Bangladesh Warehousing Market

Market Size in USD Billion

CAGR :

%

USD

3.16 Billion

USD

8.54 Billion

2025

2033

USD

3.16 Billion

USD

8.54 Billion

2025

2033

| 2026 –2033 | |

| USD 3.16 Billion | |

| USD 8.54 Billion | |

|

|

|

|

Bangladesh Warehousing Market Size

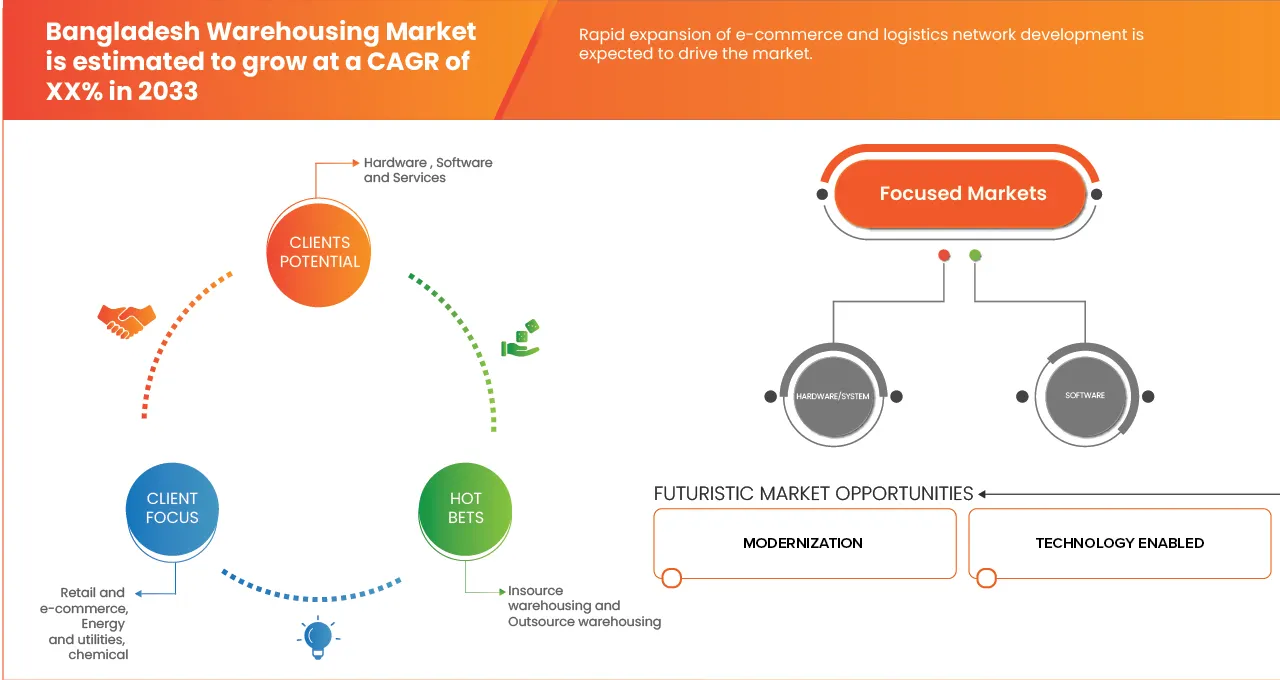

- The Bangladesh warehousing market is expected to reach USD 8.54 billion by 2033 from USD 3.16 billion in 2025, growing with a CAGR of 13.9% in the forecast period of 2026 to 2033.

- The Bangladesh warehousing market is experiencing strong growth driven by rising demand from export-oriented industries such as RMG, pharmaceuticals, leather, and agro-products, supported by expanding trade volumes, growing e-commerce activity, and increasing need for efficient storage and distribution infrastructure.

- Industry expansion is further accelerated by the adoption of modern warehouse automation technologies, digital inventory management systems, and the development of specialized facilities such as bonded warehouses, cold-chain storage, and integrated logistics hubs to improve operational efficiency.

- Government incentives, logistics-sector reforms, and large-scale infrastructure investments—including port modernization, special economic zones (SEZs), and improved road/rail connectivity are supporting warehouse capacity expansion, attracting private and foreign investment, and enhancing supply-chain efficiency across the country.

- Additionally, the shift toward value-added warehousing services, increasing investments by 3PL/4PL players, and the growing need for temperature-controlled storage for pharmaceuticals, food, and perishables are strengthening Bangladesh’s position as an emerging logistics and warehousing hub with strong long-term growth potential.

Bangladesh Warehousing Market Analysis

- .The Bangladesh warehousing market encompasses the storage, management, and distribution of goods across sectors such as FMCG, e-commerce, textiles, pharmaceuticals, agro-products, and industrial materials. Market growth is driven by the rising need for efficient storage solutions, organized inventory management, and enhanced logistics capabilities, supported by increasing domestic trade, industrial growth, and the rapid expansion of e-commerce logistics.

- Hardware and warehouse management systems (WMS) are projected to dominate the Bangladesh warehousing market, capturing 52.41% market share and expected to grow at a CAGR of 14.5%. This dominance is fueled by the adoption of advanced storage technologies, automation solutions, and digital inventory systems, which help businesses streamline operations, reduce errors, and enhance operational efficiency across industrial, retail, and e-commerce sectors.

- The Bangladesh warehousing market is reflecting rapid adoption of modern warehouse technologies and increased investment in smart, scalable storage solutions. Market players are focusing on integrating automated material handling equipment, cloud-based inventory management systems, and value-added services to meet evolving business demands.

- The adoption of automated and system-driven warehousing solutions is particularly strong, enabling efficient handling of perishable goods, pharmaceuticals, and high-volume retail products. Companies are increasingly leveraging technology to optimize storage space, improve order fulfillment times, and enhance real-time tracking and inventory visibility.

- Market growth is further supported by government initiatives to improve transport infrastructure, establish industrial zones, and promote logistics modernization, positioning Bangladesh as a high-potential and rapidly evolving warehousing market in South Asia with significant long-term growth opportunities.

Report Scope and Bangladesh Warehousing Market Segmentation

|

Attributes |

Bangladesh Warehousing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bangladesh Warehousing Market Dynamics

Driver

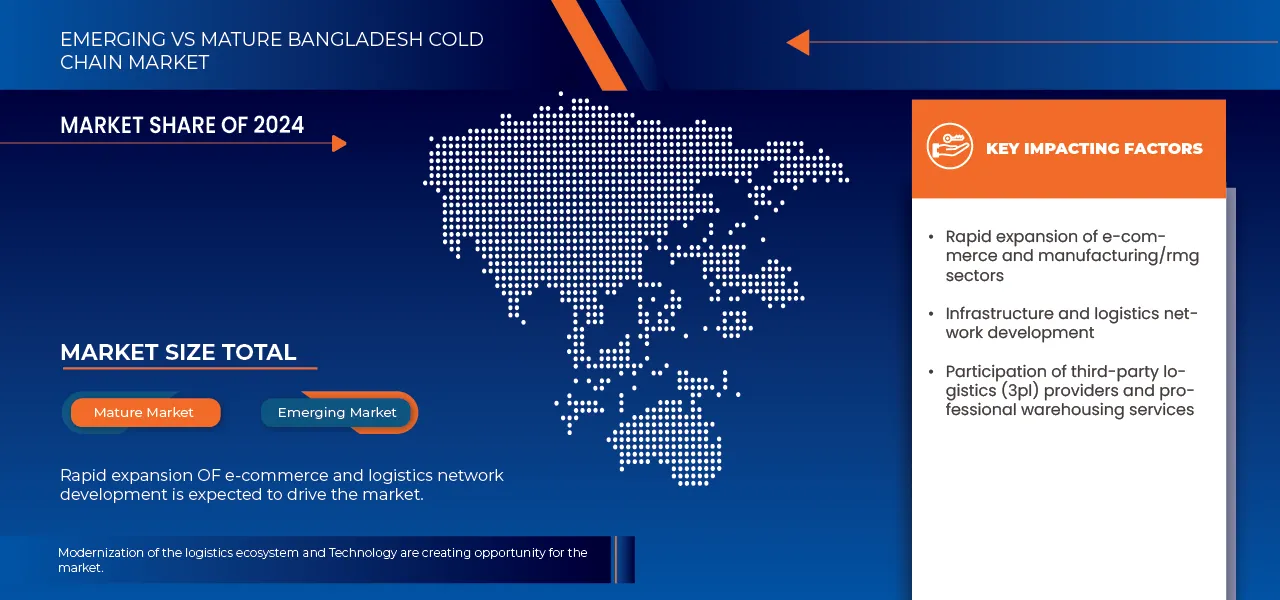

“Rapid expansion of e-commerce and manufacturing/RMG sectors”

- The fast-growing e-commerce industry in Bangladesh is creating strong demand for modern warehousing facilities to support higher order volumes, faster delivery expectations, and efficient last-mile logistics, leading companies to expand storage capacity and invest in advanced warehouse systems.

- The manufacturing and RMG sectors—key contributors to Bangladesh’s exports are scaling production, which increases the need for larger, more organized warehouses to handle raw materials, finished goods, and international shipment requirements.

- As both e-commerce and manufacturing/RMG grow, businesses are prioritizing automation, inventory management technologies, and improved supply-chain infrastructure, directly accelerating investment in warehousing development across the country.

For Instances

- In November 2021, Dhaka Tribune reported that Bangladesh Economic Zones Authority (BEZA) planned to establish 100 economic zones by 2030, a policy initiative expected to drive industrial capacity expansion and thereby increase demand for warehousing infrastructure.

- In January 2023, Dhaka Tribune reported that Bangladesh was pushing forward development of 100 special economic zones to boost green industrialization and export-oriented manufacturing a move anticipated to stimulate warehousing and logistics infrastructure requirements.

- In March 2023, The Business Standard reported that BEZA had confirmed that multiple economic zones including privately and public-private managed ones — had begun production and land allocation, indicating early-stage industrial output growth that would necessitate warehousing and logistics supports..

Restraint/Challenge

“Fragmented and underdeveloped infrastructure”

- Fragmented and underdeveloped infrastructure continues to act as a major restraint on the expansion and operational efficiency of the Bangladesh warehousing market.

- Limited integration between transport corridors, inadequate last-mile connectivity, and persistent congestion across key freight routes undermine the smooth movement of goods into and out of storage facilities.

- Insufficient container-handling capacity, uneven road conditions and inadequate multimodal linkages create delays and increase transportation costs, thereby reducing the effectiveness of warehousing operations.

- These structural weaknesses contribute to unpredictable cargo flows, lower warehouse utilisation and higher logistics risk, constraining the ability of the warehousing industry to scale in line with growing national demand.

For Instances,

- In July 2025, an editorial in The Daily Star noted that poor infrastructure, high transport costs and policy gaps continue to challenge Bangladesh’s logistics sector — factors that undermine export competitiveness and raise warehousing and distribution inefficiencies.

- In August 2025, a research article titled “Current Status and Development Strategies of the Logistics Industry in Bangladesh” described insufficient warehousing infrastructure, lack of coordination, high operational costs and underdeveloped logistics networks as systemic constraints hindering supply-chain efficiency.

Bangladesh Warehousing Market Scope

The Bangladesh Warehousing market is segmented into ten notable segments based on the Components, Type, Function, Size, Ownership, Tenure, Scale, Warehousing Storage Nature, WMS Tier Type, Application.

- By Components

On the basis of Components, the Bangladesh Warehousing market is segmented into Hardware/System, Software, Services. Hardware/System is further sub segmented by type into Pallets, Conveyor System, Automated Storage and Retrieval System, Transport System, Automated Guided Vehicles (AGVS), Sortation System, Autonomous Mobile Robotics, Barcode System, Others.

The Hardware/System segment is expected to dominate the Bangladesh Warehousing market with a 52.10% market share growing with the highest CAGR of 14.5% largely because the sector is rapidly shifting toward modernization and automation to meet rising logistical demands. With strong growth in e-commerce, export-oriented manufacturing, and the RMG industry, companies are increasingly investing in physical automation tools such as pallets, conveyor systems, AS/RS units, sortation systems, barcode systems, and automated guided vehicles to improve operational efficiency and handle higher throughput. Traditional warehouses can no longer support the speed, accuracy, and volume required by modern supply chains, pushing operators to prioritize hardware upgrades as their primary capital investment.

- By Type

On the basis of Type, the Bangladesh Warehousing market is segmented into Insource Warehousing, Outsource Warehousing.

The Insource Warehousing segment is expected to dominate the Bangladesh Warehousing market with a 52.62% market share and growing with the highest CAGR of 14.5% because many large manufacturers, exporters, and RMG companies prefer maintaining direct control over their storage operations to ensure better quality, security, and efficiency. As production volumes increase especially in RMG, pharmaceuticals, FMCG, and e-commerce businesses are choosing to develop or expand their own warehouse facilities to streamline inventory management, reduce dependency on external providers, and support faster turnaround times. Insource warehousing also allows companies to customize layouts, integrate automation technologies, and align warehousing processes with their internal production and distribution needs.

- By Function

On the basis of Function, the Bangladesh Warehousing market is segmented into Inventory Control and Management, Order Fulfilment, Asset Tracking, Shipping, Workforce and Task (Process) Management, Yard and Dock Management, Predictive Maintenance, Other.

The Inventory Control and Management segment is expected to dominate the Bangladesh Warehousing market with a 24.96% market share and growing with the highest CAGR of 14.8% because businesses across manufacturing, RMG, pharmaceuticals, FMCG, and e-commerce are increasingly prioritizing accurate, real-time inventory visibility to support faster and more efficient supply-chain operations. As trade volumes rise and customer expectations for timely delivery increase, companies are investing in advanced inventory tracking systems, barcode/RFID solutions, warehouse management software (WMS), and automated monitoring tools to reduce stockouts, minimize losses, and optimize space utilization.

- By Size

On the basis of Size, the Bangladesh Warehousing market is segmented into Small, Medium, Large.

The small segment is expected to dominate the Bangladesh Warehousing market with a 39.39% market share and growing with the highest CAGR of 14.6% primarily because the country’s logistics landscape is still largely driven by small and mid-sized businesses that rely on compact, cost-efficient storage facilities. Bangladesh’s booming e-commerce sector, expanding retail networks, and the presence of numerous small manufacturers especially in RMG subcontracting, light engineering, agro-processing, and pharmaceuticals are fueling the need for flexible, affordable warehousing spaces.

- By Ownership

On the basis of Ownership, the Bangladesh Warehousing market is segmented into Public Warehouses, Private Warehouses, Bonded Warehouses, Consolidated Warehouse.

The Public Warehouses segment is expected to dominate the Bangladesh Warehousing market with a 57.19% market share and growing with the highest CAGR of 14.2% because these facilities offer flexible, low-cost storage solutions that cater to a wide range of users, including SMEs, importers, exporters, e-commerce sellers, and distributors who may not have the capital to build or operate private warehouses. As Bangladesh’s trade volumes expand particularly in RMG, consumer goods, agriculture, and pharmaceuticals businesses increasingly rely on public warehouses for short-term and scalable storage to manage fluctuating inventory needs. Public warehouses also provide easier access to logistics services such as handling, packaging, customs support, and distribution, making them an attractive option for both domestic firms and new market entrants.

- By Tenure

On the basis of Tenure, the Bangladesh Warehousing market is segmented into Long Term (1–10 Years), Medium Term (3–12 Months), Short Term (Up to 3 Months), Pay Per Use.

The Long Term (1–10 Years) segment is expected to dominate the Bangladesh Warehousing market with a 45.23% market share and growing with the highest CAGR of 14.3% because businesses increasingly seek stable and secure storage solutions to support sustained growth, large-scale manufacturing, and export-oriented operations. Long-term leases provide companies with the certainty of space availability, the ability to customize facilities, and cost advantages compared to frequently renewing short-term contracts. Industries such as RMG, pharmaceuticals, FMCG, and e-commerce prefer long-term warehousing to manage consistent inventory flows, streamline supply chains, and integrate advanced systems like automated storage, conveyor belts, and inventory management software.

- By Scale

On the basis of Scale, the Bangladesh Warehousing market is segmented into Up to 5,000 m², 5,000–25,000 m², Above 25,000 m².

The 5,000 m² segment is expected to dominate the Bangladesh Warehousing market with a 49.67% market share and is expected to reach USD 4,372.44 million by 2033, growing with the highest CAGR of 14.3% because this size range offers the ideal balance between capacity, cost, and operational efficiency for a wide range of businesses. Mid-sized warehouses are particularly attractive to manufacturers, exporters (especially in the RMG sector), e-commerce companies, and distributors who require substantial storage space without the high investment and management complexity associated with very large facilities. These warehouses can accommodate automated material handling systems, inventory management technologies, and multi-product storage, making them highly adaptable to growing and diversified business needs.

- By Warehousing Storage Nature

On the basis of Storage Nature, the Bangladesh Warehousing market is segmented into Ambient Warehousing (Around 80°F), Air Conditioned (56°F And 75°F), Refrigerated (33°F And 55°F), Cold/Frozen (of or Below 32°F), Others.

The Ambient Warehousing (Around 80°F) segment is expected to dominate the Bangladesh Warehousing market with a 36.21% market share and growing with the highest CAGR of 14.6% because the majority of goods stored in the country—such as textiles, garments, FMCG products, consumer electronics, and general merchandise—do not require temperature-controlled conditions. Ambient warehouses are cost-effective, easier to operate, and suitable for high-volume storage, making them the preferred choice for manufacturers, exporters, and e-commerce companies looking to optimize operational efficiency.

- By WMS Tier Type

On the basis of WMS Tier Type, the Bangladesh Warehousing market is segmented into Advanced WMS, Basic WMS, Intermediate WMS.

The Advanced WMS segment is expected to dominate the Bangladesh Warehousing market with a 60.01% market share and growing with the highest CAGR of 14.1% because businesses are increasingly adopting sophisticated warehouse management systems to improve operational efficiency, accuracy, and scalability. Advanced WMS solutions provide real-time inventory tracking, automation integration, order management, and analytics, which are critical for sectors such as RMG, pharmaceuticals, e-commerce, and FMCG that deal with high-volume and fast-moving goods.

- By Application

On the basis of Application, the Bangladesh Warehousing market is segmented into Food and Beverages, Transportation and Logistics, Retail and E-Commerce, Energy and Utilities, Chemical, Ready-Made Garments (RMG), Automotive, Electrical and Electronics, Healthcare, Agriculture, Others.

The Food and Beverages segment is expected to dominate the Bangladesh Warehousing market with a 18.42% market share and growing with the highest CAGR of 14.8% because this sector requires specialized storage solutions to manage high-volume, perishable, and fast-moving products efficiently. With rising urbanization, increasing consumer demand, and the expansion of organized retail and e-commerce channels in Bangladesh, companies in the food and beverage industry are investing heavily in modern warehousing facilities, including ambient, refrigerated, and cold storage units. Proper inventory management and timely distribution are critical to minimize spoilage, ensure food safety, and maintain compliance with national and international quality standards.

Bangladesh Warehousing Market Regional Analysis

The Bangladesh warehousing market is regionally concentrated around major industrial and commercial hubs, with Dhaka and Chattogram leading due to their dense population, high concentration of RMG factories, export-oriented industries, and port access for international trade. Dhaka serves as the primary center for e-commerce fulfillment, consumer goods distribution, and corporate warehouses, while Chattogram’s proximity to the country’s largest seaport makes it critical for bonded warehouses, import-export storage, and large-scale manufacturing logistics.

Bangladesh. Warehousing Market Insight

The Bangladesh warehousing market is witnessing robust growth driven by the country’s expanding manufacturing, RMG, e-commerce, and FMCG sectors. Rising domestic consumption, export-oriented production, and increasing trade volumes are fueling demand for modern storage solutions. The market is characterized by a strong preference for hardware/system investments, advanced warehouse management systems (WMS), and ambient or temperature-controlled facilities to ensure operational efficiency and compliance with international standards. Public and insourced warehouses dominate due to cost-effectiveness and control over inventory, while mid-sized (5,000–25,000 m²) and long-term tenure facilities are increasingly preferred for scalability and stability. Growth is further supported by government initiatives, logistics infrastructure development, and private-sector investments. Additionally, the food and beverages, RMG, and e-commerce sectors are the key applications driving demand. With rising automation, digitalization, and 3PL adoption, Bangladesh’s warehousing sector is poised for sustained expansion in the coming decade..

Bangladesh Warehousing Market Share

The Warehousing industry is primarily led by well-established companies, including:

- DHL (Germany)

- Kuehne+Nagel (Switzerland)

- DSV (Denmark)

- CEVA Logistics (Switzerland)

- Yusen Logistics Global Management Co., Ltd. (Japan)

- Nippon Express Holdings (Japan)

- Expeditors International of Washington, Inc. (U.Ss.)

- GEODIS (France)

- Summit Alliance Port Limited (SAPL) (Bangladesh)

- A H Khan & Company Limited. (Bangladesh)

Latest Developments in Bangladesh Warehousing Market

- In November 2025, CEVA extended its global logistics partnership with Scuderia Ferrari HP and will add support for the upcoming 2026 Ferrari Hypercar programme, handling logistics for race-assets through ocean, air, and low-carbon transport modes.

- In September 2025, CEVA was awarded “Integrated Logistics Supplier of the Year” by Caterpillar Inc., recognising CEVA’s excellence across air, ocean, ground, customs brokerage, and contract-logistics services during the 2024-25 performance period.

- In November 2025, DHL announced a major planned investment EUR 130 million to build a new multi‑user warehouse and distribution hub in the Special Integrated Logistics Zone (SILZ) near Riyadh (Saudi Arabia), with 53,000 m² of warehouse space. The facility is intended to strengthen regional supply‑chain infrastructure and serve multiple industries including retail, automotive, energy, and e‑commerce.

- In October 2024, DHL extended its contract‑logistics portfolio in the UAE by transferring seven facilities (previously under its forwarding arm) to DHL Supply Chain enabling warehousing, fulfilment and related services in the region for industries such as automotive, e‑commerce, manufacturing and retail.

- In April 2025, Agility announced that three warehouses at its ALP park in Maputo, Mozambique, became the first warehouses in the country to earn EDGE Advanced certification a globally recognized standard for energy‑ and resource‑efficient “green” buildings. The certified warehouses (one 14,000 sqm and two 9,000 sqm units) achieved substantial performance benefits: over 62.7% energy savings, more than 40% water savings, and about 68% reduction in embodied carbon in construction materials compared to typical buildings. For tenants and users of these warehouses, that means lower operating costs, reduced environmental footprint, and assurance that their storage or logistics operations are hosted in world‑class, sustainable infrastructure.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF BANGLADESH WAREHOUSING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES ANALYSIS

4.2 BRAND COMPARATIVE ANALYSIS — BANGLADESH WAREHOUSING MARKET

4.3 CHALLENGES

4.3.1 OVERVIEW

4.3.2 CHALLENGES FACED BY MANUFACTURERS

4.3.3 CHALLENGES FACED BY WAREHOUSE SERVICE PROVIDERS

4.3.4 INDUSTRY IMPLICATIONS

4.3.5 CONCLUSION

4.4 CONSUMER BEHAVIOUR

4.4.1 CONSUMER BEHAVIOR

4.4.2 BUYING PATTERN

4.4.3 USES ANALYSIS

4.5 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.6 INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

4.6.1 CUSTOMER BASE

4.6.2 SERVICE POSITIONING

4.6.3 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

4.6.4 APPLICATION REACH

4.7 NEW BUSINESS AND EMERGING BUSINESS'S REVENUE OPPORTUNITIES

4.8 PRICING ANALYSIS BASED ON SALES, MARKETING & CUSTOMER SERVICE

4.9 TECHNOLOGY ANALYSIS

4.9.1 KEY TECHNOLOGIES

4.9.2 COMPLEMENTARY TECHNOLOGIES

4.9.3 ADJACENT TECHNOLOGIES

4.1 FUNDING DETAILS

5 TARIFFS & IMPACT ON THE BANGLADESH WAREHOUSING MARKET

5.1 TARIFF & CUSTOMS FRAMEWORK

5.2 VAT TREATMENT

5.3 IMPORT DUTIES AND CAPITAL EXPENDITURE IMPLICATIONS

5.4 ENERGY & UTILITY TARIFFS —

5.5 PORT, ICD, AND CFS CHARGES —

5.6 POLICY DIRECTION & INVESTOR IMPLICATIONS

5.7 NET MARKET IMPACTS (EVIDENCE-BASED SYNTHESIS)

6 REGULATORY STANDARDS IN THE BANGLADESH WAREHOUSING MARKET

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RAPID EXPANSION OF E-COMMERCE AND MANUFACTURING/RMG SECTORS

7.1.2 INFRASTRUCTURE AND LOGISTICS NETWORK DEVELOPMENT

7.1.3 PARTICIPATION OF THIRD-PARTY LOGISTICS (3PL) PROVIDERS AND PROFESSIONAL WAREHOUSING SERVICES

7.2 RESTRAINTS

7.2.1 FRAGMENTED AND UNDERDEVELOPED INFRASTRUCTURE

7.2.2 REGULATORY AND LAND-RELATED BARRIERS

7.3 OPPORTUNITIES

7.3.1 MODERNIZATION OF THE LOGISTICS ECOSYSTEM

7.3.2 TECHNOLOGY-ENABLED SMART SOLUTIONS

7.4 CHALLENGES

7.4.1 SKILL GAPS AND LOW-TECH INTEGRATION

7.4.2 GLOBAL COMPETITION AND REGULATORY COMPLEXITY

8 BANGLADESH WAREHOUSING MARKET, BY COMPONENT.

8.1 OVERVIEW

8.2 BANGLADESH WAREHOUSING MARKET, BY COMPONENTS, 2018-2033 (USD MILLION)

8.2.1 HARDWARE/SYSTEM

8.2.2 SOFTWARE

8.2.3 SERVICES

8.3 BANGLADESH WAREHOUSING MARKET, HARDWARE/SYSTEM, BY TYPE, 2018-2033 (USD MILLION)

8.3.1 PALLETS

8.3.2 CONVEYOR SYSTEM

8.3.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

8.3.4 TRANSPORT SYSTEM

8.3.5 AUTOMATED GUIDED VEHICLES (AGVS)

8.3.6 SORTATION SYSTEM

8.3.7 AUTONOMOUS MOBILE ROBOTICS

8.3.8 BARCODE SYSTEM

8.3.9 OTHERS

8.4 BANGLADESH WAREHOUSING MARKET, BY PALLETS BY MATERIAL, 2018-2033 (USD MILLION)

8.4.1 WOODEN PALLET

8.4.2 PLASTIC PALLETS

8.4.3 METAL PALLETS

8.4.4 PAPER/ CORRUGATED PALLETS

8.5 BANGLADESH WAREHOUSING MARKET, BY PALLETS BY TYPE, 2018-2033 (USD MILLION)

8.5.1 CANTILEVER

8.5.2 SELECTIVE

8.5.3 DOUBLE DEEP

8.5.4 OTHERS

8.6 BANGLADESH WAREHOUSING MARKET, CONVEYOR SYSTEM, BY TYPE, 2018-2033 (USD MILLION)

8.6.1 ROLLER CONVEYORS

8.6.2 BELT CONVEYORS

8.6.3 SLAT CONVEYORS

8.7 BANGLADESH WAREHOUSING MARKET, AUTOMATED STORAGE AND RETRIEVAL SYSTEM, BY TYPE, 2018-2033 (USD MILLION)

8.7.1 UNIT LOAD

8.7.2 MINILOAD

8.7.3 DEEP LANE

8.7.4 MAN ON BOARD

8.8 BANGLADESH WAREHOUSING MARKET, TRANSPORT SYSTEM, BY TYPE, 2018-2033 (USD MILLION)

8.8.1 INDUSTRIAL TRUCKS

8.8.2 CRANES

8.9 BANGLADESH WAREHOUSING MARKET, AUTOMATED GUIDED VEHICLES (AGVS), BY TYPE, 2018-2033 (USD MILLION)

8.9.1 MATERIAL HANDLING

8.9.2 PICKING

8.9.3 SORTING

8.1 BANGLADESH WAREHOUSING MARKET, BY SORTATION SYSTEM BY TYPE, 2018-2033 (USD MILLION)

8.10.1 UNIT SORTER

8.10.2 CASE SORTER

8.11 BANGLADESH WAREHOUSING MARKET, BY AUTONOMOUS MOBILE ROBOTS, BY TYPE, 2018-2033 (USD MILLION)

8.11.1 MATERIAL HANDLING

8.11.2 ORDER FULFILMENT

8.11.3 INVENTORY SCANNING

8.12 BANGLADESH WAREHOUSING MARKET, SOFTWARE, BY TYPE, 2018-2033 (USD MILLION)

8.12.1 CLOUD

8.12.2 ON PREMISES

8.13 BANGLADESH WAREHOUSING MARKET, HARDWARE/SYSTEM, BY TYPE, 2018-2033 (USD MILLION)

8.13.1 MANAGED SERVICES

8.13.2 PROFESSIONAL SERVICES

8.14 BANGLADESH WAREHOUSING MARKET, PROFESSIONAL SERVICES, BY TYPE, 2018-2033 (USD MILLION)

8.14.1 INTEGRATION

8.14.2 TRAINING AND CONSULTING

8.14.3 TESTING

9 BANGLADESH WAREHOUSING MARKET, BY TYPE

9.1 OVERVIEW

9.2 INSOURCE WAREHOUSING

9.3 OUTSOURCE WAREHOUSING

10 BANGLADESH WAREHOUSING MARKET, BY FUNCTION

10.1 OVERVIEW

10.2 BANGLADESH WAREHOUSING MARKET, BY FUNCTION, 2018-2033 (USD MILLION)

10.2.1 INVENTORY CONTROL AND MANAGEMENT

10.2.2 ORDER FULFILMENT

10.2.3 ASSET TRACKING

10.2.4 SHIPPING

10.2.5 WORKFORCE AND TASK( PROCESS) MANAGEMENT

10.2.6 YARD AND DOCK MANAGEMENT

10.2.7 PREDICTIVE MAINTENANCE

10.2.8 OTHER

10.3 BANGLADESH WAREHOUSING MARKET, INVENTORY CONTROL & MANAGEMENT, BY TYPE, 2018-2033 (USD MILLION)

10.3.1 INVENTORY OPTIMIZATION

10.3.2 REAL-TIME INVENTORY TRACKING

10.4 BANGLADESH WAREHOUSING MARKET, INVENTORY OPTIMIZATION, BY TYPE, 2018-2033 (USD MILLION)

10.4.1 SAFETY STOCK MANAGEMENT

10.4.2 DYNAMIC REORDERING

10.4.3 DEMAND SENSING

10.5 BANGLADESH WAREHOUSING MARKET, REAL-TIME INVENTORY TRACKING, BY TYPE, 2018-2033 (USD MILLION)

10.5.1 RFID BASED TRACKING

10.5.2 BARCODE SCANNING

10.5.3 GPS BASED TRACKING

10.6 BANGLADESH WAREHOUSING MARKET, INVENTORY CONTROL & MANAGEMENT, BY STOCK LOCATION, 2018-2033 (USD MILLION)

10.6.1 FIXED LOCATION

10.6.2 FLOATING (RANDOM) LOCATION

10.7 BANGLADESH WAREHOUSING MARKET, ORDER FULFILLMENT, 2018-2033 (USD MILLION)

10.7.1 PICKING AND PACKAGING AUTOMATION

10.7.2 ORDER ROUTING AND OPTIMIZATION

10.7.3 RECEIVING AND PUT AWAY

10.8 BANGLADESH WAREHOUSING MARKET, ORDER ROUTING & OPTIMIZATION, BY TYPE, 2018-2033 (USD MILLION)

10.8.1 MULTI-CHANNEL ORDER MANAGEMENT

10.8.2 ROUTE PLANNING ALGORITHM

10.8.3 DYNAMIC SLOTTING

10.9 BANGLADESH WAREHOUSING MARKET, PICKING & PACKING AUTOMATION, BY TYPE, 2018-2033 (USD MILLION)

10.9.1 COBOTS

10.9.2 ROBOT PICKERS

10.9.3 GOODS-TO-PERSON PICKING (GTP)

10.1 BANGLADESH WAREHOUSING MARKET, ASSET TRACKING, 2018-2033 (USD MILLION)

10.10.1 PRODUCT & PACKAGE TRACKING

10.10.2 EQUIPMENT & VEHICLE TRACKING

10.11 BANGLADESH WAREHOUSING MARKET, PRODUCT & PACKAGE TRACKING, BY TYPE, 2018-2033 (USD MILLION)

10.11.1 RFID TAGGING

10.11.2 SMART PACKAGING

10.11.3 BLOCK CHAIN BASED TRACKING

10.12 BANGLADESH WAREHOUSING MARKET, EQUIPMENT & VEHICLE TRACKING, BY TYPE, 2018-2033 (USD MILLION)

10.12.1 GPS TRACKING

10.12.2 TELEMATICS

10.12.3 CONDITION MONITORING

10.13 BANGLADESH WAREHOUSING MARKET, PREDICTIVE MAINTENANCE, 2018-2033 (USD MILLION)

10.13.1 SENSOR-BASED

10.13.2 AI-DRIVEN

10.13.3 FAILURE MODE & EFFECT ANALYSIS

11 BANGLADESH WAREHOUSING MARKET, BY SIZE.

11.1 OVERVIEW

11.2 BANGLADESH WAREHOUSING MARKET, BY SIZE, 2018-2033 (USD MILLION)

11.2.1 SMALL

11.2.2 MEDIUM

11.2.3 LARGE

11.3 BANGLADESH WAREHOUSING MARKET, BY SMALL, 2018-2033 (USD MILLION)

11.3.1 SMALL-SCALE DISTRIBUTION CENTERS

11.3.2 MICRO WAREHOUSES

11.4 BANGLADESH WAREHOUSING MARKET, BY MEDIUM, 2018-2033 (USD MILLION)

11.4.1 REGIONAL WAREHOUSES

11.4.2 CROSS DOCKING FACILITIES

11.5 BANGLADESH WAREHOUSING MARKET, BY LARGE, 2018-2033 (USD MILLION)

11.5.1 NATIONAL DISTRIBUTION CENTERS

11.5.2 MEGA WAREHOUSES

12 BANGLADESH WAREHOUSING MARKET, BY OWNERSHIP.

12.1 OVERVIEW

12.2 BANGLADESH WAREHOUSING MARKET, BY OWNERSHIP, 2018-2033 (USD MILLION)

12.2.1 PUBLIC WAREHOUSES

12.2.2 PRIVATE WAREHOUSES

12.2.3 BONDED WAREHOUSES

12.2.4 CONSOLIDATED WAREHOUSE

13 BANGLADESH WAREHOUSING MARKET, BY TENURE.

13.1 OVERVIEW

13.2 BANGLADESH WAREHOUSING MARKET, BY TENURE, 2018-2033 (USD MILLION)

13.2.1 LONG TERM (1–10 YEARS)

13.2.2 MEDIUM TERM (3–12 MONTHS)

13.2.3 SHORT TERM (UP TO 3 MONTHS)

13.2.4 PAY PER USE

14 BANGLADESH WAREHOUSING MARKET, BY SCALE.

14.1 OVERVIEW

14.2 BANGLADESH WAREHOUSING MARKET, BY SCALE, 2018-2033 (USD MILLION)

14.2.1 UP TO 5,000 M²

14.2.2 5,000–25,000 M²

14.2.3 ABOVE 25,000 M²

15 BANGLADESH WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE

15.1 OVERVIEW

15.2 BANGLADESH WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2018-2033 (USD MILLION)

15.2.1 AMBIENT WAREHOUSING (AROUND 80°F)

15.2.2 AIR CONDITIONED (56°F AND 75°F)

15.2.3 REFRIGERATED (33°F AND 55°F)

15.2.4 COLD/FROZEN (OF OR BELOW 32°F)

15.2.5 OTHERS

15.3 BANGLADESH WAREHOUSING MARKET, AMBIENT WAREHOUSING (AROUND 80°F), BY PROCUT TYPE,2018-2033 (USD MILLION)

15.3.1 FOOD & BEVERAGES

15.3.2 ELECTRONICS

15.3.3 PAPER PRODUCTS

15.3.4 PHARMACEUTICALS

15.3.5 COSMETICS

15.3.6 OTHERS

15.4 BANGLADESH WAREHOUSING MARKET, BY FOOD & BEVERAGES, 2018-2033 (USD MILLION)

15.4.1 BREADS AND CEREALS

15.4.2 SAUCES AND CONDIMENTS

15.4.3 TEA AND COFFEE

15.4.4 BISCUITS AND CAKES

15.4.5 PASTA AND RICE

15.4.6 OTHERS

15.5 BANGLADESH WAREHOUSING MARKET, AIR CONDITIONED (56–75°F), PROCUT TYPE, 2018-2033 (USD MILLION)

15.5.1 FOOD

15.5.2 OIL & PETROLEUM

15.5.3 CHEMICALS

15.5.4 OTHERS

15.6 BANGLADESH WAREHOUSING MARKET, BY FOOD, 2018-2033 (USD MILLION)

15.6.1 FRUITS & VEGETABLES

15.6.2 CANNED FISH AND MEATS

15.6.3 CANNED FRUIT AND VEGETABLES

15.6.4 CONFECTIONERY PRODUCTS

15.6.5 CHOCOLATE AND CANDIES

15.7 BANGLADESH WAREHOUSING MARKET, BY FRUITS & VEGETABLES, 2018-2033 (USD MILLION)

15.7.1 TOMATOES

15.7.2 WATERMELON

15.7.3 BANANAS

15.7.4 COCONUT

15.7.5 BASILS

15.7.6 OTHERS

15.8 BANGLADESH WAREHOUSING MARKET, REFRIGERATED (33–55°F), PROCUT TYPE, 2018-2033 (USD MILLION)

15.8.1 FOOD AND BEVERAGES

15.8.2 CHEMICALS

15.8.3 BIO-PHARMACEUTICALS

15.8.4 PLANTS AND FLOWERS

15.8.5 OTHERS

15.9 BANGLADESH WAREHOUSING MARKET, BY FOOD & BEVERAGES, 2018-2033 (USD MILLION)

15.9.1 FRUITS AND VEGETABLES

15.9.2 DAIRY PRODUCTS

15.9.3 MEAT

15.9.4 FISH

15.9.5 EGGS

15.9.6 OTHERS

15.1 BANGLADESH WAREHOUSING MARKET, BY FRUITS & VEGETABLES, 2018-2033 (USD MILLION)

15.10.1 ORANGES

15.10.2 APPLES

15.10.3 CUCUMBER

15.10.4 BEANS

15.10.5 KIWIS

15.10.6 EGGPLANT

15.10.7 GUAVAS

15.10.8 BLUEBERRIES

15.10.9 OTHERS

15.11 BANGLADESH WAREHOUSING MARKET, BY BIO-PHARMACEUTICALS, 2018-2033 (USD MILLION)

15.11.1 VACCINE

15.11.2 BLOOD BANKS

15.11.3 OTHERS

15.12 BANGLADESH WAREHOUSING MARKET, COLD / FROZEN (BELOW 32°F), PROCUT TYPE, 2018-2033 (USD MILLION)

15.13 BANGLADESH WAREHOUSING MARKET, BY FRUITS & VEGETABLES, 2018-2033 (USD MILLION)

15.13.1 GRAPES

15.13.2 SWEET CORN

15.13.3 CABBAGE

15.13.4 CHERRIES

15.13.5 STRAWBERRIES

15.13.6 MUSHROOMS

15.13.7 LETTUCE

15.13.8 BROCCOLI

15.13.9 BRUSSELS SPROUTS

15.13.10 OTHERS

16 BANGLADESH WAREHOUSING MARKET, BY WMS TIER TYPE.

16.1 OVERVIEW

16.2 BANGLADESH WAREHOUSING MARKET, BY WMS TIER TYPE, 2018-2033 (USD MILLION)

16.2.1 ADVANCED WMS

16.2.2 BASIC WMS

16.2.3 INTERMEDIATE WMS

17 BANGLADESH WAREHOUSING MARKET , BY APPLICATION.

17.1 OVERVIEW

17.2 BANGLADESH WAREHOUSING MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

17.2.1 FOOD AND BEVERAGES

17.2.2 TRANSPORTATION AND LOGISTICS

17.2.3 RETAIL AND E-COMMERCE

17.2.4 ENERGY AND UTILITIES

17.2.5 CHEMICAL

17.2.6 READY-MADE GARMENTS (RMG)

17.2.7 AUTOMOTIVE

17.2.8 ELECTRICAL AND ELECTRONICS

17.2.9 HEALTHCARE

17.2.10 AGRICULTURE

17.2.11 OTHERS

17.3 BANGLADESH WAREHOUSING MARKET, BY FOOD AND BEVERAGES, BY TYPE, 2018-2033 (USD MILLION)

17.3.1 NON PERISHABLE GOODS

17.3.2 WAREHOUSING MARKET LOGISTICS

17.4 BANGLADESH WAREHOUSING MARKET, BY FOOD AND BEVERAGES, BY COMPONENT, 2018-2033 (USD MILLION)

17.4.1 HARDWARE/SYSTEM

17.4.2 SOFTWARE

17.4.3 SERVICES

17.5 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

17.5.1 PALLETS

17.5.2 CONVEYOR SYSTEM

17.5.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

17.5.4 TRANSPORT SYSTEM

17.5.5 AUTOMATED GUIDED VEHICLES (AGVS)

17.5.6 SORTATION SYSTEM

17.5.7 AUTONOMOUS MOBILE ROBOTICS

17.5.8 BARCODE SYSTEM

17.5.9 OTHERS

17.6 BANGLADESH WAREHOUSING MARKET, BY TRANSPORTATION & LOGISTICS BY TYPE, 2018-2033 (USD MILLION)

17.6.1 LAST-MILE DELIVERY PROVIDER

17.6.2 THIRD-PARTY LOGISTICS PROVIDER

17.6.3 FREIGHT FORWARDERS

17.7 BANGLADESH WAREHOUSING MARKET, BY THIRD-PARTY LOGISTICS PROVIDER BY MEDIUM, 2018-2033 (USD MILLION)

17.7.1 AIR FREIGHT

17.7.2 OCEAN FREIGHT

17.7.3 LAND TRANSPORT

17.7.4 CONTRACT LOGISTICS

17.8 BANGLADESH WAREHOUSING MARKET, BY THIRD-PARTY LOGISTICS PROVIDER BY BUSINESS TYPE, 2018-2033 (USD MILLION)

17.8.1 B2C

17.8.2 B2B

17.9 BANGLADESH WAREHOUSING MARKET, BY TRANSPORTATION & LOGISTICS BY COMPONENT, 2018-2033 (USD MILLION)

17.9.1 HARDWARE/SYSTEM

17.9.2 SOFTWARE

17.9.3 SERVICES

17.1 BANGLADESH WAREHOUSING MARKET, BY TRANSPORTATION & LOGISTICS BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

17.10.1 PALLETS

17.10.2 CONVEYOR SYSTEM

17.10.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

17.10.4 TRANSPORT SYSTEM

17.10.5 AUTOMATED GUIDED VEHICLES (AGVS)

17.10.6 SORTATION SYSTEM

17.10.7 AUTONOMOUS MOBILE ROBOTICS

17.10.8 BARCODE SYSTEM

17.10.9 OTHERS

17.11 BANGLADESH WAREHOUSING MARKET, BY RETAIL & E-COMMERCE BY TYPE, 2018-2033 (USD MILLION)

17.11.1 E-COMMERCE

17.11.2 BRICK AND MOTOR

17.12 BANGLADESH WAREHOUSING MARKET, BY RETAIL & E-COMMERCE, 2018-2033 (USD MILLION)

17.12.1 ONLINE MARKETPLACES

17.12.2 DIRECT-TO-CONSUMER BRANDS

17.13 BANGLADESH WAREHOUSING MARKET, BY RETAIL & E-COMMERCE BY COMPONENT, 2018-2033 (USD MILLION)

17.13.1 HARDWARE/SYSTEM

17.13.2 SOFTWARE

17.13.3 SERVICES

17.14 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

17.14.1 PALLETS

17.14.2 CONVEYOR SYSTEM

17.14.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

17.14.4 TRANSPORT SYSTEM

17.14.5 AUTOMATED GUIDED VEHICLES (AGVS)

17.14.6 SORTATION SYSTEM

17.14.7 AUTONOMOUS MOBILE ROBOTICS

17.14.8 BARCODE SYSTEM

17.14.9 OTHERS

17.15 BANGLADESH WAREHOUSING MARKET, BY ENERGY & UTILITIES BY TYPE, 2018-2033 (USD MILLION)

17.15.1 OIL AND GAS

17.15.2 UTILITIES

17.15.3 RENEWABLE ENERGY

17.15.4 MINING AND RESOURCES

17.16 BANGLADESH WAREHOUSING MARKET, BY ENERGY & UTILITIES BY COMPONENT, 2018-2033 (USD MILLION)

17.16.1 HARDWARE/SYSTEM

17.16.2 SOFTWARE

17.16.3 SERVICES

17.17 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

17.17.1 PALLETS

17.17.2 CONVEYOR SYSTEM

17.17.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

17.17.4 TRANSPORT SYSTEM

17.17.5 AUTOMATED GUIDED VEHICLES (AGVS)

17.17.6 SORTATION SYSTEM

17.17.7 AUTONOMOUS MOBILE ROBOTICS

17.17.8 BARCODE SYSTEM

17.17.9 OTHERS

17.18 BANGLADESH WAREHOUSING MARKET, BY CHEMICAL BY COMPONENT, 2018-2033 (USD MILLION)

17.18.1 HARDWARE/SYSTEM

17.18.2 SOFTWARE

17.18.3 SERVICES

17.19 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

17.19.1 PALLETS

17.19.2 CONVEYOR SYSTEM

17.19.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

17.19.4 TRANSPORT SYSTEM

17.19.5 AUTOMATED GUIDED VEHICLES (AGVS)

17.19.6 SORTATION SYSTEM

17.19.7 AUTONOMOUS MOBILE ROBOTICS

17.19.8 BARCODE SYSTEM

17.19.9 OTHERS

17.2 BANGLADESH WAREHOUSING MARKET, BY READY-MADE GARMENTS (RMGS) & TEXTILES BY TYPE, 2018-2033 (USD MILLION)

17.20.1 APPAREL

17.20.2 ACCESSORIES

17.21 BANGLADESH WAREHOUSING MARKET, BY READY-MADE GARMENTS (RMGS) & TEXTILES BY COMPONENT, 2018-2033 (USD MILLION)

17.21.1 HARDWARE/SYSTEM

17.21.2 SOFTWARE

17.21.3 SERVICES

17.22 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

17.22.1 PALLETS

17.22.2 CONVEYOR SYSTEM

17.22.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

17.22.4 TRANSPORT SYSTEM

17.22.5 AUTOMATED GUIDED VEHICLES (AGVS)

17.22.6 SORTATION SYSTEM

17.22.7 AUTONOMOUS MOBILE ROBOTICS

17.22.8 BARCODE SYSTEM

17.22.9 OTHERS

17.23 BANGLADESH WAREHOUSING MARKET, BY AUTOMOTIVE BY TYPE, 2018-2033 (USD MILLION)

17.23.1 HARDWARE/SYSTEM

17.23.2 SOFTWARE

17.23.3 SERVICES

17.24 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

17.24.1 PALLETS

17.24.2 CONVEYOR SYSTEM

17.24.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

17.24.4 TRANSPORT SYSTEM

17.24.5 AUTOMATED GUIDED VEHICLES (AGVS)

17.24.6 SORTATION SYSTEM

17.24.7 AUTONOMOUS MOBILE ROBOTICS

17.24.8 BARCODE SYSTEM

17.24.9 OTHERS

17.25 BANGLADESH WAREHOUSING MARKET, BY ELECTRICAL & ELECTRONICS BY TYPE, 2018-2033 (USD MILLION)

17.25.1 HARDWARE/SYSTEM

17.25.2 SOFTWARE

17.25.3 SERVICES

17.26 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

17.26.1 PALLETS

17.26.2 CONVEYOR SYSTEM

17.26.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

17.26.4 TRANSPORT SYSTEM

17.26.5 AUTOMATED GUIDED VEHICLES (AGVS)

17.26.6 SORTATION SYSTEM

17.26.7 AUTONOMOUS MOBILE ROBOTICS

17.26.8 BARCODE SYSTEM

17.26.9 OTHERS

17.27 BANGLADESH WAREHOUSING MARKET, BY HEALTHCARE BY TYPE, 2018-2033 (USD MILLION)

17.27.1 PHARMACEUTICAL

17.27.2 MEDICAL DEVICE

17.27.3 BIOTECH AND RESEARCH

17.27.4 OTHERS

17.28 BANGLADESH WAREHOUSING MARKET, BY HEALTHCARE BY COMPONENT, 2018-2033 (USD MILLION)

17.28.1 HARDWARE/SYSTEM

17.28.2 SOFTWARE

17.28.3 SERVICES

17.29 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

17.29.1 PALLETS

17.29.2 CONVEYOR SYSTEM

17.29.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

17.29.4 TRANSPORT SYSTEM

17.29.5 AUTOMATED GUIDED VEHICLES (AGVS)

17.29.6 SORTATION SYSTEM

17.29.7 AUTONOMOUS MOBILE ROBOTICS

17.29.8 BARCODE SYSTEM

17.29.9 OTHERS

17.3 BANGLADESH WAREHOUSING MARKET, BY AGRICULTURE BY TYPE, 2018-2033 (USD MILLION)

17.30.1 HARDWARE/SYSTEM

17.30.2 SOFTWARE

17.30.3 SERVICES

17.31 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

17.31.1 PALLETS

17.31.2 CONVEYOR SYSTEM

17.31.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

17.31.4 TRANSPORT SYSTEM

17.31.5 AUTOMATED GUIDED VEHICLES (AGVS)

17.31.6 SORTATION SYSTEM

17.31.7 AUTONOMOUS MOBILE ROBOTICS

17.31.8 BARCODE SYSTEM

17.31.9 OTHERS

18 BANGLADESH WAREHOUSING MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: BANGLADESH

19 SWOT ANALYSIS

20 COMAPANY PROFILES

20.1 3I LOGISTICS PVT. LTD.

20.1.1 COMPANY SNAPSHOT

20.1.2 PRODUCT PORTFOLIO

20.1.3 RECENT DEVELOPMENT

20.2 AGILITY LOGISTICS PARKS (A SUBSIDIARY COMPANY OF AGILITY GLOBAL)

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 A H KHAN & COMPANY LIMITED

20.3.1 COMPANY SNAPSHOT

20.3.2 SERVICE PORTFOLIO

20.3.3 RECENT DEVELOPMENT

20.4 ALL-TRANS CARGO SERVICES LTD.

20.4.1 COMPANY SNAPSHOT

20.4.2 PRODUCT PORTFOLIO

20.4.3 RECENT DEVELOPMENT

20.5 BLUE OCEAN FREIGHT SYSTEM LTD

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 RECENT DEVELOPMENT

20.6 BOLLORÉ GROUP

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENT

20.7 BUILDING CONSTRUCTION LIMITED (BCL)

20.7.1 COMPANY SNAPSHOT

20.7.2 SERVICE PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 CEVA LOGISTICS

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 CROWN LOGISTICS LTD

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENTS

20.1 DHL (A SUBSIDIARY COMPANY OF DEUTSCHE POST AG)

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

20.11 EUR SERVICE (BD) LTD.

20.11.1 COMPANY SNAPSHOT

20.11.2 SERVICE PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 KM GROUP

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 LR GROUP

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 NIPPON EXPRESS HOLDINGS.

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

20.16 PAPERFLY PRIVATE LIMITED.

20.16.1 COMPANY SNAPSHOT

20.16.2 SERVICE PORTFOLIO

20.16.3 RECENT DEVELOPMENT

20.17 SKY LOGISTICS (BD) LIMITED.

20.17.1 COMPANY SNAPSHOT

20.17.2 SERVICE PORTFOLIO

20.17.3 RECENT DEVELOPMENT

20.18 TRANSCOM LIMITED

20.18.1 COMPANY SNAPSHOT

20.18.2 SERVICE PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 TRANSMOVE

20.19.1 COMPANY SNAPSHOT

20.19.2 SERVICE PORTFOLIO

20.19.3 RECENT DEVELOPMENT

20.2 VAN LOGISTICS BANGLADESH LTD

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENTS

20.21 YUSEN LOGISTICS GLOBAL MANAGEMENT CO., LTD

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

List of Table

TABLE 1 SERVICE PLATFORM MATRIX

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 COMPANY SERVICE PLATFORM MATRIX

TABLE 4 PRICING ANALYSIS BASED ON SALES

TABLE 5 MARKETING BASED PRICING POSITIONING OF COMPANIES

TABLE 6 PRICING POSITIONING BASED ON CUSTOMER SERVICE

TABLE 7 TECHNOLOGY MATRIX

TABLE 8 BANGLADESH WAREHOUSING MARKET, BY COMPONENTS, 2018-2033 (USD MILLION)

TABLE 9 BANGLADESH WAREHOUSING MARKET, HARDWARE/SYSTEM, BY TYPE, 2018-2033 (USD MILLION)

TABLE 10 BANGLADESH WAREHOUSING MARKET, BY PALLETS BY MATERIAL, 2018-2033 (USD MILLION)

TABLE 11 BANGLADESH WAREHOUSING MARKET, BY PALLETS BY TYPE, 2018-2033 (USD MILLION)

TABLE 12 BANGLADESH WAREHOUSING MARKET, CONVEYOR SYSTEM, BY TYPE, 2018-2033 (USD MILLION)

TABLE 13 BANGLADESH WAREHOUSING MARKET, AUTOMATED STORAGE AND RETRIEVAL SYSTEM, BY TYPE, 2018-2033 (USD MILLION)

TABLE 14 BANGLADESH WAREHOUSING MARKET, TRANSPORT SYSTEM, BY TYPE, 2018-2033 (USD MILLION)

TABLE 15 BANGLADESH WAREHOUSING MARKET, AUTOMATED GUIDED VEHICLES (AGVS), BY TYPE, 2018-2033 (USD MILLION)

TABLE 16 BANGLADESH WAREHOUSING MARKET, BY SORTATION SYSTEM BY TYPE, 2018-2033 (USD MILLION)

TABLE 17 BANGLADESH WAREHOUSING MARKET, BY AUTONOMOUS MOBILE ROBOTS, BY TYPE, 2018-2033 (USD MILLION)

TABLE 18 BANGLADESH WAREHOUSING MARKET, SOFTWARE, BY TYPE, 2018-2033 (USD MILLION)

TABLE 19 BANGLADESH WAREHOUSING MARKET, HARDWARE/SYSTEM, BY TYPE, 2018-2033 (USD MILLION)

TABLE 20 BANGLADESH WAREHOUSING MARKET, PROFESSIONAL SERVICES, BY TYPE, 2018-2033 (USD MILLION)

TABLE 21 BANGLADESH WAREHOUSING MARKET, BY TYPE, 2018-2033 (USD MILLION)

TABLE 22 BANGLADESH WAREHOUSING MARKET, BY FUNCTION, 2018-2033 (USD MILLION)

TABLE 23 BANGLADESH WAREHOUSING MARKET, INVENTORY CONTROL & MANAGEMENT, BY TYPE, 2018-2033 (USD MILLION)

TABLE 24 BANGLADESH WAREHOUSING MARKET, INVENTORY OPTIMIZATION, BY TYPE, 2018-2033 (USD MILLION)

TABLE 25 BANGLADESH WAREHOUSING MARKET, REAL-TIME INVENTORY TRACKING, BY TYPE, 2018-2033 (USD MILLION)

TABLE 26 BANGLADESH WAREHOUSING MARKET, INVENTORY CONTROL & MANAGEMENT, BY STOCK LOCATION, 2018-2033 (USD MILLION)

TABLE 27 BANGLADESH WAREHOUSING MARKET, ORDER FULFILLMENT, 2018-2033 (USD MILLION)

TABLE 28 BANGLADESH WAREHOUSING MARKET, ORDER ROUTING & OPTIMIZATION, BY TYPE, 2018-2033 (USD MILLION)

TABLE 29 BANGLADESH WAREHOUSING MARKET, PICKING & PACKING AUTOMATION, BY TYPE, 2018-2033 (USD MILLION)

TABLE 30 BANGLADESH WAREHOUSING MARKET, ASSET TRACKING, 2018-2033 (USD MILLION)

TABLE 31 BANGLADESH WAREHOUSING MARKET, PRODUCT & PACKAGE TRACKING, BY TYPE, 2018-2033 (USD MILLION)

TABLE 32 BANGLADESH WAREHOUSING MARKET, EQUIPMENT & VEHICLE TRACKING, BY TYPE, 2018-2033 (USD MILLION)

TABLE 33 BANGLADESH WAREHOUSING MARKET, PREDICTIVE MAINTENANCE, 2018-2033 (USD MILLION)

TABLE 34 BANGLADESH WAREHOUSING MARKET, BY SIZE, 2018-2033 (USD MILLION)

TABLE 35 BANGLADESH WAREHOUSING MARKET, BY SMALL, 2018-2033 (USD MILLION)

TABLE 36 BANGLADESH WAREHOUSING MARKET, BY MEDIUM, 2018-2033 (USD MILLION)

TABLE 37 BANGLADESH WAREHOUSING MARKET, BY LARGE, 2018-2033 (USD MILLION)

TABLE 38 BANGLADESH WAREHOUSING MARKET, BY OWNERSHIP, 2018-2033 (USD MILLION)

TABLE 39 BANGLADESH WAREHOUSING MARKET, BY TENURE, 2018-2033 (USD MILLION)

TABLE 40 BANGLADESH WAREHOUSING MARKET, BY SCALE, 2018-2033 (USD MILLION)

TABLE 41 BANGLADESH WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2018-2033 (USD MILLION)

TABLE 42 BANGLADESH WAREHOUSING MARKET, AMBIENT WAREHOUSING (AROUND 80°F), BY PROCUT TYPE,2018-2033 (USD MILLION)

TABLE 43 BANGLADESH WAREHOUSING MARKET, BY FOOD & BEVERAGES, 2018-2033 (USD MILLION)

TABLE 44 BANGLADESH WAREHOUSING MARKET, AIR CONDITIONED (56–75°F), PROCUT TYPE, 2018-2033 (USD MILLION)

TABLE 45 BANGLADESH WAREHOUSING MARKET, BY FOOD, 2018-2033 (USD MILLION)

TABLE 46 BANGLADESH WAREHOUSING MARKET, BY FRUITS & VEGETABLES, 2018-2033 (USD MILLION)

TABLE 47 BANGLADESH WAREHOUSING MARKET, REFRIGERATED (33–55°F), PROCUT TYPE, 2018-2033 (USD MILLION)

TABLE 48 BANGLADESH WAREHOUSING MARKET, BY FOOD & BEVERAGES, 2018-2033 (USD MILLION)

TABLE 49 BANGLADESH WAREHOUSING MARKET, BY FRUITS & VEGETABLES, 2018-2033 (USD MILLION)

TABLE 50 BANGLADESH WAREHOUSING MARKET, BY BIO-PHARMACEUTICALS, 2018-2033 (USD MILLION)

TABLE 51 BANGLADESH WAREHOUSING MARKET, COLD / FROZEN (BELOW 32°F), PROCUT TYPE, 2018-2033 (USD MILLION)

TABLE 52 BANGLADESH WAREHOUSING MARKET, BY FRUITS & VEGETABLES, 2018-2033 (USD MILLION)

TABLE 53 BANGLADESH WAREHOUSING MARKET, BY WMS TIER TYPE, 2018-2033 (USD MILLION)

TABLE 54 BANGLADESH WAREHOUSING MARKET, BY APPLICATION, 2018-2033 (USD MILLION)

TABLE 55 BANGLADESH WAREHOUSING MARKET, BY FOOD AND BEVERAGES, BY TYPE, 2018-2033 (USD MILLION)

TABLE 56 BANGLADESH WAREHOUSING MARKET, BY FOOD AND BEVERAGES, BY COMPONENT, 2018-2033 (USD MILLION)

TABLE 57 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

TABLE 58 BANGLADESH WAREHOUSING MARKET, BY TRANSPORTATION & LOGISTICS BY TYPE, 2018-2033 (USD MILLION)

TABLE 59 BANGLADESH WAREHOUSING MARKET, BY THIRD-PARTY LOGISTICS PROVIDER BY MEDIUM, 2018-2033 (USD MILLION)

TABLE 60 BANGLADESH WAREHOUSING MARKET, BY THIRD-PARTY LOGISTICS PROVIDER BY BUSINESS TYPE, 2018-2033 (USD MILLION)

TABLE 61 BANGLADESH WAREHOUSING MARKET, BY TRANSPORTATION & LOGISTICS BY COMPONENT, 2018-2033 (USD MILLION)

TABLE 62 BANGLADESH WAREHOUSING MARKET, BY TRANSPORTATION & LOGISTICS BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

TABLE 63 BANGLADESH WAREHOUSING MARKET, BY RETAIL & E-COMMERCE BY TYPE, 2018-2033 (USD MILLION)

TABLE 64 BANGLADESH WAREHOUSING MARKET, BY RETAIL & E-COMMERCE BY E-COMMERCE, 2018-2033 (USD MILLION)

TABLE 65 BANGLADESH WAREHOUSING MARKET, BY RETAIL & E-COMMERCE BY COMPONENT, 2018-2033 (USD MILLION)

TABLE 66 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

TABLE 67 BANGLADESH WAREHOUSING MARKET, BY ENERGY & UTILITIES BY TYPE, 2018-2033 (USD MILLION)

TABLE 68 BANGLADESH WAREHOUSING MARKET, BY ENERGY & UTILITIES BY COMPONENT, 2018-2033 (USD MILLION)

TABLE 69 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

TABLE 70 BANGLADESH WAREHOUSING MARKET, BY CHEMICAL BY COMPONENT, 2018-2033 (USD MILLION)

TABLE 71 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

TABLE 72 BANGLADESH WAREHOUSING MARKET, BY READY-MADE GARMENTS (RMGS) & TEXTILES BY TYPE, 2018-2033 (USD MILLION)

TABLE 73 BANGLADESH WAREHOUSING MARKET, BY READY-MADE GARMENTS (RMGS) & TEXTILES BY COMPONENT, 2018-2033 (USD MILLION)

TABLE 74 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

TABLE 75 BANGLADESH WAREHOUSING MARKET, BY AUTOMOTIVE BY TYPE, 2018-2033 (USD MILLION)

TABLE 76 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

TABLE 77 BANGLADESH WAREHOUSING MARKET, BY ELECTRICAL & ELECTRONICS BY TYPE, 2018-2033 (USD MILLION)

TABLE 78 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

TABLE 79 BANGLADESH WAREHOUSING MARKET, BY HEALTHCARE BY TYPE, 2018-2033 (USD MILLION)

TABLE 80 BANGLADESH WAREHOUSING MARKET, BY HEALTHCARE BY COMPONENT, 2018-2033 (USD MILLION)

TABLE 81 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

TABLE 82 BANGLADESH WAREHOUSING MARKET, BY AGRICULTURE BY TYPE, 2018-2033 (USD MILLION)

TABLE 83 BANGLADESH WAREHOUSING MARKET, BY HARDWARE/SYSTEM, 2018-2033 (USD MILLION)

List of Figure

FIGURE 1 BANGLADESH WAREHOUSING MARKET: SEGMENTATION

FIGURE 2 BANGLADESH WAREHOUSING MARKET: DATA TRIANGULATION

FIGURE 3 BANGLADESH WAREHOUSING MARKET: DROC ANALYSIS

FIGURE 4 BANGLADESH WAREHOUSING MARKET: GLOBAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 BANGLADESH WAREHOUSING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BANGLADESH WAREHOUSING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 BANGLADESH WAREHOUSING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 BANGLADESH WAREHOUSING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 BANGLADESH WAREHOUSING MARKET: MULTIVARIATE MODELING

FIGURE 10 BANGLADESH WAREHOUSING MARKET: COMPONENTS TIMELINE CURVE

FIGURE 11 BANGLADESH WAREHOUSING MARKET: END-USER COVERAGE GRID

FIGURE 12 BANGLADESH WAREHOUSING MARKET: SEGMENTATION

FIGURE 13 FIVE SEGMENTS COMPRISE THE BANGLADESH WAREHOUSING MARKET, BY SERVICE TYPE (2025)

FIGURE 14 BANGLADESH WAREHOUSING MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 COMPETITIVE LABOR COSTS AND A LARGE WORKFORCE SUPPORT HIGH-VOLUME APPAREL PRODUCTION IS EXPECTED TO DRIVE THE BANGLADESH WAREHOUSING MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033

FIGURE 17 SPOT HAULAGE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BANGLADESH WAREHOUSING MARKET IN 2026 & 2033

FIGURE 18 DROC ANALYSIS

FIGURE 19 BANGLADESH WAREHOUSING MARKET, BY COMPONENTS, 2025

FIGURE 20 BANGLADESH WAREHOUSING MARKET, BY TYPE, 2025

FIGURE 21 BANGLADESH WAREHOUSING MARKET, BY FUNCTION, 2025

FIGURE 22 BANGLADESH WAREHOUSING MARKET, BY SIZE, 2025

FIGURE 23 BANGLADESH WAREHOUSING MARKET, BY OWNERSHIP, 2025

FIGURE 24 BANGLADESH WAREHOUSING MARKET, BY TENURE, 2025

FIGURE 25 BANGLADESH WAREHOUSING MARKET, BY SCALE, 2025

FIGURE 26 BANGLADESH WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2025

FIGURE 27 BANGLADESH WAREHOUSING MARKET, BY WMS TIER TYPE, 2025

FIGURE 28 BANGLADESH WAREHOUSING MARKET, BY APPLICATION, 2025

FIGURE 29 BANGLADESH WAREHOUSING MARKET: COMPANY SHARE 2025 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.