Asia Pacific Xylose Market

Market Size in USD Billion

CAGR :

%

USD

2.10 Billion

USD

3.47 Billion

2024

2032

USD

2.10 Billion

USD

3.47 Billion

2024

2032

| 2025 –2032 | |

| USD 2.10 Billion | |

| USD 3.47 Billion | |

|

|

|

|

Asia-Pacific Xylose Market Size

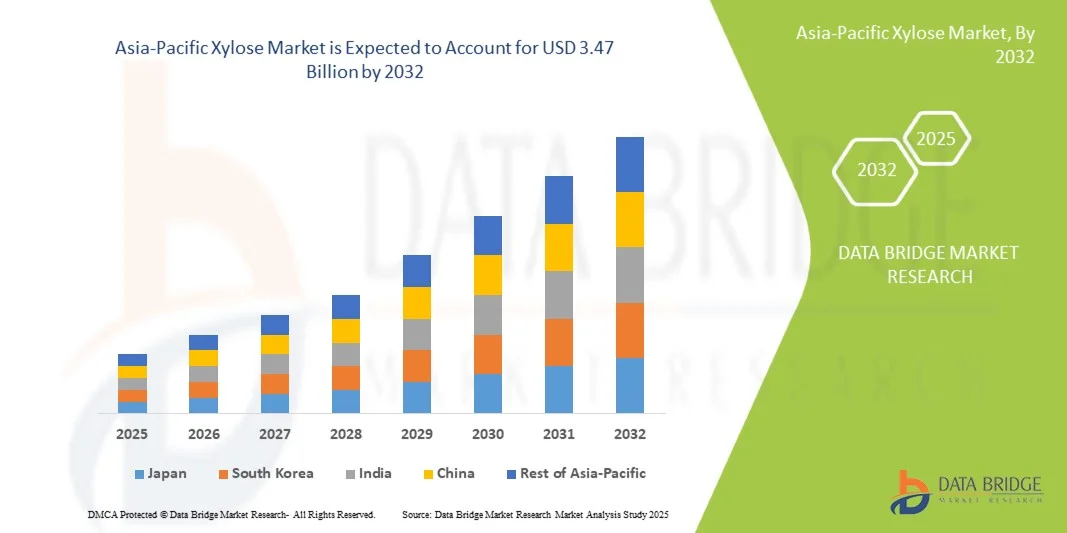

- The Asia-Pacific Xylose Market size was valued at USD 2.10 billion in 2024 and is projected to reach USD 3.47 billion by 2032, exhibiting a CAGR of 6.50% during the forecast period.

- The market expansion is primarily driven by the rising demand for natural sweeteners and growing health awareness among consumers, encouraging the shift toward low-calorie and plant-based sugar alternatives across the food and beverage industry.

- Additionally, technological advancements in xylose extraction and processing, coupled with increasing applications in pharmaceuticals and cosmetics, are enhancing product utilization. These trends collectively propel market growth, strengthening the region’s position in the global xylose industry.

Asia-Pacific Xylose Market Analysis

- Xylose, a naturally occurring sugar derived from plant-based sources such as wood and agricultural biomass, is increasingly becoming a crucial ingredient in the food, beverage, and pharmaceutical industries due to its low-calorie profile, natural origin, and versatility in formulation applications.

- The growing demand for xylose is primarily fueled by increasing consumer preference for natural sweeteners, rising health consciousness, and the expanding use of bio-based ingredients in food processing, nutraceuticals, and personal care products.

- China dominated the Asia-Pacific Xylose Market with the largest revenue share of 33.8% in 2024, attributed to its robust industrial base, abundant raw material availability, and strong presence of key manufacturers, alongside expanding applications in food additives and biochemicals driven by technological advancements and supportive government initiatives.

- India is expected to be the fastest-growing country in the Asia-Pacific Xylose Market during the forecast period due to increasing health awareness, a growing food processing industry, and rising adoption of natural ingredients in packaged foods and beverages.

- The D-Xylose segment dominated the market with the largest revenue share of 68.5% in 2024, driven by its extensive use as a natural sweetener and flavor enhancer in the food and beverage industry.

Report Scope and Asia-Pacific Xylose Market Segmentation

|

Attributes |

Asia-Pacific Xylose Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Xylose Market Trends

“Growing Adoption of Biotechnological Advancements in Xylose Production”

- A significant and accelerating trend in the global Asia-Pacific Xylose Market is the increasing integration of advanced biotechnological processes, including enzymatic hydrolysis and microbial fermentation, to enhance xylose yield and production efficiency from lignocellulosic biomass. This innovation-driven approach is significantly improving product quality, sustainability, and cost-effectiveness across industries.

- For instance, Shandong Longlive Bio-Technology Co., Ltd. has implemented enzyme-based conversion techniques that enable higher xylose extraction rates from agricultural residues, minimizing waste and reducing environmental impact. Similarly, Futaste Group utilizes advanced fermentation technology to produce high-purity xylose suitable for food and pharmaceutical applications.

- Biotechnological advancements also enable the development of customized xylose derivatives for specialized applications in nutraceuticals, personal care, and biochemicals. For example, companies are leveraging microbial strains engineered to enhance conversion efficiency, lowering production costs and supporting large-scale commercialization.

- The integration of biotechnology into xylose manufacturing facilitates greater process optimization and environmental sustainability. Through these innovations, producers can utilize renewable feedstocks such as corn cobs, sugarcane bagasse, and wood chips, aligning with global sustainability goals and circular bioeconomy initiatives.

- This trend toward technologically advanced, eco-efficient production methods is reshaping the competitive landscape of the xylose industry. Consequently, companies such as Zhejiang Huakang Pharmaceutical Co., Ltd. and Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. are expanding their research efforts to develop high-performance bio-based xylose and related sugar derivatives.

- The demand for biotechnologically refined xylose is rapidly increasing across the food, beverage, and pharmaceutical sectors, as consumers and manufacturers alike prioritize natural, sustainable, and high-quality ingredients in line with evolving health and environmental standards.

Asia-Pacific Xylose Market Dynamics

Driver

“Growing Demand Driven by Health Awareness and Shift Toward Natural Sweeteners”

- The rising consumer preference for healthier, low-calorie alternatives to traditional sugars, coupled with growing awareness of the adverse effects of excessive sugar consumption, is a key driver for the increasing demand for xylose across the Asia-Pacific region.

- For instance, in 2024, Shandong Longlive Bio-Technology Co., Ltd. expanded its production capacity to meet the surging demand for natural sweeteners derived from plant-based sources, aligning with global trends toward clean-label and health-focused food products. Such strategic expansions by key manufacturers are expected to further accelerate market growth during the forecast period.

- As consumers become more health-conscious and seek natural ingredients in foods, beverages, and nutraceuticals, xylose offers a promising alternative due to its lower caloric value and non-cariogenic properties. This makes it particularly attractive in functional foods, dietary supplements, and diabetic-friendly formulations.

- Furthermore, the expanding applications of xylose in pharmaceuticals, cosmetics, and bio-based chemicals are contributing to its growing market presence. Its versatility in formulation and compatibility with various end-use industries enhance its appeal as a sustainable, plant-derived ingredient.

- The increasing focus on natural product formulations, rising disposable incomes, and urbanization across emerging economies such as China, India, and Indonesia are further propelling xylose demand. The trend toward clean eating and regulatory support for natural ingredients continue to strengthen the industry’s growth outlook.

Restraint/Challenge

“High Production Costs and Limited Raw Material Availability”

- Despite its promising potential, the xylose market faces challenges related to high production costs and limited availability of suitable raw materials for large-scale extraction. The complex and resource-intensive processes involved in deriving xylose from lignocellulosic biomass often lead to elevated manufacturing expenses.

- For instance, fluctuations in agricultural residue supply and high energy consumption during hydrolysis and purification stages can impact production efficiency and overall profitability, discouraging small and mid-sized producers from market entry.

- Addressing these cost challenges requires the adoption of advanced biotechnological processes, such as enzymatic hydrolysis and microbial fermentation, which can improve yields and reduce waste. Companies such as Futaste Group and Zhejiang Huakang Pharmaceutical Co., Ltd. are actively investing in R&D to enhance process efficiency and lower operational costs.

- Additionally, the dependence on specific feedstocks like corn cobs and wood chips limits scalability, especially in regions with inconsistent biomass availability. The development of alternative feedstock sources and improved supply chain management are essential to ensure sustainable production.

- While technological progress and government support for bio-based industries are expected to gradually reduce production costs, overcoming raw material constraints and scaling up efficient manufacturing processes remain critical for the long-term growth and competitiveness of the Asia-Pacific xylose market.

Asia-Pacific Xylose Market Scope

Asia-Pacific Xylose Market is segmented into two notable segments which are based on product type and applications

• By Product Type

On the basis of product type, the Asia-Pacific Xylose Market is segmented into L-Xylose, D-Xylose, and DL-Xylose. The D-Xylose segment dominated the market with the largest revenue share of 68.5% in 2024, driven by its extensive use as a natural sweetener and flavor enhancer in the food and beverage industry. D-Xylose is widely utilized in bakery, confectionery, and beverage formulations due to its low-calorie profile and ability to retain sweetness during high-temperature processing. Moreover, it serves as a key intermediate in the production of xylitol, further fueling its demand.

The L-Xylose segment is expected to witness the fastest CAGR from 2025 to 2032, attributed to its growing utilization in pharmaceuticals and biochemical research. The segment’s growth is supported by rising R&D investments in bio-based products and increasing applications in medical formulations, where L-Xylose serves as a precursor for advanced biotechnological compounds and health supplements.

• By Application

On the basis of application, the Asia-Pacific Xylose Market is segmented into Food & Beverages, Cosmetics/Personal Care, Pharmaceuticals, Biofuel Industry, and Others. The Food & Beverages segment held the largest market share of 52.4% in 2024, owing to the increasing consumer shift toward natural sweeteners and clean-label ingredients. Xylose is commonly used in food products for its pleasant sweetness, moisture retention, and browning properties, enhancing flavor and texture in bakery and confectionery applications. Rising health consciousness and the demand for sugar alternatives are further strengthening segment growth.

The Biofuel Industry segment is anticipated to register the fastest CAGR from 2025 to 2032, driven by growing efforts to produce renewable fuels from lignocellulosic biomass. Xylose plays a crucial role as a fermentable sugar in bioethanol production, aligning with regional sustainability goals and government initiatives promoting bio-based energy solutions. Increasing R&D in biomass conversion technologies further propels this segment’s rapid expansion.

Asia-Pacific Xylose Market Regional Analysis

- China dominated the Asia-Pacific Xylose Market with the largest revenue share of 33.8% in 2024, driven by its strong industrial base, abundant availability of agricultural biomass, and well-established manufacturing infrastructure for xylose and related sugar derivatives.

- Consumers and industries in the region increasingly prefer natural, low-calorie sweeteners and bio-based ingredients, propelling the adoption of xylose across the food, beverage, and pharmaceutical sectors. The growing focus on health-conscious and sustainable product formulations further enhances xylose utilization in various end-use applications.

- This widespread adoption is further supported by government initiatives promoting bio-based industries, advancements in biotechnology, and expanding exports of xylose-derived products. Together, these factors position China as a key production and consumption hub in the Asia-Pacific region, driving the overall growth and competitiveness of the xylose market.

China Xylose Market Insight

The China xylose market captured the largest revenue share of 58% in 2024 within the Asia-Pacific region, driven by abundant raw material availability, cost-effective production capabilities, and strong domestic demand for natural sweeteners. China serves as a major manufacturing hub for xylose and its derivatives, supported by a well-developed biotechnology and food processing industry. The country’s expanding health-conscious consumer base and preference for plant-derived, low-calorie ingredients are key growth drivers. Furthermore, continuous advancements in extraction technologies and increasing exports to global markets are expected to sustain China’s dominance in the regional xylose market.

Japan Xylose Market Insight

The Japan xylose market is projected to grow at a noteworthy CAGR during 2025–2032, fueled by the country’s strong focus on health, wellness, and product innovation. Japan’s food and beverage sector is increasingly adopting xylose for its functional benefits, including low caloric content and ability to enhance flavor stability in processed foods. Rising consumer preference for sugar alternatives, coupled with the use of xylose in pharmaceuticals and personal care formulations, further supports market expansion. Additionally, Japan’s advanced research capabilities and emphasis on high-quality bio-based ingredients contribute to growing domestic demand.

India Xylose Market Insight

The India xylose market is anticipated to witness the fastest CAGR during the forecast period, driven by increasing health awareness, urbanization, and the expanding food processing sector. Rising disposable incomes and growing consumer interest in natural sweeteners are propelling xylose adoption in bakery, beverage, and confectionery products. Moreover, government initiatives promoting bio-based industries and sustainable manufacturing are encouraging domestic production. The expanding nutraceutical and pharmaceutical industries in India further create significant opportunities for xylose applications, particularly in diabetic-friendly and low-calorie formulations.

South Korea Xylose Market Insight

The South Korea xylose market is expected to experience substantial growth during the forecast period, supported by the nation’s rising focus on health-conscious consumption and innovation in functional food ingredients. The local food and cosmetic industries are increasingly incorporating xylose as a natural sweetener and humectant. Furthermore, South Korea’s commitment to sustainability and biotechnology development is fostering the adoption of bio-based sugar alternatives. Growing R&D collaborations and consumer demand for clean-label products are anticipated to further drive market growth across multiple sectors.

Asia-Pacific Xylose Market Share

The Xylose industry is primarily led by well-established companies, including:

- Futaste Group (China)

- Shandong Longlive Bio-Technology Co., Ltd. (China)

- Zhejiang Huakang Pharmaceutical Co., Ltd. (China)

- Mitsubishi Chemical Corporation (Japan)

- Towa Chemical Industry Co., Ltd. (Japan)

- Sanyo Chemical Industries, Ltd. (Japan)

- Dongguan Xiangsheng Chemical Co., Ltd. (China)

- Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. (China)

- Nichirei Foods Inc. (Japan)

- Hubei Xingfa Chemicals Co., Ltd. (China)

- China National Chemical Corporation (ChemChina) (China)

- Daicel Corporation (Japan)

- Gujarat State Fertilizers & Chemicals Ltd. (India)

- Lenzing AG (Austria, operations in APAC)

- Anhui Sunhere Biotech Co., Ltd. (China)

- Shandong Jincheng Biotech Co., Ltd. (China)

- Changsha Tianjia Biochemical Co., Ltd. (China)

- Hangzhou Xinghe Chemical Co., Ltd. (China)

- Tianjin Bohai Chemical Co., Ltd. (China)

- Jiangsu Guotai International Group Co., Ltd. (China)

What are the Recent Developments in Asia-Pacific Xylose Market?

- In April 2024, Shandong Longlive Bio-Technology Co., Ltd., a leading Chinese biotechnology company, announced the expansion of its xylose production facility in Shandong Province to meet the rising global demand for natural sweeteners. This strategic move aims to enhance production capacity and efficiency through the integration of enzymatic hydrolysis technology. By leveraging advanced bioprocessing techniques, the company is reinforcing its position as a key player in the rapidly growing Asia-Pacific Xylose Market, while supporting sustainable manufacturing practices aligned with global environmental goals.

- In March 2024, Futaste Group, a major xylose and xylitol manufacturer in China, introduced a new high-purity D-Xylose product line designed for use in food, pharmaceutical, and nutraceutical applications. The new formulation emphasizes improved sweetness stability and thermal resistance, catering to the increasing demand for natural, low-calorie sweeteners in health-oriented products. This innovation underscores Futaste’s commitment to research-driven product development and to advancing healthier sugar alternatives for consumers worldwide.

- In March 2024, Zhejiang Huakang Pharmaceutical Co., Ltd. launched an R&D collaboration with Towa Chemical Industry Co., Ltd. (Japan) to develop advanced fermentation-based xylose extraction processes. This partnership aims to optimize resource utilization and enhance the purity of bio-based sugars, supporting large-scale production for food and pharmaceutical sectors. The initiative reflects growing regional cooperation in biotechnology and sustainable ingredient innovation across the Asia-Pacific market.

- In February 2024, Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. announced the completion of its pilot project to produce xylose and xylitol from agricultural waste, including corn cobs and sugarcane bagasse. This initiative supports China’s circular economy and green manufacturing policies by reducing waste and utilizing renewable biomass feedstocks. The success of this project highlights the increasing adoption of eco-friendly production methods in the xylose industry and sets a precedent for future bio-based innovations.

- In January 2024, Mitsubishi Chemical Group Corporation (Japan) introduced a biotechnology-driven xylose extraction system designed to improve production yield and reduce environmental impact. This technology enables efficient conversion of lignocellulosic biomass into high-quality xylose for use in functional foods, pharmaceuticals, and cosmetic formulations. The development reinforces Mitsubishi Chemical’s strategic focus on sustainable innovation and positions Japan as a regional leader in bio-based material technology within the Asia-Pacific Xylose Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Xylose Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Xylose Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Xylose Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.