Asia Pacific Wireless Fire Detection Market

Market Size in USD Billion

CAGR :

%

USD

5.49 Billion

USD

11.35 Billion

2024

2032

USD

5.49 Billion

USD

11.35 Billion

2024

2032

| 2025 –2032 | |

| USD 5.49 Billion | |

| USD 11.35 Billion | |

|

|

|

|

Wireless Fire Detection Market Size

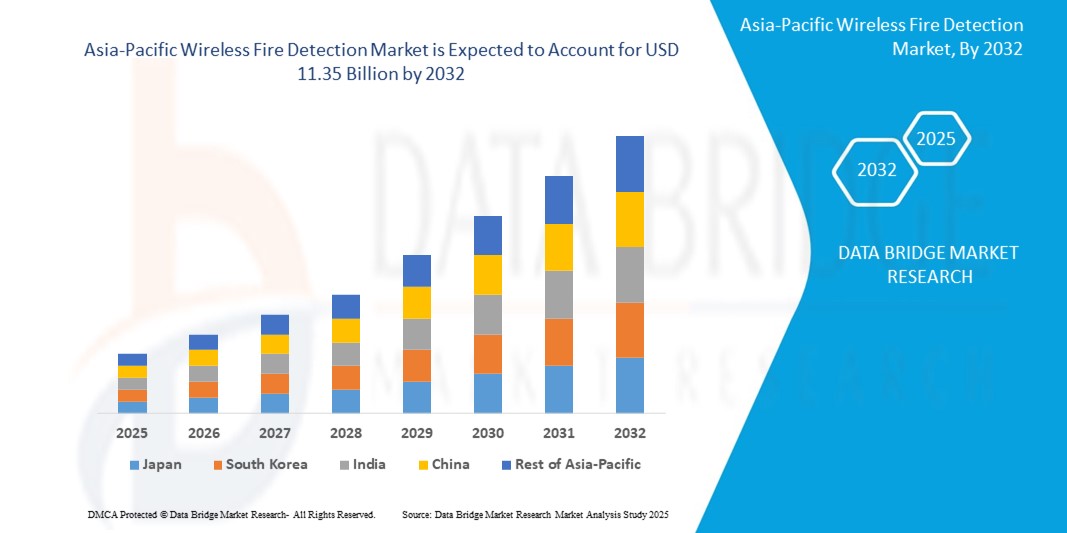

- The Asia-Pacific Wireless Fire Detection market size was valued at USD 5.49 billion in 2024 and is expected to reach USD 11.35 billion by 2032, at a CAGR of 9.50% during the forecast period

- Market expansion is primarily driven by rapid urbanization and infrastructure development across emerging economies such as China, India, Indonesia, and Vietnam. As new residential complexes, commercial spaces, and industrial facilities rise, there is an increasing demand for cost-effective, scalable, and non-invasive fire safety systems, making wireless solutions a compelling choice.

- Moreover, the region's stringent fire safety regulations—notably in countries like Japan and South Korea—are promoting the integration of advanced wireless fire detection systems in both new constructions and retrofit projects. Governments are increasingly mandating fire safety compliance across sectors including manufacturing, transportation, and healthcare.

Wireless Fire Detection Market Analysis

- Wireless fire detection systems are witnessing accelerating adoption across the Asia-Pacific region due to their non-invasive installation, cost-efficiency, and high reliability, making them suitable for both new construction and retrofit applications. These systems eliminate the need for extensive wiring, thus reducing labor and material costs, while providing flexible deployment in commercial buildings, heritage sites, manufacturing plants, and healthcare facilities.

- Rapid urbanization and infrastructure growth in emerging economies such as China, India, Indonesia, and the Philippines are significantly contributing to the increased demand for advanced fire safety systems. Smart buildings and large-scale real estate developments are incorporating wireless fire detection systems to meet stringent building safety regulations and improve real-time threat detection.

- The increasing frequency of fire-related incidents and government mandates for fire safety compliance—such as India's National Building Code and China's Fire Protection Law—are driving adoption across commercial, residential, and industrial sectors. Wireless systems offer quick deployment and minimal disruption to operations, making them ideal for high-density areas and operational facilities.

- China leads the Asia-Pacific wireless fire detection market, commanding over 35.9% of the regional revenue share in 2024. This dominance is attributed to its early adoption of smart technologies, expanding construction sector, and robust investments in safety infrastructure, particularly in smart city initiatives and industrial parks.

- India is emerging as one of the fastest-growing markets in the region, driven by government-led initiatives such as Smart Cities Mission, Make in India, and increasing awareness about workplace and public safety. The proliferation of commercial complexes, retail centers, and high-rise buildings has amplified the need for flexible and scalable fire detection solutions.

- The Smoke Detectors segment holds the largest market share of 42.7% in 2024, due to their critical role in providing early warning signals in both residential and commercial settings. Their wireless variants are widely used in heritage buildings, hotels, and modular construction where preserving structural aesthetics and ensuring operational continuity is a priority.

Report Scope and Wireless Fire Detection Market Segmentation

|

Attributes |

Wireless Fire Detection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wireless Fire Detection Market Trends

“IoT-Enabled Monitoring and Smart Infrastructure Integration Driving Innovation”

- A key trend in the Asia-Pacific wireless fire detection market is the rapid integration of IoT (Internet of Things) capabilities, enabling real-time monitoring, remote diagnostics, and intelligent fire response systems across smart buildings and industrial environments.

- For instance, in February 2024, Hochiki Corporation launched its next-generation FIRElink+ wireless fire detection system in Japan, featuring IoT-based analytics and multi-zone alerting capabilities tailored for commercial buildings and data centers. The system improves threat identification speed and enhances false alarm immunity, aligning with increasing demand for smart infrastructure.

- Governments across countries like India, China, and Australia are promoting Smart City initiatives, which include integrated safety systems. In March 2024, the Indian Ministry of Housing and Urban Affairs mandated the use of wireless fire detection systems in newly approved smart city projects, pushing demand in high-density urban areas.

- Additionally, manufacturers are integrating cloud connectivity and mobile app controls into their wireless systems. In April 2024, Siemens introduced the Cerberus Cloud Apps in Southeast Asia, allowing facility managers to monitor fire detection systems remotely, perform predictive maintenance, and optimize fire safety readiness from a centralized dashboard.

- Wireless fire detectors are also being designed to integrate with energy management and security systems, creating comprehensive smart building ecosystems. This trend is accelerating adoption across commercial offices, shopping malls, hospitals, and educational institutions in urban Asia-Pacific regions.

Wireless Fire Detection Market Dynamics

Driver

“Stringent Fire Safety Regulations and Growth of High-Rise Infrastructure”

- The Asia-Pacific wireless fire detection market is largely driven by increasing fire safety regulations and growing urban development, particularly the rise of high-rise buildings where wireless systems are preferred for retrofitting and minimal wiring.

- In January 2024, China’s Ministry of Emergency Management revised its National Fire Safety Code, making it mandatory for large-scale commercial buildings to install wireless fire alarm systems with networked control capabilities. This regulation is boosting deployment in malls, airports, and public transit hubs.

- Similarly, Australia's Building Code (BCA) updated in 2024 now requires advanced wireless fire safety systems in certain multi-tenant commercial spaces and remote rural infrastructures where wired installations are impractical.

- With Asia-Pacific witnessing a surge in smart city and infrastructure investments, especially in India, Vietnam, and Indonesia, the demand for scalable, non-invasive, and reliable fire detection systems is growing rapidly.

- The ease of integration, faster installation, and minimal disruption to ongoing operations make wireless fire detection systems attractive to property developers and municipal planners.

Restraint/Challenge

“Signal Interference and Regulatory Disparity across Countries”

- Despite their benefits, wireless fire detection systems face challenges in signal reliability, particularly in dense concrete structures or areas with heavy electromagnetic interference, which is common in older commercial and industrial buildings across Asia-Pacific.

- For instance, in a 2023 pilot project in Seoul, developers reported a 17% higher false alarm rate in a mixed-use complex due to signal distortion caused by overlapping wireless devices and thick structural walls, highlighting the need for better frequency management and system calibration.

- Another major restraint is the lack of standardized fire safety regulations across Asia-Pacific countries. While nations like Japan and Australia have well-defined wireless safety protocols, emerging markets such as Myanmar or Cambodia lack uniform standards, making regional expansion difficult for manufacturers.

- Cost-sensitive markets in the region also pose a challenge, where wired systems are still favored due to lower initial costs, despite the long-term savings of wireless alternatives.

- Additionally, limited awareness and training among facility managers and fire safety inspectors in developing nations can lead to improper system usage or delayed adoption. Industry players must focus on education campaigns and localized solutions to navigate these constraints effectively.

Wireless Fire Detection Market Scope

The market is segmented on the basis of product type, system type, installation type, application, and vertical.

• By Product Type

On the basis of product type, the Smoke Detectors segment dominated the Asia-Pacific Wireless Fire Detection market with the largest revenue share in 2024. Smoke detectors are widely preferred in residential and commercial buildings due to their cost-effectiveness and reliable early warning capabilities. Increasing regulatory mandates across countries such as Japan, China, and Australia for smoke alarm installations in housing units are fueling demand.

The Multi-Sensor Detectors segment is anticipated to witness the fastest CAGR from 2025 to 2032. These detectors combine smoke, heat, and gas sensors, offering enhanced detection accuracy and reduced false alarms. For example, in March 2024, Panasonic introduced a new wireless multi-sensor detector in the Japanese market, designed for high-density urban buildings and smart offices.

• By System Type

On the basis of system type, Fully Wireless Systems held the largest market share in 2024, due to their ease of installation, cost savings on wiring infrastructure, and flexibility in retrofitting older buildings. These systems are increasingly adopted in smart city projects across India and Southeast Asia, where rapid urbanization demands scalable and fast-deployment fire safety solutions.

The Hybrid Systems segment is expected to record the highest growth rate from 2025 to 2032. These systems combine the reliability of wired backbones with the flexibility of wireless nodes, making them ideal for large commercial complexes and industrial facilities. In 2024, Hochiki and Honeywell introduced hybrid fire detection solutions in high-rise developments across China and Singapore, supporting this trend.

• By Installation Type

Based on installation type, New Installation accounted for the largest share of the Asia-Pacific market in 2024. The surge in greenfield construction projects, particularly in India, Vietnam, and Indonesia, is driving the deployment of wireless fire detection systems in new residential towers, hospitals, and educational campuses.

Meanwhile, the Retrofit Installation segment is projected to grow at a faster CAGR over the forecast period. Older buildings, especially heritage sites and government offices, are increasingly upgrading to wireless systems to comply with evolving safety regulations without the need for structural modifications.

• By Application

In terms of application, the Indoor segment dominated the market in 2024, supported by widespread adoption in enclosed spaces such as offices, homes, hospitals, and malls. Indoor wireless systems offer faster response and minimal installation disruption, making them preferred for existing infrastructure.

The Outdoor segment is poised to witness strong growth through 2032, driven by rising awareness of fire risks in industrial storage yards, solar farms, and utility facilities. In 2024, Notifier by Honeywell expanded its outdoor wireless detection solutions in Australia for use in mining and oil & gas facilities.

• By Vertical

On the basis of vertical, the Commercial sector captured the largest revenue share in 2024, with wireless systems being widely deployed in shopping malls, hotels, airports, and office buildings. Increased focus on employee and public safety, as well as compliance with updated fire safety codes, is driving demand.

The Healthcare sector is expected to experience the fastest growth from 2025 to 2032. Hospitals and laboratories are investing in advanced wireless fire detection systems to protect critical assets and maintain patient safety. For example, in February 2024, several private hospitals in Singapore and South Korea adopted wireless gas and smoke detection systems integrated with nurse alert panels and central monitoring units.

The Industrial segment is also seeing significant traction due to the need for reliable detection in hazardous and dynamic environments, particularly in chemical and electronics manufacturing.

Wireless Fire Detection Market Regional Analysis

- Asia-Pacific is poised to be the fastest-growing regional market for Wireless Fire Detection systems, projected to expand at a significant CAGR through 2032. This growth is fueled by rapid urbanization, increased infrastructure investments, and stringent fire safety regulations across major economies including China, India, Japan, South Korea, and Australia.

- The demand for wireless fire detection solutions is being driven by the increasing preference for retrofit installations in aging infrastructure and the need for faster, more cost-effective fire safety system deployments in new buildings. Technological advancements such as multi-sensor detectors, AI-driven smoke analysis, and cloud-based alarm monitoring are accelerating market adoption across residential, commercial, industrial, and healthcare verticals.

China Wireless Fire Detection Market Insight

China dominated the Asia-Pacific wireless fire detection market in 2024, accounting for over 45.0% of the regional revenue share. This is attributed to strict fire safety mandates, massive infrastructure development, and growing integration of smart building technologies in urban centers.

For instance, in February 2024, Hochiki partnered with Chinese property developers to deploy its wireless fire detection systems in smart apartment complexes in Shanghai and Shenzhen, leveraging IoT-based centralized monitoring for real-time alerting and maintenance.

Additionally, China's strong domestic manufacturing of fire safety components and government-backed smart city projects are further boosting local deployments.

India Wireless Fire Detection Market Insight

India is emerging as one of the fastest-growing markets for wireless fire detection systems in Asia-Pacific, driven by industrialization, construction growth, and updated national fire safety norms under Smart Cities Mission and Real Estate Regulation (RERA).

In March 2024, Agni Devices Pvt Ltd, a key Indian manufacturer, launched a new series of wireless smoke and heat detectors designed for quick installation in mid-rise commercial and residential buildings. This aligns with the government’s push for cost-efficient safety solutions in Tier 2 and Tier 3 cities.

The growing number of commercial complexes, IT parks, and urban residential societies is expected to further accelerate wireless fire safety system deployments.

Wireless Fire Detection Market Share

The Wireless Fire Detection industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- Siemens AG (Germany)

- HOCHIKI Corporation (Japan)

- Tyco International PLC (Ireland)

- Halma Plc (U.K.)

- EMS Security Group Ltd. (U.K.)

- Sterling Safety Systems (U.K.)

- Zeta Alarms Ltd. (U.K.)

- Ceasefire Industries Pvt. Ltd. (India)

- Napco Security Technologies, Inc. (U.S.)

Latest Developments in Asia-Pacific Wireless Fire Detection Market

- In August 2024, Hochiki Corporation launched a new line of Smart Wireless Multi-Sensor Detectors in Japan and South Korea, equipped with integrated AI analytics and enhanced battery life. These detectors are designed for commercial high-rises and historic buildings, where wiring poses challenges. The devices allow for real-time anomaly detection and remote diagnostics, enhancing fire response accuracy and system uptime in densely populated urban zones.

- In May 2024, Honeywell Building Technologies announced the rollout of its NOTIFIER Intelli-Wireless Series across India and Southeast Asia. These new systems support seamless retrofitting in mid-sized commercial and healthcare buildings, with a 20% faster installation time and compatibility with legacy wired systems. The solution is tailored for regions with aging infrastructure and evolving fire safety standards.

- In February 2024, Siemens introduced its Cerberus Cloud-enabled Wireless Fire Detection Platform in Australia and Singapore, focusing on smart building integration. The platform offers wireless smoke, heat, and gas detectors that communicate via an IoT gateway, allowing building managers to monitor multi-site fire safety systems in real-time through a central dashboard. This supports the growing demand for integrated smart building ecosystems.

- In October 2023, Agni Devices Pvt. Ltd.—a leading Indian manufacturer—unveiled its AgniLink Wireless Detectors series for residential and small commercial use. The detectors feature mobile app integration, auto-testing features, and tamper alerts. These innovations are gaining strong traction in India’s Tier 2 cities due to ease of installation and alignment with government-driven smart city infrastructure expansion.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Wireless Fire Detection Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Wireless Fire Detection Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Wireless Fire Detection Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.