Bangladesh Fright Forwarding Market

Market Size in USD Billion

CAGR :

%

USD

20.21 Billion

USD

34.65 Billion

2025

2033

USD

20.21 Billion

USD

34.65 Billion

2025

2033

| 2026 –2033 | |

| USD 20.21 Billion | |

| USD 34.65 Billion | |

|

|

|

|

Bangladesh Freight Forwarding Market Size

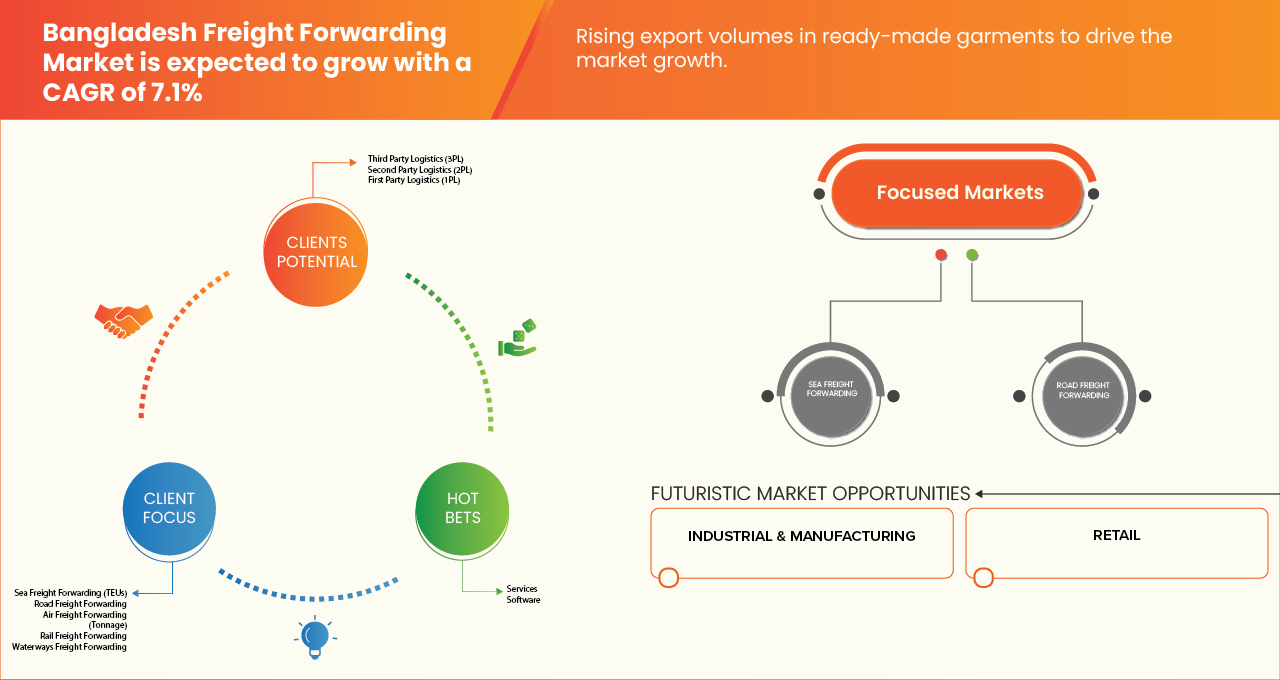

- The Bangladesh Freight Forwarding market is expected to reach USD 34.65 billion by 2033 from USD 20.21 billion in 2025, growing with a substantial CAGR of 7.1% in the forecast period of 2026 to 2033

- The Bangladesh Freight Forwarding market is witnessing strong growth due to increasing global demand, particularly from emerging Asian markets, driven by cost competitiveness, skilled labor availability, and strong export infrastructure.

- Industry expansion is further fuelled by automation in manufacturing, adoption of digital textile solutions, and sustainability initiatives such as eco-friendly fabrics and energy-efficient production processes.

- Government incentives, favorable trade agreements, and foreign direct investments are accelerating factory modernization and compliance with international quality standards. This is positioning Bangladesh one of the significant shareholder for freight forwarding.

- Moreover, rising investments in R&D, diversification into technical and functional shipping, and development of high-value sea transportation are enhancing the country’s export competitiveness and long-term market potential.

Bangladesh Freight Forwarding Market Analysis

- The Bangladesh freight forwarding market is witnessing accelerated growth, driven by rising demand for reliable, energy-efficient, and high-performance temperature-controlled logistics solutions. Freight forwarding systems offer advantages such as reduced product wastage, improved temperature precision, and scalable storage and transport compared to conventional handling methods. Their adoption is increasing across food & beverage (meat, seafood, dairy, fruits & vegetables), pharmaceuticals (vaccines, insulin, biologics), healthcare supplies, and horticulture exports. However, the market still faces challenges related to energy costs, limited rural cold storage penetration, infrastructure gaps, and the need for improved temperature monitoring and operational reliability.

- In 2026, Services is expected to sustain a strong growth trajectory with a share of 91.60%, supported by rising global export orders, increasing demand for affordable fashion and fast-fashion products, and Bangladesh’s competitive production advantages—such as low labor costs, high workforce availability, and an established manufacturing ecosystem. Additionally, the adoption of automation, digital design tools, and sustainable textile practices is enabling higher productivity and compliance with international standards, further reinforcing the dominance of the apparel segment in 2025.

Report Scope and Bangladesh Freight Forwarding Market Segmentation

|

Attributes |

Bangladesh Freight Forwarding Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include regulatory standards, tariff and its analysis, value chain analysis, technology matrix, supply chain analysis, market penetration vs growth prospect matrix, penetration and growth prospect mapping, new business and emerging business’s revenue opportunities & future outlook, import & export data, company comparative analysis, pricing analysis, company evaluation quadrant, porters five forces analysis. |

Bangladesh Freight Forwarding Market Trends

“Digital Transformation and Integrated Logistics Solutions”

- A prominent and accelerating trend in the Bangladesh freight forwarding market is the increasing adoption of digital platforms, automation, and data-driven logistics management to enhance shipment visibility, documentation accuracy, and operational efficiency. Freight forwarders are progressively shifting from manual, paper-based processes to integrated digital systems to manage growing trade volumes

- For instance, leading freight forwarding companies in Bangladesh are implementing cloud-based freight management systems, e-documentation, and real-time cargo tracking solutions to streamline export-import operations, particularly for the ready-made garments (RMG) sector. These digital tools enable faster booking, customs coordination, and shipment monitoring across air, sea, and land routes

- Digital integration allows freight forwarders to optimize route planning, reduce transit delays, and improve coordination with shipping lines, airlines, ports, and customs authorities. For example, automated data analytics platforms help forwarders forecast shipment volumes, manage container availability, and minimize demurrage and detention costs

- The growing use of centralized logistics dashboards enables freight forwarders to manage multiple services—including warehousing, customs clearance, multimodal transport, and last-mile delivery—through a single interface. This creates a more transparent, efficient, and customer-centric logistics ecosystem

- This trend toward technology-enabled, end-to-end logistics solutions is reshaping service expectations in the Bangladesh freight forwarding market. As a result, both local players and international logistics companies are investing in digital freight platforms and integrated supply chain capabilities to gain competitive advantage

- The demand for digitally enabled freight forwarding services is rising rapidly across export-oriented industries, particularly textiles, pharmaceuticals, and consumer goods, as shippers increasingly prioritize speed, cost efficiency, regulatory compliance, and real-time visibility

Bangladesh Freight Forwarding Market Dynamics

Driver

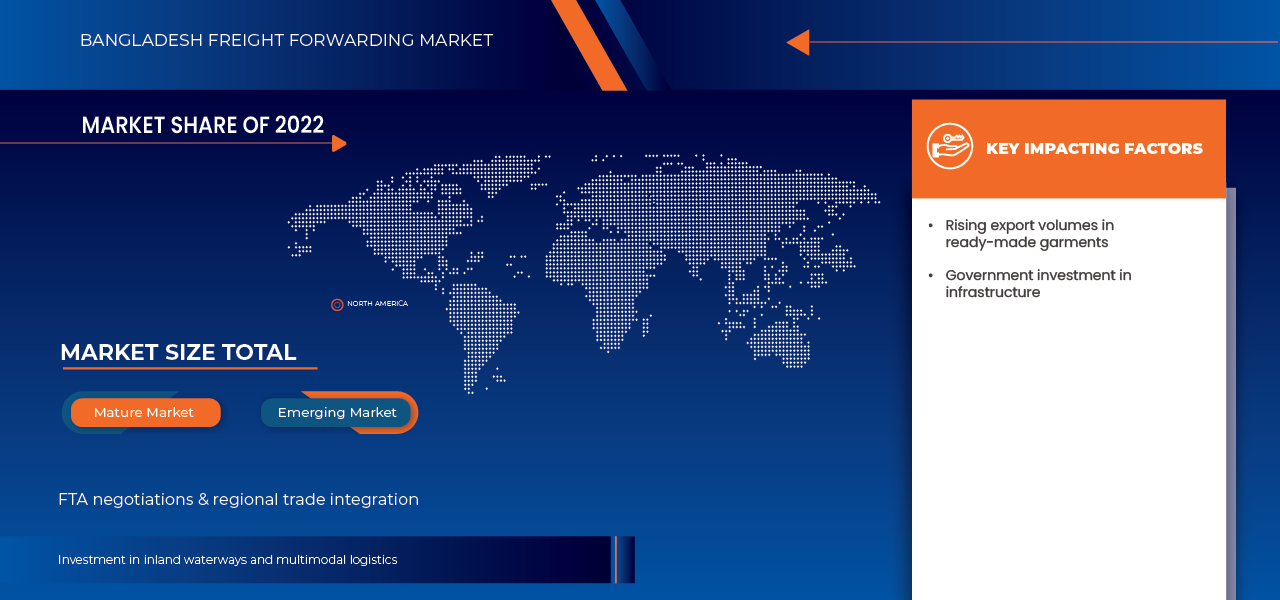

“Growth Driven by Expanding Export Trade and Infrastructure Development”

- The rapid growth of Bangladesh’s export-oriented economy, led by the ready-made garments (RMG) industry, is a major driver fueling demand for freight forwarding services. Rising export volumes to North America, Europe, and Asia continue to increase the need for efficient international logistics and cargo handling solutions

- For instance, ongoing investments in port modernization projects such as the expansion of Chittagong Port and the development of Payra and Matarbari deep-sea ports are expected to significantly enhance cargo handling capacity and reduce congestion. These infrastructure developments are anticipated to boost freight forwarding activities across maritime and multimodal transport

- As international trade volumes increase, freight forwarders play a critical role in managing complex customs procedures, regulatory compliance, and cross-border documentation. Their expertise helps exporters minimize delays, reduce costs, and ensure timely delivery to global markets

- Furthermore, government initiatives to improve road, rail, and inland waterway connectivity are strengthening domestic and cross-border logistics networks, creating new opportunities for freight forwarding companies to offer multimodal and integrated transport solutions

- The growing participation of multinational brands and buyers sourcing from Bangladesh is increasing demand for reliable, scalable, and time-sensitive freight forwarding services. This is particularly important for fast fashion supply chains that require strict adherence to delivery timelines

- The combined impact of export growth, infrastructure investment, and rising global trade integration is expected to remain a key driver supporting sustained expansion of the Bangladesh freight forwarding market during the forecast period

Restraint/Challenge

“Port congestion and operational delays”

- Port congestion and operational delays at major seaports represent a critical structural restraint for the freight forwarding market in Bangladesh. Congestion reduces port throughput, delays vessel berthing and container unloading/loading — all of which drive up transit times, demurrage and storage costs, and erode reliability.

- For forwarders, unpredictable delays and container pile-ups add complexity in scheduling inland transport, customs clearance and onward delivery, undermining their service promise and increasing working capital tied up in port yards and inland container depots (ICDs). Over time, persistent bottlenecks diminish overall competitiveness of Bangladesh’s logistics and freight-forwarding sector, dissuading clients reliant on time-sensitive trade, such as apparel exporters or perishable-goods importers.

- The foregoing instances illustrate that port congestion and operational delays at Bangladesh’s major gateway ports especially Chattogram remain persistent and systemic. Repeated yard over-capacity, inadequate inland container clearance, shortage of lighter vessels or rail/road transport capacity, and intermittent workforce disruptions at customs and handling operations combine to create a fragile and unpredictable supply-chain environment.

- For the freight-forwarding sector, such instability undermines service reliability, inflates demurrage and storage costs, increases turnaround times, ties up working capital, and reduces competitiveness particularly for clients whose supply chains depend on timely delivery. Until infrastructural and institutional reforms significantly improve port operations, congestion and associated delays will continue to restrain growth and efficiency of Bangladesh’s freight-forwarding market.

For Instances,

- In August 2025, The Financial Express noted that around 45,000 TEUs were piled up at Chattogram port yards (out of ~53,000 TEU capacity), with about a dozen container ships anchored outside waiting three to six days - suggesting that port yard over-capacity and berthing delays remain a recurring issue.

- In May 2025, bdnews24.com reported that a pen-down protest by customs officials at Chattogram Port deepened container pile-up, with ships waiting up to six days to dock, despite the port's yard having capacity for 53,518 TEUs.

- In July 2025, The Business Standard reported that about 20 container ships were waiting at outer anchorage for nine days, pointing to vessel backlog as infrastructure limitations (e.g. insufficient gantry cranes, yard space) rather than sheer volume.

Bangladesh Freight Forwarding Market Scope

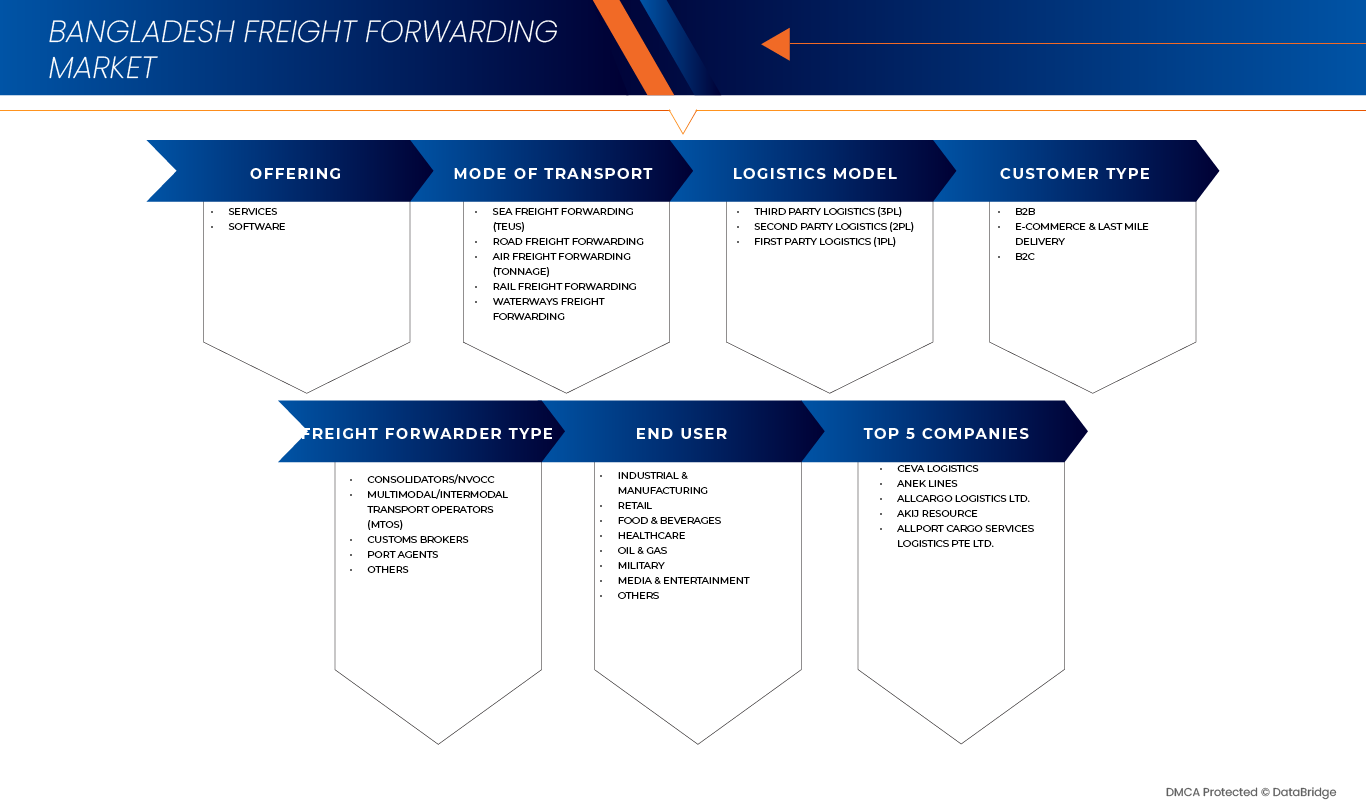

The Bangladesh freight forwarding market is segmented into notable segments based on offering, mode of transport, logistics model, customer type, freight forwarder type, and end user.

- By Offering

On the basis of Offering, the market is segmented into Services and Software

Services segment is expected to dominate the market owing to the country’s heavy reliance on exports, particularly from the Ready-Made Garments (FREIGHT FORWARDING) sector, which necessitates extensive logistics support through large-scale sea and air freight operations. The FREIGHT FORWARDING industry, being a major contributor to national revenue, drives substantial demand for efficient transportation services to ensure timely delivery of goods to international markets. This dependency on freight transport underscores the critical role of shipping and air cargo infrastructure in sustaining export growth and meeting global supply chain requirements..

- By Logistics Model

On the basis of Logistics Model, the market is segmented into Third Party Logistics (3PL), Second Party Logistics (2PL), and First Party Logistics (1PL).

Third-Party Logistics (3PL) segment is expected to dominate the market, driven by strong outsourcing trends among FREIGHT FORWARDING exporters, FMCG companies, retailers, and e-commerce players. These businesses increasingly seek end-to-end logistics solutions to optimize costs, enhance supply chain efficiency, and focus on core operations, fueling the demand for integrated 3PL services across warehousing, transportation, and last-mile delivery.

- By Mode of Transport

On the basis of Mode of Transport, the market is segmented into Sea Freight Forwarding (TEUs), Road Freight Forwarding, Air Freight Forwarding (Tonnage), Rail Freight Forwarding, and Waterways Freight Forwarding

Sea Freight Forwarding (TEUs) segment is expected to dominate the market due to the country’s high-volume apparel exports, which increasingly rely on containerized shipping. This growth is further supported by the expansion of Chattogram and Mongla Port operations, along with improvements in container handling efficiency, enabling faster turnaround times, reduced congestion, and more reliable logistics for international trade. The combined effect of rising export demand and enhanced port infrastructure positions sea freight forwarding as the leading segment in the country’s freight transport landscape.

- By Consumer Type

On the basis of Customer Type, the market is segmented into B2B, E-Commerce & Last Mile Delivery, and B2C.

B2B segment is expected to dominate the market, driven by a strong industrial base, high-volume export manufacturing, and steady demand from key sectors including FREIGHT FORWARDING, textiles, pharmaceuticals, chemicals, and electronics, which collectively require large-scale, reliable logistics and supply chain solutions..

- By Freight Forwarder Type

On the basis of Freight Forwarder Type, the market is segmented into Consolidators/NVOCC, Multimodal/Intermodal Transport Operators (MTOs), Customs Brokers, Port Agents, and Others..

Consolidators/NVOCC segment is expected to dominate, driven by increasing container volumes and the growing demand for LCL (Less-than-Container Load) consolidation services among small and medium-sized exporters seeking cost-effective and efficient shipping solutions..

- By End User

On the basis of End User, the market is segmented into Industrial & Manufacturing, Retail, Food & Beverages, Healthcare, Oil & Gas, Military, Media & Entertainment, and Others.

The Industrial & Manufacturing segment will dominate the Bangladesh Freight Forwarding Market due to the country’s strong export-oriented production base, led by the Ready-Made Garments (FREIGHT FORWARDING) industry which accounts for the majority of Bangladesh’s trade volume. High dependence on international markets, continuous inflow of raw materials (fabrics, machinery, chemicals), and large-scale outbound shipments of finished goods create substantial demand for sea, air, road, rail, and waterways freight services.

Bangladesh Freight Forwarding Market Insight

The Bangladesh freight forwarding market is witnessing robust growth, fueled by the country’s expanding readymade garments (FREIGHT FORWARDING) exports and increasing international trade volumes. Rising demand for efficient, cost-effective logistics solutions, coupled with the need for faster transit times, is driving adoption of third-party logistics (3PL), consolidator/NVOCC services, and advanced supply chain management systems. Investments in port infrastructure, container handling efficiency at Chattogram and Mongla ports, and enhanced digital tracking solutions are accelerating operational efficiency and reliability. Furthermore, growing collaboration between freight forwarders, exporters, shipping lines, and warehousing providers is enabling end-to-end logistics solutions, improving service quality and competitiveness in global markets. These factors collectively position Bangladesh as a key player in regional freight forwarding and global apparel supply chains.

Bangladesh Freight Forwarding Market Share

The Bangladesh Freight Forwarding industry is primarily led by well-established companies, including:

- CEVA Logistics (Switzerland)

- AKIJ Resource (Bangladesh)

- Allport Cargo Services Logistics Pte Ltd. (Singapore)

- ANEK Lines – Acquired by Attica Group (Greece)

- Allcargo Logistics Ltd. (India)

- United Parcel Service of America, Inc. – UPS (U.S.)

- AEx Group (Bangladesh)

- ASF Express (BD) Ltd (Bangladesh)

- Alif International Agency (Bangladesh)

- ALLIED SEA-AIR LOGISTICS LTD (Bangladesh)

- Cargo Distribution Network (BD) Ltd. (Bangladesh)

- AMRA Logistics Ltd. (Bangladesh)

- Fareast Logistics BD Ltd (Bangladesh)

- RK Freight Ltd (Bangladesh)

- Allied Maritime Services (Bangladesh)

- Ambition Inc. (Bangladesh)

- APS Logistics (Bangladesh)

- 2C Shipping (Bangladesh)

- Mars Freight Bangladesh Ltd. (Bangladesh)

- Shams Group of Companies (Bangladesh)

- AEx Cargo Intl. (Bangladesh)

- DSV (Denmark)

- MOL Logistics Co., Ltd. (Japan)

- FedEx (United States)

Latest Developments in Bangladesh Freight Forwarding Market

- In June 2025, DHL has partnered with Daimler Truck and hylane to introduce 30 fully electric Mercedes-Benz eActros 600 trucks under a “transport-as-a-service” model to enhance parcel-center transportation in Germany. The collaboration supports DHL’s sustainability goals by reducing emissions, improving energy efficiency, and integrating advanced electric trucking technology into daily logistics operations. This initiative strengthens DHL’s shift toward greener, more efficient long-haul road transport solutions.

- In May 2025, Kuehne+Nagel has recently entered a lead-logistics provider agreement with Evonik across Asia-Pacific (China, India, Southeast Asia, etc.), managing ~70,000 air, sea, and road shipments annually under an integrated transport-management framework.

- In September 2022, 3i Logistics was named as “One of South Asia’s top sustainable logistics & supply chain solutions providers” under the South Asian Business Excellence Awards 2022 recognizing its performance in project logistics, freight forwarding, transport & supply chain services under challenging conditions (including deliveries during COVID 19).

- In March 2023, A H Khan & Company Ltd. marked a key milestone in its growth by receiving ISO 9001:2015 and ISO 28000:2007 certifications, formally recognizing its commitment to quality management and secure supply chain operations. The certification ceremony was held at Dhaka Club, reflecting the company’s strengthened focus on operational excellence and global standards.

- In 2024, Crown Logistics published company material highlighting efforts to optimise operations, embrace technology and strengthen service quality across warehousing, consolidation and project-cargo handling — underlining a continued emphasis on improving operational efficiency and sustainability in its Bangladesh operations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUN INSIGHT

4.1 PESTEL ANALYSIS

4.2 PRICING ANALYSIS

4.2.1 KEY PRICING DRIVERS

4.2.2 CUSTOMER SEGMENTATION AND PRICE SENSITIVITY

4.2.3 VALUE-ADDED SERVICES AND PREMIUM PRICING

4.2.4 MARKET IMPLICATIONS

4.2.5 CONCLUSION

4.3 CONSUMER BUYING BEHAVIOUR

4.3.1 OVERVIEW OF BUYER PRIORITIES

4.3.2 PRICE SENSITIVITY AND SERVICE EXPECTATIONS

4.3.3 TECHNOLOGY ADOPTION AND DIGITAL PREFERENCES

4.3.4 BRAND LOYALTY AND TRUST FACTORS

4.3.5 DEMAND FOR VALUE-ADDED LOGISTICS SERVICES

4.3.6 CHANGING ENGAGEMENT AND COMMUNICATION CHANNELS

4.4 ECONOMIC ANALYSIS

4.4.1 KEY COMPONENTS OF ECONOMIC ANALYSIS

4.5 ECONOMIC ANALYSIS

4.6 REGIONAL GROWTH OPPORTUNITIES

4.6.1 STRATEGIC GEOGRAPHIC POSITION AS A REGIONAL GATEWAY

4.6.2 DEEP-SEA AND SEAPORT DEVELOPMENTS AS CATALYSTS FOR REGIONAL FLOWS

4.6.2.1 MATARBARI DEEP SEA PORT AND BAY OF BENGAL HUB POTENTIAL

4.6.2.2 CAPACITY EXPANSION AT CHATTOGRAM, MONGLA, AND PAYRA PORTS

4.6.3 INLAND CONNECTIVITY AND MULTIMODAL CORRIDOR DEVELOPMENT

4.6.3.1 DHAKA–CHATTOGRAM–MATARBARI LOGISTICS SPINE

4.6.3.2 DHIRASRAM INLAND CONTAINER DEPOT AND RAIL-BASED FREIGHT EXPANSION

4.6.3.3 INLAND WATERWAYS AND PROTOCOL TRANSIT ROUTES

4.6.4 CROSS-BORDER AND TRANSIT TRADE OPPORTUNITIES

4.6.4.1 BBIN AND SUB-REGIONAL CONNECTIVITY ADVANCEMENTS

4.6.4.2 GATEWAY POTENTIAL FOR NEPAL AND BHUTAN

4.6.5 EMERGING REGIONAL CLUSTER OPPORTUNITIES WITHIN BANGLADESH

4.6.5.1 DHAKA–GAZIPUR–NARAYANGANJ MANUFACTURING BELT

4.6.5.2 CHATTOGRAM–COX’S BAZAR–MATARBARI COASTAL CORRIDOR

4.6.5.3 SOUTHWEST EXPORT CORRIDOR VIA MONGLA AND PADMA BRIDGE

4.7 TECHNOLOGICAL ANALYSIS

4.7.1 OVERVIEW OF TECHNOLOGICAL MATURITY IN FREIGHT FORWARDING

4.7.2 CORE TRADE FACILITATION AND CUSTOMS TECHNOLOGIES

4.7.2.1 BANGLADESH SINGLE WINDOW AND PAPERLESS TRADE SYSTEMS

4.7.2.2 AUTOMATED CUSTOMS RISK MANAGEMENT

4.7.3 PORT AND TERMINAL DIGITALIZATION

4.7.3.1 PORT COMMUNITY SYSTEMS AND TERMINAL OPERATING SYSTEMS

4.7.3.2 TRANSITION TOWARD SMART PORT TECHNOLOGIES

4.7.4 DIGITALIZATION OF FREIGHT FORWARDING OPERATIONS

4.7.4.1 TRANSPORT AND WAREHOUSE MANAGEMENT SYSTEMS

4.7.4.2 ELECTRONIC DATA INTERCHANGE AND CLIENT SYSTEM INTEGRATION

4.8 EMERGING TECHNOLOGIES AND INNOVATION TRENDS

4.8.1.1 DATA ANALYTICS AND PREDICTIVE OPERATIONS

4.8.1.2 INTERNET OF THINGS (IOT) FOR TRACKING AND CONDITION MONITORING

4.8.1.3 AUTOMATION AND ROBOTICS IN PORT-CENTRIC LOGISTICS

4.8.2 TECHNOLOGY IN E-COMMERCE AND LAST-MILE LOGISTICS

4.9 KEY STRATEGIC INITIATIVES

4.9.1 INTEGRATION OF MARITIME, PORT, AND INLAND LOGISTICS SERVICES

4.9.1.1 DEVELOPMENT OF END-TO-END LOGISTICS CAPABILITIES

4.9.1.2 EXPANSION OF PORT-CENTRIC AND DRY-PORT INFRASTRUCTURE

4.9.1.3 COORDINATION OF MULTIMODAL TRANSPORT NETWORKS

4.9.2 EMPHASIS ON MODERNISATION, INNOVATION AND TECHNOLOGY ADOPTION

4.9.2.1 DEPLOYMENT OF DIGITAL LOGISTICS SYSTEMS

4.9.2.2 INTRODUCTION OF INTELLIGENT TRANSPORT AND TRACKING SOLUTIONS

4.9.3 REGIONAL POSITIONING AND HINTERLAND/TRANSSHIPMENT STRATEGY

4.9.3.1 STRATEGIC POSITIONING AS A REGIONAL GATEWAY

4.9.3.2 INVESTMENT IN MULTIMODAL AND PORT-LINKED INFRASTRUCTURE

4.9.3.3 EXPANSION INTO CROSS-BORDER AND TRANSSHIPMENT LOGISTICS

4.9.4 DIVERSIFICATION OF SERVICE PORTFOLIO — FROM BASIC FORWARDING TO VALUE-ADDED LOGISTICS

4.9.4.1 EXPANSION BEYOND TRADITIONAL FORWARDING

4.9.4.2 DEVELOPMENT OF INTEGRATED 3PL AND 4PL SOLUTIONS

4.9.5 ALIGNMENT WITH SUSTAINABILITY AND GLOBAL COMPLIANCE TRENDS

4.9.5.1 EVOLVING TOWARD GREENER LOGISTICS

4.9.5.2 PREPARING FOR INTERNATIONAL COMPLIANCE REQUIREMENTS

4.9.6 CONCLUSION

4.1 CASE STUDY ANALYSIS

4.10.1 CASE STUDY: PORT DIGITALISATION AND ITS IMPACT ON FREIGHT FORWARDING EFFICIENCY

4.10.1.1 BACKGROUND AND STRATEGIC CONTEXT

4.10.1.2 OPERATIONAL CHALLENGES BEFORE CROSS-BORDER INTEGRATION

4.10.1.2.1 LACK OF REAL-TIME OPERATIONAL VISIBILITY

4.10.1.2.2 MANUAL DOCUMENTATION AND PHYSICAL PROCESSING

4.10.1.2.3 INEFFICIENT COORDINATION AMONG STAKEHOLDERS

4.10.1.3 DIGITALIZATION MEASURES INTRODUCED

4.10.1.3.1 DEPLOYMENT OF TERMINAL OPERATING SYSTEMS (TOS)

4.10.1.3.2 INTRODUCTION OF PORT COMMUNITY SYSTEMS (PCS)

4.10.1.3.3 ELECTRONIC GATE PASSES AND DIGITAL CARGO DOCUMENTATIONS

4.10.1.3.4 PARTIAL INTEGRATION WITH CUSTOMS AND SINGLE WINDOW PLATFORMS

4.10.1.4 IMPACT ON FREIGHT FORWARDING EFFICIENCY

4.10.1.4.1 IMPROVED PLANNING AND RESOURCE ALLOCATION

4.10.1.4.2 REDUCTION IN CONTAINER DWELL TIME

4.10.1.4.3 ENHANCED RELIABILITY FOR EXPORT SECTORS

4.10.1.4.4 LOWER OPERATING COSTS AND FEWER ADMINISTRATIVE BURDENS

4.10.1.4.5 STRONGER ALIGNMENT WITH GLOBAL SUPPLY CHAIN STANDARDS

4.10.2 CASE STUDY: CROSS-BORDER LOGISTICS AND REGIONAL MARKET INTEGRATION

4.10.2.1 BACKGROUND & STRATEGIC CONTEXT

4.10.2.2 OPERATIONAL CHALLENGES PRIOR TO CROSS-BORDER INTEGRATION

4.10.2.2.1 REGULATORY COMPLEXITY AND FRAGMENTED DOCUMENTATION

4.10.2.2.2 WEAK BORDER INFRASTRUCTURE AND LIMITED MULTIMODAL CONNECTIVITY

4.10.2.2.3 LIMITED COORDINATION AMONG AGENCIES ACROSS BORDERS

4.10.2.3 STRATEGIC INTERVENTIONS BY LOGISTICS OPERATORS

4.10.2.3.1 FORMATION OF CROSS-BORDER PARTNERSHIPS

4.10.2.3.2 DEPLOYMENT OF DEDICATED DOCUMENTATION SUPPORT TEAMS

4.10.2.3.3 ADOPTION OF MULTIMODAL ROUTING THROUGH RIVER PORTS AND ROAD CORRIDORS

4.10.2.3.4 ALIGNMENT WITH NEW TRANSIT AGREEMENTS

4.10.2.4 KEY OUTCOMES FOR FREIGHT FORWARDING OPERATIONS

4.10.2.4.1 REDUCED TRANSIT TIME AND GREATER PREDICTABILITY

4.10.2.4.2 EXPANSION OF SERVICE PORTFOLIOS

4.10.2.4.3 NEW REVENUE STREAMS AND MARKET PENETRATION

4.10.2.4.4 STRENGTHENING BANGLADESH’S ROLE AS A REGIONAL GATEWAY

4.11 SUPPLY CHAIN ANALYSIS – BANGLADESH FREIGHT FORWARDING MARKET

4.11.1 CUSTOMER BOOKING & CONTRACTING

4.11.2 DOCUMENTATION, COMPLIANCE & CUSTOMS CLEARANCE

4.11.3 INLAND TRANSPORTATION & FIRST-MILE MOVEMENT

4.11.4 PORT OPERATIONS & TERMINAL HANDLING

4.11.5 INTERNATIONAL CARRIAGE (OCEAN & AIR FREIGHT)

4.11.6 WAREHOUSING, DISTRIBUTION & VALUE-ADDED SERVICES

4.11.7 LAST-MILE DELIVERY & IMPORT DISTRIBUTION

4.11.8 DIGITALISATION & TRADE FACILITATION

4.11.9 BOTTLENECKS, RISKS & MITIGATION

5 REGULATORY

5.1 NATIONAL REGULATORY FRAMEWORK

5.2 OPERATIONAL & DOCUMENTATION REQUIREMENTS

5.3 DANGEROUS GOODS, SECURITY & SPECIAL CARGO

5.4 TRADE FACILITATION, RISK MANAGEMENT & DIGITALISATION

5.5 INSTITUTIONAL & INDUSTRY COMPLIANCE PROGRAMMES

5.6 LABOUR, PROFESSIONAL STANDARDS & FINANCIAL COMPLIANCE

5.7 REGULATORY GAPS & MARKET IMPLICATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING EXPORT VOLUMES IN READY-MADE GARMENTS

6.1.2 GOVERNMENT INVESTMENT IN INFRASTRUCTURE

6.1.3 E-COMMERCE & RETAIL GROWTH

6.2 RESTRAINTS

6.2.1 PORT CONGESTION AND OPERATIONAL DELAYS

6.2.2 HIGH LOGISTICS COSTS

6.3 OPPORTUNITIES

6.3.1 FTA NEGOTIATIONS & REGIONAL TRADE INTEGRATION

6.3.2 INVESTMENT IN INLAND WATERWAYS AND MULTIMODAL LOGISTICS

6.4 CHALLENGES

6.4.1 FRAGMENTED FREIGHT FORWARDING MARKET

6.4.2 SKILLED WORKFORCE SHORTAGE

7 BANGLADESH FREIGHT FORWARDING MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SERVICES

7.3 SOFTWARE

8 BANGLADESH FREIGHT FORWARDING MARKET, BY CUSTOMER TYPE

8.1 OVERVIEW

8.2 B2B

8.3 E-COMMERCE & LAST MILE DELIVERY

8.4 B2C

9 BANGLADESH FREIGHT FORWARDING MARKET, BY FREIGHT FORWARD TYPE

9.1 OVERVIEW

9.2 CONSOLIDATORS/NVOCC

9.3 MULTIMODAL/INTERMODAL TRANSPORT OPERATORS (MTOS)

9.4 CUSTOMS BROKERS

9.5 PORT AGENTS

9.6 OTHERS

10 BANGLADESH FREIGHT FORWARDING MARKET, BY LOGISTICS MODEL

10.1 OVERVIEW

10.2 THIRD PARTY LOGISTICS (3PL)

10.3 SECOND PARTY LOGISTICS (2PL)

10.4 FIRST PARTY LOGISTICS (1PL)

11 BANGLADESH FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT

11.1 OVERVIEW

11.2 SEA FREIGHT FORWARDING

11.3 ROAD FREIGHT FORWARDING

11.4 AIR FREIGHT FORWARDING

11.5 RAIL FREIGHT FORWARDING

11.6 WATERWAYS FREIGHT FORWARDING

12 BANGLADESH FREIGHT FORWARDING MARKET, BY END USER

12.1 OVERVIEW

12.2 INDUSTRIAL & MANUFACTURING

12.3 RETAIL

12.4 FOOD & BEVERAGES

12.5 HEALTHCARE

12.6 OIL & GAS

12.7 MILITARY

12.8 MEDIA & ENTERTAINMENT

12.9 OTHERS

13 BANGLADESH FREIGHT FORWARDING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: BANGLADESH

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CEVA LOGISTICS

15.1.1 COMPANY SNAPSHOT

15.1.2 SERVICE PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 ANEK LINES

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 ALLCARGO LOGISTICS LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 AKIJ RESOURCE

15.4.1 COMPANY SNAPSHOT

15.4.2 SERVICE PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 ALLPORT CARGO SERVICES LOGISTICS PTE LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 AEX CARGO INTL.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 AEX GROUP

15.7.1 COMPANY SNAPSHOT

15.7.2 SERVICE PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ALIF INTERNATIONAL AGENCY

15.8.1 COMPANY SNAPSHOT

15.8.2 SERVICE PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 ALLIED MARITIME SERVICES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 ALLIED SEA-AIR LOGISTICS LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 SERVICE PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 AMBITION INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 AMRA LOGISTICS LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 APS LOGISTICS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 ASF EXPRESS (BD) LTD

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 CARGO DISTRIBUTION NETWORK (BD) LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 DSV

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 FAREAST LOGISTICS BD LTD

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 FEDEX

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 MARS FREIGHT BANGLADESH LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 MARVEL FREIGHT LTD.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 MOL LOGISTICS CO., LTD.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 RK FREIGHT LTD

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 SHAMS GROUP OF COMPANIES

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 UNITED PARCEL SERVICE OF AMERICA, INC.

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 SERVICE PORTFOLIO

15.24.4 RECENT DEVELOPMENT

15.25 2C SHIPPING

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 A.H. KHAN & CO.

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

15.27 BADAL & COMPANY

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENT

15.28 BLUE OCEAN FREIGHT SYSTEM LTD.

15.28.1 COMPANY SNAPSHOT

15.28.2 PRODUCT PORTFOLIO

15.28.3 RECENT DEVELOPMENT

15.29 CDZ GLOBAL LOGISTICS LTD.

15.29.1 COMPANY SNAPSHOT

15.29.2 PRODUCT PORTFOLIO

15.29.3 RECENT DEVELOPMENT

15.3 CMX (PVT.) LTD.

15.30.1 COMPANY SNAPSHOT

15.30.2 PRODUCT PORTFOLIO

15.30.3 RECENT DEVELOPMENT

15.31 COMPASS GLOBAL LOGISTICS, LLC

15.31.1 COMPANY SNAPSHOT

15.31.2 PRODUCT PORTFOLIO

15.31.3 RECENT DEVELOPMENT

15.32 CROWN LOGISTICS LTD

15.32.1 COMPANY SNAPSHOT

15.32.2 PRODUCT PORTFOLIO

15.32.3 RECENT DEVELOPMENT

15.33 DB SCHENKER

15.33.1 COMPANY SNAPSHOT

15.33.2 PRODUCT PORTFOLIO

15.33.3 RECENT DEVELOPMENT

15.34 DHAKA LOGISTICS NETWORK

15.34.1 COMPANY SNAPSHOT

15.34.2 PRODUCT PORTFOLIO

15.34.3 RECENT DEVELOPMENT

15.35 DHL GROUP

15.35.1 COMPANY SNAPSHOT

15.35.2 REVENUE ANALYSIS

15.35.3 PRODUCT PORTFOLIO

15.35.4 RECENT DEVELOPMENT

15.36 EAST WEST HOLDINGS LTD. (EWHL)

15.36.1 COMPANY SNAPSHOT

15.36.2 PRODUCT PORTFOLIO

15.36.3 RECENT DEVELOPMENT

15.37 FARAJI LOGISTICS

15.37.1 COMPANY SNAPSHOT

15.37.2 PRODUCT PORTFOLIO

15.37.3 RECENT DEVELOPMENT

15.38 FEEDERLOGISTICS.

15.38.1 COMPANY SNAPSHOT

15.38.2 PRODUCT PORTFOLIO

15.38.3 RECENT DEVELOPMENT

15.39 FLEET FREIGHT

15.39.1 COMPANY SNAPSHOT

15.39.2 PRODUCT PORTFOLIO

15.39.3 RECENT DEVELOPMENT

15.4 FREIGHT CONNECTION INDIA PVT. LTD.

15.40.1 COMPANY SNAPSHOT

15.40.2 PRODUCT PORTFOLIO

15.40.3 RECENT DEVELOPMENT

15.41 FREIGHTWALLA

15.41.1 COMPANY SNAPSHOT

15.41.2 PRODUCT PORTFOLIO

15.41.3 RECENT DEVELOPMENT

15.42 GAC.

15.42.1 COMPANY SNAPSHOT

15.42.2 PRODUCT PORTFOLIO

15.42.3 RECENT DEVELOPMENT

15.43 GEODIS.

15.43.1 COMPANY SNAPSHOT

15.43.2 PRODUCT PORTFOLIO

15.43.3 RECENT DEVELOPMENT

15.44 GLOBAL LOGISTICS SOLUTIONS PVT LTD.

15.44.1 COMPANY SNAPSHOT

15.44.2 PRODUCT PORTFOLIO

15.44.3 RECENT DEVELOPMENT

15.45 GREENLINE LOGISTICS.

15.45.1 COMPANY SNAPSHOT

15.45.2 PRODUCT PORTFOLIO

15.45.3 RECENT DEVELOPMENT

15.46 HUB FREIGHT BANGLADESH

15.46.1 COMPANY SNAPSHOT

15.46.2 PRODUCT PORTFOLIO

15.46.3 RECENT DEVELOPMENT

15.47 INTERTRANS GROUP

15.47.1 COMPANY SNAPSHOT

15.47.2 PRODUCT PORTFOLIO

15.47.3 RECENT DEVELOPMENT

15.48 JB LOGISTICS.

15.48.1 COMPANY SNAPSHOT

15.48.2 PRODUCT PORTFOLIO

15.48.3 RECENT DEVELOPMENT

15.49 JEBSEN & JESSEN PTE LTD.

15.49.1 COMPANY SNAPSHOT

15.49.2 PRODUCT PORTFOLIO

15.49.3 RECENT DEVELOPMENT

15.5 K & S FREIGHT SYSTEMS INC.

15.50.1 COMPANY SNAPSHOT

15.50.2 PRODUCT PORTFOLIO

15.50.3 RECENT DEVELOPMENT

15.51 KHAN BROTHER'S GROUPS.

15.51.1 COMPANY SNAPSHOT

15.51.2 PRODUCT PORTFOLIO

15.51.3 RECENT DEVELOPMENT

15.52 KHIMJI POONJA FREIGHT FORWARDERS PVT. LTD.

15.52.1 COMPANY SNAPSHOT

15.52.2 PRODUCT PORTFOLIO

15.52.3 RECENT DEVELOPMENT

15.53 KUEHNE + NAGEL

15.53.1 COMPANY SNAPSHOT

15.53.2 REVENUE ANALYSIS

15.53.3 PRODUCT PORTFOLIO

15.53.4 RECENT DEVELOPMENT

15.54 MAXPEED

15.54.1 COMPANY SNAPSHOT

15.54.2 PRODUCT PORTFOLIO

15.54.3 RECENT DEVELOPMENT

15.55 MGH

15.55.1 COMPANY SNAPSHOT

15.55.2 PRODUCT PORTFOLIO

15.55.3 RECENT DEVELOPMENT

15.56 MIR LOGISTIC.

15.56.1 COMPANY SNAPSHOT

15.56.2 PRODUCT PORTFOLIO

15.56.3 RECENT DEVELOPMENT

15.57 MULTI FREIGHT LIMITED

15.57.1 COMPANY SNAPSHOT

15.57.2 PRODUCT PORTFOLIO

15.57.3 RECENT DEVELOPMENT

15.58 NABIL GROUP OF INDUSTRIES

15.58.1 COMPANY SNAPSHOT

15.58.2 PRODUCT PORTFOLIO

15.58.3 RECENT DEVELOPMENT

15.59 NAVANA LOGISTICS LTD.

15.59.1 COMPANY SNAPSHOT

15.59.2 PRODUCT PORTFOLIO

15.59.3 RECENT DEVELOPMENT

15.6 NIPPON EXPRESS BANGLADESH LTD.

15.60.1 COMPANY SNAPSHOT

15.60.2 PRODUCT PORTFOLIO

15.60.3 RECENT DEVELOPMENT

15.61 ORIGIN SOLUTIONS LTD.

15.61.1 COMPANY SNAPSHOT

15.61.2 PRODUCT PORTFOLIO

15.61.3 RECENT DEVELOPMENT

15.62 PIONEER LOGISTICS HOLDINGS PTE LTD. .

15.62.1 COMPANY SNAPSHOT

15.62.2 PRODUCT PORTFOLIO

15.62.3 RECENT DEVELOPMENT

15.63 PRIME LOGISTICS LIMITED.

15.63.1 COMPANY SNAPSHOT

15.63.2 PRODUCT PORTFOLIO

15.63.3 RECENT DEVELOPMENT

15.64 QNS GLOBAL GROUP.

15.64.1 COMPANY SNAPSHOT

15.64.2 PRODUCT PORTFOLIO

15.64.3 RECENT DEVELOPMENT

15.65 RAJPAT SHIPPING & LOGISTICS.

15.65.1 COMPANY SNAPSHOT

15.65.2 PRODUCT PORTFOLIO

15.65.3 RECENT DEVELOPMENT

15.66 SEAWAYS FREIGHT LINKS

15.66.1 COMPANY SNAPSHOT

15.66.2 PRODUCT PORTFOLIO

15.66.3 RECENT DEVELOPMENT

15.67 SWIFT FREIGHT INTERNATIONAL LTD.

15.67.1 COMPANY SNAPSHOT

15.67.2 PRODUCT PORTFOLIO

15.67.3 RECENT DEVELOPMENT

15.68 TOWER FREIGHT LOGISTICS LIMITED (TFL)

15.68.1 COMPANY SNAPSHOT

15.68.2 PRODUCT PORTFOLIO

15.68.3 RECENT DEVELOPMENT

15.69 YOUNGONE LOGISTICS

15.69.1 COMPANY SNAPSHOT

15.69.2 PRODUCT PORTFOLIO

15.69.3 RECENT DEVELOPMENT

15.7 3I LOGISTICS GROUP

15.70.1 COMPANY SNAPSHOT

15.70.2 PRODUCT PORTFOLIO

15.70.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 MACROECONOMIC FACTORS

TABLE 2 COMPREHENSIVE ECONOMIC ANALYSIS FOR BANGLADESH FREIGHT FORWARDING MARKET

TABLE 3 BANGLADESH FREIGHT FORWARDING MARKET, BY OFFERING, 2018-2033 (USD THOUSAND)

TABLE 4 BANGLADESH FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 5 BANGLADESH WAREHOUSING IN FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 6 BANGLADESH VALUE-ADDED SERVICES IN FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 BANGLADESH FREIGHT FORWARDING MARKET, BY CUSTOMER TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 BANGLADESH FREIGHT FORWARDING MARKET, BY FREIGHT FORWARD TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 BANGLADESH FREIGHT FORWARDING MARKET, BY LOGISTICS MODEL, 2018-2033 (USD THOUSAND)

TABLE 10 BANGLADESH FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 11 BANGLADESH FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 BANGLADESH FREIGHT FORWARDING MARKET, BY END USER, 2018-2033 (USD THOUSAND)

TABLE 13 BANGLADESH INDUSTRIAL & MANUFACTURING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 BANGLADESH READY-MADE GARMENTS (RMGS) IN FREIGHT FORWARDING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 BANGLADESH READY-MADE GARMENTS (RMGS) IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 16 BANGLADESH RETAIL IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 17 BANGLADESH FOOD & BEVERAGES IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 18 BANGLADESH HEALTHCARE IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 19 BANGLADESH OIL & GAS IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 20 BANGLADESH MILITARY IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 21 BANGLADESH MEDIA & TRANSPORT IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

TABLE 22 BANGLADESH OTHERS IN FREIGHT FORWARDING MARKET, BY MODE OF TRANSPORT, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 BANGLADESH FREIGHT FORWARDING MARKET

FIGURE 2 BANGLADESH FREIGHT FORWARDING MARKET: DATA TRIANGULATION

FIGURE 3 BANGLADESH FREIGHT FORWARDING MARKET: DROC ANALYSIS

FIGURE 4 BANGLADESH FREIGHT FORWARDING MARKET: COUNTRYWISE MARKET ANALYSIS

FIGURE 5 BANGLADESH FREIGHT FORWARDING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BANGLADESH FREIGHT FORWARDING MARKET: MULTIVARIATE MODELLING

FIGURE 7 BANGLADESH FREIGHT FORWARDING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 BANGLADESH FREIGHT FORWARDING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 BANGLADESH FREIGHT FORWARDING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 STRATEGIC DECISIONS

FIGURE 12 TWO SEGMENTS COMPRISE THE BANGLADESH FREIGHT FORWARDING MARKET, BY OFFERING (2025)

FIGURE 13 BANGLADESH FREIGHT FORWARDING MARKET: SEGMENTATION

FIGURE 14 GOVERNMENT INVESTMENT IN INFRASTRUCTURE, E-COMMERCE & RETAIL IS EXPECTED TO DRIVE THE BANGLADESH FREIGHT FORWARDING MARKET IN THE FORECAST PERIOD

FIGURE 15 THE SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BANGLADESH FREIGHT FORWARDING MARKET IN 2026 AND 2033

FIGURE 16 DROC ANALYSIS

FIGURE 17 BANGLADESH FREIGHT FORWARDING MARKET: BY OFFERING, 2025

FIGURE 18 BANGLADESH FREIGHT FORWARDING MARKET: BY CUSTOMER TYPE, 2025

FIGURE 19 BANGLADESH FREIGHT FORWARDING MARKET: BY FREIGHT FORWARD TYPE, 2025

FIGURE 20 BANGLADESH FREIGHT FORWARDING MARKET: BY LOGISTICS MODEL, 2025

FIGURE 21 BANGLADESH FREIGHT FORWARDING MARKET: BY MODE OF TRANSPORT, 2025

FIGURE 22 BANGLADESH FREIGHT FORWARDING MARKET: BY END USER, 2025

FIGURE 23 BANGLADESH FREIGHT FORWARDING MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.