businesses. Expansion of e-commerce grocery platforms, government initiatives supporting cold-chain development, and rising focus on food safety position India as the fastest-growing market in the region.

Asia-Pacific Walk-In Refrigerators and Freezers Market Share

The walk-in refrigerators and freezers industry is primarily led by well-established companies, including:

- Perlick Corporation (U.S.)

- WHYNTER LLC (U.S.)

- ULine (U.S.)

- NewAir and NewAir (U.S.)

- Lancer Worldwide (U.S.)

- Haier Inc. (China)

- Vinotemp (U.S.)

- Foster Refrigerator, Division of ITW Ltd (U.K.)

- Master-Bilt Products, LLC (U.S.)

- NorLake, Inc. (U.S.)

- KOLPAK (U.S.)

- BSH Hausgeräte GmbH (Germany)

- AB Electrolux (Sweden)

- Amerikooler (U.S.)

- Zhejiang Xingxing Refrigeration Co., Ltd. (China)

- Arctic Industries (U.S.)

- Beverage-Air (U.S.)

- Precision Refrigeration Ltd (U.K.)

- Polar King International, Inc. (U.S.)

- supcool (U.S.)

Latest Developments in Asia-Pacific Walk-In Refrigerators and Freezers Market

- In January 2025, Hussmann, a Panasonic company, launched Evolve Technologies to advance sustainable refrigeration practices by using low-GWP refrigerants such as R-744 (CO₂) and R-290 (propane). This initiative reflects a strategic shift toward environmentally responsible refrigeration systems that comply with tightening global climate regulations. By focusing on natural refrigerants with lower environmental impact, the company strengthens its position in sustainable cold chain solutions. This move is expected to positively impact the walk-in refrigerators and freezers market by accelerating adoption of energy-efficient and eco-friendly systems across commercial and industrial sectors

- In November 2024, Anthony introduced its Automatic Beer Cave Door for Walk-In Coolers, featuring motion sensors that enable seamless two-way traffic without jamming. The innovation is designed to reduce congestion and improve accessibility in high-traffic retail and food service environments. By minimizing manual handling and improving door responsiveness, the solution supports better temperature retention and energy efficiency. This advancement is likely to enhance operational efficiency and user experience, driving adoption among retailers and food service providers seeking automation and workflow optimization

- In May 2021, Arctic Industries, backed by Stoic Holdings, collaborated with the Fischer Group as part of a strategic growth initiative for the walk-in cooler and freezer manufacturer. The collaboration aimed to strengthen manufacturing capabilities, expand market reach, and leverage shared expertise in refrigeration solutions. Such partnerships typically support product innovation and operational scalability. This move helped Arctic Industries reinforce its competitive positioning and contributed to ongoing technological advancement within the walk-in refrigeration market

- In February 2021, BSH Hausgeräte GmbH formed a collaboration with the United Nations’ World Food Programme and JOBLINGE to address global hunger and youth unemployment. This partnership highlighted BSH’s commitment to social responsibility and long-term sustainability goals beyond core manufacturing activities. By engaging in initiatives that support food security and workforce development, the company enhanced its corporate image and stakeholder trust. Such efforts can indirectly strengthen BSH’s market presence in walk-in refrigerators and freezers by aligning the brand with broader societal and sustainability objectives

- In January 2021, Emerson launched a new platform of Annual Walk-In Energy Factor (AWEF) compliant condensing units for walk-in coolers in response to updated Department of Energy regulations. The launch demonstrated proactive compliance with evolving energy efficiency standards in the refrigeration industry. These units were designed to help operators reduce energy consumption while maintaining reliable cooling performance. This development supported market growth by encouraging replacement of older systems and reinforcing the importance of regulatory-compliant, energy-efficient refrigeration solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.