Bangladesh Cold Chain Market

Market Size in USD Billion

CAGR :

%

USD

1.10 Billion

USD

2.03 Billion

2025

2033

USD

1.10 Billion

USD

2.03 Billion

2025

2033

| 2026 –2033 | |

| USD 1.10 Billion | |

| USD 2.03 Billion | |

|

|

|

|

Bangladesh Cold Chain Market Size

- The Bangladesh Cold Chain Market was valued at USD 1.10 Billion in 2025 and is expected to reach USD 2.03 Billion by 2033 at a CAGR of 8.1% during the forecast period

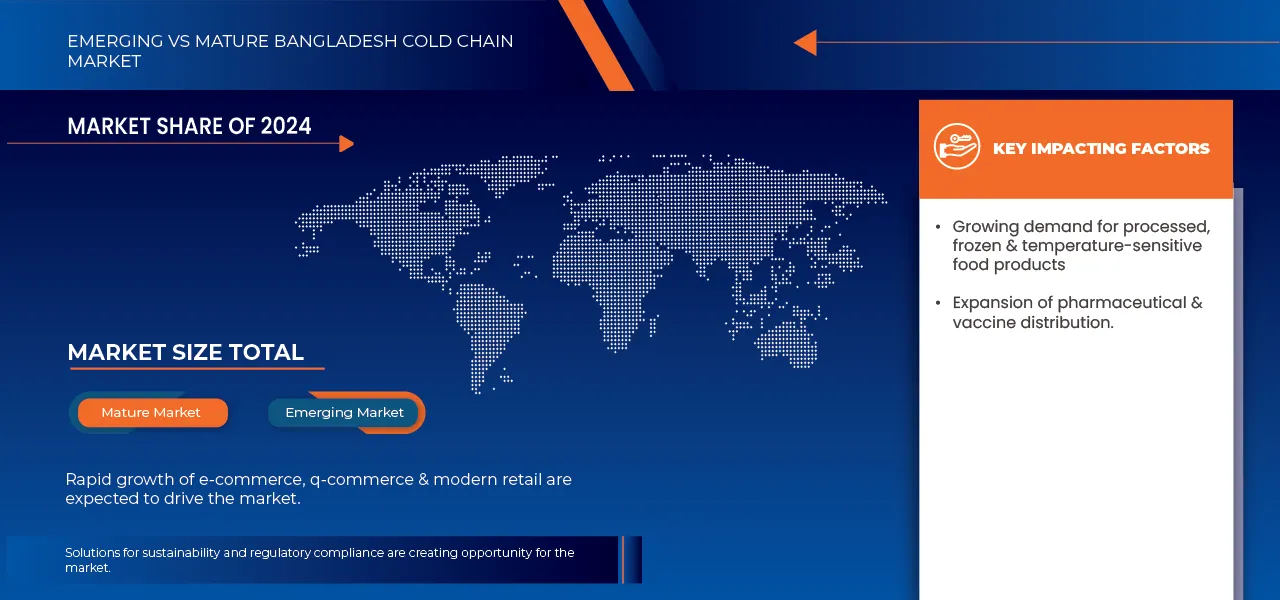

- The market is primarily driven by the rising need for temperature-controlled logistics, expanding demand for perishable food products, and increasing reliance on cold storage solutions across the pharmaceutical and healthcare sectors.

- This growth is supported by factors such as the surge in organized retail, expanding export-oriented agriculture, rising vaccine and biologics distribution requirements, and the rapid modernization of cold chain infrastructure to ensure product quality and safety

Bangladesh Cold Chain Market Analysis

- The Bangladesh Cold Chain Market is witnessing accelerated growth, driven by rising demand for reliable, energy-efficient, and high-performance temperature-controlled logistics solutions. Cold chain systems offer advantages such as reduced product wastage, improved temperature precision, and scalable storage and transport compared to conventional handling methods. Their adoption is increasing across food & beverage (meat, seafood, dairy, fruits & vegetables), pharmaceuticals (vaccines, insulin, biologics), healthcare supplies, and horticulture exports. However, the market still faces challenges related to energy costs, limited rural cold storage penetration, infrastructure gaps, and the need for improved temperature monitoring and operational reliability.

- The food and agriculture sector remains a key growth catalyst, as temperature-sensitive commodities require dependable cold storage and refrigerated transport to maintain freshness and reduce spoilage. Pharmaceutical distribution is also expanding rapidly, driven by vaccines, biologics, and life-saving drugs that require stringent temperature control. At the same time, modern retail, quick-commerce platforms, and frozen food brands are boosting demand for efficient cold chain networks. In addition, seafood and horticulture exporters increasingly rely on advanced cold logistics to meet international quality and safety standards, further strengthening market expansion.

- Asia-Pacific countries are helping influence market practices as Bangladesh continues integrating modern cold storage standards, while regions such as Europe and the Middle East are key destinations for Bangladesh’s temperature-sensitive exports, supporting the adoption of globally aligned cold chain protocols. Meanwhile, developing regions across South Asia and Africa are emerging as new markets with growing interest in improved cold supply systems.

- Key providers are investing in advanced refrigeration technologies, solar-powered cold rooms, real-time temperature monitoring, and improved insulation systems to enhance energy efficiency and reduce operational costs. New solutions include modular cold storage units, digital fleet tracking for reefer trucks, and humidity-controlled chambers for specialized products. Among the segments, cold storage facilities hold a significant share due to their widespread use in food processing, agriculture, and pharmaceuticals. Strategic partnerships between logistics providers, food processors, and government bodies are shaping industry development. As Bangladesh further strengthens regulatory standards for food safety, export quality, and pharmaceutical compliance, maintaining long-term reliability and adopting advanced monitoring systems will be essential for competitiveness and sustainable market growth.

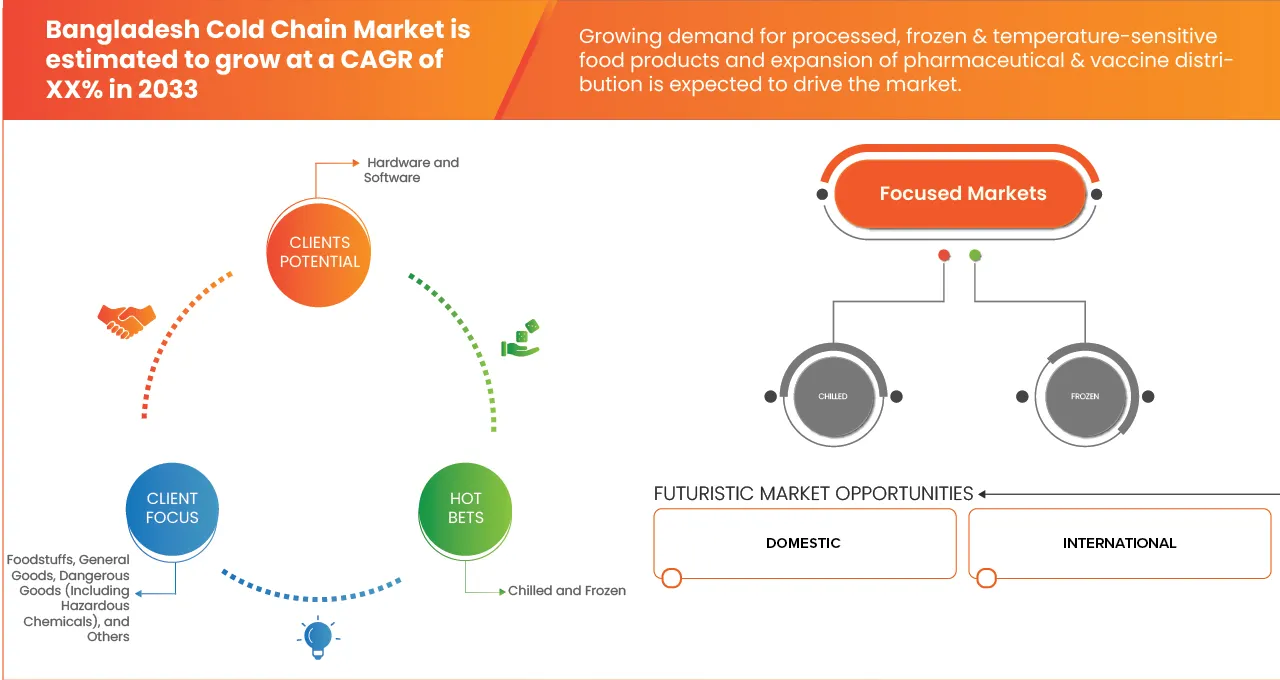

- The Hardware segment is projected to dominate the Bangladesh Cold Chain Market, accounting for the largest market share of 77.99% in 2026, as short-term and on-demand freight requirements continue to increase in line with the country’s growing retail, construction, and agricultural activities. Flexible, pay-per-trip trucking services are being preferred over long-term contracts, particularly by SMEs whose shipment volumes vary, thereby strengthening the demand for hardware-driven cold chain infrastructure.

Report Scope and Bangladesh Cold Chain Market Segmentation

|

Attributes |

Bangladesh Cold Chain Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bangladesh Cold Chain Market Trends

“Advancements in Efficiency, Capacity Expansion, and Emerging Applications”

- One prominent trend in the Bangladesh Cold Chain Market is the accelerated adoption of advanced refrigeration technologies and modern storage systems to enhance cooling efficiency, increase capacity, and support diverse applications across food processing, pharmaceuticals, agriculture, and retail distribution.

- The market is experiencing growing demand for high-capacity cold storage units and energy-efficient refrigerated transport, driven by their superior temperature stability, reduced wastage, and ability to maintain product integrity compared to traditional handling methods. This shift is particularly strong in perishable food logistics, vaccine and biologics distribution, and export-oriented supply chains where reliability and operational efficiency are essential.

- For instance, in 2024, several cold chain operators in Bangladesh expanded their temperature-controlled warehouse networks and introduced solar-assisted cold rooms to support sustainable operations and improve last-mile connectivity for rural and urban markets. Likewise, logistics firms are increasingly integrating IoT-based temperature monitoring systems to ensure real-time visibility and compliance for sensitive pharmaceutical and food products.

- Industry players are incorporating innovations such as humidity-controlled environments, enhanced insulation materials, and advanced thermal management systems to meet the rising needs of processed foods, seafood exports, and horticulture supply chains. At the same time, upgraded packaging technologies and digital tracking solutions are improving transport reliability and reducing spoilage rates across distribution routes.

- As sectors like quick-commerce, modern retail, and healthcare continue to expand, the demand for reliable, energy-efficient, and scalable cold chain solutions is intensifying. Market participants are also aligning with global best practices by adopting environmentally sustainable refrigerants, adhering to food safety and pharmaceutical regulations, and improving supply chain transparency to strengthen their position in fast-growing domestic and export markets

Bangladesh Cold Chain Market Dynamics

Driver

“Growing demand for processed, frozen & temperature-sensitive food products”

- Bangladesh is undergoing a rapid transformation in food consumption driven by urbanization, changing lifestyles, and rising disposable incomes. A growing number of consumers—especially in major cities like Dhaka, Chattogram, and Sylhet—are shifting away from traditional fresh wet-market purchases toward ready-to-cook and ready-to-eat options. This shift is fueled by busy lifestyles, higher female workforce participation, and greater exposure to global food trends.

- The rising popularity of branded frozen foods (such as poultry, fish fillets, shrimp, snacks, bakery items, ice cream, and dairy products), along with increased production of temperature-sensitive goods (vaccines, pharmaceuticals, fruits, vegetables), is creating sustained demand for reliable cold storage, refrigerated transport, and temperature-controlled distribution networks.

- Additionally, Bangladesh is a major fish and seafood exporter, requiring world-class cold logistics to meet strict international quality and safety standards for markets such as the EU, Japan, and the Middle East. Ensuring integrity across the supply chain—from landing and processing sites to export gateways—is critical to maintaining competitiveness

- Modern retail formats, including supermarkets, quick-commerce platforms, and online grocery delivery services, are expanding nationwide, placing new logistical requirements on suppliers for continuous cold chain support. To reduce post-harvest losses—currently high for perishable products like fish, meat, vegetables, and dairy—producers and distributors are investing in frozen warehouses, pre-cooling facilities, reefer trucks, and last-mile delivery infrastructure

Restraint/Challenge

“High infrastructure & energy costs”

- High infrastructure and energy costs continue to be a major restraint for the growth and efficiency of Bangladesh’s cold chain sector. Developing a modern cold chain network requires substantial investment in advanced refrigeration systems, insulated storage facilities, and temperature-controlled transport fleets. These systems depend on sophisticated technology and continuous power supply, making both installation and maintenance financially demanding. Frequent power fluctuations and unreliable grid performance compel operators to invest heavily in backup generators, fuel, and energy-management systems, further increasing operational expenses. These rising costs hinder many businesses especially small and mid-sized enterprises from upgrading to modern cold chain solutions or expanding their capacity. Similar to how consumers in premium wellness markets expect advanced, reliable, and customized solutions, industries relying on cold chain services in Bangladesh also demand consistent and high-quality temperature control. However, the high financial burden limits the sector’s ability to adopt innovative, energy-efficient technologies. As a result, the cold chain ecosystem grows more slowly, leading to gaps in quality preservation for key industries such as agriculture, fisheries, and pharmaceuticals. Addressing these cost challenges through technological innovation, efficient facility design, and strategic investment will be crucial for building a robust and competitive cold chain infrastructure in Bangladesh

- The high infrastructure and energy costs in Bangladesh’s cold-chain sector underscore a significant barrier to modernization and expansion. Maintaining temperature-controlled storage, refrigerated transport, and advanced handling systems requires substantial investment and continuous power supply, which many operators find financially challenging. These cost pressures limit the adoption of energy-efficient technologies, reduce overall operational efficiency, and constrain the ability of businesses particularly small and medium-sized enterprises—to scale their operations. As a result, critical sectors such as agriculture, fisheries, and pharmaceuticals face supply chain inefficiencies, post-harvest losses, and compromised product quality. Addressing these challenges through strategic investments, technological innovation, and energy-efficient solutions presents a key opportunity to strengthen the cold-chain ecosystem, enhance food security, and improve market competitiveness, enabling Bangladesh to build a more resilient and reliable supply infrastructure for perishable goods

Bangladesh Cold Chain Market Scope

Bangladesh Cold Chain Market is categorized into ten notable segments which are based on Components, Service Type, Type of Goods/Critical Attribute, Temperature Type, Technology, Payload Size, Operation, Customer Type, Business Model, Distance.

- By components

On the basis of components, the Bangladesh Cold Chain Market is divided into hardware and software segments. In 2026, the hardware segment is expected to dominate the market with 77.99% market share and is expected to reach USD 1,600,774.90 thousand by 2033, growing with the highest CAGR of 8.3% in the forecast period of 2026 to 2033 .

- By service type

On the basis of service type, the Bangladesh Cold Chain Market is segmented into transportation, warehousing and distribution, freight forwarding, others. In 2026, the transportation segment is expected to dominate the market with 44.61% market share and is expected to reach USD 923,402.80 thousand by 2033, growing with the highest CAGR of 8.4% in the forecast period of 2026 to 2033.

- By Type of Goods/Critical Attribute

On the basis of Type of Goods/Critical Attribute, the Bangladesh Cold Chain Market is segmented into Foodstuffs, General Goods, Dangerous Goods (including hazardous chemicals), others. . In 2026, the Foodstuffs segment is expected to dominate the market with 58.28% market share and is expected to reach USD 1,211,747.34 thousand by 2033, growing with the highest CAGR of 8.5% in the forecast period of 2026 to 2033..

- By Temperature Type

On the basis of Temperature Type, the Bangladesh Cold Chain Market is segmented into Chilled, Frozen. In 2026, the Chilled is expected to dominate the market with 58.31% market share and is expected to reach USD 1,201,748.33 thousand by 2033, growing with the highest CAGR of 8.3% in the forecast period of 2026 to 2033.

- By Technology

On the basis of Technology, the Bangladesh Cold Chain Market is segmented into Vapor Compression, Programmable Logic Controller (PLC), Blast Freezing, Cryogenic Systems, Evaporative Cooling, Other. In 2026, Vapor Compression is expected to dominate the market with 41.39% market share and is expected to reach USD 868,525.87 thousand by 2033, growing with the highest CAGR of 8.6% in the forecast period of 2026 to 2033.

- By Payload Size

On the basis of Payload Size, the Bangladesh Cold Chain Market is segmented into Large (32–66 L), Medium (21–29 L), Small (10–17 L), X-Small (3–8 L), Petite (0.9–2.7 L), Others In 2026, the Large (32–66 L) segment is expected to dominate the market with 33.64% market share and is expected to reach USD 703,917.33 thousand by 2033, growing with the highest CAGR of 8.6% in the forecast period of 2026 to 2033.

- By Operation

On the basis of Operation, the Bangladesh Cold Chain Market is segmented into Domestic, International. In 2026, the Domestic segment is expected to dominate the market with 69.67%market share and is expected to reach USD 1,442,073.76 thousand by 2033, growing with the highest CAGR of 8.4% in the forecast period of 2026 to 2033

- By Business Model

On the basis of Business Model, the Bangladesh Cold Chain Market is segmented into Asset-Based Carriers, Brokerage & 3PL, Others. In 2026, the Asset-Based Carriers segment is expected to dominate the market with 61.47% market share and is expected to reach USD 1,261,709.96 thousand by 2033, growing with the highest CAGR of 8.3% in the forecast period of 2026 to 2033

- By Distance

On the basis of Distance, the Bangladesh Cold Chain Market is segmented into 50 – 100 Miles, 101 – 200 Miles, 201 – 500 Miles, More Than 500 Miles. In 2026, the 50 – 100 Miles segment is expected to dominate the market with 41.31% market share and is expected to reach USD 856,096.62 thousand by 2033, growing with the highest CAGR of 8.4% in the forecast period of 2026 to 2033

The Major Market Leaders Operating in the Market Are:

- Yusen Logistics Global Management Co., Ltd. (Japan)

- Transcom Limited (Bangladesh)

- Bangladesh Limited (Nippon Express Holdings) (Bangladesh)

- Bcl Cold Storage Limited (India)

- Nabil Cold Storage (Bangladesh)

- MAYEKAWA MFG. CO., LTD. (Japan)

- AK Cold Storage & Engineering (Bangladesh)

- Tritech (Bangladesh)

- Empire Group (Bangladesh)

- N.M Group Bangladesh (Bangladesh)

- J & Y Group (Bangladesh)

- SS Freight Bangladesh (Bangladesh)

- Transmove (Bangladesh)

- Younus Group (Bangladesh)

- Nazrul Transport Agency (Bangladesh)

- CAPTAINS GROUP Agency (Bangladesh)

- Earnest Engineering Works Ltd. (Bangladesh)

- Alhaj Group of Industries (Bangladesh)

- Badal And Company (Bangladesh)

- DREAMCO EXPRESS PAKISTAN PVT LTD (Bangladesh)

- CONVEYOR GROUP (Bangladesh)

Latest Developments in Bangladesh Cold Chain Market

- In August 2025, the United States announced support for expanding Bangladesh’s temperature-controlled logistics network, focusing on new cold-storage facilities and improved refrigerated transport capacity to reduce post-harvest food losses and strengthen agricultural supply chains.

- In July 2025, cold-storage operators in Bangladesh urged the government to include potatoes in its national food-assistance program, emphasizing the critical role of cold-chain infrastructure in enhancing food security and requesting policy incentives to reduce equipment and operational costs.

- In June 2025, the government, together with international development partners, proposed major investments in potato seed and onion bulb cold-storage units under a public-private partnership model. The initiative aims to expand rural cold-chain capacity, improve seed preservation, and support resilient agricultural production.

- In May 2025, a nationwide capacity assessment revealed that Bangladesh has approximately 2.7 million metric tonnes of existing cold-storage capacity, highlighting a significant shortfall relative to actual demand. The report stressed the need for additional facilities and enhanced refrigerated transport to reduce spoilage and improve farm-to-market efficiency.

- • In April 2025, private sector cold-chain players expanded their refrigerated trucking fleets and integrated logistics services to support the growing demand from modern retail, pharmaceuticals, frozen foods, and export-oriented industries. Market analysts estimated steady growth for the Bangladesh cold-chain market, driven by rising urban consumption and modernization of supply chains.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF BANGLADESH COLD CHAIN MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND APPLICATION

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END USER INDUSTRY COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTE PRODUCTS

4.1.5 INDUSTRY RIVALRY

4.2 VALUE CHAIN ANALYSIS

4.3 NEW BUSINESS AND EMERGING BUSINESS REVENUE OPPORTUNITIES IN THE BANGLADESH COLD CHAIN MARKET

4.4 PENETRATION AND GROWTH PROSPECT MAPPING OF THE BANGLADESH COLD CHAIN MARKET

4.5 COMPANY EVALUATION QUADRANT

4.6 COMPANY COMPARATIVE ANALYSIS

4.7 COMPANY SERVICE PLATFORM MATRIX

4.8 TECHNOLOGY ANALYSIS

5 TARIFF & ITS ANALYSIS

5.1 OVERVIEW OF RELEVANT TARIFFS

5.2 TRADE POLICIES INFLUENCING THE MARKET

5.2.1 TARIFF LEVELS & IMPORT DUTIES

5.2.2 RECENT / PROSPECTIVE POLICY SHIFTS

5.3 COST IMPACT ON STAKEHOLDERS

5.3.1 FOR COLD-CHAIN OPERATORS / INVESTORS

5.3.2 FOR PRODUCERS / FARMERS / AGRO-SUPPLIERS:

5.3.3 FOR CONSUMERS & END-MARKETS (DOMESTIC + EXPORT):

5.4 SUPPLY CHAIN DISRUPTIONS

5.5 STRATEGIC RESPONSE BY OEM

6 REGULATORY STANDARDS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING DEMAND FOR PROCESSED, FROZEN & TEMPERATURE-SENSITIVE FOOD PRODUCTS

7.1.2 EXPANSION OF PHARMACEUTICAL & VACCINE DISTRIBUTIONE

7.2 RESTRIANTS

7.2.1 HIGH INFRASTRUCTURE & ENERGY COSTS

7.2.2 DEPENDENCE ON IMPORTED REFRIGERATION TECHNOLOGY

7.3 OPPORTUNITY

7.3.1 INTEGRATED 3PL COLD‑CHAIN LOGISTICS SERVICES

7.3.2 RAPID GROWTH OF E-COMMERCE, Q-COMMERCE & MODERN RETAIL

7.4 CHALLENGES

7.4.1 UNDERDEVELOPED ROAD LOGISTICS NETWORK

7.4.2 RECENT TARIFF CHANGES & POLITICAL INSTABILITY

8 BANGLADESH COLD CHAIN MARKET, BY COMPONENT.

8.1 OVERVIEW

8.2 BANGLADESH COLD CHAIN MARKET, BY COMPONENT, 2018-2033 (USD THOUSAND)

8.2.1 HARDWARE

8.2.2 SOFTWARE

8.3 BANGLADESH HARDWARE IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.3.1 SENSORS

8.3.2 DATA LOGGERS

8.3.3 GPS DEVICES

8.3.4 TELEMATICS & TELEMETRY DEVICES

8.3.5 NETWORKING DEVICES

8.3.6 RFID DEVICES

8.3.7 OTHERS

8.4 BANGLADESH SENSOR IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.4.1 TEMPERATURE SENSORS

8.4.2 HUMIDITY SENSORS

8.4.3 MOISTURE SENSORS

8.4.4 OTHERS

8.5 BANGLADESH SOFTWARE IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.5.1 ON-PREMISES

8.5.2 CLOUD

8.6 BANGLADESH SOFTWARE IN COLD CHAIN MARKET, BY ORGANIZATION SIZE, 2018-2033 (USD THOUSAND)

8.6.1 LARGE ORGANIZATION SIZE

8.6.2 SMALL & MEDIUM ORGANIZATION SIZE

9 BANGLADESH COLD CHAIN MARKET, BY TYPE OF GOODS/CRITICAL ATTRIBUTE.

9.1 OVERVIEW

9.2 BANGLADESH COLD CHAIN MARKET, BY TYPE OF GOODS/CRITICAL ATTRIBUTE, 2018-2033 (USD THOUSAND)

9.2.1 FOODSTUFFS

9.2.2 GENERAL GOODS

9.2.3 DANGEROUS GOODS (INCLUDING HAZARDOUS CHEMICALS)

9.2.4 OTHERS

9.3 BANGLADESH FOODSTUFFS IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 REFRIGERATED TRANSPORT WITH REFRIGERATION

9.3.2 REFRIGERATED TRANSPORT WITH FREEZING

10 BANGLADESH COLD CHAIN MARKET, BY TEMPERATURE TYPE.

10.1 OVERVIEW

10.2 BANGLADESH COLD CHAIN MARKET, BY TEMPERATURE TYPE, 2018-2033 (USD THOUSAND)

10.2.1 CHILLED

10.2.2 FROZEN

11 BANGLADESH COLD CHAIN MARKET, BY COMPONENT.

11.1 OVERVIEW

11.2 BANGLADESH COLD CHAIN MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

11.2.1 VAPOR COMPRESSION

11.2.2 PROGRAMMABLE LOGIC CONTROLLER (PLC)

11.2.3 BLAST FREEZING

11.2.4 CRYOGENIC SYSTEMS

11.2.5 EVAPORATIVE COOLING

11.2.6 OTHER TECHNOLOGIES

12 BANGLADESH COLD CHAIN MARKET, BY PAYLOAD SIZE.

12.1 OVERVIEW

12.2 BANGLADESH COLD CHAIN MARKET, BY PAYLOAD SIZE, 2018-2033 (USD THOUSAND)

12.2.1 LARGE (32–66 L)

12.2.2 MEDIUM (21–29 L)

12.2.3 SMALL (10–17 L)

12.2.4 X-SMALL (3–8 L)

12.2.5 PETITE (0.9–2.7 L)

12.2.6 OTHERS

12.3 BANGLADESH COLD CHAIN MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

13 BANGLADESH COLD CHAIN MARKET, BY OPERATION.

13.1 OVERVIEW

13.1.1 DOMESTIC

13.1.2 INTERNATIONAL

13.2 BANGLADESH COLD CHAIN MARKET, BY CUSTOMER TYPE, 2018-2033 (USD THOUSAND)

14 BANGLADESH COLD CHAIN MARKET, BY CUSTOMER TYPE.

14.1 OVERVIEW

14.2 B2B

14.3 E-COMMERCE & LAST-MILE DELIVERY

14.4 B2C

15 BANGLADESH COLD CHAIN MARKET, BY BUSINESS MODEL

15.1 OVERVIEW

15.2 BANGLADESH COLD CHAIN MARKET, BY BUSINESS MODEL, 2018-2033 (USD THOUSAND)

15.2.1 ASSET-BASED CARRIERS

15.2.2 BROKERAGE & 3PL

15.2.3 OTHERS

16 BANGLADESH COLD CHAIN MARKET, BY DISTANCE.

16.1 OVERVIEW

16.2 BANGLADESH COLD CHAIN MARKET, BY DISTANCE, 2018-2033 (USD THOUSAND)

16.2.1 50 – 100 MILES

16.2.2 101 – 200 MILES

16.2.3 201 – 500 MILES

16.2.4 MORE THAN 500 MILES

16.3 BANGLADESH COLD CHAIN MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

17 BANGLADESH COLD CHAIN MARKET, BY SERVICE TYPE.

17.1 OVERVIEW

17.1.1 TRANSPORTATION

17.1.2 WAREHOUSING AND DISTRIBUTION

17.1.3 FREIGHT FORWARDING

17.1.4 OTHERS

17.2 BANGLADESH TRANSPORTATION IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.2.1 ROAD

17.2.2 SEA

17.2.3 RAILWAY

17.2.4 AIR

17.2.5 WATERWAYS (INLAND / RIVER TRANSPORT)

17.3 BANGLADESH ROAD IN COLD CHAIN MARKET, BY TYPE OF CARRIER, 2018-2033 (USD THOUSAND)

17.3.1 FULL TRUCKLOAD (FTL)

17.3.2 SPECIALIZED FREIGHT

17.3.3 LESS THAN TRUCKLOAD (LTL)

17.3.4 PARTIAL TRUCKLOAD (PTL)

17.4 BANGLADESH ROAD IN COLD CHAIN MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

17.4.1 LIGHT COMMERCIAL VEHICLE (LCV)

17.4.2 MEDIUM COMMERCIAL VEHICLE (MCV)

17.4.3 HEAVY COMMERCIAL VEHICLE (HCV)

17.5 BANGLADESH ROAD IN COLD CHAIN MARKET, BY TRUCK TYPE, 2018-2033 (USD THOUSAND)

17.5.1 REFRIGERATED TRUCK

17.5.2 TANKER TRUCK

17.5.3 BOX TRUCKS

17.5.4 FLATBEDS TRUCK

17.6 BANGLADESH REFRIGERATED TRUCK IN COLD CHAIN MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

17.6.1 FOOD

17.6.2 PERISHABLE GOODS

17.6.3 MEDICAL SUPPLIES

17.6.4 BEVERAGES

17.6.5 NON-PERISHABLE GOODS

17.6.6 OTHERS

17.7 BANGLADESH PERISHABLE GOODS IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.7.1 FRUITS

17.7.2 VEGETABLES

17.7.3 SEAFOOD

17.7.4 MEAT

17.7.5 OTHERS

17.8 BANGLADESH MEDICAL SUPPLIES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.8.1 VACCINES

17.8.2 PHARMACEUTICALS

17.8.3 BLOOD BANKS

17.8.4 OTHERS

17.9 BANGLADESH BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.9.1 NON-ALCOHOLIC BEVERAGES

17.9.2 ALCOHOLIC BEVERAGES

17.1 BANGLADESH NON-ALCOHOLIC BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.10.1 JUICE BASED BEVERAGES

17.10.2 CARBONATED BEVERAGES

17.10.3 TEA

17.10.4 COFFEE

17.11 BANGLADESH CARBONATED BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.11.1 SPORTS & ENERGY BEVERAGE

17.11.2 CBD INFUSED RTD BEVERAGES

17.11.3 OTHERS

17.12 BANGLADESH ALCOHOLIC BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.12.1 BEER

17.12.2 SPIRITS

17.12.3 WINE

17.13 BANGLADESH NON-PERISHABLE GOODS IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.13.1 FRUITS

17.13.2 VEGETABLES

17.13.3 SEAFOOD

17.13.4 MEAT

17.13.5 OTHERS

17.14 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.14.1 LIQUID TANKERS

17.14.2 DRY BULK TANKERS

17.15 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

17.15.1 MILK

17.15.2 JUICES (BEVERAGES)

17.15.3 CHEMICALS

17.15.4 GASES

17.15.5 FUEL

17.15.6 OTHERS

17.16 BANGLADESH GASES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.16.1 OXYGEN

17.16.2 NITROGEN (LIQUID NITROGEN)

17.16.3 LPG (LIQUEFIED PETROLEUM GAS)

17.16.4 LIQUEFIED BUTANE GAS

17.16.5 HELIUM

17.16.6 PROPANE

17.16.7 OTHERS

17.17 BANGLADESH FUEL IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.17.1 DIESEL

17.17.2 PETROL

17.18 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY CATEGORY, 2018-2033 (USD THOUSAND)

17.18.1 REFRIGERATED

17.18.2 NON-REFRIGERATED

17.19 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY ISOLATION, 2018-2033 (USD THOUSAND)

17.19.1 INSULATED

17.19.2 NON-INSULATED

17.2 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY PRESSURIZED, 2018-2033 (USD THOUSAND)

17.20.1 NON-PRESSURIZED

17.20.2 PRESSURIZED

17.21 BANGLADESH WATERWAYS (INLAND / RIVER TRANSPORT) IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.21.1 FOOD & PERISHABLES

17.21.2 FISHERIES & SEAFOOD

17.21.3 MEDICAL SUPPLIES & VACCINES

17.21.4 OTHERS

17.22 BANGLADESH WAREHOUSING AND DISTRIBUTION IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.22.1 OFF GRID

17.22.2 ON-GRID

17.23 BANGLADESH OFF GRID IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.23.1 SOLAR CHILLERS

17.23.2 MILK COOLERS

17.23.3 SOLAR POWERED COLD BOXES

17.23.4 OTHERS

17.24 BANGLADESH ON-GRID IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

17.24.1 WALK-IN COOLERS

17.24.2 WALK-IN FREEZERS

17.24.3 DEEP FREEZERS

17.24.4 ICE-LINED REFRIGERATORS (ILRS)

18 BANGLADESH COLD CHAIN MARKET

18.1 COMPANY SHARE ANALYSIS: U.S.

19 SWOT ANALYSIS

20 COMAPANY PROFILES

20.1 YUSEN LOGISTICS GLOBAL MANAGEMENT CO., LTD.

20.1.1 COMPANY SNAPSHOT

20.1.2 PRODUCT PORTFOLIO

20.1.3 RECENT DEVELOPMENT

20.2 TRANSCOM LIMITED

20.2.1 COMPANY SNAPSHOT

20.2.2 PRODUCT PORTFOLIO

20.2.3 RECENT DEVELOPMENT

20.3 NIPPON EXPRESS HOLDINGS

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 BCL COLD STORAGE LIMITED

20.4.1 COMPANY SNAPSHOT

20.4.2 PRODUCT PORTFOLIO

20.4.3 RECENT DEVELOPMENT

20.5 NABIL GROUP OF INDUSTRIES

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 RECENT DEVELOPMENT

20.6 AK COLD STORAGE & ENGINEERING.

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 ALHAJ GROUP OF INDUSTRIES

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 BADAL AND COMPANY

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 CAPTAINS GROUP

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 CONVEYOR GROUP

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 DREAMCO EXPRESS

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 EARNEST

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 EMPIRE GROUP

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 J & Y GROUP

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 MAYEKAWA MFG. CO., LTD.

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

20.16 N.M GROUP BANGLADESH

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 NAZRUL TRANSPORT

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENT

20.18 SS FREIGHT BANGLADESH

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 TRANSMOVE

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENT

20.2 TRITECH

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENT

20.21 YOUNUS GROUP

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 TECHNOLOGY MATRIX

TABLE 2 TARIFFS BY HS CODE

TABLE 3 BANGLADESH COLD CHAIN MARKET, BY COMPONENT, 2018-2033 (USD THOUSAND)

TABLE 4 BANGLADESH HARDWARE IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 BANGLADESH SENSOR IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 BANGLADESH SOFTWARE IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 BANGLADESH SOFTWARE IN COLD CHAIN MARKET, BY ORGANIZATION SIZE, 2018-2033 (USD THOUSAND)

TABLE 8 BANGLADESH COLD CHAIN MARKET, BY TYPE OF GOODS/CRITICAL ATTRIBUTE, 2018-2033 (USD THOUSAND)

TABLE 9 BANGLADESH FOODSTUFFS IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 BANGLADESH COLD CHAIN MARKET, BY TEMPERATURE TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 BANGLADESH COLD CHAIN MARKET, BY TECHNOLOGY, 2018-2033 (USD THOUSAND)

TABLE 12 BANGLADESH COLD CHAIN MARKET, BY PAYLOAD SIZE, 2018-2033 (USD THOUSAND)

TABLE 13 BANGLADESH COLD CHAIN MARKET, BY OPERATION, 2018-2033 (USD THOUSAND)

TABLE 14 BANGLADESH COLD CHAIN MARKET, BY CUSTOMER TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 BANGLADESH COLD CHAIN MARKET, BY BUSINESS MODEL, 2018-2033 (USD THOUSAND)

TABLE 16 BANGLADESH COLD CHAIN MARKET, BY DISTANCE, 2018-2033 (USD THOUSAND)

TABLE 17 BANGLADESH COLD CHAIN MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 BANGLADESH TRANSPORTATION IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 BANGLADESH ROAD IN COLD CHAIN MARKET, BY TYPE OF CARRIER, 2018-2033 (USD THOUSAND)

TABLE 20 BANGLADESH ROAD IN COLD CHAIN MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 BANGLADESH ROAD IN COLD CHAIN MARKET, BY TRUCK TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 BANGLADESH REFRIGERATED TRUCK IN COLD CHAIN MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 23 BANGLADESH PERISHABLE GOODS IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 24 BANGLADESH MEDICAL SUPPLIES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 25 BANGLADESH BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 26 BANGLADESH NON-ALCOHOLIC BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 27 BANGLADESH CARBONATED BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 28 BANGLADESH ALCOHOLIC BEVERAGES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 BANGLADESH NON-PERISHABLE GOODS IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 31 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 32 BANGLADESH GASES IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 BANGLADESH FUEL IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY CATEGORY, 2018-2033 (USD THOUSAND)

TABLE 35 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY ISOLATION, 2018-2033 (USD THOUSAND)

TABLE 36 BANGLADESH TANKER TRUCK IN COLD CHAIN MARKET, BY PRESSURIZED, 2018-2033 (USD THOUSAND)

TABLE 37 BANGLADESH WATERWAYS (INLAND / RIVER TRANSPORT) IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 BANGLADESH WAREHOUSING AND DISTRIBUTION IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 BANGLADESH OFF GRID IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 BANGLADESH ON-GRID IN COLD CHAIN MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 BANGLADESH COLD CHAIN MARKET: SEGMENTATION

FIGURE 2 BANGLADESH COLD CHAIN MARKET: DATA TRIANGULATION

FIGURE 3 BANGLADESH COLD CHAIN MARKET: DROC ANALYSIS

FIGURE 4 BANGLADESH COLD CHAIN MARKET: GLOBAL VS REGIONAL ANALYSIS

FIGURE 5 BANGLADESH COLD CHAIN MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BANGLADESH COLD CHAIN MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 BANGLADESH COLD CHAIN MARKET: DBMR MARKET POSITION GRID

FIGURE 8 BANGLADESH COLD CHAIN MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 BANGLADESH COLD CHAIN MARKET: MARKET END USER INDUSTRY COVERAGE GRID…

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 TWO SEGMENTS COMPRISE THE BANGLADESH COLD CHAIN, BY COMPONENTS (2025)

FIGURE 13 BANGLADESH COLD CHAIN MARKET: SEGMENTATION

FIGURE 14 GROWING DEMAND FOR PROCESSED, FROZEN & TEMPERATURE-SENSITIVE FOOD PRODUCTS EXPECTED TO DRIVE THE BANGLADESH COLD CHAIN MARKET IN THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 15 COMPONENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BANGLADESH COLD CHAIN MARKET IN 2026 & 2033

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 FIGURE 1 COMPANY EVALUATION QUADRANT

FIGURE 18 DROC ANALYSIS

FIGURE 19 BANGLADESH COLD CHAIN MARKET, BY PRODUCT, 2025

FIGURE 20 BANGLADESH COLD CHAIN MARKET, BY TYPE OF GOODS/CRITICAL ATTRIBUTE, 2025..

FIGURE 21 BANGLADESH COLD CHAIN MARKET, BY TEMPERATURE TYPE, 2025

FIGURE 22 BANGLADESH COLD CHAIN MARKET, BY PRODUCT, 2025

FIGURE 23 BANGLADESH COLD CHAIN MARKET, BY PAYLOAD SIZE, 2025

FIGURE 24 BANGLADESH COLD CHAIN MARKET, BY OPERATION, 2025

FIGURE 25 BANGLADESH COLD CHAIN MARKET, BY CUSTOMER TYPE, 2025

FIGURE 26 BANGLADESH COLD CHAIN MARKET, BY BUSINESS MODEL, 2025

FIGURE 27 BANGLADESH COLD CHAIN MARKET, BY DISTANCE, 2025

FIGURE 28 BANGLADESH COLD CHAIN MARKET, BY SERVICE TYPE, 2025

FIGURE 29 BANGLADESH COLD CHAIN MARKET: COMPANY SHARE 2025 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.