Australia Uninterruptible Power Supply Ups Market

Market Size in USD Million

CAGR :

%

USD

275.43 Million

USD

402.88 Million

2024

2032

USD

275.43 Million

USD

402.88 Million

2024

2032

| 2025 –2032 | |

| USD 275.43 Million | |

| USD 402.88 Million | |

|

|

|

Australia Uninterruptible Power Supply (UPS) Market Analysis

The Australia Uninterruptible Power Supply (UPS) market encompasses the provision of critical power backup solutions for businesses, data centers, and industries in the region. This market is driven by the increasing reliance on electronic devices and data-intensive operations, making UPS systems a vital component to ensure uninterrupted power supply during outages. It includes a range of products and services, from traditional lead-acid battery systems to advanced lithium-ion solutions, aiming to safeguard operations against power disruptions and maintain business continuity. The market in this region is characterized by the need for robust and reliable power protection systems due to challenging environmental conditions and a rapidly evolving technological landscape.

Australia Uninterruptible Power Supply (UPS) Market Size

The Australia uninterruptible power supply (UPS) market in the forecast period is expected to reach USD 402.88 million by 2032 from USD 275.43 million in 2024, growing with a substantial CAGR of 5.0% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Australia Uninterruptible Power Supply (UPS) Market Trends

“Significant Surge In Demand For Reliable Power Plant”

In the event of a power outage, an Uninterruptible Power Supply (UPS) is an electronic device that provides power backup to numerous electronic gadgets and appliances. As the number of electronic gadgets and appliances is increasing the demand for UPS also increases due to the need for uninterrupted power requirement.

The electric power industry is in the midst of a transformation. Natural gas is becoming more affordable, renewable energy is becoming more affordable, and energy efficiency and distributed production are becoming more popular. Considering the fact that the need for renewable power plants has increased. The demand for uninterrupted power surges has also increased. The concern for demand for reliable power plants and uninterrupted energy production and distribution can be handled by Uninterruptible Power Supply (UPS) systems.

In addition, the Uninterruptible Power Supply (UPS) systems have the capacity to operate at a varied voltage fluctuation to maintain a steady frequency in power supply. This voltage varies throughout the surge in demand with transformers used to change voltages which is expected to drive the increase in urging demand for UPS in reliable power plants.

Report Scope and Australia Uninterruptible Power Supply (UPS) Market Segmentation

|

Attributes |

Australia Uninterruptible Power Supply (UPS) market Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

General Electric (USA), Siemens (Germany), Schneider Electric (France), Delta Electronics, Inc. (Taiwan), Socomec (France), ABB (Switzerland), TOSHIBA CORPORATION (Japan), OMRON Corporation (Japan), PowerShield Pty Ltd. (Australia), Real Power Solutions (New Zealand) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Australia Uninterruptible Power Supply (UPS) Market Definition

The Australia and Australia Uninterruptible Power Supply (UPS) market encompasses the provision of critical power backup solutions for businesses, data centers, and industries in the region. This market is driven by the increasing reliance on electronic devices and data-intensive operations, making UPS systems a vital component to ensure uninterrupted power supply during outages. It includes a range of products and services, from traditional lead-acid battery systems to advanced lithium-ion solutions, aiming to safeguard operations against power disruptions and maintain business continuity. The market in this region is characterized by the need for robust and reliable power protection systems due to challenging environmental conditions and a rapidly evolving technological landscape.

Australia Uninterruptible Power Supply (UPS) Market Dynamics

Drivers

- Significant Surge In Demand For Reliable Power Plant

In the event of a power outage, an Uninterruptible Power Supply (UPS) is an electronic device that provides power backup to numerous electronic gadgets and appliances. As the number of electronic gadgets and appliances is increasing the demand for UPS also increases due to the need for uninterrupted power requirement.

The electric power industry is in the midst of a transformation. Natural gas is becoming more affordable, renewable energy is becoming more affordable, and energy efficiency and distributed production are becoming more popular. Considering the fact that the need for renewable power plants has increased. The demand for uninterrupted power surges has also increased. The concern for demand for reliable power plants and uninterrupted energy production and distribution can be handled by Uninterruptible Power Supply (UPS) systems.

In addition, the Uninterruptible Power Supply (UPS) systems have the capacity to operate at a varied voltage fluctuation to maintain a steady frequency in power supply. This voltage varies throughout the surge in demand with transformers used to change voltages which is expected to drive the increase in urging demand for UPS in reliable power plants.

For instance,

- In November 2023, Panduit Australia has introduced the Panduit Uninterruptible Power Supply (UPS), offering efficient and reliable power protection for IT equipment. Equipped with intelligent battery management, advanced monitoring capabilities, and ENERGY STAR® 2.0 compliance, the solution is tailored for modern data centers, enterprises, and Edge IT systems. This launch addresses the rising demand for dependable power solutions in Australia, providing real-time monitoring, extended battery performance, and seamless integration with cloud-based DCIM to support the region's expanding digitalization and renewable energy adoption

- In March 2023, according to an article published by Crisis24, a power outage disrupted Sydney's central business district, causing potential commercial and transport disruptions. Businesses lacking backup generators faced operational suspensions. Traffic lights malfunctioned, leading to traffic issues, and power-dependent public transport experienced interruptions. The outage briefly impacted municipal water services, telecommunications, and electronic water filtration systems

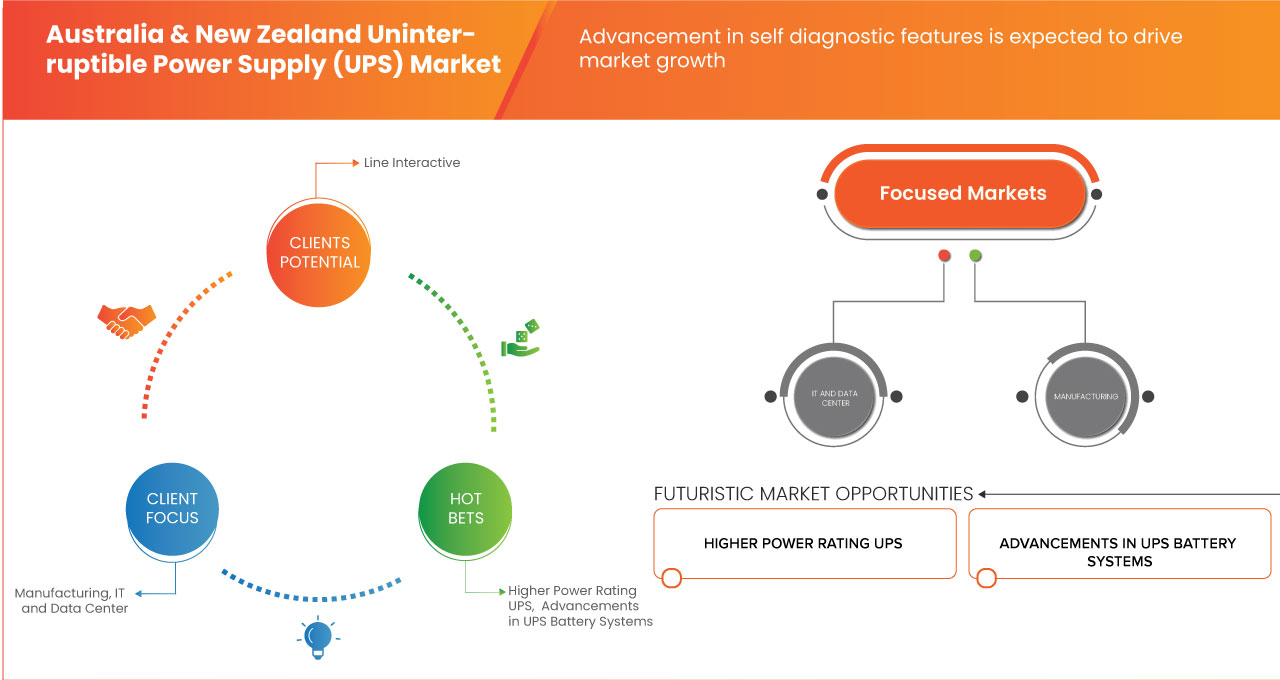

Increasing Demand For Higher Power Rating Uninterruptible Power Systems (UPS) Products In Industrial And Commercial Verticals

A UPS is often used to protect hardware such as computers, data centers, communications equipment, or other electrical equipment against power outages that could result in injuries, fatalities, major business disruption, or data loss. UPS systems help in power outages in various list of industries. The technology continues to improve as the importance of maintaining power to essential systems and operations becomes more and more critical. Uninterruptible Power Systems (UPS) have become an essential component of several data processing facilities (EDPs), ranging from desktop computers to mainframe computers. UPS systems offer some protection and security to users who are concerned about data loss and hardware failure due to power outages.

Electrical service outages occur every day in homes, companies, and government entities. The losses incurred as a result of these power interruptions can be significant.

Recently, the use of computer-based control systems in manufacturing and process control applications has necessitated the installation of UPS systems in industrial facilities. The typical applications range from distributed PLC-based controls to full Distributed Control Systems (DCS), with power needs ranging from 3 to 50 KVA. Many older plants, in addition to new plant construction, are updating pneumatic and single loop control systems to distributed control systems, primarily to enhance operating efficiency. Industrial computer applications demand different design requirements than their data processing counterparts, and while UPSs in commercial applications have essentially become commodity goods, industrial UPS systems remain an engineered product.

For instance,

- In November 2024, CyberPower has introduced the Advanced PFC Sine Wave UPS series in Australia, providing reliable power protection for home users, gamers, and small businesses. Featuring Pure Sine Wave Output, Automatic Voltage Regulation (AVR), and energy-efficient technology, these UPS systems cater to the rising demand for higher power-rating solutions in Australia’s industrial and commercial sectors, ensuring operational continuity and supporting critical infrastructure needs

- In November 2022, according to an article published by TechDay, Vertiv has unveiled a cutting-edge UPS system to meet contemporary digital demands. The system, now launched, boasted up to 97% efficiency in double conversion mode and up to 99% efficiency in eco-mode. The Liebert APM Plus, available in capacities ranging from 50 to 500kW

Opportunities

Advancement In Self Diagnostic Features

The growing demand for reliable power systems in Australia has led to a significant opportunity in the Uninterruptible Power Supply (UPS) market, especially in the area of advancements in self-diagnostic features. As industries increasingly rely on continuous, high-quality power to support critical operations, the need for UPS systems that can monitor their own health and performance in real time has become essential. The development of advanced self-diagnostic tools, such as remote monitoring, battery status tracking, and predictive analytics, allows UPS systems to identify potential issues before they lead to power disruptions. This proactive approach not only enhances the reliability of power systems but also reduces downtime, minimizing the risks of unplanned outages and improving operational efficiency for industries in Australia.

Incorporating self-diagnostic features into UPS systems enables businesses to manage their energy infrastructure more effectively. With capabilities like automatic battery health checks, temperature monitoring, and system performance analysis, operators can receive early warnings of potential faults, enabling them to schedule maintenance before a failure occurs. The ability to perform real-time diagnostics reduces the reliance on manual inspections, optimizes maintenance schedules, and extends the lifespan of UPS systems. As Australia continue to advance in their technological capabilities, the integration of self-diagnostic features in UPS solutions will play a crucial role in enhancing system resilience and supporting the growing need for uninterrupted power in sectors such as data centers, healthcare, and manufacturing .

For instance,

In July 2024, according to the article published by IT Brief, Vertiv has launched its next-generation Trinergy uninterruptible power supply (UPS), designed to meet the high-capacity demands of AI and HPC applications. The Trinergy UPS offers enhanced resilience, flexibility, and efficiency, with a 99.9999998% uptime and support for various power sources. This advancement in self-diagnostic features, including condition-based maintenance analytics and health scoring, presents a significant opportunity for the Australia UPS Market. As demand for high-reliability systems grows, these features will enable real-time monitoring, predictive maintenance, and extended operational life, making UPS systems essential for industries requiring uninterrupted power

In April 2019, according to the article published by Uninterruptible Power Ltd., the news highlights how uninterruptible power supplies (UPS) are benefiting from the Internet of Things (IoT), enabling remote monitoring and control. IoT connectivity allows UPS systems to communicate battery status, health, and operational data in real time, enhancing visibility and management. This ensures timely responses to issues like battery exhaustion and facilitates proactive maintenance. This development presents a significant opportunity for the Australia Uninterruptible Power Supply (UPS) Market, as the demand for advanced self-diagnostic features, such as remote battery monitoring and real-time health analysis, continues to grow. IoT-enabled UPS systems support early issue detection, predictive maintenance, and efficient resource management, ensuring higher system reliability and reduced downtime for industries dependent on continuous power

- Advancements In Uninterruptible Power Supply (UPS) Battery Systems

Lithium-ion UPS are a big step forward in UPS battery technology, which has been dominated by valve-regulated lead acid batteries for decades (VRLA). Lithium-ion batteries have a 10- to 15-year lifespan, compared to their lead-acid predecessors, which need to be changed every 3 to 5 years. A myriad of advancements has brought lithium-ion technology to the forefront when it comes to backup power. First and foremost, the cost has fallen dramatically, while some historical concerns regarding safety have been sufficiently addressed. The chemistry of lithium-ion batteries for UPS applications is much safer than those used in the past for other applications and is more akin to the batteries found in electric cars.

Lithium-ion batteries perform the same functions as traditional lead-acid batteries while offering a variety of advantages. With a 10- to-15-year life cycle, data centers that have traditionally been forced to replace UPS batteries every three to five years can reap significant cost savings. The upfront price of a lithium-based solution with monitoring is now on par with valve-regulated lead-acid (VRLA) battery solutions but with the added benefit of a lower Total Cost of Ownership (TCO) when maintenance and replacement costs are considered for the life of the UPS system.

For instance,

- In March 2022, according to the article published by Vertiv Group Corp., Vertiv is launching new lithium-ion UPS and cooling solutions for edge applications, including the Liebert® GXT5 Lithium-Ion and Liebert® PSI5 Lithium-Ion Short Depth UPS systems, along with the Liebert® XDU Coolant Distribution Units. These solutions offer longer battery life, scalable runtime, and reduced cooling costs, enhancing sustainability and performance. This development presents a significant opportunity for advancements in Uninterruptible Power Supply (UPS) battery systems in the Australia market, driven by the growing demand for more sustainable, efficient, and cost-effective power solutions

- In December 2021, according to the article published by ComputerWeekly.com, lithium-ion batteries are increasingly being adopted in Uninterruptible Power Supply (UPS) systems for data centers due to their smaller footprint, longer lifespan, and higher temperature tolerance compared to traditional VRLA batteries. While more expensive, they are gaining popularity, particularly among large colocation and hyperscale data center operators. This shift presents a key opportunity for advancements in UPS battery systems in the Australia market, as data center operators seek more sustainable and cost-effective solutions. The growing adoption of lithium-ion batteries will drive demand for advanced UPS systems, offering improved performance and reduced footprint, especially in space-constrained or high-temperature environments

Restraints/Challenges

- Availability Of Substitutes For Uninterruptible Power Supply (UPS) Systems

The Uninterruptible Power Supply (UPS) market in Australia has been experiencing significant growth due to the increasing demand for reliable power backup solutions across various industries. However, one challenge that the industry faces is the availability of substitutes for UPS systems. In this descriptive data report, we will explore this challenge, its impact on the UPS market in Australia, and the factors contributing to the presence of substitutes in this dynamic market.

The UPS market in Australia is driven by the need for continuous power supply, especially in critical sectors such as IT, healthcare, telecommunications, and data centers. UPS systems are designed to provide backup power during outages, preventing data loss, equipment damage, and downtime. As a result, UPS systems have become an integral part of the infrastructure for various businesses and organizations across the region.

- High Installation Costs and Expensive Maintenance

Nowadays, the need and requirement for UPS systems have increased due to rapid digitalization and improved industrialization. Most of the industries and IT sector are in need of UPS. But the fact is that, small scale industries don’t have the capacity to manage the cost, installation and maintenance charges of the UPS systems. As the need increases, the cost of the raw materials and other products with respect to UPS systems gradually increases.

Both capital expenditure (CAPEX) and operational expenditure (OPEX) are essential for UPS systems. The initial procurement of UPS systems, huge cabinets, and monitoring software is included in CAPEX. UPS systems cost more than low voltage inverter systems because they require huge cabinets to contain modules that allow for growth. As a result, in order to reap the full benefits of UPS systems, organizations must plan for their desired power capacity. UPS units and batteries require ongoing, high-cost maintenance after installation.

For instance:

- In October 2024, according to the article published by Blue Notatry, the total cost of owning a UPS system extends beyond its initial purchase price, encompassing high maintenance expenses such as periodic battery replacements, system checks, and energy efficiency considerations. These factors significantly contribute to long-term costs, particularly for businesses requiring consistent upkeep to maintain optimal performance. High installation costs and expensive maintenance are identified as major restraints in the Australia UPS market. The frequent need for battery replacements, regular servicing, and investment in energy-efficient models elevate the total cost of ownership, discouraging adoption, especially among small and medium-sized enterprises, despite the critical role of UPS systems in ensuring uninterrupted power supply

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Australia Uninterruptible Power Supply (UPS) Market Scope

The Australia uninterruptible power supply (UPS) market is segmented into six notable segments based on offering, organization size, type, output, vertical, and sales channel.

The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Solutions

- 10 Kva And Below

- 11 Kva – 100 Kva

- 101 Kva – 500 Kva

- 501 Kva – Above

- Services

- Support And Maintenance

- Integration And Implementation

- Training, Education And Consulting

Organization Size

- Large Enterprise

- Medium Enterprise

- Small Enterprise

Type

- Online

- Offline

- Line Interactive

Output

- AC To AC

- Three Phase

- Single Phase

- DC To DC

- AC To DC

Vertical

- Government And Public Sector

- Solutions

- 50 Kva And Below

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 Kva – Above

- Services

- Support And Maintenance

- Integration And Implementation

- Training, Education And Consulting

- Solutions

- It And Data Center

- Solutions

- 50 Kva And Below

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 Kva – Above

- Services

- Support And Maintenance

- Integration And Implementation

- Training, Education And Consulting

- Solutions

- Residential

- Solutions

- 50 Kva And Below

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 Kva – Above

- Services

- Support And Maintenance

- Integration And Implementation

- Training, Education And Consulting

- Solutions

- Energy And Utility

- Solutions

- 50 Kva And Below

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 Kva – Above

- Services

- Support And Maintenance

- Integration And Implementation

- Training, Education And Consulting

- Solutions

- Telecom

- Solutions

- 50 Kva And Below

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 Kva – Above

- Services

- Support And Maintenance

- Integration And Implementation

- Training, Education And Consulting

- Solutions

- Manufacturing

- Solutions

- 50 Kva And Below

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 Kva – Above

- Services

- Support And Maintenance

- Integration And Implementation

- Training, Education And Consulting

- Solutions

- Healthcare

- Solutions

- 50 Kva And Below

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 Kva – Above

- Services

- Support And Maintenance

- Integration And Implementation

- Training, Education And Consulting

- Solutions

- Retail

- Solutions

- 50 Kva And Below

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 Kva – Above

- Services

- Support And Maintenance

- Integration And Implementation

- Training, Education And Consulting

- Solutions

- Bfsi

- Solutions

- 50 Kva And Below

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 Kva – Above

- Services

- Support And Maintenance

- Integration And Implementation

- Training, Education And Consulting

- Solutions

- Education

- Solutions

- 50 Kva And Below

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 Kva – Above

- Services

- Support And Maintenance

- Integration And Implementation

- Training, Education And Consulting

- Solutions

- Others

- Solutions

- 50 Kva And Below

- 51 Kva – 100 Kva

- 101 Kva – 250 Kva

- 501 Kva – Above

- Services

- Support And Maintenance

- Integration And Implementation

- Training, Education And Consulting

- Solutions

Sales Channel

- Direct

- Indirect

- Distributor/Wholesaler

- Specialty Store

- Others

Australia Uninterruptible Power Supply (UPS) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Australia Uninterruptible Power Supply (UPS) Market Leaders Operating in the Market Are:

- General Electric (U.S.)

- Siemens (Germany)

- Schneider Electric (France)

- Delta Electronics, Inc. (Taiwan)

- Socomec (France)

- ABB (Switzerland)

- TOSHIBA CORPORATION (Japan)

- OMRON Corporation (Japan)

- PowerShield Pty Ltd. (Australia)

- Real Power Solutions ((New Zealand)

Latest Developments in Australia Uninterruptible Power Supply (UPS) market Market

- In August 2023, Cyber Power Systems, Inc. has unveiled an upgraded Smart App Sinewave UPS (Uninterruptible Power Supply) product line, marking a significant advancement in power protection technology. This revamped line boasts built-in cloud monitoring and enhanced LCD features, providing a substantial boost in convenience, reliability, and efficiency. These improvements offer crucial support for safeguarding vital electronics like servers and networking equipment in corporate and data center settings. This innovative relaunch has enabled Cyber Power Systems to solidify its position as a trusted industry leader, catering to the evolving needs of its clientele and reinforcing its commitment to delivering cutting-edge solutions for power management and security

- In April 2022, Toshiba International Corporation UPS systems is integrated by Global Power Supply, LLC. (GPS) into their mobile UPS trailer fleet, featuring custom-built, high-powered lithium-ion backup battery trailers. The addition of Toshiba G9000 and 4400 Series UPS systems enhances critical facility customers' backup power with exceptional safety, flexibility, and durability. By partnering with Global Power Supply (GPS) and integrating their state-of-the-art UPS systems into GPS's mobile UPS trailer fleet, Toshiba gains enhanced visibility and access to critical facility customers, showcasing the performance, safety, and longevity of their UPS backup power systems in various use cases and applications

- In October 2024, ABB announced the launch of medium voltage Uninterruptible Power Supply (UPS) which is purpose-built for industrial applications and harsh conditions, providing reliable and uninterrupted power protection. With its robust design, the UPS ensures continuous power supply, enhancing the performance and safety of critical industrial processes. This UPS serves as a crucial asset in maintaining operational efficiency and protecting valuable equipment in industrial facilities

- In August 2024, Socomec, a leading power solutions provider, has continued its streak of innovation following the success of its award-winning Modulys XL. The company has now unveiled its latest offering, Delphys XL, tailored to meet the unique demands of the colocation industry. This achievement has not gone unnoticed, as the remarkable advancements introduced by Delphys XL have earned Socomec the prestigious Frost & Sullivan Global Customer Value Leadership award for 2024. This recognition solidifies Socomec's reputation as a trailblazer in the power solutions sector, showcasing their commitment to addressing customers' specific needs and driving excellence in the field

- In October 2023, ATLAS ELEKTRONIK and Israel Aerospace Industries unveiled the BlueWhale ASW platform for advanced anti-submarine warfare. An advanced autonomous underwater vehicle integrating ELTA’s sophisticated sensor systems and ATLAS ELEKTRONIK’s towed passive sonar array, designed for efficient submarine detection. This collaboration enhances both companies’ capabilities in naval defense, leveraging IAI’s expertise in unmanned systems and ELTA’s advanced sensor technologies, resulting in a state-of-the-art, long-endurance ASW solution suitable for various naval operations.

- In July 2019, Toshiba International Corporation has secured a patent for their Power Electronic Department's 5000 Series N3R Uninterruptible Power System (UPS), becoming the first UPS manufacturer to offer a true purpose-built outdoor UPS. The N3R UPS is designed for harsh and dusty environments, making it ideal for applications in water/wastewater, mining, manufacturing, pipelines, and transportation hubs. This helped Toshiba has expanded its market presence and strengthened its position in providing reliable power solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 OFFERING LINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SIGNIFICANT SURGE IN DEMAND FOR RELIABLE POWER PLANT

5.1.2 INCREASING DEMAND FOR HIGHER POWER RATING UNINTERRUPTIBLE POWER SYSTEMS (UPS) PRODUCTS IN INDUSTRIAL AND COMMERCIAL VERTICALS

5.1.3 RAPID URBANIZATION AND GROWTH IN THE IT SECTOR

5.1.4 GROWING FOCUS ON ENERGY-EFFICIENT AND SUSTAINABLE POWER SOLUTIONS

5.2 RESTRAINTS

5.2.1 HIGH INSTALLATION COSTS AND EXPENSIVE MAINTENANCE

5.2.2 BREAKDOWNS IN UNINTERRUPTIBLE POWER SUPPLY SYSTEMS

5.3 OPPORTUNITIES

5.3.1 INCREASING GOVERNMENT INITIATIVE FOR GREEN POWER SUPPLY

5.3.2 ADVANCEMENT IN SELF DIAGNOSTIC FEATURES

5.3.3 ADVANCEMENTS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) BATTERY SYSTEMS

5.4 CHALLENGES

5.4.1 FREQUENT REPLACEMENT OF BATTERIES AND UPDATING THE COMPONENTS AND TECHNOLOGY DUE TO THE RAPID GROWTH OF HIGH-POWERED EQUIPMENT

5.4.2 AVAILABILITY OF SUBSTITUTES FOR UNINTERRUPTIBLE POWER SUPPLY (UPS) SYSTEMS

5.4.3 FACTORS CONTRIBUTING TO THE AVAILABILITY OF SUBSTITUTES:

6 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 101 KVA - 500 KVA

6.2.2 11 KVA - 100 KVA

6.2.3 10 KVA AND BELOW

6.2.4 501 KVA ABOVE

6.3 SERVICES

6.3.1 SUPPORT AND MAINTENANCE

6.3.2 INTEGRATION AND IMPLEMENTATION

6.3.3 TRAINING, EDUCATION, AND CONSULTING

7 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY ORGANIZATION SIZE

7.1 OVERVIEW

7.2 LARGE ENTERPRISE

7.3 MEDIUM ENTERPRISE

7.4 SMALL ENTERPRISE

8 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE

8.1 OVERVIEW

8.2 ONLINE

8.3 OFFLINE

8.4 LINE INTERACTIVE

9 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OUTPUT

9.1 OVERVIEW

9.2 AC TO AC

9.2.1 THREE PHASE

9.2.2 SINGLE PHASE

9.3 DC TO DC

9.4 AC TO DC

10 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY SALES CHANNEL

10.1 OVERVIEW

10.2 DIRECT

10.3 INDIRECT

10.3.1 DISTRIBUTOR/WHOLESALER

10.3.2 SPECIALTY STORE

10.3.3 OTHERS

11 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 MANUFACTURING

11.2.1 SOLUTIONS

11.2.1.1 101 KVA - 500 KVA

11.2.1.2 11 KVA - 100 KVA

11.2.1.3 10 KVA AND BELOW

11.2.1.4 501 KVA ABOVE

11.2.2 SERVICES

11.2.2.1 SUPPORT AND MAINTENANCE

11.2.2.2 INTEGRATION AND IMPLEMENTATION

11.2.2.3 TRAINING, EDUCATION AND CONSULTING

11.3 IT AND DATA CENTER

11.3.1 SOLUTIONS

11.3.1.1 101 KVA - 500 KVA

11.3.1.2 11 KVA - 100 KVA

11.3.1.3 10 KVA AND BELOW

11.3.1.4 501 KVA ABOVE

11.3.2 SERVICES

11.3.2.1 SUPPORT AND MAINTENANCE

11.3.2.2 INTEGRATION AND IMPLEMENTATION

11.3.2.3 TRAINING, EDUCATION AND CONSULTING

11.4 HEALTHCARE

11.4.1 SOLUTIONS

11.4.1.1 101 KVA - 500 KVA

11.4.1.2 11 KVA - 100 KVA

11.4.1.3 10 KVA AND BELOW

11.4.1.4 501 KVA ABOVE

11.4.2 SERVICES

11.4.2.1 SUPPORT AND MAINTENANCE

11.4.2.2 INTEGRATION AND IMPLEMENTATION

11.4.2.3 TRAINING, EDUCATION AND CONSULTING

11.5 BFSI

11.5.1 SOLUTIONS

11.5.1.1 101 KVA - 500 KVA

11.5.1.2 11 KVA - 100 KVA

11.5.1.3 10 KVA AND BELOW

11.5.1.4 501 KVA ABOVE

11.5.2 SERVICES

11.5.2.1 SUPPORT AND MAINTENANCE

11.5.2.2 INTEGRATION AND IMPLEMENTATION

11.5.2.3 TRAINING, EDUCATION AND CONSULTING

11.6 ENERGY AND UTILITY

11.6.1 SOLUTIONS

11.6.1.1 101 KVA - 500 KVA

11.6.1.2 11 KVA - 100 KVA

11.6.1.3 10 KVA AND BELOW

11.6.1.4 501 KVA ABOVE

11.6.2 SERVICES

11.6.2.1 SUPPORT AND MAINTENANCE

11.6.2.2 INTEGRATION AND IMPLEMENTATION

11.6.2.3 TRAINING, EDUCATION AND CONSULTING

11.7 GOVERNMENT AND PUBLIC SECTOR

11.7.1 SOLUTIONS

11.7.1.1 101 KVA - 500 KVA

11.7.1.2 11 KVA - 100 KVA

11.7.1.3 10 KVA AND BELOW

11.7.1.4 501 KVA ABOVE

11.7.2 SERVICES

11.7.2.1 SUPPORT AND MAINTENANCE

11.7.2.2 INTEGRATION AND IMPLEMENTATION

11.7.2.3 TRAINING, EDUCATION AND CONSULTING

11.8 TELECOM

11.8.1 SOLUTIONS

11.8.1.1 101 KVA - 500 KVA

11.8.1.2 11 KVA - 100 KVA

11.8.1.3 10 KVA AND BELOW

11.8.1.4 501 KVA ABOVE

11.8.2 SERVICES

11.8.2.1 SUPPORT AND MAINTENANCE

11.8.2.2 INTEGRATION AND IMPLEMENTATION

11.8.2.3 TRAINING, EDUCATION AND CONSULTING

11.9 RETAIL

11.9.1 SOLUTIONS

11.9.1.1 101 KVA - 500 KVA

11.9.1.2 11 KVA - 100 KVA

11.9.1.3 10 KVA AND BELOW

11.9.1.4 501 KVA ABOVE

11.9.2 SERVICES

11.9.2.1 SUPPORT AND MAINTENANCE

11.9.2.2 INTEGRATION AND IMPLEMENTATION

11.9.2.3 TRAINING, EDUCATION AND CONSULTING

11.1 RESIDENTIAL

11.10.1 SOLUTIONS

11.10.1.1 101 KVA - 500 KVA

11.10.1.2 11 KVA - 100 KVA

11.10.1.3 10 KVA AND BELOW

11.10.1.4 501 KVA ABOVE

11.10.2 SERVICES

11.10.2.1 SUPPORT AND MAINTENANCE

11.10.2.2 INTEGRATION AND IMPLEMENTATION

11.10.2.3 TRAINING, EDUCATION AND CONSULTING

11.11 EDUCATION

11.11.1 SOLUTIONS

11.11.1.1 101 KVA - 500 KVA

11.11.1.2 11 KVA - 100 KVA

11.11.1.3 10 KVA AND BELOW

11.11.1.4 501 KVA ABOVE

11.11.2 SERVICES

11.11.2.1 SUPPORT AND MAINTENANCE

11.11.2.2 INTEGRATION AND IMPLEMENTATION

11.11.2.3 TRAINING, EDUCATION AND CONSULTING

11.12 OTHERS

11.12.1 SOLUTIONS

11.12.1.1 101 KVA - 500 KVA

11.12.1.2 11 KVA - 100 KVA

11.12.1.3 10 KVA AND BELOW

11.12.1.4 501 KVA ABOVE

11.12.2 SERVICES

11.12.2.1 SUPPORT AND MAINTENANCE

11.12.2.2 INTEGRATION AND IMPLEMENTATION

11.12.2.3 TRAINING, EDUCATION AND CONSULTING

12 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: AUSTRALIA

12.2 COMPANY SHARE ANALYSIS: NEW ZEALAND

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 SIEMENS

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENT

14.2 SCHNEIDER ELECTRIC

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 TOSHIBA INTERNATIONAL CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENTS

14.4 GE HEALTHCARE

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 OMRON CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCTS PORTFOLIO

14.5.4 RECENT DEVELOPMENTS

14.6 ABB

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 DELTA ELECTRONICS, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 POWERSHIELD PTY LTD.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCTS PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 REAL POWER SOLUTIONS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCTS PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 SOCOMEC

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 AVERAGE COST TO INSTALL A UPS BATTERY SYSTEM

TABLE 2 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 3 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 4 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 5 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 6 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 7 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 8 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY ORGANIZATION SIZE, 2021-2032 (USD THOUSAND)

TABLE 9 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY ORGANIZATION SIZE, 2021-2032 (USD THOUSAND)

TABLE 10 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 11 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 12 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OUTPUT, 2021-2032 (USD THOUSAND)

TABLE 13 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OUTPUT, 2021-2032 (USD THOUSAND)

TABLE 14 AUSTRALIA AC TO AC IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 15 NEW ZEALAND AC TO AC IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 16 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY SALES CHANNEL, 2021-2032 (USD THOUSAND)

TABLE 17 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY SALES CHANNEL, 2021-2032 (USD THOUSAND)

TABLE 18 AUSTRALIA INDIRECT IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 19 NEW ZEALAND INDIRECT IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 20 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY VERTICAL, 2021-2032 (USD THOUSAND)

TABLE 21 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY VERTICAL, 2021-2032 (USD THOUSAND)

TABLE 22 AUSTRALIA MANUFACTURING IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 23 NEW ZEALAND MANUFACTURING IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 24 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 25 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 26 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 27 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 28 AUSTRALIA IT AND DATA CENTER IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 29 NEW ZEALAND IT AND DATA CENTER IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 30 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 31 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 32 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 33 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 34 AUSTRALIA HEALTHCARE IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 35 NEW ZEALAND HEALTHCARE IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 36 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 37 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 38 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 39 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 40 AUSTRALIA BFSI IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 41 NEW ZEALAND BFSI IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 42 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 43 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 44 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 45 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 46 AUSTRALIA ENERGY AND UTILITY IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 47 NEW ZEALAND ENERGY AND UTILITY IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 48 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 49 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 50 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 51 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 52 AUSTRALIA GOVERNMENT AND PUBLIC SECTOR IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 53 NEW ZEALAND GOVERNMENT AND PUBLIC SECTOR IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 54 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 55 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 56 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 57 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 58 AUSTRALIA TELECOM IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 59 NEW ZEALAND TELECOM IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 60 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 61 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 62 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 63 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 64 AUSTRALIA RETAIL IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 65 NEW ZEALAND RETAIL IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 66 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 67 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 68 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 69 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 70 AUSTRALIA RESIDENTIAL IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 71 NEW ZEALAND RESIDENTIAL IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 72 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 73 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 74 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 75 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 76 AUSTRALIA EDUCATION IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 77 NEW ZEALAND EDUCATION IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 78 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 79 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 80 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 81 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 82 AUSTRALIA OTHERS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 83 NEW ZEALAND OTHERS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY OFFERING, 2021-2032 (USD THOUSAND)

TABLE 84 AUSTRALIA SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 85 NEW ZEALAND SOLUTIONS IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 86 AUSTRALIA SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

TABLE 87 NEW ZEALAND SERVICES IN UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET, BY TYPE, 2021-2032 (USD THOUSAND)

List of Figure

FIGURE 1 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: SEGMENTATION

FIGURE 2 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET ANALYSIS: COUNTRY-WISE ANALYSIS

FIGURE 5 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: COUNTRY-WISE ANALYSIS

FIGURE 6 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: FUNCTION COVERAGE GRID ANALYSIS

FIGURE 11 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: MULTIVARIATE MODELLING

FIGURE 12 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: OFFERING LINE CURVE

FIGURE 13 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: OFFERING LINE CURVE

FIGURE 14 AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: SEGMENTATION

FIGURE 15 TWO SEGMENTS COMPRISE THE AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET (2024)

FIGURE 16 TWO SEGMENTS COMPRISE THE NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET (2024)

FIGURE 17 EXECUTIVE SUMMARY: AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET

FIGURE 18 EXECUTIVE SUMMARY: NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET

FIGURE 19 STRATEGIC DECISIONS

FIGURE 20 SIGNIFICANT SURGE IN DEMAND FOR RELIABLE POWER PLANT IS EXPECTED TO BE KEY DRIVER FOR AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 21 RAPID URBANIZATION AND GROWTH IN THE IT SECTOR IS EXPECTED TO BE KEY DRIVER FOR NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 22 THE SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET FROM 2025 TO 2032

FIGURE 23 THE SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF AUSTRALIA AND NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET FROM 2025 TO 2032

FIGURE 24 DRIVERS, RESTRAINTS, AND OPPORTUNITIES OF AUSTRALIA & NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET

FIGURE 25 ENERGY CONSUMPTION IN AUSTRALIA

FIGURE 26 RENEWABLES ENERGY CONSUMPTION IN AUSTRALIA

FIGURE 27 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY OFFERING, 2024

FIGURE 28 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY OFFERING, 2024

FIGURE 29 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 30 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 31 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY TYPE, 2024

FIGURE 32 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY TYPE, 2024

FIGURE 33 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY OUTPUT, 2024

FIGURE 34 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY OUTPUT, 2024

FIGURE 35 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY SALES CHANNEL, 2024

FIGURE 36 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY SALES CHANNEL, 2024

FIGURE 37 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY VERTICAL, 2024

FIGURE 38 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: BY VERTICAL, 2024

FIGURE 39 AUSTRALIA UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: COMPANY SHARE 2024 (%)

FIGURE 40 NEW ZEALAND UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET: COMPANY SHARE 2024 (%)

Australia Uninterruptible Power Supply Ups Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Australia Uninterruptible Power Supply Ups Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Australia Uninterruptible Power Supply Ups Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.