Asia Pacific White Goods Market

Market Size in USD Billion

CAGR :

%

USD

381.60 Billion

USD

542.68 Billion

2024

2032

USD

381.60 Billion

USD

542.68 Billion

2024

2032

| 2025 –2032 | |

| USD 381.60 Billion | |

| USD 542.68 Billion | |

|

|

|

|

Asia-Pacific White Goods Market Size

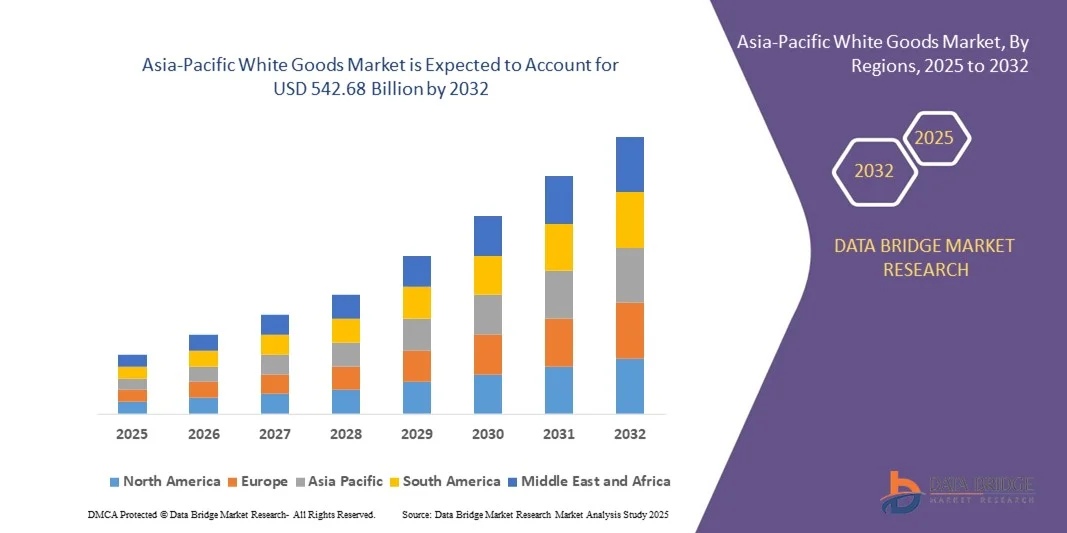

- The Asia-Pacific White Goods Market size was valued at USD 381.60 billion in 2024 and is projected to reach USD 542.68 billion by 2032, growing at a CAGR of 4.50% during the forecast period

- Market expansion is primarily driven by increasing urbanization, rising disposable incomes, and growing demand for energy-efficient appliances across emerging economies in the region

- Additionally, advancements in IoT-enabled devices and smart home integration are transforming consumer expectations, leading to a surge in demand for intelligent, connected white goods that enhance convenience, sustainability, and energy management

Asia-Pacific White Goods Market Analysis

- White goods, encompassing large household appliances such as refrigerators, washing machines, and air conditioners, are becoming essential in modern residential and commercial environments due to their role in enhancing convenience, efficiency, and quality of life

- The rising demand for white goods in Asia-Pacific is primarily driven by rapid urbanization, expanding middle-class populations, and increasing consumer preference for technologically advanced, energy-efficient appliances

- China dominated the Asia-Pacific white goods market with the largest revenue share of 39.7% in 2024, attributed to its robust manufacturing base, strong domestic demand, and continuous innovation by leading appliance brands, with significant growth seen in smart and eco-friendly product segments

- India is expected to be the fastest-growing market for white goods during the forecast period, fueled by rising disposable incomes, improving electrification, and government incentives promoting energy-efficient appliances

- The air conditioner segment dominated the market with the largest revenue share of 36.8% in 2024, driven by growing demand for energy-efficient cooling solutions in residential and commercial sectors amid rising global temperatures and urbanization.

Report Scope and Asia-Pacific White Goods Market Segmentation

|

Attributes |

White Goods Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific White Goods Market Trends

Enhanced Convenience Through AI and Voice Integration

- A significant and accelerating trend in the Asia-Pacific White Goods Market is the increasing integration of artificial intelligence (AI) and voice-controlled platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit. This convergence is greatly enhancing user experience by enabling intelligent automation, predictive functionality, and seamless hands-free control of household appliances.

- For Instance, LG’s ThinQ-enabled refrigerators and washing machines can be controlled via voice assistants, allowing users to check appliance status, start or stop operations, and receive maintenance alerts through simple voice commands. Similarly, Samsung’s SmartThings platform integrates with a wide range of smart white goods, offering centralized voice-controlled management.

- AI integration in white goods enables appliances to learn user habits, optimize energy usage, and suggest personalized settings. For instance, AI-enabled washing machines can detect load types and adjust water and detergent levels accordingly, while smart air conditioners can learn preferred temperature settings and adjust cooling patterns in real time for maximum comfort and efficiency.

- The ability to control multiple smart appliances via a unified voice-controlled ecosystem simplifies household management. Users can, for instance, instruct their smart speaker to start the dishwasher, adjust the fridge temperature, or preheat the oven—all without lifting a finger.

- This trend of intelligent and interconnected appliances is redefining consumer expectations, pushing manufacturers to focus on delivering intuitive, AI-driven solutions that offer a more personalized and efficient living experience. Leading companies like Samsung, LG, and Haier are investing heavily in AI R&D to offer white goods that are not just functional but also adaptive and self-learning.

- Demand for AI- and voice-integrated white goods is rapidly increasing across urban and semi-urban Asia-Pacific markets, as consumers embrace smart home ecosystems that deliver convenience, sustainability, and time-saving automation.

Asia-Pacific White Goods Market Dynamics

Driver

Growing Need Due to Urbanization, Lifestyle Changes, and Smart Home Adoption

- The Asia-Pacific White Goods Market is experiencing accelerated growth driven by rapid urbanization, shifting consumer lifestyles, and the increasing adoption of smart home technologies across both emerging and developed economies in the region

- For Instance, in April 2024, Haier Smart Home announced expanded investment in AI-driven manufacturing and smart product lines tailored for urban households in Southeast Asia, aiming to meet the rising demand for connected and energy-efficient appliances

- As consumers become more time-conscious and environmentally aware, they are opting for smart white goods that offer features like remote operation, auto-sensing capabilities, and energy optimization—enhancing convenience while reducing operational costs

- The growing prevalence of dual-income households, smaller living spaces, and increased access to electricity and the internet in rural and semi-urban areas are also key factors boosting demand for compact, smart, and multifunctional appliances

- The integration of white goods with smart ecosystems—such as refrigerators that can suggest grocery lists, or washing machines that auto-adjust cycles based on load and fabric—has positioned these appliances as critical elements of the modern connected lifestyle

- Additionally, the rising trend of DIY smart home setups and increasing awareness about energy efficiency are pushing consumers to invest in modern white goods, especially in fast-growing markets like India, Indonesia, and Vietnam

Restraint/Challenge

High Initial Costs and Digital Infrastructure Gaps

- Despite growing demand, the high initial cost of advanced white goods—especially smart and energy-efficient models—continues to pose a barrier in price-sensitive and rural segments of the Asia-Pacific market

- For instance, while energy-efficient inverter-based air conditioners or AI-powered washing machines offer long-term savings, their upfront pricing remains considerably higher than conventional models, discouraging many consumers from upgrading

- In addition, uneven digital infrastructure and limited access to stable internet in remote or underserved regions create challenges for the adoption of smart white goods that rely on IoT connectivity and app-based controls

- Moreover, lack of awareness or technical know-how around smart home integrations can further limit penetration, particularly among older or non-tech-savvy consumer groups

- Bridging this gap through government subsidies for energy-efficient appliances, consumer education programs, and the launch of more affordable, entry-level smart white goods will be crucial to driving long-term market expansion in the regionAsia-Pacific White Goods Market Dynamics

Asia-Pacific White Goods Market Scope

The white goods market is segmented on the basis of type, end-user and Distribution channel.

- By Product

On the basis of product, the market is segmented into air conditioner, refrigerator, washing machine, dishwasher, microwave oven, and others. The air conditioner segment dominated the market with the largest revenue share of 36.8% in 2024, driven by growing demand for energy-efficient cooling solutions in residential and commercial sectors amid rising global temperatures and urbanization. Consumers increasingly prefer smart and inverter-based air conditioners for better performance and reduced electricity consumption.

The dishwasher segment is anticipated to witness the fastest growth rate of 19.4% from 2025 to 2032, fueled by rising consumer preference for convenience and hygiene, especially in urban households. Growing awareness about water and energy conservation, alongside the adoption of smart kitchen appliances, is accelerating the uptake of dishwashers. Refrigerators and washing machines also hold significant shares due to their indispensable role in daily life and continued innovation in smart and energy-saving features.

- By End-User

On the basis of end-user, the market is segmented into residential and commercial. The residential segment accounted for the largest market revenue share of 63.5% in 2024, driven by rising disposable incomes, increasing urbanization, and growing adoption of smart and energy-efficient appliances at home. Government initiatives encouraging energy conservation and smart home technologies further propel this segment.

The commercial segment is expected to witness the fastest CAGR of 17.2% from 2025 to 2032, supported by expanding hospitality, retail, and institutional sectors. Commercial establishments are investing heavily in high-capacity, energy-efficient appliances to optimize operations and reduce costs. The increasing number of commercial infrastructure projects and rising emphasis on sustainability and regulatory compliance also drive growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into supermarket and hypermarket, specialty store, retail store, e-commerce, and others. The supermarket and hypermarket segment held the largest revenue share of 41.3% in 2024, benefiting from their wide product variety, competitive pricing, and strong offline presence, which attract a broad consumer base. Specialty and retail stores continue to generate steady demand through focused product selections and personalized customer service, especially in urban and semi-urban regions.

The e-commerce segment is projected to witness the fastest CAGR of 23.5% from 2025 to 2032, driven by rising internet penetration, smartphone adoption, and a growing preference for convenient, contactless shopping. The expansion of online marketplaces and improvements in logistics infrastructure are fueling e-commerce growth, particularly among younger and tech-savvy consumers.

Asia-Pacific White Goods Market Regional Analysis

- China dominated the white goods market with the largest revenue share of 39.8% in 2024, driven by rapid urbanization, rising disposable incomes, and the growing penetration of energy-efficient and smart appliances across both developed and emerging economies

- Consumers in the region are increasingly prioritizing convenience, automation, and sustainability, leading to strong demand for connected appliances such as smart refrigerators, AI-enabled washing machines, and inverter-based air conditioners

- This widespread adoption is further supported by expanding middle-class populations, improving access to electricity and internet connectivity, and government initiatives promoting energy-efficient home appliances, positioning white goods as essential components of modern urban living across the region

India White Goods Market Insight

The India white goods market is expected to grow at a noteworthy CAGR during the forecast period, driven by rising incomes, expanding urban population, and growing aspirations for a modern lifestyle. Government schemes like “Make in India”, along with increasing electrification and digitization in rural areas, are further supporting the demand for affordable and energy-efficient appliances. Indian consumers are showing a strong preference for mid-range smart appliances that offer connectivity, durability, and low maintenance. The surge in online retail and growth in residential construction, especially in Tier 2 and Tier 3 cities, are expanding the market footprint for brands like LG, Samsung, IFB, and Godrej.

Japan White Goods Market Insight

The Japan white goods market is gaining momentum, driven by its aging population, high-tech consumer expectations, and emphasis on product reliability and energy efficiency. Consumers in Japan prefer compact, multi-functional appliances that suit urban living conditions and support sustainable consumption. The integration of AI and IoT in appliances such as washing machines, refrigerators, and air conditioners is becoming increasingly common, aligning with the nation’s smart home growth. Japan’s focus on automation and technological innovation ensures continued demand for premium white goods, particularly in metropolitan areas such as Tokyo and Osaka.

South Korea White Goods Market Insight

The South Korea white goods market continues to grow steadily, supported by the nation’s strong consumer electronics industry and leading manufacturers such as Samsung and LG Electronics. South Korean consumers are highly receptive to smart, interconnected appliances that offer convenience, energy savings, and seamless integration with digital platforms. Products like AI-based refrigerators, voice-controlled washing machines, and app-enabled HVAC systems are gaining widespread popularity. South Korea's advanced infrastructure, high internet penetration, and consumer preference for innovation position the country as a key player in both regional and global white goods markets.

Asia-Pacific White Goods Market Share

The White Goods industry is primarily led by well-established companies, including:

- Whirlpool Corporation (U.S.)

- Johnson Controls (Ireland)

- IFB Industries (India)

- Samsung (South Korea)

- LG Electronics (South Korea)

- Panasonic Corporation (Japan)

- Symphony Limited (India)

- Blue Star Limited (India)

- ARÇELIK A.S. (Turkey)

- Godrej & Boyce Mfg. Co. Ltd. (India)

- AB Electrolux (Sweden)

- Hitachi, Ltd. (Japan)

- Sharp Corporation (Japan)

- Haier Inc. (China)

- Midea Group (China)

- Siemens (Germany)

- TCL Corporation (China)

- Mitsubishi Electric Corporation (Japan)

- Robert Bosch GmbH (Germany)

- The Middleby Corporation (U.S.)

What are the Recent Developments in Asia-Pacific White Goods Market?

- In April 2023, Haier Smart Home announced the launch of its AI-powered Smart Laundry Solutions across Southeast Asia, aimed at transforming consumer experience through intelligent automation and energy-efficient technologies. These solutions include washing machines capable of detecting fabric types, adjusting water and detergent levels automatically, and integrating with voice assistants. The initiative demonstrates Haier’s focus on expanding its smart home portfolio while catering to the evolving lifestyle needs of Asia-Pacific consumers and reinforcing its leadership in the regional white goods market.

- In March 2023, LG Electronics introduced its Dual Inverter Heat Pump Dryer and AI Direct Drive Washing Machine in India, aligning with its strategy to provide high-performance, energy-efficient appliances for environmentally conscious consumers. These appliances feature smart diagnosis, remote operation via the LG ThinQ app, and AI-powered load detection. LG’s expansion underscores its commitment to technological innovation and its responsiveness to rising demand for premium white goods in growing markets.

- In March 2023, Panasonic Corporation launched its Prime+ Edition Refrigerators in the Philippines, equipped with nanoe™ X air purification and AI-based cooling management. Designed to meet health-conscious consumer demands, these refrigerators also offer app-enabled controls and personalized usage insights. This release highlights Panasonic’s dedication to fusing innovation with wellness and reinforces its competitive positioning in Southeast Asia’s dynamic white goods segment.

- In February 2023, Samsung Electronics rolled out its Bespoke Home Appliance Series in Australia and Singapore, including customizable refrigerators, washing machines, and air purifiers. The launch targets style-driven, tech-savvy consumers seeking integration between design and functionality. Samsung's push into modular, AI-powered home appliances is part of its broader strategy to dominate the Asia-Pacific smart appliance market while responding to consumer preferences for personalization and automation.

- In January 2023, Godrej Appliances, a division of Godrej & Boyce, unveiled its next-gen Frost-Free Green Inverter Refrigerator range in India, combining eco-friendly R600a refrigerant with digital inverter technology. The product aligns with India’s push for sustainable living and growing middle-class demand for affordable, energy-efficient appliances. This launch emphasizes Godrej’s role in supporting local manufacturing and green innovation in the Asia-Pacific white goods landscape.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.