Asia Pacific Wearable Devices Market

Market Size in USD Million

CAGR :

%

USD

410.00 Million

USD

1,353.44 Million

2025

2033

USD

410.00 Million

USD

1,353.44 Million

2025

2033

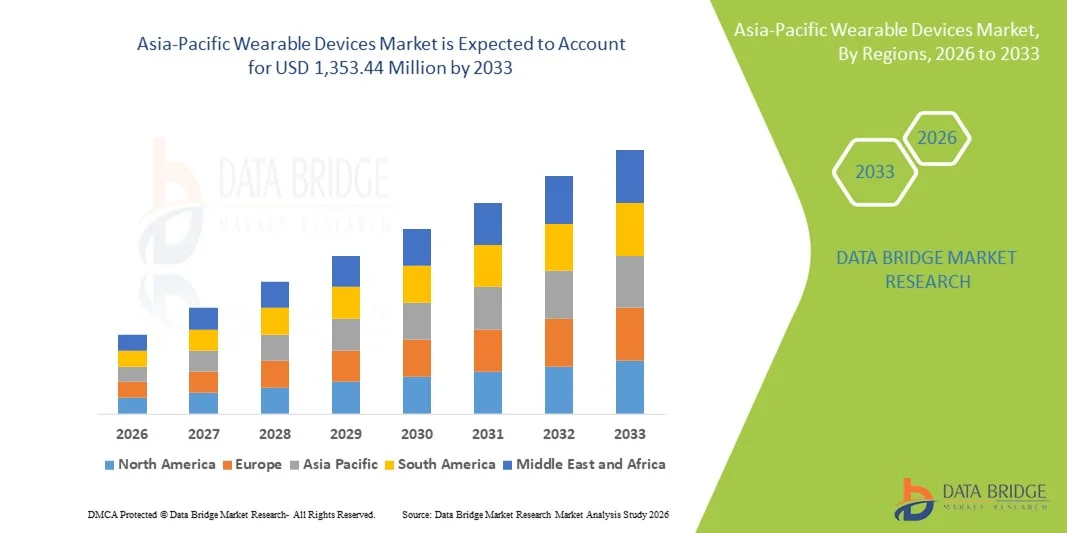

| 2026 –2033 | |

| USD 410.00 Million | |

| USD 1,353.44 Million | |

|

|

|

|

Asia-Pacific Wearable Devices Market Size

- The Asia-Pacific wearable devices market size was valued at USD 410.00 million in 2025 and is expected to reach USD 1,353.44 million by 2033, at a CAGR of 16.1% during the forecast period

- The market growth is largely fueled by the rising adoption of health monitoring, fitness tracking, and connected wearable technology, along with increasing integration of IoT and AI capabilities in wearable devices across healthcare, sports, and consumer electronics sectors

- Furthermore, growing consumer awareness of personal health and wellness, combined with demand for convenient, real-time monitoring solutions, is driving the proliferation of wearable devices in both urban and semi-urban regions. These converging factors are accelerating the adoption of wearable technology, thereby significantly boosting the industry's growth

Asia-Pacific Wearable Devices Market Analysis

- Wearable devices, including smartwatches, fitness trackers, and health monitoring gadgets, are increasingly essential components of personal health management, fitness tracking, and connected lifestyles in both consumer and healthcare sectors due to their real-time monitoring, connectivity, and seamless integration with mobile and cloud-based platforms

- The escalating demand for wearable devices is primarily driven by growing health awareness, increasing adoption of connected technology, and rising consumer preference for convenient, on-the-go health and fitness monitoring solutions

- China dominated the Asia-Pacific wearable devices market with the largest revenue share of 45.3%, characterized by early adoption of wearable tech, high smartphone penetration, and a strong presence of domestic and global manufacturers, with cities such as Beijing and Shanghai witnessing substantial growth in wrist-wear and fitness trackers, driven by AI-assisted health monitoring and mobile app integration

- India is expected to be the fastest-growing country in the Asia-Pacific wearable devices market during the forecast period due to rising disposable incomes, increasing digital literacy, and a growing focus on health and fitness among urban populations, which is encouraging adoption of wearable devices across metropolitan areas

- Wrist-wear segment dominated the wearable devices market with a market share of 40.9% in 2025, driven by its multifunctionality, health tracking features, and seamless integration with smartphones and fitness ecosystems

Report Scope and Asia-Pacific Wearable Devices Market Segmentation

|

Attributes |

Asia-Pacific Wearable Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Asia-Pacific Wearable Devices Market Trends

Enhanced Functionality Through AI and Health Integration

- A significant and accelerating trend in the Asia-Pacific wearable devices market is the increasing integration of artificial intelligence (AI) and health monitoring technologies, which is enhancing real-time insights into fitness, vitals, and lifestyle patterns

- For instance, the Mi Smart Band integrates AI-driven activity recognition and sleep monitoring to provide personalized health insights, while Apple Watch models offer ECG and blood oxygen tracking to support proactive health management

- AI in wearable devices enables features such as predicting health anomalies, providing personalized fitness coaching, and generating intelligent alerts for irregular heart rates or activity levels. For instance, Fitbit’s AI-based algorithms analyze sleep and exercise patterns to suggest lifestyle adjustments

- The seamless integration of wearables with smartphones, mobile apps, and cloud platforms allows centralized management of health and fitness data. Through a single interface, users can track multiple health metrics, set goals, and receive insights, creating a unified and personalized wellness experience

- This trend toward smarter, more interconnected, and health-focused wearable devices is fundamentally reshaping user expectations for personal monitoring. Consequently, companies such as Garmin are developing AI-enabled wearables with predictive health analytics and advanced workout guidance

- The demand for wearables with intelligent health tracking and AI-powered analytics is growing rapidly across consumer and healthcare sectors, as users increasingly prioritize personalized, data-driven wellness solutions

- Expansion of fashion-forward and customizable wearables is a growing trend, with brands offering stylish, interchangeable wristbands and designs to attract tech-savvy millennials. For instance, Fitbit Luxe and Apple Watch Hermès appeal to users who want both functionality and fashion

Asia-Pacific Wearable Devices Market Dynamics

Driver

Rising Health Awareness and Digital Fitness Adoption

- The increasing focus on personal health, fitness, and wellness, coupled with growing smartphone penetration and connectivity, is a significant driver for the heightened demand for wearable devices

- For instance, in April 2025, Xiaomi expanded its Mi Band series with enhanced health monitoring sensors to cater to a rising fitness-conscious urban population, driving wearable adoption in Asia-Pacific

- As consumers become more aware of the benefits of real-time health tracking and proactive wellness, wearables offer advanced features such as heart rate monitoring, sleep tracking, and personalized activity insights, providing a compelling upgrade over traditional fitness tracking methods

- Furthermore, the growing popularity of connected fitness apps and digital health ecosystems is making wearables an integral component of daily wellness routines, offering seamless integration with mobile devices and cloud-based platforms

- The convenience of continuous health monitoring, personalized fitness guidance, and remote medical data sharing are key factors propelling wearable adoption in both urban and semi-urban populations. The trend towards affordable, user-friendly devices further contributes to market growth

- Rising corporate wellness initiatives in countries such as Japan, South Korea, and Australia are driving demand for wearable devices among employees, as companies encourage health tracking and preventive care programs. For instance, some firms provide Fitbit or Garmin devices to employees to monitor activity and promote fitness

- Increasing penetration of IoT-enabled gyms and fitness studios is driving wearable adoption, as gym equipment and apps sync with wearable devices to provide personalized workout plans and performance metrics. For instance, Technogym devices integrate directly with major wearable platforms for real-time analytics

Restraint/Challenge

Battery Life Limitations and Data Privacy Concerns

- Limitations in battery performance, frequent charging requirements, and short operational life of some wearable devices pose a significant challenge to broader market penetration

- For instance, reports highlighting rapid battery drain in certain entry-level smartwatches have made some consumers hesitant to adopt advanced wearable solutions

- Addressing these challenges through energy-efficient hardware, longer battery life, and optimized software is crucial for improving user experience. Companies such as Samsung and Fitbit emphasize extended battery performance and low-power AI modes to reassure potential buyers. In addition, concerns regarding the collection, storage, and use of personal health data can act as barriers to adoption, particularly in privacy-conscious markets

- While data security measures are improving, apprehensions about potential breaches and unauthorized access to sensitive health information can still hinder widespread adoption

- Overcoming these challenges through enhanced battery technologies, robust data encryption, and consumer education on privacy best practices will be vital for sustained market growth

- Variations in regulatory standards across Asia-Pacific countries create compliance challenges, slowing product launches and increasing development costs for manufacturers. For instance, some devices require separate certifications in India, China, and Japan

- Limited interoperability among devices and platforms can frustrate users and restrict adoption, as not all wearables seamlessly integrate with third-party health apps or hospital systems. For instance, certain Xiaomi models may not sync fully with Apple Health or hospital portals

Asia-Pacific Wearable Devices Market Scope

The market is segmented on the basis of product, type, industry, and end users.

- By Product

On the basis of product, the Asia-Pacific wearable devices market is segmented into wrist-wear, eyewear, footwear, neckwear, body wear, and others. The wrist-wear segment dominated the market with the largest revenue share of 40.9% in 2025, driven by the multifunctionality of smartwatches and fitness bands. Wrist-wear devices are widely preferred due to their continuous health monitoring, activity tracking, and seamless integration with smartphones and apps. Consumers in countries such as China, Japan, and South Korea prioritize wrist-wear for its convenience, portability, and real-time feedback. In addition, wrist-wear devices often include features such as heart rate monitoring, sleep tracking, ECG, and AI-based fitness coaching, which enhance their adoption across both urban and semi-urban populations. The segment also benefits from strong brand recognition and aggressive marketing by companies such as Apple, Garmin, and Xiaomi, boosting consumer confidence. Overall, wrist-wear remains the most accessible and versatile wearable device in the Asia-Pacific region.

The eyewear segment is anticipated to witness the fastest growth from 2026 to 2033 due to increasing adoption of AR-enabled smart glasses and heads-up display technology. Eyewear wearables offer hands-free access to notifications, navigation, and augmented reality experiences, making them attractive for both enterprise and consumer applications. The growth is supported by innovations from companies such as Epson and Vuzix, which are targeting industrial, educational, and healthcare sectors. AR eyewear adoption is also driven by the gaming and remote collaboration markets, where immersive experiences enhance productivity and engagement. Increasing urbanization and rising disposable incomes in countries such as India and Singapore further fuel demand. Furthermore, regulatory support for tech-enabled learning and workplace safety is encouraging businesses to invest in smart eyewear solutions.

- By Type

On the basis of type, the market is segmented into smart textile, passive, active, ultra-smart, and non-textile devices. The active segment dominated the market in 2025, owing to its widespread use in real-time health monitoring, fitness tracking, and connected lifestyle applications. Active wearables use embedded sensors, AI algorithms, and Bluetooth connectivity to provide continuous data on heart rate, activity levels, and sleep patterns. This type is highly preferred by personal users, healthcare providers, and fitness enthusiasts due to its accuracy and actionable insights. Countries such as Japan, China, and South Korea have witnessed high adoption of active wearables thanks to urban tech-savvy populations and growing awareness of preventive healthcare. Major brands, including Fitbit, Apple, and Garmin, focus heavily on active devices due to their high-profit margins and consistent consumer demand. Active wearables also integrate seamlessly with mobile apps and cloud platforms, facilitating long-term user engagement and ecosystem growth.

The ultra-smart segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing innovations in AI, IoT, and telemedicine integration. Ultra-smart wearables combine advanced sensor technologies, predictive health analytics, and cloud-based monitoring to deliver highly personalized wellness and medical insights. Countries such as India and Singapore are emerging as growth hubs due to rising digital literacy, health-conscious millennials, and expanding telehealth adoption. Ultra-smart devices are increasingly adopted in healthcare settings for chronic disease monitoring and post-operative care, enhancing their credibility. In addition, the rise of enterprise wellness programs and corporate health initiatives encourages deployment of ultra-smart wearables among employees. These devices also attract early adopters seeking cutting-edge technology, contributing to premium segment growth.

- By Industry

On the basis of industry, the Asia-Pacific wearable devices market is segmented into consumer products, healthcare, industrial, and others. The consumer products segment dominated the market with the largest revenue share in 2025, as individuals increasingly adopt wearables for fitness tracking, health monitoring, and lifestyle management. Consumer wearables are popular due to their user-friendly design, affordability, and integration with mobile apps and cloud services. Urban populations in China, Japan, and South Korea are leading consumers, driven by rising health awareness and tech adoption. Brands focus on stylish and multifunctional devices that appeal to millennials and Gen Z consumers, further boosting demand. Retail channels, online marketplaces, and brand stores facilitate easy accessibility and adoption. Moreover, the segment benefits from continuous innovation in features such as AI-based coaching, real-time analytics, and social fitness challenges.

The healthcare segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing adoption of wearables for remote patient monitoring, chronic disease management, and hospital-based digital health programs. Countries such as India, Singapore, and Australia are witnessing rising investments in connected healthcare infrastructure, which promotes wearable integration. Wearables in healthcare provide continuous vital monitoring, alert systems, and telehealth connectivity, enabling early intervention and reducing hospital visits. In addition, government initiatives supporting digital health and reimbursement schemes for remote monitoring accelerate adoption. Partnerships between wearable manufacturers and hospitals or insurance providers further drive growth. Patients and caregivers increasingly rely on wearables for accurate data tracking and health insights, expanding the segment’s market potential.

- By End Users

On the basis of end users, the market is segmented into personal users and enterprises. The personal users segment dominated the market in 2025, accounting for the largest revenue share due to widespread adoption of wrist-wear and other consumer-focused devices for fitness and health tracking. Personal users benefit from continuous monitoring of vitals, activity tracking, and integration with mobile apps for data visualization and goal setting. Urban populations in China, Japan, and South Korea lead adoption due to high smartphone penetration and lifestyle awareness. Wearables also appeal to tech-savvy millennials and fitness enthusiasts seeking convenience, personalized insights, and gamified experiences. Companies such as Apple, Fitbit, and Xiaomi target personal users with marketing campaigns and ecosystem integrations, driving market growth. The segment also benefits from increased awareness of preventive health measures, promoting long-term engagement.

The enterprise segment is expected to witness the fastest growth from 2026 to 2033, driven by the rising adoption of wearables in corporate wellness programs, industrial safety, and employee health monitoring. Enterprises in countries such as Japan, Australia, and Singapore are increasingly providing wearables to monitor employee activity, ergonomics, and overall well-being. In industrial sectors, wearables improve worker safety, detect fatigue, and track hazardous exposure. Telehealth-enabled wearables for employees allow companies to proactively manage health risks and reduce absenteeism. Collaboration between wearable providers and corporate organizations accelerates adoption. The segment growth is further supported by government incentives for workplace health programs and enterprise adoption of digital health technologies.

Asia-Pacific Wearable Devices Market Regional Analysis

- China dominated the Asia-Pacific wearable devices market with the largest revenue share of 45.3%, characterized by early adoption of wearable tech, high smartphone penetration, and a strong presence of domestic and global manufacturers

- Consumers in the country highly value the multifunctionality, real-time health monitoring, and seamless integration of wearable devices with smartphones, mobile apps, and cloud-based platforms for personal wellness and fitness tracking

- This widespread adoption is further supported by strong domestic and global brand presence, growing disposable incomes, and a tech-savvy population that prioritizes preventive healthcare, making wearable devices the preferred solution for both personal users and enterprise wellness programs

The China Wearable Devices Market Insight

The China wearable devices market captured the largest revenue share of 45.3% in 2025, fueled by high smartphone penetration, urban tech-savvy populations, and rising awareness of personal health and fitness. Consumers are increasingly prioritizing multifunctional devices such as wrist-wear for continuous health monitoring, activity tracking, and mobile app integration. The growing presence of both domestic and global brands, combined with rising disposable incomes, further propels market growth. Moreover, government initiatives supporting digital health, wearable technology research, and smart city projects are boosting adoption across urban centers. The seamless integration of wearables with AI-enabled fitness and health platforms enhances personalized wellness, making China a dominant market in APAC.

Japan Wearable Devices Market Insight

The Japan wearable devices market is gaining momentum due to the country’s high-tech culture, aging population, and strong focus on health and preventive care. Adoption is driven by multifunctional wrist-wear and ultra-smart devices that support continuous health monitoring, fall detection, and chronic disease management. Integration with telemedicine services and IoT-enabled smart home systems further fuels growth. Japanese consumers value convenience, accuracy, and reliability, making wearable devices an integral part of daily life for both personal and healthcare applications. In addition, innovations from local and international wearable brands are contributing to the growing preference for connected, AI-powered devices.

India Wearable Devices Market Insight

The India wearable devices market accounted for a growing market revenue share of 18% in 2025, attributed to rapid urbanization, rising disposable incomes, and expanding digital literacy. India is emerging as a major market for wrist-wear, smart textiles, and health monitoring devices in both personal and enterprise wellness applications. The push toward smart cities, increasing focus on fitness, and availability of affordable wearable options are key factors propelling the market. Domestic manufacturers and global brands are expanding distribution channels through online and offline retail, further boosting adoption. Increasing awareness of preventive healthcare and telemedicine integration is also encouraging users to adopt wearable devices for continuous health tracking and lifestyle management.

South Korea Wearable Devices Market Insight

The South Korea wearable devices market is experiencing rapid growth due to the country’s advanced technology infrastructure, high smartphone penetration, and strong consumer interest in health and fitness monitoring. Multifunctional wrist-wear and smart textiles are increasingly adopted for fitness tracking, healthcare monitoring, and enterprise wellness programs. Integration with AI-enabled mobile apps, cloud platforms, and IoT devices enhances user experience and personalized insights. The government’s focus on digital healthcare initiatives and smart city development further supports market expansion. Local innovation, coupled with high disposable incomes and urban lifestyle adoption, is driving wearable device uptake in both personal and corporate segments. Partnerships between wearable manufacturers and healthcare providers are also accelerating growth in chronic disease management and telehealth solutions.

Asia-Pacific Wearable Devices Market Share

The Asia-Pacific Wearable Devices industry is primarily led by well-established companies, including:

- Apple Inc. (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Xiaomi Corporation (China)

- Huawei Technologies Co., Ltd. (China)

- Garmin Ltd. (U.S.)

- Sony Corporation (Japan)

- Withings (France)

- Omron Healthcare Co., Ltd. (Japan)

- A&D Company, Limited (Japan)

- Polar Electro Oy (Finland)

- Transtek Medical (China)

- Noise (India)

- Fire Boltt (India)

- Zepp Health (China)

- BOAT Lifestyle Ltd. (India)

- Casio Computer Co., Ltd. (Japan)

- Fossil Group, Inc. (U.S.)

- HTC Corporation (Taiwan)

- Acer Incorporated (Taiwan)

- Soundbrenner (Hong Kong)

What are the Recent Developments in Asia-Pacific Wearable Devices Market?

- In November 2025, Wearable Devices Ltd. secured an exclusive distribution agreement with Sky Commerce to bring its AI‑powered Mudra Band and Mudra Link neural wristbands to South Korea, highlighting strategic expansion of cutting‑edge gesture control wearables into one of Asia’s leading tech hubs

- In November 2025, Wearable Devices Ltd. also completed and demonstrated pre‑commercial EMG‑based weight‑estimation technology on its Mudra Link neural wristband, showcasing advanced sensing capabilities that could broaden the functional scope of wearable devices beyond traditional health and fitness tracking

- In August 2025, Reliance announced its AI‑powered smart wearable Jio Frames at its 48th Annual General Meeting, marking the company’s expansion into advanced wearable technology with smart glasses designed to integrate digital functionalities into everyday eyewear and enhance the digital ecosystem across India and the broader Asia‑Pacific market

- In July 2025, Chinese e‑commerce giant Alibaba announced the Quark AI Glasses, powered by its proprietary Qwen large language model and AI assistant Quark, marking its entry into AI‑enhanced smart wearables and signifying intensified competition in the smart eyewear category within China’s booming wearable market

- In May 2025, Cristiano Ronaldo‑backed US wearable brand Whoop launched the Whoop 5.0 and Whoop MG devices, offering extended battery life, advanced ECG heart screening, and blood pressure insights, expanding premium wearable health monitoring options available to fitness enthusiasts in the Asia‑Pacific region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.