Benelux Africa And Saudi Arabia Construction Market

Market Size in USD Billion

CAGR :

%

USD

583.91 Billion

USD

816.84 Billion

2024

2032

USD

583.91 Billion

USD

816.84 Billion

2024

2032

| 2025 –2032 | |

| USD 583.91 Billion | |

| USD 816.84 Billion | |

|

|

|

Construction Market Analysis

The construction market in Benelux is driven by sustainable infrastructure projects, smart city developments, and increasing investments in green buildings, aligning with EU climate goals. In Africa, rapid urbanization, foreign direct investment, and government-led infrastructure initiatives fuel growth, although challenges such as regulatory complexities and funding constraints persist. Meanwhile, Saudi Arabia is witnessing a construction boom, largely propelled by Vision 2030, which prioritizes megaprojects in tourism, residential, and commercial sectors. Strong government spending, public-private partnerships, and technological advancements in construction methodologies further shape market dynamics across these regions, with each exhibiting distinct growth drivers and investment opportunities.

Construction Market Size

The Benelux, Africa, and Saudi Arabia construction market is expected to reach USD 816.84 billion by 2032 from USD 583.91 billion in 2024, growing with a substantial CAGR of 4.4% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Construction Market Trends

“Sustainable Building Initiatives, Urban Redevelopment, and Infrastructure Modernization”

The Benelux, Africa, and Saudi Arabia construction market is driven by sustainable building initiatives, urban redevelopment, and infrastructure modernization. Green construction, energy-efficient buildings, and smart city projects are gaining traction. In Africa, rapid urbanization, population growth, and foreign investments are fueling construction activities, particularly in residential, commercial, and transportation sectors. However, economic challenges and political instability may impact growth in certain regions. Saudi Arabia’s construction market is booming, supported by Vision 2030 projects, including NEOM, Red Sea developments, and smart city initiatives. Government investments in tourism, housing, and infrastructure, alongside private sector participation, are driving expansion in the sector. These trends indicate a dynamic and evolving construction sector poised for long-term expansion.

Report Scope and Construction Market Segmentation

|

Attributes |

Construction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Luxembourg, Belgium, Netherlands, Africa, and Saudi Arabia |

|

Key Market Players |

CRH (U.S.), Cemex, S.A.B. de C.V. (Mexico), SIKA AG (Switzerland), HOLCIM (Switzerland), Cementir Holding N.V. (Netherlands), Aditya Birla Management Corporation Pvt. Ltd. (India), Alturki Holding (Saudi Arabia), Buzzi S.p.A. (Germany), Dangote Industries Limited. (Switzerland), and Yanbu Cement Company (Saudi Arabia) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Construction Market Definition

Construction is the process of building, assembling, or modifying structures, infrastructure, and facilities, including residential, commercial, industrial, and civil engineering projects. It involves planning, design, procurement, and execution using materials, labor, and machinery. The construction industry encompasses various sectors such as real estate, transportation, energy, and utilities. Key stages include site preparation, foundation work, structural framing, and finishing. Modern construction integrates advanced technologies such as sustainable materials, automation, and smart building systems. It plays a crucial role in economic development, urbanization, and societal progress by creating essential infrastructure, enhancing living standards, and supporting industries worldwide.

Construction Market Dynamics

Drivers

- Rapid Urbanization and Growing Population

The Benelux region faces the challenge of accommodating an expanding urban population in a space-constrained environment. With cities such as Amsterdam, Brussels, and Luxembourg experiencing population surges, there is a pressing need for smart urban planning, high-density housing, and sustainable infrastructure. The emphasis is on green buildings, smart cities, and energy-efficient construction to support the region's commitment to environmental sustainability. In addition, the demand for office spaces, logistics hubs, and transport networks to facilitate economic growth further drives construction activities.

Africa is witnessing one of the fastest population growth rates globally, with urban centers expanding rapidly. Countries such as Nigeria, Egypt, Kenya, and South Africa are investing heavily in large-scale infrastructure projects, including roads, bridges, railways, and housing developments. The rising middle class and increasing urban migration are accelerating the need for affordable and high-quality housing solutions. Governments and private investors are focusing on Public-Private Partnerships (PPPs) to address the housing deficit while also improving essential services such as water supply, sanitation, and energy infrastructure.

For instance,

In January 2025, according to an article by The Associated Press, Tatu City is a privately developed, mixed-use urban hub near Nairobi, Kenya, designed to accommodate over 250,000 residents. It features residential, commercial, and industrial zones, easing congestion in Nairobi and promoting sustainable urban growth. The project reflects Africa’s shift toward planned cities amid rapid population expansion.

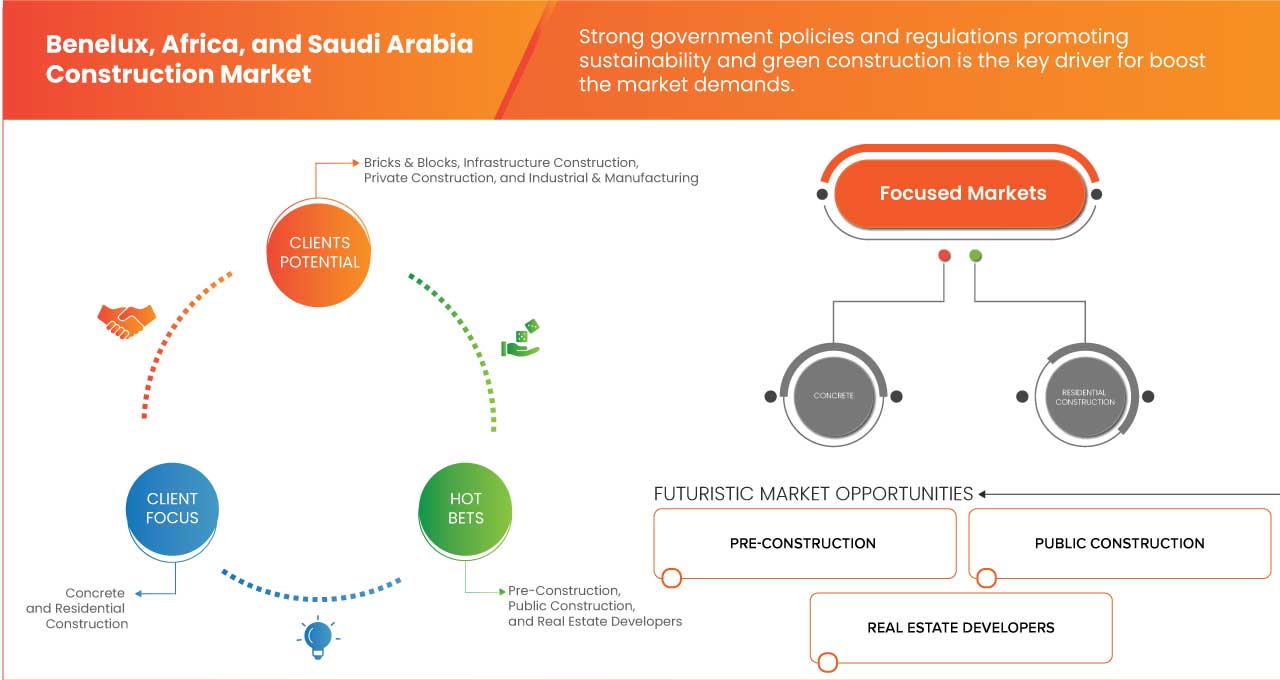

- Strong Government Policies and Regulations Promoting Sustainability and Green Construction

The Benelux region has been at the forefront of sustainable construction. The European Union's Green Deal and the region’s national policies emphasize reducing carbon footprints, increasing energy efficiency, and utilizing circular economy principles in construction. The Dutch government, for example, enforces stringent energy performance standards for buildings and encourages the use of bio-based and recycled materials. Luxembourg has introduced subsidies and tax incentives for developers incorporating green technologies. Belgium is advancing sustainable urban development projects, such as smart cities and green roofs, to reduce energy consumption and promote eco-friendly living spaces.

In Africa, governments are increasingly prioritizing green construction as part of their long-term development goals. Countries such as South Africa, Kenya, and Nigeria have introduced building codes and sustainability standards that align with global environmental goals. South Africa’s Green Building Council has developed a Green Star rating system to encourage energy-efficient designs, while Kenya’s Vision 2030 framework promotes sustainable infrastructure. In addition, the African Development Bank (ADB) is investing in green projects, providing financial incentives for sustainable construction initiatives. The growing adoption of renewable energy sources, such as solar and wind, is also reshaping the continent’s construction landscape, reducing reliance on fossil fuels.

For instance,

- In April 2024, according to policy by IEA, the Saudi Building Code is a collection of legislative, administrative, and technical rules for new buildings in Saudi Arabia. The Green Building Code is part of it and promotes green practices in the sector over energy efficiency and CO2 emissions reduction.

Opportunities

- Expansion of Smart Cities and Urban Infrastructure

The Benelux region is at the forefront of smart city initiatives. Cities such as Amsterdam, Rotterdam, and Brussels are investing heavily in sustainable infrastructure, digital connectivity, and intelligent mobility solutions. The emphasis on energy-efficient buildings, smart grids, and green transportation creates demand for advanced construction techniques, including prefabrication, modular construction, and energy-efficient materials. The European Union’s green transition policies further drive opportunities for firms specializing in eco-friendly urban development.

Africa is experiencing unprecedented urban growth, with cities expanding at a rapid pace due to population increases and economic development. Countries such as Nigeria, Kenya, Egypt, and South Africa are prioritizing infrastructure projects, including smart housing, transportation networks, and digital infrastructure. The rise of smart city projects, such as Konza Technopolis in Kenya and Eko Atlantic in Nigeria, highlights Africa’s commitment to technology-driven urbanization. Construction companies can benefit from partnerships with governments and international investors to deliver projects involving smart water management, waste recycling systems, and sustainable energy solutions. Moreover, Africa’s focus on Public-Private Partnerships (PPPs) creates additional opportunities for global construction firms.

For instance,

In September 2024, according to an article by The Wilson Center, the article highlights how Gulf countries, including Saudi Arabia and the UAE, are rapidly developing smart cities like NEOM and Masdar City. These projects emphasize AI, renewable energy, and digital infrastructure to improve urban living. The initiatives align with economic diversification goals under Saudi Vision 2030.

- Integration of Digital Technologies in Construction Market

The integration of digital technologies in the construction industry is transforming operations, improving efficiency, and unlocking new opportunities across different regions. In the Benelux, Africa, and Saudi Arabia, the adoption of technologies such as Building Information Modeling (BIM), Artificial Intelligence (AI), Internet of Things (IoT), and automation presents significant growth potential.

The Benelux region has a highly developed construction sector that is rapidly embracing digital innovations. The adoption of BIM and digital twin technology is enhancing project visualization and collaboration, reducing costs and project delays. In addition, prefabrication and modular construction, powered by automation and robotics, are gaining traction, further improving efficiency and sustainability. Smart infrastructure solutions, driven by IoT, are also enabling real-time monitoring and predictive maintenance of buildings and bridges, enhancing safety and durability.

For instance,

In November 2024, according to an article by the Brookings article, The article highlights how 3D printing in Africa reduces construction time by 70% and lowers carbon emissions by 48%. Digital technologies like AI, IoT, and smart grids enhance infrastructure sustainability, improving efficiency in energy, transportation, and urban planning while addressing climate challenges. These innovations drive economic and environmental benefits.

Restraints/Challenges

- High Cost of Raw Materials and Supply Chain Disruptions

The escalating prices of essential raw materials such as steel, cement, aluminum, and lumber are acting as a major restraint on the construction industry. Factors such as global inflation, increasing energy costs, and geopolitical instability have driven up production and transportation expenses. In Saudi Arabia, the high demand for materials due to large-scale infrastructure projects under Vision 2030 is straining supply chains and elevating costs. Similarly, in Africa, limited local production capacity forces reliance on expensive imports, making construction projects financially burdensome. The Benelux region also faces cost constraints due to strict environmental regulations, carbon taxation, and fluctuating material prices, impacting the affordability and feasibility of projects.

Supply chain inefficiencies further restrict the growth of the construction sector in these regions. Delays in raw material procurement, transportation bottlenecks, and labor shortages have resulted in prolonged project timelines and increased costs. In Africa, inadequate logistics infrastructure and port congestion hinder the timely delivery of construction materials. Saudi Arabia, despite having a well-developed supply chain network, remains dependent on global imports, making it vulnerable to international trade disruptions. The Benelux region, heavily reliant on maritime trade, faces shipment delays and supply inconsistencies, restraining market momentum.

For instance,

In February 2025, according to an article by Zawya, The rising construction costs in Saudi Arabia and the UAE are further exacerbated by inflation, supply chain disruptions, and increased infrastructure project demands. Developers and contractors must adapt by optimizing resources, exploring alternative materials, and implementing cost-effective strategies to mitigate financial strain and ensure project feasibility.

- Restrictions on Imports and Exports of Certain Construction Materials

The Benelux region relies heavily on imports of raw materials such as steel, cement, and timber. Trade barriers, including stringent EU regulations on carbon emissions and restrictions on non-EU suppliers, have led to higher material costs. Additionally, post-pandemic supply chain bottlenecks have further complicated imports. Export restrictions on European-manufactured construction equipment to non-EU markets have also hindered growth opportunities for Benelux-based firms looking to expand internationally.

Africa faces unique challenges due to heavy dependence on imports for essential materials like cement, steel, and machinery. Several countries have implemented restrictions to protect domestic industries, leading to higher local production costs. Moreover, international sanctions, fluctuating foreign exchange rates, and high import duties make it difficult for construction companies to procure affordable materials. Political instability and inconsistent trade policies in some regions further exacerbate supply chain disruptions, delaying infrastructure projects crucial for economic development.

For instance,

In December 2024, according to an article by Reuters, the European Commission is considering extending steel import caps beyond their mid-2026 expiration to protect the EU steel industry during its decarbonization efforts. This initiative, led by Executive Vice-President Stephane Sejourne, aims to address challenges such as high energy costs and competition from subsidized Chinese imports.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

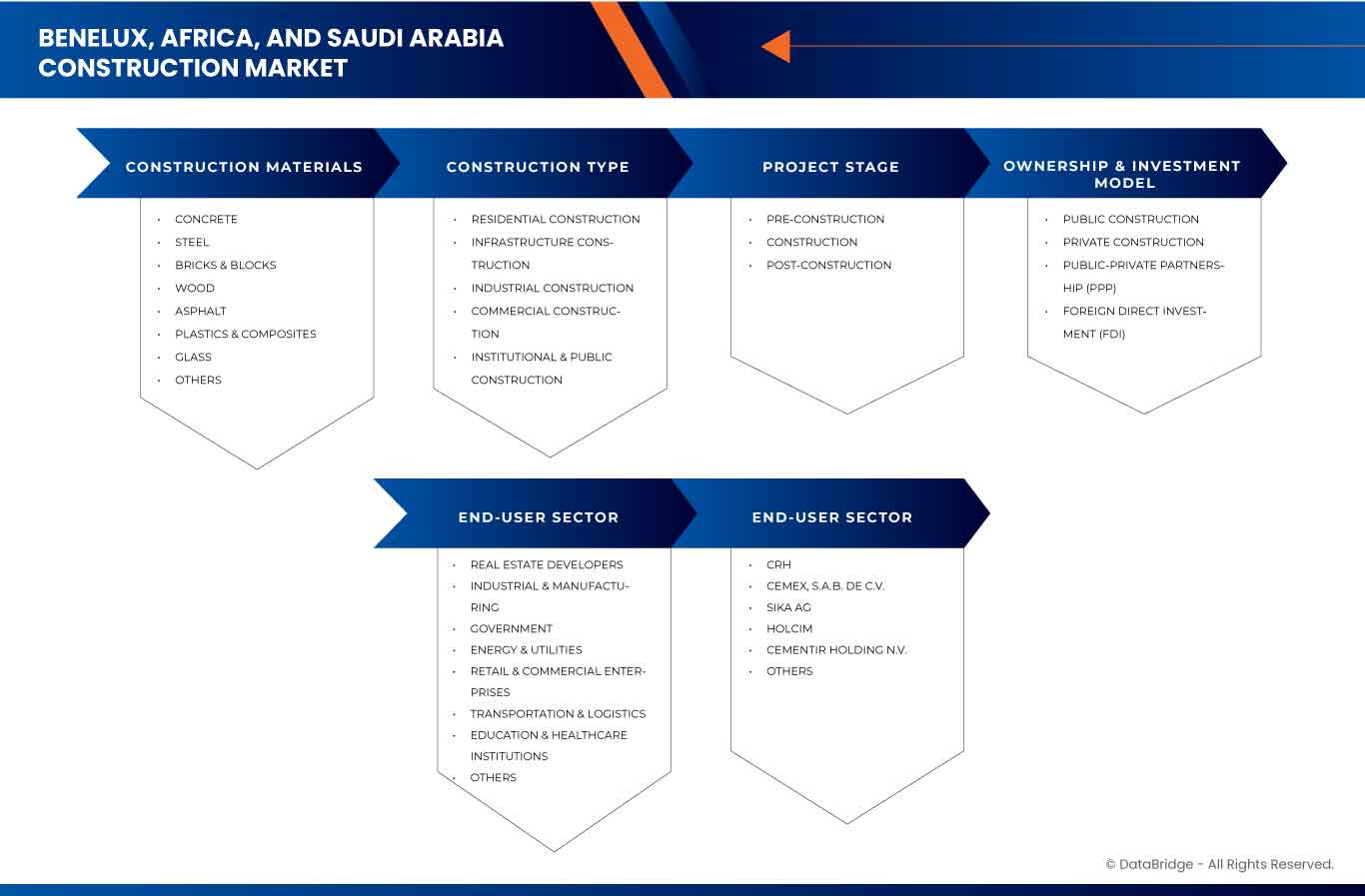

Construction Market Scope

The market is segmented on the basis of construction materials, construction type, project stage, ownership & investment model, and end user sector. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Construction Materials

- Concrete

- Steel

- Bricks & Blocks

- Wood

- Asphalt

- Plastics & Composites

- Glass

- Others

Construction Type

- Residential Construction

- By Construction Type

- Single-Family Housing

- Multi-Family Housing

- Affordable Housing

- Luxury Housing

- Others

- By Construction Type

- Infrastructure Construction

- By Construction Type

- Transportation

- Energy Infrastructure

- Water & Waste Management

- Others

- By Construction Type

- Industrial Construction

- By Construction Type

- Manufacturing Plants

- Warehouses & Logistics Centers

- Oil & Gas Facilities

- Mining Infrastructure

- Others

- By Construction Type

- Commercial Construction

- By Construction Type

- Office Buildings

- Retail Spaces

- Hospitality

- Entertainment & Recreation

- Others

- By Construction Type

- Institutional & Public Construction

- By Construction Type

- Educational Facilities

- Healthcare

- Government Buildings

- Religious & Cultural Centers

- Others

- By Construction Type

Project Stage

- Pre-Construction

- Construction

- Post-Construction

Ownership & Investment Model

- Public Construction

- Private Construction

- Public-Private Partnership (PPP)

- Foreign Direct Investment (FDI)

End-User Sector

- Real Estate Developers

- Industrial & Manufacturing

- Government

- Energy & Utilities

- Retail & Commercial Enterprises

- Transportation & Logistics

- Education & Healthcare Institutions

- Others

Construction Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, construction materials, construction type, project stage, ownership & investment model, end user sector as referenced above.

The countries covered in the market are Luxembourg, Belgium, Netherlands, Africa, and Saudi Arabia.

Africa is expected to dominate the Benelux, Africa, and Saudi Arabia construction market due to rapid urbanization, large-scale infrastructure projects, and increasing foreign investments. Growing demand for housing, transportation, and energy developments positions Africa as the fastest-expanding construction market among the three countries.

Saudi Arabia is the fastest-growing country in the Benelux, Africa, and Saudi Arabia construction market, driven by Vision 2030, large-scale infrastructure projects, smart cities, and increased investments in tourism, residential, and commercial developments, fostering rapid industry expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Construction Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Construction Market Leaders Operating in the Market Are:

- CRH (U.S.)

- Cemex, S.A.B. de C.V. (Mexico)

- SIKA AG (Switzerland)

- HOLCIM (Switzerland)

- Cementir Holding N.V. (Netherlands)

- Aditya Birla Management Corporation Pvt. Ltd. (India)

- Alturki Holding (Saudi Arabia)

- Buzzi S.p.A. (Germany)

- Dangote Industries Limited. (Switzerland)

- Yanbu Cement Company (Saudi Arabia)

Latest Developments in Construction Market

- In October 2022, CRH and Shell signed a memorandum of understanding to collaborate on developing and implementing decarbonization solutions. Their partnership focuses on reducing emissions across transport, operations, and materials by exploring vehicle electrification, low-carbon fuels, renewable electricity, and sustainable asphalt solutions. This initiative aims to accelerate progress toward net zero emissions across Europe, North America, and Asia-Pacific

- In October 2024, Cemex expanded its electric mixer fleet to Mexico as part of its strategy to decarbonize operations under the Future in Action program, targeting net-zero CO₂ emissions by 2050. These mixers offer full-load capacity and day-long operation, with previous deployments in Germany and Dubai and planned expansions in France, Spain, Poland, and the Czech Republic

- In May 2024, Cemex was recognized as the top-ranking company in the World Benchmarking Alliance’s Climate and Energy Benchmark for the cement industry. This achievement highlights Cemex’s commitment to reducing carbon emissions and becoming a net-zero CO₂ company by 2050. The ranking assessed 91 global aluminum, cement, and steel companies based on climate targets and transition efforts

- In 2024, Sika has been honored with the Qatar Corporate Social Responsibility (CSR) Award in the Construction Sector for its holistic approach to sustainability and outstanding Green Building Initiatives. The award, recognizing the "Best Initiative" in the construction sector, celebrates Sika's unwavering commitment globally and locally in Qatar to ecological integrity, social well-being, and sound governance principles, all while generating value for shareholders. The awarding ceremony took place in the context of the 2nd edition of Qatar CSR Summit which took place from the 30 April to 2 May 2024. This CSR Summit is a significant event that focuses on Corporate Social Responsibility (CSR) in Qatar

- In April 2023, Sika has signed an agreement with the University of Cádiz (UCA) to cooperate in the domains of concrete protection, building facades, and industrial processes. The cooperation results from a successful partnership focusing on innovative techniques for the preservation of concrete structures. Now, the UCA and Sika bundle their knowledge to expand these technologies to further areas of application and to open new market potential

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET END-USER SECTOR COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.1.7 CONCLUSION

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRY RIVALRY

4.3 TECHNOLOGICAL ADVANCEMENTS

4.3.1 DIGITALIZATION AND SMART CONSTRUCTION TECHNOLOGIES

4.3.2 MODULAR AND PREFABRICATED CONSTRUCTION

4.3.3 3D PRINTING AND ADDITIVE MANUFACTURING

4.3.4 DRONES AND AI-POWERED SITE MONITORING

4.3.5 SUSTAINABLE AND GREEN CONSTRUCTION TECHNOLOGIES

4.3.6 CONCLUSION

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID URBANIZATION AND GROWING POPULATION

6.1.2 STRONG GOVERNMENT POLICIES AND REGULATIONS PROMOTING SUSTAINABILITY AND GREEN CONSTRUCTION

6.1.3 BOOST IN FOREIGN DIRECT INVESTMENTS (FDI) & PUBLIC-PRIVATE PARTNERSHIPS (PPP)

6.2 RESTRAINTS

6.2.1 HIGH COST OF RAW MATERIALS AND SUPPLY CHAIN DISRUPTIONS

6.2.2 LABOR SHORTAGES AND SKILLED WORKFORCE AVAILABILITY

6.3 OPPORTUNITIES

6.3.1 EXPANSION OF SMART CITIES AND URBAN INFRASTRUCTURE

6.3.2 INTEGRATION OF DIGITAL TECHNOLOGIES IN CONSTRUCTION MARKET

6.4 CHALLENGES

6.4.1 RESTRICTIONS ON IMPORTS AND EXPORTS OF CERTAIN CONSTRUCTION MATERIALS

6.4.2 LONG APPROVAL TIMELINES FOR NEW MATERIALS

7 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY CONSTRUCTION MATERIALS

7.1 OVERVIEW

7.2 CONCRETE

7.3 STEEL

7.4 BRICKS & BLOCKS

7.5 WOOD

7.6 ASPHALT

7.7 PLASTICS & COMPOSITES

7.8 GLASS

7.9 OTHERS

8 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY CONSTRUCTION TYPE

8.1 OVERVIEW

8.2 RESIDENTIAL CONSTRUCTION

8.3 INFRASTRUCTURE CONSTRUCTION

8.4 INDUSTRIAL CONSTRUCTION

8.5 COMMERCIAL CONSTRUCTION

8.6 INSTITUTIONAL & PUBLIC CONSTRUCTION

9 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY PROJECT STAGE

9.1 OVERVIEW

9.2 PRE-CONSTRUCTION

9.3 CONSTRUCTION

9.4 POST-CONSTRUCTION

10 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY OWNERSHIP & INVESTMENT MODEL

10.1 OVERVIEW

10.2 PUBLIC CONSTRUCTION

10.3 PRIVATE CONSTRUCTION

10.4 PUBLIC-PRIVATE PARTNERSHIP (PPP)

10.5 FOREIGN DIRECT INVESTMENT (FDI)

11 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY END-USER SECTOR

11.1 OVERVIEW

11.2 REAL ESTATE DEVELOPERS

11.3 INDUSTRIAL & MANUFACTURING

11.4 GOVERNMENT

11.5 ENERGY & UTILITIES

11.6 RETAIL & COMMERCIAL ENTERPRISES

11.7 TRANSPORTATION & LOGISTICS

11.8 EDUCATION & HEALTHCARE INSTITUTIONS

11.9 OTHERS

12 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY REGION/COUNTRY

12.1 OVERVIEW

12.2 AFRICA

12.3 SAUDI ARABIA

12.4 BENELUX

12.4.1 NETHERLANDS

12.4.2 BELGIUM

12.4.3 LUXEMBOURG

13 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: BENELUX, AFRICA, AND SAUDI ARABIA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CRH

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 CEMEX, S.A.B. DE C.V.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS/NEWS

15.3 SIKA AG

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS/NEWS

15.4 HOLCIM

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS/NEWS

15.5 CEMENTIR HOLDING N.V.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ADITYA BIRLA MANAGEMENT CORPORATION PVT. LTD.

15.6.1 COMPANY SNAPSHOT

15.6.2 BUSINESS PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ALTURKI HOLDING

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BUZZI S.P.A.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS/NEWS

15.9 DANGOTE INDUSTRIES LIMITED.

15.9.1 COMPANY SNAPSHOT

15.9.2 BUSINESS PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 YANBU CEMENT COMPANY

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY CONSTRUCTION MATERIALS, 2018-2032 (USD THOUSAND)

TABLE 3 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 BENELUX, AFRICA, AND SAUDI ARABIA RESIDENTIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 BENELUX, AFRICA, AND SAUDI ARABIA INFRASTRUCTURE CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 BENELUX, AFRICA, AND SAUDI ARABIA INDUSTRIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 BENELUX, AFRICA, AND SAUDI ARABIA COMMERCIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 BENELUX, AFRICA, AND SAUDI ARABIA INSTITUTIONAL & PUBLIC CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY PROJECT STAGE, 2018-2032 (USD THOUSAND)

TABLE 10 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY OWNERSHIP & INVESTMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 11 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY END-USER SECTOR, 2018-2032 (USD THOUSAND)

TABLE 12 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 13 AFRICA CONSTRUCTION MARKET, BY CONSTRUCTION MATERIALS, 2018-2032 (USD THOUSAND)

TABLE 14 AFRICA CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 AFRICA RESIDENTIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 AFRICA INFRASTRUCTURE CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 AFRICA INDUSTRIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 AFRICA COMMERCIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 AFRICA INSTITUTIONAL & PUBLIC CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 AFRICA CONSTRUCTION MARKET, BY PROJECT STAGE, 2018-2032 (USD THOUSAND)..

TABLE 21 AFRICA CONSTRUCTION MARKET, BY OWNERSHIP & INVESTMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 22 AFRICA CONSTRUCTION MARKET, BY END-USER SECTOR, 2018-2032 (USD THOUSAND)

TABLE 23 SAUDI ARABIA CONSTRUCTION MARKET, BY CONSTRUCTION MATERIALS, 2018-2032 (USD THOUSAND)

TABLE 24 SAUDI ARABIA CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 SAUDI ARABIA RESIDENTIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 SAUDI ARABIA INFRASTRUCTURE CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 SAUDI ARABIA INDUSTRIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 SAUDI ARABIA COMMERCIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 SAUDI ARABIA INSTITUTIONAL & PUBLIC CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 SAUDI ARABIA CONSTRUCTION MARKET, BY PROJECT STAGE, 2018-2032 (USD THOUSAND)

TABLE 31 SAUDI ARABIA CONSTRUCTION MARKET, BY OWNERSHIP & INVESTMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 32 SAUDI ARABIA CONSTRUCTION MARKET, BY END-USER SECTOR, 2018-2032 (USD THOUSAND)

TABLE 33 BENELUX CONSTRUCTION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 34 BENELUX CONSTRUCTION MARKET, BY CONSTRUCTION MATERIALS, 2018-2032 (USD THOUSAND)

TABLE 35 BENELUX CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 BENELUX RESIDENTIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 BENELUX INFRASTRUCTURE CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 BENELUX INDUSTRIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 BENELUX COMMERCIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 BENELUX INSTITUTIONAL & PUBLIC CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 BENELUX CONSTRUCTION MARKET, BY PROJECT STAGE, 2018-2032 (USD THOUSAND)

TABLE 42 BENELUX CONSTRUCTION MARKET, BY OWNERSHIP & INVESTMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 43 BENELUX CONSTRUCTION MARKET, BY END-USER SECTOR, 2018-2032 (USD THOUSAND)

TABLE 44 NETHERLANDS CONSTRUCTION MARKET, BY CONSTRUCTION MATERIALS, 2018-2032 (USD THOUSAND)

TABLE 45 NETHERLANDS CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NETHERLANDS RESIDENTIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NETHERLANDS INFRASTRUCTURE CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 NETHERLANDS INDUSTRIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 NETHERLANDS COMMERCIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NETHERLANDS INSTITUTIONAL & PUBLIC CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NETHERLANDS CONSTRUCTION MARKET, BY PROJECT STAGE, 2018-2032 (USD THOUSAND)

TABLE 52 NETHERLANDS CONSTRUCTION MARKET, BY OWNERSHIP & INVESTMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 53 NETHERLANDS CONSTRUCTION MARKET, BY END-USER SECTOR, 2018-2032 (USD THOUSAND)

TABLE 54 BELGIUM CONSTRUCTION MARKET, BY CONSTRUCTION MATERIALS, 2018-2032 (USD THOUSAND)

TABLE 55 BELGIUM CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 BELGIUM RESIDENTIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 BELGIUM INFRASTRUCTURE CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 BELGIUM INDUSTRIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 BELGIUM COMMERCIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 BELGIUM INSTITUTIONAL & PUBLIC CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 BELGIUM CONSTRUCTION MARKET, BY PROJECT STAGE, 2018-2032 (USD THOUSAND)

TABLE 62 BELGIUM CONSTRUCTION MARKET, BY OWNERSHIP & INVESTMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 63 BELGIUM CONSTRUCTION MARKET, BY END-USER SECTOR, 2018-2032 (USD THOUSAND)

TABLE 64 LUXEMBOURG CONSTRUCTION MARKET, BY CONSTRUCTION MATERIALS, 2018-2032 (USD THOUSAND)

TABLE 65 LUXEMBOURG CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 LUXEMBOURG RESIDENTIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 LUXEMBOURG INFRASTRUCTURE CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 LUXEMBOURG INDUSTRIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 LUXEMBOURG COMMERCIAL CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 LUXEMBOURG INSTITUTIONAL & PUBLIC CONSTRUCTION IN CONSTRUCTION MARKET, BY CONSTRUCTION TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 LUXEMBOURG CONSTRUCTION MARKET, BY PROJECT STAGE, 2018-2032 (USD THOUSAND)

TABLE 72 LUXEMBOURG CONSTRUCTION MARKET, BY OWNERSHIP & INVESTMENT MODEL, 2018-2032 (USD THOUSAND)

TABLE 73 LUXEMBOURG CONSTRUCTION MARKET, BY END-USER SECTOR, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET

FIGURE 2 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: DATA TRIANGULATION

FIGURE 3 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: DROC ANALYSIS

FIGURE 4 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: MULTIVARIATE MODELLING

FIGURE 7 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: END-USER SECTOR COVERAGE GRID

FIGURE 11 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: SEGMENTATION

FIGURE 12 EIGHT SEGMENTS COMPRISE THE BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET, BY CONSTRUCTION MATERIAL (2024)

FIGURE 13 EXECUTIVE SUMMARY

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RAPID URBANIZATION AND GROWING POPULATIONS EXPECTED TO DRIVE THE BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET IN THE FORECAST PERIOD

FIGURE 16 THE CONCRETE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET

FIGURE 20 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: BY CONSTRUCTION MATERIALS, 2024

FIGURE 21 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: BY CONSTRUCTION TYPE, 2024

FIGURE 22 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: BY PROJECT STAGE, 2024

FIGURE 23 BENELUX, AFRICA, AND SAUDI CONSTRUCTION MARKET: BY OWNERSHIP & INVESTMENT MODEL, 2024

FIGURE 24 BENELUX, AFRICA, AND SAUDI ARABIA CONSTRUCTION MARKET: BY END-USER SECTOR, 2024

FIGURE 25 BENELUX, AFRICA AND SAUDI ARABIA CONSTRUCTION MARKET: COMPANY SHARE 2024 (%)

Benelux Africa And Saudi Arabia Construction Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Benelux Africa And Saudi Arabia Construction Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Benelux Africa And Saudi Arabia Construction Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.