Bangladesh Ready Made Garments Market

Market Size in USD Billion

CAGR :

%

USD

3.08 Billion

USD

4.71 Billion

2025

2033

USD

3.08 Billion

USD

4.71 Billion

2025

2033

| 2026 –2033 | |

| USD 3.08 Billion | |

| USD 4.71 Billion | |

|

|

|

|

Bangladesh Ready Made Garments Market Size

- The Bangladesh Ready Made Garments market is expected to reach USD 4.71 billion by 2033 from USD 3.08 billion in 2025, growing with a substantial CAGR of 5.5% in the forecast period of 2026 to 2033

- The Bangladesh RMG market is witnessing strong growth due to increasing global demand, particularly from North America, Europe, and emerging Asian markets, driven by cost competitiveness, skilled labor availability, and strong export infrastructure.

- Industry expansion is further fuelled by automation in manufacturing, adoption of digital textile solutions, and sustainability initiatives such as eco-friendly fabrics and energy-efficient production processes.

- Government incentives, favorable trade agreements, and foreign direct investments are accelerating factory modernization and compliance with international quality standards. This is positioning Bangladesh as one of the world’s leading hubs for ready-made garment manufacturing.

- Moreover, rising investments in R&D, diversification into technical and functional textiles, and development of high-value apparel segments (sportswear, medical textiles, smart clothing) are enhancing the country’s export competitiveness and long-term market potential.

Bangladesh Ready Made Garments Market Analysis

- In 2025, Apparel is expected to sustain a strong growth trajectory with a share of 93.28%, supported by rising global export orders, increasing demand for affordable fashion and fast-fashion products, and Bangladesh’s competitive production advantages—such as low labor costs, high workforce availability, and an established manufacturing ecosystem. Additionally, the adoption of automation, digital design tools, and sustainable textile practices is enabling higher productivity and compliance with international standards, further reinforcing the dominance of the apparel segment in 2025.

Report Scope and Bangladesh Ready Made Garments Market Segmentation

|

Attributes |

Bangladesh Ready Made Garments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include regulatory standards, tariff and its analysis, value chain analysis, technology matrix, supply chain analysis, market penetration vs growth prospect matrix, penetration and growth prospect mapping, new business and emerging business’s revenue opportunities & future outlook, import & export data, company comparative analysis, pricing analysis, company evaluation quadrant, porters five forces analysis. |

Bangladesh Ready Made Garments Market Dynamics

Driver

“Competitive Labor Costs and A Large Workforce Support High-Volume Apparel Production”

- Bangladesh’s Ready-Made Garments (RMG) sector continues to strengthen its position as one of the world’s leading apparel manufacturing hubs, largely due to its competitive labor costs and the availability of a sizable, skilled workforce. With over four million workers employed in the industry—most of them women—the sector benefits from a stable labor supply that supports mass production, fast order fulfillment, and the scalability required for global buyers. This labor advantage has enabled Bangladesh to consistently maintain lower production expenses compared to competing markets such as Vietnam, India, and China, making the country a preferred destination for brands seeking cost-efficient sourcing without compromising quality.

- The presence of a young demographic and continuous employment generation further reinforce the industry’s growth potential. Over the last decade, Bangladesh has worked to improve worker training systems, upgrade industrial zones, and increase labor compliance standards, resulting in a more productive and reliable workforce. International retailers increasingly favor Bangladesh for bulk orders of knitwear and woven garments because the workforce is accustomed to large-scale operations and standardized production processes.

- Moreover, national policies focused on labor development and industrial expansion enhance the country’s competitive edge. Government-led training programs, skill enhancement centers, and collaboration with global organizations have helped strengthen worker capabilities, enabling more efficient handling of complex manufacturing tasks. These initiatives contribute to higher output levels, improved product quality, and reduced lead times—key factors that global buyers consider when selecting suppliers.

For Instances

- In December 2023, a World Bank publication noted that Bangladesh’s demographic composition—with a large portion of the population under the age of 35—supports a continuous pipeline of new labor entrants, ensuring long-term workforce sustainability for the apparel industry

- In January 2025, findings from the International Labour Organization (ILO) emphasized that ongoing skill-development programs in Bangladesh’s garment factories have improved sewing efficiency and reduced production errors, directly enhancing productivity and export readiness.

- In November 2024, a report by the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) highlighted that the RMG sector employs over four million workers and remains one of the world’s most cost-competitive apparel manufacturing bases, significantly strengthening export competitiveness.

Opportunities

“Rising Global Preference for Sustainable And Ethically Produced Garments Opens Premium Market Segments”

- The global apparel industry is undergoing a significant transformation driven by increasing consumer awareness about environmental sustainability, ethical sourcing, and responsible manufacturing practices. Buyers in key markets such as the EU, US, and Japan are actively prioritizing brands that demonstrate transparency, reduce carbon footprints, ensure worker welfare, and adopt eco-friendly production technologies. This shift is reshaping global sourcing patterns and creating substantial opportunities for countries capable of meeting these elevated standards. For Bangladesh—one of the largest exporters of ready-made garments—this trend presents a powerful opportunity to reposition itself in higher-value, sustainability-driven market segments.

- International buyers are responding positively to these improvements. Major global retailers and fashion brands are now integrating sustainability metrics into their supplier selection processes, and many view Bangladesh as an emerging leader in responsible production. This shift enables Bangladeshi manufacturers to access premium and niche market segments, such as organic cotton apparel, recycled polyester clothing, low-impact denim, and circular-fashion collections. These product categories typically command higher prices and longer-term sourcing commitments—strengthening the industry's export resilience.

- Moreover, evolving regulatory frameworks in Western markets are accelerating this opportunity. New EU laws on due diligence, carbon footprint reporting, and traceability require brands to partner with factories that maintain high environmental and social standards. Bangladeshi factories that have already adopted cleaner technologies, digital compliance systems, and transparent supply-chain mechanisms are well-positioned to benefit from this regulatory shift.

For Instances,

- In February 2024, an article published by LightCastle Partners reported that major global brands such as H&M, Zara, and Nike expanded sourcing from Bangladeshi factories that implemented waterless dyeing technologies and waste-reduction systems, reflecting increased buyer confidence in sustainable production capabilities

- In August 2025, an article by SAGE Publications highlighted that rising export orders for recycled polyester blends and eco-friendly denim from Bangladesh, driven by shifts in EU and US consumer demand for low-impact garments

Restraint/Challenge

“Dependence On Imported Raw Materials Like Cotton and Specialty Fabrics Increases Production Costs and Lead Times”

- Bangladesh’s Ready-Made Garments (RMG) sector, despite being one of the world’s largest apparel exporters, remains heavily dependent on imported raw materials—particularly raw cotton, man-made fibers (MMF), and specialized fabrics used in high-value apparel segments. This structural reliance creates significant vulnerabilities in production planning, cost management, and lead-time optimization. While the country has a strong textile base for basic knitwear, it still imports the majority of its woven fabrics and almost all high-performance, synthetic, and technical textiles essential for diversifying its product portfolio.

- The global cotton market is highly volatile, influenced by supply fluctuations, weather disruptions, trade restrictions, and price instability. Since Bangladesh is the second-largest cotton importer globally, any change in international cotton prices or freight rates has an immediate impact on its garment production costs. Similarly, producers of sportswear, outerwear, lingerie, and blended fabrics rely on specialty textiles sourced mainly from China, India, and Indonesia. Dependence on foreign suppliers for these inputs increases exposure to geopolitical tensions, shipping delays, and currency fluctuations—all of which disrupt supply chain continuity.

- Longer raw-material procurement cycles also extend lead times, a critical issue in an industry where global buyers demand fast turnaround and just-in-time delivery. When mills and factories face delays in receiving fabric shipments, they struggle to maintain production schedules, often forcing them to airfreight materials at higher costs or negotiate extended delivery windows—both of which affect profitability and buyer satisfaction. Lead-time challenges become even more acute during peak seasons or global disruptions such as port congestion, container shortages, or sudden policy shifts in exporting countries.

- Moreover, the dependency on imports limits Bangladesh’s ability to fully transition into high-value apparel categories. The lack of sufficient domestic capability in producing synthetic fibers, elastane, functional fabrics, and advanced finishes prevents local manufacturers from scaling production in rapidly growing segments like activewear and performance clothing. As a result, factories often have to import small batches of specialty fabrics at higher unit costs, reducing price competitiveness compared with countries that have integrated textile supply chains, such as China, Vietnam, and India.

For Instances,

- In November 2025, findings from The Financial Express highlighted that Bangladesh imports nearly 100% of its raw cotton, making the sector highly exposed to global price volatility and shipping constraints

- In October 2025, BGMEA report noted that more than 70% of woven fabrics used by local garment factories are sourced from foreign suppliers, significantly increasing lead times and input costs

- In July 2025, Indian Textile Journal reported that fluctuations in global freight charges and exchange rates raised fabric and raw material import costs, tightening margins for apparel exporters.

Bangladesh Ready Made Garments Market Scope

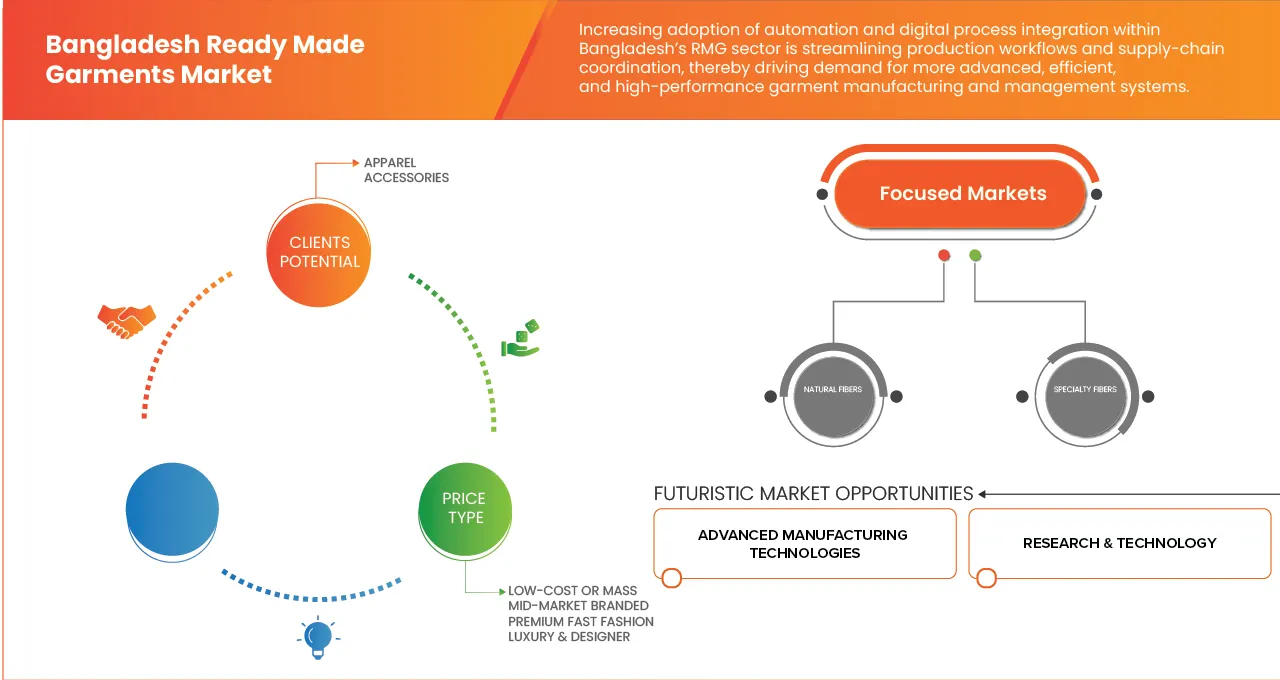

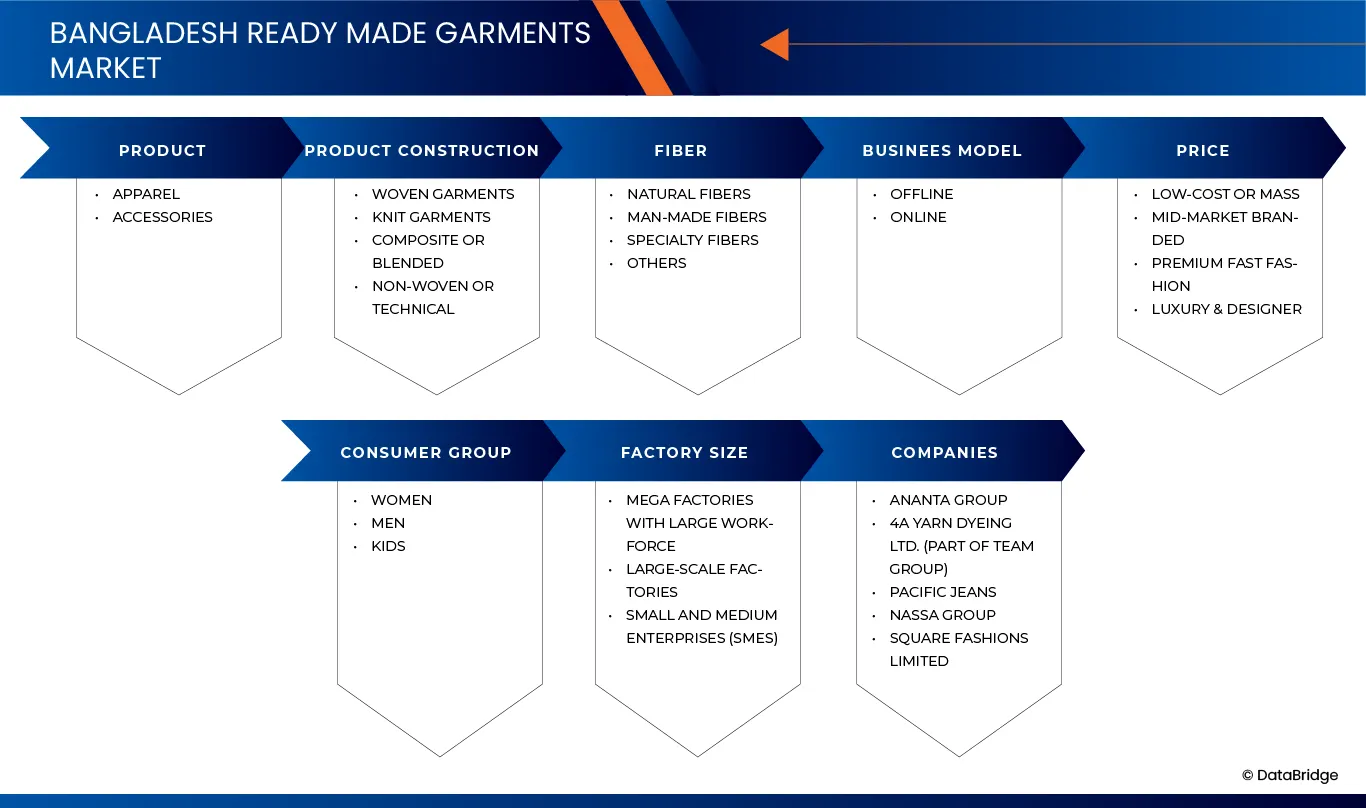

The bangladesh readymade garments market is segmented into seven notable segments based on the product type, product construction, fiber type, business model, price, consumer group and factory size.

- By Product

On the basis of product, the market is segmented into Apparel and Accessories.

The apparels segment is expected to dominate the Bangladesh readymade garments market due to its strong export-driven industry structure, large-scale manufacturing capacity, competitive labor costs, and established global buyer networks. Additionally, continuous investment in technology, compliance standards, and product diversification strengthens Bangladesh’s position as a leading apparel sourcing hub.

- By Product Construction

On the basis of Product Construction, the market is segmented into woven garments, knit garments, composite or blended, non-woven or technical. and vitamins. The woven garments segment is expected to dominate the Bangladesh readymade garments market due to its extensive production capacity, strong global demand for shirts, trousers, and formal wear, and Bangladesh’s established specialization in woven apparel manufacturing. Competitive labor costs, compliance improvements, and long-term partnerships with international brands further strengthen its dominance.

- By Fiber

On the basis of fiber, the Bangladesh Readymade Garments Market is segmented into natural fibers, man-made fibers, specialty fibers and others.

The natural fibers segment is anticipated to dominate the Bangladesh readymade garments market due to the country’s strong reliance on cotton-based apparel, high global demand for breathable and sustainable textiles, and the increasing consumer preference for eco-friendly clothing. Bangladesh’s established cotton garment manufacturing ecosystem further boosts this segment’s growth.\.

- By Business Model

On the basis of business model, the Bangladesh Readymade Garments Market is segmented into offline and online.

The offline segment is anticipated to dominate the Bangladesh readymade garments market due to the strong presence of traditional retail stores, consumer preference for physical shopping experiences, and the widespread availability of branded and unbranded apparel outlets. Additionally, limited digital penetration in rural areas continues to support offline retail dominance.

- By Price

On the basis of price, the Bangladesh Readymade Garments Market is segmented into Low Cost or Mass, Mid-Market Branded, Premium Fast Fashion and Luxury and Designer.

The low-cost or mass segment is anticipated to dominate the Bangladesh readymade garments market due to the country’s price-competitive manufacturing structure, high demand for affordable apparel among a large consumer base, and strong production efficiency. Bangladesh’s ability to offer quality garments at low prices continues to drive mass-market dominance.

- By Consumer Group

On the basis of consumer group, the market is segmented into Women, Men and Kids.

The women segment is anticipated to dominate the Bangladesh readymade garments market due to rising female workforce participation, increasing demand for diverse fashion categories, and strong growth in ethnic, casual, and formal wear. Expanding urbanization, higher disposable income among women, and a surge in trend-driven purchases further support this segment’s dominance.

- By Factory Size

On the basis of factory size, the market is segmented into Mega Factories with Large Workforce, Large-Scale Factories and Small and Medium Enterprises.

The mega factories with large workforce segment is anticipated to dominate the Bangladesh readymade garments market due to their high production capacity, ability to handle bulk export orders, and strong compliance with international standards. These large-scale units offer competitive pricing, efficient turnaround times, and advanced infrastructure, making them preferred partners for global apparel brands.

Bangladesh Readymade Garments Market Insight

The Bangladesh readymade garments (RMG) market remains one of the world’s most competitive and export-driven apparel industries, supported by low production costs, a skilled workforce, and strong government backing. The sector contributes significantly to national GDP and accounts for the majority of export earnings. Demand is driven by large global fashion retailers sourcing knitwear, woven wear, and value-added apparel from Bangladesh due to consistent quality and competitive pricing. The market is witnessing rising investments in technology, sustainability, and compliance to meet evolving international standards. Mega factories with large workforces dominate production due to their scale, efficiency, and ability to manage bulk orders. Domestically, women’s apparel, natural fibers, and low-cost mass categories hold strong demand due to affordability and shifting lifestyle trends. Despite challenges such as fluctuating raw material prices and compliance pressures, Bangladesh continues to strengthen its position as a global apparel manufacturing hub with growing diversification and export opportunities..

Bangladesh Readymade Garments Market Share

The Readymade garments industry is primarily led by well-established companies, including:

- Ananta Group (Bangladesh)

- Asian Apparels Ltd. (Bangladesh)

- Pacific Jeans (Bangladesh)

- Bitopi Group (Bangladesh)

- Fakir Apparels Ltd. (Bangladesh)

- NASSA Group (Bangladesh)

- Square Fashions Limited (Bangladesh)

- STERLING GROUP (Bangladesh)

- 4A Yarn Dyeing Ltd. (Part of Team Group) (Bangladesh)

- Envoy Group (Bangladesh)

- EPYLLION GROUP (Bangladesh)

- BLUE DREAM GROUP (Bangladesh)

- PRIDE GROUP (Bangladesh)

- Poshgarments (Bangladesh)

- Partex Group (Bangladesh)

Latest Developments in Bangladesh Readymade Garments Market

- In October 2023, Ananta Group entered a strategic alliance with NTX to launch a “Factory of the Future” in Bangladesh — a next-generation textile plant designed to combine cutting-edge fabric dyeing and printing technologies with sustainable water and energy management and full digitalization. The facility will support Ananta’s wide apparel portfolio — from denim, activewear, and outerwear to intimates and knitwear — backed by backward integration for synthetic and man-made-fibre products.

- In October, Pacific Jeans Group reopened seven factories in Chattogram Export Processing Zone after a week-long closure caused by worker unrest and safety concerns. The shutdown had involved protests, injuries, and dismissal of 421 workers linked to the disturbances. Security forces were deployed to maintain order, ensuring a stable environment for resuming full-scale denim production and operations

- Anlima Yarn Dyeing reaffirmed its core business model — supplying dyed yarns and high-tenacity sewing thread under the brand “AN Thread” to knit & woven textile industries and export-oriented garment factories, underscoring its role as a key upstream supplier in Bangladesh’s textile value chain..

- Bitopi signed a Memorandum of Understanding with the BYETS project to implement workplace-based reskilling and upskilling in two of its RMG factories (including its own factory under Bitopi), aiming to improve workforce skills and productivity

- After a period of temporary shutdown due to external protest related disruptions in Bangladesh, Bitopi Group confirmed that its factories (including its EPZ units) resumed full production and employee presence returned to normal.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF BANGLADESH READY-MADE GARMENTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 GEOGRAPHIC SCOPE

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 DBMR MARKET SWOT MODEL

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES ANALYSIS

4.2 COMPANY EVALUATION QUADRANT

4.3 PRICING ANALYSIS

4.4 COMPANY COMPARATIVE ANALYSIS

4.5 IMPORT & EXPORT DATA

4.5.1 TYPE OF PRODUCTS EXPORTED / EXPORT COMPOSITION

4.5.2 IMPORTS (RAW MATERIALS & INPUTS FOR READY MADE GARMENTS)

4.5.3 NET EXPORT EARNINGS

4.5.4 SOURCES

4.5.5 LOGISTIC PROCESS & KEY PORTS / OTHERS

4.5.6 RECENT TRENDS AND HIGHLIGHTS

4.6 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES & FUTURE OUTLOOK

4.7 PENETRATION AND GROWTH PROSPECT MAPPING

4.7.1 MARKET PENETRATION STATUS (CURRENT POSITIONING)

4.7.1.1 GLOBAL MARKET POSITION

4.7.2 BUYER SEGMENT PENETRATION

4.7.3 PRODUCT CATEGORY PENETRATION

4.7.4 GROWTH PROSPECT MAPPING (OPPORTUNITY HOTSPOTS)

4.7.5 GROWTH BY PRODUCT CATEGORY

4.7.5.1 STRONGEST GROWTH AREAS (SHORT–MEDIUM TERM)

4.7.5.2 HIGH-POTENTIAL (MEDIUM–LONG TERM)

4.7.5.3 TRANSFORMATIONAL GROWTH (LONG TERM)

4.7.6 GROWTH BY VALUE-CHAIN SEGMENT

4.7.6.1 UPSTREAM: TEXTILE & RAW MATERIALS

4.7.6.2 MIDSTREAM: GARMENT MANUFACTURING

4.7.6.3 DOWNSTREAM: BRANDING, PACKAGING, LOGISTICS

4.8 MARKET PENETRATION VS. GROWTH PROSPECT MATRIX

4.8.1 QUADRANT A — HIGH PENETRATION | HIGH GROWTH

4.8.2 QUADRANT B — LOW PENETRATION | HIGH GROWTH

4.8.3 QUADRANT C — HIGH PENETRATION | LOW GROWTH

4.8.4 QUADRANT D — LOW PENETRATION | LOW GROWTH

4.8.5 STRATEGIC IMPLICATIONS FOR BANGLADESH RMG

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 RAW MATERIAL SOURCING

4.9.3 MANUFACTURING & PROCESSING

4.9.4 LOGISTICS & DISTRIBUTION

4.9.5 END-USE & MARKET DEMAND

4.9.6 CHALLENGES & FUTURE OUTLOOK

4.1 TECHNOLOGY MATRIX

4.11 VALUE CHAIN ANALYSIS

4.11.1 RAW MATERIALS AND INPUTS

4.11.2 PROCESSING / TEXTILE MILLS

4.11.3 GARMENT MANUFACTURING

4.11.4 SUPPORT SERVICES / BACKWARD LINKAGES

4.11.5 EXPORT LOGISTICS

4.11.6 MARKETS & BUYERS

4.11.7 REGULATORY / INSTITUTIONAL ENVIRONMENT

4.11.8 CONCLUSION

5 TARIFF AND ITS ANALYSIS – BANGLADESH READY-MADE GARMENTS (RMG) MARKET

5.1 OVERVIEW OF RELEVANT TARIFFS

5.2 TRADE POLICIES INFLUENCING THE MARKET

5.3 COST IMPACT ON STAKEHOLDERS

5.3.1 IMPACT ON EXPORT-ORIENTED MANUFACTURERS

5.3.2 IMPACT ON INTERNATIONAL BUYERS AND GLOBAL BRANDS

5.3.3 IMPACT ON DOMESTIC TEXTILE AND UPSTREAM SUPPLIERS

5.3.4 IMPACT ON LOGISTICS PROVIDERS AND FREIGHT OPERATORS

5.4 SUPPLY CHAIN DISRUPTIONS

5.5 STRATEGIC RESPONSE BY OEM

6 REGULATORY STANDARDS – BANGLADESH READY MADE GARMENTS MARKET

6.1 NATIONAL REGULATORY FRAMEWORK

6.1.1 LABOUR LAWS & WORKER RIGHTS

6.1.2 FACTORY SAFETY & BUILDING COMPLIANCE

6.1.3 ENVIRONMENTAL & CHEMICAL STANDARDS

6.1.4 SOCIAL COMPLIANCE MANDATES

6.2 INDUSTRY & INSTITUTIONAL COMPLIANCE PROGRAMS

6.2.1 BGMEA & BKMEA COMPLIANCE STANDARDS

6.2.2 RMG SUSTAINABILITY COUNCIL (RSC)

6.3 INTERNATIONAL BUYER-DRIVEN STANDARDS

6.3.1 SOCIAL & ETHICAL STANDARDS (CSR)

6.3.2 FACTORY AUDIT STANDARDS

6.4 ENVIRONMENTAL & SUSTAINABILITY STANDARDS

6.4.1 INTERNATIONAL CERTIFICATIONS

6.4.2 CHEMICAL MANAGEMENT

6.5 TRADE, EXPORT & CUSTOMS REGULATIONS

6.5.1 EXPORT RULES

6.5.2 CUSTOMS & TRADE FACILITATION

6.5.3 INTERNATIONAL TRADE REQUIREMENTS

6.6 INTERNATIONAL LABOR & HUMAN RIGHTS COMPLIANCE

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 COMPETITIVE LABOR COSTS AND A LARGE WORKFORCE SUPPORT HIGH-VOLUME APPAREL PRODUCTION

7.1.2 STRONG EXPORT DEMAND FROM MAJOR MARKETS SUCH AS THE EU AND US DRIVES CONTINUOUS EXPANSION

7.1.3 GOVERNMENT INCENTIVES, POLICY SUPPORT, AND IMPROVED INFRASTRUCTURE ENHANCE MANUFACTURING EFFICIENCY

7.2 RESTRAINTS

7.2.1 DEPENDENCE ON IMPORTED RAW MATERIALS LIKE COTTON AND SPECIALTY FABRICS INCREASES PRODUCTION COSTS AND LEAD TIMES

7.2.2 LIMITED PRODUCT AND TECHNOLOGICAL DIVERSIFICATION RESTRICT MOVEMENT INTO HIGHER-VALUE SEGMENTS

7.3 OPPORTUNITIES

7.3.1 RISING GLOBAL PREFERENCE FOR SUSTAINABLE AND ETHICALLY PRODUCED GARMENTS OPENS PREMIUM MARKET SEGMENTS

7.3.2 EXPANSION INTO HIGH-VALUE CATEGORIES SUCH AS ACTIVEWEAR, OUTERWEAR, AND TECHNICAL TEXTILES BOOSTS VALUE-ADDITION

7.3.3 ADOPTION OF AUTOMATION, DIGITAL MANUFACTURING, AND ADVANCED SKILLS TRAINING IMPROVES PRODUCTIVITY

7.4 CHALLENGES

7.4.1 INCREASING COMPLIANCE REQUIREMENTS RELATED TO LABOR RIGHTS, ENVIRONMENTAL STANDARDS, AND SUPPLY CHAIN TRANSPARENCY

7.4.2 CLIMATE-RELATED RISKS SUCH AS FLOODS, CYCLONES, AND RISING TEMPERATURES THREATEN PRODUCTION CONTINUITY

8 BANGLADESH READY MADE GARMENTS MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 BANGLADESH READY MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION, 2018-2033 (USD THOUSAND)

8.2.1 APPAREL

8.2.2 ACCESSORIES

8.3 BANGLADESH APPAREL IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.3.1 T-SHIRTS AND SHIRTS

8.3.2 BOTTOMS

8.3.3 UNIFORMS & WORKWEAR

8.3.4 TOPS AND BLOUSES

8.3.5 DRESSES

8.3.6 SLEEPWEAR / LOUNGEWEAR

8.3.7 SUITS

8.3.8 OUTERWEAR

8.3.9 INTIMATES & LINGERIE

8.4 BANGLADESH T-SHIRTS AND SHIRTS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.4.1 ROUND NECK T-SHIRTS

8.4.2 POLO SHIRTS

8.4.3 V-NEC T-SHIRTS

8.4.4 DRESS SHIRTS

8.4.5 HENLEY SHIRTS

8.4.6 OTHERS

8.5 BANGLADESH BOTTOMS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.5.1 JEANS

8.5.2 CHINOS

8.5.3 TROUSERS

8.5.4 SHORTS

8.5.5 TRACK PANTS

8.5.6 LEGGINGS

8.5.7 SKIRTS

8.5.8 OTHERS

8.6 BANGLADESH UNIFORMS & WORKWEAR IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.6.1 CORPORATE UNIFORMS

8.6.2 HOSPITAL SCRUBS

8.6.3 INDUSTRIAL WORKWEAR

8.6.4 SCHOOL UNIFORM

8.6.5 SAFETY JACKETS (HI-VIS)

8.6.6 SECURITY UNIFORMS

8.6.7 CHEF COATS / APRONS

8.6.8 COVERALLS / OVERALLS

8.6.9 OTHERS

8.7 BANGLADESH SLEEPWEAR/LOUNGEWEAR IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.7.1 PAJAMAS (MEN/WOMEN/KIDS)

8.7.2 LOUNGE SETS

8.7.3 NIGHTGOWNS

8.7.4 SLEEP SHIRTS

8.7.5 ROBES

8.7.6 OTHERS

8.8 BANGLADESH SUITS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.8.1 BUSINESS CASUALS

8.8.2 TWO-PIECE

8.9 BANGLADESH OUTERWEAR IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.9.1 JACKETS

8.9.2 COATS

8.9.3 PULLOVERS

8.1 BANGLADESH ACCESSORIES IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

8.10.1 CAPS

8.10.2 SCARVES

8.10.3 SOCKS

8.10.4 GLOVES

8.10.5 OTHERS

9 BANGLADESH READY MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION

9.1 OVERVIEW

9.2 BANGLADESH READY MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION, 2018-2033 (USD THOUSAND)

9.2.1 WOVEN GARMENTS

9.2.2 KNIT GARMENTS

9.2.3 COMPOSITE OR BLENDED

9.2.4 NON-WOVEN OR TECHNICAL

9.3 BANGLADESH WOVEN GARMENTS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.3.1 DENIM

9.3.2 TWILL

9.3.3 POPLIN

9.3.4 OTHERS

9.4 BANGLADESH KNIT GARMENTS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

9.4.1 JERSEY

9.4.2 INTERLOCK

9.4.3 RIB

9.4.4 OTHERS

10 BANGLADESH READY MADE GARMENTS MARKET, BY FIBER

10.1 OVERVIEW

10.2 BANGLADESH READY MADE GARMENTS MARKET, BY FIBER, 2018-2033 (USD THOUSAND)

10.2.1 NATURAL FIBERS

10.2.2 MAN-MADE FIBERS

10.2.3 SPECIALTY FIBERS

10.2.4 OTHERS

10.3 BANGLADESH NATURAL FIBERS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.3.1 COTTON

10.3.2 LINEN

10.3.3 HEMP

10.3.4 OTHERS

10.4 BANGLADESH MAN-MADE FIBERS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.4.1 POLYESTER

10.4.2 NYLON

10.4.3 ACRYLIC

10.4.4 OTHERS

10.5 BANGLADESH SPECIALTY FIBERS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.5.1 RECYCLED POLYESTER

10.5.2 BAMBOO

10.5.3 MODAL

10.5.4 OTHERS

11 BANGLADESH READY MADE GARMENTS MARKET, BY BUSINESS MODEL

11.1 OVERVIEW

11.2 BANGLADESH READY MADE GARMENTS MARKET, BY BUSINESS MODEL , 2018-2033 (USD THOUSAND)

11.2.1 OFFLINE

11.2.2 ONLINE

12 BANGLADESH READY MADE GARMENTS MARKET, BY PRICE

12.1 OVERVIEW

12.2 BANGLADESH READY MADE GARMENTS MARKET, BY PRICE, 2018-2033 (USD THOUSAND)

12.2.1 LOW COST OR MASS

12.2.2 MID-MARKET BRANDED

12.2.3 PREMIUM FAST FASHION

12.2.4 LUXURY AND DESIGNER

13 BANGLADESH READY MADE GARMENTS MARKET, BY CONSUMER GROUP

13.1 OVERVIEW

13.2 BANGLADESH READY MADE GARMENTS MARKET, BY CONSUMER GROUP, 2018-2033 (USD THOUSAND)

13.2.1 WOMEN

13.2.2 MEN

13.2.3 KIDS

14 BANGLADESH READY MADE GARMENTS MARKET, BY FACTORY SIZE

14.1 OVERVIEW

14.2 BANGLADESH READY MADE GARMENTS MARKET, BY FACTORY SIZE, 2018-2033 (USD THOUSAND)

14.2.1 MEGA FACTORIES WITH LARGE WORKFORCE

14.2.2 LARGE-SCALE FACTORIES

14.2.3 SMALL AND MEDIUM ENTERPRISES

15 BANGLADESH READY MADE GARMENTS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: BANGLADESH

16 SWOT ANALYSIS

17 COMAPANY PROFILES

17.1 ANANTA GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS

17.2 4A YARN DYEING LTD

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENT

17.3 PACIFIC JEANS

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 NASSA GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 SQUARE FASHIONS LIMITED

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 3N FASHION (BD) LTD

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 4 STAR FASHIONS LTD

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 9 STAR APPARELS INDUSTRIES LIMITED

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 AAZTEX

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 ANLIMA GROUP.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 ARM FASHION BD

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 A.R. FASHION OUTFIT LTD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 ASIAN ERP (ASIAN APPARELS)

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 BD WEAR

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 BISHWORANG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 BITOPI GROUP

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 BLUE DREAM

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 BRANDSTORE (GG FASHION SOURCING)

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 BUSANA APPAREL GROUP

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 CLIFTON GROUP

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 DESH GROUP

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 ENVOY GROUP

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENT

17.23 ENVOY TEXTILES

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 EPIC GROUP

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 EPYLLION GROUP

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENTS

17.26 FAKIRFASHION.COM.

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENT

17.27 HA-MEEM GROUP.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENT

17.28 HULA GLOBAL

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENT

17.29 JMS GROUP LTD

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENT

17.3 JUSITEX

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENT

17.31 KEMS GROUP LTD

17.31.1 COMPANY SNAPSHOT

17.31.2 PRODUCT PORTFOLIO

17.31.3 RECENT DEVELOPMENTS

17.32 MASCO GROUP

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENT

17.33 MEERAB INDUSTRIES LTD.

17.33.1 COMPANY SNAPSHOT

17.33.2 PRODUCT PORTFOLIO

17.33.3 RECENT DEVELOPMENTS

17.34 MODELE GROUP

17.34.1 COMPANY SNAPSHOT

17.34.2 PRODUCT PORTFOLIO

17.34.3 RECENT DEVELOPMENT

17.35 MOHAMMADI GROUP

17.35.1 COMPANY SNAPSHOT

17.35.2 PRODUCT PORTFOLIO

17.35.3 RECENT DEVELOPMENT

17.36 MONNO GROUP

17.36.1 COMPANY SNAPSHOT

17.36.2 REVENUE ANALYSIS

17.36.3 PRODUCT PORTFOLIO

17.36.4 RECENT DEVELOPMENT

17.37 PARTEX GROUP

17.37.1 COMPANY SNAPSHOT

17.37.2 PRODUCT PORTFOLIO

17.37.3 RECENT DEVELOPMENT

17.38 POSH GARMENTS

17.38.1 COMPANY SNAPSHOT

17.38.2 PRODUCT PORTFOLIO

17.38.3 RECENT DEVELOPMENT

17.39 PLUMMY FASHION

17.39.1 COMPANY SNAPSHOT

17.39.2 PRODUCT PORTFOLIO

17.39.3 RECENT DEVELOPMENT

17.4 PRIDE GROUP

17.40.1 COMPANY SNAPSHOT

17.40.2 PRODUCT PORTFOLIO

17.40.3 RECENT DEVELOPMENT

17.41 SDF CLOTHING

17.41.1 COMPANY SNAPSHOT

17.41.2 PRODUCT PORTFOLIO

17.41.3 RECENT DEVELOPMENTS

17.42 SIATEX

17.42.1 COMPANY SNAPSHOT

17.42.2 PRODUCT PORTFOLIO

17.42.3 RECENT DEVELOPMENT

17.43 STANDARD GROUP

17.43.1 COMPANY SNAPSHOT

17.43.2 PRODUCT PORTFOLIO

17.43.3 RECENT DEVELOPMENT

17.44 STERLING GROUP

17.44.1 COMPANY SNAPSHOT

17.44.2 PRODUCT PORTFOLIO

17.44.3 RECENT DEVELOPMENT

17.45 STUFF LIMITED

17.45.1 COMPANY SNAPSHOT

17.45.2 PRODUCT PORTFOLIO

17.45.3 RECENT DEVELOPMENTS

17.46 STYLECRAFT LIMITED

17.46.1 COMPANY SNAPSHOT

17.46.2 REVENUE ANALYSIS

17.46.3 PRODUCT PORTFOLIO

17.46.4 RECENT DEVELOPMENT

17.47 SYLVAN APPAREL

17.47.1 COMPANY SNAPSHOT

17.47.2 PRODUCT PORTFOLIO

17.47.3 RECENT DEVELOPMENT

17.48 TOUCH APPAREL

17.48.1 COMPANY SNAPSHOT

17.48.2 PRODUCT PORTFOLIO

17.48.3 RECENT DEVELOPMENT

17.49 WENEXT APPARELS

17.49.1 COMPANY SNAPSHOT

17.49.2 PRODUCT PORTFOLIO

17.49.3 RECENT DEVELOPMENTS

17.5 WINGS2FASHION

17.50.1 COMPANY SNAPSHOT

17.50.2 PRODUCT PORTFOLIO

17.50.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 PRODUCT CATEGORY PENETRATION, BY CATEGORY

TABLE 3 PRODUCT CATEGORY PENETRATION, BY REGION

TABLE 4 GROWTH BY EXPORT MARKET

TABLE 5 TECHNOLOGY MATRIX

TABLE 6 TARRIF ANALYSIS BY REGIONS

TABLE 7 BANGLADESH READY MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 8 BANGLADESH APPAREL IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 BANGLADESH T-SHIRTS AND SHIRTS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 10 BANGLADESH BOTTOMS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 BANGLADESH UNIFORMS & WORKWEAR IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 12 BANGLADESH SLEEPWEAR/LOUNGEWEAR IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 BANGLADESH SUITS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 BANGLADESH OUTERWEAR IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 15 BANGLADESH ACCESSORIES IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 16 BANGLADESH READY MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION, 2018-2033 (USD THOUSAND)

TABLE 17 BANGLADESH WOVEN GARMENTS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 18 BANGLADESH KNIT GARMENTS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 BANGLADESH READY MADE GARMENTS MARKET, BY FIBER, 2018-2033 (USD THOUSAND)

TABLE 20 BANGLADESH NATURAL FIBERS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 BANGLADESH MAN-MADE FIBERS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 22 BANGLADESH SPECIALTY FIBERS IN READY MADE GARMENTS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 BANGLADESH READY MADE GARMENTS MARKET, BY BUSINESS MODEL , 2018-2033 (USD THOUSAND)

TABLE 24 BANGLADESH READY MADE GARMENTS MARKET, BY PRICE, 2018-2033 (USD THOUSAND)

TABLE 25 BANGLADESH READY MADE GARMENTS MARKET, BY CONSUMER GROUP, 2018-2033 (USD THOUSAND)

TABLE 26 BANGLADESH READY MADE GARMENTS MARKET, BY FACTORY SIZE, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 BANGLADESH READY MADE GARMENTS MARKET: SEGMENTATION

FIGURE 2 BANGLADESH READY MADE GARMENTS MARKET: DATA VALIDATION MODEL

FIGURE 3 BANGLADESH READY MADE GARMENTS MARKET: DROC ANALYSIS

FIGURE 4 BANGLADESH READY MADE GARMENTS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 BANGLADESH READY MADE GARMENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BANGLADESH READY MADE GARMENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 BANGLADESH READY MADE GARMENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 BANGLADESH READY MADE GARMENTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 BANGLADESH READY-MADE GARMENTS MARKET: SEGMENTATION

FIGURE 10 BNAGLADESH READY MADE GARMENTS MARKET: EXECUTIVE SUMMARY

FIGURE 11 TWO SEGMENTS COMPARISE THE GABGLADESH READY MADE GARMENTS MARKET, BY PRODUCT TYPE

FIGURE 12 STRATEGIC DECISIONS BY KEY PLAYERS

FIGURE 13 APPAREL SEGMENTS IS EXPECTED TO DOMINATE AND GROW WITH THE FASTEST GROWTH RATE IN BANGLADESH READY MADE GARMENTS MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 14 BANGLADESH READYMADE GARMENTS IS EXPECTED TO GROW WITH A CAGR OF 5.5% DURING THE FORECAST PERIOD

FIGURE 15 APPAREL SEGMENT HOLDS THE LARGEST MARKET SHARE, AND IS EXPECTED TO INCREASE ITS SHARE IN THE MARKET BY 2033

FIGURE 16 COMPANY EVALUATION QUADRANT

FIGURE 17 BANGLADESH READY MADE GARMENTS MARKET, 2025-2033, AVERAGE SELLING PRICE (USD/UNIT)

FIGURE 18 VALUE CHAIN ANALYSIS OF BANGLADESH READY-MADE GARMENTS MARKET

FIGURE 19 DROC ANALYSIS

FIGURE 20 BANGLADESH READY-MADE GARMENTS MARKET, BY PRODUCT, 2025

FIGURE 21 BANGLADESH READY-MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION, 2025

FIGURE 22 BANGLADESH READY-MADE GARMENTS MARKET, BY PRODUCT CONSTRUCTION, 2025

FIGURE 23 BANGLADESH READY-MADE GARMENTS MARKET, BY BUSINESS MODEL, 2025

FIGURE 24 BANGLADESH READY-MADE GARMENTS MARKET, BY PRICE, 2025

FIGURE 25 BANGLADESH READY-MADE GARMENTS MARKET, BY CONSUMER GROUP , 2025

FIGURE 26 BANGLADESH READY-MADE GARMENTS MARKET, BY FACTORY SIZE, 2025

FIGURE 27 BANGLADESH READY MADE GARMENTS MARKET: COMPANY SHARE 2025 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.