Bangladesh Trucking Market

Market Size in USD Billion

CAGR :

%

USD

20.24 Billion

USD

51.82 Billion

2025

2033

USD

20.24 Billion

USD

51.82 Billion

2025

2033

| 2026 –2033 | |

| USD 20.24 Billion | |

| USD 51.82 Billion | |

|

|

|

|

Bangladesh Trucking Market Size

- The Bangladesh Trucking Market size was valued at USD 20.24 billion in 2025 and is expected to reach USD 51.82 billion by 2033, at a CAGR of 6.1% during the forecast period 2026-2033.

- The growth of the Trucking Market is primarily driven by Competitive Labor Costs And A Large Workforce Support High-Volume Apparel Production

Bangladesh Trucking Market Analysis

- Rising activity in manufacturing, FMCG, textiles, construction, and agriculture is increasing demand for road freight across the country.

- Government investments in highways, bridges, and regional connectivity corridors (e.g., Padma Bridge, Dhaka–Chattogram upgrades) support faster and more reliable trucking operations.

- Congested urban centers and suboptimal rural road networks increase transit times and operation costs.

- Growing demand for GPS, route optimization, fleet management software, and fuel-efficiency tools creates scope for digital transformation.

- Inconsistent enforcement of transport regulations, overloading rules, and licensing standards complicate operations.

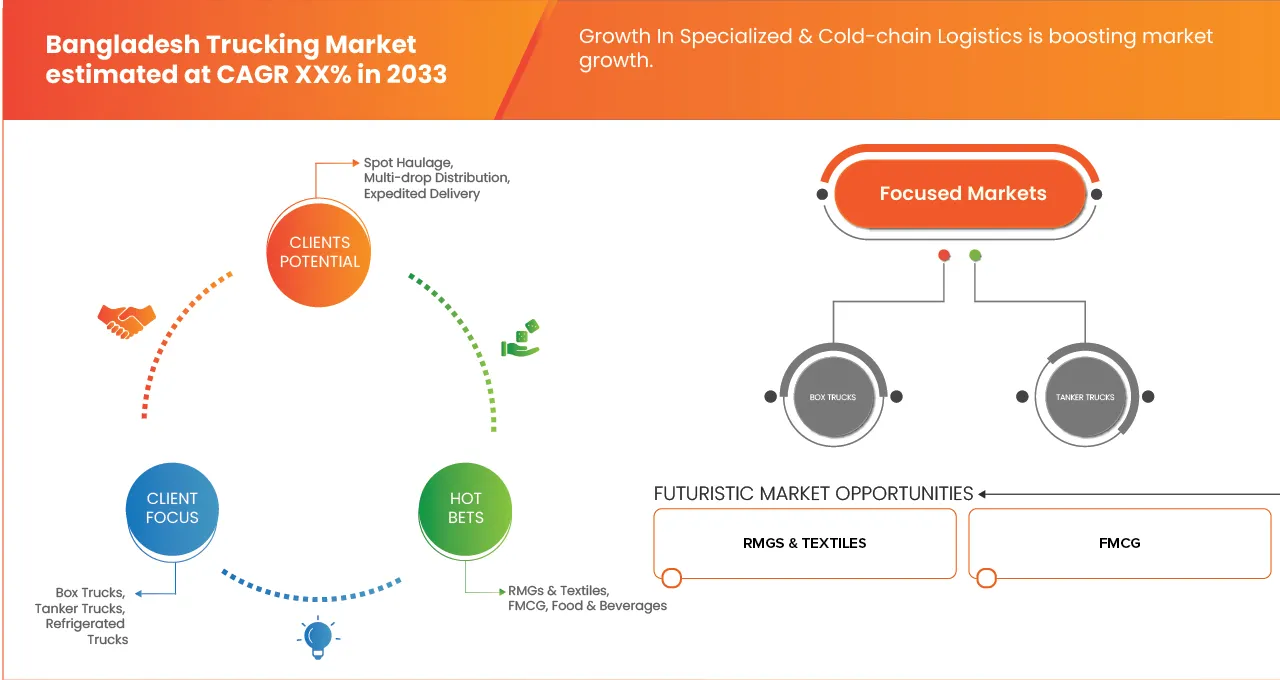

- The Spot Haulage segment is expected to dominate the Bangladesh Trucking Market with the largest market share of 48.81% in 2026, primarily due to the rising short-term, on-demand freight needs driven by Bangladesh’s expanding retail, construction, and agricultural sectors. Businesses increasingly prefer flexible, pay-per-trip trucking instead of long contracts, especially SMEs with fluctuating shipment volumes.

Report Scope and Bangladesh Trucking Market Segmentation

|

Attributes |

Bangladesh Trucking Product Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Bangladesh Trucking Market Trends

“Competitive Labor Costs and a Large Workforce Support High-Volume Apparel Production”

- Bangladesh’s industrial landscape has expanded rapidly over the last decade, supported by rising domestic manufacturing, large-scale construction activity, and growth in regional trade. This transformation has significantly increased the movement of raw materials, intermediate goods, and finished products across economic corridors, strengthening trucking demand nationwide. From steel and cement to FMCG, agro-products, and pharmaceuticals, industries now operate with higher production capacities and tighter delivery schedules—making trucking an essential component of supply-chain continuity and inland logistics efficiency.

- The country’s accelerating industrialization is closely tied to the expansion of economic zones, industrial parks, and logistics hubs. These zones attract investments from both domestic and foreign manufacturers, creating concentrated clusters of production activity that depend heavily on frequent truck-based transportation. As factories continue to spread across districts such as Gazipur, Narayanganj, Chattogram, Cumilla, and Rajshahi, the volume of inter-district cargo movement has risen sharply, driving sustained demand for medium- and heavy-duty trucks. This shift has also encouraged fleet owners to diversify vehicle types and increase capacity to meet growing freight requirements.

- Moreover, improvements in inland connectivity—supported by landmark infrastructure projects such as the Padma Bridge, upgraded national highways, and new express routes—have enabled faster, more reliable cargo movement. Reduced travel time between major industrial belts has allowed manufacturers to scale production and widen distribution networks. As travel efficiency improves, companies across construction, consumer goods, and agriculture are increasingly relying on trucking to streamline their supply chains, minimize delays, and meet market-driven lead-time expectations.

- The growth of domestic consumption further reinforces this trend. Urbanization has expanded rapidly in cities like Dhaka, Chattogram, Gazipur, and Sylhet, driving stronger demand for household goods, packaged foods, electronics, and construction materials. As retailers and distributors adapt to rising consumption, the frequency and volume of deliveries to warehouses, wholesale markets, and retail stores have increased substantially. This expanding domestic trade ecosystem directly strengthens the operational load on the trucking sector, making it one of the primary beneficiaries of Bangladesh’s evolving economic structure.

- In March 2024, a Bangladesh Planning Commission briefing highlighted that domestic freight movement grew steadily due to rising industrial production and expanding economic zones, leading to higher trucking utilization across major corridors.

- In August 2024, the Ministry of Industries reported that new manufacturing investments in consumer goods and construction materials significantly increased inter-district cargo demand, particularly along the Dhaka–Chattogram and Dhaka–Khulna routes.

- In January 2025, a logistics market review by the Bangladesh Freight Forwarders Association (BAFFA) noted that improved connectivity from key infrastructure projects has enhanced trucking efficiency and supported higher domestic trade volumes

- Bangladesh’s expanding industrial output and growing domestic trade are not just economic milestones—they are structural forces reshaping the country’s logistics backbone. As production scales up and distribution networks become more complex, the reliance on efficient trucking services intensifies. This sustained industrial momentum positions “Growing Domestic Trade & Industrialization” as one of the most influential drivers of growth in the Bangladesh trucking market

Bangladesh Trucking Market Dynamics

Driver

“Expansion of Road Infrastructure”

- Bangladesh’s road infrastructure has undergone significant improvement over the past decade, fundamentally enhancing the efficiency, reliability, and overall performance of the trucking sector. Major national highways, expressways, and bridge networks have been expanded or upgraded, enabling faster transit across key industrial and commercial corridors. These improvements have reduced travel times, minimized congestion, and supported the uninterrupted flow of goods—factors that collectively strengthen the country’s trucking-dependent logistics ecosystem.

- One of the most transformative developments has been the strategic modernization of national highways linking major economic hubs such as Dhaka, Chattogram, Khulna, Sylhet, and Rajshahi. As these highways become wider, smoother, and better managed, trucking operators are able to complete more trips within shorter timeframes, helping reduce operational costs and enhance delivery reliability. Such improvements also allow fleet owners to deploy more efficient route planning, increase truck utilization, and manage tighter turnaround cycles, benefiting industries with time-sensitive cargo needs.

- The completion of landmark projects such as the Padma Bridge has dramatically reshaped connectivity between the central and southwestern regions of the country. Previously dependent on lengthy ferry crossings, freight transport through the region now moves with significantly greater ease, enabling faster distribution of agricultural commodities, construction materials, and industrial goods. This improved access has also stimulated investment in new industrial zones, storage facilities, and logistics hubs in these regions, further increasing the demand for trucking services.

- In addition, ongoing construction of expressways, elevated roads, and improved feeder routes is gradually integrating remote districts with major urban markets. The modernization of regional road networks has been particularly beneficial for agro-based industries, allowing farmers and distributors to transport perishables more efficiently to processing centers and urban wholesale markets. With reduced risks of spoilage and faster market access, trucking has become a critical enabler of agricultural trade expansion.

- Government policies have also emphasized the development of economic corridors connecting industrial belts with seaports and land ports. Enhanced connectivity to Chattogram Port, Mongla Port, and the Payra Port development zone has strengthened export-oriented and import-dependent freight flows. As these ports expand capacity and introduce more logistics-friendly infrastructure, trucking operators benefit from smoother cargo-handling operations and improved road-port linkages.

- For instance,In July 2024, the Roads and Highways Department (RHD) reported that upgrades to the Dhaka–Chattogram Highway had reduced average freight transit time by nearly one-third, significantly boosting trucking throughput along the country’s busiest industrial corridor.

- In October 2024, the Ministry of Road Transport and Bridges highlighted that new expressway and regional connectivity projects under the National Integrated Infrastructure Development Plan were designed to support higher cargo mobility and reduce bottlenecks across major trade routes.

- In January 2025, a logistics assessment by the Bangladesh Bridge Authority (BBA) emphasized that the Padma Bridge had increased freight movement by enabling uninterrupted truck access between Dhaka and 21 southwestern districts, directly stimulating trucking demand.

- Bangladesh’s expanding road infrastructure is not only an enabler of smoother transportation—it serves as a strategic driver of national logistics transformation. As travel efficiency improves and industrial hubs become more interconnected, reliance on trucking continues to deepen. These sustained infrastructure advancements firmly position “Expansion of Road Infrastructure” as one of the most influential drivers powering the growth of the Bangladesh trucking market.

Restraint/Challenge

“Poor Road Conditions & Traffic Congestion”

- Bangladesh’s trucking industry continues to face operational inefficiencies due to persistent road infrastructure limitations and chronic traffic congestion across major transport corridors. While key highways and national routes have improved over the years, a large portion of secondary and regional roads remain narrow, uneven, or poorly maintained. These conditions significantly slow freight movement, increase vehicle wear and tear, and raise operational expenses for transport operators—ultimately affecting overall logistics performance and delivery reliability.

- The challenge is especially prominent in urban and peri-urban centers where industrial and commercial activities are concentrated. Cities such as Dhaka, Gazipur, Chattogram, and Narayanganj frequently experience severe traffic congestion, driven by high population density, limited road-width capacity, and mixed traffic patterns involving buses, cars, rickshaws, and non-motorized vehicles. For trucking operators, navigating these congestion hotspots results in unpredictable transit times, longer waiting periods at entry points, and delays in both inbound and outbound deliveries. These disruptions not only increase fuel consumption but also reduce fleet productivity, making it difficult for companies to adhere to time-sensitive supply-chain commitments.

- Congestion at key logistics touchpoints further compounds the problem. Entry points around ports, industrial zones, and wholesale markets frequently experience bottlenecks due to limited parking bays, inadequate traffic management, and high-volume vehicle clustering. Such delays can extend loading and unloading times substantially, affecting supply-chain efficiency for manufacturing, retail, and export-oriented businesses. As a result, truck operators often face reduced daily trip counts and higher operational costs, which ultimately translate into elevated freight charges for end users.

- While various infrastructure developments are underway, the gap between freight growth and road capacity expansion remains wide. This imbalance places continuous pressure on trucking operations, forcing companies to invest more in maintenance, driver overtime, and contingency routing—all of which reduce profitability. Poor road conditions and persistent congestion therefore represent a structural challenge that slows logistics modernization and weakens transport reliability across Bangladesh.

- For instance,In January 2024, a transport review by the Local Government Engineering Department (LGED) highlighted that nearly one-fourth of regional roads required major repairs, contributing to frequent freight delays and higher vehicle maintenance costs for trucking operators.

- In September 2024, the Dhaka Transport Coordination Authority (DTCA) reported that peak-hour congestion in Dhaka and Gazipur increased average truck transit time by over 40%, significantly disrupting daily logistics schedules.

- In February 2025, a logistics assessment by the Bangladesh Road Transport Authority (BRTA) indicated that limited truck access and road-width constraints near industrial belts continued to create delivery backlogs, reducing freight efficiency during high-demand periods.

- Bangladesh’s road-condition challenges and chronic congestion remain structural barriers to efficient freight movement. As freight volumes increase with industrial and commercial expansion, these issues continue to constrain trucking reliability, raise operational costs, and hinder overall logistics performance. Consequently, “Poor Road Conditions & Traffic Congestion” stands as one of the most critical restraints affecting the growth and efficiency of the Bangladesh trucking market

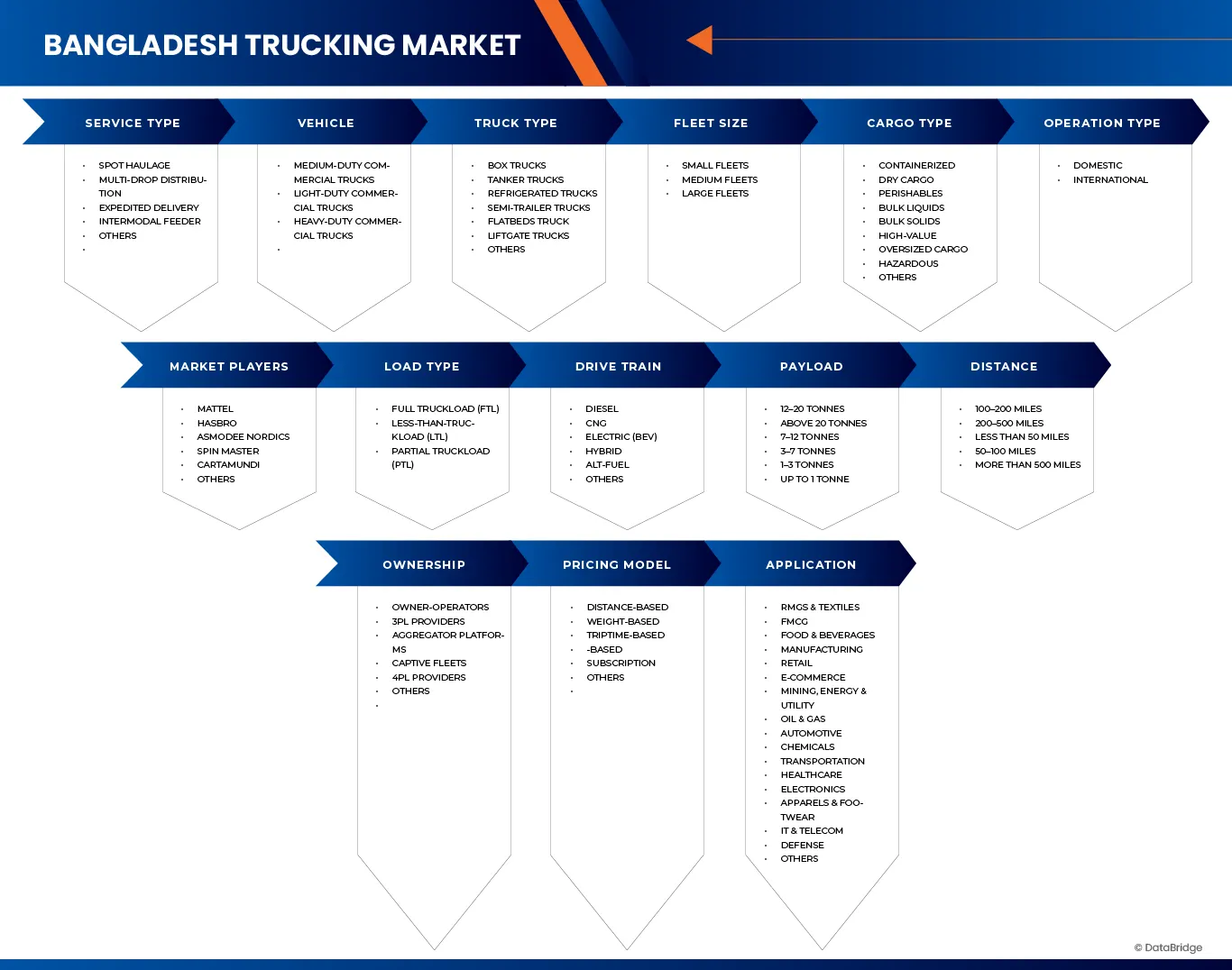

Bangladesh Trucking Market Scope

The Bangladesh Trucking Market is categorized into fifteen notable segments based on Service Type, Vehicle, Truck Type, Load Type, Drive Train, Payload, Distance, Ownership, Fleet Size, Cargo Type, Operation Type, Pricing Model, Application, Contract Type, End Use

- By Service Type

Based on service type, the Bangladesh trucking market is segmented into Spot Haulage, Multi-drop Distribution, Expedited Delivery, Intermodal Feeder, Others. In 2026, Spot Haulage segment is expected to dominate the Bangladesh Trucking Market with 48.81% market share and is expected to reach USD 25.77 billion by 2033, growing with the CAGR of 6.4% in the forecast period 2026 to 2033.

- By Vehicle

Based on vehicle, the Bangladesh trucking market is segmented into Medium-Duty Commercial Trucks, Light-Duty Commercial Trucks, Heavy-Duty Commercial Trucks. In 2026, Medium-Duty Commercial Trucks segment is expected to dominate the Bangladesh Trucking Market with 52.79% market share and is expected to reach USD 27.78 billion by 2033, growing with the CAGR of 6.3% in the forecast period 2026 to 2033.

- By Truck Type

Based on Truck Type, the Bangladesh trucking market is segmented into Box Trucks, Tanker Trucks, Refrigerated Trucks, Semi-Trailer Trucks, Flatbeds Truck, Liftgate Trucks, Others. In 2026, Box Trucks segment is expected to dominate the Bangladesh Trucking Market with 32.33% market share and is expected to reach USD 17.41 billion by 2033, growing with the CAGR of 6.7% in the forecast period 2026 to 2033.

- By Load Type

Based on Load Type, the Bangladesh trucking market is segmented into Full Truckload (FTL), Less‑Than‑Truckload (LTL), Partial Truckload (PTL). In 2026, Full Truckload (FTL) segment is expected to dominate the Bangladesh Trucking Market with 56.49% market share and is expected to reach USD 28.47 billion by 2033, growing with the CAGR of 5.7% in the forecast period 2026 to 2033.

- By Drive Train

Based on Drive Train, the Bangladesh trucking market is segmented into Diesel, CNG, Electric (BEV), Hybrid, Alt‑Fuel, Others. In 2026, Standard Malt segment is expected to dominate the Bangladesh Trucking Market with 74.18% market share and is expected to reach USD 38.67 billion by 2033, growing with the CAGR of 6.2% in the forecast period 2026 to 2033.

- By Payload

Based on Payload, , the Bangladesh trucking market is segmented into 12–20 tonnes, Above 20 tonnes, 7–12 tonnes, 3–7 tonnes, 1–3 tonnes, Up to 1 tonne. In 2026, 12–20 tonnes segment is expected to dominate the Bangladesh Trucking Market with 25.76% market share and is expected to reach USD 13.98 billion by 2033, growing with the CAGR of 6.8% in the forecast period 2026 to 2033.

- By Distance

Based on Payload, , the Bangladesh trucking market is segmented into 100–200 miles, 200–500 miles, Less than 50 miles, 50–100 miles, More than 500 miles. In 2026, 100–200 miles segment is expected to dominate the Bangladesh Trucking Market with 28.24% market share and is expected to reach USD 15.02 billion by 2033, growing with the CAGR of 6.5% in the forecast period 2026 to 2033.

- By Ownership

Based on Ownership, the Bangladesh trucking market is segmented into Owner-Operators, 3PL Providers, Aggregator Platforms, Captive Fleets, 4PL Providers, Others. In 2026, Owner-Operators segment is expected to dominate the Bangladesh Trucking Market with 45.26% market share and is expected to reach USD 23.56 billion by 2033, growing with the CAGR of 6.2% in the forecast period 2026 to 2033.

- By Fleet Size

Based on fleet size, the Bangladesh trucking market is segmented into Small Fleets, Medium Fleets, Large Fleets. In 2026, Small Fleets segment is expected to dominate the Bangladesh Trucking Market with 52.87% market share and is expected to reach USD 28.11 billion by 2033, growing with the CAGR of 6.5% in the forecast period 2026 to 2033.

- By Cargo Type

Based on Cargo Type, the Bangladesh trucking market is segmented into Containerized, Dry Cargo, Perishables, Bulk Liquids, Bulk Solids, High-Value, Oversized Cargo, Hazardous, Others. In 2026, Containerized segment is expected to dominate the Bangladesh Trucking Market with 39.30% market share and is expected to reach USD 21.01 billion by 2033, growing with the CAGR of 6.6% in the forecast period 2026 to 2033.

- By Operation Type

Based on Operation Type, the Bangladesh trucking market is segmented into Domestic, International. In 2026, Domestic segment is expected to dominate the Bangladesh Trucking Market with 85.64% market share and is expected to reach USD 44.28 billion by 2033, growing with the CAGR of 6.0% in the forecast period 2026 to 2033.

- By Pricing Model

Based on Pricing Model, the Bangladesh trucking market is segmented into Distance-Based, Weight-Based, Trip-Based, Time-Based, Subscription, Others. In 2026, Distance-Based segment is expected to dominate the Bangladesh Trucking Market with 55.10% market share and is expected to reach USD 28.45 billion by 2033, growing with the CAGR of 6.0% in the forecast period 2026 to 2033.

- By Application

Based on Application, the Bangladesh trucking market is segmented into RMGs & Textiles, FMCG, Food & Beverages, Manufacturing, Retail, E-Commerce, Mining, Energy & Utility Oil & Gas, Automotive, Chemicals, Transportation, Healthcare, Electronics, Apparels & Footwear, IT & Telecom, Defense, Others. In 2026, RMGs & Textiles segment is expected to dominate the Bangladesh Trucking Market with 22.27% market share and is expected to reach USD 11.67 billion by 2033, growing with the CAGR of 6.3% in the forecast period 2026 to 2033.

- By Contract Type

Based on Contract Type, the Bangladesh trucking market is segmented into Private Fleet Trucking, For-Hire Trucking, Dedicated Contract Carriage (DCC). In 2026, Private Fleet Trucking segment is expected to dominate the Bangladesh Trucking Market with 52.87% market share and is expected to reach USD 28.09 billion by 2033, growing with the CAGR of 6.5% in the forecast period 2026 to 2033

- By End Use

Based on End Use, the Bangladesh trucking market is segmented into B2B (Business-to-Business), B2C (Business-to-Consumer). In 2026, B2B (Business-to-Business) segment is expected to dominate the Bangladesh Trucking Market with 85.73% market share and is expected to reach USD 28.09 billion by 2033, growing with the CAGR of 6.2% in the forecast period 2026 to 2033

Bangladesh Trucking Market Share

The Bangladesh Trucking Market is primarily led by well-established companies, including:

- DHL (Germany)

- Kuehne+Nagel (Switzerland)

- DSV (Denmark)

- Nippon Express Holdings (Japan)

- Pathao Ltd. (Bangladesh)

- Truck Lagbe (Bangladesh)

- Obhai Solutions Limited (Bangladesh)

- Titas Transport Agency (Bangladesh)

- Loop (Bangladesh)

- Homebound (Bangladesh)

- Reliable Logistics Service (Bangladesh)

- Fleet Freight (Bangladesh)

- A H Khan & Company Limited (Bangladesh)

- Faraji Logistics (Bangladesh)

- WAC Bangladesh Limited (Bangladesh)

Latest Developments in Bangladesh Trucking Market

- In June 2025, DHL has partnered with Daimler Truck and hylane to introduce 30 fully electric Mercedes-Benz eActros 600 trucks under a “transport-as-a-service” model to enhance parcel-center transportation in Germany. The collaboration supports DHL’s sustainability goals by reducing emissions, improving energy efficiency, and integrating advanced electric trucking technology into daily logistics operations. This initiative strengthens DHL’s shift toward greener, more efficient long-haul road transport solutions.

- In May 2025, Kuehne+Nagel has recently entered a lead-logistics provider agreement with Evonik across Asia-Pacific (China, India, Southeast Asia, etc.), managing ~70,000 air, sea, and road shipments annually under an integrated transport-management framework.

- In March 2023, A H Khan & Company Ltd. marked a key milestone in its growth by receiving ISO 9001:2015 and ISO 28000:2007 certifications, formally recognizing its commitment to quality management and secure supply chain operations. The certification ceremony was held at Dhaka Club, reflecting the company’s strengthened focus on operational excellence and global standards. This achievement enhances its credibility in the logistics sector and supports its vision of expanding services with greater reliability, transparency, and international competitiveness.

- In November 2024, Fox Parcel announced a complete solution for Pakistani online sellers to expand their e-commerce business in Bangladesh without needing a local business license. The company offers two main options: direct shipping from Pakistan with customs and delivery handled by Fox Parcel, or cost-effective production in India or China with import, fulfillment, and returns management services in Bangladesh. Additional support includes localized Bengali-speaking customer service, safe storage, professional packing, reliable delivery, cash-on-delivery options, and optional visa guidance for in-person meetings. With end-to-end logistics and fulfillment solutions, Fox Parcel enables online sellers, digital marketing experts, and e-commerce entrepreneurs to access the rapidly growing Bangladeshi market while minimizing costs and operational barriers.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF BANGLADESH TRUCKING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES ANALYSIS

4.2 IMPORT & EXPORT DATA

4.2.1 STRATEGIC DEVELOPMENT

4.2.2 TECHNOLOGY IMPLEMENTATION PROCESS

4.2.2.1 CHALLENGES

4.2.2.2 INHOUSE IMPLEMENTATION / OUTSOURCED (THIRD-PARTY) IMPLEMENTATION

4.2.3 CUSTOMER BASE

4.2.4 SERVICE POSITIONING

4.2.5 CUSTOMER FEEDBACK / RATING (B2B)

4.2.6 APPLICATION REACH

4.2.7 SERVICE PLATFORM MATRIX

4.3 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.4 FUTURISTIC SCENARIO (2025–2040)

4.5 LIST OF PROJECTS

4.5.1 MAJOR ROAD & CORRIDOR PROJECTS

4.5.1.1 WESTERN ECONOMIC CORRIDOR & REGIONAL ENHANCEMENT (WECARE)

4.5.1.2 ACCESS PROGRAM (BANGLADESH COMPONENT) – TRADE & TRANSPORT CONNECTIVITY

4.5.1.3 RURAL CONNECTIVITY IMPROVEMENT PROJECT (RCIP)

4.5.1.4 SASEC ROAD CONNECTIVITY PROJECTS

4.5.1.5 RAMPURA–AMULIA–DEMRA (RAD) PPP TOLL ROAD

4.5.2 PORT, ICD, AND LOGISTICS INFRASTRUCTURE PROJECTS

4.5.2.1 BAY TERMINAL / BAY CONTAINER TERMINAL (CHATTOGRAM)

4.5.2.2 PATENGA CONTAINER TERMINAL (PCT)

4.5.2.3 DHIRASRAM INLAND CONTAINER DEPOT (ICD)

4.5.2.4 KHANPUR INLAND CONTAINER TERMINAL (ICT)

4.5.2.5 MULTIMODAL LOGISTICS HUBS – KAMALAPUR & DHAKA AIRPORT AREA

4.5.2.6 HALISHAHAR ICD (CHATTOGRAM)

4.5.2.7 LAND PORT & BORDER LOGISTICS UPGRADES

4.5.3 POLICY & GREEN FREIGHT–RELEVANT PROGRAMS

4.5.3.1 NATIONAL LOGISTICS POLICY INITIATIVES & ROAD MASTER PLANNING

4.5.3.2 GREEN FREIGHT PROGRAMS

4.5.3.3 MUJIB CLIMATE PROSPERITY PLAN – TRANSPORT COMPONENTS

4.5.4 DIGITAL TRUCKING, FREIGHT TECHNOLOGY & MARKET PLATFORMS

4.5.4.1 TRUCK LAGBE

4.5.4.2 OTHER DIGITAL LOGISTICS PLATFORMS

4.6 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

4.6.1 TECHNOLOGY-DRIVEN OPPORTUNITIES

4.6.1.1 DIGITAL FREIGHT MARKETPLACES (LOAD-MATCHING PLATFORMS)

4.6.1.2 TELEMATICS & FLEET MANAGEMENT SOLUTIONS

4.6.1.3 ELECTRONIC TOLLING, SMART ROUTING & AUTOMATED COMPLIANCE TOOLS

4.7 LOGISTICS SERVICE EXPANSION OPPORTUNITIES

4.7.1 EXPRESS CARGO & TIME-DEFINITE TRUCKING

4.7.1.1 COLD CHAIN TRUCKING (REEFER LOGISTICS)

4.7.1.2 E-COMMERCE MIDDLE-MILE & LAST-MILE HEAVY VEHICLE DISTRIBUTION

4.7.1.3 CONTRACT LOGISTICS FOR RMG & MANUFACTURING SECTOR

4.7.2 FLEET-RELATED & ASSET-BASED OPPORTUNITIES

4.7.2.1 FLEET LEASING & TRUCK-AS-A-SERVICE (TAAS)

4.7.2.2 TRUCK REFURBISHMENT & RE-MANUFACTURING WORKSHOPS

4.7.2.3 MULTI-AXLE HEAVY TRAILER FLEET BUSINESSES

4.7.3 INFRASTRUCTURE & ECOSYSTEM OPPORTUNITIES

4.7.3.1 PRIVATE LOGISTIC PARKS / TRUCK TERMINALS / INLAND CONTAINER DEPOTS (ICDS)

4.7.3.2 ROADSIDE SERVICES & MOBILITY CENTERS

4.7.3.3 GREEN LOGISTICS SERVICES

4.7.4 INDUSTRY-SPECIFIC EMERGING OPPORTUNITIES

4.7.4.1 RETAIL & FMCG DISTRIBUTION NETWORKS OUTSOURCING

4.7.4.2 AGRICULTURE SUPPLY CHAIN MODERNIZATION

4.7.4.3 CONTAINERIZED DOMESTIC FREIGHT

4.7.5 FINANCIAL & ANCILLARY SERVICE OPPORTUNITIES

4.7.5.1 FINTECH-ENABLED TRUCKING FINANCE

4.7.5.2 INSURANCE PRODUCTS FOR TRUCKING

4.7.5.3 DIESEL & FUEL OPTIMIZATION BUSINESS

4.8 PENETRATION AND GROWTH PROSPECT MAPPING

4.9 REGIONAL MARKET OVERVIEW

4.1 TECHNOLOGY ANALYSIS

4.10.1 VEHICLE & POWERTRAIN TECHNOLOGIES

4.10.2 TELEMATICS & FLEET CONNECTIVITY

4.10.3 DRIVER & SAFETY TECHNOLOGIES

4.10.4 DIGITAL FREIGHT & LOGISTICS PLATFORMS

4.10.5 ADJACENT & ECOSYSTEM TECHNOLOGIES

4.10.6 TECHNOLOGY ADOPTION OUTLOOK

4.11 TRUCK FLEET SIZE OF MAJOR PLAYERS

4.12 USED CASES & ITS ANALYSIS

5 TARIFF REVISIONS AND THEIR IMPACT ON THE AUTOMOTIVE INDUSTRY

5.1 TARIFF STRUCTURES

5.1.1 GLOBAL VS. REGIONAL TARIFF STRUCTURES

5.1.2 UNITED STATES: AUTOMOTIVE TARIFF POLICIES

5.1.3 BANGLADESH: CROSS-BORDER TARIFF REGULATIONS, REIMBURSEMENT POLICIES

5.1.4 BANGLADESH: GOVERNMENT-IMPOSED TARIFFS ON AUTOMOTIVE COMPONENTS

5.2 IMPACT ON AUTOMAKERS

5.2.1 INCREASED PRODUCTION COSTS

5.2.2 SUPPLY CHAIN DISRUPTIONS

5.2.3 SHIFT IN MANUFACTURING FOOTPRINT

5.2.4 COMPETITIVE DISADVANTAGE

5.2.5 INCREASED INVESTMENT IN DOMESTIC PRODUCTION

5.3 IMPACT ON SUPPLIERS

5.3.1 COST PRESSURES

5.3.2 REDUCED DEMAND

5.3.3 SUPPLY CHAIN VULNERABILITY

5.4 IMPACT ON CONSUMERS

5.4.1 HIGHER VEHICLE PRICE

5.4.2 REDUCED AVAILABILITY OF OPTIONS

5.4.3 INCREASED MAINTENANCE COSTS

5.5 THE FUTURE OF AUTOMOTIVE TRADE

5.5.1 ONGOING TRADE NEGOTIATIONS

5.5.2 TECHNOLOGICAL ADVANCEMENTS

5.5.3 GEOPOLITICAL FACTORS

5.5.4 FOCUS ON DOMESTIC PRODUCTION

6 REGULATORY STANDARDS

6.1 NATIONAL REGULATORY FRAMEWORK

6.1.1 PRIMARY TRANSPORT LAWS & OVERSIGHT

6.1.2 VEHICLE FITNESS & INSPECTION

6.1.3 1DRIVER LICENSING & WORK-TIME RULES

6.1.3.1 ROAD SAFETY & SPEED REGULATIONS

6.1.4 AXLE-LOAD & OVERLOADING CONTROL

6.1.5 MANDATORY MOTOR INSURANCE

6.2 ENVIRONMENTAL & EMISSION STANDARDS

6.2.1 VEHICLE EMISSION RULES

6.2.2 FUEL QUALITY MEASURES

6.3 DANGEROUS GOODS & SPECIAL CARGO

6.3.1 HAZARDOUS GOODS TRANSPORT

6.3.2 OVERSIZE / OVERWEIGHT CARGO

6.4 TRADE & CROSS-BORDER TRUCKING REGULATIONS

6.4.1 CUSTOMS & TRANSIT REQUIREMENTS

6.4.2 ELECTRONIC DOCUMENTATION

6.5 INDUSTRY COMPLIANCE SYSTEM

6.6 LABOUR & OCCUPATIONAL SAFETY

6.7 REGULATORY GAPS & MARKET IMPLICATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 COMPETITIVE LABOR COSTS AND A LARGE WORKFORCE SUPPORT HIGH-VOLUME APPAREL PRODUCTION

7.1.2 EXPANSION OF ROAD INFRASTRUCTURE

7.1.3 E-COMMERCE & RETAIL GROWTH

7.2 RESTRAINTS

7.2.1 POOR ROAD CONDITIONS & TRAFFIC CONGESTION

7.2.2 FRAGMENTED & UNORGANIZED TRUCKING SECTOR

7.3 OPPORTUNITIES

7.3.1 FLEET MODERNIZATION & TELEMATICS ADOPTION

7.3.2 CROSS-BORDER TRADE EXPANSION

7.3.3 GROWTH IN SPECIALIZED & COLD-CHAIN LOGISTICS

7.4 CHALLENGES

7.4.1 REGULATORY UNCERTAINTY & COMPLIANCE ISSUES

7.4.2 SAFETY RISKS & HIGH ACCIDENT RATES

8 BANGLADESH TRUCKING MARKET, BY SERVICE TYPE.

8.1 OVERVIEW

8.2 BANGLADESH TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

8.3 SPOT HAULAGE

8.4 MULTI-DROP DISTRIBUTION

8.5 EXPEDITED DELIVERY

8.6 INTERMODAL FEEDER

8.7 OTHERS

9 BANGLADESH TRUCKING MARKET, BY VEHICLE

9.1 OVERVIEW

9.2 BANGLADESH TRUCKING MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

9.3 MEDIUM-DUTY COMMERCIAL TRUCKS

9.4 LIGHT-DUTY COMMERCIAL TRUCKS

9.5 HEAVY-DUTY COMMERCIAL TRUCKS

10 BANGLADESH TRUCKING MARKET, BY TRUCK TYPE.

10.1 OVERVIEW

10.2 BANGLADESH TRUCKING MARKET, BY TRUCK TYPE, 2018-2033 (USD THOUSAND)

10.3 BOX TRUCKS

10.4 TANKER TRUCKS

10.5 REFRIGERATED TRUCKS

10.6 SEMI-TRAILER TRUCKS

10.7 FLATBEDS TRUCK

10.8 LIFTGATE TRUCKS

10.9 OTHERS

10.1 BANGLADESH BOX TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

10.10.1 LAST-MILE DELIVERIES (E-COMMERCE)

10.10.2 FOOD DELIVERY

10.10.3 HOME APPLIANCES & FURNITURE

10.10.4 OTHERS

10.11 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.11.1 LIQUID TANKERS

10.11.2 DRY BULK TANKERS

10.12 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

10.12.1 FUEL

10.12.2 CHEMICALS

10.12.3 MILK

10.12.4 JUICES

10.12.5 OTHERS

10.13 BANGLADESH FUEL IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.13.1 DIESEL

10.13.2 PETROL

10.13.3 GASES (LPG/PROPANE/BUTANE/N₂/O₂/HE)

10.14 BANGLADESH GASES IN TRUCKING, BY TYPE, 2018-2033 (USD THOUSAND)

10.14.1 LPG

10.14.2 PROPANE

10.14.3 LIQUEFIED BUTANE

10.14.4 NITROGEN

10.14.5 OXYGEN

10.14.6 HELIUM

10.15 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY PRESSURIZATION, 2018-2033 (USD THOUSAND)

10.15.1 NON-PRESSURIZED

10.15.2 PRESSURIZED

10.16 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY REFRIGERATION, 2018-2033 (USD THOUSAND)

10.16.1 NON-REFRIGERATED

10.16.2 REFRIGERATED

10.17 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY INSULATION, 2018-2033 (USD THOUSAND)

10.17.1 NON-INSULATED

10.17.2 INSULATED

10.18 BANGLADESH REFRIGERATED TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

10.18.1 FOOD

10.18.2 PERISHABLE GOODS

10.18.3 MEDICAL SUPPLIES

10.18.4 BEVERAGES

10.18.5 OTHERS

10.19 BANGLADESH PERISHABLE GOODS IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.19.1 MEAT

10.19.2 FRUITS

10.19.3 VEGETABLES

10.19.4 SEAFOOD

10.19.5 OTHERS

10.2 BANGLADESH MEDICAL SUPPLIES IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.20.1 PHARMACEUTICALS

10.20.2 VACCINES

10.20.3 BLOOD BANKS

10.20.4 OTHERS

10.21 BANGLADESH BEVERAGES IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

10.21.1 CARBONATED BEVERAGES

10.21.2 JUICE-BASED

10.21.3 SPORTS & ENERGY DRINKS

10.21.4 TEA

10.21.5 COFFEE

10.21.6 OTHERS

10.22 BANGLADESH FLATBEDS TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

10.22.1 CONSTRUCTION MATERIALS

10.22.2 MACHINERY

10.22.3 SCRAP METAL

10.22.4 CARS

10.22.5 OTHER RECYCLABLES

11 BANGLADESH TRUCKING MARKET, BY LOAD TYPE.

11.1 OVERVIEW

11.2 BANGLADESH TRUCKING MARKET, BY LOAD TYPE, 2018-2033 (USD THOUSAND)

11.3 FULL TRUCKLOAD (FTL)

11.4 LESS‑THAN‑TRUCKLOAD (LTL)

11.5 PARTIAL TRUCKLOAD (PTL)

12 BANGLADESH TRUCKING MARKET, BY DRIVE TRAIN.

12.1 OVERVIEW

12.2 BANGLADESH TRUCKING MARKET, BY DRIVE TRAIN, 2018-2033 (USD THOUSAND)

12.3 DIESEL

12.4 CNG

12.5 ELECTRIC (BEV)

12.6 HYBRID

12.7 ALT‑FUEL

12.8 OTHERS

13 BANGLADESH TRUCKING MARKET, BY PAYLOAD.

13.1 OVERVIEW

13.2 BANGLADESH TRUCKING MARKET, BY PAYLOAD, 2018-2033 (USD THOUSAND)

13.3 12–20 TONNES

13.4 ABOVE 20 TONNES

13.5 7–12 TONNES

13.6 3–7 TONNES

13.7 1–3 TONNES

13.8 UP TO 1 TONNE

14 BANGLADESH TRUCKING MARKET, BY DISTANCE.

14.1 OVERVIEW

14.2 BANGLADESH TRUCKING MARKET, BY DISTANCE, 2018-2033 (USD THOUSAND)

14.3 100–200 MILES

14.4 200–500 MILES

14.5 LESS THAN 50 MILES

14.6 50–100 MILES

14.7 MORE THAN 500 MILES

15 BANGLADESH TRUCKING MARKET, BY OWNERSHIP.

15.1 OVERVIEW

15.2 BANGLADESH TRUCKING MARKET, BY OWNERSHIP, 2018-2033 (USD THOUSAND)

15.3 OWNER-OPERATORS

15.4 3PL PROVIDERS

15.5 AGGREGATOR PLATFORMS

15.6 CAPTIVE FLEETS

15.7 4PL PROVIDERS

15.8 OTHERS

16 BANGLADESH TRUCKING MARKET, BY FLEET SIZE.

16.1 OVERVIEW

16.2 BANGLADESH TRUCKING MARKET, BY FLEET SIZE, 2018-2033 (USD THOUSAND)

16.3 SMALL FLEETS

16.4 MEDIUM FLEETS

16.5 LARGE FLEETS

17 BANGLADESH TRUCKING MARKET, BY CARGO TYPE.

17.1 OVERVIEW

17.2 BANGLADESH TRUCKING MARKET, BY CARGO TYPE, 2018-2033 (USD THOUSAND)

17.3 CONTAINERIZED

17.4 DRY CARGO

17.5 PERISHABLES

17.6 BULK LIQUIDS

17.7 BULK SOLIDS

17.8 HIGH-VALUE

17.9 OVERSIZED CARGO

17.1 HAZARDOUS

17.11 OTHERS

18 BANGLADESH READY MADE GARMENTS MARKET, BY OPERATION TYPE.

18.1 OVERVIEW

18.2 BANGLADESH TRUCKING MARKET, BY OPERATION TYPE, 2018-2033 (USD THOUSAND)

18.3 DOMESTIC

18.4 INTERNATIONAL

19 BANGLADESH TRUCKING MARKET, BY PRICING MODEL.

19.1 OVERVIEW

19.2 BANGLADESH TRUCKING MARKET, BY PRICING MODEL, 2018-2033 (USD THOUSAND)

19.3 DISTANCE-BASED

19.4 WEIGHT-BASED

19.5 TRIP-BASED

19.6 TIME-BASED

19.7 SUBSCRIPTION

19.8 OTHERS

20 BANGLADESH TRUCKING MARKET, BY APPLICATION.

20.1 OVERVIEW

20.2 BANGLADESH TRUCKING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

20.3 RMGS & TEXTILES

20.4 FMCG

20.5 FOOD & BEVERAGES

20.6 MANUFACTURING

20.7 RETAIL

20.8 E-COMMERCE

20.9 MINING, ENERGY & UTILITY

20.1 OIL & GAS

20.11 AUTOMOTIVE

20.12 CHEMICALS

20.13 TRANSPORTATION

20.14 HEALTHCARE

20.15 ELECTRONICS

20.16 APPARELS & FOOTWEAR

20.17 IT & TELECOM

20.18 DEFENSE

20.19 OTHERS

20.2 BANGLADESH RMGS & TEXTILES IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.20.1 SPOT HAULAGE

20.20.2 MULTI-DROP DISTRIBUTION

20.20.3 EXPEDITED DELIVERY

20.20.4 INTERMODAL FEEDER

20.20.5 OTHERS

20.21 BANGLADESH FMCG IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.21.1 SPOT HAULAGE

20.21.2 MULTI-DROP DISTRIBUTION

20.21.3 EXPEDITED DELIVERY

20.21.4 INTERMODAL FEEDER

20.21.5 OTHERS

20.22 BANGLADESH FOOD & BEVERAGES IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.22.1 SPOT HAULAGE

20.22.2 MULTI-DROP DISTRIBUTION

20.22.3 EXPEDITED DELIVERY

20.22.4 INTERMODAL FEEDER

20.22.5 OTHERS

20.23 BANGLADESH MANUFACTURING IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.23.1 SPOT HAULAGE

20.23.2 MULTI-DROP DISTRIBUTION

20.23.3 EXPEDITED DELIVERY

20.23.4 INTERMODAL FEEDER

20.23.5 OTHERS

20.24 BANGLADESH RETAIL IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.24.1 SPOT HAULAGE

20.24.2 MULTI-DROP DISTRIBUTION

20.24.3 EXPEDITED DELIVERY

20.24.4 INTERMODAL FEEDER

20.24.5 OTHERS

20.25 BANGLADESH E-COMMERCE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.25.1 SPOT HAULAGE

20.25.2 MULTI-DROP DISTRIBUTION

20.25.3 EXPEDITED DELIVERY

20.25.4 INTERMODAL FEEDER

20.25.5 OTHERS

20.26 BANGLADESH MINING, ENERGY & UTILITY IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.26.1 SPOT HAULAGE

20.26.2 MULTI-DROP DISTRIBUTION

20.26.3 EXPEDITED DELIVERY

20.26.4 INTERMODAL FEEDER

20.26.5 OTHERS

20.27 BANGLADESH OIL & GAS IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.27.1 SPOT HAULAGE

20.27.2 MULTI-DROP DISTRIBUTION

20.27.3 EXPEDITED DELIVERY

20.27.4 INTERMODAL FEEDER

20.27.5 OTHERS

20.28 BANGLADESH AUTOMOTIVE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.28.1 SPOT HAULAGE

20.28.2 MULTI-DROP DISTRIBUTION

20.28.3 EXPEDITED DELIVERY

20.28.4 INTERMODAL FEEDER

20.28.5 OTHERS

20.29 BANGLADESH CHEMICALS IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.29.1 SPOT HAULAGE

20.29.2 MULTI-DROP DISTRIBUTION

20.29.3 EXPEDITED DELIVERY

20.29.4 INTERMODAL FEEDER

20.29.5 OTHERS

20.3 BANGLADESH TRANSPORTATION IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.30.1 SPOT HAULAGE

20.30.2 MULTI-DROP DISTRIBUTION

20.30.3 EXPEDITED DELIVERY

20.30.4 INTERMODAL FEEDER

20.30.5 OTHERS

20.31 BANGLADESH HEALTHCARE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.31.1 SPOT HAULAGE

20.31.2 MULTI-DROP DISTRIBUTION

20.31.3 EXPEDITED DELIVERY

20.31.4 INTERMODAL FEEDER

20.31.5 OTHERS

20.32 BANGLADESH ELECTRONICS IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.32.1 SPOT HAULAGE

20.32.2 MULTI-DROP DISTRIBUTION

20.32.3 EXPEDITED DELIVERY

20.32.4 INTERMODAL FEEDER

20.32.5 OTHERS

20.33 BANGLADESH APPARELS & FOOTWEAR IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.33.1 SPOT HAULAGE

20.33.2 MULTI-DROP DISTRIBUTION

20.33.3 EXPEDITED DELIVERY

20.33.4 INTERMODAL FEEDER

20.33.5 OTHERS

20.34 BANGLADESH IT & TELECOM IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.34.1 SPOT HAULAGE

20.34.2 MULTI-DROP DISTRIBUTION

20.34.3 EXPEDITED DELIVERY

20.34.4 INTERMODAL FEEDER

20.34.5 OTHERS

20.35 BANGLADESH DEFENSE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

20.35.1 SPOT HAULAGE

20.35.2 MULTI-DROP DISTRIBUTION

20.35.3 EXPEDITED DELIVERY

20.35.4 INTERMODAL FEEDER

20.35.5 OTHERS

21 BANGLADESH TRUCKING MARKET, BY CONTRACT TYPE.

21.1 OVERVIEW

21.2 BANGLADESH TRUCKING MARKET, BY CONTRACT TYPE, 2018-2033 (USD THOUSAND)

21.3 PRIVATE FLEET TRUCKING

21.4 FOR-HIRE TRUCKING

21.5 DEDICATED CONTRACT CARRIAGE (DCC)

22 BANGLADESH TRUCKING MARKET, BY END USE.

22.1 OVERVIEW

22.2 BANGLADESH TRUCKING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

22.3 B2B (BUSINESS-TO-BUSINESS)

22.4 B2C (BUSINESS-TO-CONSUMER)

23 BANGLADESH TRUCKING MARKET: COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: BANGLADESH

24 SWOT ANALYSIS

25 COMPANY PROFILE

25.1 DHL

25.1.1 COMPANY SNAPSHOT

25.1.2 REVENUE ANALYSIS

25.1.3 PRODUCT PORTFOLIO

25.1.4 RECENT DEVELOPMENT

25.2 KUEHNE+NAGEL

25.2.1 COMPANY SNAPSHOT

25.2.2 REVENUE ANALYSIS

25.2.3 PRODUCT PORTFOLIO

25.2.4 RECENT DEVELOPMENT

25.3 DSV

25.3.1 COMPANY SNAPSHOT

25.3.2 PRODUCT PORTFOLIO

25.3.3 RECENT DEVELOPMENT

25.4 NIPPON EXPRESS HOLDINGS

25.4.1 COMPANY SNAPSHOT

25.4.2 REVENUE ANALYSIS

25.4.3 PRODUCT PORTFOLIO

25.4.4 RECENT DEVELOPMENT

25.5 PATHAO LTD

25.5.1 COMPANY SNAPSHOT

25.5.2 PRODUCT PORTFOLIO

25.5.3 RECENT DEVELOPMENT

25.6 2C SHIPPING

25.6.1 COMPANY SNAPSHOT

25.6.2 PRODUCT PORTFOLIO

25.6.3 RECENT DEVELOPMENTS

25.7 3I LOGISTICS PVT. LTD.

25.7.1 COMPANY SNAPSHOT

25.7.2 PRODUCT PORTFOLIO

25.7.3 RECENT DEVELOPMENT

25.8 A H KHAN & COMPANY LIMITED

25.8.1 COMPANY SNAPSHOT

25.8.2 PRODUCT PORTFOLIO

25.8.3 RECENT DEVELOPMENTS

25.9 ABC FREIGHT FORWARDING & SHIPPING LTD.

25.9.1 COMPANY SNAPSHOT

25.9.2 PRODUCT PORTFOLIO

25.9.3 RECENT DEVELOPMENTS

25.1 AGILITY GLOBAL.

25.10.1 COMPANY SNAPSHOT

25.10.2 PRODUCT PORTFOLIO

25.10.3 RECENT DEVELOPMENT

25.11 AN EJOGAJOG LIMITED SERVICE.

25.11.1 COMPANY SNAPSHOT

25.11.2 PRODUCT PORTFOLIO

25.11.3 RECENT DEVELOPMENT

25.12 APT MERCHANT SHIPPING LINE LTD.

25.12.1 COMPANY SNAPSHOT

25.12.2 PRODUCT PORTFOLIO

25.12.3 RECENT DEVELOPMENTS

25.13 ATLAS LOGISTICS LTD (ATLAS LOGISTICS BANGLADESH(PVT). LTD)

25.13.1 COMPANY SNAPSHOT

25.13.2 PRODUCT PORTFOLIO

25.13.3 RECENT DEVELOPMENT

25.14 CEVA LOGISTICS

25.14.1 COMPANY SNAPSHOT

25.14.2 PRODUCT PORTFOLIO

25.14.3 RECENT DEVELOPMENT

25.15 COSMOS LOGISTICS

25.15.1 COMPANY SNAPSHOT

25.15.2 PRODUCT PORTFOLIO

25.15.3 RECENT DEVELOPMENT

25.16 CROWN LOGISTICS LTD.

25.16.1 COMPANY SNAPSHOT

25.16.2 PRODUCT PORTFOLIO

25.16.3 RECENT DEVELOPMENT

25.17 EUR SERVICE (BD) LTD.

25.17.1 COMPANY SNAPSHOT

25.17.2 PRODUCT PORTFOLIO

25.17.3 RECENT DEVELOPMENTS

25.18 EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.

25.18.1 COMPANY SNAPSHOT

25.18.2 REVENUE ANALYSIS

25.18.3 PRODUCT PORTFOLIO

25.18.4 RECENT DEVELOPMENT

25.19 FARAJI LOGISTICS

25.19.1 COMPANY SNAPSHOT

25.19.2 PRODUCT PORTFOLIO

25.19.3 RECENT DEVELOPMENT

25.2 FAREAST LOGISTICS BD LTD

25.20.1 COMPANY SNAPSHOT

25.20.2 PRODUCT PORTFOLIO

25.20.3 RECENT DEVELOPMENT

25.21 FLEET FREIGHT

25.21.1 COMPANY SNAPSHOT

25.21.2 PRODUCT PORTFOLIO

25.21.3 RECENT DEVELOPMENT

25.22 FOX PARCEL

25.22.1 COMPANY SNAPSHOT

25.22.2 PRODUCT PORTFOLIO

25.22.3 RECENT DEVELOPMENT

25.23 FREIGHT OPTIONS LTD

25.23.1 COMPANY SNAPSHOT

25.23.2 PRODUCT PORTFOLIO

25.23.3 RECENT DEVELOPMENT

25.24 GEODIS

25.24.1 COMPANY SNAPSHOT

25.24.2 PRODUCT PORTFOLIO

25.24.3 RECENT DEVELOPMENT

25.25 HOMEBOUND

25.25.1 COMPANY SNAPSHOT

25.25.2 PRODUCT PORTFOLIO

25.25.3 RECENT DEVELOPMENT

25.26 KM GROUP

25.26.1 COMPANY SNAPSHOT

25.26.2 PRODUCT PORTFOLIO

25.26.3 RECENT DEVELOPMENTS

25.27 LOOP.

25.27.1 COMPANY SNAPSHOT

25.27.2 PRODUCT PORTFOLIO

25.27.3 RECENT DEVELOPMENT

25.28 M&M TRANSPORT AGENCY

25.28.1 COMPANY SNAPSHOT

25.28.2 PRODUCT PORTFOLIO

25.28.3 RECENT DEVELOPMENT

25.29 M/S. JAMUNA TRANSPORT AGENCY

25.29.1 COMPANY SNAPSHOT

25.29.2 PRODUCT PORTFOLIO

25.29.3 RECENT DEVELOPMENT

25.3 NATIONAL CARRIERS CORPORATION

25.30.1 COMPANY SNAPSHOT

25.30.2 PRODUCT PORTFOLIO

25.30.3 RECENT DEVELOPMENT

25.31 NAVANA LOGISTICS LTD

25.31.1 COMPANY SNAPSHOT

25.31.2 PRODUCT PORTFOLIO

25.31.3 RECENT DEVELOPMENT

25.32 OBHAI SOLUTIONS LIMITED

25.32.1 COMPANY SNAPSHOT

25.32.2 PRODUCT PORTFOLIO

25.32.3 RECENT DEVELOPMENT

25.33 ORIENT OVERSEAS CONTAINER LINE LIMITED

25.33.1 COMPANY SNAPSHOT

25.33.2 REVENUE ANALYSIS

25.33.3 PRODUCT PORTFOLIO

25.33.4 RECENT DEVELOPMENT

25.34 RELIABLE LOGISTICS SERVICE

25.34.1 COMPANY SNAPSHOT

25.34.2 PRODUCT PORTFOLIO

25.34.3 RECENT DEVELOPMENT

25.35 RK FREIGHT LTD

25.35.1 COMPANY SNAPSHOT

25.35.2 PRODUCT PORTFOLIO

25.35.3 RECENT DEVELOPMENT

25.36 SCAN GLOBAL LOGISTICS

25.36.1 COMPANY SNAPSHOT

25.36.2 PRODUCT PORTFOLIO

25.36.3 RECENT DEVELOPMENT

25.37 SEKO LOGISTICS

25.37.1 COMPANY SNAPSHOT

25.37.2 PRODUCT PORTFOLIO

25.37.3 RECENT DEVELOPMENT

25.38 SINOBEN GROUP

25.38.1 COMPANY SNAPSHOT

25.38.2 PRODUCT PORTFOLIO

25.38.3 RECENT DEVELOPMENT

25.39 SOFTECH (NISSHIN TRANS CONSOLIDATOR BD LTD)

25.39.1 COMPANY SNAPSHOT

25.39.2 PRODUCT PORTFOLIO

25.39.3 RECENT DEVELOPMENT

25.4 SUMMIT ALLIANCE PORT LIMITED

25.40.1 COMPANY SNAPSHOT

25.40.2 REVENUE ANALYSIS

25.40.3 PRODUCT PORTFOLIO

25.40.4 RECENT DEVELOPMENT

25.41 TITAS TRANSPORT AGENCY

25.41.1 COMPANY SNAPSHOT

25.41.2 PRODUCT PORTFOLIO

25.41.3 RECENT DEVELOPMENTS

25.42 TLI (TRANSPORTATION LOGISTICS INT'L BANGLADESH LTD.)

25.42.1 COMPANY SNAPSHOT

25.42.2 PRODUCT PORTFOLIO

25.42.3 RECENT DEVELOPMENT

25.43 TOWER FREIGHT LOGISTICS LIMITED.

25.43.1 COMPANY SNAPSHOT

25.43.2 PRODUCT PORTFOLIO

25.43.3 RECENT DEVELOPMENT

25.44 TRANSWORLD SHIPPING LIMITED

25.44.1 COMPANY SNAPSHOT

25.44.2 PRODUCT PORTFOLIO

25.44.3 RECENT DEVELOPMENT

25.45 TRUCK LAGBE LIMITED

25.45.1 COMPANY SNAPSHOT

25.45.2 PRODUCT PORTFOLIO

25.45.3 RECENT DEVELOPMENTS

25.46 URANUS FREIGHT LOGISTICS LTD

25.46.1 COMPANY SNAPSHOT

25.46.2 PRODUCT PORTFOLIO

25.46.3 RECENT DEVELOPMENTS

25.47 VISCO LOGISTICS BANGLADESH LTD

25.47.1 COMPANY SNAPSHOT

25.47.2 PRODUCT PORTFOLIO

25.47.3 RECENT DEVELOPMENT

25.48 WAC BANGLADESH LIMITED

25.48.1 COMPANY SNAPSHOT

25.48.2 PRODUCT PORTFOLIO

25.48.3 RECENT DEVELOPMENT

25.49 YUSEN LOGISTICS GLOBAL MANAGEMENT CO., LTD.

25.49.1 COMPANY SNAPSHOT

25.49.2 PRODUCT PORTFOLIO

25.49.3 RECENT DEVELOPMENT

26 QUESTIONNAIRE

27 RELATED REPORTS

List of Table

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 COMPANY SERVICE PLATFORM MATRIX

TABLE 3 TRUCK/FLEET SIZE OF MAJOR PLAYERS

TABLE 4 USED CASE ANALYSIS

TABLE 5 GLOBAL VS REGIONAL TARIFF STRUCTURES

TABLE 6 BANGLADESH TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 7 BANGLADESH TRUCKING MARKET, BY VEHICLE TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 BANGLADESH TRUCKING MARKET, BY TRUCK TYPE, 2018-2033 (USD THOUSAND)

TABLE 9 BANGLADESH BOX TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 10 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 11 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 12 BANGLADESH FUEL IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 13 BANGLADESH GASES IN TRUCKING, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 14 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY PRESSURIZATION, 2018-2033 (USD THOUSAND)

TABLE 15 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY REFRIGERATION, 2018-2033 (USD THOUSAND)

TABLE 16 BANGLADESH TANKER TRUCK IN TRUCKING MARKET, BY INSULATION, 2018-2033 (USD THOUSAND)

TABLE 17 BANGLADESH REFRIGERATED TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 18 BANGLADESH PERISHABLE GOODS IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 19 BANGLADESH MEDICAL SUPPLIES IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 20 BANGLADESH BEVERAGES IN TRUCKING MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 21 BANGLADESH FLATBEDS TRUCK IN TRUCKING MARKET, BY TRANSPORT PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 22 BANGLADESH TRUCKING MARKET, BY LOAD TYPE, 2018-2033 (USD THOUSAND)

TABLE 23 BANGLADESH TRUCKING MARKET, BY DRIVE TRAIN, 2018-2033 (USD THOUSAND)

TABLE 24 BANGLADESH TRUCKING MARKET, BY PAYLOAD, 2018-2033 (USD THOUSAND)

TABLE 25 BANGLADESH TRUCKING MARKET, BY DISTANCE, 2018-2033 (USD THOUSAND)

TABLE 26 BANGLADESH TRUCKING MARKET, BY OWNERSHIP, 2018-2033 (USD THOUSAND)

TABLE 27 BANGLADESH TRUCKING MARKET, BY FLEET SIZE, 2018-2033 (USD THOUSAND)

TABLE 28 BANGLADESH TRUCKING MARKET, BY CARGO TYPE, 2018-2033 (USD THOUSAND)

TABLE 29 BANGLADESH TRUCKING MARKET, BY OPERATION TYPE, 2018-2033 (USD THOUSAND)

TABLE 30 BANGLADESH TRUCKING MARKET, BY PRICING MODEL, 2018-2033 (USD THOUSAND)

TABLE 31 BANGLADESH TRUCKING MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 32 BANGLADESH RMGS & TEXTILES IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 33 BANGLADESH FMCG IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 34 BANGLADESH FOOD & BEVERAGES IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 35 BANGLADESH MANUFACTURING IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 36 BANGLADESH RETAIL IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 37 BANGLADESH E-COMMERCE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 38 BANGLADESH MINING, ENERGY & UTILITY IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 39 BANGLADESH OIL & GAS IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 40 BANGLADESH AUTOMOTIVE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 41 BANGLADESH CHEMICALS IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 42 BANGLADESH TRANSPORTATION IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 43 BANGLADESH HEALTHCARE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 44 BANGLADESH ELECTRONICS IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 45 BANGLADESH APPARELS & FOOTWEAR IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 46 BANGLADESH IT & TELECOM IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 47 BANGLADESH DEFENSE IN TRUCKING MARKET, BY SERVICE TYPE, 2018-2033 (USD THOUSAND)

TABLE 48 BANGLADESH TRUCKING MARKET, BY CONTRACT TYPE, 2018-2033 (USD THOUSAND)

TABLE 49 BANGLADESH TRUCKING MARKET, BY END USE, 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 BANGLADESH TRUCKING MARKET: SEGMENTATION

FIGURE 2 BANGLADESH TRUCKING MARKET: DATA TRIANGULATION

FIGURE 3 BANGLADESH TRUCKING MARKET: DROC ANALYSIS

FIGURE 4 BANGLADESH TRUCKING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 BANGLADESH TRUCKING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BANGLADESH TRUCKING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 BANGLADESH TRUCKING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 BANGLADESH TRUCKING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 BANGLADESH TRUCKING MARKET: MULTIVARIATE MODELING

FIGURE 10 BANGLADESH TRUCKING MARKET: SERVICE TYPE TIMELINE CURVE

FIGURE 11 BANGLADESH TRUCKING MARKET: END-USER COVERAGE GRID

FIGURE 12 BANGLADESH TRUCKING MARKET: SEGMENTATION

FIGURE 13 FIVE SEGMENTS COMPRISE THE BANGLADESH TRUCKING MARKET, BY SERVICE TYPE (2025)

FIGURE 14 BANGLADESH TRUCKING MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 COMPETITIVE LABOR COSTS AND A LARGE WORKFORCE SUPPORT HIGH-VOLUME APPAREL PRODUCTION IS EXPECTED TO DRIVE THE BANGLADESH TRUCKING MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 17 SPOT HAULAGE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BANGLADESH TRUCKING MARKET IN 2026 & 2033

FIGURE 18 DROC

FIGURE 19 BANGLADESH TRUCKING MARKET, BY SERVICE TYPE, 2025

FIGURE 20 BANGLADESH TRUCKING MARKET, BY VEHICLE, 2025

FIGURE 21 BANGLADESH TRUCKING MARKET, BY TRUCK TYPE, 2025

FIGURE 22 BANGLADESH TRUCKING MARKET, BY LOAD TYPE, 2025

FIGURE 23 BANGLADESH TRUCKING MARKET, BY DIESEL, 2025

FIGURE 24 BANGLADESH TRUCKING MARKET, BY PAYLOAD, 2025

FIGURE 25 BANGLADESH TRUCKING MARKET, BY DISTANCE, 2025

FIGURE 26 BANGLADESH TRUCKING MARKET, BY OWNERSHIP, 2025

FIGURE 27 BANGLADESH TRUCKING MARKET, BY FLEET SIZE, 2025

FIGURE 28 BANGLADESH TRUCKING MARKET, BY CARGO TYPE, 2025

FIGURE 29 BANGLADESH READY-MADE GARMENTS MARKET, BY OPERATION TYPE, 2025

FIGURE 30 BANGLADESH TRUCKING MARKET, BY PRICING MODEL, 2025

FIGURE 31 BANGLADESH TRUCKING MARKET, BY APPLICATION, 2025

FIGURE 32 BANGLADESH TRUCKING MARKET, BY CONTRACT TYPE, 2025

FIGURE 33 BANGLADESH TRUCKING MARKET, BY END USE, 2025

FIGURE 34 BANGLADESH TRUCKING MARKET: COMPANY SHARE 2025 (%)

Bangladesh Trucking Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Bangladesh Trucking Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Bangladesh Trucking Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.