Benelux Africa And Saudi Arabia Tools For Road And Bridge Construction Market

Market Size in USD Billion

CAGR :

%

USD

3.10 Billion

USD

4.42 Billion

2024

2032

USD

3.10 Billion

USD

4.42 Billion

2024

2032

| 2025 –2032 | |

| USD 3.10 Billion | |

| USD 4.42 Billion | |

|

|

|

Benelux, Africa and Saudi Arabia Tools for Road and Bridge Construction Market Analysis

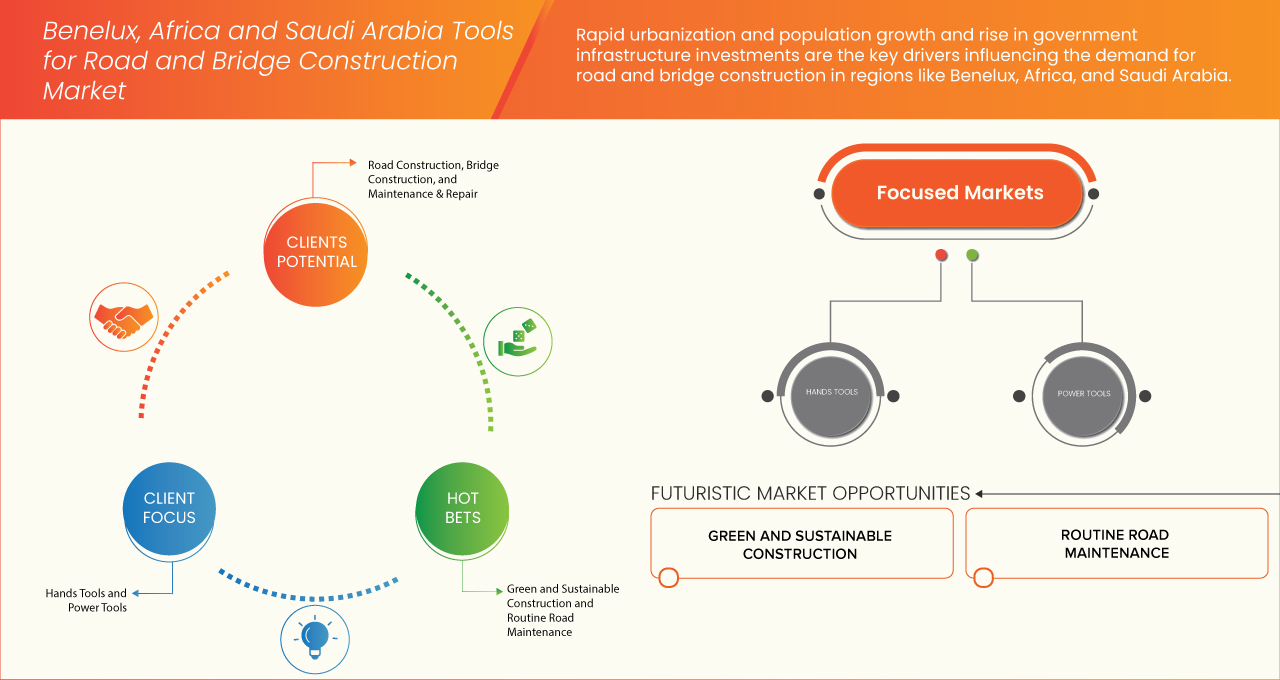

The Benelux, Africa, and Saudi Arabia road and bridge construction markets are experiencing significant growth, driven by infrastructure development and urbanization. In Benelux, advanced technology and sustainable construction practices are on the rise. Africa is witnessing increased investments in transportation networks, addressing the need for better connectivity. Saudi Arabia, with its ambitious Vision 2030 plan, is focusing on mega infrastructure projects, creating demand for road and bridge construction tools. The market is expected to expand further due to government initiatives and a growing focus on modern construction techniques across these regions.

Benelux, Africa and Saudi Arabia Tools for Road and Bridge Construction Market Size

Benelux, Africa and Saudi Arabia tools for road and bridge construction market size was valued at USD 3.10 billion in 2024 and is projected to reach USD 4.42 billion by 2032, growing with a CAGR of 4.7% during the forecast period of 2025 to 2032.

Benelux, Africa and Saudi Arabia Tools for Road and Bridge Construction Market Trends

“Rise in Government Infrastructure Investments”

The increasing focus on infrastructure development across Luxembourg, Belgium, the Netherlands, Africa, and Saudi Arabia is significantly propelling the demand for advanced tools and equipment in the road and bridge construction sector. Governments in these regions are making substantial investments in transportation networks to enhance connectivity, stimulate economic growth, and support urbanization.

In the Benelux region (Belgium, Netherlands, Luxembourg), infrastructure modernization is a key priority, with governments allocating significant budgets for road expansion, bridge maintenance, and smart infrastructure projects. The European Union's Green Deal and sustainability goals further encourage investments in eco-friendly and durable construction materials and equipment. The demand for precision tools, automation technologies, and innovative construction solutions is rising, as efficiency and environmental considerations become central to project execution.

Africa is witnessing a surge in infrastructure investments, fueled by economic growth, urban expansion, and international funding from organizations such as the World Bank and African Development Bank. Governments are prioritizing large-scale road and bridge construction projects to improve intra-regional trade and logistics. This trend has increased the need for high-performance construction tools, earthmoving machinery, and smart road-building solutions. Chinese and European contractors’ involvement in Africa’s infrastructure sector is further boosting demand for advanced construction technologies. In addition to above Saudi Arabia is also a driving massive infrastructure projects under its Vision 2030 initiative, with major investments in road networks, smart cities, and megaprojects such as NEOM. The government’s push for world-class infrastructure, alongside growing public-private partnerships (PPPs), is creating a strong market for innovative road and bridge construction tools. Demand for automation, AI-powered construction solutions, and sustainable materials is on the rise as the country aims for enhanced efficiency and sustainability in its infrastructure development.

For instance,

- According to a blog published on Suzhou TECON Construction Technology Co., Ltd government infrastructure investments in Western Europe are driving growth across key sectors, with roads leading at 46.1% market share in 2022. EU-backed funds of USD 790 billion under the Recovery and Resilience Facility (RRF) are set to accelerate projects despite past cost surges.

Government-led infrastructure investments across Benelux, Africa, and Saudi Arabia are fueling strong demand for advanced road and bridge construction tools. With a focus on modernization, sustainability, and smart technologies, the market offers lucrative prospects for innovative and efficient construction solutions.

Report Scope and Market Segmentation

|

Attributes |

Benelux, Africa and Saudi Arabia Tools for Road and Bridge Construction Key Market Insights |

|

Segments Covered |

Product: Power Tools, Hand Tools and Others Application: Road Construction, Bridge Construction, Maintenance & Repair and Others Sales Channel: Non-Store Based and Store Based |

|

Countries Covered |

Netherlands, Belgium and Luxembourg, Africa and Saudi Arabia |

|

Key Market Players |

Robert Bosch GmbH (Germany), Stanley Black & Decker, Inc. (United States), Makita Corporation (Japan), Ingersoll Rand (United States), Atlas Copco Group (Sweden), Koki Holdings Co., Ltd. (Japan), ATA (Turkey), PERI (Germany), Milwaukee Electric Tool Corporation (United States), Lasher Tools (South Africa), Festool GmbH (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Benelux, Africa and Saudi Arabia Tools for Road and Bridge Construction Market Definition

The tools for road and bridge construction market refers to a variety of equipment and machinery essential for the building, maintenance, and repair of roads, highways, and bridges. This market includes heavy-duty machinery such as excavators, road rollers, pavers, concrete mixers, and demolition tools, along with specialized safety equipment. These tools are used for tasks like excavation, paving, compaction, concrete pouring, and surface finishing. The demand for these tools is driven by growing infrastructure projects, urbanization, and the need for improved transportation networks, supporting the development and sustainability of road and bridge systems globally.

Benelux, Africa and Saudi Arabia Tools for Road and Bridge Construction Market Dynamics

Drivers

- Rapid Urbanization and Population Growth

Rapid urbanization and population growth are key drivers influencing the demand for road and bridge construction in regions like Benelux, Africa, and Saudi Arabia. These regions are experiencing significant infrastructure development due to increasing urban populations, economic growth, and the need for improved connectivity.

The Benelux region, comprising Belgium, the Netherlands, and Luxembourg, is witnessing urbanization driven by economic prosperity, industrialization, and the migration of people from rural to urban areas. With populations expanding in major cities such as Brussels, Amsterdam, and Luxembourg City, there is an increased demand for road and bridge infrastructure. This urban growth places a strain on existing transportation networks, leading to the need for modernized roadways and bridges to ensure smooth traffic flow and connectivity. Furthermore, the region’s commitment to sustainable development has boosted investments in eco-friendly infrastructure projects, including green bridges and energy-efficient road systems.

For instance,

- In December 2024, according to an article published by Researchgate Gmbh., The paper emphasizes the need for "Urban Sustainability" in Saudi Arabia's Dammam Metropolitan Area (DMA) due to rapid urbanization. It analyses unsustainable practices, reviews global sustainable urbanization approaches, and recommends strategies to address urban challenges, promoting long-term sustainability in DMA's growth and development

- In September 2024, according to an article published by Elsevier, this paper explores urbanization and counter-urbanization in Saudi Arabia, using census data to highlight how rapid urban growth occurs without economic growth. It examines the impact of these processes on urban policy, emphasizing their role in shaping urban sustainability and offering insights into urban development in the global south

Rapid urbanization and population growth are pivotal factors driving the road and bridge construction market in Benelux, Africa, and Saudi Arabia. As these regions continue to expand, the need for modern, sustainable, and efficient infrastructure solutions will remain at the forefront of development agendas

- Increased Collaborations Between Governments and Private Firms for Large-Scale Infrastructure Projects

The trend of increasing collaborations between governments and private firms for large-scale infrastructure projects is a crucial driver in the development of the road and bridge construction market in regions such as Benelux, Africa, and Saudi Arabia. These partnerships, known as Public-Private Partnerships (PPPs), combine the strengths of both sectors to address growing infrastructure needs while optimizing resources, technical expertise, and innovation.

In the Benelux region, public-private collaborations have been essential in modernizing and expanding transportation infrastructure. Governments in Belgium, the Netherlands, and Luxembourg are increasingly partnering with private companies to build and maintain roads and bridges, often through long-term concession agreements. These collaborations enable governments to access the private sector’s investment capital, expertise in construction and technology, and efficiency in project execution. For instance, the Netherlands has successfully used PPPs for major projects like the expansion of the A4 motorway. These projects not only improve transportation networks but also contribute to the region’s economic growth by enhancing mobility and supporting trade..

As sustainability becomes a critical focus, there is a rise in demand for biodegradable or recyclable packaging materials. Antilock additives are helping make these eco-friendly polymers more effective and durable, ensuring they perform well without compromising the environment. This shift towards greener packaging solutions has led to innovations in the formulation of antilock additives that are not only efficient in reducing friction but also safe for the environment. Additionally, the rise of e-commerce has heightened the need for robust packaging solutions that can withstand the rigors of global shipping. Antilock additives contribute to this by improving the performance of polymer packaging, ensuring that products remain intact during transit while reducing the risk of packaging failure.

In Africa, infrastructure deficits are a significant challenge due to rapid urbanization and population growth. Governments are increasingly relying on private firms to help address this gap. The continent’s need for new roads, bridges, and transportation corridors has led to numerous PPP agreements. Large-scale projects like the Nairobi-Mombasa highway in Kenya and the Dakar-Diamniadio Toll Highway in Senegal showcase how governments and private companies can collaborate to fund, design, and operate infrastructure projects. These partnerships not only bring in capital but also expertise in project management, technical design, and sustainable development. Through initiatives like the African Union’s Agenda 2063, which prioritizes infrastructure development, African governments are further encouraging private sector involvement to accelerate development and boost regional connectivity.

Saudi Arabia's Vision 2030 plan, aimed at diversifying its economy and reducing reliance on oil, has created significant opportunities for public-private collaborations in infrastructure development. The Kingdom has been engaging with private firms to undertake major road and bridge projects as part of its ambitious development agenda. Saudi Arabia's transportation sector, including projects such as the development of the Riyadh Metro and the King Abdulaziz International Airport expansion, relies heavily on PPP models. The government's efforts to attract foreign investment, particularly in large-scale infrastructure projects, are helping to modernize the country’s infrastructure while ensuring long-term sustainability.

For instance,

- In October 2024, according to an article published by Aninver Development Partners, S.L., Saudi Arabia's Roads General Authority (RGA) and National Center for Privatization & PPP (NCP) have launched an Expression of Interest (EOI) for the Jeddah-Makkah Direct Highway PPP project. The 64 km highway project includes road operations, maintenance, and development of motorway service areas, aimed at improving infrastructure for pilgrims

- In April 2023, according to an article published by ZAWYA, Saudi Arabia plans to tender four highway projects under the Public-Private Partnership (PPP) model as part of a broader 200-project privatization initiative. The Ministry of Transport and Logistic Services will oversee the projects, including the Jeddah-Makkah, Yanbu-Jubail, Asir-Jazan, and Jeddah-Jazan highways, aiming for infrastructure improvements

- In November 2024, according to an article published by European University Institute, Public-private partnerships (PPPs) are seen as a solution to Africa's infrastructure gap, but their success has been limited. Despite significant investment, projects often face issues like poor governance, ethical lapses, and misaligned interests. For PPPs to succeed, both sectors must prioritize transparency, innovation, and ethical responsibility to meet long-term development goals

- In January 2022, according to an article published by vinci-concessions, The Czech D4 motorway project, awarded Best European PPP at the 2021 PFI Awards, involves the completion and modernization of 48 km of motorway. Managed by the Via Salis consortium (VINCI Concessions, VINCI Highways, and Meridiam), the project will be completed by December 2024 and operated for 25 years

The growing trend of collaborations between governments and private firms for large-scale infrastructure projects is a key driver for the road and bridge construction market in Benelux, Africa, and Saudi Arabia. These partnerships enable the successful execution of major projects by combining public policy objectives with private sector efficiency, expertise, and capital. As urbanization and population growth continue, these collaborations will play a pivotal role in enhancing transportation networks and boosting economic development across these regions.

Opportunities

- Shifting Focus Towards Green and Sustainable Construction Trends

Shifting focus towards green and sustainable construction trends presents a significant opportunity for the road and bridge construction market in regions like Benelux, Africa, and Saudi Arabia. With growing awareness around climate change and the need for sustainable development, each region can benefit from adopting eco-friendly solutions in infrastructure projects.

The Benelux countries—Belgium, Netherlands, and Luxembourg—are at the forefront of sustainable infrastructure practices in Europe. The push towards reducing carbon emissions and enhancing energy efficiency is encouraging the adoption of green construction practices. In road and bridge construction, the use of recycled materials, low-carbon cement, and energy-efficient designs are becoming common. Additionally, governments in the Benelux are actively promoting public-private partnerships (PPPs) for green infrastructure projects, creating a favorable environment for innovation in sustainable construction. The region's strong regulatory framework on environmental standards further reinforces the need for sustainable practices, presenting an opportunity for companies offering sustainable construction tools and techniques, such as advanced asphalt recycling equipment and low-emission machinery.

In Africa, infrastructure development is rapidly expanding, and there is an increasing recognition of the importance of sustainability in construction. While many African countries are still developing their infrastructure, the green construction trend offers an opportunity to establish sustainable road and bridge building practices early on. By utilizing locally sourced, environmentally friendly materials and incorporating solar-powered technologies, African nations can address the dual challenge of building essential infrastructure while mitigating environmental impact. Moreover, international funding institutions are increasingly prioritizing sustainable development goals (SDGs), further pushing for green initiatives in infrastructure projects. The need for cost-effective, sustainable construction technologies provides an opportunity for companies offering specialized tools such as energy-efficient road construction equipment and environmentally friendly materials.

Saudi Arabia is investing heavily in its Vision 2030 initiative, which includes a focus on sustainability across all sectors, including infrastructure. With the country's ambition to diversify its economy and reduce its reliance on oil, there is a growing demand for green construction practices, particularly in road and bridge projects. The shift toward sustainable construction in Saudi Arabia is also driven by its efforts to combat environmental challenges, such as sandstorms and extreme temperatures, which require durable, sustainable materials and energy-efficient infrastructure. Companies offering innovative tools such as advanced bridge construction technologies, renewable energy integration in infrastructure, and sustainable materials for road construction will find great opportunities in the Saudi market.

For instance,

- In January 2025, according to an article published by ITP Media Group, Saudi Arabia has completed its first road using recycled construction and demolition (C&D) waste in the asphalt mixture. This sustainable project, in collaboration with Al Ahsa Municipality and the National Centre for Waste Management (MWAN), supports the kingdom's Vision 2030 goals, promoting a circular economy and reducing environmental impact.

- In January 2025, according to an article published by BLACK CAT GC, BlackCat GC is a leading construction company in Saudi Arabia, specializing in civil work, MEP (Mechanical, Electrical, Plumbing), excavation, infrastructure development, and green building practices. With a focus on sustainability, they offer energy-efficient and eco-friendly construction solutions, supporting Saudi Vision 2030’s goal of environmental and resource efficiency.

- In October 2024, according to an article published by Cypher Environmental, Cypher Environmental offers sustainable and cost-effective road construction solutions, focusing on soil stabilization with products like ROAD//STABILIZR. This solution utilizes in-situ clay materials, reducing costs and maintenance. It’s ideal for developing regions, such as Africa, where it enhances infrastructure while ensuring minimal environmental impact and logistical advantages.

- In May 2022, according to an article published by Autodesk Inc., the sustainable highway project in Rotterdam, Netherlands, aims to alleviate congestion while minimizing environmental impact. Key features include an energy-neutral tunnel with solar panels, wildlife protection, noise reduction, and intelligent systems for lighting and traffic management. BIM and 3D modeling ensure efficient, eco-friendly construction and operation.

The shift towards green and sustainable construction is transforming the road and bridge construction market across Benelux, Africa, and Saudi Arabia. These regions, with their varying stages of infrastructure development and commitment to sustainability, present a prime opportunity for companies to invest in sustainable construction tools and technologies. By leveraging eco-friendly solutions and contributing to sustainable development, the road and bridge construction market can drive long-term growth while meeting environmental goals.

- Expansion of Trade and Logistics Networks

The expansion of trade and logistics networks in Benelux, Africa, and Saudi Arabia presents a prime opportunity for the road and bridge construction market. As global trade grows, these regions are investing heavily in infrastructure to support efficient logistics and transportation networks, creating demand for advanced tools and technologies in road and bridge construction.

The Benelux countries, with their strategic location in Europe, play a crucial role in international trade. The development of modernized transportation corridors and logistics hubs is a key focus, with major investments in road and bridge infrastructure. This expansion creates opportunities for companies providing advanced construction tools for faster, more efficient bridge and road projects. The push for improved connectivity, including rail and port access, further emphasizes the need for high-quality, durable construction solutions.

In Africa, economic growth and urbanization are driving the expansion of trade networks, particularly through improved road and bridge infrastructure linking key ports, cities, and border regions. Governments and private investors are focused on reducing trade barriers and boosting intra-Africa trade, which will rely on efficient transportation systems. This opens doors for construction firms offering tools that cater to the specific needs of African infrastructure projects, such as modular bridge systems and cost-effective road construction technologies.

Saudi Arabia's Vision 2030 is transforming its logistics landscape, positioning the country as a global trade hub. The government is investing heavily in the construction of roads, bridges, and transportation networks to support trade routes and improve connectivity with neighboring regions. Companies supplying cutting-edge construction tools for large-scale infrastructure projects, including high-tech machinery for building durable bridges and highways, can capitalize on this growing demand in Saudi Arabia’s dynamic market.

For instance,

- According to an article published by The Economist Newspaper Limited, Saudi Arabia and the UAE are focusing on diversifying their economies and boosting trade by expanding into new markets, with a strong emphasis on non-oil sectors. Their strategic geographic location helps strengthen ties with China, India, and Europe. However, geopolitical challenges and rising shipping costs remain significant hurdles

- In February 2024, according to an article published by The Brookings Institution, The African Continental Free Trade Area (AfCFTA) offers transformative potential for African trade, addressing historical colonial models focused on resource extraction. With its vast market and potential for industrialization, AfCFTA could increase exports by 32% by 2035. However, robust trade facilitation, infrastructure, and unity are crucial for success

The expansion of trade and logistics networks in Benelux, Africa, and Saudi Arabia creates a strong demand for efficient, innovative road and bridge construction tools. This trend presents significant growth opportunities for construction companies in these regions

Restraints/Challenges

- Supply Chain Disruptions Affecting Project Timelines

Supply chain disruptions are a growing challenge for the tools used in road and bridge construction markets in the Benelux region, Africa, and Saudi Arabia. Factors such as global economic shifts, transport bottlenecks, and logistical constraints are severely impacting the timely delivery of construction tools and materials, ultimately affecting project timelines.

In the Benelux, which includes Belgium, the Netherlands, and Luxembourg, delays are driven by increasing costs of raw materials, as well as congestion at ports and transportation networks. These disruptions impact the procurement of vital construction tools, causing significant delays in road and bridge projects. With construction timelines extended, contractors are facing higher costs and difficulty in meeting deadlines, hindering the region's ability to complete infrastructure developments on time.

In Africa, many countries rely on imports for construction tools and equipment. Ongoing disruptions in the supply of machinery, spare parts, and raw materials have led to delays in road and bridge construction projects, especially in nations with less-developed infrastructure and logistics systems. Transportation challenges, such as inadequate road networks and poor port facilities, further worsen the situation, causing substantial setbacks in project completion.

Saudi Arabia, which is heavily invested in infrastructure as part of its Vision 2030 initiative, is also grappling with supply chain disruptions. The surge in demand for advanced road and bridge construction tools has created gaps in the availability of these tools. As the country seeks to meet ambitious construction goals, delays in securing critical equipment and materials are affecting project timelines, reducing overall construction efficiency and progress.

For instance,

- In September 2022, EU-backed infrastructure projects faced delays due to supply chain disruptions caused by the global pandemic. The impact was most noticeable in the delivery of construction materials for large projects like road expansions and bridge repairs

- In April 2024, according to an article published by Law Business Research, Saudi Arabia’s NEOM smart city project faced delays in its early stages due to global supply chain issues, affecting the procurement of construction materials and machinery needed for the project’s infrastructure

- In April 2024, according to an article published there was a massive increase in the prices of global steel due to supply chain disruptions, affecting road and bridge construction projects in multiple regions, including Saudi Arabia and Benelux

Supply chain problems remain a major challenge for road and bridge construction in Benelux, Africa, and Saudi Arabia. However, investing in local production, better logistics, and technology should help reduce these issues in the future. Companies that can adjust to these challenges by offering local materials, automated machinery, or smart logistics will be well-positioned to take advantage of growth in the infrastructure sector.

- Insufficient Availability of Skilled Labor

Skilled labor shortages are one of the most significant challenges facing the road and bridge construction industry in Benelux, Africa, and Saudi Arabia. The increasing complexity of infrastructure projects, coupled with a rising demand for advanced technologies and machinery, requires workers with specialized skills. However, there is a severe shortage of qualified workers in many regions, which is negatively impacting project timelines, construction quality, and overall efficiency.

In Benelux, the demand for skilled labor has grown due to large-scale infrastructure projects and a shift towards adopting more advanced technologies. However, there is a noticeable gap in the workforce when it comes to operating advanced machinery, using automation technologies, and managing complex construction projects. Whereas, In Africa, the lack of skilled labor is particularly severe due to limited access to formal training programs and educational institutions focused on construction skills. Many African nations face a gap in labor skills, particularly when it comes to working with modern machinery and adopting new technologies like automation and AI. This is a major issue in countries with ambitious infrastructure plans, such as South Africa, Nigeria, and Kenya, where the shortage of skilled workers is slowing the completion of road, bridge, and rail projects.

Saudi Arabia is also feeling the impact of this challenge, especially with the ambitious infrastructure projects under Vision 2030, such as the NEOM smart city and the Red Sea Development. These projects require a workforce skilled in advanced construction techniques, robotics, and AI-powered machinery. However, the demand for such skilled workers exceeds the local supply.

For instance,

- In December 2023, according to an article published by European Commission, In Belgium, the shortage of skilled workers, particularly in the areas of civil engineering and project management, has led to delays in several key road and bridge projects, including the renovation of major bridges and highways

- In October 2024, according to an article published by ReasearchGate Gmbh., In South Africa, a shortage of skilled workers in construction trades like welding, bricklaying, and civil engineering has delayed critical infrastructure projects, including road expansion and bridge construction

Saudi Arabia’s Vision 2030 projects, including the development of smart cities, have been delayed due to a shortage of local skilled labor. The country is facing challenges in meeting the high demand for specialized skills needed for advanced infrastructure projects.

The shortage of skilled labor continues to affect the efficiency of road and bridge construction in Benelux, Africa, and Saudi Arabia. While efforts are being made to address this issue through education and training, companies that focus on training and upskilling their workforce will be better positioned to meet the growing demand for skilled labor in the infrastructure sector.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Benelux, Africa and Saudi Arabia Tools for Road and Bridge Construction Market Scope

The market is segmented on the basis of product, application and sales channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Power Tools

- Power Tools, By Type

- Drilling & Boring Tools

- Drilling & Boring Tools, By Type

- Rotary Drills

- Impact Drills

- Augers

- Hammer Drills

- Others

- Drilling & Boring Tools, By Type

- Cutting & Grinding Tools

- Cutting & Grinding Tools, By Type

- Angle Grinders

- Circular Saws

- Concrete Saws

- Diamond Blade Saws

- Asphalt Cutters

- Others

- Cutting & Grinding Tools, By Type

- Fastening & Joining Tools

- Fastening & Joining Tools, By Type

- Nail Guns

- Impact Wrenches

- Rivet Guns

- Rebar Tiers

- Asphalt Cutters

- Others

- Fastening & Joining Tools, By Type

- Shaping & Finishing Tools

- Shaping & Finishing Tools, By Type

- Concrete Vibrators

- Power Trowels

- Scarifiers

- Others

- Shaping & Finishing Tools, By Type

- Drilling & Boring Tools

- Hand Tools

- Hand Tools, By Type

- Cutting & Chiselling Tools

- Cutting & Chiselling Tools, By Type

- Chisels

- Utility Knives

- Rebar Cutters & Benders

- Bolt Cutters

- Others

- Cutting & Chiselling Tools, By Type

- Lifting & Leveraging Tools

- Lifting & Leveraging Tools, By Type

- Crowbars

- Jack Screws

- Hoists

- Pry Bars

- Others

- Lifting & Leveraging Tools, By Type

- Shaping & Finishing Tools

- Shaping & Finishing Tools, By Type

- Trowels

- Floats

- Edgers

- Others

- Shaping & Finishing Tools, By Type

- Measurement & Layout Tools

- Measurement & Layout Tools, By Type

- Measuring Tapes

- Chalk Lines

- Plumb Bobs

- Marking Paint Applicators

- Others

- Measurement & Layout Tools, By Type

- Compaction & Tamping Tools

- Compaction & Tamping Tools, By Type

- Rammers

- Vibratory Plate Compactors

- Hand Tampers

- Plate Compactors (Manual)

- Others

- Compaction & Tamping Tools, By Type

- Others

- Power Tools, By Type

Application

- Road Construction

- Road Construction, By Type

- Urban Road Infrastructure

- Urban Road Infrastructure, By Type

- Smart Roads

- Bus Rapid Transit (BRT) Lanes

- Urban Road Infrastructure, By Type

- New Road Development

- New Road Development, By Type

- Highways

- Expressways

- Local Roads

- New Road Development, By Type

- Rural & Gravel Road Construction

- Rural & Gravel Road Construction, By Type

- Dirt Roads

- Unpaved Pathways

- Rural & Gravel Road Construction, By Type

- Tunnels & Underpasses

- Urban Road Infrastructure

- Road Construction, By Type

- Bridge Construction

- Bridge Construction, By Type

- Beam Bridges

- Truss Bridges

- Suspension Bridges

- Arch Bridges

- Cable-stayed Bridges

- Composite Material Bridges

- Bridge Construction, By Type

- Maintenance & Repair

- Maintenance & Repair, By Type

- Routine Road Maintenance

- Routine Road Maintenance, By Type

- Crack Sealing

- Pothole Patching

- Shoulder Repair

- Routine Road Maintenance, By Type

- Bridge Rehabilitation

- Bridge Rehabilitation, By Type

- Crack Sealing

- Pothole Patching

- Shoulder Repair

- Bridge Rehabilitation, By Type

- Routine Road Maintenance

- Others

- Maintenance & Repair, By Type

Sales Channel

- Non-Store Based

- Non-Store Based, By Type

- Company-owned Websites

- Third Party Websites

- Non-Store Based, By Type

- Store Based

- Store Based, By Type

- Hardware and Spare Parts Stores

- Rental Stores

- Brand Stores

- Brand Stores, By Type

- Multi Brand Stores

- Single Brand Stores

- Brand Stores, By Type

- Store Based, By Type

Benelux, Africa and Saudi Arabia Tools for Road and Bridge Construction Market Regional Analysis

The market is analyzed and market size insights and trends are provided by product, application, and sales channel.

The countries covered in the market are Benelux, Africa and Saudi Arabia.

Africa is expected to dominate the Benelux, Africa, and Saudi Arabia tools for road and bridge construction market due to its growing infrastructure investments and rapid urbanization. The continent is increasingly focusing on improving transportation networks, driven by the need for better connectivity and economic growth. Major projects funded by both governments and international organizations are creating a high demand for advanced construction tools. Additionally, Africa's vast geographical expanse and the push for modernization in both urban and rural areas further boost the demand for road and bridge construction tools.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Benelux, Africa and Saudi Arabia Tools for Road and Bridge Construction Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Benelux, Africa and Saudi Arabia Tools for Road and Bridge Construction Market Leaders Operating in the Market Are:

- Robert Bosch GmbH (Germany)

- Stanley Black & Decker, Inc. (United States)

- Makita Corporation (Japan)

- Ingersoll Rand (United States)

- Atlas Copco Group (Sweden)

- Koki Holdings Co., Ltd. (Japan)

- ATA (Turkey)

- PERI (Germany)

- Milwaukee Electric Tool Corporation (United States)

- Lasher Tools (South Africa)

- Festool GmbH (Germany)

Latest Developments in Benelux, Africa and Saudi Arabia Tools for Road and Bridge Construction Market

- In March 2022, Ingersoll Rand is a global leader in providing sustainable solutions in air and fluid technologies, with a focus on making life better through innovative products and services. Recognized for its commitment to sustainability, it was named to the 2022 Sustainability Yearbook by S&P Global, earning the "Industry Mover" award for its significant ESG progress

- In March 2022, Ingersoll Rand has joined the U.S. Department of Energy’s inaugural Better Climate Challenge, committing to reduce greenhouse gas emissions by 50% over the next decade. As part of its environmental goals, the company collaborates on decarbonization strategies, aiming to mitigate climate change and promote sustainable practices across industries

- In March 2023, HiKOKI introduced a new generation of 18V and 36V cordless angle grinders. These tools deliver performance comparable to corded models, featuring advanced brushless motors and enhanced safety features. The grinders are designed for both power and user protection, aiming to meet professional demands

- In December 2023, HiKOKI Power Tools Polska Sp. z o.o. and Metabo Polska Sp. z o.o. announced their merger, effective February 1, 2024, to form Koki Poland Sp. z o.o. This strategic move aims to combine advanced Japanese technology with German engineering excellence, enhancing service quality and promoting the growth of their brands: Metabo, HiKOKI, and Carat

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTE PRODUCTS

4.2.5 INDUSTRY RIVALRY

4.2.6 CONCLUSION

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 OVERVIEW

4.3.2 LOGISTIC COST SCENARIO

4.3.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.4 VALUE CHAIN ANALYSIS: BENELUX, AFRICA, AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

4.5 VENDOR SELECTION CRITERIA

4.6 TECHNOLOGICAL ADVANCEMENTS IN ROAD AND BRIDGE CONSTRUCTION IN BENELUX, AFRICA, AND SAUDI ARABIA

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN GOVERNMENT INFRASTRUCTURE INVESTMENTS

6.1.2 RAPID URBANIZATION AND POPULATION GROWTH

6.1.3 INCREASED COLLABORATIONS BETWEEN GOVERNMENTS AND PRIVATE FIRMS FOR LARGE-SCALE INFRASTRUCTURE PROJECTS

6.2 RESTRAINTS

6.2.1 HIGH INITIAL INVESTMENT COSTS

6.2.2 COMPLEX AND STRINGENT APPROVAL PROCESSES AND VARYING REGULATIONS

6.3 OPPORTUNITIES

6.3.1 SHIFTING FOCUS TOWARDS GREEN AND SUSTAINABLE CONSTRUCTION TRENDS

6.3.2 EXPANSION OF TRADE AND LOGISTICS NETWORKS

6.3.3 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN CONSTRUCTION TOOLS AND MACHINERY

6.4 CHALLENGES

6.4.1 SUPPLY CHAIN DISRUPTIONS AFFECTING PROJECT TIMELINES

6.4.2 INSUFFICIENT AVAILABILITY OF SKILLED LABOR

7 BENELUX, AFRICA, AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 POWER TOOLS

7.3 HAND TOOLS

7.4 OTHERS

8 BENELUX, AFRICA, AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 ROAD CONSTRUCTION

8.3 BRIDGE CONSTRUCTION

8.4 MAINTENANCE & REPAIR

8.5 OTHERS

9 BENELUX, AFRICA, AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL

9.1 OVERVIEW

9.2 NON-STORE BASED

9.3 STORE BASED

10 BENELUX, AFRICA, AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

10.1 BENELUX

10.1.1 NETHERLANDS

10.1.2 BELGIUM

10.1.3 LUXEMBOURG

10.2 AFRICA

10.3 SAUDI ARABIA

11 BENELUX, AFRICA, AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: BENELUX, AFRICA, AND SAUDI ARABIA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 ATLAS COPCO GROUP

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 MILWAUKEE ELECTRIC TOOL CORPORA

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENTS

13.3 ROBERT BOSCH GMBH

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 INGERSOLL RAND

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 KOKI HOLDINGS CO., LTD.

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENTS

13.6 ATA.

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 FESTOOL GMBH

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 LASHER TOOLS

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 MAKITA CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 PERI EGYPT

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 STANLEY BLACK & DECKER, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE IN BENELUX, AFRICA, AND SAUDI ARABIA FOR TOOLS IN ROAD AND BRIDGE CONSTRUCTION

TABLE 2 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 3 BENELUX, AFRICA AND SAUDI ARABIA POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 BENELUX, AFRICA AND SAUDI ARABIA DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 BENELUX, AFRICA AND SAUDI ARABIA CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 BENELUX, AFRICA AND SAUDI ARABIA FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 BENELUX, AFRICA AND SAUDI ARABIA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 BENELUX, AFRICA AND SAUDI ARABIA HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 BENELUX, AFRICA AND SAUDI ARABIA CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 BENELUX, AFRICA AND SAUDI ARABIA LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 BENELUX, AFRICA AND SAUDI ARABIA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 BENELUX, AFRICA AND SAUDI ARABIA MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 BENELUX, AFRICA AND SAUDI ARABIA COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 BENELUX, AFRICA AND SAUDI ARABIA ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 BENELUX, AFRICA AND SAUDI ARABIA URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 BENELUX, AFRICA AND SAUDI ARABIA NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 BENELUX, AFRICA AND SAUDI ARABIA RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 BENELUX, AFRICA AND SAUDI ARABIA BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 BENELUX, AFRICA AND SAUDI ARABIA MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 BENELUX, AFRICA AND SAUDI ARABIA ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 BENELUX, AFRICA AND SAUDI ARABIA BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 24 BENELUX, AFRICA AND SAUDI ARABIA NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 25 BENELUX, AFRICA AND SAUDI ARABIA STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 BENELUX, AFRICA AND SAUDI ARABIA BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 28 BENELUX TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 29 BENELUX TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 30 BENELUX POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 BENELUX DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 BENELUX CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 BENELUX FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 BENELUX SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 BENELUX HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 BENELUX CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 BENELUX LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 BENELUX SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 BENELUX MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 BENELUX COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 BENELUX TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 42 BENELUX ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 BENELUX URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 BENELUX NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 BENELUX RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 BENELUX BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 BENELUX MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 BENELUX ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 BENELUX BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 BENELUX TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 BENELUX NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 BENELUX STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 BENELUX BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NETHERLANDS TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 55 NETHERLANDS POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NETHERLANDS DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 NETHERLANDS CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NETHERLANDS FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NETHERLANDS SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NETHERLANDS HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NETHERLANDS CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NETHERLANDS LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NETHERLANDS SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 NETHERLANDS MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NETHERLANDS COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NETHERLANDS TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 NETHERLANDS ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NETHERLANDS URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NETHERLANDS NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 NETHERLANDS RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 NETHERLANDS BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 NETHERLANDS MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 NETHERLANDS ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 NETHERLANDS BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 NETHERLANDS TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 76 NETHERLANDS NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 NETHERLANDS STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 NETHERLANDS BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 BELGIUM TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 80 BELGIUM POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 BELGIUM DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 BELGIUM CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 BELGIUM FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 BELGIUM SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 BELGIUM HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 BELGIUM CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 BELGIUM LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 BELGIUM SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 BELGIUM MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 BELGIUM COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 BELGIUM TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 92 BELGIUM ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 BELGIUM URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 BELGIUM NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 BELGIUM RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 BELGIUM BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 BELGIUM MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 BELGIUM ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 BELGIUM BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 BELGIUM TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 101 BELGIUM NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 BELGIUM STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 BELGIUM BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 LUXEMBOURG TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 105 LUXEMBOURG POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 LUXEMBOURG DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 LUXEMBOURG CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 LUXEMBOURG FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 LUXEMBOURG SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 LUXEMBOURG HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 LUXEMBOURG CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 LUXEMBOURG LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 LUXEMBOURG SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 LUXEMBOURG MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 LUXEMBOURG COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 LUXEMBOURG TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 117 LUXEMBOURG ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 LUXEMBOURG URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 LUXEMBOURG NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 LUXEMBOURG RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 LUXEMBOURG BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 LUXEMBOURG MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 LUXEMBOURG ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 LUXEMBOURG BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 LUXEMBOURG TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 126 LUXEMBOURG NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 LUXEMBOURG STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 LUXEMBOURG BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 AFRICA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 130 AFRICA POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 AFRICA DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 AFRICA CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 AFRICA FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 AFRICA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 AFRICA HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 AFRICA CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 AFRICA LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 AFRICA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 AFRICA MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 AFRICA COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 AFRICA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 142 AFRICA ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 AFRICA URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 AFRICA NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 AFRICA RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 AFRICA BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 AFRICA MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 AFRICA ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 AFRICA BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 AFRICA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 151 AFRICA NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 AFRICA STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 AFRICA BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 155 SAUDI ARABIA POWER TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 SAUDI ARABIA DRILLING & BORING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 SAUDI ARABIA CUTTING & GRINDING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SAUDI ARABIA FASTENING & JOINING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 SAUDI ARABIA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 SAUDI ARABIA HAND TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 SAUDI ARABIA CUTTING & CHISELING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 SAUDI ARABIA LIFTING & LEVERAGING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 SAUDI ARABIA SHAPING & FINISHING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 SAUDI ARABIA MEASUREMENT & LAYOUT TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 SAUDI ARABIA COMPACTION & TAMPING TOOLS IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 167 SAUDI ARABIA ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 SAUDI ARABIA URBAN ROAD INFRASTRUCTURE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 SAUDI ARABIA NEW ROAD DEVELOPMENT IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 SAUDI ARABIA RURAL & GRAVEL ROAD CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 SAUDI ARABIA BRIDGE CONSTRUCTION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 SAUDI ARABIA MAINTENANCE & REPAIR IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 SAUDI ARABIA ROUTINE ROAD MAINTENANCE IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 SAUDI ARABIA BRIDGE REHABILITATION IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 176 SAUDI ARABIA NON-STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 SAUDI ARABIA STORE BASED IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 SAUDI ARABIA BRAND STORES IN TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

FIGURE 2 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: DATA TRIANGULATION

FIGURE 3 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: DROC ANALYSIS

FIGURE 4 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: MULTIVARIATE MODELLING

FIGURE 7 BENELUX, AFRICA, AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 BENELUX, AFRICA, AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE BENELUX, AFRICA, AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 THE GROWING DEMAND FOR PLASTIC PACKAGING GLOBALLY IS EXPECTED TO DRIVE THE BENELUX, AFRICA, AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 15 THE POWER TOOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE BENELUX, AFRICA, AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET IN 2025 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 VALUE CHAIN ANALYSIS OF BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET.

FIGURE 19 VENDOR SELECTION CRITERIA

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF BENELUX, AFRICA, AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET

FIGURE 21 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: BY PRODUCT, 2024

FIGURE 22 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: BY APPLICATION, 2024

FIGURE 23 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET, BY SALES CHANNEL, 2024

FIGURE 24 BENELUX, AFRICA AND SAUDI ARABIA TOOLS FOR ROAD AND BRIDGE CONSTRUCTION MARKET: COMPANY SHARE 2024 (%)

Benelux Africa And Saudi Arabia Tools For Road And Bridge Construction Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Benelux Africa And Saudi Arabia Tools For Road And Bridge Construction Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Benelux Africa And Saudi Arabia Tools For Road And Bridge Construction Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.